Sandblasting Media Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433218 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sandblasting Media Market Size

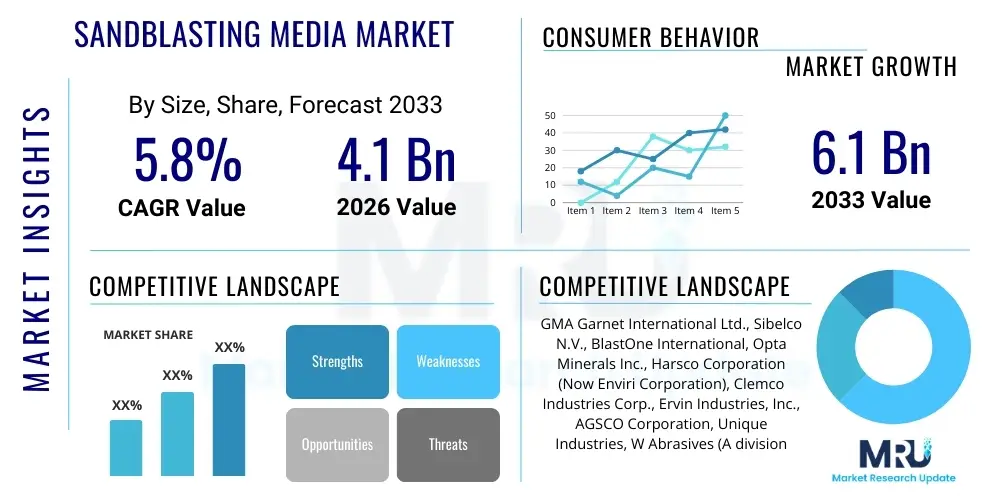

The Sandblasting Media Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Sandblasting Media Market introduction

Sandblasting media, also widely known as abrasive blasting materials, are essential components utilized in surface preparation, cleaning, and finishing across a multitude of industries. These materials, ranging from natural minerals like garnet and silica sand to manufactured products such as steel grit and glass beads, are propelled at high velocity onto a surface to remove rust, scale, old paint, corrosion, and other contaminants. The increasing need for effective surface coating adhesion in critical infrastructure and manufacturing sectors, particularly automotive and aerospace, fundamentally drives demand for high-quality, specialized sandblasting media. Regulatory shifts concerning abrasive material toxicity, favoring alternatives to traditional silica sand, also shape product innovation within this market. The effectiveness of the media is determined by several factors, including its hardness, particle shape (angular vs. spherical), size distribution, and specific gravity, all of which must be carefully selected based on the substrate material and the desired surface profile (anchor pattern) required for subsequent protective coatings.

The product description encompasses various types, categorized by hardness, particle size, shape, and reusability. Key applications include preparing ship hulls for protective coatings in the marine industry, stripping and refinishing structural steel in construction, and enhancing component fatigue resistance through peening in the automotive sector. The primary benefit of using abrasive media is achieving a precise surface profile necessary for durable coatings, significantly extending the lifespan of treated assets by ensuring optimal adhesion and preventing premature coating failure. Furthermore, specialized media allow for highly controlled processes, minimizing damage to sensitive substrates, which is crucial in high-precision industries where material conservation is paramount. The shift toward recyclable media reflects a growing focus on total cost of ownership rather than just initial purchase price, as reclaimed abrasives significantly lower disposal and replenishment expenses.

Major driving factors fueling market expansion include robust growth in global construction and infrastructure projects, particularly in developing economies, which necessitates large-scale surface preparation for steel structures. The stringent maintenance and safety standards in the oil and gas sector, requiring regular pipeline and tank coating renewal, also contribute substantially to media consumption. Technological advancements leading to reusable and eco-friendly abrasives are mitigating disposal costs and environmental concerns, thereby promoting broader adoption across industrial cleaning and maintenance operations worldwide. The consistent push towards higher performance coatings, such as plural component epoxies and polyurethanes, demands superior surface preparation, inherently escalating the consumption of high-grade blasting media across global industrial applications, ensuring product performance consistency and regulatory compliance.

Sandblasting Media Market Executive Summary

The Sandblasting Media Market is experiencing dynamic growth, propelled by accelerated infrastructure spending and stringent industrial maintenance regulations, particularly in emerging economies of the Asia Pacific region. Business trends indicate a strong pivot towards environmentally sustainable blasting solutions, with manufacturers prioritizing the development and promotion of low-dust, non-toxic alternatives like garnet and specialized slags over traditional silica. Strategic partnerships between media suppliers and blasting equipment manufacturers are crucial for optimizing material efficiency and process automation, addressing the consistent industry need for faster and safer surface preparation techniques. Consolidation among major suppliers is also evident, aiming to control raw material sourcing and enhance global distribution networks, ensuring a stable supply of certified, high-performance abrasives to large industrial consumers who require dependable quality assurance for critical infrastructure projects.

Regionally, Asia Pacific dominates the market share due to rapid industrialization, large-scale construction activities, and burgeoning ship repair and maintenance sectors in countries such as China and India. This dominance is characterized by high volume consumption of both traditional and modern media, although premium, imported abrasives are gaining traction for high-value projects. North America and Europe, while mature markets, emphasize advanced, high-performance media used in specialized applications like aerospace component manufacturing and complex corrosion control within the aging oil and gas infrastructure. Regulatory environments regarding worker health, specifically silicosis prevention, are most stringent in these Western markets, directly dictating the media types permissible for use, thereby increasing the market valuation for premium, certified non-silica abrasives like steel shot and high-grade garnet, often necessitating investment in sophisticated reclamation systems and advanced air filtration.

Segment trends highlight the dominance of mineral and synthetic abrasives based on volume, driven by their cost-effectiveness and versatility in general industrial applications such as shipyard maintenance and structural steel preparation. However, the fastest revenue growth is observed in the specialty metallic and organic media segments, utilized for delicate or high-precision cleaning tasks where substrate integrity must be preserved, particularly within high-tech manufacturing, historical restoration, and automotive refinishing. The application segment continues to be led by corrosion control and large-scale surface preparation, underpinning the market's stability, though demand for deburring and precision finishing media is rising proportionally with the global increase in automated manufacturing processes that demand tight dimensional tolerances and superior surface finishes. The consistent push for highly reusable metallic media in closed-loop systems is transforming the economics of high-volume abrasive consumption.

AI Impact Analysis on Sandblasting Media Market

User inquiries regarding AI's influence in the sandblasting media domain primarily revolve around process optimization, safety improvements, and predictive maintenance of equipment. Users are keen to understand how AI-driven vision systems and robotics might reduce media consumption through optimized nozzle movements and pressure regulation, thereby minimizing waste and enhancing efficiency. AI algorithms are increasingly being explored to analyze real-time surface contaminants and automatically adjust the abrasive delivery parameters (e.g., pressure, flow rate, media composition), eliminating the variability often associated with manual blasting and ensuring a perfectly prepared surface for subsequent coating application. This precision is vital for costly, high-performance coatings that demand flawless surface cleanliness and profile consistency.

Concerns also center on AI’s role in material selection—specifically, utilizing machine learning algorithms to recommend the optimal abrasive type and grit size based on the substrate material, desired surface profile, and environmental conditions. By processing vast datasets encompassing media performance, material hardness, humidity, and resulting coating adhesion rates, AI systems can provide highly accurate, prescriptive recommendations, reducing reliance on operator expertise and minimizing costly rework cycles. Furthermore, AI contributes significantly to operational safety by monitoring worker exposure to dust and noise, optimizing ventilation systems based on real-time particulate concentration, and predicting mechanical failures in high-pressure blasting equipment before they occur, enhancing overall operational reliability, compliance, and mitigating potential health hazards associated with certain media types.

- AI-driven optimization of blast parameters (pressure, flow rate, media type) based on real-time surface data, leading to reduced media usage and waste (AEO: maximizing media efficiency and minimizing consumption).

- Implementation of robotic blasting systems utilizing AI vision for precise targeting, ensuring consistent surface profiles, especially in complex geometries like turbine blades or intricate pipeline sections, ensuring quality control adherence.

- Predictive maintenance analytics for blasting equipment (compressors, pots, nozzles, reclamation systems), minimizing unexpected downtime and optimizing the operational lifespan of high-capital machinery through data analysis.

- Machine learning models aiding in the selection of the most environmentally compliant and effective abrasive media for specific coating requirements and substrate types, streamlining procurement and certification processes for industrial buyers.

- Enhanced safety protocols through AI monitoring of dust levels and worker proximity to blasting zones, ensuring compliance with strict occupational health standards, particularly when handling materials like coal slag or garnet in open environments.

- Automation of quality control checks using image processing and deep learning to instantly verify surface cleanliness (e.g., SA 2.5 standards) and profile standards post-blasting, eliminating manual inspection errors and accelerating project completion timelines.

- AI algorithms analyzing media reclamation data to optimize separation and cleaning cycles, maximizing the reusability of high-cost metallic and mineral abrasives and increasing economic viability.

- Development of digital twins for complex blasting operations, allowing operators to simulate the effects of different media types and parameters before physical application, minimizing material trials and errors in sensitive industrial environments.

DRO & Impact Forces Of Sandblasting Media Market

The Sandblasting Media Market is fundamentally driven by global infrastructure development and the mandatory requirement for effective corrosion control across various heavy industries, including marine, energy, and construction. This consistent demand, coupled with the need for high-quality surface preparation critical for the longevity of protective coatings (which are becoming increasingly sophisticated and performance-driven), forms the core driver. Furthermore, the global trend towards automation in manufacturing necessitates consistent and high-quality surface finishes, further boosting demand for precision media. However, its growth trajectory is significantly restrained by stringent environmental regulations concerning airborne particulate matter and the severe health risks associated with crystalline silica exposure, mandating costly shifts to alternative, often premium, media. This regulatory environment necessitates substantial investment in specialized media and closed-loop blasting technology, which can slow adoption in price-sensitive markets.

Opportunities lie in the technological advancements of eco-friendly and reusable abrasives, coupled with the increasing adoption of automated and robotic blasting systems which demand high-specification, consistent media, opening high-value market segments. The expansion of niche applications, such as the use of soft abrasives (plastic, organic) for sensitive cleaning operations in aerospace component maintenance and historical restoration, provides diversification opportunities away from traditional heavy-industry reliance. Furthermore, the growing global focus on decarbonization and maintenance of renewable energy infrastructure (e.g., wind farms, geothermal facilities) offers new, specialized demand channels for surface preparation materials and services, requiring media that perform efficiently on specialized composite and metallic substrates.

These forces collectively shape a market where sustainability and regulatory compliance are increasingly intertwined with operational efficiency. The powerful impact of environmental restrictions accelerates innovation in media material science, pushing development towards low-dust, non-toxic, and high-reusability products. Economic cycles, particularly in commodity markets (oil and gas, steel production), also exert an impact force, causing fluctuations in project timelines and maintenance budgets, thus affecting media demand volatility. Geopolitical risks can influence the supply stability and pricing of mined mineral abrasives, forcing companies to secure diverse sourcing agreements or invest in synthetic alternatives to maintain resilient supply chains and ensure continuous operation for industrial consumers who cannot tolerate supply interruptions.

Segmentation Analysis

The Sandblasting Media market is broadly segmented based on Material Type, Application, and End-User. Material type segmentation reflects the critical decision of balancing performance, cost, and environmental compliance, differentiating between mineral, metallic, synthetic, and organic media. This categorization is vital because the selection of media dictates the resulting surface profile, cleaning rate, dust emissions, and disposal requirements. For instance, metallic media offers maximum reusability and efficiency but requires expensive reclamation systems, contrasting with single-use mineral or slag products that are lower in upfront cost but incur higher disposal overheads. The increasing preference for high-efficiency mineral abrasives, such as garnet, is transforming the market share dynamics within the one-time-use category due to its performance benefits and safety profile.

Application segmentation highlights the diverse functional requirements of blasting, ranging from aggressive surface profiling for heavy coatings to gentle cleaning for delicate parts. Surface preparation remains the largest application segment globally, essential for achieving the necessary anchor profile before coating application to prevent premature failure in structural steel and marine vessels. Specialized applications like peening, which enhances the fatigue life of critical components (e.g., aerospace parts) through controlled bombardment, necessitate highly consistent, spherical metallic media like steel shot or quality glass beads, demanding premium pricing and certified quality control protocols to ensure performance reliability and component safety.

End-user classification demonstrates consumption patterns across major industrial sectors, with heavy industry sectors like construction, marine, and oil & gas being the primary consumers due to rigorous maintenance standards and coating longevity requirements. The construction and infrastructure segment drives high volume, often utilizing cost-effective slag and mineral abrasives for large structural steel projects, where surface area is vast. Conversely, the aerospace and medical device industries prioritize quality and non-contamination above cost, relying on premium, high-purity media like aluminum oxide or precision plastic abrasives. Understanding these segment dynamics is crucial for suppliers to tailor product offerings, manage inventory, and develop technical support specific to the distinct needs of each industrial client base.

- By Material Type:

- Mineral Abrasives (Garnet, Olivine, Staurolite, Silica Sand): Natural, cost-effective media; Garnet is favored for environmental compliance and high processing speed, particularly in large industrial painting and coating projects.

- Metallic Abrasives (Steel Grit, Steel Shot, Stainless Steel Media, Cast Iron Grit): Highly reusable, offering maximum efficiency in closed-loop systems; Steel Shot used for peening and general cleaning, Steel Grit for aggressive profiling and heavy scale removal.

- Synthetic Abrasives (Aluminum Oxide, Silicon Carbide, Coal Slag, Copper Slag, Glass Beads, Crushed Glass): Manufactured materials offering specific hardness and angularity; Aluminum Oxide used for precision blasting, etching, and achieving specific matte finishes on hard materials.

- Organic/Soft Abrasives (Walnut Shells, Plastic Media, Corn Cobs, Apricot Pits): Used for cleaning delicate substrates, paint stripping, and deflashing where the base material must not be damaged (AEO: specialized non-destructive cleaning for composite and sensitive parts).

- By Application:

- Surface Preparation and Profiling: The largest segment, critical for achieving anchor patterns required for optimal coating adhesion in construction and marine sectors, directly influencing coating lifespan.

- Paint and Rust Removal: Standard application across all heavy industries for maintenance, repair, and overhaul (MRO) operations, driving significant volume consumption of cost-effective abrasives.

- Deburring and Deflashing: Essential in manufacturing for removing burrs and excess material from molded, die-cast, or machined parts, often utilizing smaller, finer, or plastic media for precise results.

- Cleaning and Finishing: Used for general cleaning, etching, and achieving specific aesthetic finishes or preparing surfaces for processes like electroplating and anodizing.

- Peening (Stress Relieving): A specialized mechanical process using spherical media (shot) to improve component fatigue resistance and service life in high-stress applications like aircraft landing gear and engine components.

- By End-User Industry:

- Construction and Infrastructure: Primary consumer for large-scale steel structure preparation, bridge maintenance, and concrete surface profiling.

- Automotive and Transportation: Uses media for surface finishing, peening engine and transmission components, and rapid paint stripping during refurbishment or body shop operations.

- Marine (Shipbuilding and Repair): High volume user for hull preparation, tank coating, and maintenance in dry docks, heavily utilizing garnet and coal/copper slag due to large surface areas.

- Oil and Gas (Pipeline and Refinery Maintenance): Requires specialized, high-specification media for demanding corrosion control on pipelines, offshore platforms, and processing facilities subjected to extreme environmental stress.

- Aerospace and Defense: Demands ultra-high purity, certified media (aluminum oxide, glass beads, stainless steel shot) for critical component peening and non-contaminating precision cleaning.

- General Manufacturing: Includes machinery, heavy equipment, and general fabrication industries utilizing media for cleaning, deburring, and surface finishing prior to final assembly or coating.

Value Chain Analysis For Sandblasting Media Market

The value chain for sandblasting media begins with upstream activities involving the sourcing and processing of raw materials. For mineral abrasives like garnet or silica, this includes extensive mining, crushing, washing, drying, and highly specialized screening to achieve precise particle size distributions necessary for controlled blasting performance. Metallic abrasives, conversely, involve smelting and advanced atomization, followed by specialized heat treatment processes that require high energy input and sophisticated equipment to produce consistently spherical or angular particles with controlled hardness and microstructure. Efficiency and cost optimization at this initial stage are crucial, as raw material quality directly impacts the media's performance characteristics, such as hardness and shatter resistance, which ultimately influence reusability and operational costs for the end-user. Suppliers who control proprietary mineral deposits or utilize highly efficient metallurgical processes gain a significant competitive advantage in terms of both cost leadership and product quality assurance.

Midstream processes involve rigorous manufacturing, specialized blending, standardized packaging, and quality certification, ensuring the final product meets specific industry standards (e.g., SSPC, ISO, SAE). Logistics are a major cost component in the midstream, given the high bulk density of most abrasives and the necessity of minimizing transportation costs to remain competitive. Distribution channels play a critical role due to the necessity of timely, large-volume deliveries to remote job sites or large industrial facilities. Direct sales are common for high-volume metallic media used by major industrial clients (e.g., large shipyards or steel fabrication plants) who purchase in tonnage quantities under long-term supply agreements. Indirect channels rely heavily on regional distributors, specialized industrial supply houses, and local dealers that manage inventory, provide localized technical support, and fulfill smaller order requirements for the vast network of general contractors and maintenance shops. The selection of the channel is often dictated by the media type and the geographic dispersion of the consumer base.

Downstream activities center on end-user consumption, encompassing surface preparation contractors, industrial maintenance teams, and original equipment manufacturers (OEMs). These users require not only the physical product but also technical consulting regarding media selection, blast machine setup, and optimization strategies to ensure cost-effective and compliant operation. The high capital cost of advanced blasting equipment and reclamation systems necessitates a focus on media performance and reusability to maximize the return on investment. The value chain concludes with post-consumption activities, primarily waste management and disposal. Increasing regulatory focus mandates the implementation of effective dust collection systems and safe disposal methods, pushing the industry towards closed-loop recycling systems, especially for high-value metallic shot and premium garnet. This waste management segment represents an increasingly sophisticated ancillary service within the market ecosystem, aimed at minimizing environmental liability, complying with local regulations, and maximizing resource utilization through advanced media separation and cleaning technologies.

Sandblasting Media Market Potential Customers

The primary customers for sandblasting media are professional industrial contractors and large facility operators whose core business relies on maintaining the structural integrity and aesthetic quality of coated assets. These include specialized surface preparation firms that contract services to sectors like petrochemicals, energy, and government infrastructure projects, executing massive maintenance tasks such as bridge rehabilitation, dam cleaning, and large storage tank lining removal. Their purchasing decisions are primarily driven by media performance metrics such as surface profile achievement consistency, blasting speed, low dust emission capabilities, and overall cost per square meter of treated surface, making non-silica, high-efficiency garnet and reusable metallic media increasingly attractive investment options that ensure regulatory compliance and project efficiency under strict deadlines and quality controls.

Another significant segment of buyers comprises large, integrated industrial entities, such as international shipyards, major automotive manufacturing plants, primary steel fabricators, and heavy equipment manufacturers, which operate large, permanent in-house blasting facilities. For these customers, consistency of media supply and the ability to reclaim and reuse metallic abrasives (like high-carbon steel shot and grit) are paramount due to the massive scale and continuous nature of their operations. They often require bulk deliveries (rail car or full truckload) and tailored technical consulting to optimize their automated or semi-automated blasting chambers, focusing on media that complements their specific equipment setup and desired production throughput, seeking long-term supply contracts to mitigate price fluctuations and ensure supply security for their high-volume demands.

Furthermore, small to medium-sized contractors specializing in niche markets, such as historical preservation, art conservation, localized heavy equipment repair, and precision parts cleaning, represent a crucial segment for specialized media consumption. These users prioritize media that is gentle yet effective, often opting for organic media (walnut shells, corn cobs) or fine glass beads where substrate integrity must be preserved or contamination avoided. Their purchasing is frequently routed through local industrial suppliers, where factors like immediate availability, specialized technical assistance for complex or delicate applications, and minimal order quantities influence their procurement choices for specific job requirements, contributing to the demand for diverse, specialized media types across varied geographical locations and regulatory landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GMA Garnet International Ltd., Sibelco N.V., BlastOne International, Opta Minerals Inc., Harsco Corporation (Now Enviri Corporation), Clemco Industries Corp., Ervin Industries, Inc., AGSCO Corporation, Unique Industries, W Abrasives (A division of Wheelabrator Group), Metaltec Steel Abrasive Co., PanAbrasives (Part of Pan-Asia Group), Guyson Corporation, Strategic Materials, Inc., Barton International, US Minerals, Inc., Reade Advanced Materials, Toyo Jidoki Co., Ltd., Trinity Materials, Inc., Abrasives Inc., Rio Tinto PLC, Saint-Gobain Abrasives, 3M Company, Kleen Blast Abrasives |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sandblasting Media Market Key Technology Landscape

The technology landscape in the sandblasting media market is characterized by sophisticated advancements in material science, process automation, and environmental control systems, moving the industry towards higher precision and sustainability. Innovations in material science focus heavily on increasing the durability and efficiency of abrasives. This involves developing engineered minerals and synthetic materials with superior hardness and controlled fracture patterns to maximize cutting efficiency while minimizing fragmentation and dust production. For instance, manufacturers of high-carbon steel grit utilize advanced thermal treatments and alloy compositions to ensure maximum toughness and angularity retention across hundreds of recycling cycles, directly addressing the industry need for reduced media consumption, optimized operational expenses, and adherence to performance specifications.

In terms of application technology, the widespread integration of robotics and automated blasting cells represents a paradigm shift, particularly in high-volume manufacturing environments like the automotive and aerospace sectors. These systems incorporate precise volumetric metering devices and advanced controls, often leveraging AI or vision systems, ensuring that the exact amount of media is delivered at the precise velocity and angle required. This precision translates to significantly improved surface consistency (lowering the anchor profile variability) and faster throughput. Vapor blasting (wet blasting) technology is also gaining substantial traction, as it employs a water shroud to suppress nearly 90% of airborne particulates. This technology allows contractors to meet stringent environmental regulations in urban or sensitive industrial areas where traditional dry blasting is restricted, fundamentally expanding the applicability of abrasive media across diverse project locations.

Furthermore, technology related to media recovery and monitoring is critical for maximizing the economic and environmental value of reusable abrasives. High-efficiency magnetic and air-wash separation systems are being continuously improved to clean reclaimed metallic and mineral media, effectively removing fine dust, contaminants, and undersized particles before they re-enter the blast stream. This purification process is crucial because contaminated or fragmented media degrades surface quality and increases wear on costly blasting equipment. The adoption of digital monitoring tools, including IoT-enabled pressure sensors and acoustic analyzers, provides real-time data on media flow rate, impact energy, and dust levels, allowing operators to instantly verify adherence to technical specifications (e.g., SA 2.5 cleanliness standards) and facilitating crucial data-driven quality control and mandated regulatory reporting.

Regional Highlights

The global sandblasting media market displays significant regional variation in consumption patterns, driven by local regulatory environments, industrial concentration, and infrastructure investment levels. Asia Pacific (APAC) is projected to be the largest and fastest-growing region, fueled by massive government investments in infrastructure development, rapid industrialization, and high levels of activity in shipbuilding, automotive manufacturing, and primary steel production, particularly in China, India, and Southeast Asia. The region’s reliance on export-driven manufacturing necessitates rigorous quality control and surface preparation for international markets. While traditional media remains prominent in certain sub-sectors due to cost advantages, the transition toward safer, high-performance alternatives like garnet is accelerating in compliance with rising domestic quality standards and increasing global scrutiny of manufacturing practices.

North America and Europe represent highly mature, yet sophisticated, markets. Consumption here is driven less by sheer volume and more by high-specification requirements and strict adherence to environmental, health, and safety regulations. These regions have largely phased out or heavily restricted the use of silica sand, creating a robust demand for certified, premium abrasives such as high-purity aluminum oxide, steel shot/grit, and advanced synthetic slags. The market is characterized by high adoption rates of advanced closed-loop blasting and automated recovery systems, making media reusability a paramount consideration for end-users seeking operational cost reduction alongside compliance. Europe's strong emphasis on circular economy principles and worker safety further strengthens the market for highly sustainable, long-lasting metallic abrasives.

- Asia Pacific (APAC): Dominates market share due to unparalleled infrastructure development and shipbuilding activity. High demand for both cost-effective mineral media (e.g., coal slag) and increasingly specialized garnet for high-performance coatings, particularly in coastal regions and major manufacturing hubs; rapid growth expected in India and ASEAN nations.

- North America: Driven by strict OSHA regulations concerning silica, leading to a strong focus on premium metallic and high-grade synthetic abrasives. Key end-users include aerospace, aging energy pipeline maintenance, and general fabrication; high expenditure on automation and complex media reclamation technology.

- Europe: Characterized by stringent environmental standards (REACH, national bans on silica), leading to near-exclusive use of non-silica, reusable media. Strong market penetration of steel abrasives and specialized soft media for automotive and industrial cleaning; emphasis on advanced low dust emission processes such as vapor blasting.

- Middle East and Africa (MEA): Significant consumption linked to massive oil and gas exploration, refinery construction, and maintenance projects. Demand is heavily concentrated in pipeline corrosion control and storage tank preparation, requiring media that performs reliably in arid and high-salinity coastal environments.

- Latin America: Moderate growth driven by commodity sectors, including mining and energy infrastructure development. Increasing industrialization supports demand for standard mineral and synthetic abrasives, with major investment concentrated in Brazil and Mexico. The market is gradually adopting higher safety standards in line with global industrial trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sandblasting Media Market.- GMA Garnet International Ltd.

- Sibelco N.V.

- BlastOne International

- Opta Minerals Inc.

- Harsco Corporation (Now Enviri Corporation)

- Clemco Industries Corp.

- Ervin Industries, Inc.

- AGSCO Corporation

- Unique Industries

- W Abrasives (A division of Wheelabrator Group)

- Metaltec Steel Abrasive Co.

- PanAbrasives (Part of Pan-Asia Group)

- Guyson Corporation

- Strategic Materials, Inc.

- Barton International

- US Minerals, Inc.

- Reade Advanced Materials

- Toyo Jidoki Co., Ltd.

- Trinity Materials, Inc.

- Abrasives Inc.

- Rio Tinto PLC (Through subsidiaries)

- Saint-Gobain Abrasives

- 3M Company

- Kleen Blast Abrasives

Frequently Asked Questions

Analyze common user questions about the Sandblasting Media market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for non-silica sandblasting media?

The primary factor driving the shift away from silica sand is stringent governmental and occupational health regulations (OSHA, EU directives) aimed at preventing silicosis, a severe lung disease caused by inhaling crystalline silica dust. This regulatory pressure has mandated the widespread adoption of safer, low-dust alternatives like garnet, steel shot, and various mineral slags, particularly in developed economies.

Which type of sandblasting media is considered the most environmentally sustainable and why?

Metallic abrasives, particularly steel grit and steel shot, are often considered the most sustainable option due to their exceptional durability and high reusability. They can typically be recycled hundreds of times in specialized closed-loop systems, drastically reducing material consumption, waste generation, and associated disposal costs compared to single-use mineral or slag media, thereby minimizing environmental footprint (AEO: maximizing lifecycle value).

How does the Sandblasting Media Market utilize garnet, and what are its main advantages?

Garnet is a highly utilized mineral abrasive known for its fast-blasting speed, low dust generation, non-toxic nature, and compliance with environmental standards. Its sharp, angular structure and high specific gravity make it highly effective for achieving precise surface profiles (anchor patterns), making it ideal for marine coatings, pipeline maintenance, and large-scale steel structure corrosion control applications globally.

What role does the oil and gas industry play in the overall consumption of sandblasting media?

The oil and gas industry is a major and highly consistent consumer, utilizing media extensively for routine maintenance and corrosion control of critical assets, including pipelines, storage tanks, rigs, and refinery components. These applications require high-performance, certified media to ensure the proper adhesion of protective anti-corrosion coatings, guaranteeing asset longevity and operational safety under harsh environmental conditions.

How are advancements in robotic blasting systems impacting media requirements?

Robotic blasting systems require premium, consistently sized, and highly uniform media to function optimally within automated flow controls and nozzle delivery systems. These systems favor highly reusable metallic or engineered synthetic abrasives that maintain their shape and cleaning efficiency across numerous cycles, ensuring predictable, high-precision results essential for achieving tight quality specifications in automated, high-throughput manufacturing environments.

What is the difference between shot peening and abrasive blasting?

Abrasive blasting is primarily a cleaning or surface preparation method using angular media to create an anchor profile for coating adhesion. Shot peening is a specialized mechanical process using spherical metallic shot to induce compressive residual stress on a component's surface, which significantly improves its fatigue strength and resistance to stress corrosion cracking, particularly vital in aerospace and automotive engine parts.

Which geographical region exhibits the fastest growth rate in the market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by rapid industrialization, heavy investment in new infrastructure (e.g., bridges, ports, rail networks), and expanding shipbuilding and maintenance sectors, leading to a massive increase in demand for surface preparation materials across multiple industries.

What is the typical function of organic abrasives like walnut shells?

Organic abrasives are used for non-destructive cleaning, paint removal, and deflashing applications on sensitive substrates such as aluminum, plastics, and composites. They are softer than mineral or metallic media, meaning they clean the surface without causing pitting, etching, or damage to the underlying material (AEO: preserving substrate integrity), making them ideal for delicate restoration work.

How do coal slag and copper slag compare to traditional silica sand?

Coal slag and copper slag are popular synthetic alternatives to silica sand. They are highly efficient, relatively low-cost, and generally contain minimal or no free silica, making them safer and compliant with many environmental regulations. They offer aggressive cleaning power and are widely used in open-air blasting applications for heavy corrosion removal and large steel fabrication projects.

What key metric do end-users prioritize when selecting a reusable abrasive?

End-users prioritize the lifespan or recycling capability of the abrasive, often measured as the number of cycles before the media degrades or loses effectiveness. This durability directly impacts the total cost of ownership (TCO) and operational efficiency, as higher reusability minimizes both procurement costs and the logistical expense associated with hazardous waste disposal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager