Sand Plant Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434659 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Sand Plant Machine Market Size

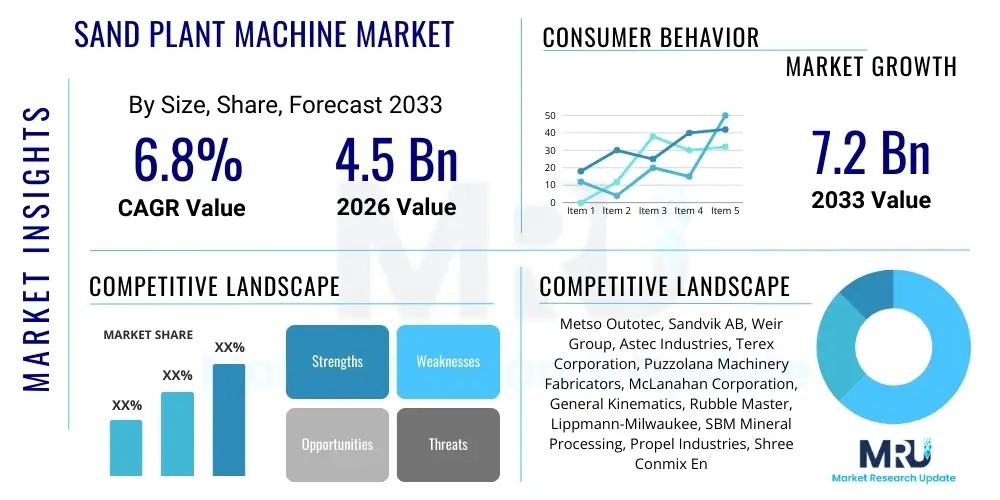

The Sand Plant Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

The robust growth trajectory of the Sand Plant Machine Market is fundamentally linked to the global acceleration in infrastructure development and the increasing regulatory pressure to conserve natural river sand resources. As governments worldwide allocate substantial budgets toward smart city projects, road networks, and high-speed rail, the demand for high-quality, consistently graded manufactured sand (M-Sand) becomes critical. This shift necessitates investment in advanced, automated sand processing plants capable of meeting stringent quality standards required for specialized applications like high-strength concrete and structural pre-cast elements. Furthermore, the market size is being inflated by replacement cycles in mature economies where older, less efficient equipment is being phased out in favor of modern, energy-efficient, and modular sand production systems.

Market expansion is also supported by technological advancements focusing on reducing water consumption and minimizing dust emissions, making the production process more sustainable and compliant with evolving environmental norms. Equipment manufacturers are developing integrated solutions that combine crushing, washing, and classifying processes into a single, cohesive system, thus optimizing operational expenditure and maximizing yield recovery from raw materials such as quarry aggregates, gravel, and construction and demolition (C&D) waste. The increased adoption of mobile and semi-mobile sand plants, particularly in remote or geographically challenging areas, contributes significantly to market volume, allowing infrastructure projects to source high-grade aggregate closer to the point of use, thereby minimizing logistical costs and environmental impact.

Sand Plant Machine Market introduction

The Sand Plant Machine Market encompasses highly engineered machinery and integrated systems designed for the production of manufactured sand (M-Sand) and high-quality fine aggregates used extensively in the construction industry. These sophisticated plants involve sequential processes including primary and secondary crushing of raw material, tertiary stage fine crushing (typically utilizing Vertical Shaft Impact or VSI crushers to achieve cubical shape), screening, washing, dewatering, and classification to ensure optimal particle size distribution and cleanliness. The core product offering includes VSI crushers, hydro-cyclone washing units, vibratory screens, sand recovery units, and sophisticated control systems that manage throughput and quality parameters in real-time. The primary applications span across civil engineering infrastructure projects, encompassing residential and commercial building construction, highways, airports, ports, and power plant construction, where precise aggregate specifications are paramount for structural integrity and durability.

Key benefits derived from utilizing specialized sand plant machinery include the production of superior quality, cubical-shaped sand, which significantly enhances the workability and strength characteristics of concrete compared to traditional, angular river sand. Furthermore, these plants enable sustainable resource management by efficiently utilizing quarry waste and C&D materials, transforming previously unusable rock fines into valuable construction input, thereby addressing resource scarcity and minimizing land pollution. Driving factors for the market include massive government investments in national infrastructure development programs, the global shortage and environmental ban on river sand mining in numerous jurisdictions, and the growing urbanization trend, particularly in Asia Pacific and Latin America, which demands reliable and high-volume aggregate supply chains. Regulatory shifts enforcing strict quality standards for concrete aggregates also compel contractors and producers to adopt advanced processing technology.

The market environment is characterized by intense competition focused on energy efficiency, automation capabilities, and the longevity of wear parts. Modern sand plants are increasingly incorporating sensors and monitoring systems to enable predictive maintenance, thereby reducing operational downtime and increasing overall equipment effectiveness (OEE). The integration of modular design principles allows for swift deployment and relocation of plants, offering flexibility to construction companies operating across multiple sites. The focus on zero-wastewater systems and dry sand processing further drives innovation, positioning the market as a critical enabler of sustainable and resilient construction practices globally.

Sand Plant Machine Market Executive Summary

The Sand Plant Machine Market is exhibiting vigorous expansion, driven predominantly by structural changes in global aggregate sourcing, migrating from ecologically detrimental natural sand extraction to technologically superior manufactured sand production. Business trends highlight a strong industry pivot toward fully automated, high-capacity VSI-based crushing and washing systems capable of delivering aggregates meeting P-200 specifications with precision. Consolidation among major original equipment manufacturers (OEMs) is noted, alongside aggressive pursuit of localized manufacturing hubs, particularly in high-demand regions like India and Southeast Asia, to mitigate supply chain disruptions and reduce import tariffs. Sustainability has become a core business differentiator, with demand spiking for water-recycling and energy-efficient machinery that minimizes the environmental footprint of aggregate production.

Regionally, the Asia Pacific (APAC) region maintains its dominance, spurred by unprecedented rates of urbanization and state-funded infrastructure mega-projects, especially in China, India, and Indonesia. North America and Europe demonstrate mature market characteristics, focusing on modernizing existing fleets, adopting advanced digital control systems, and increasing the use of recycled concrete and asphalt as input materials for sand production plants, driven by circular economy mandates. Latin America and the Middle East and Africa (MEA) present burgeoning growth opportunities, fueled by oil revenue diversification projects (MEA) and significant mining and infrastructure investments (Latin America), necessitating reliable sources of high-quality M-Sand for new construction initiatives.

Segmentation trends reveal substantial growth in the VSI Crusher segment due to its superior capability in shaping aggregates to highly desirable cubical forms, essential for high-performance concrete. Furthermore, the fixed/stationary plant segment, although requiring higher initial investment, leads in terms of market value due to its capacity to handle large-scale, long-term quarry operations. However, the mobile/portable plant segment is witnessing the fastest growth rate, addressing the flexibility needs of contract crushing companies and temporary construction sites. End-user analysis underscores the infrastructure sector—including roads, bridges, and dams—as the primary revenue generator, demanding robust, high-throughput sand processing solutions.

AI Impact Analysis on Sand Plant Machine Market

User queries regarding AI's influence in the Sand Plant Machine Market overwhelmingly focus on operational efficiency, resource optimization, and quality assurance mechanisms. Common concerns center on how Artificial Intelligence (AI) and Machine Learning (ML) can predict and prevent catastrophic equipment failures, optimize energy consumption across multi-stage crushing circuits, and autonomously adjust process parameters (like water flow, feed rate, and crusher gap settings) to maintain consistent aggregate quality irrespective of variations in raw material composition. Users seek quantifiable data on reduced downtime and minimized human intervention achieved through AI-driven process control, suggesting a strong market expectation for integrating prescriptive maintenance and cognitive process automation into next-generation sand plant machinery. Key concerns also revolve around the cybersecurity implications and the necessity for robust sensor data infrastructure to support complex AI models in harsh quarry environments.

The primary themes emerging from user inquiries indicate that the market views AI not merely as an add-on but as a fundamental disruptor capable of solving some of the industry’s most persistent challenges, notably inconsistent product quality and high maintenance costs associated with abrasive materials processing. Producers are keen on understanding how digital twins—virtual models of the physical sand plant—can be used for scenario planning, workforce training, and predictive optimization before making actual physical adjustments. There is a clear demand for AI-powered vision systems to instantaneously analyze particle size distribution and shape characteristics, providing closed-loop feedback to crushing and screening units. This demand reflects a strategic shift from reactive maintenance and manual quality checks to proactive, data-driven operational management, ensuring that every batch of M-Sand meets stringent industrial standards without relying solely on operator expertise.

Consequently, the integration of advanced algorithms is expected to redefine the competitive landscape, favoring OEMs that can embed proprietary AI systems into their machinery controls. These intelligent systems analyze patterns in vibration, temperature, acoustic emissions, and motor load data to identify potential failure modes hours or days in advance, thereby scheduling maintenance precisely when needed and maximizing operational uptime. This data-driven approach transforms plant management from a capital-intensive, high-risk operation into a more predictable, controllable, and profitable enterprise, justifying the high initial investment required for AI integration across crushing, washing, and conveying components.

- AI-driven Predictive Maintenance: Utilizing ML algorithms to analyze sensor data for anticipating component wear and failure, drastically reducing unscheduled downtime and optimizing maintenance schedules.

- Automated Quality Control: Implementing AI-powered vision systems and sensor fusion to instantly monitor aggregate gradation, particle shape, and moisture content, providing real-time process feedback.

- Energy Optimization: Machine Learning models adjusting crusher settings (e.g., choke feed, speed) and pump/fan speeds based on real-time throughput and raw material analysis to minimize specific energy consumption per ton of product.

- Digital Twin Technology: Creating virtual replicas of sand plants to simulate operational scenarios, optimize plant layout, and test process changes safely and efficiently before deployment.

- Cognitive Process Automation: Closed-loop control systems autonomously managing feed rates, water consumption, and washing cycles based on environmental factors and output specifications, improving consistency.

- Resource Efficiency Management: AI optimizing water usage in washing plants and enabling maximum recovery of fine sands, particularly critical in water-stressed regions.

DRO & Impact Forces Of Sand Plant Machine Market

The Sand Plant Machine Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively shape its growth trajectory and competitive dynamics. Primary drivers include the global infrastructure spending boom, particularly in emerging economies focused on rapid urbanization and modernization of transport links, creating immense demand for concrete aggregates. A significant structural driver is the worldwide shift from ecologically unsustainable natural river sand to manufactured sand, largely enforced by stringent environmental regulations and the exhaustion of natural reserves. The technological advancement of VSI crushers, which can produce high-quality, cubical aggregates essential for high-strength concrete, further fuels market demand, positioning M-Sand as a superior construction material.

Restraints hindering market growth primarily involve the substantial initial capital investment required for establishing a large-scale, automated sand plant, which acts as a barrier to entry for smaller enterprises. Furthermore, the operational challenges associated with running these plants, including high maintenance costs for wear parts due to the abrasive nature of raw materials, and the high energy consumption of crushing and screening processes, pose ongoing constraints. Stringent and often slow permitting processes for quarrying and processing operations, especially concerning water usage and waste disposal, further complicate and delay project timelines, limiting the speed of market expansion in certain regions. The fluctuating cost of energy, a significant operational expense, also creates unpredictability for end-users.

Opportunities for growth are abundant, particularly in the development and commercialization of modular and mobile sand plant solutions, offering flexibility and reduced setup time for temporary or remote construction projects. The increasing global focus on the circular economy presents a massive opportunity for processing Construction and Demolition (C&D) waste and slag into high-grade M-Sand, opening new revenue streams for producers while addressing waste management challenges. Furthermore, the continuing trend toward automation and digitalization, integrating IoT sensors, and AI-driven control systems, allows manufacturers to offer value-added services focused on maximized uptime, predictive maintenance, and optimized resource utilization, setting the stage for higher profitability and operational excellence across the sector. Addressing water scarcity through advanced water recycling and dry sand processing technologies also represents a crucial market opportunity, particularly in arid and semi-arid regions.

Segmentation Analysis

The Sand Plant Machine Market is comprehensively segmented based on product type, processing technology, capacity, mobility, and end-use application, providing a granular view of market dynamics and areas of high growth potential. Product segmentation distinguishes between primary components such as VSI Crushers, Jaw Crushers, Cone Crushers, Screening Machines, Sand Washing Plants, and Hydro-cyclone systems, reflecting the necessity of multi-stage processing for high-quality sand. Segmentation by mobility—fixed, semi-mobile, and mobile—is crucial, as it dictates the investment size and operational flexibility available to producers. High-throughput stationary plants dominate in terms of capacity value, while the rapidly growing mobile segment offers logistical advantages for construction contractors. End-user classification confirms the dominance of the infrastructure sector (roads, bridges, dams) over the residential and commercial building segment due to the stringent quality demands of large-scale public works. Detailed analysis of these segments helps stakeholders align investment strategies with areas of proven market demand and technological innovation.

- By Product Type:

- Vertical Shaft Impact (VSI) Crushers

- Cone Crushers (Secondary/Tertiary)

- Screening Machines (Vibratory Screens, Classifiers)

- Sand Washing and Dewatering Plants (Hydro-cyclones, Fine Sand Recovery Units)

- Feeders and Conveyors

- By Capacity (Tons Per Hour - TPH):

- Low Capacity (Below 50 TPH)

- Medium Capacity (50 TPH – 150 TPH)

- High Capacity (Above 150 TPH)

- By Mobility:

- Fixed/Stationary Plants

- Semi-Mobile Plants (Skid Mounted)

- Mobile/Portable Plants (Wheeled or Track-Mounted)

- By Application/End-Use:

- Infrastructure (Roads, Highways, Bridges, Dams)

- Residential and Commercial Construction

- Mining and Quarrying Operations

- Others (Pre-cast, Railway Ballast)

Value Chain Analysis For Sand Plant Machine Market

The value chain for the Sand Plant Machine Market begins with the upstream suppliers who provide critical raw materials and components, including high-grade steel alloys for structural frames and wear parts (such as crusher liners and screen media), specialized hydraulic and electrical systems, and robust powertrain components like motors and gearboxes. The quality and longevity of these upstream components directly dictate the reliability and lifespan of the final sand plant machinery, creating significant dependence on specialized material providers who focus on abrasion resistance and durability. Key upstream activities also involve intensive research and development (R&D) focused on material science to enhance the resilience of components exposed to high-impact environments, ensuring reduced maintenance frequency and improved operational profitability for the end-user.

Mid-stream activities encompass the core manufacturing processes undertaken by OEMs, including design engineering, heavy fabrication, precision machining, and system integration. This stage is crucial for innovation, particularly in designing energy-efficient crushing circuits and modular plant layouts. The mid-stream phase also incorporates stringent quality control and assembly procedures, where complex washing and classification equipment—like hydro-cyclones and dewatering screens—are integrated with the crushing units to form a complete, optimized system. Distribution channels are twofold: direct sales are typically utilized for large, high-value stationary plants, allowing OEMs to provide extensive customization, installation, and after-sales service directly to large quarry operators and mining firms. Indirect channels, involving authorized regional distributors and dealers, are more common for standardized, mobile, and lower-capacity plants, leveraging local presence for sales, spare parts stocking, and immediate field service.

The downstream segment involves installation, commissioning, after-sales service, and the provision of spare parts. Given the harsh operating environment of sand plants, the longevity of the machine is highly dependent on continuous maintenance and the timely supply of wear components. Consequently, OEMs generate substantial recurring revenue from providing specialized maintenance contracts, genuine replacement parts, and technical support throughout the operational lifecycle of the machinery. End-users in the construction and infrastructure sectors utilize the processed M-Sand, making the final quality and consistent supply of the output (fine aggregate) the ultimate measure of the machine's value chain success. Optimization across this chain focuses heavily on enhancing digital connectivity to facilitate remote diagnostics and predictive spare parts stocking, minimizing operational bottlenecks for the final consumers.

Sand Plant Machine Market Potential Customers

The primary potential customers for Sand Plant Machines are large-scale mining and quarrying enterprises that operate high-volume aggregate production facilities, seeking to convert raw rock into high-specification fine aggregate for concrete production. These customers require robust, high-capacity stationary plants (typically 200 TPH and above) with advanced automation features to ensure consistent output quality and minimal labor dependency across continuous operations. Investment decisions in this segment are primarily driven by long-term strategic supply contracts with major infrastructure developers and governmental entities, demanding the highest reliability and lowest specific energy consumption (SEC) per ton of produced sand.

Another significant customer segment comprises contract crushing and screening companies. These firms specialize in providing aggregate processing services on a project-by-project basis, often utilizing mobile or semi-mobile sand plants. Their flexibility allows them to serve various temporary construction sites, highway projects, and smaller localized developments. For this segment, the criteria for purchase prioritize quick setup time, ease of relocation, and versatility to handle diverse raw feed materials, making mobile VSI plants and integrated tracked systems highly desirable. Their business model relies heavily on minimizing transportation costs and maximizing utilization rates, thus favoring manufacturers offering comprehensive financing and long-term service agreements.

Furthermore, major infrastructure developers and construction conglomerates, particularly those engaged in vertically integrated projects such as high-speed rail lines, large dams, or smart city construction, represent direct end-users. These companies often establish captive sand plants to secure a reliable, cost-effective source of high-quality aggregates, shielding themselves from volatile external market prices and supply chain risks. For these customers, the focus is on machinery that guarantees compliance with specific engineering standards (e.g., grading curves, cleanliness), prioritizing sophisticated washing and classification technology, and robust environmental compliance features, such as minimal water consumption and effective dust suppression systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Metso Outotec, Sandvik AB, Weir Group, Astec Industries, Terex Corporation, Puzzolana Machinery Fabricators, McLanahan Corporation, General Kinematics, Rubble Master, Lippmann-Milwaukee, SBM Mineral Processing, Propel Industries, Shree Conmix Engineers Pvt. Ltd., Crusher & Screen Equipment, Dragon Machinery, Telsmith, FLSmidth, Keestrack, Kleemann (Wirtgen Group), CDE Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sand Plant Machine Market Key Technology Landscape

The contemporary Sand Plant Machine market is defined by a technological shift towards advanced integration, automation, and sustainability, moving far beyond basic mechanical crushing. A foundational technology driving market superiority is the continuous evolution of Vertical Shaft Impactor (VSI) technology, specifically in rotor design and material composition. Modern VSI crushers utilize advanced ceramics and specialized tungsten carbide composites for wear parts, drastically increasing their lifespan and reducing maintenance downtime, which is a critical operational cost factor. Furthermore, VSI machines are now engineered with improved crushing chambers and adjustable speed controls, allowing operators to fine-tune the aggregate shape (cubicity) and gradation curve to meet specific concrete mix requirements with unparalleled precision, which is a major quality differentiator for manufactured sand.

Another pivotal technological advancement involves the integration of sophisticated wet processing and classification systems, often centered around hydro-cyclone technology and high-frequency dewatering screens. The focus here is on achieving ultra-fine sand recovery and minimizing silt and clay contamination (material finer than 75 microns), which is detrimental to concrete strength. New generations of washing plants incorporate advanced water management systems, including thickening and filtration units, capable of achieving near-zero wastewater discharge. This closed-loop water system addresses environmental regulations and resource scarcity, offering a significant competitive advantage, especially in arid regions. The optimization of these wet processing stages, often through computational fluid dynamics (CFD) modeling, ensures maximum fine recovery while maintaining water clarity for recycling.

The most transformative technology permeating the market is Industry 4.0 integration, specifically the deployment of the Internet of Things (IoT) and centralized Programmable Logic Controller (PLC) systems. Sand plants are increasingly equipped with hundreds of sensors monitoring variables like bearing temperature, vibration spectrum, power draw, and material flow rates. This data is fed into cloud-based platforms, enabling remote monitoring and diagnostics, crucial for managing dispersed quarry operations efficiently. The deployment of sophisticated SCADA systems allows operators to monitor and adjust an entire multi-stage plant from a single control room, automating sequencing, interlocks, and emergency shutdowns, thereby minimizing human error and maximizing operational safety and throughput. The synergy between high-durability mechanical design and intelligent digital control represents the forefront of modern sand plant machinery development.

Regional Highlights

The Sand Plant Machine Market exhibits highly diversified growth patterns across key geographic regions, driven primarily by local infrastructure investment cycles, raw material availability, and the enforcement of environmental regulations regarding natural sand extraction. Asia Pacific (APAC) dominates the global market, accounting for the largest revenue share, primarily due to the massive scale of infrastructure development underway in China, India, and Southeast Asian nations like Vietnam and Indonesia. The unprecedented pace of urbanization in these countries necessitates a consistently high supply of quality aggregates, compelling governments and private enterprises to heavily invest in modern, high-capacity, and often stationary sand processing plants to meet long-term demand. Furthermore, severe ecological damage caused by river sand mining has led many APAC nations to actively promote and subsidize manufactured sand production, creating a robust, structurally supported market.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on operational efficiency, advanced automation, and sustainable processing methods. Growth in these regions is less driven by sheer volume expansion and more by the replacement and modernization of aging machinery fleets, adopting technology like advanced VSI crushers for better aggregate shaping and integrated C&D waste recycling capabilities. European markets, in particular, are leading the way in adopting zero-wastewater sand washing systems and dry classification technologies, spurred by stringent EU environmental directives and a strong focus on circular economy principles. The highly regulated environment ensures that only the most technically sophisticated and environmentally compliant machinery finds success here, favoring premium, automated solutions.

The Middle East & Africa (MEA) and Latin America regions are positioned as high-potential emerging markets. MEA countries, notably those within the Gulf Cooperation Council (GCC), are undergoing massive construction booms related to economic diversification projects (e.g., NEOM, Expo 2020 infrastructure), necessitating reliable M-Sand supply in water-scarce environments, which drives demand for dry processing and highly efficient water recovery systems. Latin America’s market growth is tied to large-scale mining operations and national infrastructure stimulus packages aimed at improving connectivity and logistics. Both regions display a preference for mobile and semi-mobile plant solutions that offer flexibility for projects spanning vast, often remote, territories, requiring OEMs to provide robust, heavy-duty machines capable of operating reliably under diverse and challenging climatic conditions.

- Asia Pacific (APAC): Market leader driven by rapid urbanization, massive infrastructure projects (e.g., India's National Infrastructure Pipeline), and strict regulatory shifts favoring M-Sand over natural river sand. Key demand focus is on high-capacity stationary plants and localized manufacturing.

- North America: Focus on modernization, integration of AI/IoT for predictive maintenance, and high demand for recycling technologies that process construction and demolition (C&D) debris into usable aggregates. Preference for semi-mobile and robust, high-efficiency equipment.

- Europe: Driven by environmental compliance (Net Zero targets), circular economy mandates, and demand for ultra-low emission, quiet, and water-efficient washing and processing plants. High uptake of mobile tracked crushing and screening units.

- Middle East & Africa (MEA): Emerging market characterized by mega-project infrastructure (e.g., Saudi Arabia Vision 2030), intense demand for sand in arid environments, favoring water-saving technologies like dry processing and sophisticated water recycling systems.

- Latin America: Growth linked to renewed government investment in public works, mining sector expansion, and demand for flexible, high-durability mobile plants suitable for geographically challenging terrains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sand Plant Machine Market.- Metso Outotec

- Sandvik AB

- Weir Group

- Astec Industries

- Terex Corporation

- Puzzolana Machinery Fabricators

- McLanahan Corporation

- General Kinematics

- Rubble Master

- Lippmann-Milwaukee

- SBM Mineral Processing

- Propel Industries

- Shree Conmix Engineers Pvt. Ltd.

- Crusher & Screen Equipment

- Dragon Machinery

- Telsmith

- FLSmidth

- Keestrack

- Kleemann (Wirtgen Group)

- CDE Global

Frequently Asked Questions

Analyze common user questions about the Sand Plant Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is manufactured sand (M-Sand) and why is it replacing natural river sand?

Manufactured sand (M-Sand) is high-quality fine aggregate produced by crushing hard rock using specialized sand plant machinery, typically VSI crushers, to create cubical, well-graded particles. It is replacing natural river sand (N-Sand) due to environmental concerns, governmental bans on river mining, and M-Sand's superior consistency and shape, which enhances the strength and workability of concrete, crucial for modern infrastructure projects.

What are the key technological advancements enhancing sand plant efficiency and sustainability?

Key advancements include the integration of Vertical Shaft Impact (VSI) crushing technology for superior particle shape; the adoption of closed-loop water management and hydro-cyclone systems for near-zero wastewater discharge; and the implementation of IoT, AI, and digital twin technology for real-time process control, predictive maintenance, and energy consumption optimization across the entire crushing and washing circuit.

How does the mobility (fixed vs. mobile) of a sand plant affect operational choice and market share?

Fixed/Stationary plants hold the largest market value, suitable for long-term quarrying operations requiring high capacity (200+ TPH) and extensive automation. Mobile/Portable plants are the fastest-growing segment, preferred by contract crushers and short-term projects, offering flexibility, faster setup, and reduced logistical costs by processing raw materials closer to the construction site, thus maximizing operational utilization rates.

Which regions are driving the highest demand for Sand Plant Machines and why?

The Asia Pacific (APAC) region, led by China and India, is driving the highest demand due to massive government investment in infrastructure development, rapid urbanization, and stringent environmental regulations restricting natural sand sources. North America and Europe primarily drive demand for modernization, highly automated, and sustainable recycling equipment.

What role does automation play in ensuring the quality of manufactured sand?

Automation, utilizing PLC control systems, sensors, and sometimes AI-powered vision systems, ensures consistent sand quality by autonomously adjusting key operational variables such as feed rate, crusher speed, and water injection pressure. This closed-loop control minimizes variations in particle size distribution and cleanliness, guaranteeing that the final aggregate product consistently meets the stringent technical specifications required for high-performance concrete applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager