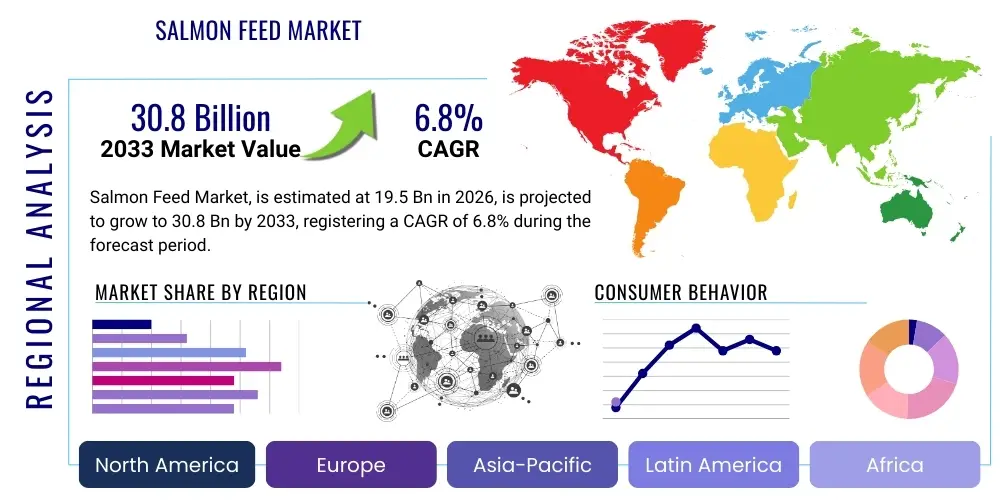

Salmon Feed Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440458 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Salmon Feed Market Size

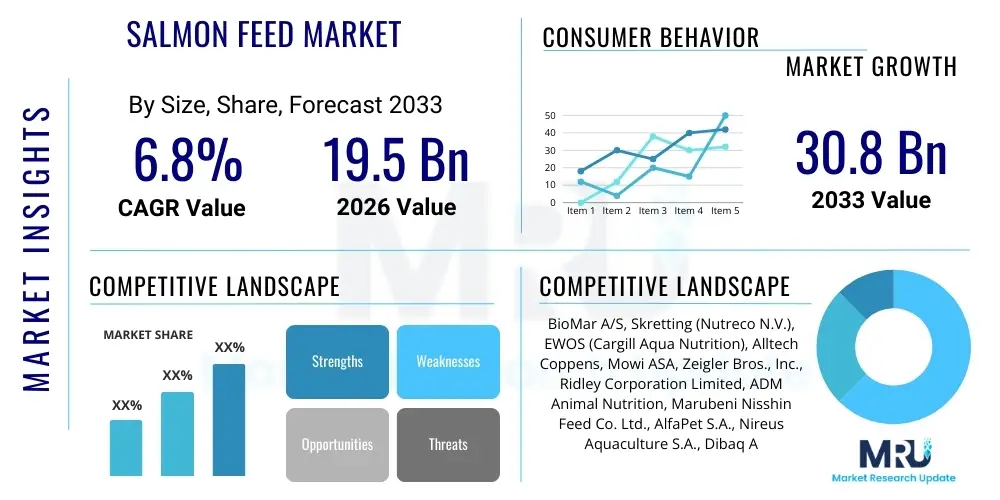

The Salmon Feed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 30.8 Billion by the end of the forecast period in 2033.

Salmon Feed Market introduction

The global salmon feed market constitutes a critical segment within the broader aquaculture industry, providing specialized nutritional solutions essential for the sustainable growth and health of farmed salmon. Salmon aquaculture has emerged as a cornerstone of global seafood production, driven by increasing consumer demand for healthy protein sources, advancements in farming technologies, and growing awareness regarding sustainable practices. Salmon feed, therefore, is not merely a commodity but a sophisticated product engineered to optimize growth rates, feed conversion ratios (FCR), disease resistance, and flesh quality in various salmonid species, including Atlantic salmon, Pacific salmon, and trout. The industry's evolution is marked by a continuous pursuit of innovative formulations that incorporate a diverse range of raw materials while addressing environmental concerns and resource scarcity. Key components often include marine-derived ingredients such as fishmeal and fish oil, alongside plant-based proteins like soy, corn gluten, and pea protein, as well as novel ingredients such as insect meal, algal oils, and microbial proteins.

The primary applications of salmon feed span across all life stages of salmon farming, from smolt to grow-out, each requiring tailored nutritional profiles to support specific developmental needs. Early-stage feeds are typically high in protein and essential fatty acids to promote robust growth and immune system development in juvenile fish, while grow-out feeds focus on efficient weight gain, muscle development, and the deposition of omega-3 fatty acids. The benefits derived from high-quality salmon feed are multifaceted, impacting both the economic viability of aquaculture operations and the nutritional value of the final product. Optimized feed leads to faster growth cycles, reduced mortality rates, improved feed conversion, and enhanced product quality, contributing to higher profitability for farmers. Furthermore, the strategic use of feed formulations allows for the enrichment of salmon flesh with beneficial nutrients, particularly omega-3 long-chain polyunsaturated fatty acids (LC-PUFAs), which are highly valued for human health.

Driving factors for the salmon feed market are robust and interconnected. The burgeoning global demand for salmon and other farmed fish, fueled by population growth, rising disposable incomes, and a growing preference for seafood as a healthy protein, is a primary catalyst. Alongside this, the increasing recognition of aquaculture as a sustainable alternative to wild-capture fisheries places greater emphasis on efficient feed utilization and environmentally responsible production. Technological advancements in feed formulation, processing techniques, and aquaculture systems continually enhance feed efficacy and reduce environmental footprints. The shift towards sustainable sourcing of raw materials, including the development of alternative protein and lipid sources, further propels market expansion by addressing resource limitations and improving the ecological profile of salmon farming. Regulatory frameworks that promote responsible aquaculture and impose stringent quality standards also play a significant role in shaping market dynamics, encouraging innovation and compliance among feed producers.

Salmon Feed Market Executive Summary

The salmon feed market is currently experiencing a period of dynamic transformation, characterized by significant business trends, evolving regional market landscapes, and distinct segment-specific developments. From a business perspective, the industry is witnessing a robust consolidation among major players, driven by the need for economies of scale, vertical integration, and enhanced research and development capabilities to innovate feed formulations. Strategic partnerships and collaborations between feed manufacturers, aquaculture technology providers, and raw material suppliers are becoming increasingly common, aimed at securing sustainable ingredient supplies and accelerating product development. There is a strong emphasis on sustainability initiatives across the value chain, with companies investing in traceable sourcing, reducing carbon footprints, and developing feeds with lower reliance on marine resources. This includes significant R&D into novel ingredients such as insect meal, algae, and single-cell proteins, alongside the optimization of plant-based components to maintain nutritional integrity and palatability while minimizing environmental impact. Digitalization and data analytics are also playing a pivotal role in optimizing feed management, leading to more precise feeding strategies and improved resource efficiency for salmon farmers globally.

Regionally, the market exhibits diverse growth patterns and operational characteristics. Europe, particularly Norway, Scotland, and the Faroe Islands, continues to dominate the salmon aquaculture landscape and consequently represents a primary market for salmon feed, driven by established farming infrastructure, advanced technological adoption, and strong consumer demand. However, there is significant growth observed in other regions. The Americas, with Chile and Canada as key producers, are expanding their aquaculture output, leading to increased demand for high-quality feeds adapted to local conditions and species. Asia-Pacific, while traditionally a smaller salmon producer, is showing promising growth, especially in countries like Australia and New Zealand, where premium salmon products are cultivated. This region also presents opportunities for feed manufacturers to address emerging markets with increasing seafood consumption. Each region faces unique challenges related to climate, disease management, and regulatory environments, which influence the types of feed formulations and sustainable practices adopted, necessitating a localized approach from feed suppliers.

Segmentation trends within the salmon feed market highlight a clear trajectory towards specialization and sustainability. By ingredient type, there is a gradual but significant shift away from traditional fishmeal and fish oil towards a greater inclusion of alternative protein and lipid sources. Plant-based ingredients like soy protein concentrate, corn gluten meal, and rapeseed oil are increasingly utilized, while novel ingredients are gaining traction due to their sustainability profile and nutritional benefits. The market for functional feeds, which are designed to enhance specific biological functions such as immune response, stress reduction, or pigmentation, is experiencing robust growth. These specialized feeds address critical challenges in salmon farming, including disease prevention and improved fish welfare. Furthermore, segmentations by life stage (smolt feed, grow-out feed) continue to be crucial, with ongoing innovation aimed at optimizing feed performance for each developmental phase. The emphasis on high-performance, sustainable, and functional feeds underpins the future direction of the salmon feed market, ensuring resilience and adaptability in the face of evolving industry demands and environmental considerations.

AI Impact Analysis on Salmon Feed Market

User inquiries concerning the integration of Artificial Intelligence (AI) into the salmon feed market predominantly revolve around questions of efficiency optimization, predictive analytics for resource management, disease prevention, and the development of sustainable feed formulations. Stakeholders are keen to understand how AI can reduce operational costs, minimize waste, and enhance the overall sustainability footprint of salmon aquaculture. Specific concerns often highlight the potential for AI to optimize feeding regimes by analyzing real-time data on fish behavior, environmental conditions, and growth rates, thereby reducing feed conversion ratios and improving profitability. There is also significant interest in AI's capacity for advanced analytics to predict disease outbreaks, allowing for proactive intervention and minimizing losses. Furthermore, users explore AI's role in accelerating the R&D cycle for novel feed ingredients, assessing their nutritional efficacy and environmental impact before large-scale production, and even in ensuring traceability and quality control throughout the feed supply chain. The overarching expectation is that AI will usher in a new era of precision aquaculture, transforming conventional practices through data-driven insights and automation, making salmon farming more resilient, efficient, and environmentally responsible.

- Precision Feeding: AI-driven sensors and algorithms analyze fish behavior, biomass, and environmental factors (temperature, oxygen levels) in real-time to optimize feeding schedules and quantities, reducing feed waste by up to 15-20% and improving feed conversion ratios.

- Disease Detection and Prevention: AI-powered image recognition and data analytics monitor fish health, detecting early signs of disease or stress through changes in swimming patterns, skin lesions, or fin condition, enabling timely intervention and minimizing outbreaks.

- Raw Material Optimization: AI algorithms evaluate the nutritional profiles, cost-effectiveness, and sustainability metrics of various raw materials, assisting formulators in developing optimal feed compositions that meet fish requirements while minimizing environmental impact and maximizing resource utilization.

- Supply Chain Optimization: AI enhances logistics for sourcing ingredients and distributing feed, predicting demand fluctuations, optimizing inventory management, and ensuring timely delivery, thereby reducing spoilage and operational inefficiencies.

- Predictive Analytics for Growth: Machine learning models forecast salmon growth rates based on feed intake, genetics, and environmental data, allowing farmers to plan production cycles more accurately and optimize harvesting times for maximum yield.

- Automated Quality Control: AI vision systems can monitor the quality of feed pellets during production, ensuring consistency in size, density, and integrity, which is crucial for optimal nutrient delivery and reduced feed dust.

- Environmental Monitoring and Mitigation: AI processes data from water quality sensors to predict potential environmental stressors or pollution events, enabling proactive measures to maintain optimal conditions in aquaculture pens and minimize ecological impact.

- Genetic Selection Enhancement: AI tools can analyze vast genomic data to identify genetic markers associated with desirable traits like faster growth, disease resistance, and higher omega-3 content, aiding in selective breeding programs for improved salmon stock.

DRO & Impact Forces Of Salmon Feed Market

The salmon feed market is influenced by a complex interplay of drivers, restraints, and opportunities, all contributing to significant impact forces that shape its current trajectory and future outlook. Key drivers propelling the market forward include the burgeoning global demand for salmon, driven by its reputation as a healthy and sustainable protein source, coupled with rising per capita seafood consumption worldwide. The expansion of salmon aquaculture operations globally, particularly in emerging markets, further amplifies the need for high-quality, efficient feed. Technological advancements in feed formulation, including the development of functional ingredients that boost fish health and growth, along with improved processing technologies, also serve as significant drivers. Moreover, increasing awareness and regulatory pressures for sustainable aquaculture practices necessitate innovation in feed ingredients and production methods, encouraging a shift towards eco-friendly solutions and circular economy principles. These drivers collectively create a robust foundation for sustained market growth, pushing for continuous improvement in feed efficacy and sustainability. The global push for food security and the limited capacity of wild fisheries also underscore the critical role of aquaculture, and thus salmon feed, in meeting future protein demands.

Conversely, several restraints pose challenges to the salmon feed market's growth. The most significant constraint is the volatile pricing and limited availability of traditional marine-derived ingredients, such as fishmeal and fish oil. These ingredients, while highly nutritious, are subject to fluctuations based on fishing quotas, environmental factors, and competition from other industries, leading to supply chain instability and increased production costs. The increasing cost of raw materials, both marine and plant-based, exerts considerable pressure on profit margins for feed manufacturers and ultimately impacts the economic viability for salmon farmers. Environmental concerns related to the sustainability of ingredient sourcing, particularly overfishing for fishmeal and fish oil, and the carbon footprint associated with long-distance transportation, also act as a restraint. Furthermore, stringent regulatory frameworks concerning feed composition, additive usage, and environmental impact vary across regions, adding complexity and cost to compliance for global feed producers. The perception and occasional negative publicity surrounding aquaculture's environmental impact, though often challenged by scientific evidence and improved practices, can also affect consumer confidence and market demand indirectly.

Despite these restraints, substantial opportunities exist for growth and innovation within the salmon feed market. The most prominent opportunity lies in the continuous research and development of novel and sustainable alternative protein and lipid sources. Ingredients like insect meal, single-cell proteins, microbial biomass, and various types of algae offer promising alternatives to traditional marine and plant-based components, addressing supply limitations and improving the ecological footprint of feeds. The growing demand for functional feeds that enhance specific aspects of salmon health, such as disease resistance, stress tolerance, and improved nutrient utilization, presents a significant market niche for specialized products. Furthermore, advancements in precision aquaculture technologies, including AI-driven feeding systems and real-time monitoring, offer opportunities to optimize feed efficiency and reduce waste, enhancing profitability for farmers. The expansion into new geographic markets and the increasing adoption of aquaculture in regions with high seafood consumption but limited local production capacities also provide fertile ground for market penetration. Lastly, a rising consumer preference for sustainably certified seafood creates a market advantage for producers who can demonstrate responsible sourcing and production through their feed choices, opening doors for premiumization and brand differentiation.

Segmentation Analysis

The salmon feed market is meticulously segmented to reflect the diverse needs of the aquaculture industry and the various factors influencing production and consumption. These segmentations provide a structured view of the market, allowing for a detailed analysis of trends, opportunities, and challenges across different product types, ingredient sources, life stages, and geographical regions. Understanding these distinct segments is crucial for stakeholders to tailor products, strategies, and investments effectively, ensuring the delivery of optimal nutritional solutions that meet the specific requirements of salmon farming operations worldwide. The market's complexity necessitates a granular approach to segmentation, moving beyond broad categories to address the nuanced demands of a rapidly evolving industry, emphasizing both efficiency and sustainability. This detailed breakdown highlights the sophistication of modern aquaculture, where specialized feeds are paramount for maximizing growth, minimizing environmental impact, and ensuring the health and welfare of farmed salmon, ultimately influencing the quality and marketability of the final seafood product.

- By Ingredient Type:

- Fishmeal and Fish Oil

- Plant-based Ingredients (Soy Protein Concentrate, Corn Gluten Meal, Rapeseed Meal, Wheat)

- Novel Ingredients (Insect Meal, Algae Meal, Single-Cell Proteins, Fermented Products)

- Additives (Vitamins, Minerals, Amino Acids, Pigments, Probiotics, Prebiotics)

- By Product Type:

- Starter Feed (Smolt Feed)

- Grow-out Feed

- Finisher Feed

- Functional Feed (Health Feeds, Stress-reducing Feeds, Pigmentation Feeds)

- Organic Feed

- By Life Stage:

- Fry/Smolt

- Grower

- Broodstock

- By Form:

- Pellets

- Crumble

- By Application:

- Atlantic Salmon

- Pacific Salmon (Coho, Chinook, Sockeye)

- Trout (Rainbow Trout, Brown Trout)

- Other Salmonids

- By Distribution Channel:

- Direct Sales (Manufacturer to Farm)

- Distributors/Wholesalers

- Retailers

- Online Channels

Value Chain Analysis For Salmon Feed Market

The value chain for the salmon feed market is intricate and multi-layered, encompassing a wide array of activities from raw material sourcing to the final delivery of feed to aquaculture farms, directly influencing the quality and cost-effectiveness of salmon production. The upstream segment of the value chain is critical, focusing on the procurement and processing of diverse raw materials. This includes marine resources such as forage fish for fishmeal and fish oil, which are harvested by fishing fleets and processed by specialized rendering plants. Simultaneously, agricultural commodities like soy, corn, wheat, and rapeseed are cultivated, harvested, and processed into protein concentrates and oils by agricultural suppliers. A rapidly growing segment in upstream involves the development and production of novel ingredients, such as insect farms producing insect meal, biorefineries cultivating algae for oils and proteins, and fermentation facilities generating single-cell proteins. The quality, sustainability, and availability of these upstream inputs directly dictate the formulation possibilities and cost structure of the final feed product. Efficient management of upstream logistics, including transportation and storage, is paramount to maintaining ingredient integrity and managing costs, especially given the global nature of ingredient sourcing.

Moving further along the chain, these raw materials are then transported to feed manufacturing facilities. This midstream segment involves extensive research and development to formulate nutritionally balanced and species-specific feeds, followed by the actual production process. Feed manufacturers invest heavily in R&D to optimize nutrient profiles, improve digestibility, enhance palatability, and incorporate functional additives that boost fish health and growth. The manufacturing process itself involves grinding, mixing, extrusion (to create pellets), drying, cooling, and coating the feed, ensuring precise nutrient delivery and physical stability. Quality control is stringent at every stage to meet regulatory standards and farmer expectations. Once produced, the finished salmon feed enters the distribution channel, which represents a crucial link connecting manufacturers to aquaculture farms. Distribution can occur through direct sales, where large feed companies supply directly to major salmon farming operations, fostering strong long-term relationships and offering tailored support. Alternatively, indirect channels involve distributors and wholesalers who manage logistics, warehousing, and delivery to a wider network of smaller farms. The choice of distribution channel often depends on the scale of the farming operation, geographic location, and the level of technical support required.

The downstream segment of the value chain focuses on the end-users, primarily salmon aquaculture farms. Here, the salmon feed is utilized to nourish fish through various life stages, from hatcheries to grow-out pens. Efficient feed management on the farm is critical, involving precise feeding systems, monitoring of fish behavior, and environmental conditions to optimize feed conversion ratios and minimize waste. The performance of the feed directly impacts the growth rates, health, and final quality of the salmon, which in turn affects the farmers' profitability and the marketability of their product. Post-harvest, the farmed salmon is processed, packaged, and distributed to retailers, restaurants, and consumers globally. The effectiveness of the entire value chain, from sustainable sourcing of ingredients to efficient on-farm utilization, ultimately contributes to the quality, price, and environmental footprint of the salmon available to the consumer. Direct distribution channels offer greater control over product quality and delivery schedules, allowing for closer collaboration between feed producers and farmers, often leading to customized feed solutions and technical assistance. Indirect channels, while potentially adding a layer of cost, can provide broader market reach and cater to diverse farming scales, ensuring accessibility of specialized feeds across different regions.

Salmon Feed Market Potential Customers

The primary potential customers and end-users of salmon feed are entities engaged in the commercial aquaculture of salmon and other salmonid species. This encompasses a broad spectrum of operations, ranging from large-scale, multinational salmon farming corporations that operate across multiple geographies to smaller, independent family-owned farms. These customers share a common need for high-quality, nutritionally complete, and cost-effective feeds that support optimal growth, health, and welfare of their fish throughout various life stages. The decision-making process for these buyers is typically driven by several key factors, including the feed's performance in terms of feed conversion ratio (FCR), growth rates, and survivability, as well as its impact on flesh quality and pigmentation. Furthermore, the sustainability profile of the feed, its compliance with regulatory standards, and the technical support provided by the feed manufacturer are increasingly important considerations for modern aquaculture producers. These customers are continuously seeking innovative feed solutions that enhance productivity, reduce environmental impact, and contribute to the economic viability of their operations in a competitive global market, making them highly discerning and demanding buyers.

Within this broad category, specific sub-segments of potential customers can be identified. Hatcheries and smolt production facilities represent a crucial customer segment, requiring specialized starter feeds designed to promote robust early growth, strong immune development, and efficient metamorphosis from fry to smolt. These early life stage feeds are critical for laying the foundation for healthy fish throughout their grow-out period. Another significant customer group comprises the large marine cage farming operations, which are the primary producers of market-sized salmon. These operations require high-performance grow-out and finisher feeds that optimize weight gain, muscle development, and fatty acid profiles, ensuring that the salmon reach target market size and quality specifications efficiently. The demand from these large-scale farms is substantial, often leading to long-term contracts and strategic partnerships with feed manufacturers. Additionally, land-based recirculating aquaculture systems (RAS) are an emerging customer base for salmon feed. These advanced systems demand highly specialized feeds that not only meet nutritional requirements but also maintain water quality efficiently, as feed waste can significantly impact system performance and operational costs. The unique environmental control and biosecurity protocols of RAS farms necessitate specific feed formulations adapted to their closed-system environments, minimizing effluent and maximizing nutrient retention.

Beyond commercial farming operations, other potential customers, though smaller in volume, include research institutions and academic facilities involved in aquaculture studies and breeding programs. These entities require various types of salmon feed for experimental purposes, testing new ingredients, evaluating genetic lines, or developing novel farming techniques. While not high-volume purchasers, their influence on future feed development and industry standards can be significant. Lastly, companies involved in the processing of salmon may indirectly influence feed purchasing decisions by setting quality specifications for the raw fish, which in turn drives demand for feeds that can produce salmon with desired characteristics such as color, texture, and fat content. Essentially, any entity with a vested interest in the healthy and efficient production of salmon, from initial hatching to final market product, represents a potential customer for the specialized and diverse offerings within the salmon feed market. The continuous evolution of aquaculture technologies and sustainability imperatives ensures that feed manufacturers must remain highly responsive to the dynamic and specialized needs of this varied customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 30.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BioMar A/S, Skretting (Nutreco N.V.), EWOS (Cargill Aqua Nutrition), Alltech Coppens, Mowi ASA, Zeigler Bros., Inc., Ridley Corporation Limited, ADM Animal Nutrition, Marubeni Nisshin Feed Co. Ltd., AlfaPet S.A., Nireus Aquaculture S.A., Dibaq Aquaculture S.A., Aller Aqua Group, Gold Coin Group, CP Foods PCL, Nippon Suisan Kaisha, Ltd., STIM AS, Bio-Oregon, Inc., Aquafauna Bio-Marine, Inc., Ocean Star International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Salmon Feed Market Key Technology Landscape

The salmon feed market is continuously being reshaped by an evolving technological landscape that drives efficiency, sustainability, and innovation in feed production and application. At the core of this landscape are advancements in feed formulation technologies. These include sophisticated software algorithms and nutritional modeling tools that enable feed manufacturers to precisely balance macronutrients, micronutrients, and functional additives, optimizing diets for specific salmon species, life stages, and environmental conditions. The use of near-infrared (NIR) spectroscopy and other analytical techniques has become standard for rapid and accurate assessment of raw material quality and composition, ensuring consistency and preventing nutritional imbalances. Furthermore, microencapsulation technologies are increasingly employed to protect sensitive ingredients like vitamins, probiotics, and certain amino acids from degradation during processing and digestion, ensuring their targeted delivery and efficacy. These formulation advancements are critical for maximizing feed conversion ratios and promoting robust fish health, thereby enhancing the economic viability of aquaculture operations while reducing their environmental footprint. The integration of advanced data analytics and machine learning into formulation processes allows for continuous improvement and adaptation of diets based on real-world performance data.

Beyond formulation, significant technological progress is observed in feed processing and manufacturing. Extrusion technology remains central, but continuous innovation in extruder design, die technology, and drying processes allows for the production of highly stable, palatable, and digestible feed pellets with precise buoyancy characteristics, critical for different feeding strategies. Advanced coating technologies are used post-extrusion to apply heat-sensitive nutrients, medications, or flavor enhancers, ensuring their integrity. Automation and robotics are increasingly being integrated into feed mills to enhance precision, reduce labor costs, and improve operational efficiency. Real-time process control systems monitor and adjust parameters such as temperature, pressure, and moisture content, ensuring consistent product quality and minimizing waste. Energy-efficient manufacturing processes are also gaining prominence, driven by sustainability goals and rising energy costs, with technologies like heat recovery systems being adopted. These processing innovations collectively contribute to the production of high-quality feeds that meet stringent industry standards, ensuring nutritional integrity and optimal physical properties for effective delivery to the fish. The ability to produce feeds with customizable features, such as varying sinking rates or specific palatability enhancers, is a direct result of these sophisticated manufacturing technologies.

The application of digital and data-driven technologies at the aquaculture farm level also forms a crucial part of the salmon feed market's technological landscape. Precision feeding systems, often integrated with AI and IoT (Internet of Things) sensors, are transforming how feed is delivered. Underwater cameras, acoustic sensors, and biomass estimation technologies monitor fish behavior, appetite, and growth in real-time, allowing for automated and optimized feed delivery. This minimizes waste, improves feed conversion ratios, and reduces the environmental impact of uneaten feed. Data analytics platforms collect and interpret vast amounts of data on fish health, growth, water quality, and environmental parameters, providing actionable insights for farmers to make informed decisions regarding feeding strategies, disease prevention, and overall farm management. Remote monitoring capabilities enable farmers to manage operations efficiently, even across geographically dispersed sites. Furthermore, blockchain technology is emerging as a tool for enhanced traceability of feed ingredients and finished products, bolstering transparency and consumer confidence in the sustainability and safety of farmed salmon. The convergence of these advanced formulation, processing, and farm-level digital technologies is creating a highly optimized and sustainable ecosystem for salmon aquaculture, directly impacting the demand for and evolution of salmon feed products. This holistic technological integration allows for a more responsive and adaptive approach to meeting the dynamic needs of the global salmon farming industry.

Regional Highlights

- Europe: This region stands as the undisputed leader in global salmon aquaculture and consequently represents the largest market for salmon feed. Norway is the dominant producer, followed by Scotland and the Faroe Islands. The market here is characterized by highly advanced farming technologies, stringent environmental regulations, and a strong focus on sustainable practices and innovative feed formulations. Europe drives demand for functional feeds and alternative ingredients to reduce reliance on marine resources, reflecting a mature and highly conscious industry. Key market trends include increasing investments in land-based RAS facilities and offshore aquaculture, requiring specialized feed solutions.

- North America: Comprising significant markets in Canada (British Columbia, Atlantic Provinces) and the United States (primarily Maine and Washington), North America is a vital region for salmon feed. The market here is growing steadily, with a strong emphasis on maintaining high product quality and meeting increasingly strict environmental standards. There's a notable trend towards adopting advanced farming technologies and sustainable feed ingredients. The demand for feeds that support disease resistance and efficient growth, particularly for Atlantic salmon and Pacific species like Chinook, is prominent. Expansion of land-based aquaculture projects also contributes to market growth.

- Latin America: Chile is the second-largest global producer of farmed salmon and a critical market for salmon feed in Latin America. The industry here is characterized by large-scale production, driven by export markets, particularly to the U.S. and Asia. The focus is on cost-effective, high-performance feeds that optimize growth rates and feed conversion ratios. Challenges related to disease management mean there is also a significant demand for functional feeds that enhance fish immunity. Recent efforts towards improving environmental sustainability and reducing antibiotic use are influencing feed formulations.

- Asia Pacific (APAC): While traditionally not a primary salmon farming region, countries like Australia and New Zealand have established niche markets for premium salmon products, demanding high-quality feeds. Emerging aquaculture sectors in other APAC countries are showing interest in salmon farming, driven by rising consumer demand for seafood. This region represents a significant growth opportunity, with increasing urbanization and disposable incomes fueling seafood consumption. The demand here often focuses on feeds optimized for faster growth and robust health, with an eye on sustainable ingredient sourcing as the industry matures.

- Middle East and Africa (MEA): This region is an emerging market for salmon aquaculture, with nascent projects aiming to capitalize on local demand for premium seafood and diversify food sources. While currently smaller in scale compared to other regions, MEA presents future growth potential as investments in aquaculture infrastructure increase. Feed demand will likely focus on robust, climate-resilient formulations, and the region could be a testbed for novel feed ingredients suitable for warm-water aquaculture. Sustainability and efficiency will be key drivers as these markets develop.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Salmon Feed Market.- BioMar A/S

- Skretting (Nutreco N.V.)

- EWOS (Cargill Aqua Nutrition)

- Alltech Coppens

- Mowi ASA

- Zeigler Bros., Inc.

- Ridley Corporation Limited

- ADM Animal Nutrition

- Marubeni Nisshin Feed Co. Ltd.

- AlfaPet S.A.

- Nireus Aquaculture S.A.

- Dibaq Aquaculture S.A.

- Aller Aqua Group

- Gold Coin Group

- CP Foods PCL

- Nippon Suisan Kaisha, Ltd.

- STIM AS

- Bio-Oregon, Inc.

- Aquafauna Bio-Marine, Inc.

- Ocean Star International

Frequently Asked Questions

Analyze common user questions about the Salmon Feed market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Salmon Feed Market?

The primary drivers are increasing global demand for salmon as a healthy protein, the expansion of aquaculture operations worldwide, continuous technological advancements in feed formulation and processing, and a growing emphasis on sustainable practices within the aquaculture industry.

How is the Salmon Feed Market addressing concerns about the sustainability of marine ingredients?

The market is actively addressing this by investing heavily in research and development of novel alternative ingredients such as insect meal, algae, single-cell proteins, and optimized plant-based proteins, reducing reliance on fishmeal and fish oil to enhance environmental sustainability.

What role does Artificial Intelligence (AI) play in the Salmon Feed Market?

AI is increasingly vital for precision feeding systems that optimize feed delivery based on real-time fish behavior and environmental data, predictive analytics for disease prevention, raw material optimization in feed formulation, and overall supply chain efficiency to reduce waste and improve sustainability.

What are 'functional feeds' and why are they important in salmon aquaculture?

Functional feeds are specialized formulations designed to enhance specific biological functions in salmon, such as improving immune response, reducing stress, or optimizing pigmentation. They are important for improving fish health, disease resistance, and overall welfare, leading to better farm productivity and reduced need for interventions.

Which regions are leading in salmon feed consumption and what are their unique market characteristics?

Europe, especially Norway and Scotland, leads due to established aquaculture. Latin America (Chile) is a major producer focusing on high-volume, cost-effective feeds. North America emphasizes quality and sustainability, while Asia Pacific shows emerging growth driven by increasing seafood demand and premium markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager