Sanding Pads Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432885 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sanding Pads Market Size

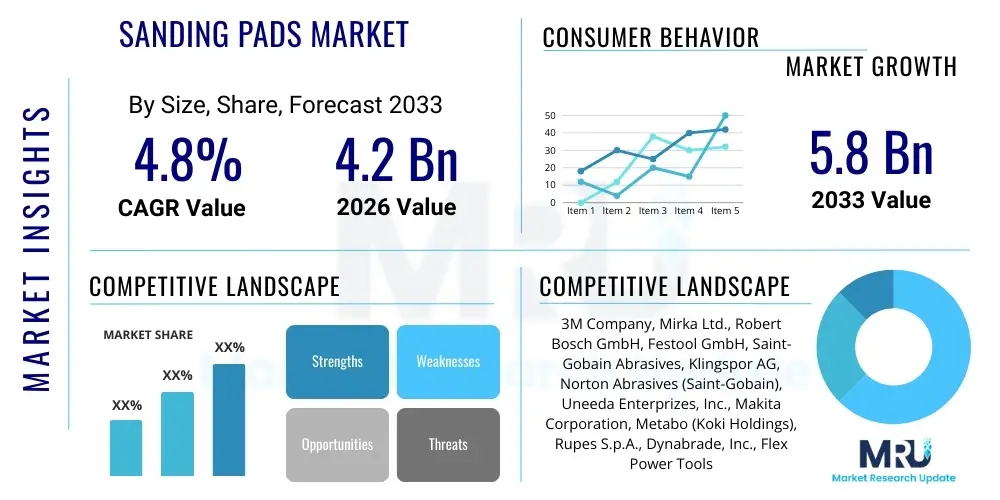

The Sanding Pads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033.

Sanding Pads Market introduction

Sanding pads, often referred to as backing pads or backup pads, constitute a critical component in abrasive finishing processes, providing the necessary support and interface between the power sanding tool (such as orbital, random orbital, or angle grinders) and the abrasive material (sandpaper disc). These pads are essential for achieving consistent surface finishes across various materials, including wood, metal, composites, and plastics. The primary function of a sanding pad is to distribute pressure evenly, absorb vibration, and facilitate efficient dust extraction, thereby maximizing the lifespan of the abrasive and improving the overall quality of the finished surface. Different applications necessitate varying degrees of flexibility, density, and hardness, leading to a diverse product offering tailored for specific sanding requirements, from aggressive material removal to ultra-fine finishing.

The product range within the Sanding Pads Market includes standard polyurethane (PU) pads, foam interface pads, rubber pads, and specialized pads designed for high-heat or extreme-load applications. Key applications driving market demand are found predominantly in the automotive sector for refinishing and body repair, the woodworking industry for furniture and cabinet production, and the construction and aerospace sectors requiring precise surface preparation. The durability and efficiency benefits offered by advanced sanding pads, such as those featuring multi-hole configurations for superior dust control and improved material composition for enhanced heat resistance, are significant factors underpinning their market growth, particularly as regulatory standards for air quality in industrial settings become more stringent worldwide.

Driving factors for this market are closely linked to global economic indicators, including consistent growth in the residential and commercial construction sectors, increasing automotive production and maintenance cycles, and rising consumer preference for high-quality finished products. Furthermore, the burgeoning popularity of Do-It-Yourself (DIY) projects, especially in developed economies, contributes significantly to the demand for consumer-grade sanding pads. Technological advancements focusing on ergonomics, such as vibration damping systems integrated into the pads and improved hook-and-loop adhesion technology, continue to propel adoption rates across professional and industrial user bases seeking higher productivity and reduced operational fatigue.

Sanding Pads Market Executive Summary

The global Sanding Pads Market is characterized by steady expansion, driven primarily by persistent demand from high-growth end-use industries and continuous innovation aimed at enhancing sanding efficiency and dust management. Business trends indicate a marked shift towards premium, specialized pads, particularly those manufactured using advanced thermoplastic elastomers and high-density foam, which offer superior durability and heat dissipation compared to traditional materials. Manufacturers are strategically investing in developing systems that integrate seamlessly with power tools, focusing on optimized hole patterns (e.g., net sanding systems) that adhere to stringent occupational health and safety standards by minimizing airborne dust particles. This focus on system integration—where the pad, the abrasive, and the tool work synergistically—represents a key competitive differentiator and market trend.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, fuelled by massive infrastructure development projects, burgeoning manufacturing capabilities, and rapid industrialization, particularly in countries like China and India, leading to high volume consumption. Conversely, mature markets in North America and Europe emphasize value over volume, prioritizing high-performance and environmentally compliant products. In these regions, the trend leans heavily towards specialized backing pads designed for intricate, high-precision tasks in aerospace maintenance and specialized automotive restoration, demanding high flexibility and dimensional stability. Furthermore, regulatory pressures regarding volatile organic compounds (VOCs) and dust exposure in European markets necessitate continuous material substitution and design refinements in pad construction.

Segmentation trends reveal that the random orbital segment remains the dominant product type due to its versatility and ability to achieve swirl-free finishes across various materials, making it a staple in both industrial and professional environments. By material type, polyurethane (PU) continues to hold the largest market share, though specialized foam and rubber compounds are gaining traction in niche applications requiring extreme heat resistance or superior cushioning. The automotive end-use segment maintains its leadership due to the non-negotiable requirement for high-quality surface preparation in both OEM production and the large, consistent demand from the automotive aftermarket (refinishing and repair). Overall, the market trajectory is defined by a move toward automation-compatible, high-efficiency sanding solutions that minimize manual labor and maximize operational uptime.

AI Impact Analysis on Sanding Pads Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Sanding Pads Market primarily revolve around optimizing manufacturing processes, predictive maintenance of sanding equipment, and enhancing quality control. Common questions address how AI algorithms can predict the optimal pad replacement cycle based on usage patterns and material stress, or how machine learning can analyze sensor data (such as vibration, temperature, and pressure) to automatically adjust sanding parameters for a consistent finish, irrespective of operator variables. Users are also keen on understanding AI's role in automated quality inspection systems that utilize computer vision to detect minute surface imperfections that human operators might miss, thereby ensuring defect-free output, especially in high-volume production lines like automotive painting facilities. The consensus expectation is that AI integration will not directly alter the chemical or physical composition of the pad itself but will fundamentally optimize the ecosystem surrounding the pad's application and maintenance, leading to significant cost reductions and improved consistency.

The application of AI in the manufacturing segment focuses heavily on process optimization. AI-driven systems can analyze raw material input variations (e.g., polymer batch consistency) and automatically adjust molding parameters (temperature, pressure, curing time) during the production of polyurethane or foam pads to ensure uniform density and durability across large production runs. This leads to reduced waste, improved yield rates, and highly consistent product quality, which is crucial for professional users who depend on reliable performance. Furthermore, supply chain resilience is bolstered through AI-powered demand forecasting, allowing manufacturers to optimize inventory levels of critical raw materials like chemical agents and specialized polymers, mitigating risks associated with supply chain disruptions.

In the end-user environment, while fully autonomous sanding remains a niche application, AI contributes significantly through advanced diagnostics. Sanding machines equipped with IoT sensors collect real-time data on vibration intensity, motor load, and operating temperature. AI models process this data to provide predictive maintenance alerts for the sanding pad or the backing system, preventing catastrophic failures, tool damage, and poor surface quality. For instance, increased vibration frequency might signal early wear or material breakdown in the pad’s interface layer, prompting a proactive replacement before quality degradation occurs. This predictive capability translates directly into lower maintenance costs and maximized operational efficiency for large industrial users.

- AI-driven optimization of manufacturing parameters for uniform pad density and durability.

- Predictive maintenance algorithms forecasting optimal sanding pad replacement cycles based on real-time usage and stress data.

- Integration of computer vision and AI for automated, high-speed surface quality inspection post-sanding.

- Enhanced supply chain logistics using machine learning for accurate forecasting of raw material demand (polymers, elastomers).

- Development of smart sanding systems that use AI feedback loops to adjust tool speed and pressure based on surface resistance.

- Use of generative design processes, potentially AI-assisted, to develop optimized dust extraction hole patterns in pads.

DRO & Impact Forces Of Sanding Pads Market

The Sanding Pads Market dynamics are shaped by a complex interplay of increasing infrastructure spending globally (Driver), inherent volatility in the cost of petrochemical-derived raw materials (Restraint), and the emergence of specialized application niches, particularly in advanced manufacturing (Opportunity). A crucial driver is the sustained growth in the automotive sector, both in initial equipment manufacturing (OEM) and, more significantly, in the robust automotive refinishing market where high-quality surface preparation is paramount for paint adhesion and aesthetic finish. Concurrently, the global surge in construction and renovation activities, coupled with the increasing emphasis on aesthetic finishes in residential and commercial properties, further necessitates reliable and efficient sanding solutions. However, the market faces structural constraints related to the disposal of composite waste materials (abrasives and pads), which pose environmental challenges and increase overall waste management costs for industrial users, often necessitating the use of specialized, costly recycling programs.

Key impact forces influencing the market structure include the bargaining power of buyers, which is moderate to high, especially for large OEMs who purchase high volumes under long-term contracts and demand customizations related to tool integration and dust extraction performance. The threat of new entrants is relatively low due to the high capital required for sophisticated manufacturing processes (precision molding and material science) and the established distribution networks controlled by major players like 3M and Saint-Gobain. The intensity of competitive rivalry is high, characterized by continuous product differentiation based on pad hardness, durability, unique dust evacuation channel designs, and proprietary hook-and-loop systems, compelling manufacturers to invest heavily in R&D to maintain market share and pricing power. Furthermore, the substitution threat is moderate; while conventional hand sanding exists, it is economically unfeasible for large-scale industrial applications, yet new non-abrasive surface finishing technologies pose a long-term risk.

Opportunities for growth are strongly vested in the development of next-generation, high-performance sanding pads designed specifically for automated or robotic sanding systems. As industrial automation accelerates across various manufacturing sectors (aerospace, wind energy components), the demand for pads capable of withstanding extreme, continuous loads and consistent performance profiles rises dramatically. The move towards specialized materials, such as those featuring carbon fiber reinforcement or advanced dampening polymers, enables superior heat dissipation and vibration reduction, significantly extending both the pad life and the tool life. Furthermore, the trend toward solvent-free finishing systems creates opportunities for pads engineered to work effectively with water-based coatings, which often require different abrasive and pad pressure characteristics compared to traditional solvent-based systems.

Segmentation Analysis

The Sanding Pads Market is systematically segmented based on various technical and functional parameters, allowing for detailed analysis of consumption patterns across different industries and applications. Primary segmentation categories include Type (such as Random Orbital, Rotary, and Profile/Detail Sanders), Material (Polyurethane, Rubber, Foam, and Composites), and End-Use Application (Automotive, Woodworking, Construction, and Aerospace). This granular division helps manufacturers tailor their product offerings to specific performance requirements—for instance, high flexibility for contoured surfaces (automotive body repair) versus high rigidity for flat, stock removal applications (wood preparation). The fastest-growing segment is typically aligned with high-performance materials and complex dust-extraction systems, catering to industrial users demanding reduced operational downtime and adherence to strict workplace safety standards regarding air quality.

-

By Type

- Random Orbital Sanding Pads (Dominant Segment)

- Rotary/Disc Sanding Pads

- Detail/Finger Sanding Pads

- Belt Sanding Backing Pads

-

By Material

- Polyurethane (PU)

- Rubber

- Foam and Interface Pads

- Composite Materials

-

By Attachment Method

- Hook-and-Loop (Velcro)

- Pressure Sensitive Adhesive (PSA)

- Quick Change Systems

-

By End-Use Application

- Automotive (OEM & Aftermarket Refinishing)

- Woodworking and Furniture

- Construction and Infrastructure

- Aerospace and Marine

- Metal Fabrication and Finishing

-

By Distribution Channel

- Direct Sales (Industrial and OEM)

- Indirect Sales (Distributors, Retailers, E-commerce)

Value Chain Analysis For Sanding Pads Market

The Sanding Pads market value chain begins with the upstream sourcing of raw materials, primarily petrochemical derivatives. This involves acquiring specialized polymers (like polyester polyols, isocyanates, and additives) required for manufacturing high-quality, durable polyurethane foams and elastomers, which form the core of most sanding pads. Key upstream challenges involve managing price volatility of crude oil and maintaining supply chain stability for specific performance-enhancing additives. Successful manufacturers often maintain strategic partnerships with global chemical suppliers to ensure consistent material quality and cost-effective procurement. Material processing then moves into the midstream, where manufacturers utilize injection molding, compression molding, and casting techniques to shape the pads, focusing heavily on precision engineering for dust hole alignment and density control, which are critical for performance.

The midstream manufacturing process is highly specialized, involving sophisticated machinery to embed the attachment mechanism (such as hook-and-loop material) onto the pad body and ensure optimal balancing, which is crucial for high-speed orbital sanding. Quality control at this stage focuses on testing the pad’s flexibility, hardness (measured in shore values), thermal resistance, and vibration dampening capabilities. Efficient manufacturing, characterized by reduced scrap rates and optimized cycle times, provides a significant competitive advantage. Downstream activities involve complex logistics and distribution, tailored to reach diverse customer segments ranging from high-volume automotive assembly plants (Direct Channel) to small independent contractors or DIY consumers (Indirect Channel).

The distribution channels are crucial for market reach. Direct distribution is preferred for large industrial customers and OEMs, facilitating bulk purchases, technical support, and customization services. This channel demands robust logistical capabilities and specialized sales teams. Indirect distribution, leveraging industrial distributors, hardware retailers, and a rapidly growing e-commerce presence, serves the fragmented aftermarket and professional contractor segments. The growth of digital platforms has enabled manufacturers to bypass some traditional intermediaries, improving inventory management and allowing direct engagement with end-users for product feedback and tailored offers. Successful players invest heavily in optimizing this multi-channel approach to maximize market penetration and responsiveness.

Sanding Pads Market Potential Customers

The potential customer base for the Sanding Pads Market is expansive and highly diverse, spanning major industrial sectors that rely on high-quality surface finishing for functionality and aesthetics. The largest and most consistent buyers are found within the automotive manufacturing and aftermarket sectors. Automotive OEMs require thousands of pads daily for production lines, demanding highly specialized pads for robotic sanding systems on vehicle body components. The automotive refinishing market, comprising body shops and repair garages, represents massive recurring demand for general-purpose random orbital pads used in primer and clear coat preparation, where defect-free surface finish is non-negotiable for customer satisfaction and warranty compliance.

Another significant group of customers resides in the woodworking and furniture industry, ranging from large-scale cabinet manufacturers utilizing automated sanding machines to custom furniture makers who demand flexible and specialized pads for intricate contours and fine wood species. These customers prioritize pads that offer excellent dust extraction to maintain a clean working environment and prevent wood dust accumulation, which can cause surface defects. Construction and renovation professionals, including drywall contractors, painters, and floor refinishers, represent a substantial segment, primarily purchasing robust pads capable of handling heavy-duty, demanding applications on plaster, concrete, and large wooden surfaces.

Furthermore, niche but high-value customer segments include the aerospace, marine, and advanced composites industries. Aerospace customers require pads manufactured to extremely high tolerances, often utilized in preparing sensitive composite materials for bonding or painting, where consistent pressure distribution is critical to avoid structural damage. Marine maintenance and manufacturing demand pads resilient to moisture, heat, and harsh chemical environments typical of boat building and repair processes. These demanding segments typically purchase high-performance, higher-priced composite or advanced polymer pads, emphasizing reliability and technical specifications over mere cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Mirka Ltd., Robert Bosch GmbH, Festool GmbH, Saint-Gobain Abrasives, Klingspor AG, Norton Abrasives (Saint-Gobain), Uneeda Enterprizes, Inc., Makita Corporation, Metabo (Koki Holdings), Rupes S.p.A., Dynabrade, Inc., Flex Power Tools, TuffStuff Abrasives, SIA Abrasives (Bosch Group), Carborundum (Saint-Gobain), PFERD, Starcke Abrasives. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sanding Pads Market Key Technology Landscape

Technological innovation in the Sanding Pads Market is predominantly focused on material science, ergonomic design, and optimized dust management systems, aiming to significantly enhance sanding efficiency and compliance with health regulations. A paramount technological advancement involves the design of multi-hole and net sanding pad configurations. Traditional pads often have a limited number of holes, leading to inefficient dust capture and abrasive clogging. The transition to proprietary spiral or multi-zone dust extraction systems, often integrating with net abrasives (like those developed by Mirka), allows for near-total dust capture, maintaining abrasive sharpness and extending pad life. This technology significantly improves air quality for operators and reduces time spent on cleaning, driving market adoption in professional settings.

Material technology represents another crucial area of development. Manufacturers are increasingly utilizing advanced polyurethane compounds and specialized thermoplastic elastomers (TPEs) to engineer pads that offer superior heat resistance and vibration dampening capabilities. Heat buildup during high-speed sanding can cause the abrasive material to fail prematurely and warp the backing pad. New formulations are designed to maintain structural integrity and consistent flexibility even under continuous, high-friction operation. Furthermore, integrated sensor technology, although nascent, is beginning to appear in high-end industrial sanding pads. These sensors monitor parameters like pad temperature and pressure distribution, transmitting data to the sanding tool or a connected application for real-time feedback and process optimization, moving the industry toward 'smart sanding' solutions.

The refinement of the hook-and-loop attachment system is a continuous technological focus. Enhancements include developing more durable and consistent hook materials (e.g., molded nylon hooks) that resist wear, prevent disc slippage under high torque, and maintain strong adhesion throughout the pad's lifespan. Ergonomic advancements, such as pads designed with specific stiffness zones (firmer near the center for power transfer, softer near the edge for contouring), allow a single pad to perform optimally across diverse geometries. These material and design innovations ensure that sanding pads remain reliable components in increasingly demanding automated and high-precision finishing processes, solidifying their role as performance enhancers rather than just passive supports.

Regional Highlights

- North America: This region is characterized by high market maturity, significant adoption of premium, high-efficiency sanding systems, and stringent occupational safety standards. The market is primarily driven by the robust automotive repair and maintenance sector, large-scale residential renovation, and advanced manufacturing activities in aerospace. Consumers and professionals in the US and Canada prioritize efficiency and advanced dust extraction technologies. Key players often focus their R&D efforts here on integrating pads with advanced power tools (cordless solutions) and proprietary abrasive systems, emphasizing durability and ergonomic performance to cater to a high labor cost environment.

- Europe: Europe represents a technologically sophisticated market segment, heavily influenced by strict environmental regulations (e.g., REACH compliance) and mandatory standards for workplace dust exposure (e.g., ATEX directives). The demand is particularly strong for specialized, high-density pads used in sophisticated woodworking, maritime manufacturing, and complex surface preparation tasks in the automotive OEM sector. Germany, Italy, and the Nordic countries are major hubs for both consumption and technological development, leading the market towards sustainable materials and systems designed for minimal environmental impact and maximal dust capture efficiency.

- Asia Pacific (APAC): APAC stands as the fastest-growing region globally, dominating the market in terms of volume consumption due to rapid industrialization, massive infrastructure development, and burgeoning middle-class consumer demand driving the construction and furniture manufacturing sectors in China, India, and Southeast Asian nations. While price sensitivity remains a factor in certain segments, the rising focus on quality finishes, particularly in the automotive and luxury goods segments, is accelerating the adoption of mid-to-high performance sanding pads. The local competitive landscape is intensely fragmented, but multinational corporations are aggressively expanding their manufacturing and distribution capabilities to capitalize on this exponential growth.

- Latin America (LATAM): The LATAM market, while smaller than APAC or North America, presents significant growth opportunities driven by expanding automotive assembly operations (especially in Mexico and Brazil) and improving residential construction sectors. The market often favors cost-effective and general-purpose sanding pads, but there is a gradual shift towards higher-quality professional products as industrial standards modernize. Economic instability in certain nations can occasionally restrain investment in premium tooling and abrasives, but underlying demand remains fundamentally strong due to population growth and industrial expansion.

- Middle East and Africa (MEA): Growth in the MEA region is closely tied to large-scale construction projects (infrastructure, hospitality, and residential complexes), particularly in the Gulf Cooperation Council (GCC) countries. The demand for sanding pads is primarily centered around surface preparation for architectural coatings and high-end fit-out projects. Oil and gas infrastructure maintenance also creates a niche demand for pads suitable for heavy-duty metal fabrication finishing. Market development is heavily reliant on foreign direct investment and the successful completion of large governmental development initiatives, leading to fluctuating demand profiles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sanding Pads Market.- 3M Company

- Mirka Ltd.

- Robert Bosch GmbH

- Festool GmbH

- Saint-Gobain Abrasives

- Klingspor AG

- Norton Abrasives (Saint-Gobain)

- Uneeda Enterprizes, Inc.

- Makita Corporation

- Metabo (Koki Holdings)

- Rupes S.p.A.

- Dynabrade, Inc.

- Flex Power Tools

- TuffStuff Abrasives

- SIA Abrasives (Bosch Group)

- Carborundum (Saint-Gobain)

- PFERD

- Starcke Abrasives

- CS Unitec Inc.

- Showa Tools Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Sanding Pads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Sanding Pads Market?

Market growth is primarily driven by escalating demand from the global automotive refinishing sector, increased infrastructure and residential construction spending, and technological advancements focusing on efficient dust extraction and improved pad material composition, which enhance user productivity and adhere to environmental health standards.

Which material segment holds the largest share in the Sanding Pads Market?

The Polyurethane (PU) material segment currently holds the largest market share due to its excellent balance of flexibility, durability, and cost-effectiveness, making it suitable for the widest range of applications, especially in random orbital sanding systems used across automotive and woodworking industries.

How does the type of sanding pad attachment (Hook-and-Loop vs. PSA) impact professional users?

Hook-and-Loop (Velcro) systems are favored by professional users for their speed and ease of abrasive disc replacement, offering better efficiency for high-volume work and reusable properties. Pressure Sensitive Adhesive (PSA) pads, while offering stronger initial adhesion, are typically used in specialized, heavy-duty applications or where minimal profile thickness is required.

What role does Asia Pacific (APAC) play in the future market trajectory?

APAC is projected to be the fastest-growing regional market due to rapid industrialization, high volume production in manufacturing sectors (especially furniture and consumer goods), and substantial investments in infrastructure, which collectively generate immense demand for industrial and professional sanding consumables.

What are the key technological advancements expected in sanding pads?

Future advancements focus on incorporating specialized thermoplastic elastomers for superior thermal stability, developing proprietary net sanding configurations for maximum dust capture efficiency, and potentially integrating micro-sensors for real-time monitoring of pad wear and sanding pressure in automated industrial applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager