SAP Consulting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434327 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

SAP Consulting Market Size

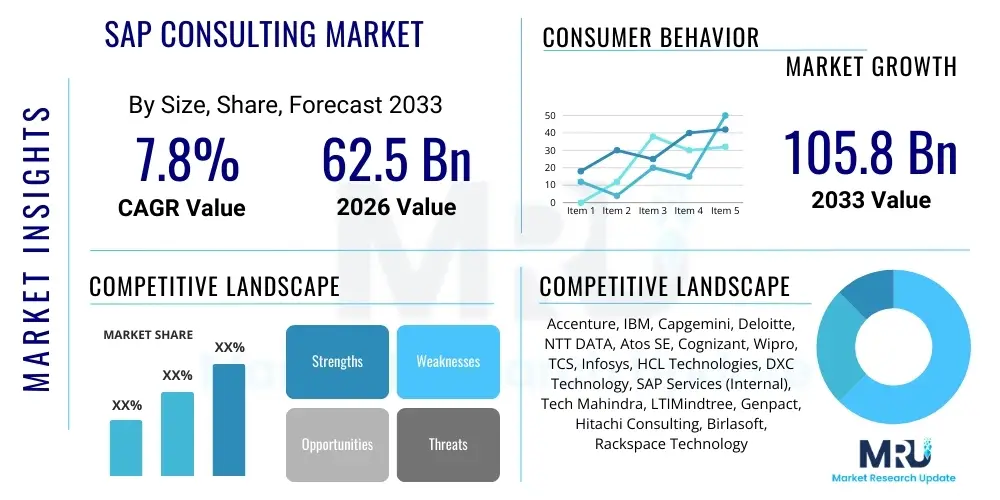

The SAP Consulting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 62.5 Billion in 2026 and is projected to reach USD 105.8 Billion by the end of the forecast period in 2033.

SAP Consulting Market introduction

The SAP Consulting Market encompasses advisory and implementation services related to the deployment, optimization, and management of SAP’s enterprise software suite. This market is fundamentally driven by the global imperative for digital transformation, where organizations seek to modernize their core business processes through robust Enterprise Resource Planning (ERP) systems. The core offering involves strategic consulting for technology roadmapping, system integration, technical development, and post-implementation support, primarily centered around SAP S/4HANA, SAP SuccessFactors, SAP Ariba, and SAP Customer Experience (CX) solutions. As complexity in enterprise architecture increases, specialized SAP consulting expertise becomes critical for ensuring successful outcomes, compliance, and competitive advantage.

Product description within this market segment includes various service types, ranging from high-level management consulting focused on business process redesign enabled by SAP technologies, to technical implementation and Application Management Services (AMS). A major shift defining the current landscape is the migration from legacy SAP ERP Central Component (ECC) systems to the cloud-native S/4HANA platform. This mandatory transition creates a sustained, high-demand environment for consultants proficient in cloud infrastructure, data migration, and the new functional capabilities inherent in S/4HANA, particularly those related to real-time analytics and embedded intelligence.

Major applications of SAP consulting span virtually every major industry vertical, including manufacturing, retail, banking, and government, facilitating key operational functions such as finance, supply chain management, human resources, and customer relationship management. The benefits derived from employing SAP consulting services include accelerated implementation timelines, reduced operational risk, optimized business processes aligned with best practices, and leveraging advanced features like machine learning and IoT integration that modern SAP solutions offer. Key driving factors accelerating market growth include the widespread adoption of cloud computing models, increasing regulatory complexity requiring agile system adaptations, and the constant need for supply chain resilience and transparency in a volatile global economy.

SAP Consulting Market Executive Summary

The SAP Consulting Market is currently characterized by robust business trends centered on cloud migration, particularly the move to SAP S/4HANA Cloud and the Business Technology Platform (BTP). Service providers are consolidating their expertise around intelligent technologies, embedding Artificial Intelligence (AI) and Machine Learning (ML) capabilities directly into their service offerings to enhance automation and predictive analytics for clients. Geographically, North America remains the dominant revenue contributor due to high enterprise technology expenditure and early adoption of cloud ERP, although the Asia Pacific (APAC) region is demonstrating the fastest growth owing to rapid industrialization and significant investment in digital infrastructure by large enterprises and ambitious Small and Medium-sized Enterprises (SMEs). The competitive landscape is intensely focused on acquiring and retaining highly specialized talent, leading to strategic mergers and acquisitions (M&A) among mid-sized firms to bolster specific geographic or vertical competencies.

Regional trends indicate a maturing market in Western Europe, where consultants are primarily focused on optimizing existing S/4HANA installations and driving sustainability-focused implementations, utilizing tools like SAP Responsible Design and Production. Conversely, Latin America and the Middle East and Africa (MEA) are seeing initial large-scale greenfield implementations, particularly within the energy, government, and heavy manufacturing sectors, creating significant opportunities for implementation and rollout service segments. The demand across all regions is heavily skewed toward services that offer quantifiable returns on investment (ROI), such as supply chain planning optimization and financial reporting automation, cementing the market shift from purely technical services to integrated business and technology consulting.

Segmentation trends highlight the increasing importance of Application Management Services (AMS) as complexity necessitates continuous maintenance and enhancement, often delivered through outcome-based managed services contracts. By enterprise size, while Large Enterprises constitute the largest revenue base for complex, multi-year transformation projects, the SME segment is exhibiting accelerated adoption of standardized, cloud-based SAP solutions, such as SAP Business ByDesign and tailored S/4HANA Cloud editions, driving demand for rapid deployment services. Vertically, the Manufacturing and BFSI sectors continue to be the largest consumers of SAP consulting, demanding deep functional expertise in areas like smart factory integration (Industry 4.0) and stringent regulatory compliance (e.g., Basel IV, IFRS 17). Furthermore, sustainability and ESG reporting requirements are emerging as a critical horizontal segment demanding new specialized consulting skills.

AI Impact Analysis on SAP Consulting Market

Common user questions regarding AI's impact on the SAP Consulting Market typically revolve around whether AI will automate and reduce the need for consultants, or if it will instead augment their capabilities and shift the required skill set. Users are keen to understand how AI-driven tools, particularly those embedded within SAP BTP and S/4HANA (such as SAP Leonardo and embedded ML functionalities), are changing project implementation methodologies, maintenance requirements, and overall ROI calculations. Key concerns center on the need for consultants to rapidly upskill in data science and AI governance to effectively utilize these tools, alongside expectations that routine tasks like system monitoring, regression testing, and low-complexity data migration will be heavily automated, forcing consulting firms to refocus on strategic advisory roles, complex integration challenges, and change management involving intelligent processes.

The integration of Artificial Intelligence and Machine Learning (AI/ML) is fundamentally transforming the SAP consulting lifecycle from project initiation to post-go-live support. During the scoping phase, AI tools are now used for predictive risk assessment and optimized blueprint generation based on industry benchmarks. For implementation, low-code/no-code platforms utilizing AI enable faster development cycles and configuration. Furthermore, the highest impact is seen in Application Management Services (AMS), where intelligent automation (i.e., AIOps) handles the majority of monitoring and incident resolution, shifting the consultant's role from reactive support to proactive system improvement and innovation. This necessity for consultants to design, deploy, and manage intelligent, self-optimizing SAP landscapes ensures that while the nature of the work changes, the demand for high-value strategic consulting remains strong.

- Automation of Routine Tasks: AI significantly automates repetitive processes like system configuration documentation, data quality checks, and Level 1 and 2 support requests, increasing consultant efficiency.

- Enhanced Predictive Analytics: Consultants leverage embedded AI in S/4HANA to offer advanced predictive maintenance and demand forecasting services, moving clients toward proactive decision-making.

- Shift in Required Skill Set: Increased demand for consultants proficient in data engineering, AI governance, cloud infrastructure management, and SAP Business Technology Platform (BTP) development.

- Accelerated Implementation: AI-driven tools facilitate accelerated testing, automated code generation, and risk identification, potentially reducing overall implementation timeframes.

- Intelligent Process Mining: AI analyzes client business processes pre-implementation to identify optimal SAP configurations and efficiency gains, improving advisory quality.

DRO & Impact Forces Of SAP Consulting Market

The SAP Consulting Market dynamics are strongly influenced by a robust combination of compelling drivers, persistent restraints, and significant emerging opportunities, all mediated by critical impact forces that shape market trajectory. The primary driver is the mandated technological sunset of the legacy SAP ECC system, compelling a non-negotiable migration to SAP S/4HANA, often leveraging cloud deployments (such as RISE with SAP). This transition, coupled with the overwhelming global push for comprehensive digital transformation across all industry verticals, ensures a sustained pipeline of large-scale, complex projects for consulting providers. Conversely, the market faces intense restraints, notably the prohibitive initial investment costs associated with major ERP transformations, which can be a barrier for price-sensitive organizations, and the severe global shortage of certified, niche SAP consultants, particularly those specializing in advanced modules like EWM, IBP, and specialized cloud landscapes. This scarcity often results in high labor costs and project delays, moderating market expansion.

Opportunities within the market largely revolve around strategic augmentation of SAP core services with new technologies and specialized vertical solutions. The integration of cutting-edge technologies like industrial IoT (IIoT), Blockchain, and advanced AI/ML capabilities, often built on the SAP Business Technology Platform (BTP), represents a key avenue for service differentiation and higher-margin engagements. Furthermore, the growing focus on Environmental, Social, and Governance (ESG) reporting and supply chain sustainability is creating a specialized niche for consulting services related to SAP solutions designed for circular economy management and carbon accounting. Geographically, untapped emerging markets offer substantial growth potential for consultancies willing to establish local presence and tailor offerings to unique regional regulatory and infrastructure challenges. The shift towards outcome-based consulting models, where fees are tied to measurable business results rather than hours spent, also presents an opportunity for innovative delivery models.

The overarching impact forces shaping market evolution include the speed of technological adoption, particularly the enterprise acceptance rate of true public cloud ERP (S/4HANA Cloud), economic volatility affecting IT budgets, and the ever-changing global regulatory landscape regarding data privacy (e.g., GDPR, CCPA). Global economic conditions significantly dictate the size and frequency of transformational projects, as these are typically long-term, capital-intensive undertakings. Moreover, intensified competition from hyperscalers and boutique firms, coupled with SAP's own internal services capabilities, puts continuous pressure on pricing and the quality of delivery. The success of consulting providers is increasingly measured by their ability to manage complex integrations with non-SAP systems and demonstrate deep, industry-specific functional expertise rather than just technical implementation proficiency.

Segmentation Analysis

The SAP Consulting Market is analyzed based on several dimensions including the type of service delivered, the size of the client organization, the specific industry vertical served, and the deployment methodology utilized. The Service Type segment is critical, determining the revenue stream structure for consulting firms, with Implementation and Rollout services often generating the highest short-term revenues, while Application Management Services (AMS) provide stable, recurring income. The segmentation by Enterprise Size highlights the difference between complex, bespoke transformation projects favored by Large Enterprises and the standardized, rapid deployment models preferred by Small and Medium-sized Enterprises (SMEs). This granular analysis helps consulting firms tailor their go-to-market strategies, resource allocation, and intellectual property development to effectively address the distinct needs and maturity levels across various client groups and technological landscapes.

- By Service Type:

- Management Consulting & Advisory

- Implementation & Rollout Services

- Application Management Services (AMS)

- Upgrade & Migration Services (Focused on S/4HANA)

- Training and Support Services

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- Manufacturing (Discrete and Process)

- Retail and Consumer Goods (RCG)

- Healthcare and Pharmaceuticals

- IT and Telecom

- Government and Public Sector

- Utilities and Energy

- By Deployment Mode:

- On-Premise

- Cloud-Based (Public, Private, Hybrid)

Value Chain Analysis For SAP Consulting Market

The value chain for the SAP Consulting Market begins with the upstream activities primarily dominated by SAP SE, which provides the intellectual property (the software and platform architecture, such as S/4HANA and BTP), alongside Independent Software Vendors (ISVs) who contribute specialized add-ons and vertical solutions. Upstream analysis focuses on the partnership ecosystem, where consulting firms invest heavily in gaining and maintaining SAP certifications, developing proprietary industry accelerators, and training specialized consultants. Key upstream inputs are human capital (highly skilled functional and technical experts) and technological partnerships, which dictate the firm’s capability to deliver modern, complex cloud transformations. The strength of the partnership with SAP (e.g., Global Strategic Service Partner status) is a critical determinant of market visibility and access to early development insights and priority sales leads.

The mid-stream segment involves the core delivery of consulting services, encompassing project management, business blueprinting, technical configuration, data migration, and system integration. This is where value is primarily generated through efficient resource deployment, effective methodologies (like SAP Activate), and successful change management. Distribution channels in this market are predominantly direct, involving long-term strategic relationships between the consulting firm and the client enterprise. However, indirect channels also play a role, particularly through regional resellers or niche technology partners who integrate consulting services into broader solution packages for the SME segment. The shift to cloud models necessitates closer collaboration between the consulting firm, the client, and the cloud hyperscalers (AWS, Azure, Google Cloud), adding a layer of complexity to service delivery logistics.

Downstream analysis focuses on the realization of value by the end-user, typically measured by post-implementation benefits such as operational efficiencies, real-time reporting capabilities, and improved regulatory compliance. Downstream activities include continuous improvement consulting, Application Management Services (AMS), and ongoing strategic advisory regarding roadmap evolution and future technology adoption (e.g., moving from S/4HANA Private Cloud to Public Cloud). The success in the downstream phase ensures client retention and repeat business, which is vital for sustained revenue. The quality of support and optimization services directly influences the client's total cost of ownership (TCO) and perceived value, solidifying the consulting firm's position as a long-term strategic technology partner, rather than just a one-time implementer.

SAP Consulting Market Potential Customers

Potential customers for SAP Consulting services are defined primarily by their size, industry, and their current stage in the digital transformation lifecycle—specifically, their readiness to transition to modern, integrated enterprise systems. The largest pool of customers comprises Global 2000 companies that are mandated to migrate their legacy SAP ECC systems to S/4HANA by the deadline, representing continuous, high-value conversion projects. These large enterprises require highly complex, multi-country rollouts involving deep functional specialization in areas such as global tax reporting, complex manufacturing supply chains, and extensive change management across thousands of employees. The decision-makers are typically the Chief Information Officer (CIO), Chief Financial Officer (CFO), and Chief Operations Officer (COO), all seeking measurable strategic outcomes.

A rapidly growing segment includes mid-market companies (SMEs) that are seeking their first integrated ERP solution or migrating from smaller systems to scalable, cloud-based SAP offerings (like S/4HANA Cloud Essential or SAP Business ByDesign). These buyers are highly cost-sensitive and prefer standardized, predictable implementation packages with rapid deployment times. Their primary need is often streamlining core processes—finance, procurement, and inventory—to achieve competitive efficiency gains, positioning the CFO and operational leaders as key decision-makers. Consultants targeting this segment must excel in providing pre-packaged solutions and templates, minimizing customization requirements that drive up cost and complexity.

Furthermore, any organization operating in a highly regulated industry, such as BFSI, Healthcare, or Government, represents a critical customer base due to the inherent complexity of compliance requirements and data security standards. These customers require consulting services not just for technical implementation, but for expert interpretation and configuration of SAP modules (e.g., SAP Treasury, SAP CML, validated systems for Pharma) to meet industry-specific regulations. These engagements often demand highly specialized consultants with dual expertise in the SAP application and the specific regulatory framework of the industry, positioning regulatory compliance officers and risk management executives as influential end-users and buyers of specialized SAP consulting expertise.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 62.5 Billion |

| Market Forecast in 2033 | USD 105.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, IBM, Capgemini, Deloitte, NTT DATA, Atos SE, Cognizant, Wipro, TCS, Infosys, HCL Technologies, DXC Technology, SAP Services (Internal), Tech Mahindra, LTIMindtree, Genpact, Hitachi Consulting, Birlasoft, Rackspace Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SAP Consulting Market Key Technology Landscape

The SAP Consulting Market is defined by a technology landscape dominated by the transition to SAP S/4HANA and the strategic deployment of the SAP Business Technology Platform (BTP). S/4HANA, as the modern core ERP system, mandates a shift in consulting focus from transactional efficiency to real-time analytics and embedded machine learning capabilities. Consultants must now be experts in managing HANA database intricacies and leveraging its in-memory computing speed to redesign business processes. The core technology challenge lies in converting historical ECC customizations into clean, standard S/4HANA processes, requiring deep expertise in 'fit-to-standard' methodologies and specialized data transformation tools.

The SAP Business Technology Platform (BTP) is emerging as the central technological differentiator for consulting firms. BTP acts as the innovation layer, enabling clients to extend, integrate, and build custom applications (often low-code/no-code) without modifying the core S/4HANA system. This platform, encompassing database services, analytics, application development, and intelligent technologies (AI/ML, RPA), requires consultants to possess cloud development skills, proficiency in various programming languages like JavaScript and Python, and an understanding of microservices architecture. Firms that successfully integrate BTP offerings into their S/4HANA projects achieve higher margins by providing tailored, industry-specific innovations and intellectual property (IP).

Furthermore, cloud infrastructure management, particularly involving the three major hyperscalers (AWS, Microsoft Azure, Google Cloud), is now a foundational technological requirement. The "RISE with SAP" offering has institutionalized the concept of a cloud-first ERP, demanding that consulting teams be certified in cloud architecture and operations (FinOps, DevOps) to manage the underlying infrastructure and ensure optimal performance, security, and scalability of the SAP environment. Other crucial technologies include Robotic Process Automation (RPA) for task automation within business processes, and comprehensive data management tools essential for complex data harmonization during large-scale migration projects.

Regional Highlights

The global SAP Consulting Market exhibits significant regional variations in maturity, growth velocity, and project focus, reflecting differing levels of digital maturity and economic drivers. North America, encompassing the United States and Canada, represents the largest revenue share, characterized by high IT spending, a mature cloud adoption ecosystem, and an urgent requirement for complex, cross-functional S/4HANA transformations, often focused on optimizing financial services, high-tech manufacturing, and retail operations. Consultancies in this region specialize in advanced integration and innovative use of BTP.

Europe, particularly Western Europe (Germany, UK, France), maintains a strong position, driven by regulatory compliance needs (e.g., EU data privacy rules) and the push towards sustainable supply chains (e.g., using SAP solutions for carbon accounting). The market here is sophisticated, with consultants focusing heavily on optimizing existing ECC and S/4HANA landscapes rather than purely greenfield implementations. Central and Eastern Europe are increasingly adopting SAP solutions, driving demand for localized implementation expertise and template rollouts.

Asia Pacific (APAC) is projected to record the highest growth rate, fueled by rapid industrialization, massive infrastructure projects in countries like India and China, and the expansion of multinational corporations into Southeast Asia. This region sees a mix of greenfield S/4HANA implementations for new market entrants and large-scale transformation projects for established regional conglomerates, often emphasizing supply chain resilience and cloud adoption tailored to local regulatory environments.

Latin America and the Middle East & Africa (MEA) are emerging regions that present substantial opportunity, although market penetration is lower. Projects in Latin America often revolve around complex tax and legal localization requirements, while the MEA region sees large public sector and energy sector contracts, reflecting high government investments in national digital agendas. Consultants operating here must have deep understanding of regional governmental procurement processes and localized compliance complexities.

- North America (NA): Dominant market share; focus on S/4HANA cloud transition, BTP innovation, and finance transformation in BFSI and Technology sectors.

- Europe: High adoption maturity; emphasis on regulatory compliance, sustainability reporting (ESG), and sophisticated optimization of complex manufacturing landscapes.

- Asia Pacific (APAC): Fastest growing region; driven by new market entries, large-scale industrialization, rapid cloud adoption, particularly in supply chain and logistics.

- Latin America (LATAM): Growth centered on regulatory compliance, tax localization, and modernization of resource-intensive industries like mining and energy.

- Middle East and Africa (MEA): Significant investments from government and energy sectors; focus on building resilient digital infrastructure and national technology agendas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SAP Consulting Market.- Accenture

- IBM

- Capgemini

- Deloitte

- NTT DATA

- Atos SE

- Cognizant

- Wipro

- TCS (Tata Consultancy Services)

- Infosys

- HCL Technologies

- DXC Technology

- SAP Services (Internal Consulting Organization)

- Tech Mahindra

- LTIMindtree

- Genpact

- Hitachi Consulting (Now Hitachi Vantara)

- Birlasoft

- Rackspace Technology

- T-Systems International GmbH

Frequently Asked Questions

Analyze common user questions about the SAP Consulting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the SAP Consulting Market?

The primary driver is the impending end-of-support deadline for the legacy SAP ECC system, necessitating large-scale, mandatory migration projects to SAP S/4HANA. This transition is further fueled by the universal need for enterprise cloud adoption and digital process transformation to achieve real-time operational visibility.

How is AI impacting the demand for SAP consultants?

AI is shifting demand away from transactional and repetitive support tasks towards highly specialized strategic advisory roles. While AI automates basic maintenance and configuration, it increases the need for consultants skilled in AI governance, advanced data integration, and building innovative solutions on the SAP Business Technology Platform (BTP).

Which industry vertical is the largest consumer of SAP Consulting services?

The Manufacturing sector, including both discrete and process manufacturing, remains the largest consumer due to the complexity of integrating global supply chains, managing Industry 4.0 initiatives, and optimizing large-scale production planning and execution using sophisticated SAP modules.

What are the main financial restraints facing the SAP Consulting Market?

The main restraints are the high initial implementation costs and the substantial Total Cost of Ownership (TCO) associated with large-scale S/4HANA transformations. Additionally, the increasing scarcity of certified, specialized SAP talent drives up consulting rates, potentially delaying adoption among budget-constrained organizations.

What is the significance of the SAP Business Technology Platform (BTP) for consulting firms?

BTP is crucial as it allows consulting firms to move beyond core implementation and offer high-value, customized extensions, integrations, and intelligent applications (utilizing AI/ML and IoT) without altering the core S/4HANA system. This capability enables rapid innovation and creates long-term, sticky Application Management Services (AMS) contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager