Salon and Spa Suite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438762 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Salon and Spa Suite Market Size

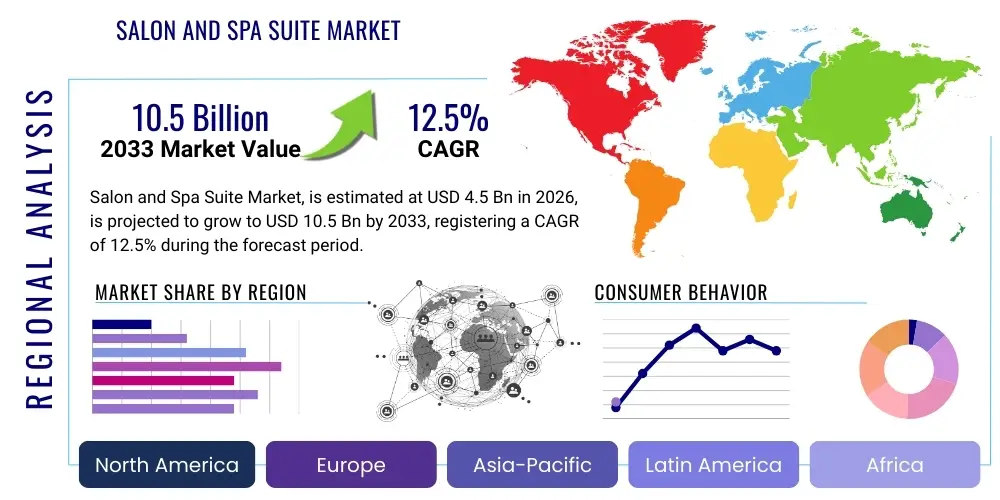

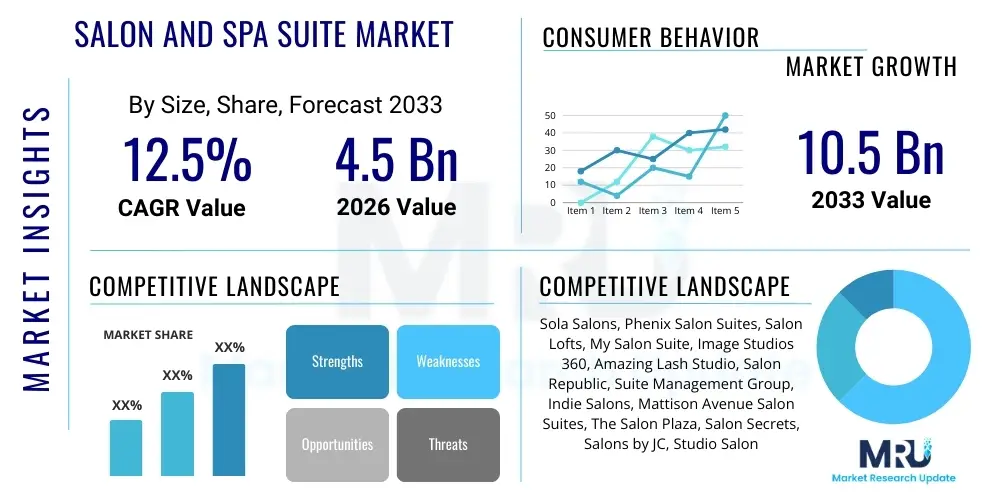

The Salon and Spa Suite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. This significant growth trajectory is underpinned by the increasing preference among beauty and wellness professionals for entrepreneurial freedom and personalized operational environments, moving away from traditional commission-based salon models. The market expansion reflects a deep structural change in the personal care industry, favoring individualized service delivery and flexible commercial real estate solutions tailored to micro-businesses. This calculated CAGR highlights the strong investor confidence and the scalability of the suite rental business model across diverse geographic regions and specialized beauty niches.

The market is estimated at $4.5 Billion in 2026, driven primarily by high demand in mature North American markets where the concept originated and has achieved widespread adoption, alongside burgeoning expansion in European urban centers. This initial valuation accounts for revenue generated through monthly and yearly suite rental fees, franchise royalties, and ancillary services provided by suite management companies, such as educational resources and professional insurance packages. The foundational valuation in 2026 reflects a post-pandemic surge where professionals sought greater control over sanitation protocols and client scheduling.

The market is projected to reach $10.5 Billion by the end of the forecast period in 2033. This substantial projected valuation increase is contingent upon two major factors: the geographical penetration into high-density Asia-Pacific and Latin American urban areas, and the introduction of advanced technological integrations within the suites, such as smart infrastructure and integrated payment systems. Furthermore, market maturity is expected to drive consolidation among independent suite operators, leading to larger, more professionalized real estate holdings and greater standardization of service offerings across national and international portfolios. The consistent demand from experienced professionals seeking business autonomy ensures robust long-term growth.

Salon and Spa Suite Market introduction

The Salon and Spa Suite Market represents a transformative segment within the commercial real estate and personal care industries, fundamentally reshaping the operational landscape for independent beauty and wellness professionals. These suites are purpose-built, move-in-ready private mini-salons or treatment rooms leased to licensed professionals—including hairstylists, estheticians, massage therapists, and nail technicians—who operate their businesses independently under a centralized facility. This model provides the professional with the autonomy of owning their own business without the substantial overhead associated with leasing, designing, and maintaining an entire traditional salon or spa. The core value proposition lies in providing a secure, professional, and customizable environment that supports individual brand development and client retention, allowing for flexible scheduling and complete control over pricing and product selection.

Major applications for salon and spa suites span the entire spectrum of personal care services. For hair professionals, suites offer private washing stations, cutting areas, and color processing spaces; for estheticians and spa professionals, they provide tranquil environments suitable for facials, waxing, and specialized skin treatments; and for massage therapists, the secure, quiet rooms are ideal for therapeutic bodywork. The key benefits driving adoption include significantly reduced startup costs compared to a full salon, zero commission reliance, increased privacy for clients, and the flexibility to decorate and brand the space according to the professional’s unique aesthetic. The operational independence is a powerful motivator, shifting the professional from an employee or contractor status to a fully self-governed business owner within a supportive community structure.

Driving factors for the market’s accelerated expansion include macroeconomic shifts toward entrepreneurship, where skilled laborers prefer self-employment over traditional employment structures. Technological advancements, particularly in booking and customer relationship management (CRM) software tailored for micro-businesses, have lowered the administrative barriers to entry for professionals operating out of a suite. Furthermore, consumer preferences are evolving towards highly personalized, one-on-one service experiences, which the private suite model is uniquely positioned to deliver, especially in the wake of heightened health and privacy consciousness. Favorable commercial real estate trends, including the repurposing of underutilized retail spaces in high-traffic suburban areas, also contribute significantly to the accessibility and proliferation of suite locations.

Salon and Spa Suite Market Executive Summary

The Salon and Spa Suite Market is currently characterized by vigorous business model refinement and expansive geographic penetration, indicating a shift from a niche concept to a mainstream commercial real estate offering within the beauty sector. Key business trends show dominant growth driven by franchising and corporate expansion, where major players are rapidly scaling standardized, high-quality suite environments. The market is consolidating around technologically sophisticated platforms that offer integrated business support, moving beyond merely providing physical space to offering comprehensive operational ecosystems for tenants. High occupancy rates across established locations underscore the model's resilience, demonstrating a reliable recurring revenue stream for property owners and management companies, even amidst fluctuating economic conditions, as beauty services remain relatively non-discretionary for affluent consumer segments.

Regional trends highlight North America, particularly the United States, as the global epicenter, possessing the highest concentration of suites and the most mature operational frameworks, setting industry benchmarks for design, technology integration, and leasing strategies. Europe, particularly the UK and Germany, shows rapid acceleration, adapting the US model to local labor laws and distinct architectural structures, focusing on boutique, high-end offerings in major metropolitan areas. Asia Pacific remains an emerging market, with initial deployments concentrated in major capital cities, focusing on luxury positioning to cater to the burgeoning middle and upper classes demanding premium, personalized aesthetic services. Expansion into secondary and tertiary markets across all regions is a core growth strategy, aimed at capturing independent professionals outside major urban hubs.

Segment trends emphasize the increasing specialization within suite offerings. There is a noticeable shift towards Multi-Room Suites, catering to professionals who wish to hire assistants or establish small, collaborative practices, thereby enabling revenue expansion beyond single-operator limitations. The Estheticians and Massage Therapists segments are witnessing disproportionately high growth, fueled by the rising consumer spending on clinical and wellness services that require privacy and specialized equipment, which suites can accommodate more effectively than open-concept salons. The dominance of the Franchise ownership model continues, leveraging standardized brand recognition and established management protocols, though independent operators maintain a strong presence, often occupying high-traffic, mixed-use developments, demonstrating the flexibility of the real estate asset class.

AI Impact Analysis on Salon and Spa Suite Market

Common user questions regarding AI’s impact on the Salon and Spa Suite Market typically revolve around operational efficiency, personalization of client experiences, and the administrative burden on independent professionals. Users frequently inquire about how AI can automate booking processes, manage dynamic pricing for services, optimize inventory of retail products within the micro-businesses, and generate highly targeted marketing campaigns based on client history and preferences. Concerns often center on the cost and complexity of implementing sophisticated AI tools for solo operators and ensuring that technology enhances, rather than diminishes, the crucial personal interaction that defines high-touch beauty services. Expectations are high for AI to free up the professional's time spent on non-revenue-generating activities, thereby maximizing service delivery capacity and profitability within the fixed space of the suite.

AI’s primary influence is manifesting through advanced Customer Relationship Management (CRM) systems and predictive analytics platforms, integrated directly into the suite management software provided by the facility operators. These tools utilize machine learning algorithms to analyze client scheduling patterns, predict no-show rates (allowing for optimized overbooking strategies), and recommend personalized upsells or cross-service bookings based on historical service data and professional recommendations. Furthermore, generative AI is increasingly used by suite professionals for rapid creation of social media content and personalized client communication, maintaining a consistent brand presence without diverting substantial time away from service provision. This integration transforms the professional's operational toolkit, enabling sophisticated large-business administrative capabilities within a small-scale operation.

The long-term implication of AI in this market involves transforming the physical suite itself into a smart environment. AI-powered environmental controls can adjust lighting and temperature based on client profiles or specific service requirements, while automated inventory reordering systems ensure professionals never run out of critical supplies, minimizing downtime. Crucially, AI-driven data aggregation across multiple independent suites within a facility provides the suite operator with valuable macroeconomic insights into local service demand and pricing elasticity, which they can then use to strategically advise their tenants, fostering a collaborative ecosystem designed for maximum revenue generation per square foot. The seamless integration of AI is positioning the salon suite model as a technological incubator for the beauty industry's independent professionals.

- List AI impacts in concise points

- Enhanced personalized marketing campaigns leveraging client purchase history and demographic data.

- Optimized dynamic pricing models to maximize revenue during peak and off-peak hours.

- Automated smart scheduling and predictive analytics to minimize costly no-show appointments.

- AI-driven virtual assistants for 24/7 client booking and initial inquiry handling.

- Smart inventory management systems triggering automated reorders based on consumption rates.

- Data synthesis for facility operators to provide localized market trend advisory to tenants.

- Implementation of AI-powered security and smart access controls for enhanced suite security.

DRO & Impact Forces Of Salon and Spa Suite Market

The dynamics of the Salon and Spa Suite Market are significantly shaped by a powerful confluence of Drivers (D), Restraints (R), and Opportunities (O), which collectively determine the Impact Forces influencing market trajectory and strategic direction. A central Driver is the overwhelming desire for professional autonomy and entrepreneurship among skilled beauty practitioners, coupled with the affordability and reduced risk associated with the suite model compared to opening a full salon. Restraints predominantly involve the risk of market saturation in primary urban centers, leading to competitive pricing pressures and high initial capital expenditure required for real estate conversion and specialized build-out. Opportunities are strongly linked to geographical expansion into underserved suburban and secondary markets, and the integration of high-tech amenities and business support services that enhance the tenant value proposition. These forces dictate investment decisions, tenant retention strategies, and the pace of market expansion.

The key Impact Forces sustaining market expansion include the structural shift away from traditional employer-employee relationships towards gig economy models, making the independent contractor model highly appealing to younger generations of professionals seeking flexibility. Furthermore, favorable regulatory environments in many jurisdictions support micro-business growth, inadvertently benefiting the suite model. However, the regulatory complexity around defining the relationship between the suite operator and the professional tenant (landlord vs. employer) poses a consistent challenge and a restraining force that requires careful legal structuring to avoid misclassification issues. The market's success is heavily reliant on real estate availability and the feasibility of converting existing retail spaces, making the health of the commercial real estate sector an external impact force of critical importance.

Ultimately, the long-term growth hinges on the ability of suite operators to continually differentiate their offerings, moving beyond simple space provision to becoming true partners in their tenants’ business growth. This includes offering premium services such as advanced training, discounted product purchasing networks, and sophisticated digital tools. The major opportunity remains the vertical integration of services, such as financing options for equipment purchase or specialized marketing consultation, transforming the lease agreement into a comprehensive business partnership. Navigating the delicate balance between rapid expansion and maintaining a high-quality, professional environment across all locations will determine the sustainability and future valuation of leading market participants.

Segmentation Analysis

The Salon and Spa Suite Market is meticulously segmented based on key criteria including the physical characteristics of the space (Type), the primary function and professional utilizing the space (Application/End-User), and the underlying business model of the facility (Ownership Model). This detailed segmentation is crucial for understanding demand patterns, optimizing facility design, and developing targeted marketing strategies for both tenant acquisition and real estate investment. The differentiation by Type, such as between Single Suites designed for individual operators and Multi-Room Suites targeting small collaborations, reflects varying tenant needs concerning space requirement and team size. Analyzing these segments provides actionable insights into capital allocation and regional development strategies, ensuring that the supply matches the localized professional demand profile, particularly concerning density and specialization.

The segmentation by Application, encompassing categories like Hair Stylists, Estheticians, and Massage Therapists, clearly indicates the diversity of service provision within these facilities and allows facility operators to tailor their location and amenity packages accordingly. For instance, locations prioritizing estheticians may require enhanced plumbing and specialized lighting, while those focusing on massage therapists need superior soundproofing and tranquil environments. Furthermore, the Ownership Model segmentation, differentiating between Franchise, Independent Operator, and Corporate-Owned structures, reveals the dominant forces shaping market structure, stability, and speed of expansion. Franchise models offer rapid growth and standardized quality, while Corporate-Owned operations often leverage deeper capital pools for high-end, strategic urban developments, indicating varied operational risk profiles and investor appeal.

Understanding the interplay between these segments is vital for competitive positioning. For instance, a Franchise model expanding into a secondary market might prioritize Single Suites tailored for general Hair Stylists (due to universal demand), whereas a Corporate-Owned entity in a prime metropolitan area might focus on high-end Multi-Room Suites geared toward specialized Estheticians who require larger footprints and clinical-grade amenities. This granular market view allows investors and developers to identify areas of unmet demand and deploy capital efficiently, minimizing vacancy rates and maximizing the revenue per suite. The growing consumer trend towards wellness is particularly influencing the expansion of segments catering to massage and specialized therapeutic services.

- List all key segments in bullet format

- Type:

- Single Suite (Standard one-person operation)

- Double Suite (Accommodating two professionals or one professional with an assistant)

- Multi-Room Suite (Larger space suitable for multiple services or small team collaboration)

- Application/End-User:

- Hair Stylists and Colorists

- Estheticians and Skin Care Specialists

- Massage Therapists and Wellness Practitioners

- Nail Technicians and Manicurists/Pedicurists

- Other Wellness Professionals (e.g., Microblading, Tattoo Artists, Physical Therapists)

- Ownership Model:

- Franchise Model

- Independent Operator Model

- Corporate-Owned Model

Value Chain Analysis For Salon and Spa Suite Market

The Value Chain of the Salon and Spa Suite Market begins with the Upstream activities centered on real estate acquisition, site selection, and the specialized construction or renovation required to convert standard commercial space into functional, leasable suites. This initial phase involves complex negotiations with landlords or property developers, detailed architectural planning to incorporate essential infrastructure like extensive plumbing, specialized electrical wiring, and soundproofing, and the procurement of high-quality, professional-grade fixtures, cabinetry, and security systems. Efficiency in the upstream segment directly determines the initial investment cost and the long-term operational viability of the suite facility. Strong partnerships with commercial real estate brokers specializing in retail conversion and construction firms adept at high-density, small-space commercial interiors are critical for cost containment and rapid deployment.

The Midstream phase is dominated by the Salon and Spa Suite management company—the primary market player. Their core activities involve marketing the facility, recruiting and screening prospective independent professional tenants, establishing leasing agreements, managing facility operations (utilities, common area maintenance, security), and, increasingly, providing tenant support services such as centralized booking technology platforms and educational resources. This phase is characterized by intensive customer relationship management (CRM) and facility maintenance, ensuring high occupancy rates and low tenant turnover, which are the fundamental metrics of success for this business model. Effective midstream management transforms a commercial asset into a high-yield, recurring-revenue business.

Downstream activities involve the professional tenant and the ultimate consumer. The distribution channel is primarily direct, where the professional utilizes the leased suite to provide services directly to their client base. Indirect channels may exist where the suite operator partners with product suppliers or technology providers who offer services or goods to the professional tenants, adding value to the lease agreement and creating ancillary revenue streams. The professional's success (measured by client base growth and profitability) directly reinforces the stability of the entire value chain, as successful tenants are retained tenants. The client experience, therefore, is the final determinant of value, emphasizing the need for pristine, professional, and private environments within the suites.

Salon and Spa Suite Market Potential Customers

The primary cohort of potential customers for the Salon and Spa Suite Market consists overwhelmingly of skilled, licensed independent beauty and wellness professionals seeking to transition from traditional employment models to self-employment without the substantial financial risk and administrative burden associated with owning a full-scale salon or spa. These individuals, often mid-career or senior professionals with established clienteles, are primarily motivated by the desire for complete operational autonomy, including setting their own pricing, managing their own schedules, selecting their preferred professional product lines, and designing their workspace to reflect their personal brand identity. They value the ability to capture 100% of the service revenue, moving away from commission splits that significantly reduce their earnings potential in conventional settings. This demographic values flexibility, privacy, and control over their immediate business environment.

A secondary but rapidly growing segment includes new professionals or those relocating who seek a structured, low-overhead environment to launch or restart their business. For this group, the suite model acts as a vital incubator, providing immediate access to a professional space, often coupled with supportive business infrastructure (e.g., shared laundry facilities, communal reception areas, and centralized marketing exposure) that reduces the administrative complexity of starting out. This segment highly values the immediate access to utilities and high-end finishes that would be prohibitively expensive to install independently, allowing them to focus almost exclusively on service provision and client acquisition, thereby accelerating their path to profitability.

Furthermore, the market also serves specialized professionals, such as medical estheticians or niche practitioners (e.g., specialized lash artists or scalp micro-pigmentation experts), who require highly specific, secure, and often clinically clean environments that traditional salon settings often cannot provide. These specialists are willing to pay a premium for suites that offer enhanced security, specific power requirements, and regulatory compliance features necessary for their advanced services. Facility owners target these potential customers by customizing suite build-outs to meet niche demands, ensuring maximum space utilization and securing long-term, high-value leases from stable, specialized businesses that cater to high-net-worth clientele.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $10.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sola Salons, Phenix Salon Suites, Salon Lofts, My Salon Suite, Image Studios 360, Amazing Lash Studio, Salon Republic, Suite Management Group, Indie Salons, Mattison Avenue Salon Suites, The Salon Plaza, Salon Secrets, Salons by JC, Studio Salons, Elite Salon Suites, Beauty Suites, Premier Salon Suites, Lux Salon Suites, Salon Suites International, Salon Centric Suites |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Salon and Spa Suite Market Key Technology Landscape

The technology landscape supporting the Salon and Spa Suite Market is rapidly evolving from basic operational tools to comprehensive, integrated digital ecosystems that enhance both the tenant's business efficiency and the facility operator's management capabilities. The foundation of this landscape rests on robust property management software (PMS) tailored specifically for high-volume leasing of micro-commercial units, handling complex billing structures, lease tracking, and centralized communication. Beyond facility management, the critical differentiating technologies are client-facing solutions. Professionals within suites rely heavily on specialized Customer Relationship Management (CRM) and scheduling software, such as Vagaro, Square Appointments, or customized proprietary platforms provided by the suite operators, which enable seamless online booking, automated confirmations, point-of-sale (POS) integration, and secure client data management—all essential for maximizing profitability in an independent setting. The reliance on mobile-optimized platforms is paramount, enabling business management directly from a smartphone or tablet.

Further technological advancements center on access control, security, and facility automation. Smart access systems utilizing key fobs, mobile applications, or biometric recognition provide secure, 24/7 access to tenants while tracking entry logs for security purposes, significantly enhancing the professional nature of the environment. Integrated security systems, including high-definition surveillance in common areas and individual suite locking mechanisms, reassure tenants and safeguard valuable equipment and retail inventory. Furthermore, there is an increasing adoption of IoT (Internet of Things) devices for environmental control, allowing tenants to manage lighting, HVAC, and even background music within their individual suite via a centralized application, optimizing the client experience and managing utility costs effectively for the facility operator.

The strategic deployment of these technologies is a major competitive differentiator. Leading suite operators invest heavily in proprietary technology stacks that go beyond basic functionality, offering data analytics dashboards to tenants, personalized business coaching based on performance metrics, and seamless integration with external financial and marketing tools. This focus on "tech-enabled entrepreneurship" ensures that the suite model remains attractive to highly skilled professionals who seek operational sophistication without the capital investment usually required. Future technology developments are expected to focus on AI-driven personalization for clients and enhanced augmented reality (AR) tools for virtual suite customization during the leasing process, further streamlining operations and tenant acquisition.

Regional Highlights

- Highlight key countries or regions and their market relevance

- North America (Dominant Market): The United States constitutes the largest and most mature market globally, serving as the benchmark for operational models, franchise expansion, and technology integration. The market's maturity is characterized by high penetration rates in major metropolitan areas (e.g., Dallas, Los Angeles, Atlanta) and a rapid expansion into affluent suburban corridors. Key drivers include a highly entrepreneurial culture among beauty professionals and favorable real estate availability for conversion. Canada is also experiencing significant expansion, focusing on dense urban markets like Toronto and Vancouver, where high commercial rents make the suite model a financially attractive alternative for independent professionals. The region excels in offering diverse suite formats and comprehensive business support systems.

- Europe (Rapid Growth Market): European market penetration is accelerating, particularly in Western economies like the United Kingdom, Germany, and France. Growth is driven by the increasing professionalization of the beauty industry and a shift in consumer demand towards private, boutique services. The UK market is highly competitive, adapting the US franchise model to stricter building regulations and diverse historical building structures. Germany's focus is on high-quality, specialized suites catering to medical esthetics and advanced hair care. Challenges include complex labor laws governing independent contractors, requiring careful legal structuring of leasing agreements, but the opportunity for scaling remains immense as the concept gains broader acceptance.

- Asia Pacific (Emerging Opportunity): The APAC region, driven by strong economic growth and rapidly increasing disposable income, represents the largest long-term growth opportunity. Initial focus is on luxury and high-end suites in tier-one cities such as Seoul, Singapore, and Shanghai, targeting professionals specializing in high-demand services like anti-aging treatments and advanced cosmetic procedures. The market entrance strategy often involves joint ventures with local real estate developers to secure prime locations. While the concept is nascent, the high population density and cultural emphasis on personal grooming predict eventual mass adoption, though unique challenges related to cultural preferences for open vs. private service environments must be addressed in facility design.

- Latin America (Development Phase): The market is in the early development phase, concentrated primarily in economic hubs like Brazil (São Paulo) and Mexico (Mexico City). Growth is spurred by economic volatility that pushes skilled professionals toward self-employment and the need for standardized, professional spaces. Investment risk is higher, requiring robust security measures and strong local partnerships, but the underlying demand for low-cost, high-autonomy business ownership is very strong. Initial successes often focus on niche segments like hair extensions and specialized cosmetic artistry, capitalizing on localized beauty trends.

- Middle East and Africa (Niche & Luxury): This region exhibits a polarized market dynamic. The Gulf Cooperation Council (GCC) countries show demand for ultra-luxury, female-only suites catering to high-net-worth clientele and culturally sensitive service delivery. Investment is high-capital, focusing on superior finishes and integrated technology. The African market is primarily characterized by micro-enterprise solutions in high-growth urban centers, focusing on providing affordable, secure, and professional infrastructure to empower local entrepreneurs, particularly in countries like South Africa and Nigeria, where demand for formalized beauty services is rapidly rising.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Salon and Spa Suite Market.- Sola Salons

- Phenix Salon Suites

- Salon Lofts

- My Salon Suite

- Image Studios 360

- Salon Republic

- Suite Management Group

- Indie Salons

- Mattison Avenue Salon Suites

- The Salon Plaza

- Salons by JC

- Studio Salons

- Elite Salon Suites

- Premier Salon Suites

- Lux Salon Suites

- Beauty Suites

- Salon Secrets

- Salon Suites International

- Salon Centric Suites

- Amazing Lash Studio (Operating specialized suite models)

Frequently Asked Questions

Analyze common user questions about the Salon and Spa Suite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary financial advantage of renting a salon suite over working in a traditional salon?

The primary financial advantage is achieving 100% of the service revenue. Unlike commission-based models where professionals earn 40-60% of service costs, suite renters pay a fixed weekly or monthly lease fee, retaining all income from services and retail sales, thereby maximizing profitability and providing predictable expense budgeting for independent business operations.

How does the salon suite market address the need for business support and professional development for solo operators?

Leading suite operators provide crucial business support through shared amenities (laundry, utilities, common areas), integrated technology platforms for booking and payments, and centralized security. Many facilities also offer specialized educational seminars, mentorship programs, and retail purchasing networks to enhance the professional development and operational success of their independent tenants.

What are the key differences between Franchise-owned and Corporate-owned salon suite facilities?

Franchise-owned facilities operate under a standardized brand and operational manual, prioritizing rapid, scalable expansion and consistent quality. Corporate-owned facilities, conversely, typically have deeper capital resources, allowing for strategic, high-end developments in prime urban locations, often focusing on customized, boutique offerings and greater internal control over property management and tenant selection.

Which technology tools are considered essential for a professional operating within a modern salon suite?

Essential technology tools include mobile-optimized Customer Relationship Management (CRM) and scheduling software for streamlined online booking, integrated Point-of-Sale (POS) systems for secure transactions, and smart access control systems (key fobs or mobile apps) for 24/7 personalized security and entry management into their private business space.

What is the driving factor behind the geographic expansion of the Salon and Spa Suite Market into secondary cities?

The driving factor is the reduced market saturation and lower commercial real estate acquisition costs in secondary cities compared to primary urban centers. This expansion strategy taps into a significant latent demand from skilled professionals seeking independence outside of hyper-competitive metro areas, offering suite operators favorable returns on investment and less tenant acquisition friction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager