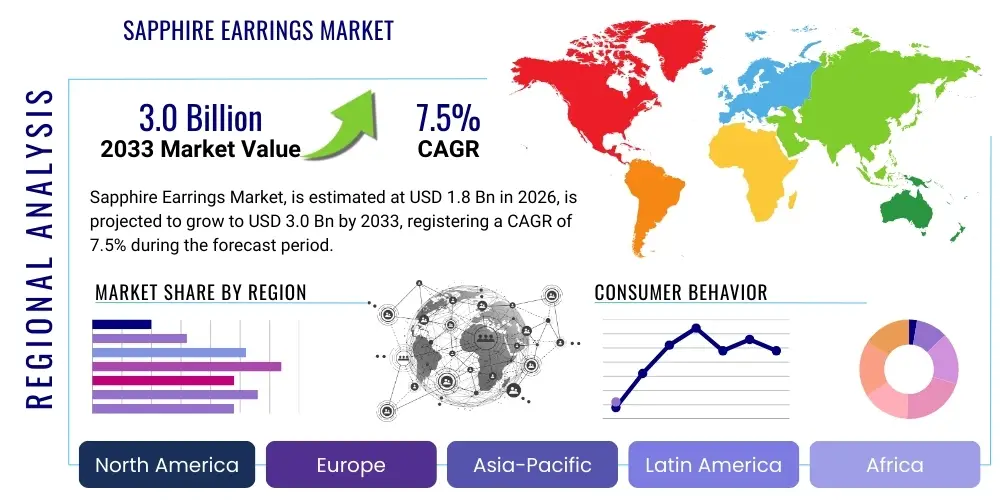

Sapphire Earrings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437288 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Sapphire Earrings Market Size

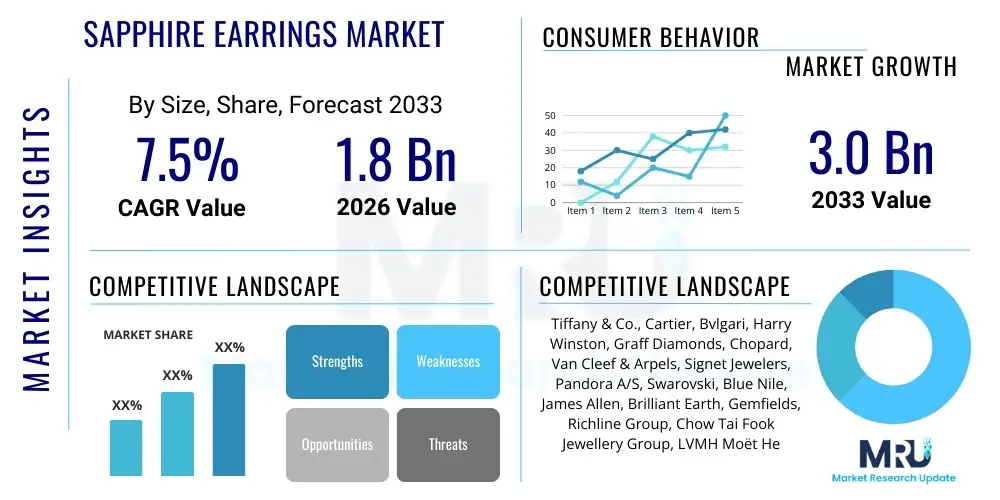

The Sapphire Earrings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $3.0 Billion by the end of the forecast period in 2033. This growth is primarily fueled by the increasing disposable incomes in emerging economies, the rising preference for personalized and custom jewelry, and sapphire’s enduring status as a durable and luxurious gemstone alternative to diamonds. The high consumer value placed on sustainability and ethical sourcing is also driving demand for certified sapphire products, bolstering market expansion, particularly in North American and European markets where ethical consumption trends are robust.

Sapphire Earrings Market introduction

The Sapphire Earrings Market encompasses the design, manufacture, distribution, and retail of earrings featuring natural or laboratory-created sapphire gemstones set in various precious metals, predominantly gold, platinum, and silver. Sapphire, chemically an aluminum oxide, is highly prized for its exceptional hardness, brilliance, and wide spectrum of colors, including the iconic deep blue, as well as pink, yellow, green, and the highly sought-after padparadscha. These earrings serve multiple purposes, ranging from everyday wear and fashion accessories to high-end investment pieces and ceremonial gifts, making them a versatile segment within the broader luxury jewelry sector. The market is characterized by a mix of highly established global luxury brands and specialized artisan jewelers, all competing to meet the complex demands of sophisticated consumers looking for unique design aesthetics and proven gemstone authenticity.

Major applications of sapphire earrings span across several categories, including bridal and wedding jewelry, where sapphire studs or drops often serve as the traditional "something blue," high fashion and red-carpet events, and personal investment collections. The durability of sapphire (rated 9 on the Mohs scale) makes it highly desirable for everyday jewelry, ensuring longevity and resistance to scratching. Furthermore, the advent of sophisticated laboratory-grown sapphires offers consumers a sustainable and cost-effective alternative that possesses the identical chemical, physical, and optical properties of natural stones, thus broadening the market accessibility and appeal to budget-conscious luxury buyers without compromising on quality or appearance. The application landscape is continuously evolving, driven by social media trends and celebrity endorsements which frequently showcase intricate sapphire designs.

Key factors driving the market include the cultural significance of sapphires in various parts of the world, symbolizing wisdom, virtue, and good fortune, which enhances their appeal as heirloom pieces. Additionally, effective marketing strategies focusing on the rarity and historical provenance of certain sapphire colors, particularly Kashmir blue and Burmese pink sapphires, sustain high price points in the high-end segment. The recent surge in popularity of colored gemstones over traditional colorless diamonds, particularly among younger generations seeking unique expressions of individuality, significantly contributes to market momentum. Furthermore, technological advancements in cutting and polishing techniques allow jewelers to create intricate designs that maximize the stone's brilliance and fire, appealing to modern aesthetic sensibilities while maintaining the timeless elegance associated with fine jewelry.

Sapphire Earrings Market Executive Summary

The Sapphire Earrings Market is experiencing steady growth driven by converging macro and micro business trends, including the robust expansion of luxury e-commerce platforms and the increasing global wealth concentration among high-net-worth individuals (HNWIs). Key business trends reveal a strong shift towards personalized and bespoke jewelry services, utilizing digital visualization tools that allow consumers to participate actively in the design process, thereby increasing engagement and perceived value. Furthermore, transparency in the supply chain, facilitated by initiatives like blockchain tracking, is becoming a non-negotiable expectation, compelling major retailers to adopt stringent ethical sourcing policies to mitigate reputational risks and satisfy the demands of environmentally and socially conscious consumers. This focus on traceability is reshaping competitive dynamics, favoring brands that can credibly demonstrate their commitment to conflict-free sourcing and sustainable practices from mine to market.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market, primarily due to the rapid urbanization, the burgeoning middle class in India and China, and the deep cultural appreciation for colored gemstones in these regions. North America and Europe, however, remain the largest revenue contributors, characterized by mature consumer bases with high purchasing power and a strong preference for branded, designer sapphire jewelry. In North America, demand is particularly strong for classic, investment-grade pieces, while European consumers often favor vintage or antique styles and contemporary minimalist designs. The Middle East demonstrates sustained demand for large, high-carat, elaborate sapphire settings as a symbol of status and traditional gifting, ensuring continued stability in this region's high-value segment. Manufacturers are consequently adapting their product portfolios to address these distinct regional style preferences and cultural buying patterns.

Segmentation trends highlight the increasing dominance of the natural sapphire segment in terms of revenue, primarily due to its rarity and investment value, although the laboratory-created sapphire segment is gaining significant traction in terms of volume and accessibility. By cut type, the traditional round brilliant and cushion cuts maintain popularity, but bespoke cuts and unique asymmetrical shapes are increasingly favored in the high-fashion segment. The distribution channel analysis shows a significant shift towards online retail and brand-specific e-commerce portals, which offer convenience, wider inventory selection, and competitive pricing, challenging the traditional dominance of physical specialty jewelry stores. Nonetheless, physical showrooms remain crucial for the ultra-luxury segment, where customers prefer a tactile and personalized consultation experience before making substantial purchases. The integration of augmented reality (AR) in both online and offline retail is a growing trend supporting segment diversification.

AI Impact Analysis on Sapphire Earrings Market

Common user questions regarding AI’s influence on the Sapphire Earrings market frequently revolve around how artificial intelligence can authenticate gemstones, personalize shopping experiences, and optimize supply chain efficiency. Users are keenly interested in whether AI-driven gemstone grading tools can objectively assess color saturation, clarity, and cut quality, potentially removing human subjectivity and ensuring fair pricing. Furthermore, there is significant inquiry into AI's role in predictive fashion analytics, helping jewelers forecast demand for specific colors (like Teal or Royal Blue) or settings (like halo or bezel) before trends fully materialize. Key concerns often focus on data privacy when using personalization algorithms and the fear of AI-generated designs eroding the artisanal craft integral to high-end jewelry manufacturing.

AI's primary impact is revolutionizing customer interaction and operational efficiency. By analyzing vast datasets of past purchases, browsing behaviors, and social media trends, AI algorithms can create highly personalized recommendations, suggesting specific sapphire earring styles, metal types, and price points directly tailored to individual consumer preferences, significantly boosting conversion rates for e-commerce platforms. Operationally, AI is deployed in sophisticated inventory management systems to forecast optimal stock levels, reducing carrying costs and minimizing the risk of holding obsolete designs. In the manufacturing phase, AI-powered computer vision systems are being integrated to enhance quality control during cutting and setting, identifying microscopic flaws in the sapphire or imperfections in the metalwork far more efficiently and accurately than manual inspection. This comprehensive integration of AI across the value chain promises increased profitability and a superior, customized customer journey.

- AI enhances personalized marketing and recommendation engines, driving higher conversion rates through tailored product suggestions.

- Predictive analytics optimize inventory management, forecasting demand for specific sapphire colors, cuts, and settings, reducing excess stock.

- Computer vision systems improve quality control in manufacturing, accurately grading sapphire characteristics (color, clarity) and detecting flaws in setting craftsmanship.

- Blockchain technology, often complemented by AI analytics, increases supply chain transparency and verifies the ethical and conflict-free sourcing of gemstones.

- AI-driven chatbot systems provide 24/7 customer support and virtual try-on experiences using Augmented Reality (AR) integration.

- Generative AI assists designers in rapidly iterating new earring prototypes and variations based on current market data and aesthetic trend analysis.

DRO & Impact Forces Of Sapphire Earrings Market

The Sapphire Earrings Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), significantly influencing its trajectory and competitive landscape. A primary driver is the increasing preference for colored gemstones as centerpiece jewelry, shifting away from the diamond monoculture, driven by changing consumer aesthetics and the desire for unique luxury items. Restraints include the persistent challenge of sourcing ethically and the high cost associated with certified natural sapphires, which can limit consumer base expansion. Opportunities lie primarily in the technological advancement of laboratory-grown sapphires, offering sustainable alternatives that appeal to environmentally conscious consumers, and the expansion of digital retail channels, which lowers entry barriers for bespoke jewelry brands. The impact forces are multifaceted, incorporating stringent regulatory pressures related to gemstone disclosure (natural vs. synthetic) and the powerful influence of social media trends and celebrity endorsements, which can rapidly elevate or diminish the popularity of specific earring styles or sapphire colors.

Impact forces specifically relate to the macroeconomic climate and shifts in consumer confidence. Economic volatility often restricts discretionary spending on ultra-luxury items, acting as a major external restraint. Conversely, the rising wealth in Asian economies generates a powerful upward impact force on demand for high-carat, investment-grade sapphires. The shift toward direct-to-consumer (D2C) models, facilitated by e-commerce, is a transformative force that disintermediates traditional distribution channels, enabling smaller, specialized brands to compete effectively on price and unique product offerings. Regulatory bodies worldwide are increasingly demanding clarity regarding the origin and treatment of sapphires, making ethical sourcing compliance a critical force shaping market operations. Companies failing to adapt to these stringent transparency requirements risk losing market share, particularly among affluent, informed consumers who prioritize provenance and sustainable business practices above all else in their luxury purchases.

Segmentation Analysis

The Sapphire Earrings Market is comprehensively segmented based on several critical dimensions, allowing manufacturers and retailers to target specific consumer groups with tailored product offerings and marketing strategies. Key segmentation parameters include the type of sapphire (natural vs. lab-created), the cut of the gemstone (round, princess, cushion, pear, oval, emerald), the metal used for setting (14K Gold, 18K Gold, Platinum, Sterling Silver), and the distribution channel (online stores, specialty jewelers, mass retailers, auction houses). Analyzing these segments provides deep insights into consumer behavior, price elasticity, and evolving preferences, crucial for effective product portfolio management. For instance, the demand for natural, high-carat sapphires set in platinum is typically inelastic and concentrated among HNWIs, while the market for lab-created sapphires set in sterling silver is highly price-sensitive and appeals to younger, fashion-forward demographics seeking affordable luxury and sustainable options.

Further segmentation explores application type (casual, ceremonial, investment) and earring style (studs, drops, dangle, hoops, chandelier). Stud earrings remain the highest volume segment due to their versatility and suitability for everyday wear, while elaborate chandelier and drop earrings dominate the ceremonial and high-fashion segments. The distinction between natural and synthetic stones is becoming increasingly important; while natural sapphire commands premium pricing due to its inherent rarity and investment potential, lab-grown sapphires are rapidly gaining acceptance, especially in markets where sustainability and verifiable purity are highly valued. This segmentation dichotomy necessitates different manufacturing processes, pricing strategies, and disclosure requirements, forcing market players to clearly articulate the value proposition for each product line to avoid consumer confusion and maintain brand integrity in a highly competitive luxury landscape.

- By Type:

- Natural Sapphire

- Lab-Created (Synthetic) Sapphire

- By Cut:

- Round Brilliant Cut

- Cushion Cut

- Oval Cut

- Emerald Cut

- Pear Cut

- Other Fancy Cuts (Asscher, Radiant, Trillion)

- By Metal Type:

- Gold (Yellow, White, Rose)

- Platinum

- Sterling Silver

- Other Precious Alloys

- By Style:

- Stud Earrings

- Drop/Dangle Earrings

- Hoop Earrings

- Chandelier Earrings

- By Distribution Channel:

- Specialty Jewelry Stores (Independent Retailers, Brand Boutiques)

- Online Channels (E-commerce Platforms, Brand Websites)

- Department Stores

- Auction Houses

Value Chain Analysis For Sapphire Earrings Market

The value chain for the Sapphire Earrings Market is intricate, starting from upstream activities involving global gemstone mining and raw material procurement, moving through manufacturing and design, and culminating in downstream retail and after-sales service. Upstream activities are critical, focusing on ethical sourcing of rough sapphire from key regions like Sri Lanka, Madagascar, and Australia. This stage involves complex geological exploration, mining, and initial sorting. Transparency and traceability are paramount in the upstream phase, as consumers increasingly demand verifiable proof that their gemstones are conflict-free and extracted under fair labor conditions. Direct sourcing models are gaining popularity among major brands to ensure quality control and ethical compliance, bypassing traditional gem brokers and large-scale wholesale auctions, although these traditional routes still form a substantial part of the supply infrastructure.

Midstream processes involve cutting, polishing, and treatment (such as heat enhancement) of the rough stones, transforming them into marketable gems, followed by design and manufacturing of the earring settings. This phase often utilizes advanced technology, including Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM), to achieve precision in metalwork and optimal stone setting geometry. The distribution channel, which represents the critical downstream segment, is highly diversified. Direct distribution through brand-owned boutiques offers maximized margin control and brand experience consistency, appealing to the ultra-luxury buyer. Indirect distribution utilizes specialized multi-brand jewelry retailers, e-commerce giants (such as Net-a-Porter or dedicated jewel platforms), and mass retailers. The rapid growth of online channels has fundamentally disrupted the downstream segment, requiring traditional brick-and-mortar stores to pivot towards omni-channel strategies, integrating in-store experiences with digital convenience, particularly for product viewing and customer service interactions.

Sapphire Earrings Market Potential Customers

Potential customers for Sapphire Earrings primarily fall into distinct demographic and psychographic segments, spanning High-Net-Worth Individuals (HNWIs), the affluent millennial population, and individuals marking significant life events such as engagements, anniversaries, or milestone birthdays. HNWIs and established collectors typically seek rare, untreated, high-carat natural sapphires, viewing these purchases as tangible investment assets and status symbols. Their purchasing decisions are often driven by provenance, the jeweler's heritage, and exclusivity. They predominantly engage through brand-specific boutiques and private auction houses, valuing personalized consultations and discretion. Geographically, these customers are concentrated in major metropolitan areas across North America, Western Europe, and key financial hubs in Asia.

Conversely, the affluent millennial and Generation Z consumers represent a rapidly growing customer base, characterized by a demand for unique style, sustainability, and transparency. This segment often prefers lab-created sapphires or ethically sourced natural stones set in contemporary designs, valuing authenticity and eco-conscious manufacturing over sheer carat weight or brand antiquity. They are highly influenced by social media, prioritize customization, and primarily utilize online channels and specialized digital retailers for product research and purchase. Another crucial segment includes the gifting market, where consumers purchase sapphire earrings for celebratory occasions. These buyers look for classic, versatile styles (like blue sapphire studs) that offer high perceived value and timeless appeal, often relying on the expertise and reputation of established retail jewelry chains for reliable guidance and certification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $3.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tiffany & Co., Cartier, Bvlgari, Harry Winston, Graff Diamonds, Chopard, Van Cleef & Arpels, Signet Jewelers, Pandora A/S, Swarovski, Blue Nile, James Allen, Brilliant Earth, Gemfields, Richline Group, Chow Tai Fook Jewellery Group, LVMH Moët Hennessy Louis Vuitton SE, Richemont, Mouawad, Damas Jewellery. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sapphire Earrings Market Key Technology Landscape

The technology landscape in the Sapphire Earrings market is primarily centered around enhancing precision in manufacturing, ensuring authenticity, and optimizing the consumer experience. In the manufacturing sector, the integration of advanced Computer-Aided Design (CAD) and high-resolution 3D printing (Additive Manufacturing) allows jewelers to rapidly prototype intricate earring designs with superior accuracy and minimal material waste. This technology is particularly crucial for creating complex settings that securely hold large or unique-cut sapphires while maximizing the stone’s exposure to light. Furthermore, laser cutting and micro-setting techniques enable high-volume precision assembly, reducing human error and achieving uniformity across mass-produced lines, thereby bridging the gap between bespoke craftsmanship and industrial scalability. The use of advanced surface treatment technologies also improves the durability and aesthetic finish of the precious metals used in the earring settings, ensuring longevity and resistance to tarnishing.

Beyond manufacturing, technology is fundamentally transforming sourcing and consumer assurance. The adoption of blockchain technology is rapidly becoming a standard practice for creating immutable digital ledgers that track sapphires from their origin (mine or laboratory) through the cutting, setting, and retail processes. This technology addresses the critical consumer demand for transparency and ethical sourcing by providing verifiable proof of a stone's journey, thereby mitigating the risk of purchasing conflict gems or fraudulent synthetics being misrepresented as natural. Furthermore, advancements in spectroscopy and specialized gemological equipment, often augmented by AI, are crucial for accurately identifying and grading the quality of sapphires, distinguishing natural stones from lab-created ones, and detecting specific treatments that affect value. Finally, customer-facing technologies like Augmented Reality (AR) virtual try-on applications, accessible via mobile devices or e-commerce sites, are significantly boosting online engagement and reducing return rates by allowing potential buyers to visualize how the earrings look before purchase.

Regional Highlights

- North America: North America holds a significant share of the Sapphire Earrings market revenue, driven by high disposable income, established luxury consumer culture, and a strong affinity for branded, high-end jewelry, particularly in the United States. The region is characterized by a mature market that exhibits stable demand for classic blue sapphire designs, often purchased as investment pieces or traditional gifts. However, the market is also a leader in adopting ethical sourcing and sustainability trends, leading to strong growth in the certified and traceable sapphire segments. E-commerce penetration is exceptionally high, making digital marketing and online retail strategies critical for market penetration and sustained success.

- Europe: The European market, encompassing Western European fashion capitals like Paris, London, and Milan, is marked by a deep appreciation for artisanal craftsmanship, antique styles, and unique design heritage. Demand for sapphire earrings here is bifurcated: there is steady interest in vintage and period pieces, and simultaneously, robust growth in contemporary, minimalist designs often featuring unusual sapphire colors (like pink or yellow). Strict regulatory standards regarding gemstone disclosure and consumer protection foster a market environment where reputable, established jewelers thrive. Germany and the UK are key contributors, showing consistent demand for affordable luxury options alongside high-end designer pieces.

- Asia Pacific (APAC): APAC is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily attributable to robust economic growth, increasing urbanization, and the substantial expansion of the middle- and high-income classes in countries like China, India, and Southeast Asia. Cultural factors strongly favor colored gemstones, particularly blue and yellow sapphires, which are associated with prosperity and good fortune. The Indian market, in particular, drives ceremonial and bridal jewelry demand, where intricate, heavy sapphire settings are highly prized. Local jewelers face increasing competition from global luxury brands expanding their physical and digital retail presence across the region.

- Latin America (LATAM): The LATAM region presents a growing, albeit volatile, market for sapphire earrings. Demand is concentrated in economically stable areas like Brazil and Mexico, focusing predominantly on mid-range and affordable luxury items. Consumption is highly influenced by local cultural traditions and economic conditions. While the market is smaller compared to North America or Europe, the growing affluence and increased visibility of international luxury brands are gradually driving consumer interest towards colored gemstone jewelry, particularly in urban centers where modern fashion trends are adopted quickly.

- Middle East and Africa (MEA): The MEA market is characterized by strong demand for ultra-luxury, high-carat sapphire earrings, primarily fueled by the wealth concentrated in the Gulf Cooperation Council (GCC) countries. Consumers in this region prioritize large, visible stones and elaborate, often custom-made, designs set in high-purity gold. The market is less price-sensitive at the high end but demands exceptional quality and verifiable authenticity. Retail is dominated by established physical boutiques and high-end malls, emphasizing the importance of personalized, in-person sales experiences for this discerning clientele.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sapphire Earrings Market.- Tiffany & Co.

- Cartier (Richemont Group)

- Bvlgari (LVMH Group)

- Harry Winston (Swatch Group)

- Graff Diamonds

- Chopard

- Van Cleef & Arpels (Richemont Group)

- Signet Jewelers Limited

- Pandora A/S

- Swarovski

- Blue Nile (Signet Jewelers)

- James Allen (Signet Jewelers)

- Brilliant Earth

- Gemfields

- Richline Group (Berkshire Hathaway)

- Chow Tai Fook Jewellery Group

- Kering (Boucheron, Pomellato)

- LVMH Moët Hennessy Louis Vuitton SE

- Mouawad

- Damas Jewellery

Frequently Asked Questions

Analyze common user questions about the Sapphire Earrings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Sapphire Earrings market?

The market growth is primarily driven by increasing consumer preference for unique, colored gemstones over traditional diamonds, rising global disposable incomes, especially in Asia Pacific, and the strong consumer demand for ethically sourced and transparently traded luxury jewelry. Technological advancements in design and the growing acceptance of high-quality lab-created sapphires also contribute significantly to market expansion and accessibility.

What is the difference in market share between natural and lab-created sapphire earrings?

While natural sapphires command a higher market share in terms of overall revenue due to their rarity and investment value, lab-created sapphires are rapidly increasing their market share in terms of unit volume. Lab-created options appeal strongly to consumers seeking sustainable, ethically verifiable alternatives that offer identical physical and optical properties at a more accessible price point.

How does the e-commerce sector influence the distribution of sapphire earrings?

E-commerce platforms, including dedicated brand websites and multi-brand luxury portals, significantly influence distribution by offering greater transparency, competitive pricing, and convenience. Digital channels facilitate global reach, utilize technologies like virtual try-ons to enhance consumer confidence, and provide personalized marketing based on data analytics, increasingly challenging the traditional dominance of physical retail stores.

Which regions demonstrate the highest growth potential for sapphire earrings?

The Asia Pacific (APAC) region, specifically China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid economic development, expanding middle-class affluence, and the cultural significance of colored gemstones in these markets. North America and Europe remain crucial established markets, but APAC offers the fastest acceleration in consumer adoption and purchasing power.

What role does ethical sourcing and transparency play in consumer purchasing decisions for sapphire earrings?

Ethical sourcing and supply chain transparency are critical decision factors, particularly among millennial and affluent Western consumers. Buyers increasingly demand verifiable proof (often through blockchain technology) that their sapphires are conflict-free and extracted under fair labor standards. Brands prioritizing clear provenance and sustainability gain a significant competitive advantage and build greater consumer trust in the luxury sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager