SAP Implementers and Consultants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437518 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

SAP Implementers and Consultants Market Size

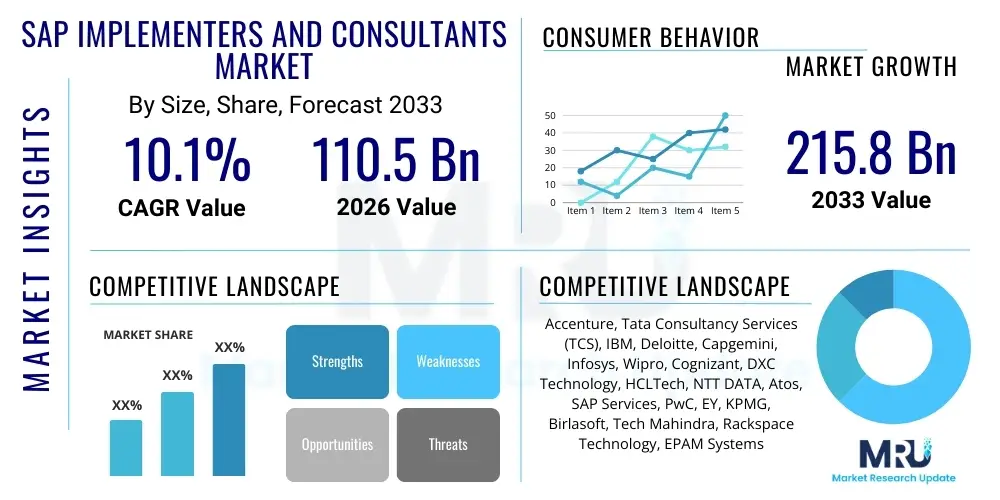

The SAP Implementers and Consultants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.1% between 2026 and 2033. The market is estimated at $110.5 Billion USD in 2026 and is projected to reach $215.8 Billion USD by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the accelerating global transition to SAP S/4HANA, mandatory cloud adoption strategies among large enterprises, and the continuous demand for hyper-specialized consulting services to optimize complex supply chains and digital core processes. The market sizing reflects the expenditure across system integration, application management services (AMS), strategic consulting, and bespoke development necessary to support the entire lifecycle of SAP solutions across various industry verticals.

SAP Implementers and Consultants Market introduction

The SAP Implementers and Consultants Market encompasses specialized services dedicated to the planning, design, deployment, customization, integration, and ongoing management of the entire SAP portfolio, ranging from core Enterprise Resource Planning (ERP) systems like SAP S/4HANA to specialized solutions such as SAP SuccessFactors, SAP Ariba, and SAP Customer Experience (CX). These services are critical catalysts for enterprise digital transformation, ensuring that complex business processes are effectively mapped, digitized, and optimized within the SAP architecture. The product—the consulting service itself—is highly knowledge-intensive, requiring deep domain expertise, certified technical proficiency, and robust project management capabilities. Major applications of these services span financial accounting, supply chain management, human capital management (HCM), customer relationship management (CRM), and advanced analytics, providing foundational infrastructure for modern, intelligent enterprises.

The principal benefits derived from employing professional SAP implementers and consultants include accelerated return on investment (ROI) from technology investments, minimization of implementation risks, achievement of regulatory compliance, and optimization of operational efficiency through process standardization. Expert consultants guide organizations through the complexities of data migration, system configuration, change management, and post-go-live support, which are often insurmountable for internal IT teams alone. Furthermore, the shift towards modular, cloud-native SAP solutions demands continuous architectural guidance to ensure hybrid environments are stable, secure, and scalable. This expertise ensures that enterprises leverage functionalities like embedded artificial intelligence (AI) and machine learning (ML) natively supported within the SAP Intelligent Suite, maximizing the value proposition of the software investment.

Key driving factors propelling market growth include the urgent global deadline for enterprises to migrate from legacy SAP ECC systems to S/4HANA, driven by end-of-maintenance concerns, forcing organizations worldwide into large-scale transformation projects. Concurrently, the increasing complexity of global supply chains and regulatory environments mandates highly specialized consulting expertise in areas like Environmental, Social, and Governance (ESG) reporting and global trade compliance, which are heavily integrated into SAP solutions. The accelerated adoption of public and private cloud models, particularly RISE with SAP and GROW with SAP, further necessitates implementation partners skilled in cloud migration strategies and hyperscaler integration, underpinning the robust demand forecast for the consulting market.

SAP Implementers and Consultants Market Executive Summary

The SAP Implementers and Consultants Market is experiencing a pivotal period defined by several concurrent shifts: the mandatory migration to S/4HANA Cloud, the integration of advanced technologies like AI and Robotic Process Automation (RPA), and a heightened focus on industry-specific cloud solutions (SAP Industry Cloud). Business trends indicate a strong move away from monolithic, protracted implementations toward agile, modular, and rapid deployment frameworks, often utilizing pre-configured industry templates to achieve faster time-to-value. Competition among consulting firms is intensifying, moving beyond technical competence to encompass advisory capabilities focused on business process redesign and organizational change management tailored for the digital age. Furthermore, the scarcity of certified S/4HANA and specific SAP technology experts (e.g., ABAP Cloud, SAP BTP) is driving up average billing rates and fostering strategic acquisitions among large system integrators to secure specialized talent pools, fundamentally altering the competitive landscape.

Regional trends reveal that North America and Europe remain the largest revenue contributors, driven by a high concentration of mature enterprises with legacy ECC systems undergoing large-scale transformations and possessing high discretionary IT spending budgets. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, particularly in emerging economies like India and Southeast Asia, fueled by rapid industrialization, digital adoption by mid-market companies, and government initiatives promoting technological modernization. Consultancies are strategically investing in establishing delivery centers and local partnerships in APAC to capitalize on both immediate implementation demand and the growing application management services (AMS) market. Latin America and the Middle East and Africa (MEA) are also showing promising growth, primarily driven by investments in national digital infrastructure projects and oil and gas industry modernization requiring advanced SAP capabilities.

Segmentation trends highlight the rapid expansion of the cloud-based implementation segment, heavily favoring solutions delivered via the RISE with SAP framework, over traditional on-premise deployments. Functionally, supply chain and finance transformation services dominate the market, reflecting the immediate need for resilient operations and real-time financial transparency. The rise of hyper-specialized boutique consultancies focused purely on niche areas like SAP Business Technology Platform (BTP) development or specific industry modules (e.g., utilities, life sciences) is challenging the traditional dominance of the Big Four and large global system integrators. Customers are increasingly opting for outcome-based engagement models where consulting fees are partially tied to measurable business improvements, demanding greater accountability and proven methodologies from implementation partners, thereby influencing pricing and service delivery structures across the market.

AI Impact Analysis on SAP Implementers and Consultants Market

User queries regarding the impact of Artificial Intelligence (AI) on the SAP consulting domain overwhelmingly focus on two core themes: the automation of routine implementation tasks (e.g., testing, documentation, data mapping) and the demand for new consulting skills centered around integrating AI/ML capabilities into SAP’s core business processes (e.g., predictive maintenance, intelligent automation in finance). Users express concern about potential job displacement for junior consultants performing repetitive tasks but also show high expectation for AI to enhance efficiency and accuracy in complex S/4HANA migrations. The dominant theme is the necessity for consultants to pivot from pure technical configuration roles to high-value advisory roles that leverage AI embedded in SAP tools (like SAP Signavio Process Intelligence and SAP AI Core) to drive process optimization and strategic business outcomes for clients.

The introduction of generative AI tools and specific SAP platforms like Joule (SAP’s generative AI copilot) is fundamentally reshaping the implementation lifecycle. AI is proving crucial in accelerating preparatory phases, such as automated discovery and documentation of existing ECC systems, reducing the human effort required for initial assessments. For consultants, this means shifting focus from manually writing configuration documents to validating AI-generated suggestions and ensuring alignment with client business objectives. Furthermore, AI capabilities are now integral to the consulting offering itself; clients seek consultants who can deploy and train machine learning models within SAP environments, moving beyond basic ERP functionality into intelligent automation and predictive analytics, creating a significant upskilling requirement across the consulting workforce.

The long-term impact analysis suggests a bifurcated market evolution. On one hand, commoditization will affect standardized services, making efficiency gains through AI-driven automation non-negotiable for competitive pricing. On the other hand, demand for strategic advisory services—identifying optimal AI use cases, designing governance frameworks for intelligent operations, and complex integration with SAP BTP—will soar. Consultants specializing in process mining, intelligent automation strategies, and ethical AI deployment within the SAP landscape are becoming highly sought after, establishing a new tier of specialized, high-margin services that traditional implementers must adapt to survive and thrive in the future SAP ecosystem.

- Automation of routine configuration, testing, and documentation tasks using AI/ML tools.

- Increased client demand for integrating SAP embedded AI capabilities (e.g., predictive analytics, intelligent automation).

- Shift in consultant skill requirements toward data science, process mining, and AI governance within the SAP framework.

- Acceleration of S/4HANA migration timelines through AI-assisted data conversion and system validation.

- Emergence of Generative AI tools like SAP Joule reducing manual effort in report generation and system querying.

DRO & Impact Forces Of SAP Implementers and Consultants Market

The market dynamics for SAP implementers and consultants are shaped by a complex interplay of powerful drivers, structural restraints, significant opportunities, and external impact forces. The dominant driver remains the imperative S/4HANA migration cycle, which creates a non-discretionary spending obligation for the vast global installed base of SAP ECC customers. This is coupled with the pressure from competitors (e.g., Oracle, Microsoft) forcing enterprises to accelerate digital transformation using cloud-native solutions, thereby strengthening the mandate for sophisticated SAP cloud expertise (RISE with SAP). Furthermore, globalization and subsequent geopolitical shifts are driving the need for continuous system updates and reconfiguration to manage complex statutory reporting, sanctions compliance, and global trade requirements, keeping consulting pipelines consistently active.

Restraints primarily revolve around the severe global shortage of highly certified and experienced S/4HANA consultants, particularly those specializing in niche modules and cloud architecture, leading to project delays and elevated implementation costs, which can deter mid-market adoption. Economic instability and inflationary pressures in certain regions can also lead to temporary project postponements or budget cuts in non-critical IT areas, although core transformation projects generally remain funded. Moreover, the inherent complexity and large scale of SAP transformations pose significant integration challenges and high failure risks, necessitating meticulous project governance and change management, which acts as a cautious restraint on rapid deployment, favoring phased approaches.

Key opportunities are centered on the burgeoning SAP Business Technology Platform (BTP) ecosystem, enabling consultants to offer high-margin, custom development services for specific innovation gaps, extending SAP's core capabilities through bespoke solutions, intelligent workflow automation, and application integration. The expansion into specialized industry cloud solutions offers hyper-specialization opportunities, allowing smaller consulting firms to gain market share by focusing deeply on vertical expertise (e.g., life sciences validation, utilities metering). Impact forces include the rapid evolution of hyperscaler partnerships (AWS, Azure, Google Cloud) with SAP, demanding consultants integrate multi-cloud strategies, and the pervasive threat of cyberattacks, requiring specialized security and compliance consulting that is now mandatory for all SAP implementations, particularly those involving public cloud infrastructure.

Segmentation Analysis

The SAP Implementers and Consultants Market is meticulously segmented based on several critical dimensions including deployment model (Cloud, On-Premise, Hybrid), service type (Consulting & Advisory, Implementation & Integration, Application Management Services (AMS)), organizational size (SMEs, Large Enterprises), and functional application (Finance, Supply Chain, HCM, Procurement). This segmentation allows market participants to tailor their service offerings to meet the highly varied needs of different customer bases, ranging from a large multinational corporation requiring a complex, global S/4HANA transformation to a mid-sized enterprise seeking standardized cloud ERP deployment via GROW with SAP. The fastest-growing segment is clearly Cloud Implementation, reflecting the enterprise movement towards SaaS and PaaS models facilitated by SAP’s strategic cloud push.

Service type segmentation highlights the shift in market value towards strategic advisory and integration services over traditional, routine AMS tasks, although AMS remains crucial for recurring revenue streams. Implementation and integration services, particularly those focusing on complex cross-system integration (SAP and non-SAP environments) and specialized data migration, command premium pricing due to their complexity and risk profile. Furthermore, the segmentation by organizational size dictates the complexity and duration of projects. Large enterprises typically undertake multi-year, multi-module global rollouts, demanding the resources of Tier 1 global system integrators, while SMEs increasingly rely on channel partners and mid-sized regional consultancies focused on standardized, cost-effective, and rapid deployment solutions.

Functional segmentation reveals significant demand concentration in areas directly impacted by real-time data requirements and regulatory compliance. Supply Chain Management (SCM) consulting is experiencing a major renaissance, driven by the need for resilient, traceable, and optimized global logistics networks (e.g., SAP Integrated Business Planning, SAP Transportation Management). Similarly, Finance and Controlling (FICO) transformation remains consistently high, propelled by the requirement for real-time reporting, automated closing processes, and improved regulatory adherence (IFRS 16, US GAAP). The market is seeing a growing niche in specialized Human Capital Management (HCM) consulting, particularly the implementation of SAP SuccessFactors, driven by global remote work trends and the need for unified employee experience platforms.

- By Service Type:

- Strategic Consulting & Advisory

- Implementation & Integration Services (Greenfield, Brownfield, Selective Data Transition)

- Application Management Services (AMS)

- Support & Maintenance

- By Deployment Model:

- Cloud (Public, Private, Hybrid, RISE with SAP)

- On-Premise

- By Organizational Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Functional Application:

- Finance & Controlling (FICO)

- Supply Chain Management (SCM)

- Human Capital Management (HCM)

- Customer Experience (CX) and Sales

- Procurement (SAP Ariba)

- By Industry Vertical:

- Manufacturing and Automotive

- Retail and Consumer Products (CPG)

- Utilities and Energy

- Life Sciences and Healthcare

- Banking and Financial Services

Value Chain Analysis For SAP Implementers and Consultants Market

The value chain for SAP Implementers and Consultants is intricate, beginning with the upstream analysis involving SAP SE itself as the core intellectual property provider, followed by the development of tools and training materials by independent software vendors (ISVs) and specialized training academies. Upstream activities primarily focus on product innovation, software release cycles (e.g., mandatory S/4HANA feature packs), and certification programs, which directly dictate the knowledge base and technical requirements for consulting firms. Consulting companies invest heavily upstream in internal knowledge management, specialized training paths for new SAP technologies (like SAP BTP and S/4HANA), and establishing strategic partnership levels (e.g., Global Strategic Service Partner, Gold Partner) with SAP SE, which determines their access to early-release programs and support resources, fundamentally shaping their market competitiveness.

The core of the value chain is the service delivery process, which involves advisory, blueprinting, realization (configuration and development), testing, training, and go-live support. This highly customized phase is where the consultant’s expertise is monetized. Downstream activities involve long-term engagement models such as Application Management Services (AMS), continuous process improvement consulting, and system optimization services following the initial implementation. These downstream phases ensure system stability, regulatory adherence, and continuous adoption of new SAP features, establishing recurring revenue streams and long-term customer relationships. The shift towards cloud environments has intensified the downstream focus on operations and cloud infrastructure management, often requiring collaboration with hyperscalers.

Distribution channels in this market are predominantly direct and partner-based. Large global system integrators typically engage directly with global enterprise accounts, leveraging their massive scale and geographical reach. Indirect channels include regional SAP Value Added Resellers (VARs) and mid-market focused partners who often bundle SAP software licenses with implementation services, particularly within the SME segment utilizing solutions like GROW with SAP. The advent of digital platforms and marketplaces, while not replacing traditional direct engagement, is beginning to play a role in lead generation and providing access to specialized, niche consulting talent on a project basis. Effective control over these channels and maintaining a strong certified talent pipeline are crucial for market players to ensure high service quality and competitive pricing across both direct and indirect routes to market.

SAP Implementers and Consultants Market Potential Customers

The primary customers and end-users of SAP implementation and consulting services span virtually every industry vertical and geographical location, fundamentally categorized by size and technological maturity. Large multinational corporations (MNCs) constitute the cornerstone of the market, driven by complex, multi-country transformation projects involving the full SAP Intelligent Suite. These enterprises require services to consolidate legacy systems, standardize global business processes, and integrate advanced functionalities like intelligent SCM and predictive maintenance. Their purchasing decisions are heavily influenced by the consultant’s global delivery model, deep industry vertical experience, and proven track record in managing high-risk, multi-billion dollar technology investments, making them the target audience for Tier 1 global system integrators.

A rapidly expanding segment of potential customers includes Small and Medium-sized Enterprises (SMEs), particularly those in high-growth industries like specialized manufacturing or high-tech services. While SMEs have historically been slower to adopt full-scale ERP, the emergence of modular, scalable, and cloud-native solutions (like SAP Business ByDesign and GROW with SAP) has significantly lowered the entry barrier. These buyers prioritize rapid deployment, fixed-scope projects, and cost-efficiency. They typically rely on localized, specialized consulting partners who can offer comprehensive packages that cover both licensing and implementation, emphasizing ease of use and quick realization of operational efficiencies without the need for extensive internal IT staff or complex customizations.

Furthermore, the public sector (government agencies, defense, utilities) and regulated industries (financial services, healthcare, life sciences) form another critical segment, distinguished by stringent compliance and security requirements. These organizations require consultants not only with technical SAP expertise but also deep regulatory domain knowledge (e.g., FDA validation for life sciences, Basel III for banking). The migration to cloud-based SAP solutions in these sectors is accelerating, creating sustained demand for highly specialized consultants focused on data privacy, sovereign cloud configurations, and audit trail implementation. Their buying process is often long, characterized by rigorous tender processes, prioritizing vendors who demonstrate exceptional security maturity and long-term commitment to public sector specific compliance mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $110.5 Billion USD |

| Market Forecast in 2033 | $215.8 Billion USD |

| Growth Rate | 10.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, Tata Consultancy Services (TCS), IBM, Deloitte, Capgemini, Infosys, Wipro, Cognizant, DXC Technology, HCLTech, NTT DATA, Atos, SAP Services, PwC, EY, KPMG, Birlasoft, Tech Mahindra, Rackspace Technology, EPAM Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SAP Implementers and Consultants Market Key Technology Landscape

The technological landscape driving the SAP Implementers and Consultants Market is dominated by the strategic shift from the legacy SAP ECC core towards the SAP S/4HANA platform, which utilizes the high-speed in-memory HANA database. S/4HANA is not merely an upgrade but a full architectural redesign enabling real-time analytics, simplification of data models, and embedded intelligence. Consultants must possess advanced skills in S/4HANA conversion methodologies, including Greenfield (new implementation), Brownfield (system conversion), and Selective Data Transition (SDT), often leveraging specialized tools like SAP DMLT (Data Migration and Landscape Transformation) to manage complex data movements. Furthermore, the mandatory push to cloud adoption requires deep proficiency in hyperscaler environments (AWS, Azure, GCP) and the architecture of private and public cloud editions of S/4HANA, particularly within the RISE with SAP framework which integrates hosting, licensing, and services.

A second critical technological element is the SAP Business Technology Platform (BTP), which serves as the innovation and extension layer for modern SAP landscapes. BTP consulting services are rapidly becoming high-value offerings, focusing on building custom applications, intelligent workflows, and integrating third-party solutions using services such as the Integration Suite, Process Automation, and SAP Analytics Cloud (SAC). Consultants specialized in BTP architecture are essential for clients seeking to future-proof their systems, ensuring that core S/4HANA processes remain clean and standard while innovations occur outside the core on BTP. The demand for proficiency in low-code/no-code tools available on BTP, such as SAP Build, is also escalating, enabling business users and fusion teams to accelerate development and customization with limited deep technical expertise.

Finally, the proliferation of disruptive technologies such as Robotic Process Automation (RPA), Machine Learning (ML), and Generative AI within the SAP ecosystem is reshaping how implementations are performed and how business processes are optimized. Consultants are now required to embed intelligence directly into client operations, using SAP AI Core for model deployment and leveraging tools like SAP Signavio for process discovery and mining before implementation begins. This analytical phase, powered by Signavio, ensures that the business blueprint is optimized before configuration starts, moving the consulting value proposition further upstream into strategic process redesign. This technological evolution necessitates continuous learning and certification in specialized, fast-moving areas of the SAP portfolio.

Regional Highlights

Geographical analysis reveals significant variance in market maturity and growth drivers across major regions. North America represents the largest revenue share, primarily driven by a mature market characterized by large-scale, complex transformation projects across highly regulated industries like financial services and healthcare. The urgency for S/4HANA migration is high, supported by large IT budgets and a strong willingness to adopt cutting-edge cloud technologies and innovation extensions like SAP BTP. US and Canadian firms often demand highly specialized consultants who can manage large teams and integrate complex multinational corporate structures, leading to premium pricing for specialized talent, particularly in cloud security and compliance.

Europe, encompassing Western and Central Europe, holds the second-largest share, marked by distinct country-specific regulatory requirements (e.g., GDPR, local tax regulations) that mandate extensive customization and localization during SAP implementations. Germany, as SAP's home base, shows sustained high demand, particularly in the automotive and manufacturing sectors focusing on Industry 4.0 integration with S/4HANA. The European market is slower but highly diligent in adopting new technology, preferring comprehensive, highly compliant, and often hybrid cloud solutions. The Nordics, however, are fast adopters of public cloud SAP models, positioning themselves as innovation hubs within the continent.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is fueled by rapid digital transformation initiatives in India, China, and Southeast Asia, coupled with increasing adoption by mid-sized companies moving away from basic local ERP systems to global SAP platforms. The market here is cost-sensitive but increasingly values speed and scalability, favoring simplified cloud deployments. Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions where growth is driven by national modernization efforts, infrastructure projects, and the need for standardized financial systems, particularly in the resource and energy sectors. MEA growth is notably influenced by large government-backed digital initiatives requiring significant SAP expertise for public sector modernization.

- North America: Market leader; high adoption of S/4HANA Cloud and BTP; driven by financial services and life sciences.

- Europe: Large installed base; demand focused on regulatory compliance and Industry 4.0 integration in manufacturing; strong preference for hybrid solutions.

- Asia Pacific (APAC): Fastest growing region; high adoption rate among mid-market companies; significant investment in localized cloud solutions.

- Latin America (LATAM): Growth driven by commodity markets and national infrastructure projects; characterized by high complexity due to localized tax and regulatory requirements.

- Middle East and Africa (MEA): Growth stimulated by public sector digitization and energy sector investments, specifically requiring high-security cloud deployment models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SAP Implementers and Consultants Market.- Accenture

- Tata Consultancy Services (TCS)

- IBM

- Deloitte

- Capgemini

- Infosys

- Wipro

- Cognizant

- DXC Technology

- HCLTech

- NTT DATA

- Atos

- SAP Services

- PwC

- EY

- KPMG

- Birlasoft

- Tech Mahindra

- Rackspace Technology

- EPAM Systems

- Larsen & Toubro Infotech (LTI)

- Mphasis

- CGI Inc.

- Fujitsu

- Alight Solutions

Frequently Asked Questions

Analyze common user questions about the SAP Implementers and Consultants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant driver for the SAP Implementers and Consultants Market growth?

The most significant market driver is the mandatory global migration deadline for customers using the legacy SAP ECC system to transition to SAP S/4HANA, coupled with SAP's strong push for cloud adoption through the RISE with SAP program. This technological inflection point necessitates massive, complex system transformation projects worldwide, demanding highly specialized external consulting expertise for successful execution and risk mitigation.

How is the adoption of SAP S/4HANA Cloud affecting traditional consulting models?

S/4HANA Cloud adoption is shifting traditional consulting models from long, heavily customized implementation projects to shorter, standardized, and agile deployments focused on rapid time-to-value. Consultants must increasingly focus on business process redesign, change management, and leveraging SAP Business Technology Platform (BTP) for extensions, rather than deep customization of the core ERP, fundamentally altering required skill sets.

Which segments within SAP consulting are experiencing the highest growth rates?

The highest growth rates are observed in services related to Cloud Implementation (specifically RISE with SAP and hybrid environments), consulting focused on the SAP Business Technology Platform (BTP) for custom development and integration, and advisory services specializing in Supply Chain Management (SCM) optimization and embedding AI/ML capabilities into SAP processes, driven by global instability and demand for intelligent operations.

What are the primary challenges faced by organizations seeking SAP implementation services?

The primary challenges include the substantial complexity and high initial cost of large-scale S/4HANA transformations, the global scarcity of highly certified and experienced SAP consultants (especially in niche modules), difficulties in managing data migration quality and volume, and internal organizational resistance to the process changes mandated by modern SAP systems.

What role does Artificial Intelligence (AI) play in the future of SAP consulting?

AI, particularly generative AI and embedded machine learning (e.g., SAP Joule), is expected to automate routine consulting tasks such as system testing, documentation, and data mapping, significantly boosting consultant efficiency and accuracy. The future role of the SAP consultant will pivot towards high-value strategic advisory, focused on integrating AI capabilities into client business processes and governing intelligent automation strategies via platforms like SAP AI Core.

Why is the SAP Business Technology Platform (BTP) essential for modern implementers?

BTP is essential because it serves as the strategic innovation layer, allowing organizations to extend standard S/4HANA functionalities, build custom applications, automate workflows, and integrate non-SAP systems without modifying the clean core. Consultants proficient in BTP are crucial for delivering tailored business value while maintaining system stability and compliance with SAP's upgrade path, ensuring flexibility and rapid innovation capabilities.

How does the shift to Application Management Services (AMS) influence market competition?

The AMS segment provides crucial recurring revenue and long-term customer lock-in for consulting firms. Competition is intense, often focusing on advanced service delivery models, including global delivery centers, remote support capabilities, and the use of automation tools to lower operational costs, moving from reactive maintenance to proactive, predictive application management using AI operations (AIOps).

What is the impact of hyper-specialization on market share distribution?

Hyper-specialization allows smaller, boutique consulting firms to challenge the dominance of large global system integrators (GSIs). By focusing exclusively on niche, high-demand areas—such as SAP Integrated Business Planning (IBP), SAP Ariba integration, or specific Industry Cloud solutions—these specialized firms can offer deeper expertise and more competitive rates for defined scope projects, attracting clients who prioritize domain depth over sheer scale.

Which regions are leading the investment in SAP digital supply chain consulting?

North America and Europe are currently leading investments in SAP digital supply chain consulting, driven by the need to create resilient supply chains following recent global disruptions. Key areas of focus include the implementation of SAP IBP for planning and forecasting, SAP Transportation Management (TM) for logistics optimization, and leveraging S/4HANA embedded intelligence for real-time inventory visibility and risk assessment.

How is the public sector market for SAP consulting evolving?

The public sector market is evolving rapidly, driven by global digital government initiatives. While historically dominated by on-premise solutions, there is an accelerated trend toward adopting cloud-based SAP solutions, particularly those that meet high standards for data sovereignty and regulatory compliance. Consulting demand is focused on financial transformation, procurement modernization (SAP Ariba), and managing large-scale human capital systems (SAP SuccessFactors) within strict budget and security frameworks.

What are the key differences between a Greenfield and a Brownfield S/4HANA implementation?

Greenfield is a fresh, new implementation where no existing SAP system is migrated, allowing for complete process redesign and clean data setup, often preferred by companies seeking radical simplification. Brownfield (system conversion) involves technical conversion of the existing ECC system and data structure to S/4HANA, maintaining existing customizations and historical data, generally faster but retaining historical process inefficiencies. Consultants guide clients in selecting the appropriate methodology based on business needs and risk tolerance.

What role do SAP partners play in the mid-market segment?

SAP partners, particularly Value Added Resellers (VARs) and regional consultancies, are crucial in the mid-market segment. They provide packaged, localized implementation services, often combining licensing with standardized S/4HANA deployment (like GROW with SAP). Their role is vital as SMEs require affordable, rapid deployments with less customization, favoring partners who understand specific local regulatory and business contexts.

How significant is change management consulting in modern SAP projects?

Change management consulting is highly significant and non-negotiable for successful modern SAP implementations. S/4HANA transformations introduce profound changes to business processes and user interfaces. Consultants specializing in Organizational Change Management (OCM) ensure user adoption, conduct effective training, and mitigate resistance, directly correlating with project success and ultimate return on investment (ROI).

What is the current trend regarding consultant pricing models?

The current trend in consultant pricing models is moving away from purely time-and-materials (T&M) toward hybrid models. These include fixed-price engagements for standardized phases (like technical conversion), outcome-based pricing where fees are tied to measurable business performance improvements, and managed services contracts for AMS, reflecting a shift toward greater accountability and value delivery from the consulting firm.

How does security and compliance consulting integrate into SAP implementations?

Security and compliance consulting is now mandatory at every phase of an SAP implementation, especially with cloud adoption. This involves designing role-based access controls, configuring advanced security features within S/4HANA, ensuring data encryption, and performing regulatory audits (e.g., SOX, GDPR). Specialized consultants guarantee the system architecture adheres to corporate governance and global statutory requirements from the blueprint stage forward.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager