SATCOM Amplifier Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431936 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

SATCOM Amplifier Systems Market Size

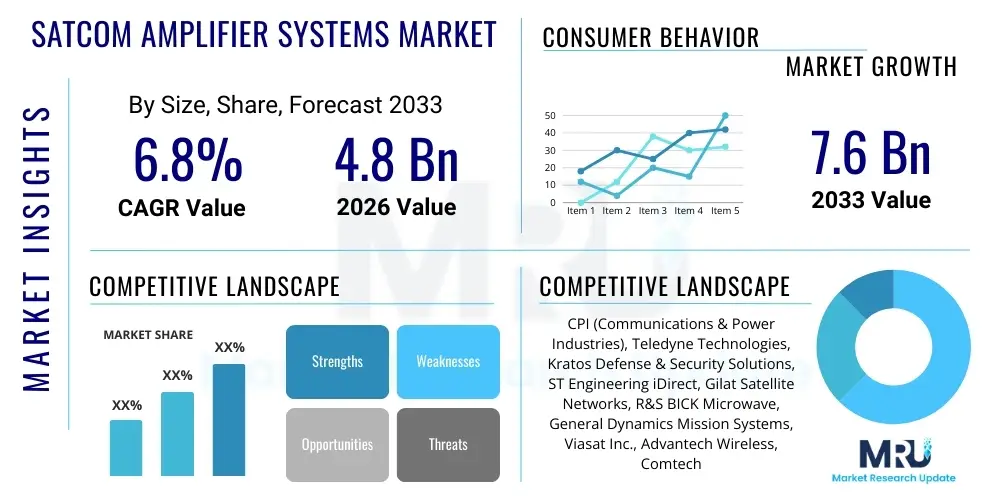

The SATCOM Amplifier Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

SATCOM Amplifier Systems Market introduction

The SATCOM Amplifier Systems Market encompasses devices crucial for boosting the power of radio frequency (RF) signals transmitted to and from satellites, ensuring reliable and high-throughput communication links. These systems, primarily categorized as High Power Amplifiers (HPAs) and Low Noise Amplifiers (LNAs), are indispensable components in ground stations, mobile terminals, and airborne platforms. HPAs, which include Solid State Power Amplifiers (SSPAs) and Traveling Wave Tube Amplifiers (TWTAs), are vital for the uplink, providing the necessary power to overcome atmospheric and distance losses to reach the satellite successfully. The core function is enabling long-distance data transmission, voice communication, and broadcast services across diverse sectors.

Major applications for SATCOM amplifier systems span military and defense communications, commercial telecommunications (including 5G backhaul), broadcasting, maritime, and aerospace industries. The increasing demand for global connectivity, particularly in remote and underserved areas, drives the adoption of advanced SATCOM solutions. Furthermore, the proliferation of High Throughput Satellites (HTS) operating in higher frequency bands (Ku and Ka-bands) necessitates more powerful, efficient, and linear amplifier technologies to manage the increased data rates and complex modulation schemes. Key benefits include extended coverage, enhanced signal reliability, and the ability to maintain continuous communication links, which are critical for mission-critical operations.

Key driving factors propelling the market include the modernization of military satellite communication infrastructure, the transition from GEO to LEO and MEO constellations requiring new ground segment equipment, and the relentless consumer demand for bandwidth-intensive applications like streaming video and high-speed internet access globally. Technological advancements, particularly in Gallium Nitride (GaN) based SSPAs, are improving power density and efficiency, making solid-state alternatives increasingly viable substitutes for traditional tube-based technology in many medium-power applications. The confluence of these technological and demand-side factors establishes a strong foundation for sustained market growth over the forecast period.

SATCOM Amplifier Systems Market Executive Summary

The SATCOM Amplifier Systems Market is undergoing a rapid evolution characterized by a fundamental shift towards higher frequency bands and the deployment of massive Low Earth Orbit (LEO) constellations, which significantly impact the demand profile for ground segment amplifiers. Business trends indicate strong investment in Gallium Nitride (GaN) technology, positioning Solid State Power Amplifiers (SSPAs) as the preferred solution for reliability and lower maintenance in lower-to-medium power ranges, while Traveling Wave Tube Amplifiers (TWTAs) maintain dominance in high-power applications, particularly in large teleports and deep space communication. The market is witnessing consolidation among system integrators aiming to provide end-to-end SATCOM solutions, alongside intense competition to reduce the size, weight, and power (SWaP) characteristics of portable and airborne units.

Regionally, North America remains the leading market due to extensive defense spending on secure satellite communications and the presence of major technology innovators and satellite operators. Asia Pacific (APAC) is projected to exhibit the highest growth rate, driven by rapidly expanding telecommunications infrastructure, increased commercial satellite service adoption in developing economies, and governmental initiatives to enhance connectivity across vast geographies. Europe shows steady growth, primarily fueled by military modernization programs and investment in advanced space technologies, including participation in global LEO projects. This regional divergence emphasizes the need for solutions tailored to varying power requirements, frequency licenses, and environmental ruggedness specific to local market demands.

Segment trends highlight the growing importance of the Ka-band due to its ability to support higher data throughput, necessitating amplifiers capable of operating efficiently at these higher frequencies and managing increased heat dissipation. By application, the Commercial segment, encompassing broadband internet access, enterprise networks, and cellular backhaul, is expected to dominate market share, while the Military & Defense segment remains critical, focusing on highly resilient, redundant, and secure communication links. The LEO/MEO satellite architecture shift is creating unprecedented demand for multi-band and rapidly reconfigurable amplifier systems capable of tracking fast-moving satellites, thereby driving innovation in phased array technology and adaptive beamforming capabilities integrated into ground infrastructure.

AI Impact Analysis on SATCOM Amplifier Systems Market

Common user questions regarding AI's impact on SATCOM amplifiers center primarily on optimizing operational efficiency, enhancing network resilience, and enabling predictive maintenance cycles. Users inquire about how AI-driven algorithms can manage amplifier linearity, dynamically adjust power output based on real-time atmospheric conditions and traffic loads (Dynamic Power Control), and optimize resource allocation across multi-beam satellites. Key concerns revolve around the integration complexity of AI software with legacy hardware, the required computational infrastructure at ground stations, and ensuring the reliability and security of autonomous decision-making processes. The overarching expectation is that AI will transform amplifier management from reactive maintenance to proactive, efficiency-driven operation, maximizing system uptime and reducing operational expenditure (OPEX).

- AI-driven Predictive Maintenance: Utilizing machine learning models to analyze telemetry data (temperature, current, voltage) from amplifier units to predict potential failures, reducing unplanned downtime and optimizing component replacement schedules.

- Dynamic Power and Linearity Control: Employing AI algorithms to automatically adjust amplifier bias and gain settings in real-time to compensate for signal degradations (e.g., rain fade) or varying traffic demands, maximizing throughput while maintaining optimal spectral efficiency.

- Network Resource Optimization: Integrating amplifier control into a wider Software-Defined Networking (SDN) framework, allowing AI to dynamically allocate power resources across different beams and terminals based on priority and instantaneous demand.

- Enhanced Fault Detection and Isolation: AI facilitates faster and more accurate identification of performance anomalies within complex amplifier chains, accelerating troubleshooting and minimizing service disruption.

- Autonomous Link Management: AI enabling ground systems to autonomously select the most efficient amplifier chain and power level for establishing and maintaining communication links with non-geostationary satellites (LEO/MEO).

DRO & Impact Forces Of SATCOM Amplifier Systems Market

The SATCOM Amplifier Systems Market is heavily influenced by a potent combination of technological advancements, defense modernization needs, and high initial investment costs. Key drivers include the global expansion of satellite broadband services, particularly the deployment of massive LEO and MEO constellations which necessitate high-volume production of ground segment equipment, including high-efficiency amplifiers. Restraints largely stem from the high cost of components, particularly advanced GaN semiconductors, and the substantial expenditure required for the initial installation and maintenance of high-power systems, creating barriers to entry for smaller operators. Opportunities arise from the rapidly expanding commercial use cases, such as IoT connectivity via satellite, military migration to high-throughput platforms, and the development of energy-efficient, multi-band amplifiers capable of supporting emerging standards.

Impact forces are centered around the rapid pace of technological obsolescence and stringent regulatory requirements. The transition from legacy technologies (e.g., GaAs) to advanced materials (GaN) mandates continuous R&D investment, pressuring manufacturers to shorten product lifecycles. Furthermore, the operational environment is demanding higher linearity and power output from smaller physical footprints (SWaP optimization), particularly for mobile and airborne platforms. This environment creates competitive pressure among manufacturers to deliver innovation that adheres to increasingly complex spectrum management rules and electromagnetic compatibility (EMC) standards set by international bodies like the ITU, directly impacting design choices and overall system costs.

The interdependence of amplifier technology with satellite payload and frequency allocation is another critical force. The market's success is tied directly to the successful launch and deployment schedule of HTS and LEO constellation operators. Delays in satellite programs can ripple down, slowing the demand for compatible ground equipment. Conversely, the successful commercialization of advanced space assets accelerates the demand for robust, reliable, and high-power density amplifiers capable of handling the massive bandwidth requirements. The balance between maximizing power output and minimizing thermal footprint represents a continuous engineering challenge that shapes procurement decisions across both defense and commercial end-users, underscoring the dynamic nature of the market's internal forces.

Segmentation Analysis

The SATCOM Amplifier Systems Market is comprehensively segmented based on technology type, frequency band, end-user application, and platform. This segmentation allows for precise analysis of market dynamics, revealing that technological shifts, particularly the increasing maturity and reliability of Solid State Power Amplifiers (SSPAs), are influencing procurement decisions across nearly all segments. The fundamental differentiation between SSPA and Traveling Wave Tube Amplifiers (TWTA) defines the power and reliability trade-offs for various deployment scenarios, with SSPAs dominating low-to-medium power applications due to longevity and lower maintenance, while TWTAs retain market share in extreme high-power, high-frequency segments like deep space and large teleports.

Frequency band segmentation is crucial as it directly relates to data throughput capacity and atmospheric attenuation challenges. The Ka-band is the fastest-growing segment, driven by High Throughput Satellite (HTS) deployments, necessitating higher power density amplifiers optimized for this band. Conversely, the C-band remains essential for reliable communication, particularly in regions prone to heavy rainfall (rain fade), requiring robust, medium-power systems. Application segmentation highlights the dominance of the Commercial segment, where the explosion of consumer and enterprise broadband demand fuels requirements for high-efficiency and cost-effective ground terminals.

Geographically, while North America and Europe lead in terms of revenue contribution due to mature defense and aerospace sectors, the Asia Pacific region is expected to lead in terms of deployment volume, specifically driven by expanding cellular backhaul and fixed satellite services (FSS) deployments aimed at bridging the digital divide. The continuous refinement of miniaturized, ruggedized amplifiers designed for tactical military and airborne platforms represents a niche but highly profitable segment focusing intensely on Size, Weight, and Power (SWaP) optimization rather than pure cost reduction.

- By Component Type:

- Solid State Power Amplifiers (SSPA)

- Traveling Wave Tube Amplifiers (TWTA)

- Low Noise Amplifiers (LNA)

- Block Upconverters (BUC)

- By Frequency Band:

- L-band

- C-band

- X-band

- Ku-band

- Ka-band

- V/Q-band

- By End-User Application:

- Commercial Telecommunications (Broadband, Cellular Backhaul)

- Military & Defense

- Broadcasting

- Maritime

- Aviation (In-Flight Connectivity)

- By Platform:

- Ground Fixed Systems (Gateways, Teleports)

- Ground Mobile Systems (VSAT-on-the-Move)

- Airborne Systems

- Shipborne Systems

- By Technology (for SSPAs):

- Gallium Nitride (GaN)

- Gallium Arsenide (GaAs)

Value Chain Analysis For SATCOM Amplifier Systems Market

The value chain for SATCOM Amplifier Systems begins with sophisticated upstream activities involving raw material procurement and highly specialized component manufacturing. The initial stage focuses on securing high-purity semiconductor materials, specifically Gallium Nitride (GaN) and Gallium Arsenide (GaAs) wafers, which are crucial for high-efficiency SSPAs. Specialized components like Traveling Wave Tubes (TWTs), magnetrons, passive RF components, and complex power supply units are sourced from a limited number of expert suppliers. Innovation in the upstream segment, particularly around advanced thermal management solutions and high-frequency substrate materials, directly dictates the performance and power density achievable in the final amplifier product. This segment is characterized by high barriers to entry due to required intellectual property and fabrication complexity.

The midstream phase involves the design, manufacturing, and assembly of the amplifier system itself. Original Equipment Manufacturers (OEMs) integrate the core components, design the RF chains, and rigorously test the final product for critical parameters such as linearity, gain, noise figure, and reliability under environmental stress (temperature, vibration). The shift towards highly integrated, compact systems requires expertise in system-in-package (SiP) technology and advanced digital pre-distortion (DPD) techniques to maximize spectral efficiency. Distribution channels are varied: direct sales are common for large defense and telecom infrastructure projects, while indirect channels utilize specialized distributors and value-added resellers (VARs) who provide localized support, integration services, and maintenance contracts, particularly important in geographically dispersed regions.

Downstream activities involve system integration, installation, maintenance, and end-user deployment. Large satellite operators, military organizations, and major telecommunication companies purchase systems and integrate them into their established ground segment infrastructure (teleports or VSAT networks). Maintenance and lifecycle support are critical, especially for TWTA systems requiring periodic tube replacement, though SSPAs offer lower overall maintenance overhead. The effectiveness of the indirect channel is essential for penetrating smaller, enterprise VSAT markets and providing necessary training and technical support to regional installers, ensuring that the complex technology is correctly calibrated and maintained for optimal performance over its operational life.

SATCOM Amplifier Systems Market Potential Customers

Potential customers for SATCOM Amplifier Systems are primarily large entities requiring robust, high-availability, and global communication coverage, falling broadly into three major categories: telecommunications/broadband providers, government/defense agencies, and specialized commercial users. Telecommunication providers constitute the largest commercial customer base, utilizing these amplifiers in earth stations (teleports) to provide high-speed satellite broadband, cellular backhaul, and enterprise connectivity, demanding high power, high linearity Ka-band systems compatible with HTS architectures. The rapid expansion of LEO constellation ground infrastructure is generating significant new demand from companies dedicated to global internet services, requiring cost-effective, high-volume production SSPAs.

Government and defense agencies represent a crucial segment focused on secure, resilient, and tactical communications. These end-users demand amplifiers that adhere to stringent military standards (MIL-STD), emphasizing ruggedization, SWaP optimization for mobile platforms (vehicles, aircraft, manpacks), and the ability to operate across multiple frequency bands (e.g., X-band and military Ka-band). Procurement in this segment is characterized by long acquisition cycles, rigorous testing, and a preference for established suppliers capable of providing long-term support and system redundancy to ensure mission success under hostile or extreme environmental conditions.

Specialized commercial users include the maritime industry (cruise ships, commercial fleets), the aviation sector (in-flight connectivity providers), and broadcast media companies. Maritime and aviation customers require highly reliable, compact, and sometimes liquid-cooled systems designed for continuous operation under challenging conditions, prioritizing high Mean Time Between Failures (MTBF). Broadcast companies, particularly those transmitting high-definition content globally, rely on powerful C-band and Ku-band amplifiers in their uplink centers to ensure robust signal delivery, demanding exceptional spectral purity and reliability for continuous content transmission.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CPI (Communications & Power Industries), Teledyne Technologies, Kratos Defense & Security Solutions, ST Engineering iDirect, Gilat Satellite Networks, R&S BICK Microwave, General Dynamics Mission Systems, Viasat Inc., Advantech Wireless, Comtech Telecommunications Corp., Terrasat Communications, Norsat International Inc., ETL Systems, Ampleon, Qorvo, Analog Devices, EchoStar Corporation, BAE Systems, L3Harris Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SATCOM Amplifier Systems Market Key Technology Landscape

The technological landscape of the SATCOM Amplifier Systems Market is defined by the ongoing performance optimization of High Power Amplifiers (HPAs), focusing intensely on efficiency, linearity, and miniaturization. The primary technological dichotomy exists between Traveling Wave Tube Amplifiers (TWTAs) and Solid State Power Amplifiers (SSPAs). TWTAs utilize a vacuum tube to amplify signals and remain indispensable for the highest power outputs (kilowatt ranges) across very high frequencies (Ka-band and beyond), offering superior efficiency at the highest power levels required by major teleports and deep space missions. However, they possess shorter lifecycles and higher maintenance requirements due to the fragility of the tube itself. Continuous innovation in TWTAs focuses on improving longevity and reducing size through better heat management techniques.

SSPAs, relying on semiconductor technology, dominate the low-to-medium power segments (up to hundreds of watts) due to their inherent reliability, redundancy, and near-zero maintenance. The fundamental technological shift within the SSPA segment is the pervasive adoption of Gallium Nitride (GaN) devices over legacy Gallium Arsenide (GaAs) technology. GaN amplifiers offer significantly higher power density, higher breakdown voltage, and superior operating efficiency at higher frequencies (Ku and Ka-bands), enabling manufacturers to produce smaller, lighter, and more powerful amplifier modules, directly addressing the critical SWaP constraints of mobile and airborne platforms. This technological superiority is making GaN SSPAs competitive even in power ranges traditionally dominated by TWTAs, especially for systems deployed in harsh or inaccessible environments where maintenance is prohibitive.

Furthermore, digital signal processing techniques, specifically Digital Pre-Distortion (DPD), are crucial for enhancing amplifier linearity. DPD algorithms are implemented to correct non-linear distortions introduced by the HPA, allowing the amplifier to operate closer to its saturation point without causing adjacent channel interference. This results in maximized power usage and spectral efficiency, essential for handling the complex, high-order modulation schemes used in HTS networks. Another key advancement involves modular and redundant architectures, where multiple low-power modules are combined to achieve the desired high-power output (power combining), ensuring system reliability; if one module fails, the system continues operating at a reduced capacity, significantly improving overall operational uptime and resilience.

Regional Highlights

Regional dynamics within the SATCOM Amplifier Systems Market are governed by defense expenditure, commercial bandwidth demand, and the regulatory environment governing satellite spectrum allocation. North America holds the largest market share, fueled by the substantial presence of defense primes, continuous investment in military satellite communication (MILSATCOM) systems modernization (particularly secure X-band and Ka-band infrastructure), and the concentration of major LEO/MEO satellite operators and ground station technology developers. The region benefits from a mature technological ecosystem driving innovation in GaN-based amplifiers and highly integrated terminal solutions.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by explosive demand for connectivity across vast populations and developing nations, stimulating massive investment in FSS and cellular backhaul via satellite. Countries like China, India, and Australia are rapidly deploying new ground infrastructure to support government initiatives and commercial broadband expansion, leading to high-volume procurement of cost-effective, high-efficiency SSPAs, primarily operating in the C-band and Ku-band, reflecting regional requirements for combating heavy rain fade in tropical zones.

Europe demonstrates steady growth, anchored by key players in the space industry and strong governmental commitment to space programs (e.g., ESA initiatives). Demand is focused on advanced, highly specialized military and institutional communications, alongside commercial applications supporting maritime and aeronautical connectivity. The Middle East and Africa (MEA) region show moderate growth, heavily influenced by defense expenditure and the critical need for reliable satellite communication to bridge infrastructure gaps in remote areas, driving demand for robust, ruggedized, and easily deployable mobile SATCOM systems.

- North America: Dominant market share driven by high military spending, technological innovation (GaN), and the proliferation of major satellite constellation ground networks.

- Asia Pacific (APAC): Fastest growth rate due to high demand for cellular backhaul, fixed satellite services, and aggressive governmental investment in national space programs.

- Europe: Stable growth propelled by military modernization, strong institutional space projects, and demand for sophisticated maritime/aeronautical communication systems.

- Latin America: Growing demand driven by the need for remote connectivity, oil & gas exploration communications, and broadcasting services.

- Middle East & Africa (MEA): Growth linked to defense needs, securing critical infrastructure, and leveraging satellite communication to bypass inadequate terrestrial networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SATCOM Amplifier Systems Market.- CPI (Communications & Power Industries)

- Teledyne Technologies Incorporated

- Kratos Defense & Security Solutions, Inc.

- ST Engineering iDirect

- Gilat Satellite Networks

- R&S BICK Microwave

- General Dynamics Mission Systems

- Viasat Inc.

- Advantech Wireless Technologies

- Comtech Telecommunications Corp.

- Terrasat Communications, Inc.

- Norsat International Inc. (A Privitar Company)

- ETL Systems Ltd.

- Ampleon (A subsidiary of BJT, focusing on GaN components)

- Qorvo, Inc.

- Analog Devices, Inc.

- EchoStar Corporation

- BAE Systems plc

- L3Harris Technologies, Inc.

- MaxLinear, Inc.

Frequently Asked Questions

Analyze common user questions about the SATCOM Amplifier Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between SSPA and TWTA technology in SATCOM systems?

SSPA (Solid State Power Amplifier) uses semiconductor devices like GaN or GaAs and is favored for its high reliability, redundancy, and low maintenance, dominating low-to-medium power applications. TWTA (Traveling Wave Tube Amplifier) uses vacuum tubes, offering significantly higher power output (kilowatt range) and efficiency at high frequencies (Ka-band and beyond), making it suitable for large teleports and mission-critical high-power links, despite requiring higher maintenance.

How is the proliferation of LEO and MEO constellations affecting demand for SATCOM amplifiers?

LEO/MEO constellations drive demand for high-volume, standardized, and cost-effective SSPAs, particularly those optimized for Ka-band and supporting wideband links. Furthermore, they necessitate the development of rapidly reconfigurable, high-efficiency amplifiers integrated into tracking earth stations (VSATs) capable of handling the handover between fast-moving satellites, prioritizing modularity and automation.

Which frequency band is experiencing the fastest growth in the amplifier market, and why?

The Ka-band is exhibiting the fastest growth due to the extensive deployment of High Throughput Satellites (HTS) and LEO constellations that utilize this band for higher data rates and increased capacity. This growth requires high-power, highly linear amplifiers built predominantly on Gallium Nitride (GaN) technology to overcome atmospheric attenuation and maintain signal quality for bandwidth-intensive applications.

What is the significance of Gallium Nitride (GaN) technology in modern SATCOM amplifiers?

GaN technology significantly enhances amplifier performance by offering higher power density, increased operating efficiency, and better thermal tolerance compared to traditional GaAs materials. GaN enables the development of smaller, lighter, and more robust SSPAs that can effectively compete with TWTAs in certain power ranges, crucial for size, weight, and power (SWaP) sensitive applications like airborne and mobile military communication platforms.

What role does Digital Pre-Distortion (DPD) play in optimizing SATCOM amplifier performance?

DPD is a critical technology used to electronically compensate for the non-linear distortions inherent in high-power amplifiers. By utilizing DPD algorithms, operators can drive the amplifier closer to its saturation point, maximizing the effective radiated power (EIRP) and significantly improving spectral efficiency, which is essential for maximizing throughput in bandwidth-limited satellite systems.

Why is the Military and Defense segment a crucial driver for advanced amplifier research?

The Military and Defense segment demands amplifiers that operate under extreme conditions, requiring stringent adherence to MIL-STD specifications for shock, vibration, and temperature. This sector drives research into highly resilient, multi-band, and highly secure communication systems, pushing innovations in SWaP reduction, frequency agility, and redundancy necessary for tactical, mission-critical operations worldwide.

How do atmospheric conditions, such as rain fade, influence amplifier requirements in specific regions?

Atmospheric attenuation, particularly rain fade, significantly impacts signal strength in higher frequency bands (Ku and Ka-bands). This necessitates the use of higher output power amplifiers (HPAs) or adaptive systems capable of dynamically increasing power to compensate for signal loss, often leading to regional preferences for robust C-band systems in heavy rainfall areas due to their lower susceptibility to weather effects.

What characterizes the upstream segment of the SATCOM amplifier value chain?

The upstream segment is characterized by specialized manufacturing and high technological complexity, focusing on the production of core components. This includes the sourcing and processing of high-purity semiconductor wafers (GaN, GaAs), the fabrication of Traveling Wave Tubes (TWTs), and the development of specialized high-frequency passive and active RF components that dictate the ultimate performance and efficiency of the finished amplifier system.

In what ways does amplifier linearity impact satellite network capacity and throughput?

Amplifier linearity is vital because non-linear operation generates intermodulation products and spectral regrowth, causing interference in adjacent channels. Maintaining high linearity, often through DPD, allows the use of more efficient, high-order modulation schemes (e.g., QAM), which directly increases the achievable data throughput and maximizes the utilization of precious satellite bandwidth.

Which geographical region is expected to lead market growth in terms of volume deployment?

The Asia Pacific (APAC) region is forecasted to lead in terms of volume deployment of SATCOM amplifier systems. This is driven by massive infrastructure expansion projects aimed at bridging the digital divide, supporting widespread cellular backhaul, and meeting the explosive commercial demand for fixed satellite services across diverse and geographically challenging territories.

What is the key driver for optimizing the Size, Weight, and Power (SWaP) characteristics of amplifiers?

SWaP optimization is primarily driven by the requirements of mobile and airborne SATCOM platforms, including drones, commercial aircraft (In-Flight Connectivity), and tactical military vehicles. Reduced SWaP minimizes fuel consumption, allows for easier integration into restricted spaces, and enables greater operational range and portability, making the unit more deployable and efficient.

How do regulatory policies influence the SATCOM Amplifier Systems Market?

Regulatory policies, particularly those related to spectrum allocation (managed by organizations like the ITU) and electromagnetic compatibility (EMC) standards, directly influence amplifier design. Manufacturers must ensure their systems meet stringent spectral mask requirements to prevent interference, pushing development towards high-linearity solutions and mandating compliance with regional transmission standards.

What major commercial end-user segment dominates the adoption of SATCOM amplifiers?

The Commercial Telecommunications segment, encompassing satellite broadband providers, cellular network operators utilizing satellite backhaul, and enterprise VSAT users, dominates adoption. This segment demands reliable, cost-effective, and high-throughput amplifiers to satisfy the relentless global consumer and business demand for high-speed internet connectivity and data services.

What maintenance advantage do SSPAs hold over TWTAs?

SSPAs offer superior maintenance advantages, characterized by a much longer Mean Time Between Failures (MTBF) and requiring minimal periodic servicing because they lack fragile components like vacuum tubes. Conversely, TWTAs require periodic replacement of the traveling wave tube, leading to higher long-term operational costs and potential system downtime.

What is the relationship between the shift to V/Q-band and amplifier technology development?

The shift to the V/Q-band (above 40 GHz) is driven by the need for even higher throughput capacity in next-generation satellites. This pushes amplifier technology toward materials and designs capable of efficient operation at extremely high frequencies, requiring advanced thermal management and highly specialized millimeter-wave component integration, representing the frontier of solid-state and tube technology research.

How is AI being utilized to improve the operational lifespan of SATCOM amplifiers?

AI is employed for predictive maintenance by analyzing continuous streams of operational data, such as temperature fluctuations, power consumption, and signal degradation patterns. Machine learning models can accurately forecast component wear or imminent failures, allowing ground teams to perform preventative maintenance or module replacement before catastrophic system failure occurs, thereby maximizing the operational lifespan.

What role do Block Upconverters (BUCs) play in the overall amplifier system?

BUCs are integral components, often integrated with the SSPA, responsible for taking the intermediate frequency (IF) input signal from the modem and converting it to the required higher radio frequency (RF) signal for transmission (uplink) to the satellite. They ensure frequency compatibility between the ground equipment and the satellite transponder, making them essential for link establishment.

What market trend is pushing manufacturers toward modular amplifier architectures?

The need for redundancy, scalability, and ease of maintenance in high-power systems drives the trend toward modular architectures. By combining multiple lower-power amplifier modules (power combining), the system achieves the required output power while ensuring that the failure of a single module does not result in total system failure, significantly increasing the overall resilience and availability.

In the Value Chain, why is system integration considered a critical downstream activity?

System integration is critical downstream because SATCOM amplifiers must be precisely calibrated and integrated with modems, antennas, control software, and power systems specific to the end-user's platform (e.g., ground station, ship, or aircraft). Successful integration ensures the system meets the link budget requirements, adheres to regulatory compliance, and operates reliably within the complex SATCOM ecosystem.

How does the military shift to X-band and Ka-band influence the amplifier market?

The military shift to X-band (secure communications) and Ka-band (high-throughput battlefield data) necessitates amplifiers capable of operating across these often-separate military frequency allocations. This drives innovation toward multi-band amplifiers and robust, highly secure systems designed for tactical deployment, often requiring specialized filter and power supply designs to minimize electromagnetic vulnerability.

What is a key financial restraint limiting the growth of the high-power amplifier market?

The high initial capital expenditure (CapEx) required for high-power SATCOM systems acts as a significant restraint. This includes the cost of advanced semiconductor materials (GaN), the complexity of TWTA manufacturing, specialized integration labor, and the necessary redundant power supply and cooling infrastructure, particularly for large teleports.

Why is the maritime industry a vital end-user for specialized SATCOM amplifier systems?

The maritime industry requires continuous, reliable connectivity for crew welfare, operational logistics, and safety protocols globally. They are vital customers for specialized amplifiers optimized for shipborne platforms, demanding robust construction, resistance to salt spray and vibration, and high reliability (low maintenance) under continuous operation for Inmarsat and VSAT services.

What challenges does thermal management pose for high-efficiency SSPAs?

As SSPAs are driven to higher power densities (especially GaN-based units), thermal management becomes a critical challenge. Excessive heat reduces efficiency, compromises linearity, and shortens the component lifespan. This necessitates sophisticated cooling solutions, including liquid cooling loops and advanced heatsink designs, which add complexity and volume to the final product architecture.

Beyond broadband, what emerging commercial application is driving new demand for compact amplifiers?

The emerging application of Satellite IoT (Internet of Things) connectivity is driving new demand. This requires compact, low-power, and highly reliable amplifier systems integrated into low-cost terminals, often operating in L-band or Ku-band, suitable for mass deployment across remote monitoring applications such as asset tracking and environmental sensing.

How are geopolitical factors impacting the regional market distribution of SATCOM amplifiers?

Geopolitical tensions and national security priorities significantly impact the market by accelerating defense spending and the demand for indigenous SATCOM solutions, particularly in North America and parts of Asia Pacific. Export controls and supply chain restrictions related to advanced technology (like GaN) also influence where manufacturing occurs and which companies secure major governmental contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager