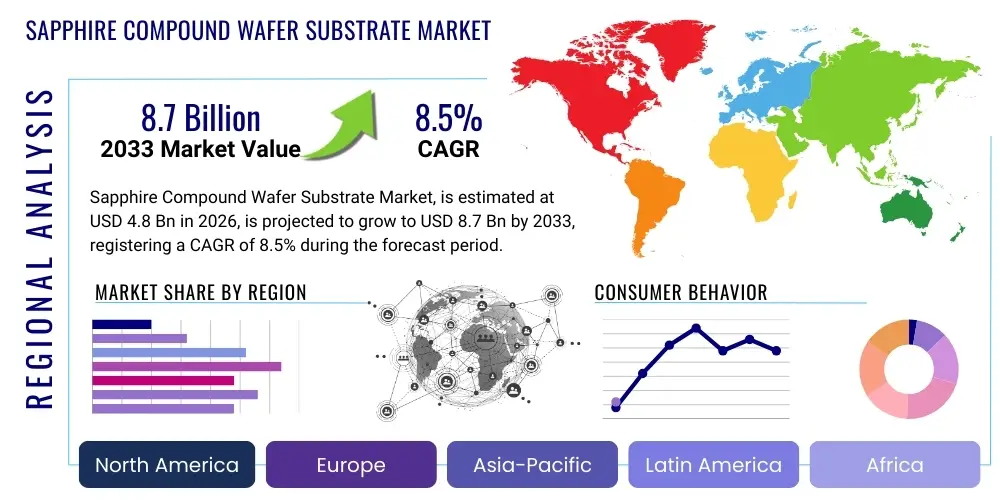

Sapphire Compound Wafer Substrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437775 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Sapphire Compound Wafer Substrate Market Size

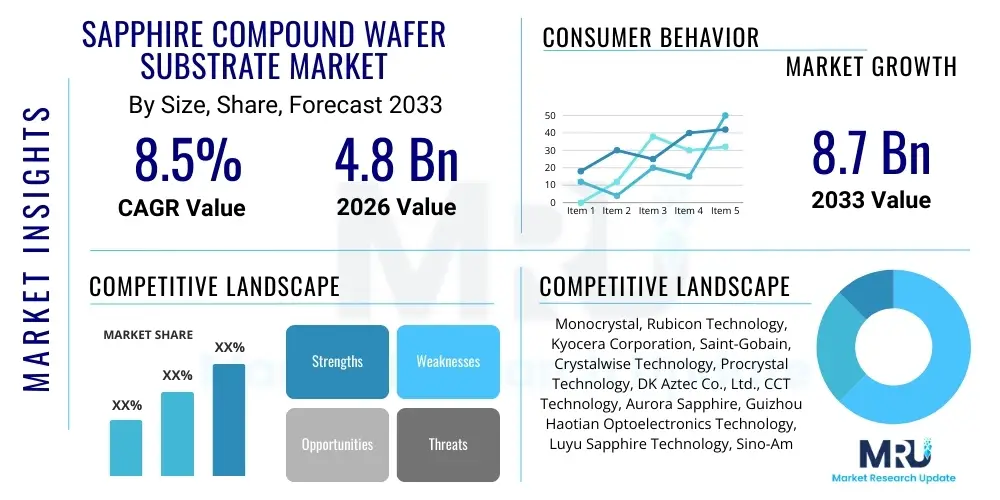

The Sapphire Compound Wafer Substrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

Sapphire Compound Wafer Substrate Market introduction

The Sapphire Compound Wafer Substrate market is a crucial segment within the global semiconductor industry, specifically serving as a foundational material for the deposition of compound semiconductor layers, predominantly Gallium Nitride (GaN). Sapphire (Al2O3) is utilized extensively due to its unique combination of mechanical strength, high thermal stability, chemical inertness, and superior optical transparency, making it an ideal platform for high-brightness light-emitting diodes (HB-LEDs), Radio Frequency (RF) devices, and power electronic components. Its crystalline structure, while presenting a lattice mismatch challenge for GaN growth, is overcome through sophisticated buffer layers and specialized epitaxial growth techniques like Metal-Organic Chemical Vapor Deposition (MOCVD), enabling the production of high-performance optoelectronic and electronic devices that are central to modern technology, including advanced lighting systems and 5G infrastructure. The versatility of sapphire substrates across multiple wavelengths and device architectures solidifies its indispensable role in compound semiconductor manufacturing.

Sapphire compound wafers are intrinsically linked to the proliferation of energy-efficient lighting and advanced communications technology. In the LED sector, sapphire substrates remain the dominant choice, driven by global initiatives toward energy conservation and the subsequent demand for high-efficiency, long-lasting illumination across residential, commercial, and automotive sectors. Beyond lighting, the market is increasingly influenced by high-frequency applications, particularly the migration to 5G networks, which require robust RF power amplifiers and filters often fabricated on sapphire substrates or derivative technologies like Silicon-on-Sapphire (SOS). These applications leverage sapphire’s excellent dielectric properties and high resistance to radiation, offering superior performance compared to traditional silicon-based solutions in demanding operational environments. The integration into miniature and high-power density modules further expands the substrate's footprint in consumer electronics and specialized defense applications.

Key benefits driving market adoption include cost-effectiveness relative to alternatives like Silicon Carbide (SiC) or bulk GaN, established manufacturing infrastructure, and the ability to scale production volumes necessary for mass-market applications such as smartphone displays and general lighting. Furthermore, ongoing innovation in sapphire growth techniques, such as the Kyropoulos method and Edge-defined Film-fed Growth (EFG), coupled with advancements in defect reduction and larger wafer diameter availability (up to 8 inches), are continually enhancing the performance and reducing the cost per unit area. These factors collectively position sapphire compound wafers as the foundational pillar for emerging technologies in solid-state lighting, ultraviolet (UV) sterilization, and high-frequency, high-power electronics, sustaining robust demand throughout the forecast period and cementing its importance in the global electronic materials supply chain.

Sapphire Compound Wafer Substrate Market Executive Summary

The Sapphire Compound Wafer Substrate Market is characterized by intense technological evolution, shifting application landscapes, and geopolitical dynamics influencing supply chains. Business trends indicate a consolidation among major substrate manufacturers, focusing on scaling up 6-inch and 8-inch wafer production to meet the high volume demands of LED and RF fabrication facilities. Strategic alliances between substrate suppliers and compound semiconductor foundries are becoming critical to optimize the GaN-on-Sapphire manufacturing process, specifically targeting defect density reduction and enhanced thermal management solutions crucial for high-power devices. The market exhibits cyclical behavior tied primarily to capital expenditure cycles in the global LED industry, though diversification into UV-C disinfection and advanced power electronics is providing stabilizing growth drivers, ensuring resilient market momentum even amid fluctuations in general lighting demand.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, driven by massive manufacturing capacities in China, Taiwan, South Korea, and Japan, which collectively account for the majority of global LED production and advanced semiconductor fabrication. China, in particular, has become both a significant consumer and producer, investing heavily in subsidized domestic capacity, thus altering global pricing structures and supply dynamics. North America and Europe, while possessing smaller manufacturing footprints, are pivotal centers for research and development, particularly in high-reliability applications such as aerospace, defense, and specialized power electronics utilizing sapphire or SOS technology, demanding stringent quality control and high-performance specifications. Furthermore, governmental incentives promoting widespread adoption of energy-efficient technologies are accelerating market penetration across these established economic regions.

Segmentation trends reveal that the LED segment, particularly HB-LEDs for backlighting and general illumination, remains the largest revenue contributor by application, sustaining consistent demand for PSS (Patterned Sapphire Substrates) which improve light extraction efficiency. However, the fastest growth is anticipated within the Micro-LED and RF/Power Electronics segments. Wafer size analysis shows a discernible shift towards larger diameters (6-inch), driven by the economic imperative of increasing die per wafer yield and reducing fabrication costs. Technology-wise, Patterned Sapphire Substrates continue to gain traction due to their performance advantages over conventional flat substrates, becoming the de facto standard for advanced optoelectronic manufacturing, thus necessitating continuous investment in lithography and etching technologies used in their production.

AI Impact Analysis on Sapphire Compound Wafer Substrate Market

User inquiries regarding AI's impact on the Sapphire Compound Wafer Substrate market predominantly center on two core areas: optimization of the complex crystal growth process and the increasing demand for compound semiconductor devices that AI systems require. Users frequently ask how Machine Learning (ML) can improve the yield and consistency of high-quality sapphire ingots, given that parameters like temperature gradients and impurity levels are highly sensitive during growth. There is also significant interest in AI's role in accelerating defect detection and classification on the wafer surface, moving beyond manual inspection. Furthermore, queries reflect the understanding that the massive computational demands of AI—from data centers running deep learning algorithms to edge devices needing energy-efficient processing—translate directly into higher demand for GaN power devices and advanced RF components built on sapphire substrates, thereby acting as a critical demand accelerator for the raw substrate material itself.

The introduction of Artificial Intelligence and Machine Learning models is revolutionizing the traditionally high-variability process of crystal growth and epitaxy. In sapphire ingot production, AI algorithms are being deployed to monitor, predict, and dynamically adjust growth parameters in real-time within the high-temperature furnaces. This predictive maintenance and process control significantly reduces waste, lowers energy consumption, and crucially improves the uniformity and structural quality of the sapphire, which directly translates into higher yields of usable compound semiconductor chips post-epitaxy. By analyzing vast datasets derived from historical growth runs, AI provides insights into optimal conditions that human operators might overlook, thereby standardizing quality across different batches and reducing the need for costly trial-and-error experimentation, accelerating time-to-market for new substrate specifications.

Beyond manufacturing optimization, the proliferation of AI infrastructure is a major demand driver. AI applications necessitate vast numbers of specialized electronic components, ranging from high-speed data transmission systems relying on RF filters and amplifiers (often sapphire-based) to high-efficiency power management systems utilizing GaN power FETs. GaN-on-Sapphire technology is key in power supplies for hyperscale data centers—the backbone of AI—due to its superior switching speed and thermal performance, leading to smaller, more efficient power modules. Therefore, AI not only refines the substrate manufacturing process through smart automation but also concurrently generates substantial, sustained demand for the end products utilizing these substrates, creating a virtuous cycle where technological efficiency drives market volume expansion.

- AI-driven optimization of sapphire crystal growth processes, resulting in reduced defects and higher material uniformity.

- Predictive maintenance implemented through ML models for MOCVD reactors, maximizing uptime and epitaxial yield on sapphire substrates.

- Enhanced automated optical inspection (AOI) systems using deep learning for faster and more accurate wafer defect classification.

- Increased demand for GaN power devices built on sapphire, necessary for efficient power delivery in AI data centers and servers.

- Acceleration of 5G and edge computing infrastructure (key components for distributed AI) requiring high-performance RF components based on sapphire substrates.

DRO & Impact Forces Of Sapphire Compound Wafer Substrate Market

The Sapphire Compound Wafer Substrate market is shaped by powerful opposing forces: robust demand from high-growth electronics segments contrasts with inherent material constraints and competitive pressure from alternative substrates. Drivers are primarily anchored in the sustained global shift toward energy-efficient lighting (HB-LEDs) and the rapid deployment of advanced communication systems (5G), which leverage sapphire's excellent properties and cost advantages. Restraints center on the fundamental challenge of lattice mismatch between sapphire and key epitaxial materials like GaN, necessitating complex and costly buffer layer technologies, alongside intense competition from emerging, superior lattice-matched materials such as bulk GaN and SiC, particularly in the high-power density and mission-critical application spaces. Opportunities arise from technological breakthroughs in patterned sapphire substrate (PSS) manufacturing and the untapped potential in emerging areas like Micro-LED displays and UV-C sterilization modules. Impact forces—the synthesis of these drivers and restraints—dictate market trajectory, pushing manufacturers towards continuous process refinement and greater wafer diameter scaling to maintain competitive relevance.

The primary driver remains the pervasive adoption of LEDs worldwide, supported by government mandates phasing out inefficient incandescent bulbs. This creates a predictable baseline demand for high-volume sapphire production. Furthermore, the exponential growth in data traffic and the deployment of 5G infrastructure have accelerated the adoption of compound semiconductors in RF front-end modules, where sapphire offers desirable performance characteristics at a lower cost than comparable technologies. These macro trends ensure stable long-term growth. However, the market is restrained significantly by the technical hurdle of internal defects arising from the high lattice and thermal expansion coefficient mismatch between sapphire and GaN. These defects can compromise device performance and longevity, creating an inherent challenge that necessitates expensive processing steps like high-temperature annealing and PSS structures, raising overall manufacturing complexity and cost relative to lattice-matched alternatives.

Opportunities for market expansion are abundant, particularly in next-generation display technology where Micro-LEDs promise superior efficiency and brightness. Sapphire's transparency and established manufacturing ecosystem make it a strong candidate for these demanding display applications, despite ongoing material challenges. The burgeoning market for deep UV LEDs (UV-C) used in water purification and air disinfection, driven by heightened public health concerns, presents a high-growth niche where sapphire is essential due to its UV transparency. The key impact forces in this market revolve around the delicate balance between cost and performance. While sapphire is cheaper than SiC or bulk GaN, the superior thermal and electrical properties of the alternatives exert continuous downward pressure on the acceptable defect density and pricing of sapphire substrates. Success is contingent upon manufacturers' ability to achieve high-quality epitaxial surfaces at low cost through continuous process innovation and scale.

Segmentation Analysis

The Sapphire Compound Wafer Substrate market is comprehensively segmented based on its structural form (substrate type), the size of the wafer, and the application in which the final compound semiconductor device is utilized. This detailed segmentation allows for granular analysis of market demand drivers, technological preferences, and regional consumption patterns, providing a clear roadmap for investment and strategic planning. The substrate type segmentation, differentiating between traditional standard substrates and advanced patterned substrates (PSS), reflects the industry's technological shift towards maximizing light extraction efficiency (LEE) and minimizing material defects in optoelectronic devices. PSS represents the premium and faster-growing segment due to its superior performance characteristics essential for modern high-brightness applications and advanced micro-LEDs, commanding higher average selling prices (ASPs).

Wafer size segmentation is crucial for understanding manufacturing scalability and cost efficiency. The market is transitioning from smaller 2-inch and 4-inch wafers—historically used for niche applications and R&D—to mainstream 6-inch diameters, which dominate high-volume commercial production for LEDs and consumer electronics. The shift towards 6-inch and the emerging feasibility of 8-inch sapphire wafers is driven by the economic principle that larger wafers significantly increase the number of dies per wafer, thereby dramatically reducing the fabrication cost per chip (cost-per-area), a vital factor in highly competitive markets like general illumination. Manufacturers are continuously investing in larger crystal growth systems and processing equipment to meet this demand, aligning with the broader semiconductor industry trend toward larger substrate sizes.

Application segmentation remains the most critical dimension, directly reflecting end-user demand. The market is dominated by solid-state lighting (HB-LEDs), which utilizes sapphire primarily for the growth of III-nitride layers. However, high-growth segments such as RF and Power Electronics (for 5G and data centers), as well as novel applications like Micro-LED displays and Deep UV-LEDs (UV-C), are driving significant future investment. Analyzing these segments helps in forecasting technology specific material requirements, such as the need for semi-insulating sapphire in RF applications versus high-purity optically clear sapphire for lighting and display purposes. This robust segmentation ensures that market dynamics are analyzed not just by volume, but by value-added technological requirement.

- By Substrate Type:

- Standard/Flat Sapphire Substrate (FSS)

- Patterned Sapphire Substrate (PSS)

- By Wafer Size:

- 2-inch and 4-inch

- 6-inch

- 8-inch

- Above 8-inch (Emerging)

- By Application:

- LED Lighting (General Illumination, Backlighting)

- RF & Power Electronics (5G Components, GaN Power Devices)

- Micro-LED Displays

- Laser Diodes (Blue and Green Lasers)

- Optoelectronics (UV-C, Sensors)

- Silicon-on-Sapphire (SOS) Devices

- By End-Use Industry:

- Consumer Electronics

- Automotive

- Industrial

- Aerospace & Defense

Value Chain Analysis For Sapphire Compound Wafer Substrate Market

The value chain for Sapphire Compound Wafer Substrates is complex, commencing with the highly specialized upstream processing of raw alumina powder and concluding with the downstream integration of finished compound semiconductor devices into end-user products. Upstream activities involve the energy-intensive crystal growth process, typically utilizing methods like Kyropoulos or EFG to produce large sapphire boules. This stage is capital-intensive and requires stringent control over material purity and crystallographic orientation. Subsequent midstream processing transforms the raw boule into a polished, often patterned, substrate. This includes slicing, grinding, chemical mechanical polishing (CMP), and finally, advanced lithography and etching for Patterned Sapphire Substrates (PSS). Optimization at this stage is critical for maximizing wafer quality and minimizing the Total Thickness Variation (TTV) and surface roughness required for subsequent epitaxial growth.

The midstream/downstream junction involves the compound semiconductor fabrication houses (foundries). These facilities use sophisticated epitaxial growth techniques, predominantly MOCVD, to deposit active layers of GaN, AlGaN, or InGaN onto the prepared sapphire substrate. The quality of the sapphire substrate directly impacts the performance and yield of these costly epitaxial processes. Downstream activities involve device manufacturing, packaging, testing, and final integration into modules such as LED chips, RF components, or power modules. The distribution channel is predominantly indirect, utilizing specialized distributors and sales agents who manage the complex logistics between substrate suppliers (often based in Asia) and semiconductor foundries globally, ensuring just-in-time delivery and adherence to rigorous quality standards required for cleanroom environments. Direct sales relationships are typically reserved for strategic partnerships between Tier 1 substrate manufacturers and major integrated device manufacturers (IDMs).

The overall structure of the value chain is highly susceptible to demand fluctuations in the consumer electronics and automotive sectors. Profit margins are generally higher in the upstream crystal growth and the final semiconductor device packaging stages, while the midstream wafer processing is highly price-competitive, particularly in high-volume, standard substrate manufacturing. Geographical specialization is also pronounced: raw sapphire boule growth is concentrated in regions with access to low-cost, high-volume energy (e.g., China, Russia), while advanced PSS processing and epitaxial deposition are often conducted in technologically advanced centers in South Korea, Taiwan, and the US. The efficiency of this channel relies heavily on minimizing material loss throughout the slicing and polishing phases, as sapphire processing is inherently challenging due to its extreme hardness.

Sapphire Compound Wafer Substrate Market Potential Customers

The primary consumers (End-Users/Buyers) of Sapphire Compound Wafer Substrates are the leading Integrated Device Manufacturers (IDMs) and specialized semiconductor foundries that engage in the epitaxial growth of III-V materials, particularly Gallium Nitride (GaN). These customers require high-purity, structurally flawless substrates to serve as the template for creating active electronic and optoelectronic layers. Major customers include companies specializing in LED chip fabrication, such as those supplying the general illumination and display backlighting markets, necessitating vast quantities of 4-inch and 6-inch Patterned Sapphire Substrates (PSS). The decision criteria for these large-scale buyers revolve around substrate uniformity, defect density (critical for maximizing LED efficiency), scalability, and competitive pricing, often secured through long-term supply contracts to ensure stability for high capital expenditure manufacturing lines.

A rapidly growing segment of potential customers includes manufacturers focused on advanced Radio Frequency (RF) and Power Electronics. These companies utilize sapphire, or its derivative Silicon-on-Sapphire (SOS), for high-performance applications such as RF switching modules, low-noise amplifiers, and GaN power transistors for electric vehicles and industrial motor drives. Customers in this high-reliability sector, which includes aerospace, defense, and telecommunications equipment providers, prioritize superior thermal stability and electrical insulation provided by the sapphire material. For these specialized applications, quality specifications are often stricter than for general lighting, focusing on low parasitic capacitance and robustness against harsh operating environments, driving demand for specialized, high-purity substrates, often in smaller volumes but at a premium price.

Furthermore, emerging technology developers focusing on Micro-LEDs and Deep UV-C LEDs represent significant future potential customers. Display manufacturers exploring Micro-LED technology for watches, AR/VR devices, and high-definition televisions require innovative sapphire substrates that can support highly uniform, dense arrays of microscopic light emitters. Similarly, companies producing UV-C sterilization equipment, which has seen booming demand due to public health imperatives, are critical buyers, as sapphire is one of the few materials transparent to deep ultraviolet wavelengths necessary for germicidal action. These customers are highly sensitive to technological innovation and are early adopters of larger wafer sizes and customized PSS patterns designed for specific light extraction or emission requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Monocrystal, Rubicon Technology, Kyocera Corporation, Saint-Gobain, Crystalwise Technology, Procrystal Technology, DK Aztec Co., Ltd., CCT Technology, Aurora Sapphire, Guizhou Haotian Optoelectronics Technology, Luyu Sapphire Technology, Sino-American Silicon Products Inc. (SAS), Tomoegawa, Precision Surfacing Solutions (PSS), Wafer Works Corporation, Meller Optics, SCHOTT AG, GT Advanced Technologies, Coherent, Inc., Sumitomo Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sapphire Compound Wafer Substrate Market Key Technology Landscape

The technology landscape governing the Sapphire Compound Wafer Substrate market is dominated by advancements in crystal growth methods, surface preparation techniques, and epitaxial templates designed to mitigate the inherent material incompatibility with GaN. The primary methods for producing high-quality sapphire boules include the Kyropoulos (KY) method and the Edge-defined Film-fed Growth (EFG) method. The KY method is widely adopted for producing large-diameter, high-purity boules required for optoelectronic applications, optimizing for uniform crystal structure and minimizing internal strain. EFG, conversely, is recognized for its ability to produce substrates with specified crystallographic orientations efficiently, albeit sometimes at the cost of internal material quality compared to KY-grown crystals. Continuous refinement of these growth processes focuses on automated, closed-loop control systems and improved thermal modeling to increase yield and reduce the inclusion of micro-defects that propagate into the epitaxial layers, which is crucial for maximizing device performance and longevity, particularly in high-power applications.

A critical technological evolution shaping the modern market is the development and widespread adoption of Patterned Sapphire Substrates (PSS). PSS technology involves etching micro- or nano-scale structures onto the sapphire surface prior to GaN deposition, typically using advanced photolithography and dry etching techniques. These patterns serve multiple functions: they effectively scatter light, significantly increasing the Light Extraction Efficiency (LEE) of LEDs, and they act as nucleation sites, promoting lateral epitaxial overgrowth (LEO). LEO is vital for bending and terminating the threading dislocations (defects) originating from the lattice mismatch interface, resulting in a cleaner, higher-quality GaN layer. The move towards highly precise, repeatable patterning techniques, including advanced nano-imprint lithography and deep reactive ion etching (DRIE), is a central driver in maintaining sapphire’s competitive edge against alternative substrates and meeting the rigorous demands of Micro-LED fabrication, where pattern precision is paramount.

Further technological innovation focuses on developing specialized buffer layers and stress engineering techniques to improve the performance of GaN-on-Sapphire devices, particularly in RF and power electronics. High-temperature Aluminum Nitride (AlN) buffer layers are essential for managing the thermal mismatch during MOCVD growth, reducing bowing and cracking in larger wafers. For Silicon-on-Sapphire (SOS) technology—a specialized segment used heavily in harsh-environment RF and radiation-hardened electronics—the technological focus is on enhancing the silicon-sapphire interface to minimize interface trap density and maximize carrier mobility. Future technological breakthroughs are anticipated in heterogeneous integration techniques, where manufacturers explore ways to combine the cost benefits of sapphire with the high thermal conductivity of other materials, potentially using wafer bonding or transfer techniques to create hybrid substrates optimized for next-generation thermal management in high-power density applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the unquestioned epicenter of the Sapphire Compound Wafer Substrate market, dominating both production capacity and consumption. This dominance is fundamentally driven by the region's massive concentration of LED manufacturing giants, particularly in China, South Korea, and Taiwan. China's aggressive investment in the solid-state lighting supply chain, supported by substantial government subsidies, has resulted in unparalleled production scale, making it the largest end-user market for sapphire wafers globally, largely fueling the demand for 6-inch PSS. Taiwan and South Korea maintain strong technological leadership, focusing on high-end, customized substrates for premium display backlighting and advanced Micro-LED development. Japan, while maintaining a smaller output volume, contributes significantly through cutting-edge material science research and specialized equipment manufacturing crucial for crystal growth and PSS processing. The regional dynamics are heavily influenced by pricing competition and the constant pressure to scale wafer size for cost efficiency.

- North America: North America represents a critical hub for high-value, specialized applications, including aerospace, defense, and high-performance RF electronics (particularly SOS technology). While large-scale commercial LED production has largely shifted overseas, the region maintains a strong presence in research and development, focusing on advanced GaN-on-Sapphire power devices and next-generation communications technology. Demand is characterized by stringent quality requirements, specialized crystallographic orientations, and high-reliability mandates, often dictating bespoke substrate specifications. Key market drivers here include government contracts for defense electronics and private sector investment in next-generation satellite communications and high-frequency radar systems, which favor the dielectric properties and radiation resistance of sapphire and SOS materials.

- Europe: The European market demonstrates steady growth, primarily driven by strong regulatory support for energy-efficient lighting and a growing focus on industrial power electronics and automotive applications. European companies are leaders in implementing stringent quality control and high-efficiency standards in LED module assembly, which necessitates consistent, high-quality sapphire substrates. Furthermore, the region is a key consumer for specialized deep UV-LED (UV-C) technology, driven by robust health and safety standards for water and air purification systems. The European R&D ecosystem is also actively involved in exploring the integration of sapphire-based GaN devices into electric vehicle power management systems, focusing on robust and thermally efficient solutions critical for advanced automotive design.

- Latin America (LATAM): The Latin American market currently holds a smaller share but is experiencing moderate growth, primarily tied to increasing infrastructure development and the gradual replacement of older lighting technologies with LED systems across major urban centers. Demand for sapphire substrates is largely indirect, relying on imported LED chips and modules from APAC. Market growth is contingent upon sustained economic stability and government efforts to adopt energy conservation policies, driving the installation base for energy-efficient commercial and street lighting, thereby creating a moderate but reliable import demand stream for finished sapphire-based products.

- Middle East and Africa (MEA): The MEA region is characterized by significant infrastructure projects and rapid urbanization, particularly in the Gulf Cooperation Council (GCC) states. These large-scale developments necessitate vast quantities of LED lighting for residential, commercial, and massive entertainment complexes, driving high consumption rates of sapphire-based products. The regional demand is almost entirely met through imports. Additionally, investments in telecommunications infrastructure and defense modernization programs, especially in countries like Saudi Arabia and the UAE, create specialized demand for RF components utilizing sapphire substrates. However, market adoption remains sensitive to fluctuating oil revenues and local geopolitical stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sapphire Compound Wafer Substrate Market.- Monocrystal

- Rubicon Technology

- Kyocera Corporation

- Saint-Gobain

- Crystalwise Technology

- Procrystal Technology

- DK Aztec Co., Ltd.

- CCT Technology

- Aurora Sapphire

- Guizhou Haotian Optoelectronics Technology

- Luyu Sapphire Technology

- Sino-American Silicon Products Inc. (SAS)

- Tomoegawa

- Precision Surfacing Solutions (PSS)

- Wafer Works Corporation

- Meller Optics

- SCHOTT AG

- GT Advanced Technologies

- Coherent, Inc.

- Sumitomo Chemical

Frequently Asked Questions

Analyze common user questions about the Sapphire Compound Wafer Substrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the current growth of the Sapphire Compound Wafer Substrate market?

The primary applications driving market growth are High-Brightness Light-Emitting Diodes (HB-LEDs) for general illumination and backlighting, and the increasing adoption of Gallium Nitride (GaN) power and RF devices crucial for 5G telecommunications infrastructure and efficient data center power supplies.

How does Patterned Sapphire Substrate (PSS) technology impact device performance?

PSS significantly enhances the performance of LEDs by introducing microstructures that improve the Light Extraction Efficiency (LEE) and act as templates for epitaxial lateral overgrowth (ELOG), thereby reducing the density of threading dislocations and enhancing the overall crystal quality and longevity of the GaN layer.

Which geographical region dominates the production and consumption of sapphire compound wafers?

The Asia Pacific (APAC) region, spearheaded by manufacturing hubs in China, Taiwan, and South Korea, dominates both the production capacity and consumption of sapphire compound wafers, driven by the massive scale of their domestic LED and compound semiconductor fabrication industries.

What restraints are currently limiting the large-scale adoption of sapphire wafers in high-power electronics?

The main restraint is the large lattice mismatch and difference in thermal expansion coefficients between sapphire and GaN, which introduces defects that limit high-power device performance. This constraint drives competition from alternative, lattice-matched materials like Silicon Carbide (SiC) and bulk GaN for high-power density applications.

What is the current trend regarding wafer size in the sapphire substrate market?

The market trend indicates a significant shift towards larger diameters, with 6-inch wafers becoming the dominant standard for high-volume manufacturing. There is also increasing R&D and pilot production focused on 8-inch sapphire wafers to further reduce manufacturing costs and increase yield per wafer area.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager