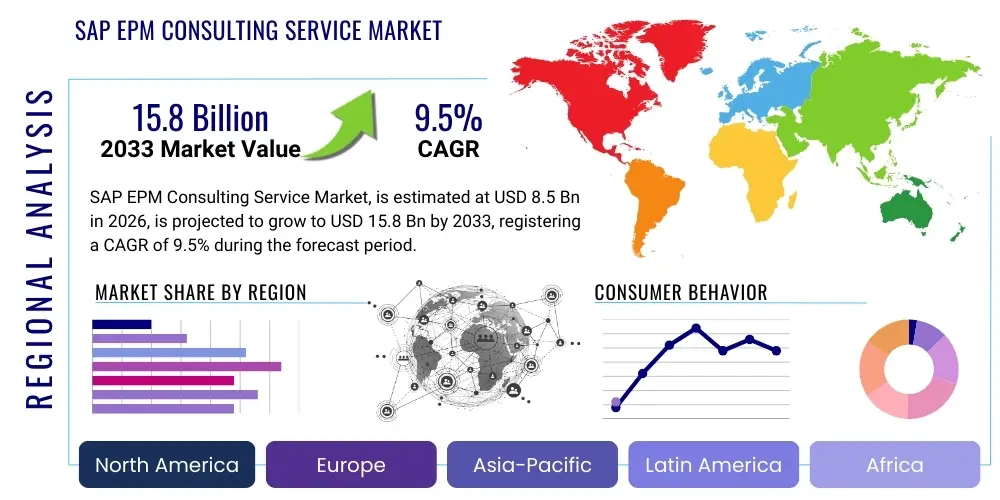

SAP EPM Consulting Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435488 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

SAP EPM Consulting Service Market Size

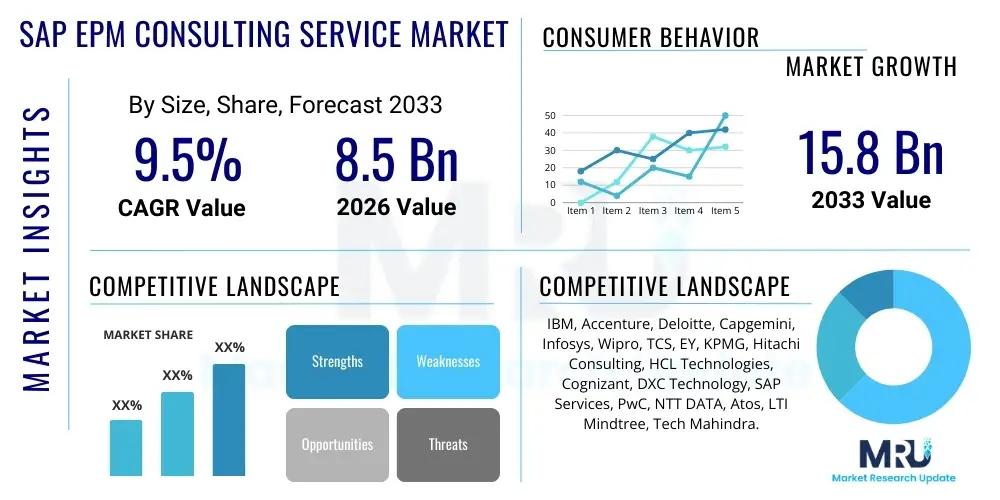

The SAP EPM Consulting Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 15.8 Billion by the end of the forecast period in 2033.

SAP EPM Consulting Service Market introduction

The SAP Enterprise Performance Management (EPM) consulting service market encompasses advisory, implementation, migration, and managed services aimed at optimizing organizational planning, budgeting, forecasting, financial consolidation, and profitability analysis using SAP’s comprehensive suite of EPM solutions. These services are crucial for enterprises navigating complex financial landscapes, regulatory requirements, and the imperative for faster, data-driven decision-making. The demand is heavily fueled by the transition towards cloud-based EPM platforms, particularly SAP Analytics Cloud (SAC) for planning and SAP S/4HANA Group Reporting, which necessitate specialized consulting expertise for seamless integration and deployment across diverse business functions.

Product description highlights the specialized support provided by consulting firms in implementing SAP tools such as SAP Business Planning and Consolidation (BPC), SAP Group Reporting, and SAC Planning. These services ensure that organizations can effectively integrate their financial and operational data, moving beyond disparate spreadsheets to achieve a single source of financial truth. Major applications span strategic planning, operational budgeting, legal and management consolidation, statutory reporting, and granular cost analysis. Consulting firms guide clients through process transformation, ensuring EPM systems align with corporate objectives and global compliance standards.

The primary benefits delivered by SAP EPM consulting services include enhanced financial accuracy, accelerated planning cycles, improved regulatory compliance (e.g., IFRS, GAAP), and deeper business insights through advanced analytics and predictive capabilities. Driving factors include the global push for digital finance transformation, the complexity associated with migrating legacy SAP systems (like SAP BPC 10.1 or 11.0) to newer cloud-native platforms, the need for real-time reporting facilitated by S/4HANA, and the increasing organizational requirement for continuous, integrated planning (xP&A – Extended Planning and Analysis).

SAP EPM Consulting Service Market Executive Summary

The SAP EPM Consulting Service Market is experiencing robust growth, primarily driven by mandatory large-scale cloud migration projects and the enterprise shift towards Extended Planning and Analysis (xP&A) frameworks, replacing traditional siloed planning functions. Business trends indicate a strong preference for managed services post-implementation, ensuring continuous optimization and swift adaptation to evolving financial regulations. Consulting delivery models are rapidly pivoting towards agile, outcome-based approaches, leveraging specialized accelerators and pre-configured content packs to reduce deployment time and risk, significantly impacting client value perception and service pricing structures across the competitive landscape.

Regional trends demonstrate North America and Europe maintaining leadership due to high adoption rates of SAP S/4HANA and established financial maturity, necessitating complex consolidation and planning implementations. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid industrialization, increasing governmental focus on stringent financial transparency, and substantial foreign direct investment driving large enterprises to adopt standardized, global EPM systems. This regional growth is creating significant opportunities for consulting firms capable of handling multi-country implementations and localized compliance requirements effectively.

Segmentation trends reveal that the deployment of cloud-based EPM solutions, particularly those leveraging SAP Analytics Cloud (SAC) Planning capabilities, dominates new project starts, overtaking traditional on-premise implementations. Service types show a high concentration in complex Advisory and Implementation services, but Managed Services are capturing increasing market share as organizations seek long-term operational support and expertise transfer. Furthermore, the BFSI (Banking, Financial Services, and Insurance) and Manufacturing sectors remain the largest spenders on EPM consulting, due to high regulatory burden and the inherent complexity of their global financial processes, demanding highly sophisticated profitability and cost management models.

AI Impact Analysis on SAP EPM Consulting Service Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the SAP EPM consulting space often revolve around whether AI will automate core consulting tasks, specifically implementation effort reduction, and how AI-driven predictive capabilities (within SAP tools like SAC) will change the nature of planning services. Users are keenly interested in understanding how AI can enhance forecasting accuracy, automate financial close processes, and identify anomalies in large financial datasets, thus shifting the consultant's role from data manipulation to strategic interpretation and system governance. Key themes center on the necessity for consulting firms to quickly integrate AI/Machine Learning (ML) expertise into their implementation teams, transforming traditional functional consultants into hybrid experts capable of deploying intelligent EPM solutions and ensuring data integrity for AI consumption.

The integration of AI/ML into SAP EPM solutions, particularly through SAC Planning's predictive forecasting algorithms and automated data integration features, fundamentally changes the consulting value proposition. Consultants are now focused on architecting intelligent planning models that leverage historical data, external factors, and predictive techniques to deliver rolling forecasts with greater speed and reliability than manual methods. This shift necessitates consulting skill augmentation in data science and statistical modeling, moving away from purely functional configuration. Moreover, AI is being deployed within the consulting process itself, utilizing tools for automated configuration documentation, code testing, and project management, streamlining delivery timelines and improving the quality assurance phase of major EPM transformation projects.

The impact of AI is generating new service lines focused on 'Intelligent EPM Strategy' and 'AI Model Governance.' Consultants advise clients not only on system configuration but also on establishing frameworks for continuously training, monitoring, and validating AI/ML models embedded within their planning and consolidation systems. While AI automates repetitive tasks like variance analysis and basic forecasting, it elevates the consultant's role to a strategic advisor focused on interpreting AI outputs, managing biases, and using the resulting insights to drive strategic business decisions. This ensures that the human element remains central to high-value EPM consulting, focusing on complex change management and executive buy-in for AI-driven financial insights.

- AI enhances predictive planning accuracy, reducing manual forecasting effort.

- Automation of financial close tasks via AI streamlines compliance processes.

- Consultants must integrate data science skills to deploy intelligent EPM models effectively.

- AI tools optimize consulting delivery by automating documentation and testing phases.

- New service offerings focus on AI Model Governance and Intelligent EPM Strategy formulation.

- Shift in consulting focus from data entry/manipulation to strategic interpretation of AI-generated insights.

DRO & Impact Forces Of SAP EPM Consulting Service Market

The SAP EPM Consulting Service market is significantly influenced by a dynamic interplay of factors, summarized by robust market drivers, critical restraints, and substantial opportunities shaping future growth. Key drivers include the mandatory migration to SAP S/4HANA, which often necessitates a complete overhaul of financial processes including EPM, pushing organizations to adopt modern SAP solutions like SAC Planning and Group Reporting. The perpetual need for regulatory compliance (e.g., ESG reporting integration, constantly updated financial standards) serves as a constant demand generator for specialized EPM consulting expertise. Conversely, the primary restraints center around the high complexity and cost associated with large-scale EPM transformations, coupled with a severe global shortage of certified, experienced SAP EPM consultants, which limits service delivery capacity and drives up pricing.

Opportunities for market expansion are vast, primarily residing in the shift towards cloud-native solutions, creating long-term recurring revenue streams through Managed Services and continuous solution enhancements (DevOps model). The increasing adoption of Extended Planning and Analysis (xP&A), integrating financial, operational, HR, and sales planning onto a unified platform, opens consulting engagements far beyond the traditional finance department. Furthermore, niche services focused on integrating ESG (Environmental, Social, and Governance) metrics into financial planning processes, utilizing SAP solutions for Sustainability Performance Management, represent a significant untapped market segment requiring specialized advisory services and technical implementation skills.

The primary impact force remains technological disruption, specifically the accelerated development cycle of SAP’s cloud offerings (SAC) which requires continuous consultant upskilling and solution refinement. Competitive intensity among global system integrators and boutique specialized firms forces innovation in delivery models, often leveraging proprietary accelerators and intellectual property (IP) to differentiate services and justify premium pricing. Economic volatility acts as a mitigating force; while recessions might defer capital expenditure on new implementation projects, the resulting pressure for greater financial transparency and efficiency often drives demand for smaller, focused optimization and managed services engagements, ensuring stable foundational demand in the consulting sector.

Segmentation Analysis

The SAP EPM Consulting Service market is highly fragmented yet structurally defined by the nature of the service delivered, the specific SAP solution utilized, the deployment architecture preferred by the client, and the end-use industry being served. Segmentation provides critical clarity into market dynamics, revealing where investment is focused and where specialized consulting expertise is most required. The shift from legacy solution support to cloud-native platform implementation (SAC) is the most defining trend across all service and solution segments, requiring consultants to be proficient in modern agile methodologies and cloud infrastructure management.

- By Service Type: Implementation Services, Advisory Services (Strategy & Process Design), Managed Services, Training & Support.

- By Solution: SAP Business Planning and Consolidation (BPC), SAP Analytics Cloud (SAC) Planning, SAP Group Reporting (S/4HANA), SAP Profitability and Performance Management (PaPM), Other Legacy EPM Solutions.

- By Deployment Model: On-Premise, Cloud-Based (Public, Private), Hybrid Deployment.

- By End-Use Industry: Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Manufacturing (Discrete & Process), Healthcare and Pharmaceuticals, Retail and Consumer Goods (RCG), Public Sector and Utilities.

Value Chain Analysis For SAP EPM Consulting Service Market

The value chain for SAP EPM consulting services begins with the upstream activities centered on talent acquisition, intellectual property development (pre-configured templates, methodology accelerators), and strategic partnerships with SAP. Upstream success is defined by a firm's ability to attract and retain highly certified functional and technical consultants, particularly those specialized in integrated SAC and S/4HANA environments. Consulting firms invest heavily in internal training academies and specialized research to stay ahead of SAP’s release schedule, ensuring their methodologies (e.g., SAP Activate tailored for EPM) remain cutting-edge and efficient, thereby forming the essential input for high-value service delivery.

The midstream phase focuses on core service delivery, encompassing detailed requirements gathering, process design, system configuration, data migration, and rigorous testing phases. This is where the consulting expertise translates intellectual capital into customized client solutions. Success in the midstream is governed by project management excellence, scope control, and effective change management to ensure end-user adoption of the new EPM system. Most consultancies utilize a blended approach, mixing onshore strategic leadership with offshore or nearshore execution centers to balance cost efficiency with specialized skill availability.

Downstream activities involve post-implementation support, managed services, and continuous optimization, establishing long-term revenue streams. Distribution channels are predominantly direct, where consulting firms engage directly with large enterprises via sales teams and established client relationships. However, indirect channels, such as partnerships with independent software vendors (ISVs) providing complementary tools or specialized regional resellers, play a crucial role in reaching mid-market clients. Managed services, focused on application maintenance, system upgrades, and financial data governance, represent the most critical downstream element for maximizing customer lifetime value and maintaining market presence.

SAP EPM Consulting Service Market Potential Customers

Potential customers for SAP EPM consulting services span virtually all large and mid-sized organizations globally that utilize or plan to utilize SAP as their primary Enterprise Resource Planning (ERP) backbone. The primary drivers for adopting these services are organizations currently undergoing or planning a massive digital finance transformation, particularly those moving from legacy ERP systems (like ECC) to SAP S/4HANA, as the EPM transformation is intrinsically linked to the underlying core ledger architecture. These services are essential for organizations struggling with lengthy financial closing processes, inaccurate budgeting cycles, or fragmentation caused by using numerous non-integrated planning tools.

End-users typically include Chief Financial Officers (CFOs), Heads of Financial Planning and Analysis (FP&A), Chief Accounting Officers (CAOs), and IT Directors responsible for financial systems architecture. The most significant buyers are multinational corporations (MNCs) that require complex financial consolidation and reporting across various legal entities and currencies, needing expertise in setting up SAP Group Reporting and ensuring compliance with multiple global accounting standards (e.g., IFRS 16, ASC 842). High-growth companies that are rapidly scaling, or those involved in frequent mergers and acquisitions (M&A), also represent high-potential customers, requiring rapid integration and standardization of financial systems using robust SAP EPM platforms.

Industry-specific buyers include major financial institutions (BFSI) seeking complex stress testing and regulatory reporting capabilities (often using SAP PaPM), and global manufacturers who need detailed profitability analysis (costing, margins) integrated deeply with production data. These customers require highly specialized consulting teams that understand both the SAP platform mechanics and the intricacies of their sector-specific planning challenges. The transition to integrated business planning (IBP) also positions operational leaders (e.g., Supply Chain VPs, HR Directors) as increasingly important stakeholders and customers for EPM consulting services focused on extending planning capabilities beyond the finance function.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 15.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Accenture, Deloitte, Capgemini, Infosys, Wipro, TCS, EY, KPMG, Hitachi Consulting, HCL Technologies, Cognizant, DXC Technology, SAP Services, PwC, NTT DATA, Atos, LTI Mindtree, Tech Mahindra. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SAP EPM Consulting Service Market Key Technology Landscape

The technology landscape governing the SAP EPM consulting market is primarily defined by the evolution of SAP’s core financial architecture and its push towards cloud platforms. The critical shift is the transition from SAP Business Warehouse (BW) and classic SAP BPC architecture to the modern, in-memory, cloud-native stack. SAP Analytics Cloud (SAC) Planning has emerged as the central technology, integrating planning, budgeting, and sophisticated analytics within a single interface, compelling consulting firms to rapidly build expertise in SAC’s model design, data governance, and integration capabilities (especially with non-SAP data sources). Furthermore, the underlying SAP S/4HANA architecture, particularly the universal journal and embedded analytics, forms the technological foundation that consultants must understand to design real-time reporting and consolidation systems (e.g., using S/4HANA Group Reporting).

Beyond SAP’s proprietary stack, the consulting service market leverages complementary technologies to enhance delivery and client outcomes. This includes advanced integration middleware (e.g., SAP Data Intelligence, ETL tools) necessary for bridging data gaps between SAP EPM and other enterprise systems. Robotic Process Automation (RPA) tools and Machine Learning frameworks are increasingly utilized by consulting teams. RPA helps automate routine data loading and validation tasks within the EPM process, freeing up client finance teams, while ML tools are applied to enhance the predictive modeling components within SAC, improving forecasting accuracy and reducing planning cycle times significantly.

Cloud infrastructure is a non-negotiable technology requirement, with consultants frequently architecting solutions on major hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), which host SAP systems. This requires EPM consultants to possess robust knowledge of cloud deployment models, security protocols, and performance optimization within a hybrid or pure cloud environment. The use of proprietary consulting accelerators—pre-built configurations, industry-specific data models, and automated migration tools—developed using Python or specialized APIs, forms a crucial part of the technological edge used by top consulting firms to reduce implementation risk and accelerate time-to-value for complex EPM deployments.

Regional Highlights

Regional dynamics significantly influence the demand and complexity of SAP EPM consulting services, driven by economic maturity, regulatory environment, and the pace of digital transformation adoption.

- North America: Dominates the market share due to the early and widespread adoption of SAP solutions, high IT spending, and sophisticated corporate governance requirements. The region sees continuous demand for complex consolidation implementations, advanced xP&A initiatives, and large-scale migrations to SAC Planning and S/4HANA Group Reporting. High competition among leading global consulting firms characterizes this market, with a strong focus on high-value advisory and strategic transformation services.

- Europe: Represents a mature market characterized by diverse regulatory frameworks (e.g., GDPR, varying IFRS standards across countries) that necessitate highly localized and complex EPM configuration. Demand is steady, fueled by the necessity for robust financial reporting and consolidation systems compliant with European Union directives. Growth is driven by the mandate to modernize legacy systems, particularly in Germany, the UK, and France, pushing smaller enterprises to adopt modular, cloud-based EPM solutions.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate during the forecast period. This acceleration is driven by rapid digitalization, increasing complexity of multinational operations, and stringent government efforts to enforce financial transparency in fast-growing economies like China, India, and Southeast Asia. The market favors scalable, cloud-first solutions, with consulting demand focused on establishing foundational EPM capabilities and supporting regional expansion strategies.

- Latin America (LATAM): Growth is primarily fueled by the need to manage hyperinflationary environments, currency volatility, and complex local tax and regulatory reporting requirements. EPM consulting focuses heavily on robust financial consolidation and rapid scenario planning capabilities. Economic uncertainty sometimes restrains large project spending, favoring phased implementations and optimization services over complete overhauls.

- Middle East and Africa (MEA): This region is focused on large-scale government-led digital transformation initiatives, particularly in the Gulf Cooperation Council (GCC) countries. The demand centers around adopting modern SAP platforms to manage national budgets, optimize public sector finance, and support diversification strategies. Consulting services are critical for initial implementation and knowledge transfer, often requiring significant managed service contracts due to local talent scarcity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SAP EPM Consulting Service Market.- IBM

- Accenture

- Deloitte

- Capgemini

- Infosys

- Wipro

- TCS (Tata Consultancy Services)

- EY (Ernst & Young)

- KPMG

- Hitachi Consulting

- HCL Technologies

- Cognizant

- DXC Technology

- SAP Services

- PwC (PricewaterhouseCoopers)

- NTT DATA

- Atos

- LTI Mindtree

- Tech Mahindra

- Sopra Steria

Frequently Asked Questions

Analyze common user questions about the SAP EPM Consulting Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for SAP EPM consulting services?

The primary driver is the mandatory migration and integration of financial systems with SAP S/4HANA, compelling organizations to adopt modern planning and consolidation tools like SAP Analytics Cloud (SAC) Planning and Group Reporting to achieve real-time financial transparency and Integrated Business Planning (xP&A).

How does the shift to the cloud impact SAP BPC consultant roles?

The shift necessitates that BPC consultants rapidly acquire expertise in cloud architecture, specifically SAC Planning and S/4HANA Group Reporting, moving away from purely technical configuration towards holistic functional design, predictive modeling, and data governance within hybrid cloud environments.

Which industry spends the most on SAP EPM consulting services?

The Banking, Financial Services, and Insurance (BFSI) and Manufacturing sectors are the largest spenders, driven by the need for complex regulatory compliance (Basel, Solvency II), sophisticated risk analysis, and granular cost and profitability management across global operations.

What is Extended Planning and Analysis (xP&A) and why is it important?

xP&A represents the next generation of planning that extends financial planning beyond the finance department to integrate operational planning (e.g., supply chain, HR, sales) into a single, cohesive system, enabling faster, more accurate scenario modeling and holistic business steering, which is a key focus area for modern SAP EPM consulting engagements.

What are the typical costs associated with an SAP EPM transformation project?

Costs vary widely based on scope, but generally involve high initial advisory and implementation fees (based on consultant seniority and project duration), followed by ongoing Managed Service costs. Complexity, data volume, and the geographic spread of the implementation are the primary cost determinants.

How do consulting firms address the challenge of data quality in EPM implementations?

Consulting firms utilize specialized services focused on Data Governance, employing tools and methodologies to clean, validate, and structure financial master data during the preparation phase, ensuring the EPM system and its underlying AI models receive accurate input, which is critical for trustworthy output.

What is the role of SAP PaPM (Profitability and Performance Management) in modern EPM consulting?

SAP PaPM consulting services focus on designing high-volume calculation engines for detailed cost allocation, transfer pricing, and profitability modeling, especially relevant for industries needing complex activity-based costing or regulatory risk calculations.

What security considerations are paramount when deploying cloud-based SAP EPM solutions?

Consulting services prioritize identity and access management (IAM), data residency compliance, and ensuring robust security protocols around sensitive financial data stored in the cloud. They must design systems that adhere to both corporate security policies and global regulatory requirements like GDPR and CCPA.

How long does a typical SAP EPM implementation project take?

Implementation timelines vary significantly; a standard SAP BPC or mid-sized SAC Planning implementation typically ranges from 6 to 12 months. Complex, multinational S/4HANA Group Reporting projects or comprehensive xP&A rollouts often require 12 to 18 months or longer, utilizing agile methodologies to deliver value incrementally.

What is the significance of the SAP Activate methodology in EPM projects?

SAP Activate is the prescribed methodology for SAP cloud and S/4HANA implementations. Consulting firms adapt Activate stages (Discover, Prepare, Explore, Realize, Deploy, Run) to EPM projects, ensuring a standardized, agile, and iterative approach, maximizing efficiency and minimizing risk throughout the transformation lifecycle.

Are boutique SAP consulting firms competitive against the Big Four accounting firms in this market?

Yes, boutique firms often maintain a strong competitive edge by specializing deeply in specific SAP EPM modules (like PaPM or SAC Planning), offering highly focused expertise, proprietary accelerators, and typically lower overhead costs compared to global system integrators, making them attractive for niche or mid-market projects.

How is ESG reporting driving consulting engagement within EPM?

ESG reporting drives demand as companies seek consulting support to integrate non-financial (sustainability) data directly into their EPM systems, using SAP solutions to measure, plan, and report against ESG targets, necessitating new data models and process flows.

What technological skills are most in demand for an SAP EPM consultant today?

High-demand skills include SAP Analytics Cloud (SAC) Planning proficiency, deep understanding of S/4HANA Universal Journal, proficiency in Python/R for predictive modeling integration, and strong skills in cloud infrastructure (AWS/Azure) configuration specific to SAP hosting environments.

What are the key differences between SAP BPC and SAC Planning in terms of consulting delivery?

BPC projects focused heavily on on-premise infrastructure and technical scripting (NetWeaver, ABAP). SAC Planning projects emphasize integration with the cloud ecosystem, focusing on front-end user experience (UX) design, simplified modeling, and embedded predictive analytics, requiring a shift in core consulting competencies.

How do companies measure the Return on Investment (ROI) of SAP EPM consulting services?

ROI is measured through quantifiable metrics such as reduced time required for financial close and reporting, improved accuracy in forecasting, decreased regulatory compliance costs, and demonstrable efficiency gains in the budgeting cycle, often tracked using consulting firm benchmarks and pre-defined key performance indicators (KPIs).

What is the biggest restraint facing the SAP EPM consulting market globally?

The single biggest restraint is the critical global shortage of experienced, dual-certified consultants proficient in both the complex financial processes and the latest cloud-native SAP technologies (S/4HANA and SAC), leading to inflated resource costs and limitations on scaling project capacity.

How is the adoption of real-time data affecting financial consolidation services?

Real-time data, enabled by S/4HANA’s Universal Journal and Group Reporting, is transforming consolidation services by eliminating the traditional batch processing delays. Consulting firms now focus on designing systems that leverage immediate data access for faster, more continuous financial closing processes and near-instantaneous reporting.

What is the primary challenge in migrating existing BPC solutions to SAC Planning?

The primary challenge involves redefining the planning process architecture, as SAC is not a direct replication of BPC. Consultants must manage data model restructuring, translation of complex BPC logic into SAC capabilities, and significant change management to train users on the new interface and planning paradigms.

Why are Managed Services growing rapidly in the SAP EPM sector?

Managed Services are growing because organizations lack the internal specialized resources to continuously maintain, optimize, and quickly adapt their complex EPM systems to new regulatory changes or SAP updates. Outsourcing management ensures system stability, compliance, and access to highly specialized, contemporary expertise on demand.

What unique challenges do SAP EPM consultants face in the Public Sector?

Public Sector consulting involves unique challenges related to stringent governmental budgetary processes, fund accounting complexity, compliance with public auditing standards, and the need to integrate financial planning with complex organizational performance metrics and statutory reporting requirements.

How do consulting firms ensure successful user adoption post-implementation?

User adoption is ensured through comprehensive change management programs, including role-based training, creation of detailed process documentation, establishing internal EPM Centers of Excellence, and providing dedicated post-go-live support focused on empowering key users and driving system utilization.

What is the future outlook for SAP EPM consulting related to AI?

The future outlook is extremely positive; consulting demand will pivot towards embedding AI/ML into planning models (predictive forecasting, anomaly detection) and guiding clients on data readiness and governance required to fully leverage intelligent EPM capabilities provided by SAP.

How does profitability analysis (PaPM) differ from standard EPM planning?

Profitability analysis often requires highly detailed, transactional-level cost allocation using complex rules (which PaPM facilitates), whereas standard EPM planning typically operates at a higher aggregate level (e.g., product group or cost center) for budgeting and forecasting purposes.

What specific considerations apply to EPM consulting for multinational mergers and acquisitions (M&A)?

M&A activity requires rapid integration consulting focused on harmonizing disparate financial systems, standardizing master data definitions, and quickly configuring the target company into the parent’s SAP Group Reporting structure to ensure timely and accurate consolidation reporting.

In which regional market is the competition most intense among SAP EPM consulting providers?

Competition is most intense in North America and Western Europe, where global system integrators (Accenture, Deloitte, IBM) compete fiercely with highly specialized boutique firms and strong regional players for complex, high-margin transformation projects involving proprietary IP and strategic advisory.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager