Sampling Scoop Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433830 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Sampling Scoop Market Size

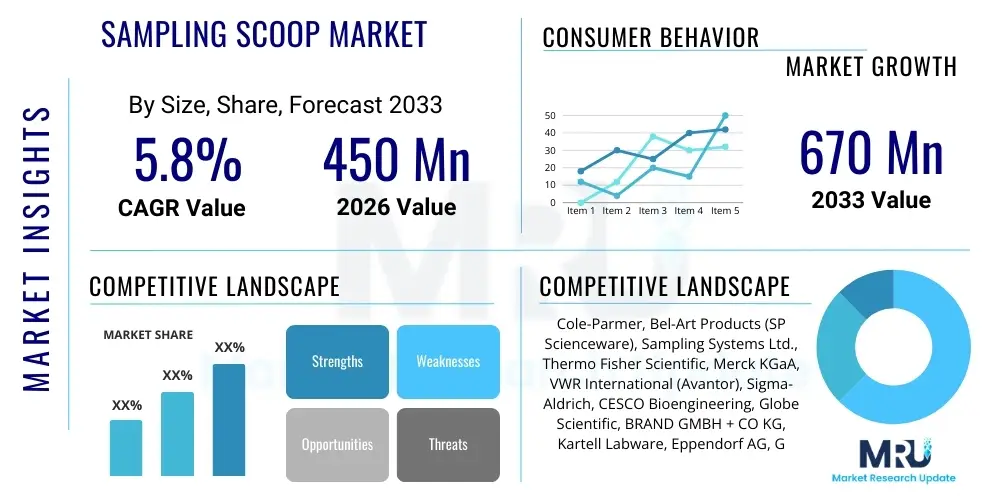

The Sampling Scoop Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033.

Sampling Scoop Market introduction

The Sampling Scoop Market encompasses the global trade and utilization of specialized instruments designed for the accurate and contamination-free collection of bulk materials, powders, granules, and liquids from containers, drums, or production lines. Sampling scoops are critical tools in various industries, including pharmaceuticals, food and beverage, chemicals, and cosmetics, where precise material handling and adherence to strict quality control standards are non-negotiable. These instruments vary widely in design, material composition (e.g., stainless steel, polypropylene, HDPE), and capacity, catering to diverse application requirements such as sterile sampling in cleanrooms or heavy-duty chemical handling.

The primary function of a sampling scoop is to extract a representative sample from a larger batch, ensuring the sample accurately reflects the characteristics of the entire volume for subsequent testing or analysis. Major applications span across raw material inspection, quality assurance testing, blending processes verification, and regulatory compliance monitoring. Benefits derived from using specialized sampling scoops include enhanced sample integrity, minimization of cross-contamination risks, improved worker safety through ergonomic designs, and standardization of sampling procedures, which is vital for achieving reproducible results in accredited laboratories.

Driving factors contributing to the market's robust growth include the increasing stringency of regulatory guidelines (such as FDA and GMP standards) necessitating documented and standardized sampling procedures across manufacturing sectors. Furthermore, the rapid expansion of the pharmaceutical and biotechnology industries, particularly in emerging economies, alongside heightened consumer awareness regarding food safety and quality, propels the demand for reliable and certified sampling tools. The market is also benefiting from technological advancements focusing on single-use, sterile, and traceably manufactured scoops that reduce cleaning validation costs and enhance operational efficiency.

Sampling Scoop Market Executive Summary

The Sampling Scoop Market is poised for steady growth, driven primarily by evolving global quality standards and increased production capacity in regulated industries. Business trends indicate a strong shift toward disposable and single-use sampling tools, particularly those manufactured in certified cleanroom environments, to eliminate the risk associated with cleaning validation and potential sample cross-contamination. Key market players are focusing heavily on product innovation, offering specialized features such as extended handles, tamper-proof designs, and material certification (e.g., FDA-approved and detectable plastics) to capture market share in high-value segments like pharmaceuticals and specialized chemicals. Strategic acquisitions and partnerships aimed at strengthening distribution networks in APAC and Latin America are also noticeable business strategies.

Regional trends reveal that North America and Europe currently dominate the market due to the presence of large, well-established pharmaceutical and food processing industries characterized by rigorous regulatory oversight. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period, fueled by rapid industrialization, expanding domestic drug manufacturing, and increasing foreign direct investment in manufacturing infrastructure. Regulatory harmonization efforts across regions are driving demand for globally consistent sampling solutions. The Middle East and Africa (MEA) market, though smaller, is showing promising growth, particularly in the petrochemical and nascent pharmaceutical sectors.

In terms of segment trends, the Plastic (Polypropylene and HDPE) material segment holds the largest volume share, primarily due to the versatility, cost-effectiveness, and disposable nature of these materials, crucial for applications requiring sterility and minimal processing. Conversely, the Stainless Steel segment maintains dominance in terms of value, owing to its durability, reusability, resistance to harsh chemicals, and necessity in high-temperature or heavy-duty industrial settings. Application-wise, the Pharmaceutical segment remains the primary revenue generator, demanding the highest quality standards, followed closely by the Food and Beverage sector, which prioritizes food-grade compliance and large-capacity sampling for quality control checks of bulk ingredients.

AI Impact Analysis on Sampling Scoop Market

Common user questions regarding the impact of AI on the Sampling Scoop Market center around whether automation, facilitated by AI and machine learning (ML), will render manual sampling tools obsolete, and how AI can optimize the sampling process itself. Users express concerns about the transition from traditional labor-intensive sampling to robotic systems and seek clarity on how AI-driven predictive maintenance and supply chain logistics might affect the procurement and inventory management of sampling equipment. The key themes revolve around efficiency gains, predictive quality control, and the integration of physical sampling data into broader AI analytical frameworks. Although AI does not directly manufacture or use the scoop itself, it fundamentally influences the need, frequency, location, and documentation requirements of the physical sampling event.

AI’s influence is primarily felt upstream in process optimization and quality prediction, and downstream in data management. AI algorithms, leveraging sensor data and process parameters (e.g., temperature, pressure, flow rates), can precisely determine the statistically optimal moments and locations for manual or automated sampling. This predictive capacity reduces unnecessary sampling events, thereby optimizing the usage of scoops (especially high-value sterile disposable ones) and reducing labor costs. Furthermore, AI-powered image recognition systems can be deployed to verify the cleanliness and integrity of reusable stainless steel scoops post-cleaning, enhancing quality assurance beyond human inspection capabilities and reducing regulatory risk.

In logistics, AI and ML models optimize inventory management for consumable scoops, predicting demand fluctuations based on production schedules and historical usage patterns, ensuring just-in-time supply and preventing stockouts, particularly for specialized, custom-manufactured scoops. Overall, while the physical act of scooping remains, AI integration drives a shift towards smarter, less frequent, and highly targeted sampling protocols, necessitating higher quality, traceable, and sometimes custom-engineered sampling apparatus that can feed reliable physical data into advanced computational models.

- AI optimizes sampling frequency and location based on predictive process monitoring, potentially reducing the total number of manual sampling events.

- Machine learning improves inventory management and supply chain predictability for disposable sampling scoops.

- AI-driven vision systems enhance quality control verification for reusable scoop cleanliness and material integrity.

- Integration platforms use AI to cross-reference physical sample data (collected via the scoop) with continuous digital sensor data for comprehensive quality analysis.

- Advanced analytics define the required precision and material specifications for sampling tools, driving demand toward higher-grade, certified equipment.

DRO & Impact Forces Of Sampling Scoop Market

The Sampling Scoop Market is significantly influenced by a complex interplay of stringent regulatory demands (Driver), the high cost associated with single-use sterile products (Restraint), and the expanding scope of applications in personalized medicine and niche industrial processing (Opportunity). These factors, together with competitive intensity and technological maturity, create powerful impact forces shaping market direction. Regulatory adherence, particularly in the pharmaceutical and biotech sectors, mandates the use of certified, non-contaminating, and traceable sampling apparatus, compelling manufacturers to invest heavily in quality control and documentation, thereby sustaining premium pricing and continuous demand for specialized scoops. The push towards sustainable manufacturing practices also impacts material choices, introducing both opportunities and restraints related to recyclability and material certifications.

Drivers: A primary driver is the accelerating focus on global food and drug safety standards, compelling manufacturers worldwide to implement Good Manufacturing Practice (GMP) and Good Laboratory Practice (GLP) protocols, which rely heavily on standardized and verifiable sampling techniques. Secondly, the rapid expansion of biotechnology and complex chemical processing requires specialized, inert, and non-reactive sampling tools, often made of high-grade stainless steel or PTFE, driving value growth. The convenience and risk reduction offered by disposable, sterile sampling scoops are also major stimulants, allowing companies to bypass expensive and time-consuming cleaning validation processes, particularly in highly regulated sterile environments. Increased industrial production across key emerging economies also drives baseline volume demand.

Restraints: Significant restraints include the substantial environmental concerns and waste generated by the growing trend of single-use plastic scoops, prompting regulatory bodies and industries to explore sustainable alternatives, which currently possess higher manufacturing costs. Another restraint is the operational challenge of ensuring proper training for personnel regarding correct sampling techniques; improper usage, regardless of the scoop quality, can lead to inaccurate results and costly batch rejections. Furthermore, the market faces price pressure in highly commoditized segments where standard plastic scoops are utilized, leading to lower profitability margins for basic products. The upfront investment required for specialized, high-capacity, automated sampling systems also limits immediate adoption among smaller enterprises.

Opportunities: Opportunities lie in the development of innovative, traceable sampling tools featuring integrated smart technology, such as RFID or QR codes, facilitating automated documentation and chain of custody tracking, catering to Industry 4.0 standards. The growing demand for customized sampling solutions tailored to specific non-standard materials (e.g., highly abrasive powders or highly viscous liquids) offers specialized market niches. Furthermore, the expansion of the environmental testing sector, focused on monitoring water, soil, and air quality using standardized sampling tools, represents a robust, untapped application area, particularly in developing nations facing rapid industrialization and environmental scrutiny.

Segmentation Analysis

The Sampling Scoop Market is comprehensively segmented based on material type, capacity, application, and end-use, allowing for a detailed analysis of market dynamics and targeted strategic planning. Understanding these segments is crucial as material choice directly impacts regulatory compliance, chemical resistance, and sterilization methods, while application dictates the required capacity and handle length. The segmentation reflects the diverse needs ranging from small-volume, sterile sampling in clinical laboratories to large-volume, heavy-duty collection in chemical manufacturing plants. Material properties, such as resistance to corrosion and cleanability, define the premium versus commodity status within the market, profoundly affecting pricing structures and competitive strategies across geographical regions.

The Material segment is the most crucial differentiator, separating expensive reusable stainless steel products, favored for durability and chemical inertness in robust industrial settings, from cost-effective disposable plastics (HDPE, PP), which dominate applications requiring strict sterility control like biotech and high-purity pharmaceutical sampling. Capacity segmentation addresses operational requirements; smaller scoops are ideal for expensive or toxic raw material sampling, ensuring minimal material loss, whereas large scoops are essential for bulk food ingredient or chemical batch sampling where high throughput is required. Application segmentation highlights the pharmaceutical industry's leading revenue contribution due to strict quality controls, contrasted with the volume demand from the Food & Beverage sector.

- By Material:

- Stainless Steel (304, 316 Grade)

- Plastic (Polypropylene (PP), High-Density Polyethylene (HDPE), Polystyrene (PS))

- Others (Aluminum, Polytetrafluoroethylene (PTFE))

- By Capacity:

- Small (Up to 50 ml)

- Medium (50 ml - 200 ml)

- Large (Above 200 ml)

- By Application:

- Pharmaceutical and Biotechnology

- Food and Beverage Processing

- Chemical and Petrochemical Industry

- Cosmetic and Personal Care

- Environmental Testing

- Academic and Research Institutions

- By End-Use:

- Manufacturing Facilities (Production Lines)

- Quality Control (QC) Laboratories

- Research & Development (R&D) Departments

Value Chain Analysis For Sampling Scoop Market

The value chain for the Sampling Scoop Market begins with the upstream sourcing of raw materials, primarily high-grade stainless steel alloys (e.g., 316L for sterile environments) and specialty polymer resins (HDPE, PP). Manufacturers must secure reliable and certified suppliers, as the quality and grade of the raw material directly determine the scoop's suitability for regulated applications, such as those requiring FDA approval or EU food contact compliance. Manufacturing involves precision molding for plastics or complex stamping, welding, and polishing for stainless steel, often requiring specialized cleanroom facilities (especially for sterile, single-use scoops). Efficiency in manufacturing processes, including validation and certification, represents a major value-add activity in this stage, leading to differentiated products.

The distribution channel represents a critical bottleneck and value-creation point, utilizing both direct and indirect models. Direct sales are common for highly specialized or customized sampling tools sold directly to major pharmaceutical and chemical corporations requiring technical consultation and regulatory documentation. However, the majority of standardized and commodity scoops are distributed indirectly through a global network of specialized laboratory equipment distributors, catalog houses (e.g., VWR, Fisher Scientific), and regional chemical supply companies. These distributors handle inventory, logistics, and localized customer support, leveraging strong relationships with end-users in laboratories and QC departments.

The downstream analysis focuses on the end-users—laboratories and production facilities—who utilize the scoops for critical quality control and research functions. The value captured downstream is related to the integration of the sampling process into the overall quality assurance workflow. Customers demand full traceability, material certification, and ergonomic design to maximize efficiency and minimize operational risk. After use, the value chain concludes with disposal (for plastics, often requiring specialized waste management) or cleaning/sterilization (for reusable stainless steel scoops), which adds operational cost but extends the product lifespan and maintains material integrity.

Sampling Scoop Market Potential Customers

Potential customers for sampling scoops are defined by their stringent need for precise, representative, and contamination-free material handling across various industrial and research settings. The most critical segment is the pharmaceutical and biotechnology industry, encompassing drug manufacturers, contract manufacturing organizations (CMOs), and vaccine producers. These customers rely on sterile, traceable, and GMP-compliant scoops for sampling everything from raw active pharmaceutical ingredients (APIs) and excipients to in-process material and final product quality checks, making them the highest-value end-users demanding premium, certified products.

Another large volume-driven customer segment is the Food and Beverage industry, including large-scale processors of grains, dairy, snacks, and ingredients, as well as bottling plants. These entities require robust, food-grade scoops (often color-coded for zone control) to ensure ingredient quality, detect contaminants, and comply with food safety standards like HACCP. Their usage often involves larger capacity scoops for handling bulk materials. The chemical and petrochemical sectors constitute the third major customer group, requiring highly chemical-resistant and durable scoops, usually made of stainless steel or specialized PTFE, for handling corrosive or hazardous substances during production and blending processes.

Furthermore, academic and governmental research institutions, environmental testing laboratories, and cosmetic manufacturers represent specialized customer bases. Environmental labs use scoops for standardized soil and sediment collection, while cosmetic companies require clean, specific tools for sampling pigments, powders, and creams to maintain product integrity and safety. In essence, any organization involved in processing bulk materials where quality assurance and regulatory compliance are mandated constitutes a potential customer for specialized sampling scoops.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cole-Parmer, Bel-Art Products (SP Scienceware), Sampling Systems Ltd., Thermo Fisher Scientific, Merck KGaA, VWR International (Avantor), Sigma-Aldrich, CESCO Bioengineering, Globe Scientific, BRAND GMBH + CO KG, Kartell Labware, Eppendorf AG, Gilson, Inc., Sarstedt AG & Co. KG, Heathrow Scientific, Dynalon Labware, Mettler-Toledo, Troemner LLC, Qorpak, Justrite Mfg. Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sampling Scoop Market Key Technology Landscape

The technology landscape in the Sampling Scoop Market is primarily focused on material science advancements, sterilization techniques, and the integration of traceability features, rather than complex machinery. A key technological trend is the development of ultra-high molecular weight polyethylene (UHMWPE) and specialized polymer blends that offer enhanced chemical resistance and durability, bridging the gap between standard plastics and stainless steel for certain applications. For stainless steel scoops, advanced polishing and electro-polishing techniques are crucial, ensuring smooth, crevice-free surfaces that minimize material residue and facilitate easier, validated cleaning, which is essential for GMP compliance and preventing cross-contamination.

Sterilization technology is paramount, especially for disposable products destined for pharmaceutical and biotech sterile environments. This includes certified Gamma Irradiation or Electron Beam (E-beam) sterilization processes, which require specialized manufacturing and packaging in ISO Class cleanrooms to guarantee sterility assurance levels (SAL). This technological requirement significantly elevates the barrier to entry for manufacturers in the sterile segment. Furthermore, detectable plastics (often containing metallic fillers) represent a crucial safety technology, particularly in the Food and Beverage sector, where the accidental inclusion of plastic pieces can be detected by standard metal detection systems on the production line, enhancing overall product safety.

Traceability technologies, such as laser etching of unique serialization numbers, RFID tagging, or integration of barcoding, are increasingly standard for specialized and high-value reusable scoops. These technologies enable digital tracking of the scoop’s usage history, sterilization cycles, and calibration data, supporting stringent audit trails required by regulatory bodies. The future technology landscape points toward integrating predictive maintenance indicators into sampling protocols, possibly requiring specialized scoop designs compatible with robotic handling systems for complete automated process sampling.

Regional Highlights

Regional dynamics within the Sampling Scoop Market reflect varying levels of industrial maturity, regulatory stringency, and consumption patterns across the globe. North America and Europe, collectively, represent the dominant revenue contributors, characterized by stringent regulatory environments imposed by bodies like the FDA and EMA. This regulatory pressure necessitates consistent investment in certified, high-quality, and often single-use sampling equipment in the highly lucrative pharmaceutical and biotechnology sectors. Market saturation, however, is relatively higher compared to emerging regions, leading to slower, but stable, growth driven by innovation and replacement cycles.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth trajectory, primarily due to large-scale infrastructure investments in pharmaceutical manufacturing (especially generics and biosimilars in India and China), booming food processing industries, and rapid industrialization in Southeast Asian nations. APAC manufacturers are increasingly shifting from basic, low-cost sampling methods to international quality standards, thereby fueling significant demand for both bulk disposable scoops and specialized stainless steel tools. Investment in local manufacturing capabilities for sampling equipment is also rising in this region to meet escalating demand.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging markets with strong potential. LATAM growth is primarily tied to expanding domestic food and beverage production and nascent pharmaceutical industries, focusing initially on cost-effective plastic scoops but gradually moving toward certified stainless steel as quality standards improve. MEA exhibits strong demand driven by the petrochemical industry's need for durable sampling tools and regulatory development in rapidly growing regional pharmaceutical hubs like the UAE and Saudi Arabia, necessitating standardized, professional sampling apparatus.

- North America (USA, Canada): Market leader driven by strict FDA regulations, high concentration of R&D, and substantial adoption of single-use, sterile sampling technology in biotech.

- Europe (Germany, UK, France): High demand for premium, reusable stainless steel scoops and strong regulatory compliance (EMA, GMP). Focus on sustainable and environmentally compliant materials.

- Asia Pacific (China, India, Japan): Highest growth region fueled by expanding pharmaceutical manufacturing base, increasing food safety standards, and rising industrial chemical production. Price sensitivity remains a factor in certain sub-segments.

- Latin America: Stable growth projected, driven by expansion in the food processing sector and increasing investment in quality control across various industries.

- Middle East and Africa (MEA): Growth centered on petrochemical and emerging pharmaceutical sectors, demanding durable and chemically resistant sampling tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sampling Scoop Market.- Cole-Parmer

- Bel-Art Products (SP Scienceware)

- Sampling Systems Ltd.

- Thermo Fisher Scientific

- Merck KGaA

- VWR International (Avantor)

- Sigma-Aldrich

- CESCO Bioengineering

- Globe Scientific

- BRAND GMBH + CO KG

- Kartell Labware

- Eppendorf AG

- Gilson, Inc.

- Sarstedt AG & Co. KG

- Heathrow Scientific

- Dynalon Labware

- Mettler-Toledo

- Troemner LLC

- Qorpak

- Justrite Mfg. Co.

Frequently Asked Questions

Analyze common user questions about the Sampling Scoop market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are essential for pharmaceutical-grade sampling scoops?

Pharmaceutical-grade sampling scoops primarily utilize high-grade 316L stainless steel for reusable applications due to its superior corrosion resistance and ease of validated cleaning, or sterile, certified Polypropylene (PP) and HDPE plastics for single-use, contamination-sensitive sampling.

Why are single-use sampling scoops gaining market share?

Single-use scoops eliminate the extensive cost and regulatory burden associated with cleaning validation in GMP environments, ensuring zero risk of cross-contamination between batches, which significantly enhances operational safety and compliance in biotech and sterile drug manufacturing.

How does capacity segmentation influence sampling scoop selection?

Capacity directly relates to the batch size and material value. Small capacity scoops (up to 50 ml) are preferred for expensive APIs or toxic chemicals to minimize material waste, while large capacity scoops (over 200 ml) are used for bulk quality control of raw ingredients in the food and chemical processing industries.

What role does traceability technology play in the sampling market?

Traceability, often implemented via laser-etched serial numbers or RFID tags, ensures the chain of custody for the sample and the tool. This documentation satisfies regulatory auditors by providing a clear history of the scoop's usage, sterilization status, and compliance verification.

Which regional market shows the highest growth potential for sampling scoops?

The Asia Pacific (APAC) region demonstrates the highest growth potential, driven by significant increases in pharmaceutical production capacity, harmonization of regulatory standards toward global quality benchmarks, and robust expansion across the food and chemical sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager