Sanctions Screening Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438313 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sanctions Screening Software Market Size

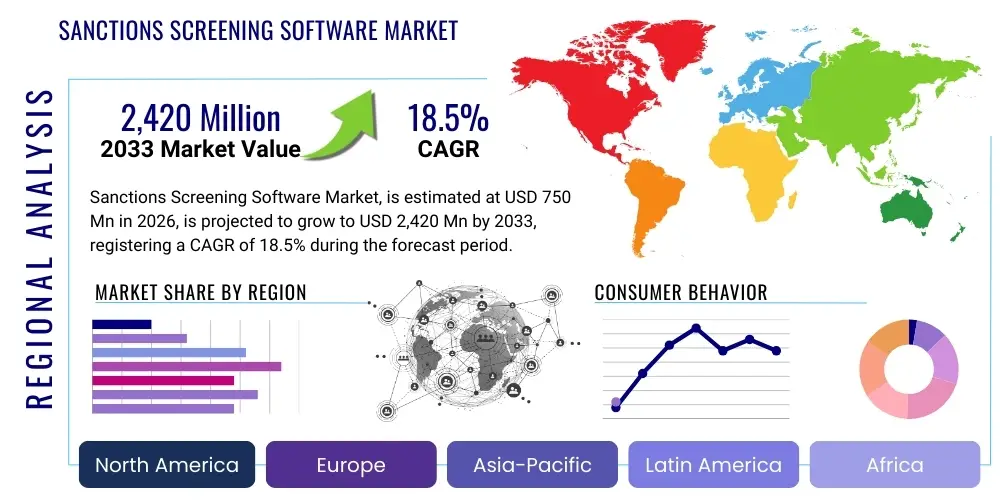

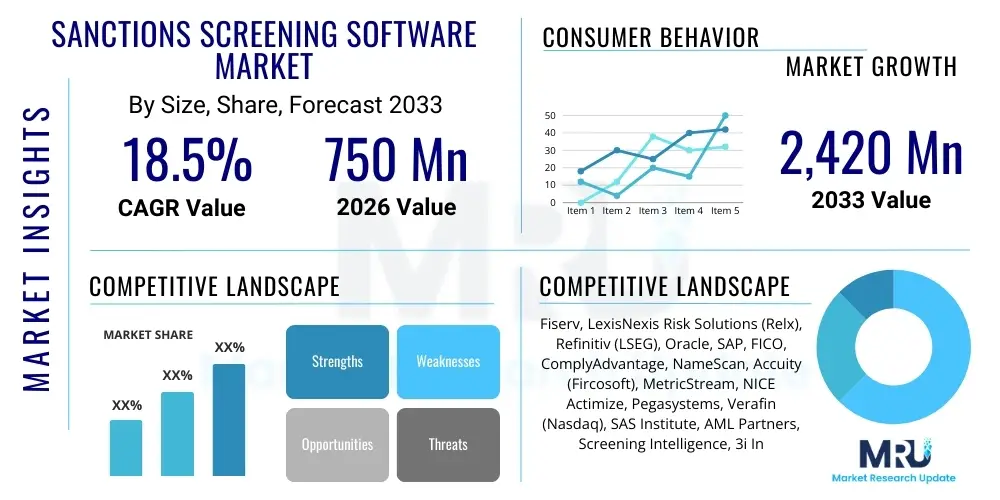

The Sanctions Screening Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 2,420 Million by the end of the forecast period in 2033.

Sanctions Screening Software Market introduction

The Sanctions Screening Software Market is fundamentally driven by the escalating complexity of global geopolitical landscapes and the rigorous enforcement of anti-money laundering (AML) and counter-terrorist financing (CTF) regulations worldwide. This essential software provides financial institutions, trading companies, and various corporate entities with automated tools necessary to verify customer identities, transaction counterparties, and ultimate beneficial owners against expansive, continuously updated global sanctions lists maintained by authoritative bodies such as the Office of Foreign Assets Control (OFAC), the European Union (EU), and the United Nations (UN). The primary objective is to prevent prohibited transactions, mitigate significant regulatory non-compliance risks, and avoid crippling financial penalties that can severely damage corporate reputations and operational stability.

Modern sanctions screening solutions have evolved significantly beyond simple name matching, integrating sophisticated technologies like Natural Language Processing (NLP) and Artificial Intelligence (AI) to handle phonetic variations, cultural name complexities, and large data volumes with unparalleled speed and precision. Key applications span across customer onboarding (Know Your Customer or KYC), real-time transaction monitoring, trade finance documentation verification, and periodic customer portfolio reassessment. The continuous influx of new, dynamic sanctions targets and the increasingly aggressive stance taken by global regulatory bodies necessitate highly adaptable, scalable, and API-driven software architectures that can integrate seamlessly into existing core banking systems and enterprise resource planning (ERP) platforms.

The core benefit derived from utilizing specialized sanctions screening software is the reduction of manual effort associated with compliance, significantly lowering the incidence of false positives, which traditionally consume considerable compliance department resources. Driving factors include the sheer volume of global trade and cross-border payments, the geopolitical strategy shifts leading to targeted sanctions imposition, and the proactive efforts by companies to adopt a risk-based approach (RBA) to compliance management, transforming compliance from a cost center into a strategic risk management function.

Sanctions Screening Software Market Executive Summary

The global Sanctions Screening Software Market is experiencing accelerated expansion, largely fueled by pervasive regulatory scrutiny and the geopolitical fragmentation observed across major economies. Key business trends indicate a strong pivot towards Software as a Service (SaaS) models, offering scalability and immediate list updates critical for real-time compliance, displacing traditional on-premise deployments which often lag in maintenance and data synchronization. Furthermore, the market is rapidly integrating advanced AI and machine learning (ML) capabilities to tackle the primary operational pain point: the high rate of false positives generated by legacy rule-based systems, thus improving screening accuracy and overall operational efficiency (Straight-Through Processing).

Regionally, North America and Europe maintain market dominance due to early adoption, stringent regulatory frameworks (e.g., AMLD6, FinCEN advisories), and the presence of major financial hubs. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily driven by rapid financial digitalization, the expansion of cross-border payment systems, and strengthening local regulatory requirements in jurisdictions like Singapore, Hong Kong, and India. The Middle East and Africa (MEA) are also emerging as significant growth centers, propelled by massive infrastructure investment, increased international trade flows, and the imperative to meet global anti-financial crime standards to attract foreign direct investment.

Segment trends highlight the critical role of transaction screening, which constitutes the largest segment by application, reflecting the constant regulatory demand for real-time risk assessment during payment processing. Deployment segmentation shows robust growth in the cloud-based sector, appealing particularly to smaller and medium-sized financial institutions (FIs) and burgeoning fintech companies seeking reduced capital expenditure and quicker implementation times. Among end-users, banks and non-banking financial institutions (NBFIs) remain the primary consumers, although the demand is notably increasing within the corporate sector, especially in high-risk industries such as trade finance, maritime shipping, and complex manufacturing supply chains, which require thorough third-party and vendor screening.

AI Impact Analysis on Sanctions Screening Software Market

Users frequently inquire about AI's capacity to reduce false positives, the cost implications of implementing machine learning models, and how AI can ensure compliance with rapidly changing sanctions lists without human intervention errors. Concerns often revolve around the explainability (XAI) and auditability of AI-driven decisions—a critical requirement in regulated environments—and whether smaller firms can afford these sophisticated solutions. The underlying user expectation is that AI must deliver a paradigm shift from reactive compliance to proactive risk identification, providing dynamic profiles of sanctioned entities and their networks rather than just static list matching. Users also seek clarification on whether AI can effectively screen complex, unstructured data sources like shipping manifests and trade documentation.

The key themes emerging from user concerns indicate a profound shift towards demanding intelligent automation for compliance workflows. Users expect AI tools to utilize sophisticated Natural Language Processing (NLP) to parse ambiguous names and addresses, differentiate between legitimate aliases and actual matches, and significantly lower the volume of alerts requiring manual review. Furthermore, there is a strong demand for AI-driven network analysis, allowing institutions to uncover complex ownership structures and hidden connections to sanctioned individuals or entities, moving beyond simple direct matches to sophisticated linkage discovery. The integration of graph databases powered by ML is becoming a prerequisite for effective due diligence in complex global environments.

In summary, AI is perceived as the indispensable technological catalyst transforming the sanctions screening market from a burdensome administrative task into an efficient, risk-mitigating operational function. The primary value proposition of AI and ML in this domain is enhancing accuracy, enabling real-time decision-making, ensuring continuous list integration, and providing a superior, transparent audit trail. The market is trending toward integrated compliance platforms where sanctions screening is merely one module within a broader AI-powered anti-financial crime ecosystem.

- AI-powered systems reduce False Positive Rates (FPR) by up to 60%, significantly optimizing compliance workload.

- Machine Learning models facilitate continuous screening list interpretation and rapid adaptation to new regulatory requirements.

- Natural Language Processing (NLP) enhances accuracy in screening unstructured data, including varying linguistic contexts and complex naming conventions.

- Graph database analytics, leveraging AI, enables the identification of concealed beneficial ownership and complex sanctions evasion networks.

- Predictive analytics allow institutions to anticipate potential sanctions risks based on geopolitical indicators and trade activity patterns.

DRO & Impact Forces Of Sanctions Screening Software Market

The market dynamics are defined by powerful regulatory drivers and geopolitical instability, tempered by significant implementation hurdles and complexity, while opportunities arise from technological evolution and underserved customer segments. The overriding impact force is the regulatory imperative: non-compliance with sanctions regimes results in astronomical fines, criminal charges, and lasting reputational damage, making investment in robust screening software mandatory rather than optional for any institution operating internationally. This external pressure ensures consistent market demand despite high initial setup costs and integration challenges.

Drivers: Stringent Global Regulatory Landscape and Escalating Geopolitical Risk are the primary drivers. The imposition of unilateral and multilateral sanctions by major global powers—often implemented rapidly and without extensive warning—necessitates agile, instantaneous screening capabilities. Furthermore, regulatory bodies consistently raise expectations regarding the depth and breadth of due diligence (e.g., insistence on ultimate beneficial ownership screening). The digitalization of finance, especially the proliferation of immediate payment schemes and decentralized ledger technology (DLT), mandates real-time screening capability, which only sophisticated software can deliver. This systemic requirement for speed and accuracy continuously pushes organizations to upgrade or replace legacy systems.

Restraints: The most significant restraints include the high initial capital expenditure (CAPEX) required for sophisticated solutions, the complexity of integrating new screening software with disparate legacy IT infrastructure common in older financial institutions, and the persistent challenge of managing false positives, even with advanced AI systems. Although AI reduces the rate, the sheer volume of global transactions ensures that manual review remains necessary, which requires substantial internal expertise. Additionally, data privacy concerns, particularly in regions with strict data localization laws (like GDPR and similar emerging frameworks), impose limitations on cross-border data processing required for global screening accuracy.

Opportunities: Major opportunities exist in developing cloud-native, API-first solutions targeting emerging markets (APAC, LATAM, MEA) where financial institutions are undergoing rapid modernization and prefer scalable SaaS models. The integration of screening tools into broader enterprise risk management (ERM) suites, providing a single pane of glass for all compliance risks, offers significant market expansion potential. Furthermore, niche opportunities are opening up within the non-financial sector, including e-commerce, virtual asset service providers (VASPs), and manufacturing supply chains, all of which now face heightened scrutiny regarding their counterparties and logistical routes.

Segmentation Analysis

The Sanctions Screening Software Market is segmented comprehensively based on Component, Deployment Type, Application, and End-User, reflecting the diverse needs and operational scales of global organizations attempting to meet compliance obligations. Analyzing these segments provides strategic insights into market maturity and growth vectors. Component segmentation differentiates between core software platforms and the essential services required for implementation, training, and ongoing managed screening processes. Deployment type analysis underscores the ongoing structural shift from traditional IT infrastructure to agile, subscription-based cloud environments.

Application segmentation reveals the varied operational touchpoints where screening is indispensable, with Customer Due Diligence (CDD) and Transaction Monitoring forming the critical pillars of regulatory defense. Transaction screening, particularly for high-frequency cross-border payments, represents the highest volume segment, necessitating robust real-time processing capabilities. Conversely, the segmentation by End-User clearly highlights the highly regulated financial services sector as the dominant consumer base, while simultaneously pointing to burgeoning adoption within specialized corporate environments that have complex supply chains or substantial international trade exposure.

The strategic focus remains on optimizing the screening workflow through technological integration across these segments. For instance, the combination of cloud deployment (scalability) and AI/ML component integration (accuracy) is particularly attractive to Tier-2 banks and fintechs. Understanding the granular demand across these axes allows vendors to tailor solutions—providing modular, lower-cost SaaS options for smaller entities focused primarily on customer onboarding, and providing robust, highly customizable enterprise platforms for large, geographically dispersed financial conglomerates requiring high-throughput transaction processing and centralized risk management.

- By Component:

- Software (Platform and APIs)

- Services (Managed Services, Integration, Consulting, Training)

- By Deployment Type:

- On-Premise

- Cloud-Based (SaaS)

- By Application:

- Customer Screening (KYC/CDD)

- Transaction Screening (Real-time Payments, SWIFT, ACH)

- Trade Finance Screening

- Periodic Review

- By End-User:

- Banking, Financial Services, and Insurance (BFSI)

- Non-Banking Financial Institutions (NBFIs)

- Government and Public Sector

- Trade and Retail

- E-commerce and Fintech

- Others (Healthcare, Maritime, Manufacturing)

- By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Value Chain Analysis For Sanctions Screening Software Market

The value chain for Sanctions Screening Software is complex, beginning with data sourcing and research, transitioning through software development and technological enhancement, culminating in implementation, deployment, and end-user support. Upstream activities are dominated by specialized data providers who meticulously aggregate, standardize, and maintain the complex global sanctions lists (OFAC, UN, EU, regional lists) and crucial Negative News/Politically Exposed Persons (PEP) databases. This data quality is paramount, as the accuracy of the final screening result directly depends on the integrity and timeliness of the underlying data feeds. Software vendors often invest heavily in partnerships or acquire these data sources to ensure continuous compliance and list hygiene.

Midstream activities involve core software development, where vendors integrate advanced technologies such as AI/ML, NLP, and fuzzy logic algorithms to create scalable, high-performance screening engines capable of handling vast volumes of data with minimal latency. Strategic differentiation at this stage often relies on the sophistication of the matching algorithms and the ability to reduce false positives effectively. Distribution channels are twofold: direct sales involving large, customized enterprise contracts often negotiated with Tier-1 financial institutions, and indirect sales leveraging system integrators (SIs), value-added resellers (VARs), and compliance consulting firms. The indirect channel is critical for reaching smaller institutions and organizations lacking specialized in-house IT expertise.

Downstream activities focus on deployment, integration, and ongoing client support, primarily targeting compliance officers and risk management teams within end-user organizations. Successful deployment requires deep integration with core banking systems, payment gateways, and KYC platforms, demanding highly skilled technical consultation. Direct interaction post-sale includes providing continuous updates reflecting new sanctions lists, maintenance services, and specialized training for compliance staff to accurately interpret and act upon alerts generated by the software. The shift to SaaS models has centralized much of the maintenance and update burden on the vendor, simplifying the downstream operational complexity for the end-user.

Sanctions Screening Software Market Potential Customers

The primary consumers and end-users of Sanctions Screening Software are institutions operating under strict financial and trade regulatory mandates. Financial institutions, particularly global and regional banks, remain the cornerstone of market demand, necessitated by their role in processing the majority of international payments, managing correspondent banking relationships, and maintaining large customer portfolios. Non-Banking Financial Institutions (NBFIs), including asset managers, hedge funds, insurance companies, and money service businesses (MSBs), are rapidly increasing their adoption rate as regulatory scrutiny extends deeper into the shadow banking sector.

Beyond traditional finance, the growth in fintech and payment processing companies represents a significant emerging customer base. These organizations, often built on modern, scalable architecture, seek cloud-native, API-driven screening solutions that can integrate quickly into proprietary digital platforms to ensure seamless compliance during high-velocity transactions and digital onboarding processes. Furthermore, any entity engaged in complex international trade, encompassing large manufacturing firms, commodity traders, and maritime logistics companies, are increasingly mandated or choosing to proactively screen their third-party suppliers, distributors, and vessels to mitigate risks associated with secondary sanctions and reputation harm.

Government agencies, public sector organizations, and large enterprises that handle grants, public funds, or manage international procurement processes also constitute important potential customers. The growing prevalence of targeted sanctions against specific sectors or state-owned enterprises means that due diligence is no longer confined solely to financial transactions but extends to procurement and contract management. Compliance managers, Chief Compliance Officers (CCOs), and heads of Anti-Money Laundering (AML) are the key buyers within these organizations, prioritizing solutions that offer auditability, integration flexibility, and demonstrable reductions in operational overhead.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 2,420 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiserv, LexisNexis Risk Solutions (Relx), Refinitiv (LSEG), Oracle, SAP, FICO, ComplyAdvantage, NameScan, Accuity (Fircosoft), MetricStream, NICE Actimize, Pegasystems, Verafin (Nasdaq), SAS Institute, AML Partners, Screening Intelligence, 3i Infotech, Dow Jones Risk & Compliance, BearingPoint, Wolters Kluwer Financial Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sanctions Screening Software Market Key Technology Landscape

The technological evolution within the sanctions screening domain is characterized by a shift towards intelligent, interoperable, and centralized platforms designed to handle massive data throughput and complex risk scenarios instantly. Central to this landscape is the adoption of highly modular, API-first architectures. These Application Programming Interfaces allow organizations to seamlessly integrate sanctions screening functionality directly into core operational systems—such as instant payment gateways, trade processing systems, and customer relationship management (CRM) platforms—without requiring extensive, disruptive overhauls. This focus on seamless integration supports the modern requirement for compliance checks to be invisible to the end customer while being instantaneous and comprehensive at the operational level.

Advanced data processing technologies are also defining the current landscape. Natural Language Processing (NLP) is critical for accurately matching names across various languages and dealing with unstructured data in supporting documentation, enhancing matching accuracy significantly beyond traditional algorithms. Furthermore, Machine Learning (ML) models are deployed for behavioral analytics and pattern recognition, helping to risk-score alerts and prioritize review queues, which drastically improves the efficiency of compliance teams by distinguishing truly suspicious activities from benign alerts. The use of graph databases, often overlaid with ML, is accelerating the ability of institutions to visualize and uncover complex network linkages, providing a holistic view of associated risks that static lists cannot offer.

Finally, the growing maturity of cloud-native infrastructure is paramount. Utilizing hyperscalers provides the necessary elastic scalability to handle peak processing loads (e.g., during mass transaction cycles or sudden sanctions list updates) while ensuring geographical redundancy and high availability. Technology leaders are focusing on developing unified Anti-Financial Crime (AFC) platforms, where sanctions screening functions are converged with AML monitoring, Know Your Customer (KYC) processes, and fraud detection capabilities. This centralization minimizes data redundancy, ensures consistency across compliance domains, and provides a single, unified view of customer risk, maximizing resource utilization and enhancing regulatory reporting capabilities.

Regional Highlights

- North America (NA): North America dominates the market, primarily due to the powerful regulatory oversight exerted by OFAC, FinCEN, and Canadian authorities. The United States, home to major global financial institutions and complex international trade flows, sets the global standard for sanctions compliance, creating an environment of continuous investment in high-end, technologically advanced screening solutions. The region is characterized by early and aggressive adoption of AI/ML in compliance technology, driven by the necessity to process enormous volumes of cross-border transactions efficiently while minimizing the risk of multi-million dollar regulatory fines. The mature IT infrastructure and the concentration of leading compliance technology vendors further solidify NA's leading position, with a strong preference for integrated enterprise solutions and advanced risk analytics.

- Europe: Europe represents a highly fragmented yet significant market, influenced by both EU-level sanctions directives and individual national authorities' enforcement actions. Driven by the recent implementation of AMLD6 and the inherent complexity arising from diverse linguistic and jurisdictional requirements, European institutions necessitate highly customizable software capable of adhering to varied sanctions regimes. The region shows robust adoption of cloud-based SaaS models, particularly among mid-tier banks and regional payment providers, seeking flexible, rapid deployment options. The emphasis is often placed on data governance and transparency, requiring software solutions with impeccable audit trails and explainable AI capabilities (XAI) to satisfy stringent EU regulatory demands, contributing to sustained market growth.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This rapid growth is underpinned by extensive financial market liberalization, increasing cross-border capital flows, and proactive efforts by countries like Singapore, Australia, and Hong Kong to strengthen their domestic anti-financial crime regimes to maintain their status as reputable global financial centers. The sheer diversity of languages and naming conventions in APAC drives strong demand for sophisticated NLP-driven screening solutions. Furthermore, the burgeoning fintech sector and the rapid digitalization of trade finance across Southeast Asia are major catalysts, favoring modern, easily scalable API-based screening technologies over traditional, resource-heavy on-premise deployments.

- Middle East and Africa (MEA): The MEA region is demonstrating impressive growth, stemming from aggressive modernization initiatives in the Gulf Cooperation Council (GCC) countries and increased global economic integration. Investment in sanctions screening software is viewed as crucial for improving transparency, aligning with Financial Action Task Force (FATF) guidelines, and safeguarding access to the international banking system. Geopolitical volatility in the broader region necessitates frequent and rapid updates to sanctions lists, making robust, reliable data feed management a primary software requirement. Governments and major financial institutions are investing heavily in establishing centralized compliance technology hubs, creating substantial opportunities for global vendors specializing in high-security, scalable enterprise solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sanctions Screening Software Market.- Fiserv

- LexisNexis Risk Solutions (Relx)

- Refinitiv (LSEG)

- Oracle Corporation

- SAP SE

- FICO

- ComplyAdvantage

- NameScan

- Accuity (Fircosoft)

- MetricStream

- NICE Actimize

- Pegasystems

- Verafin (Nasdaq)

- SAS Institute

- AML Partners

- Screening Intelligence

- 3i Infotech

- Dow Jones Risk & Compliance

- BearingPoint

- Wolters Kluwer Financial Services

Frequently Asked Questions

Analyze common user questions about the Sanctions Screening Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between sanctions screening and AML transaction monitoring?

Sanctions screening focuses on matching names and associated attributes (individuals, entities, locations) against mandated government lists (e.g., OFAC, UN) to prevent prohibited dealings. AML transaction monitoring uses behavioral rules and predictive models to detect unusual or suspicious financial activity patterns indicative of money laundering, often analyzing transactions that have already cleared initial sanctions checks.

How is cloud-based deployment changing the market dynamics for sanctions screening?

Cloud-based (SaaS) models are democratizing access to high-end screening technology, offering instant scalability, lower CAPEX, and guaranteed, automated real-time updates of sanctions lists. This shift allows smaller financial institutions and fintech startups to maintain the same level of compliance rigor as larger enterprises without the need for extensive in-house infrastructure management.

What is the biggest operational challenge addressed by integrating AI into sanctions screening?

The most significant operational challenge AI addresses is the high volume of False Positives (FPs). AI/ML algorithms, through fuzzy matching and contextual analysis (NLP), dramatically improve match accuracy, significantly reducing the alerts that require costly manual investigation by compliance officers, thereby optimizing resource allocation.

Which geographical region is expected to demonstrate the highest growth rate and why?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) due to rapid digital transformation, increasing global trade engagement, strengthening local regulatory enforcement, and a strong foundational shift towards modern, cloud-native compliance technology among emerging financial institutions.

Beyond financial institutions, which corporate sectors are showing increased demand for sanctions screening software?

Increased demand is notable in sectors heavily involved in international supply chains and trade logistics, including maritime shipping, large manufacturing firms, commodity traders, and specialized industries like Virtual Asset Service Providers (VASPs). These entities require screening to mitigate risks associated with secondary sanctions and complex third-party vendor relationships.

How does the fragmentation of global sanctions lists affect software providers?

The fragmentation—where numerous national and international bodies issue different, often overlapping, sanctions lists—requires software providers to possess sophisticated data aggregation and standardization engines. Their platforms must be capable of harmonizing these varied lists, ensuring comprehensive coverage and minimizing data redundancy while maintaining low latency for real-time risk scoring, increasing the complexity and value of specialist data service offerings within the software.

What role do APIs play in modern sanctions screening architecture?

APIs (Application Programming Interfaces) are fundamental to modern architecture, enabling seamless, instantaneous integration of the screening engine into existing core banking systems, payment gateways, and customer onboarding interfaces. This allows for transactional screening to occur in real-time without disrupting the customer journey, supporting the industry shift towards immediate payments and streamlined digital experiences.

What are the key differences between rules-based and machine learning-based screening engines?

Rules-based engines rely on static, pre-defined criteria (e.g., exact matches, threshold similarity scores) and generate alerts based on binary logic. Machine learning-based engines learn from historical data, dynamically adjust risk scoring based on context, behavior, and frequency, leading to far fewer false positives and better detection of novel evasion techniques, offering predictive and adaptive compliance capabilities.

What is the significance of the Ultimate Beneficial Owner (UBO) screening requirement?

UBO screening is significant because sanctioned entities often hide ownership through complex corporate structures. Screening software must penetrate multiple layers of ownership to verify the identity of the natural persons who ultimately control the funds or entity, a process increasingly mandated by global AML/CTF regulations to prevent sanctions evasion and illicit finance.

How does geopolitical instability influence market growth for sanctions screening software?

Geopolitical instability, such as military conflicts or major diplomatic disputes, directly results in the sudden and aggressive imposition of new sanctions regimes, often targeting entire sectors or specific individuals overnight. This volatility forces financial institutions to immediately invest in faster, more flexible software solutions capable of rapid deployment and instantaneous list integration, thereby accelerating market demand and technological innovation.

Why is ongoing training and support services a critical component segment?

Ongoing training and support services are critical because sanctions regulations and evasion techniques are constantly evolving. Compliance teams require continuous education on new sanctions lists, software updates, and advanced screening functionalities (like AI interpretations). Managed services often help organizations navigate integration complexity and ensure their software remains optimally configured for complex regulatory environments, maximizing the return on investment in the core platform.

What is the role of centralized compliance platforms in the current market trend?

Centralized platforms integrate various anti-financial crime functions (Sanctions Screening, AML, Fraud Detection, KYC) into a single, cohesive system. This integration eliminates data silos, ensures consistent risk assessment across all business lines, facilitates comprehensive regulatory reporting, and reduces overall operational costs by managing disparate risk functions holistically, representing the future direction of enterprise compliance technology architecture.

Are small and medium enterprises (SMEs) a viable target segment for vendors?

Yes, SMEs are becoming a significant and viable target segment, particularly those involved in cross-border trade or specialized financial activities. Vendors are increasingly addressing this segment by offering tailored, subscription-based SaaS solutions that are cost-effective, easy to implement via APIs, and scalable, fulfilling their regulatory obligation without requiring massive IT investment.

How do vendors manage the complexity of phonetic and character set variations in global names?

Vendors utilize advanced phonetic algorithms (like Soundex or Metaphone), fuzzy logic, and Natural Language Processing (NLP) specifically trained on multilingual and multicultural datasets. These technologies ensure that slight misspellings, transliterations, or variations in naming conventions (common in APAC and MEA regions) do not lead to false negatives, which is crucial for comprehensive screening accuracy.

What is the average latency requirement for real-time transaction screening systems?

For high-volume, real-time payment schemes (like immediate payment rails), the required latency for the screening process is typically measured in milliseconds (often under 500 ms). Low latency is non-negotiable, as delays directly impact transaction completion times and the overall efficiency of immediate payment systems, driving the need for optimized, high-performance computing infrastructure, often leveraging cloud elasticity.

How does the risk-based approach (RBA) impact the utilization of screening software?

RBA dictates that organizations allocate compliance resources proportional to the assessed risk level. Screening software supports RBA by providing granular risk scoring capabilities, allowing institutions to automatically triage alerts and subject high-risk customers or transactions to enhanced due diligence, optimizing resource deployment and demonstrating prudent governance to regulators.

What are "secondary sanctions" and how do they impact screening requirements?

Secondary sanctions are measures imposed by one country (notably the U.S.) on foreign entities or individuals for engaging in certain transactions with sanctioned parties, even if those transactions do not directly involve the imposing country's jurisdiction. This significantly broadens screening requirements, forcing global companies to screen all their third-party relationships—suppliers, customers, and partners—to avoid being cut off from the imposing country's financial system.

What is the role of explainability (XAI) in AI-driven sanctions compliance?

Explainable AI (XAI) is essential in highly regulated environments, requiring AI models to provide clear, auditable reasons for why a specific name or transaction triggered an alert or was cleared. Compliance officers must be able to articulate the decision logic to internal audit teams and external regulators, ensuring that the software remains compliant with due process and regulatory scrutiny requirements.

How do trade finance operations differ in their screening needs compared to retail banking?

Trade finance requires screening of far more complex, unstructured data, including shipping documents, invoices, and manifests, often requiring screening of vessels, ports, goods, and involved parties simultaneously. Retail banking primarily focuses on KYC/CDD of individuals and immediate payment screening. Trade finance solutions must integrate specialized modules for dual-use goods checks and vessel tracking against prohibited lists.

What constitutes an effective ongoing periodic review in sanctions screening?

An effective ongoing periodic review involves systematically re-screening the entire client base and associated parties against the latest comprehensive sanctions lists at defined intervals, or immediately following significant list updates. Modern software automates this process, ensuring that long-standing relationships remain compliant even as geopolitical sanctions regimes evolve rapidly over time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager