SAR Measurement Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434167 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

SAR Measurement Systems Market Size

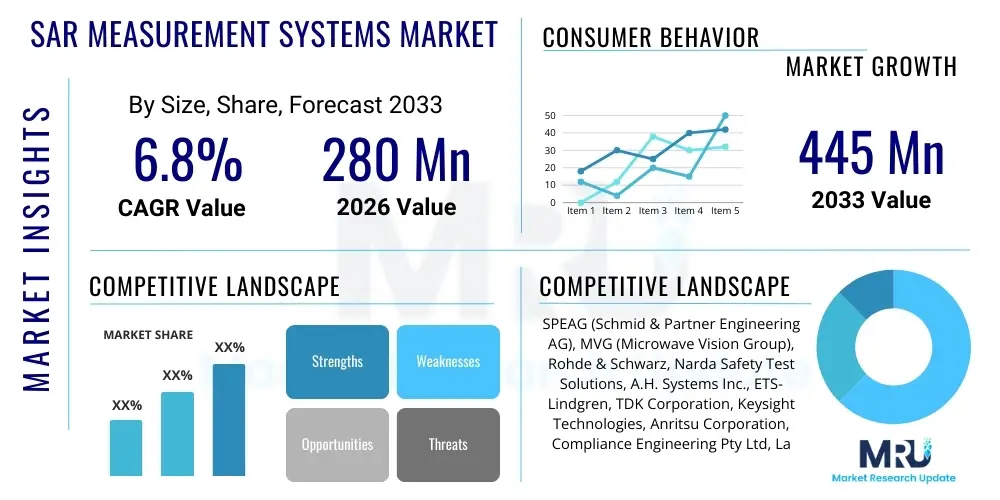

The SAR Measurement Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 280 million in 2026 and is projected to reach USD 445 million by the end of the forecast period in 2033.

SAR Measurement Systems Market introduction

The Specific Absorption Rate (SAR) Measurement Systems Market encompasses specialized instruments and integrated robotic platforms designed to accurately quantify the electromagnetic energy absorbed by biological tissues, particularly the human body, when exposed to radiofrequency (RF) fields emitted by wireless communication devices. These sophisticated systems are critical for ensuring compliance with international safety standards established by regulatory bodies such as the Federal Communications Commission (FCC) in the US, the International Commission on Non-Ionizing Radiation Protection (ICNIRP), and various regional standards in Europe and Asia. The core components typically include a robotic arm for precise probe positioning, specialized liquid phantoms simulating human tissue, high-precision field probes, and advanced data acquisition and processing software.

The primary application of SAR measurement systems resides in the validation and certification of consumer electronics, especially smartphones, tablets, wearable technology, and 5G network components, prior to commercial launch. With the exponential growth in wireless device usage and the increasing complexity of RF environments—driven by high-frequency bands and multiple-input multiple-output (MIMO) technologies—the demand for highly accurate, repeatable, and fast SAR assessment tools has intensified. Furthermore, emerging applications in medical implants, automotive radar systems, and industrial IoT devices are broadening the scope of necessary RF safety compliance testing, thus bolstering market growth.

The benefits derived from deploying these advanced systems are manifold, primarily centering on public health protection and regulatory adherence. Driving factors include the continuous proliferation of new wireless technologies (5G, future 6G), which operate across wider and higher frequency ranges requiring revised measurement techniques; the increasing regulatory scrutiny over health risks associated with RF exposure; and the global trend toward stricter enforcement of mandatory safety certifications. These factors compel manufacturers to invest in cutting-edge SAR systems to validate device performance under diverse operational conditions and ensure consumer safety, positioning the market for sustained expansion over the forecast horizon.

SAR Measurement Systems Market Executive Summary

The SAR Measurement Systems Market is characterized by robust growth, propelled by relentless technological advancements in wireless communication and stringent global regulatory frameworks mandating electromagnetic radiation safety checks. Current business trends indicate a strong shift towards automated, integrated, and high-throughput systems capable of handling complex testing scenarios involving multi-band, multi-radio devices, particularly those leveraging mmWave frequencies associated with 5G technology. Key market participants are focusing intensely on developing AI-enhanced software solutions for faster data processing, improved measurement accuracy, and reduced test time, recognizing that speed and compliance are critical competitive differentiators in the dynamic consumer electronics landscape.

Regionally, North America and Europe currently dominate the market due to the early establishment of rigorous RF safety standards and the presence of major technological innovation hubs, including leading mobile device manufacturers and testing laboratories. However, the Asia Pacific region, led by China, South Korea, and Japan, is projected to exhibit the highest growth rate, driven by massive investments in 5G infrastructure deployment, burgeoning production of consumer wireless devices, and the subsequent need for localized certification and testing capabilities. Developing economies in APAC are rapidly adopting global safety standards, creating substantial opportunities for both system providers and accredited testing houses.

Segment trends reveal that the component segment, specifically high-precision robotic positioning systems and advanced dielectric probes, maintains a significant market share due to continuous technological upgrades required to meet higher frequency testing demands. Application-wise, the Mobile Devices segment remains the largest end-user, but the Automotive and Medical Devices segments are accelerating rapidly. The increasing integration of wireless connectivity (e.g., V2X communication, wireless charging, and connected medical devices) mandates specialized SAR compliance testing tailored to these specific operational environments, demanding flexible and customizable measurement platforms capable of simulating diverse user exposure scenarios.

AI Impact Analysis on SAR Measurement Systems Market

User queries regarding the impact of Artificial Intelligence (AI) on the SAR Measurement Systems Market frequently center on efficiency gains, predictive modeling capabilities, and the potential for automating highly complex measurement tasks. Common questions include: "Can AI reduce the lengthy SAR testing cycle time?", "How does Machine Learning improve the accuracy of SAR extrapolation?", and "Will AI replace the need for physical phantom measurements?" The analysis suggests that users are primarily concerned with how AI can optimize the costly and time-consuming compliance process, moving beyond traditional, sequential testing methodologies toward more adaptive and intelligent systems. Users expect AI to handle the increasing complexity introduced by 5G and IoT deployments, where the number of possible test configurations (modes, bands, distances) becomes computationally overwhelming for manual or standard automated approaches.

AI’s influence is manifesting in the development of sophisticated predictive SAR algorithms, allowing manufacturers to estimate SAR distribution and compliance margins earlier in the product design cycle, significantly reducing the reliance on late-stage physical prototyping. Furthermore, AI-driven calibration routines enhance the reliability and repeatability of measurements by detecting and correcting minor environmental or instrumental drifts in real-time. This integration ensures that the vast amount of data generated during high-throughput testing—especially relevant for devices employing dynamic power control or beamforming—can be analyzed instantaneously to certify compliance across all operational states, a task previously requiring extensive post-processing and manual verification.

The incorporation of deep learning models enables the systems to learn correlations between device operational parameters (e.g., antenna structure, power output, modulation scheme) and measured SAR values. This allows for intelligent test plan creation, focusing resources on worst-case scenarios and reducing redundant testing steps. Consequently, AI is transforming SAR testing from a purely reactive compliance activity into a proactive design tool, accelerating time-to-market for new wireless devices while maintaining rigorous safety standards, thereby offering substantial competitive advantages to system providers who successfully embed these functionalities.

- AI-enhanced Predictive Modeling: Reduces the need for extensive physical prototyping by accurately estimating SAR values during the design phase.

- Automated Calibration and Validation: Uses ML algorithms to optimize system calibration processes, improving measurement accuracy and minimizing human error.

- Accelerated Test Throughput: Enables rapid analysis of massive multi-dimensional datasets generated by 5G devices operating with complex beamforming techniques.

- Intelligent Worst-Case Scenario Identification: Deep learning models identify critical operational modes that lead to maximum exposure, optimizing the test matrix.

- Real-time Compliance Monitoring: Provides dynamic adjustments to testing parameters based on ongoing measurement feedback, crucial for adaptive power control devices.

DRO & Impact Forces Of SAR Measurement Systems Market

The SAR Measurement Systems Market is shaped by a critical interplay between technological necessity (driven by new wireless standards) and regulatory requirements. The primary driver is the global proliferation and subsequent densification of 5G networks, necessitating complex and highly accurate measurements across higher frequency bands (especially millimeter-wave, mmWave). Regulatory agencies globally are constantly updating standards to address the complexities of these new technologies, forcing device manufacturers to adopt advanced measurement solutions. However, a significant restraint is the high initial capital investment required for state-of-the-art SAR measurement labs, coupled with the need for specialized technical expertise to operate and maintain these sophisticated robotic systems, which limits adoption among smaller manufacturers or independent testing labs in developing regions.

Opportunities in the market stem mainly from the convergence of wireless technology with non-traditional sectors. The emergence of connected vehicles (V2X), advanced industrial automation (Industry 4.0), and increasingly complex medical telemetry devices all require specific, tailored SAR assessments that standard mobile device testing platforms cannot fulfill, opening niche segments for specialized system developers. Furthermore, the trend toward over-the-air (OTA) testing methodologies, where SAR measurement is integrated with overall antenna performance evaluation, represents a future growth trajectory. The critical impact force is the regulatory environment: any modification or tightening of ICNIRP or FCC exposure limits immediately impacts the demand curve for updated, higher-sensitivity measurement equipment capable of demonstrating compliance under new, stricter parameters.

The inherent complexity of measuring SAR for devices utilizing beamforming technology—where the radiation pattern changes dynamically—presents both a technical challenge and a commercial opportunity. Systems capable of accurately assessing spatial and temporal peak average SAR for these adaptive technologies will gain significant competitive advantage. The interplay between stringent mandatory compliance (Driver) and the high cost of sophisticated testing equipment (Restraint) means that market growth is characterized by cyclical investment spikes tied directly to major regulatory updates (Impact Force) and the launch cycles of new wireless standards (Opportunity).

Segmentation Analysis

The SAR Measurement Systems Market is highly fragmented and segmented based on the specific technical requirements for compliance testing. Segmentation allows companies to target specific end-user needs, whether it involves measuring SAR for small, low-power wearables or complex, high-frequency telecommunication base station components. The primary segmentation dimensions include the type of component (hardware vs. software), the application/end-user vertical, and the specific technology or frequency band being tested. The robustness and modularity of the systems are key differentiators, as testing laboratories often need flexible platforms that can adapt to rapid changes in wireless standards without complete hardware overhaul. This segmentation structure is crucial for understanding technological focus and market penetration strategies across different regulatory domains.

The Component segment holds substantial importance because the accuracy of the entire SAR process hinges on the precision of the hardware elements, particularly the E-field probes, robotic manipulators, and tissue-simulating liquids (phantoms). Software solutions are increasingly integrated, offering data processing, extrapolation, and regulatory reporting features, enhancing efficiency and reducing the manual burden on technicians. Meanwhile, the application segmentation highlights the diversification of RF exposure risks beyond traditional mobile phones, pushing system providers to develop specialized solutions for environments such as automotive interiors, where multiple RF sources interact in a confined space, or high-density medical imaging environments.

- By Component:

- SAR Measurement Systems (Robotics, Data Acquisition, Phantoms)

- E-Field Probes (Isotropic, High-Frequency)

- Software and Automation Modules

- Tissue Simulating Liquids and Phantoms

- Calibration and Validation Kits

- By Application/End-User:

- Mobile Devices (Smartphones, Tablets)

- Wearable Devices (Smartwatches, Fitness Trackers)

- Medical Devices and Implants

- Automotive and Aerospace

- Military and Defense Communication Equipment

- Test Labs and Regulatory Bodies

- By Frequency Range:

- Below 3 GHz

- 3 GHz to 6 GHz

- Above 6 GHz (Millimeter Wave/mmWave)

Value Chain Analysis For SAR Measurement Systems Market

The value chain for the SAR Measurement Systems Market is highly specialized, starting with upstream suppliers who provide highly precise mechanical components, advanced semiconductor sensors for probes, and specialized software development tools. These upstream activities are critical, as the accuracy of the final measurement system is directly dependent on the quality and calibration precision of these components. Manufacturers (integrators) then assemble the complete robotic DASY or EASY systems, incorporating proprietary algorithms and ensuring seamless integration between the mechanical positioning system, the RF probes, and the data processing unit. Given the regulatory nature of the product, robust R&D focused on meeting evolving standards (e.g., IEC 62209, IEEE 1528) is a central upstream investment.

The downstream segment primarily consists of distribution channels, which are often direct due to the high-value, niche nature of the equipment, although specialized regional distributors and value-added resellers (VARs) play a role in installation, maintenance, and training. The end-users are predominantly large mobile device manufacturers (who maintain in-house testing facilities), third-party accredited testing laboratories, and governmental regulatory agencies. The service component, including regular system calibration, software updates, and technical support to navigate complex regulatory requirements, adds significant value downstream and often represents a stable recurring revenue stream for the primary system providers.

The complexity of the system often dictates a direct sales model, allowing the manufacturer to provide necessary pre-sales consultation and post-sales specialized support essential for accurate compliance testing. Indirect channels are typically used for consumable components like tissue-simulating liquids and replacement probes. The effectiveness of the value chain is measured by its ability to rapidly incorporate new technological requirements (like mmWave support) and deliver highly reliable, certified systems quickly to device manufacturers who are operating under compressed product launch schedules, highlighting the intense link between upstream R&D and downstream customer service.

SAR Measurement Systems Market Potential Customers

Potential customers for SAR measurement systems are predominantly entities responsible for the design, manufacturing, or regulatory approval of wireless communication devices and radiating equipment. These customers operate under mandatory compliance requirements, meaning the purchase of a system is driven by regulatory necessity rather than optional operational efficiency. The largest segment remains the consumer electronics industry, requiring rapid, repeatable, and automated testing solutions to certify mass-market products like smartphones, laptops, and smart home hubs before they can legally be sold in major global markets.

Beyond traditional mobile communications, specialized laboratories operated by automotive manufacturers and tier-one suppliers represent a burgeoning customer base. As vehicles become increasingly integrated with wireless technology (e.g., 5G connectivity for autonomous driving, in-car Wi-Fi hotspots, and advanced radar systems), the need to assess RF exposure risks within the vehicle cabin becomes critical. Similarly, the medical device sector, including manufacturers of wirelessly enabled monitoring systems, active implants, and therapeutic equipment, requires SAR testing to ensure the devices do not pose unintended heating hazards to patients.

Furthermore, government and independent organizations form a cornerstone of the customer base. National regulatory bodies (such as the FCC, CE certification houses, and national standardization bureaus) require these systems to perform independent checks and audits of commercial devices. Research and academic institutions, particularly those focused on electromagnetics, bio-effects, and advanced antenna design, also utilize these systems for scientific inquiry and developmental prototyping, albeit typically purchasing fewer, highly specialized units compared to large commercial test houses. The buying decision is heavily influenced by system certification status, measurement uncertainty specifications, and the vendor's reputation for regulatory adherence and technical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 280 Million |

| Market Forecast in 2033 | USD 445 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SPEAG (Schmid & Partner Engineering AG), MVG (Microwave Vision Group), Rohde & Schwarz, Narda Safety Test Solutions, A.H. Systems Inc., ETS-Lindgren, TDK Corporation, Keysight Technologies, Anritsu Corporation, Compliance Engineering Pty Ltd, Laird Connectivity, Intertek Group, DEKRA, UL LLC, SGS SA, PMM/Narda Test Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SAR Measurement Systems Market Key Technology Landscape

The technology landscape of the SAR Measurement Systems market is defined by continuous innovation aimed at reducing measurement uncertainty, increasing speed, and extending frequency capability. The core technology relies on high-precision robotic systems coupled with isotropic E-field probes made of low-dielectric materials to minimize disturbance to the measured field. Recent technological shifts are centered around addressing the challenges posed by 5G’s mmWave frequencies (up to 60 GHz and beyond), which necessitate new approaches like the use of specialized near-field scanning techniques and temperature-based SAR measurement methodologies (C-SAR) that are better suited for assessing localized heating effects at higher frequencies where penetration depth is minimal.

A major technological advancement is the integration of vector measurement techniques and sophisticated computational electromagnetic (CEM) modeling. Traditional systems relied solely on physical measurements, but modern labs frequently utilize hybrid approaches where computational simulations validate and complement physical measurements, particularly for estimating complex near-field distributions. Software technology, including advanced interpolation algorithms and uncertainty assessment tools, is paramount. Vendors are leveraging cloud computing for large-scale data storage and processing, allowing global testing labs to harmonize their measurement protocols and rapidly share calibration data, ensuring consistency across different geographic regions.

Furthermore, the development of specialized phantoms and tissue-simulating liquids remains a crucial technological focus. New liquid formulations must accurately mimic the dielectric properties of human tissue across the expanding range of wireless frequencies, including the higher bands used by 5G and future IoT devices. The move towards fast SAR measurement techniques, such as array probes and volumetric scanning optimized for time efficiency, is essential for high-volume manufacturing environments. The future landscape will likely see greater integration between SAR systems and other electromagnetic compatibility (EMC) testing equipment, creating unified testing platforms for comprehensive wireless device certification.

Regional Highlights

- North America: This region maintains a dominant position, primarily driven by the presence of major regulatory bodies (FCC, ISED) establishing global compliance benchmarks and the headquarters of leading mobile technology innovators. The early and aggressive deployment of 5G infrastructure, coupled with rigorous health safety standards, ensures consistent demand for the latest, most advanced SAR measurement systems capable of handling multi-band and complex wireless technologies. The market here is characterized by high investment in R&D for specialized mmWave testing solutions, particularly in the US.

- Europe: Europe represents a mature and highly regulated market, with growth fueled by mandatory CE marking requirements and strict adherence to ICNIRP guidelines. The region's emphasis on public health safety and sustainable technology development prompts continuous upgrades of existing testing facilities. Demand is strong among European automotive manufacturers integrating V2X technologies and among medical device companies requiring specialized SAR compliance for connected health solutions. Germany, France, and the UK are key markets due to the concentration of accredited testing labs and research institutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market segment. This rapid expansion is attributed to the massive scale of mobile device manufacturing in countries like China, South Korea, and Taiwan, and vast governmental investment in 5G and 6G research and deployment. As APAC countries increasingly align their national standards with international protocols, the necessity for sophisticated SAR testing equipment grows exponentially. The region is seeing a surge in demand for high-throughput, automated systems suitable for factory-floor quality assurance and high-volume certification testing.

- Latin America (LATAM): The LATAM market is experiencing steady growth, driven by the rollout of 4G and nascent 5G networks and increasing consumer awareness regarding RF exposure. While typically trailing North America and Europe in terms of adopting the absolute latest technology, the demand is strong for reliable, cost-effective, and standardized systems necessary for local regulatory compliance checks and device importation certification across major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Growth in MEA is primarily confined to the Gulf Cooperation Council (GCC) states and South Africa, fueled by infrastructure modernization and increasing penetration of mobile broadband services. Government initiatives to establish independent national testing and calibration laboratories are boosting demand. The market generally seeks robust, entry-to-mid-level SAR systems to build foundational compliance testing capabilities in line with international best practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SAR Measurement Systems Market.- SPEAG (Schmid & Partner Engineering AG)

- MVG (Microwave Vision Group)

- Rohde & Schwarz

- Narda Safety Test Solutions

- ETS-Lindgren

- Keysight Technologies

- TDK Corporation

- A.H. Systems Inc.

- Anritsu Corporation

- Compliance Engineering Pty Ltd

- Laird Connectivity

- Intertek Group

- DEKRA

- UL LLC

- SGS SA

- PMM/Narda Test Solutions

- EMC Technologies

- CETECOM GmbH

- Telecommunication Technology Association (TTA)

- CSA Group

Frequently Asked Questions

Analyze common user questions about the SAR Measurement Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the SAR Measurement Systems Market?

The primary driver is the global proliferation of advanced wireless technologies, particularly 5G and future 6G networks, which require complex Specific Absorption Rate (SAR) measurements across wider and higher frequency bands (including mmWave) to comply with increasingly stringent international electromagnetic exposure safety standards (FCC, ICNIRP).

How does 5G technology specifically impact SAR testing complexity and system requirements?

5G introduces complexity through its use of higher frequencies (mmWave), beamforming, and multiple dynamic transmitting antennas. This requires SAR systems to have faster scanning capabilities, specialized near-field measurement techniques, high-frequency probes, and sophisticated software to accurately assess dynamic peak spatial-average SAR, necessitating significant system upgrades.

Which market segment is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate due to massive investments in 5G infrastructure, high-volume manufacturing of consumer electronics, and the rapid alignment of regional regulatory bodies with global SAR compliance standards, creating significant demand for advanced testing equipment.

What role does Artificial Intelligence (AI) play in modern SAR measurement systems?

AI and Machine Learning (ML) are being integrated to enhance efficiency by reducing test cycle time. AI is used for predictive modeling of SAR distribution during the design phase, automating complex calibration procedures, and intelligently identifying worst-case operational scenarios, thereby optimizing the required physical testing matrix.

What are the typical components included in a standard SAR measurement system?

A standard SAR measurement system typically comprises a high-precision robotic manipulator, specialized isotropic E-field probes (sensors), standardized tissue-simulating liquid phantoms (representing the human body), and dedicated data acquisition and analysis software (DAE) for processing raw measurement data and generating compliance reports.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager