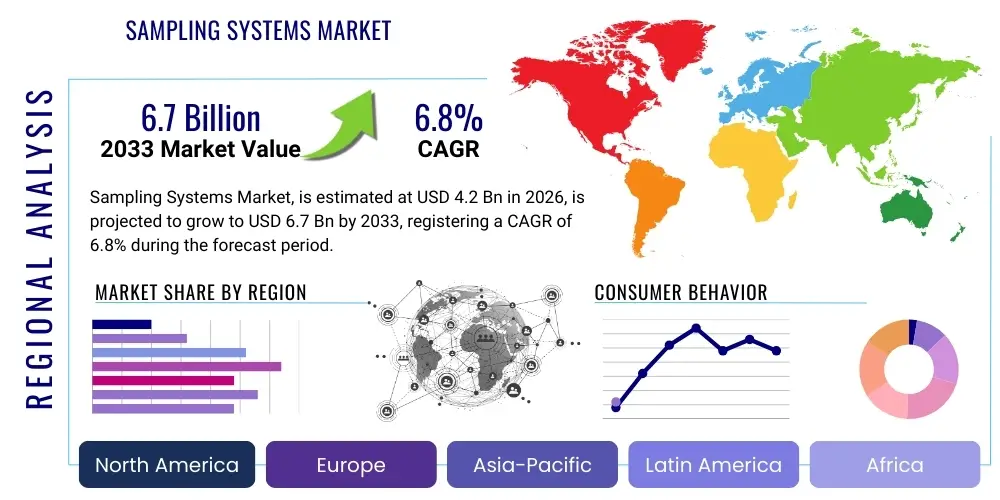

Sampling Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438024 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Sampling Systems Market Size

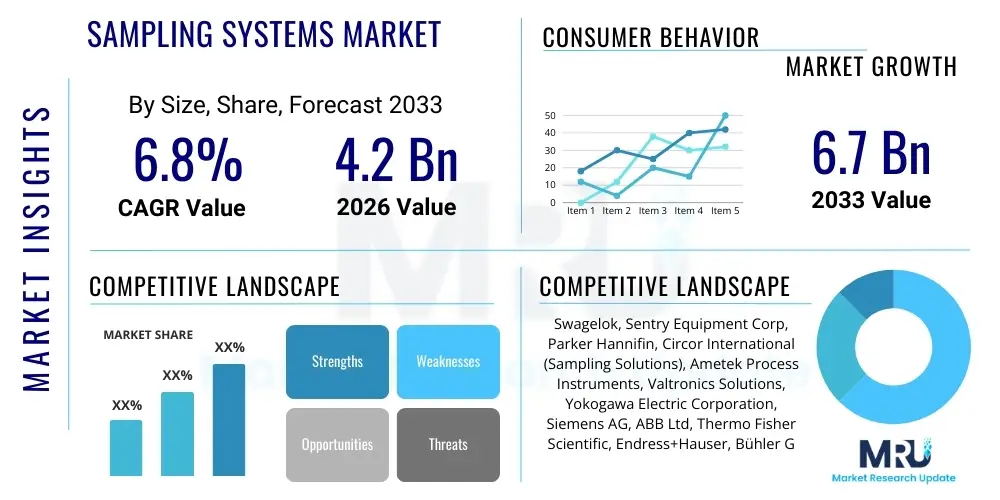

The Sampling Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Sampling Systems Market introduction

The Sampling Systems Market encompasses specialized equipment and integrated solutions designed to extract representative samples from a process stream, environment, or bulk material for subsequent laboratory or online analysis. These systems are pivotal across industries like oil and gas, pharmaceuticals, chemicals, and water treatment, ensuring quality control, safety, regulatory compliance, and process optimization. The primary product function involves conditioning the sample (pressure, temperature, filtration) to make it suitable for a specific analyzer, thereby bridging the gap between the process line and the analytical instrument. Major applications include continuous emission monitoring (CEMs), hydrocarbon custody transfer, beverage quality testing, and chemical composition verification.

The core benefit derived from advanced sampling systems is the provision of accurate, timely, and repeatable data, which is essential for maximizing operational efficiency and minimizing product quality variances. By ensuring the sample presented to the analyzer truly reflects the bulk material, operators can make critical, informed decisions regarding process adjustments. The inherent challenges of handling volatile, high-pressure, or abrasive materials necessitate robust and often customized sampling solutions that can withstand harsh industrial environments while maintaining sample integrity. This reliability is a key differentiator in a market driven by stringent regulatory frameworks.

Driving factors in the market are prominently linked to the global push towards industrial automation, the rising adoption of process analytical technology (PAT) in pharmaceuticals and petrochemicals, and increasing environmental mandates requiring precise emissions monitoring. Furthermore, the growth in complex refining and chemical processes demands more sophisticated and automated sampling solutions capable of dealing with multi-phase fluids and reactive substances. The integration of modular components and intelligent diagnostics is currently transforming the architecture of these traditional systems, making them easier to maintain and more reliable for continuous operation.

Sampling Systems Market Executive Summary

The Sampling Systems Market is witnessing a strong transition driven by Industry 4.0 principles, emphasizing automation, modularity, and predictive maintenance. Business trends indicate a shift towards fully integrated, pre-engineered solutions rather than component-based sales, offering users reduced installation time and guaranteed system performance. Key companies are focusing on developing certified systems for hazardous areas (e.g., ATEX, IECEx) and incorporating self-cleaning and self-validating capabilities to enhance reliability. Strategic partnerships between sampling component manufacturers and process analyzer vendors are becoming commonplace, aimed at delivering holistic, skid-mounted analytical packages. Furthermore, sustainability initiatives are accelerating the demand for sampling systems used in carbon capture and storage (CCS) and advanced water recycling processes.

Regional trends highlight the rapid expansion of demand in the Asia Pacific (APAC) region, fueled by massive infrastructure projects, burgeoning chemical and power generation sectors, and evolving environmental regulations, particularly in China and India. North America and Europe remain mature markets, characterized by high adoption rates of advanced, high-precision sampling systems primarily driven by strict safety standards (OSHA, EPA) and the necessity for continuous process optimization in established petrochemical and pharmaceutical hubs. Meanwhile, Latin America and the Middle East and Africa (MEA) are seeing robust growth tied to upstream and downstream oil and gas investments, where accurate custody transfer sampling is paramount for commercial transactions.

Segment trends reveal that automated sampling systems are rapidly displacing manual methods, especially in highly regulated sectors where sample contamination or operator exposure risks are high. The Liquid segment, particularly within the petrochemical and food and beverage industries, dominates the market share, but the Gas segment is projected to show the highest CAGR, driven by increasing regulatory focus on fugitive emissions and natural gas quality monitoring. By component, the Analytical Components segment (including filters, probes, and regulators) remains essential, but the Software and Service segment is experiencing significant growth as end-users seek managed services, remote diagnostics, and data integration platforms to maximize system uptime and performance predictability.

AI Impact Analysis on Sampling Systems Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) will enhance the accuracy, automation, and predictive capabilities of traditional sampling systems. Common user questions revolve around AI’s role in optimizing sample selection timing, diagnosing component failures before they occur, reducing unnecessary consumption of buffer chemicals, and validating sample integrity in real-time. The primary concern is often the integration complexity and the requirement for specialized data scientists to maintain such advanced systems. Users expect AI to translate historical process and sampling data into actionable insights, moving sampling from a reactive necessity to a predictive component of the entire process analytical workflow, thereby ensuring higher system availability and lower operational expenditure.

The integration of AI fundamentally transforms sampling systems from passive data providers into intelligent, self-optimizing units. AI algorithms are increasingly being deployed to analyze multivariate process data (pressure, flow, temperature, historical analyzer results) to determine the optimal moment and rate for sample extraction, drastically reducing lag time and improving the representativeness of the sample. This predictive capability significantly extends the maintenance intervals for filters, cooling systems, and pumps by forecasting potential clogs or failures based on trending operational parameters, thus enhancing overall system reliability (OEE). Furthermore, AI models are essential for automating the calibration verification processes and minimizing human intervention, crucial in hazardous or remote operational environments.

Moreover, AI contributes heavily to data quality and compliance. By utilizing ML models to detect anomalies or drift in the measured sample composition against historical or expected process norms, the system can instantly flag potential issues in the sampling loop, such as bypass failure or insufficient conditioning. This instantaneous validation minimizes the risk of analyzing a non-representative sample, which could lead to costly production errors or regulatory violations. As sampling systems generate vast amounts of data regarding operational performance and sample quality, AI platforms are necessary tools for processing this data, correlating it with plant-wide performance metrics, and ultimately closing the control loop more effectively.

- AI-driven Predictive Maintenance: Forecasts component wear and filter clogging, maximizing uptime.

- Automated Sample Validation: Uses ML to verify sample integrity against historical process data in real-time.

- Optimization of Extraction Timing: Dynamically adjusts sampling frequency based on process variability and analyzer needs.

- Enhanced Data Correlation: Links sampling data directly to process control systems for smarter loop closure.

- Reduced Operational Complexity: Automates calibration and troubleshooting procedures, lowering reliance on expert field technicians.

DRO & Impact Forces Of Sampling Systems Market

The Sampling Systems Market expansion is predominantly driven by increasing global mandates for environmental protection and worker safety, necessitating precise and continuous process monitoring. The stringent requirement for sample representativeness in high-value industries like custody transfer (oil and gas) and pharmaceutical production (validation) further propels the adoption of highly reliable and automated systems. However, the market faces significant restraints, chiefly the high initial capital investment required for complex, customized analytical skids and the lack of standardization across various international regulatory bodies, complicating global deployment. Opportunities lie mainly in integrating sampling technology with IoT and cloud platforms for remote diagnostics and in expanding applications into emerging sectors like green hydrogen production and bioprocessing. The resultant impact forces strongly favor market growth, leveraging technological advancements to overcome cost and complexity barriers.

Drivers for market growth are rooted in operational efficiency and compliance. The global expansion of refining capacity and chemical manufacturing requires real-time composition analysis to prevent costly downtime and ensure product specifications are met consistently. Specifically, the adoption of Process Analytical Technology (PAT) in the pharmaceutical industry mandates validated, automated sampling systems to achieve quality-by-design (QbD) principles. Furthermore, aging industrial infrastructure in mature markets often necessitates the replacement of legacy, manual sampling systems with modern, enclosed, and highly automated alternatives to mitigate fugitive emissions and minimize operator exposure to hazardous substances, complying with increasingly strict EPA and regional standards.

Restraints primarily concern economic barriers and technical challenges. Specialized sampling systems designed for high-pressure or high-temperature applications require components made of exotic alloys, leading to elevated procurement costs. This financial burden is often prohibitive for smaller facilities or developing regions. Additionally, the technical complexity involved in maintaining representative samples from multi-phase fluids (gas/liquid/solid mixtures) requires sophisticated engineering and highly trained personnel, which presents a staffing and expertise bottleneck globally. The lack of universal interoperability standards between sampling components, analyzers, and control systems further slows widespread adoption and integration into existing plant architecture.

Opportunities center on technological convergence and emerging industrial applications. The movement toward modular, standardized sampling probes and systems allows for quicker deployment and easier maintenance, lowering the total cost of ownership (TCO). Integrating cloud-based monitoring and remote diagnostic tools provides a massive opportunity for service providers to offer subscription-based performance monitoring and predictive maintenance contracts. New market applications, such as the growing bioethanol and wastewater treatment sectors, which require highly specialized chemical and microbiological sampling, offer fertile ground for innovative product development and market penetration beyond traditional oil and gas applications.

Segmentation Analysis

The Sampling Systems Market is comprehensively segmented based on the phase of the sampled material (Liquid, Gas, Multiphase), the degree of automation (Manual and Automated), the component type (Analytical and Non-Analytical), and the end-user industry. This segmentation provides a granular view of market dynamics, revealing that automation is the fastest-growing segment across nearly all end-user verticals, driven by the imperative for real-time, error-free data. The Liquid segment currently holds the largest revenue share due to its widespread use in hydrocarbon processing and general chemical production, but the technological focus is shifting toward solving the complex challenges associated with multiphase sampling for upstream oil and gas applications and complex chemical mixtures.

Component segmentation highlights the critical role of pre-conditioning equipment—filters, pressure regulators, vaporizers, and heat exchangers—which are collectively referred to as Non-Analytical Components. While these components may not perform the final analysis, their proper functioning is absolutely crucial for the accuracy of the entire analytical system, driving demand for high-reliability, long-life parts. The End-user segmentation underscores the dominance of the Oil & Gas sector, which demands the highest accuracy due to custody transfer requirements, followed closely by the Chemical and Petrochemical industries, which require continuous quality monitoring to ensure process safety and product specifications. The Pharmaceuticals segment is rapidly increasing its market footprint due to stringent regulatory validation requirements.

Geographically, market segmentation reflects disparities in regulatory environments and industrial maturity. North America and Europe lead in the adoption of high-end, bespoke automated systems, whereas APAC focuses on volume-driven deployment across new manufacturing facilities. The trend toward modular design simplifies the customization process across these diverse geographical needs. Understanding these segment trends is vital for manufacturers focusing their R&D investments, particularly into developing compact, robust, and highly integrated analytical skids suitable for both onshore and offshore applications, adhering to different regional climate and safety standards.

- By Phase: Liquid Sampling Systems, Gas Sampling Systems, Multiphase Sampling Systems, Solid Sampling Systems.

- By Type of Automation: Manual Sampling Systems, Automated Sampling Systems, Semi-Automated Sampling Systems.

- By Component: Analytical Components (e.g., sample probes, fast loops, stream selectors), Non-Analytical Components (e.g., filters, regulators, coolers, vaporizers, pumps, tubing).

- By End-User Industry: Oil and Gas (Upstream, Midstream, Downstream/Refining), Chemical and Petrochemical, Pharmaceutical and Biotechnology, Water and Wastewater Treatment, Power Generation, Food and Beverage, Metals and Mining.

Value Chain Analysis For Sampling Systems Market

The value chain for the Sampling Systems Market begins with upstream activities focused on the design and manufacturing of highly specialized components, including corrosion-resistant materials (e.g., stainless steel, specialty alloys), high-precision valves, regulators, and advanced filtration media. Component suppliers, often niche market leaders, provide these critical parts to System Integrators and Original Equipment Manufacturers (OEMs). Research and development costs are significant at this stage, focusing on miniaturization, material compatibility, and extreme operating condition resilience. The competitiveness in the upstream segment relies heavily on maintaining rigorous quality certifications and supply chain reliability.

Midstream activities are dominated by System Integrators and OEMs who perform the complex task of designing, assembling, and testing the final sampling skid or system. This stage involves engineering the sample conditioning process specific to the end-user's application, ensuring that the sample is delivered to the analytical instrument at the correct pressure, temperature, and phase. Distribution channels are generally categorized into Direct and Indirect. Direct distribution involves OEMs selling high-value, customized systems directly to large end-users (e.g., major petrochemical complexes) through dedicated sales engineers and specialized field service teams, ensuring technical alignment and post-sales support.

Downstream analysis involves the final installation, commissioning, maintenance, and ongoing service. Indirect channels utilize specialized third-party distributors and local engineering firms, particularly for standardized or smaller volume systems, providing wider geographical reach. A critical element of the downstream segment is after-sales service, including spare parts supply, calibration services, and analytical system optimization consulting. The profitability of the downstream segment is increasingly driven by long-term service contracts and digital offerings, such as remote diagnostics platforms, which secure recurring revenue streams and enhance customer loyalty by guaranteeing high system availability.

Sampling Systems Market Potential Customers

Potential customers for sampling systems are predominantly found in industries characterized by continuous manufacturing processes, stringent regulatory oversight, and high-value products where slight deviations in composition can lead to significant financial or safety consequences. The largest buyer segment is the Oil & Gas sector, encompassing crude oil refineries, natural gas processing plants, and pipeline operators requiring accurate custody transfer measurements and continuous environmental emissions monitoring. These entities purchase complex, highly integrated, and durable sampling skids designed for extreme environments and critical financial transactions.

The Chemical and Petrochemical industries form the second major customer group, utilizing sampling systems for reactor control, raw material verification, and final product quality assurance (e.g., polymers, specialty chemicals). These customers often require systems capable of handling corrosive, toxic, or highly reactive substances, demanding systems engineered with advanced material science. Pharmaceutical and Biotechnology companies represent a rapidly growing, high-value customer base, driven by the necessity for fully documented, validated, and automated sampling protocols to comply with Good Manufacturing Practices (GMP) and Quality by Design (QbD) initiatives for active pharmaceutical ingredients (APIs).

Other significant end-users include Power Generation facilities (especially those utilizing fossil fuels, requiring flue gas and water quality sampling), Municipal Water and Wastewater Treatment plants (critical for public health and regulatory discharge compliance), and the Food and Beverage sector (focused on quality control, blending accuracy, and hygiene monitoring). The common characteristic among all these potential customers is the requirement for representative data that reduces risk, ensures product consistency, and supports regulatory reporting. Procurement decisions are typically centralized and heavily influenced by regulatory compliance officers, process engineers, and health, safety, and environmental (HSE) managers, favoring vendors who offer certified, reliable, and low-maintenance solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swagelok, Sentry Equipment Corp, Parker Hannifin, Circor International (Sampling Solutions), Ametek Process Instruments, Valtronics Solutions, Yokogawa Electric Corporation, Siemens AG, ABB Ltd, Thermo Fisher Scientific, Endress+Hauser, Bühler Group, GE Analytical Instruments, Jiskoot, ProSys Sampling. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sampling Systems Market Key Technology Landscape

The technological landscape of the Sampling Systems Market is rapidly evolving, driven by the need for enhanced accuracy, reduced maintenance, and increased safety. A major technological trend is the shift towards modular, standardized components using "fast loop" and "close-coupled" designs. Fast loop systems are optimized to reduce time lag by rapidly circulating the sample from the process line to the analyzer and back, ensuring the analyzed sample truly reflects current process conditions. Close-coupled systems aim to minimize the length and complexity of the sample path, which is critical for reducing adsorption, condensation, or changes in sample composition before it reaches the analyzer. These architectural improvements significantly enhance the system’s responsiveness and overall reliability.

Another pivotal technology is the incorporation of advanced materials and micro-components. The increasing use of inert materials like PFA, PTFE, and specialized alloys is crucial for sampling highly corrosive or reactive chemical streams, preventing material degradation and sample contamination. Furthermore, miniaturization through Micro-Electro-Mechanical Systems (MEMS) technology is being explored to create smaller, more efficient filters, pressure regulators, and flow sensors integrated directly into the sample probe, bringing sample conditioning closer to the source. This trend supports the development of compact, portable, and distributed sampling units, especially valuable in environmental monitoring and field testing applications, moving away from large, centralized analytical shelters.

Digitalization forms the backbone of modern sampling systems. Smart probes and components are equipped with integrated sensors and communication capabilities (e.g., HART, Modbus) to provide continuous diagnostic data on operational health, flow rates, temperatures, and pressures within the sampling loop. This data is leveraged for predictive maintenance and remote monitoring, often integrated into the plant's Distributed Control System (DCS) or cloud platforms. Emerging technologies include the use of non-invasive or non-contact sampling techniques, particularly for solids and highly viscous fluids, reducing the risk of component clogging and increasing operational lifespan, albeit adoption remains challenging in certain high-pressure environments.

Regional Highlights

Regional dynamics illustrate varying maturity levels and drivers across the globe. North America maintains a strong market presence, driven by strict environmental regulations (EPA mandates for CEMs) and the significant capital expenditure in the petrochemical and shale gas sectors. The region's focus is on implementing high-end, customized automated systems that comply with demanding safety standards, particularly in explosive atmospheres (e.g., Class I, Division 1/Zone 0 requirements). Key investment areas include upgrading infrastructure for natural gas quality analysis and investing heavily in advanced sampling solutions for LNG production and export terminals.

Europe is characterized by an emphasis on sustainability and digitalization. The region is a leader in adopting sampling systems for wastewater recycling, industrial process water quality, and renewable energy projects. Strict EU directives on emissions monitoring (e.g., Industrial Emissions Directive) drive demand for highly accurate and validated continuous sampling systems. Furthermore, Europe’s robust pharmaceutical and fine chemical industries prioritize the integration of sampling systems compatible with Process Analytical Technology (PAT) frameworks, demanding superior validation documentation and modular design for quick system modifications.

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This accelerated growth is primarily attributed to rapid industrialization, expansion of manufacturing capacity (especially chemicals and refining) in countries like China, India, and Southeast Asia, and the increasing implementation of stricter environmental laws mirroring Western standards. While the market initially favored cost-effective, manual systems, the trend is shifting rapidly toward automated solutions to meet increasing safety concerns and to manage the quality control requirements of complex export-oriented manufacturing operations. Infrastructure development, particularly in power and water utilities, further boosts the foundational demand for reliable sampling equipment.

- North America: Focus on petrochemical efficiency, high safety standards, and LNG production.

- Europe: Leadership in environmental monitoring, pharmaceutical PAT adoption, and water treatment applications.

- Asia Pacific (APAC): Highest growth, driven by massive industrial expansion, refining capacity additions, and regulatory evolution.

- Middle East & Africa (MEA): Strong demand linked to upstream and downstream oil and gas investment, focused on custody transfer and hydrocarbon processing.

- Latin America: Growing market supported by expansion in mining, petrochemicals, and basic chemical production, driven by resource exploitation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sampling Systems Market.- Swagelok

- Sentry Equipment Corp

- Parker Hannifin

- Circor International (Sampling Solutions)

- Ametek Process Instruments

- Valtronics Solutions

- Yokogawa Electric Corporation

- Siemens AG

- ABB Ltd

- Thermo Fisher Scientific

- Endress+Hauser

- Bühler Group

- GE Analytical Instruments

- Jiskoot

- ProSys Sampling

- Teledyne Analytical Instruments

- Servomex

- Hach Company

- Dopak Sampling Systems

- Welker, Inc.

Frequently Asked Questions

Analyze common user questions about the Sampling Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for Automated Sampling Systems?

The primary drivers are stringent regulatory mandates concerning environmental emissions and worker safety, coupled with the need for high-accuracy, real-time data to optimize complex industrial processes (Industry 4.0), thus reducing operational errors associated with manual collection.

How does AI technology enhance the reliability and performance of modern sampling systems?

AI significantly enhances reliability through predictive maintenance, forecasting component failures before they occur. It improves performance by optimizing sample extraction timing based on process variability, ensuring the delivered sample is representative and reducing analyzer downtime.

Which end-user segment holds the largest market share for sampling systems globally?

The Oil and Gas segment holds the largest market share, predominantly due to the critical requirement for precise custody transfer measurement, rigorous environmental compliance, and the demanding operational environments of upstream and downstream facilities.

What is the main challenge associated with implementing multiphase sampling solutions?

The main challenge is maintaining sample representativeness while accurately measuring the flow rates and composition of gas, liquid, and solid fractions simultaneously under high pressure and temperature conditions, which requires highly complex separation and conditioning technology.

What are the critical non-analytical components necessary for effective sample conditioning?

Critical non-analytical components include highly efficient particulate filters, precise pressure and flow regulators, vaporizers, heat exchangers, and tubing materials chosen for corrosion resistance, all of which prepare the sample to the exact specification required by the downstream process analyzer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager