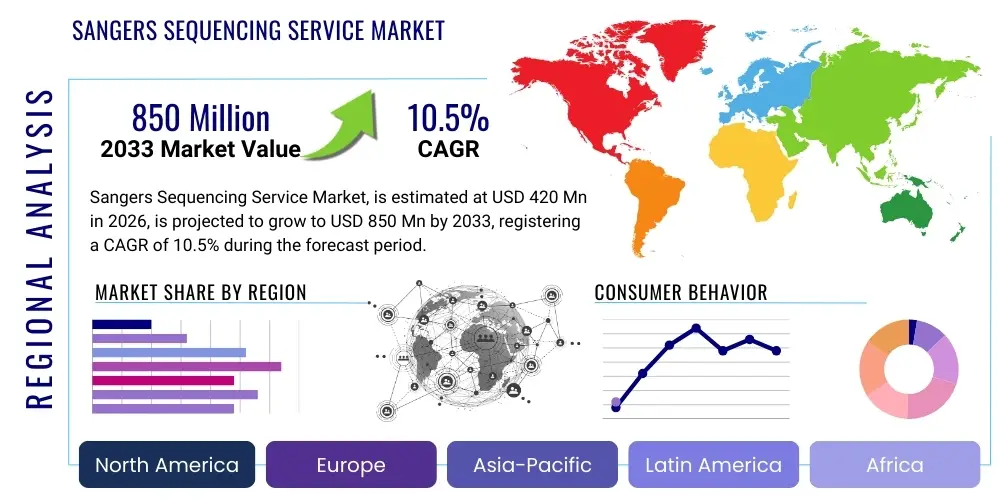

Sangers Sequencing Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439055 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Sangers Sequencing Service Market Size

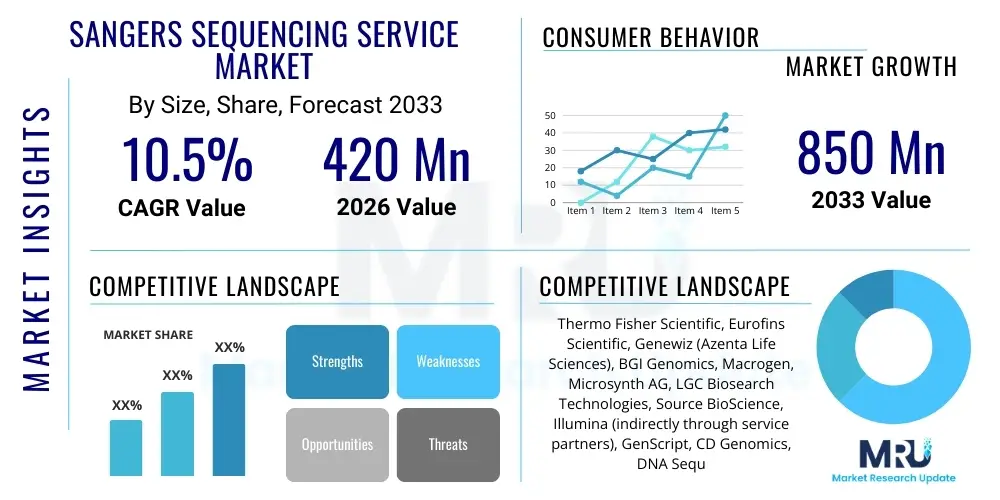

The Sangers Sequencing Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 420 Million in 2026 and is projected to reach USD 850 Million by the end of the forecast period in 2033. This consistent expansion is primarily driven by the sustained demand for highly accurate, reliable sequencing data required for validating results obtained from Next-Generation Sequencing (NGS) platforms, along with its foundational role in numerous academic research protocols and small-scale microbiological studies.

Sangers Sequencing Service Market introduction

The Sanger Sequencing Service Market revolves around providing sequencing solutions utilizing the established chain-termination method, commonly known as the dideoxy method. Although surpassed by NGS technologies in terms of throughput and speed, Sanger sequencing remains the gold standard for high-fidelity, long-read accuracy, particularly in crucial applications such as DNA fragment analysis, mutation detection, and plasmid verification. Service providers leverage highly optimized automated capillary electrophoresis (CE) platforms to deliver quick turnaround times and unparalleled accuracy for short to medium read lengths, catering predominantly to research institutions, pharmaceutical companies, and clinical laboratories needing definitive validation data.

The foundational strength of Sanger sequencing services lies in their simplicity, robustness, and cost-effectiveness when dealing with lower throughput or specific genomic regions. Major applications span clinical diagnostics (e.g., targeted gene sequencing for known pathogenic variants), forensic science, and extensive quality control checks in molecular biology projects. Key benefits include minimal sample preparation complexity compared to NGS, established standard operating procedures, and the production of clean, unambiguous data necessary for regulatory submissions and peer-reviewed publications. The primary driving factors sustaining this market include persistent global investment in life science research, the necessity for independent sequence verification, and the foundational requirement of this technology in drug discovery pipelines where precision is paramount.

Furthermore, the accessibility and established infrastructure of Sanger sequencing services make them highly attractive to academic laboratories and small biotechnology firms that lack the resources or scale required for internal NGS operations. The services offered often include comprehensive upstream processes, such as PCR optimization and template purification, ensuring high-quality input material for successful sequencing runs. This full-service approach, combined with decreasing costs per reaction, solidifies Sanger sequencing’s indispensable niche within the broader molecular diagnostics and genomics landscape.

Sangers Sequencing Service Market Executive Summary

The Sanger Sequencing Service Market demonstrates resilient growth, anchored by its crucial role in validation and targeted analysis across diverse sectors. Business trends show a strategic shift among major service providers towards optimizing automated Capillary Electrophoresis (CE) platforms to reduce costs and enhance turnaround times, securing its relevance against the backdrop of rapidly advancing NGS technologies. The market is characterized by fierce competition based on service speed, pricing structures, and data quality assurance, compelling vendors to invest heavily in robust quality management systems and customer support, especially targeting the academic and small biotech sectors.

Regionally, North America maintains its dominance due to high levels of research and development funding, presence of leading biotechnology and pharmaceutical companies, and advanced healthcare infrastructure facilitating targeted clinical testing. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by expanding government genomics initiatives, increasing foreign investment in research infrastructure, and the rising prevalence of infectious diseases requiring rapid sequencing identification. European markets show stable demand, primarily driven by strong academic research networks and increasing application in molecular diagnostics, particularly in personalized medicine screening where high accuracy for specific variants is non-negotiable.

Segment trends indicate that the Application segment of Fragment Analysis and De Novo Sequencing are experiencing steady uptake, while the End-User segment remains dominated by Academic & Government Research Institutions, which rely extensively on Sanger sequencing for fundamental research and thesis validation. The pharmaceutical and biotechnology segment is also a critical revenue driver, focusing on using these services for vector construction confirmation and quality control in biological manufacturing. The competitive environment is leaning towards specialized providers offering comprehensive bioinformatics support alongside raw data delivery, optimizing the value proposition for end-users seeking turnkey solutions.

AI Impact Analysis on Sangers Sequencing Service Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Sanger Sequencing Service Market typically center on whether AI can extend the life or utility of this mature technology, primarily through enhancing data quality control, streamlining analysis, and reducing potential human error. Users are concerned about integrating AI tools designed predominantly for high-throughput NGS data into the lower-throughput, high-fidelity Sanger workflow. The consensus expectation is that AI will primarily serve to automate the interpretation of complex chromatograms, rapidly identifying ambiguous regions, optimizing base-calling accuracy, and integrating quality metrics seamlessly into laboratory information management systems (LIMS), thereby increasing operational efficiency rather than fundamentally changing the sequencing chemistry itself.

- AI enhances chromatogram interpretation and base-calling accuracy, reducing manual review time.

- Machine learning algorithms improve quality control checks, flagging low-quality reads or anomalous peaks automatically.

- AI facilitates rapid comparison of Sanger results against NGS datasets for validation and discrepancy resolution.

- Automation of workflow scheduling and sample tracking through LIMS integration optimized by AI.

- Predictive maintenance for Capillary Electrophoresis instruments based on operational data analysis.

DRO & Impact Forces Of Sangers Sequencing Service Market

The dynamics of the Sanger Sequencing Service Market are shaped by a unique balance of sustained demand drivers and significant technological restraints imposed by competing platforms. Key drivers include the technology's undisputed status as the gold standard for validation, its high accuracy over short reads, and its established, lower operational cost relative to setting up customized NGS runs for small projects. Conversely, the market faces strong headwinds primarily from the exponential growth and reduced cost of Next-Generation Sequencing (NGS) and third-generation sequencing technologies, which offer vastly superior throughput and speed, making Sanger sequencing less viable for large-scale genomic projects. Despite this, opportunities abound in specialized areas such as clinical oncology, infectious disease surveillance, and regulatory compliance checks, where the definitive nature of Sanger results is often mandated.

Drivers: The fundamental driver is the ongoing requirement for accurate, low-cost verification of clones, plasmids, and targeted mutations. Academic research institutions continuously rely on Sanger sequencing for routine molecular biology work due to its affordability and accessibility. Furthermore, its application in clinical diagnostics for identifying specific genetic variants, especially in hereditary diseases or tumor profiling, maintains steady demand, as regulatory bodies often favor the established protocols and unambiguous output of this method. Increased global funding for life sciences and drug discovery pipelines also necessitates stringent quality control steps, invariably utilizing Sanger sequencing services for sequence confirmation.

Restraints: The most significant restraint is the technological obsolescence concerning high-throughput applications. NGS platforms offer massive scalability, drastically reducing the cost per base pair for whole-genome sequencing or large panel analysis, diverting significant potential revenue away from Sanger services. Other restraints include the intrinsic limitation of read length (typically less than 1,000 bases), the need for high-quality template DNA, and the relatively slower throughput compared to modern sequencers. These restraints force Sanger service providers to focus intensely on niche applications and value-added services like expert interpretation and rapid turnaround times (TATs) to maintain competitiveness.

Opportunities: Opportunities arise particularly in the clinical space, specifically in targeted mutation detection, infectious disease outbreak monitoring (where rapid, simple verification is needed), and personalized medicine validation. The market also benefits from serving small biotech companies and academic labs that require small batches of high-accuracy reads but cannot afford or justify the infrastructure investment of NGS. Impact forces summarize how external trends, such as increasing regulatory scrutiny over diagnostic accuracy and the need for personalized cancer therapies, reinforce the utility of Sanger sequencing services, compelling market players to stabilize pricing and enhance service efficiency rather than focusing on radical technological change.

Segmentation Analysis

The Sanger Sequencing Service market is comprehensively segmented based on its core components, the applications it serves, and the various end-user groups that rely on its highly accurate data. The primary segmentation categories include Product Type (which covers DNA sequencing services and Fragment Analysis services), Application (focusing on gene expression, de novo sequencing, and mutation detection), and End-User (dominated by Academic and Research Institutions, Pharmaceutical and Biotechnology Companies, and Clinical Laboratories). This structured segmentation allows market players to precisely target their service offerings—whether it be rapid plasmid verification for academia or highly validated clinical testing for healthcare providers—optimizing pricing and delivery models based on segment-specific needs.

The detailed analysis reveals that while DNA sequencing remains the largest revenue segment due to routine academic demands, the Fragment Analysis segment is poised for robust growth, driven by applications in high-resolution melting curve analysis and microsatellite instability (MSI) testing within oncology. Geographically, while mature markets like North America and Europe hold the largest revenue share, the Asian Pacific market is emerging as a critical growth engine, primarily fueled by massive, government-backed genomics projects in countries like China, India, and South Korea. Understanding these segment dynamics is crucial for strategizing investments, especially in optimizing logistics and regional service hubs to meet increasingly rapid turnaround time requirements.

- Product Type:

- DNA Sequencing Service

- Fragment Analysis Service

- Application:

- Gene Expression Analysis

- De Novo Sequencing

- Mutation Detection & Validation

- Vector Construction Verification

- Forensics

- End-User:

- Academic & Government Research Institutions

- Pharmaceutical & Biotechnology Companies

- Clinical Laboratories

- Hospitals & Diagnostic Centers

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Sangers Sequencing Service Market

The value chain for the Sanger Sequencing Service Market begins with the upstream suppliers responsible for providing essential components. This includes manufacturers of high-purity reagents (such as Taq polymerases, dideoxynucleotides, and proprietary buffering solutions), sequencing dyes, and critical consumables like capillary arrays and reaction plates. These suppliers, often large chemical and life science technology companies, dictate the initial costs and quality standards for the entire chain. Maintaining stable supply relationships and ensuring the consistency of these materials is vital for service providers, as any variance directly affects sequencing fidelity and turnaround times offered to the end-user.

The core of the value chain is the service provider segment, which encompasses both specialized sequencing labs and internal core facilities within larger institutions. These entities manage the complete process: sample submission, quality assessment, PCR amplification, sequencing reaction execution using automated Capillary Electrophoresis (CE) instruments, raw data collection, and bioinformatics processing (base-calling, trimming, quality scoring). Service providers generate value by achieving high throughput, offering rapid turnaround times (often 24-48 hours), and providing comprehensive data analysis and reporting. Distribution channels are predominantly direct, involving online portals or secure physical transfer mechanisms where clients submit samples and receive results electronically. Indirect distribution is minimal but can occur via contract research organizations (CROs) that outsource specialized validation work.

The downstream segment consists of the end-users—academic researchers, biotech companies, and clinical labs—who utilize the final sequenced data for various scientific and medical applications. Feedback from these customers regarding data quality, bioinformatics support, and service speed is crucial for iterative improvement within the value chain. Efficiency in the distribution channel, particularly the speed of data transfer and the security of proprietary genetic information, directly impacts customer satisfaction. The relationship between service providers and end-users is often based on long-term service contracts or bulk ordering agreements, highlighting the importance of maintaining robust, high-quality, and cost-competitive service offerings throughout the forecast period.

Sangers Sequencing Service Market Potential Customers

The primary consumers, or potential customers, in the Sanger Sequencing Service Market are highly concentrated within research and development intensive sectors requiring definitive, high-accuracy sequence verification. Academic and Government Research Institutions represent the largest customer base, relying heavily on these services for routine molecular biology tasks, including cloning validation, plasmid screening, and confirmation of targeted mutations generated through CRISPR/Cas9 experiments. These customers prioritize cost-effectiveness and accessibility, often choosing services based on competitive pricing models and proximity to service hubs, although turnaround time remains a significant factor for time-sensitive projects like doctoral research.

The second major segment comprises Pharmaceutical and Biotechnology Companies. These customers utilize Sanger sequencing services extensively during the early stages of drug discovery and development, specifically for confirming the sequence integrity of therapeutic antibodies, verifying gene constructs used in viral vector production, and for quality control in vaccine development. For this segment, regulatory compliance, data security, and the provision of GLP/GMP-compliant documentation are paramount, leading them to prefer established service providers capable of handling large volumes with audited quality systems. The third crucial segment is Clinical Laboratories and Diagnostic Centers, which use the services for targeted genetic testing, screening known pathogenic variants, and epidemiological studies, emphasizing diagnostic accuracy and rapid results for patient care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 420 Million |

| Market Forecast in 2033 | USD 850 Million |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Eurofins Scientific, Genewiz (Azenta Life Sciences), BGI Genomics, Macrogen, Microsynth AG, LGC Biosearch Technologies, Source BioScience, Illumina (indirectly through service partners), GenScript, CD Genomics, DNA Sequencing Facility at Yale, Quintarabio, SeqGen, Fasteris SA, Cofactor Genomics, Beckman Coulter, Takara Bio. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sangers Sequencing Service Market Key Technology Landscape

The technological landscape of the Sanger Sequencing Service Market is defined almost exclusively by the utilization of high-throughput Capillary Electrophoresis (CE) instruments. These platforms, such as those manufactured by Applied Biosystems (now Thermo Fisher Scientific), are highly automated and robust, allowing service providers to handle thousands of samples daily with consistent precision. The core principle involves separating fluorescently labeled DNA fragments—each terminated by a specific dideoxynucleotide—through microscopic capillaries based on size, with a laser detector reading the order of the fluorescent signals. Continuous technological evolution in this space focuses not on chemistry modification but on optimizing the throughput capacity and data processing speed of these automated CE systems.

A secondary, yet crucial, technological area involves the upstream sample preparation and downstream bioinformatics pipelines. Service providers constantly seek advanced robotics and liquid handling systems to standardize PCR amplification and cleanup steps, ensuring that template quality is consistently high, which is critical for maximizing Sanger read lengths and quality scores. Furthermore, the integration of advanced bioinformatics algorithms (often AI-enhanced) for automated base-calling, noise reduction, and quality trimming is essential. These software enhancements allow providers to deliver cleaner, more interpretable data rapidly, distinguishing high-quality service providers in a competitive environment where raw sequencing is a commodity.

Future technological advancements impacting this market segment are largely incremental, focusing on reducing reagent volumes, shortening run times, and improving the stability of fluorescent dyes. There is also an ongoing push towards better integration between sequencing results and laboratory information management systems (LIMS) to streamline regulatory compliance and tracking, particularly for clinical samples. While NGS platforms represent a fundamentally different technological approach, the established, reliable nature of CE technology ensures its continued dominance within the Sanger sequencing service niche, supported by robust hardware and validated analytical software.

Regional Highlights

The global Sanger Sequencing Service Market exhibits distinct regional dynamics, primarily influenced by R&D expenditure, biotech infrastructure, and regulatory environment across key geographic areas. North America, encompassing the United States and Canada, stands as the leading market both in terms of revenue share and technological adoption. This dominance is attributed to significant and sustained government and private sector investment in genomics research, the high concentration of major pharmaceutical and biotechnology companies, and the robust presence of core academic sequencing facilities. The U.S. market, in particular, drives demand due to intensive clinical research, extensive diagnostic testing utilizing Sanger for validation, and a culture of outsourcing specialized scientific services, leading to competitive pricing structures and highly optimized service delivery models.

Europe represents the second-largest market, characterized by strong academic networks, particularly in the UK, Germany, and France, which are major consumers of Sanger sequencing services for basic research and targeted molecular diagnostics. European demand is stable, supported by increasing applications in infectious disease monitoring and hereditary disease testing where Sanger remains the reference standard. The region benefits from well-established regulatory pathways that often rely on the high fidelity of this technique. Service providers in Europe focus heavily on integrating services with clinical trials and providing advanced bioinformatics analysis tailored to localized regulatory requirements, ensuring continuous demand despite slower overall growth compared to emerging markets.

The Asia Pacific (APAC) region is projected to be the fastest-growing market throughout the forecast period. This rapid expansion is propelled by massive national genomics initiatives in China and South Korea, coupled with expanding investment in biotech infrastructure across India and Southeast Asia. The increasing prevalence of chronic and infectious diseases necessitates robust diagnostic capabilities, driving demand for affordable, reliable sequencing services. Furthermore, lower labor and operational costs allow local service providers to offer highly competitive pricing, attracting both regional and international outsourcing contracts. Governments in APAC are actively encouraging public-private partnerships to enhance sequencing capabilities, setting the stage for substantial market growth in both academic and clinical segments.

- North America (Dominant Market): High R&D spending, extensive presence of large pharma/biotech companies, advanced clinical diagnostics infrastructure, and high adoption rate of outsourced validation services.

- Europe (Stable Growth): Strong academic research base, increasing clinical application in personalized medicine, stringent quality standards favoring Sanger fidelity, and high demand from centralized core facilities.

- Asia Pacific (Fastest Growth): Rapid expansion of genomics initiatives (e.g., China, India), growing governmental investment in life sciences infrastructure, increasing disease prevalence requiring targeted sequencing, and cost-competitive regional service providers.

- Latin America (Emerging Potential): Growing awareness and investment in genetic research, increasing need for infectious disease characterization, but growth constrained by fragmented healthcare spending and limited local infrastructure.

- Middle East and Africa (Niche Market): Demand focused primarily on specific genetic disorders and infectious disease surveillance, driven by international collaborations and specialized research centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sangers Sequencing Service Market.- Thermo Fisher Scientific (including Applied Biosystems Services)

- Eurofins Scientific

- Genewiz (Azenta Life Sciences)

- BGI Genomics

- Macrogen

- Microsynth AG

- LGC Biosearch Technologies

- Source BioScience

- GenScript

- CD Genomics

- Quintarabio

- SeqGen

- Fasteris SA

- Cofactor Genomics

- Beckman Coulter (instrument provider influencing service)

- Takara Bio

- SOPHiA GENETICS

- GenDx

- Psomagen

- Laragen

Frequently Asked Questions

Analyze common user questions about the Sangers Sequencing Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of Sanger sequencing services in modern genomics?

The primary role is serving as the gold standard for high-accuracy verification, quality control (QC), and validation of results obtained from high-throughput Next-Generation Sequencing (NGS) platforms. It is also essential for routine tasks like plasmid confirmation and targeted mutation detection in clinical settings where definitive, long-read accuracy is required.

How is the competition from NGS technology impacting the Sanger sequencing market?

NGS technology limits the Sanger market's ability to participate in large-scale, high-throughput projects. However, it drives Sanger providers to specialize, focusing on rapid turnaround times (TAT), superior data quality, advanced bioinformatics for short reads, and maintaining cost-effectiveness for small-to-medium project validation needs, thus stabilizing its niche market share.

Which end-user segment drives the largest demand for Sanger sequencing services?

Academic and Government Research Institutions collectively constitute the largest end-user segment. These organizations continuously require affordable, reliable sequencing services for foundational molecular biology research, cloning validation, and educational purposes, often relying on core facilities or external service labs for support.

What technological advancements are key in sustaining the growth of this market?

Key technological advancements are centered on optimizing workflow efficiency, including high-throughput automation via advanced Capillary Electrophoresis (CE) instruments, sophisticated liquid handling robotics for sample preparation, and AI-enhanced bioinformatics for rapid, accurate base-calling and automated quality assessment.

What is the forecast CAGR for the Sanger Sequencing Service Market between 2026 and 2033?

The Sangers Sequencing Service Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033, driven by sustained global investment in life sciences R&D and the indispensable need for validation in clinical and pharmaceutical development pipelines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager