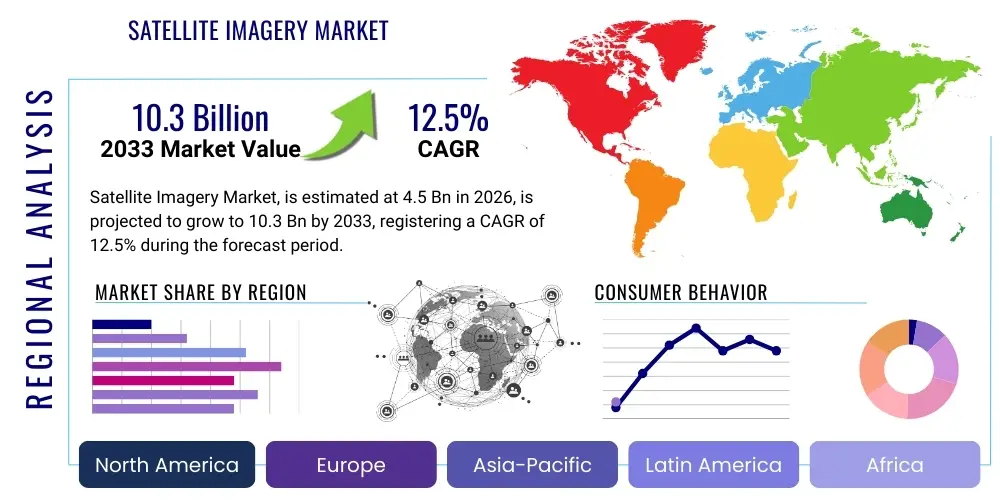

Satellite Imagery Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440201 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Satellite Imagery Market Size

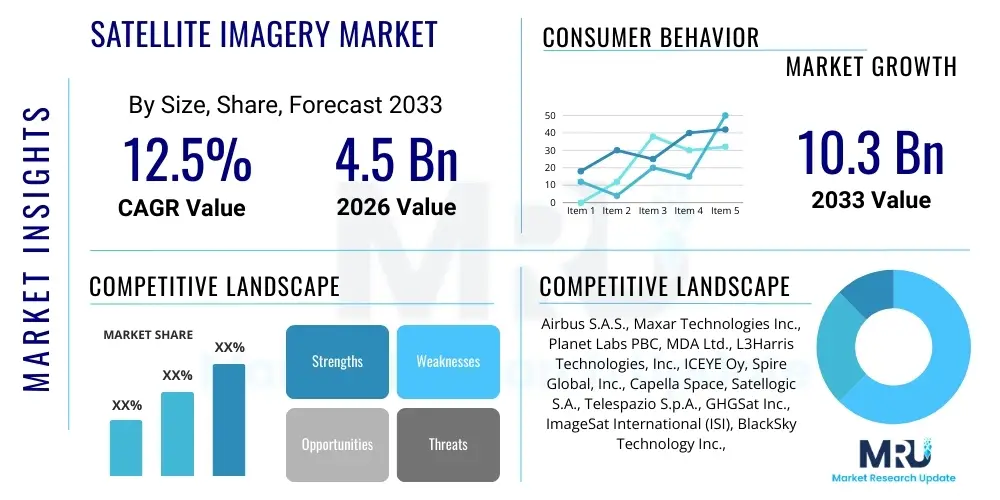

The Satellite Imagery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Satellite Imagery Market introduction

The satellite imagery market encompasses the collection, processing, and distribution of images captured by Earth-orbiting satellites. These images provide critical geospatial intelligence across a multitude of applications, offering unparalleled perspectives for monitoring changes, analyzing trends, and supporting decision-making processes on a global scale. The core product revolves around high-resolution optical, synthetic aperture radar (SAR), and hyperspectral data, which are increasingly refined and integrated with advanced analytical tools to extract meaningful insights. Major applications span defense and intelligence, agriculture, urban planning, environmental monitoring, disaster management, and infrastructure development, highlighting the pervasive utility of this technology.

The benefits of satellite imagery are extensive, including vast geographical coverage, remote accessibility to hazardous or inaccessible areas, cost-effectiveness compared to traditional aerial surveys for large regions, and the ability to conduct repetitive monitoring over time for change detection. This consistent data stream is invaluable for tracking deforestation, urban sprawl, crop health, ice melt, and military movements. Key driving factors propelling market expansion include the escalating demand for accurate geospatial information across both commercial and government sectors, significant advancements in satellite technology leading to smaller, more agile satellites and larger constellations, and the continuous reduction in launch costs, making satellite data more accessible than ever before.

Furthermore, the integration of artificial intelligence and machine learning algorithms is revolutionizing the processing and analysis of satellite data, enabling automated feature extraction, predictive analytics, and real-time insights, which previously required extensive human effort. The proliferation of cloud-based platforms for data storage and analysis has also democratized access to satellite imagery, empowering a wider array of businesses and researchers to leverage this powerful resource. These combined forces are not only expanding the traditional applications of satellite imagery but also fostering the emergence of entirely new use cases and business models, cementing its role as a foundational technology for a data-driven world.

Satellite Imagery Market Executive Summary

The global satellite imagery market is experiencing robust growth, driven by dynamic business trends, evolving regional demands, and significant advancements across various market segments. Business trends indicate a shift towards satellite-as-a-service models, increased commercialization of data, and a surge in strategic partnerships and mergers aimed at consolidating capabilities and expanding service offerings. Companies are increasingly focusing on providing integrated solutions that combine imagery acquisition with sophisticated data analytics, artificial intelligence, and cloud platforms, moving beyond raw data provision to delivering actionable intelligence. This vertical integration helps address the complex needs of diverse end-users and creates new revenue streams, fostering innovation in data fusion and application development.

Regional trends reveal North America and Europe as mature markets characterized by high adoption in defense, intelligence, and advanced commercial applications, benefiting from significant government and private sector investments in space technologies. The Asia Pacific region, however, is emerging as the fastest-growing market, propelled by rapid urbanization, infrastructure development, agricultural modernization, and increasing environmental concerns, leading to a surge in demand for geospatial intelligence. Latin America and the Middle East & Africa are also demonstrating considerable potential, driven by resource management needs, border security challenges, and nascent smart city initiatives. Each region presents unique market dynamics influenced by local regulatory frameworks, technological readiness, and economic development priorities, shaping distinct demand patterns for satellite imagery products and services.

Segment trends highlight the increasing importance of high-resolution imagery for precise monitoring and analysis, while synthetic aperture radar (SAR) imagery is gaining traction due to its all-weather, day-and-night imaging capabilities, crucial for critical infrastructure monitoring and disaster response. The application segment is diversifying, with significant growth observed in sectors like precision agriculture, where satellite data optimizes crop yields and resource allocation, and in environmental monitoring, where it supports climate change assessment and biodiversity conservation efforts. The defense and intelligence sector remains a cornerstone, continuously demanding higher resolution, more frequent revisits, and enhanced analytical tools for surveillance and strategic planning. This multi-faceted growth across various segments underscores the versatility and indispensable nature of satellite imagery in addressing contemporary global challenges.

AI Impact Analysis on Satellite Imagery Market

The integration of Artificial Intelligence (AI) is fundamentally transforming the satellite imagery market, addressing common user questions related to data processing efficiency, analytical accuracy, and the extraction of actionable insights from vast datasets. Users frequently inquire about how AI can automate the laborious process of sifting through terabytes of imagery, identify subtle patterns or anomalies, and reduce the time from data acquisition to decision-making. Concerns often revolve around the reliability of AI algorithms, the need for domain-specific training data, and the potential for bias in automated interpretations. Expectations are high for AI to unlock new levels of precision in object detection, enhance predictive modeling for phenomena like crop yields or disaster impacts, and facilitate the fusion of satellite data with other disparate data sources for comprehensive situational awareness. This indicates a strong user desire for AI to not just process, but intelligently interpret and contextualize satellite observations, making them more valuable and accessible.

AI's influence extends across the entire satellite imagery value chain, from optimizing satellite operations and data downlink to advanced analytics and application development. Machine learning algorithms, particularly deep learning, are proving instrumental in tasks such as cloud detection and removal, image stitching, and radiometric calibration, significantly improving the quality and usability of raw satellite data. Furthermore, AI-powered computer vision techniques enable highly accurate object recognition, classification, and change detection, automating what was once a manual, time-consuming process. This allows for rapid identification of assets, infrastructure changes, deforestation, illegal mining, and urban expansion, providing unparalleled monitoring capabilities. The development of AI models tailored to specific geographical regions or application domains is also addressing concerns about model generalizability and improving the robustness of analytical outcomes.

Beyond automating traditional tasks, AI is paving the way for entirely new applications and services within the satellite imagery market. Predictive analytics, driven by AI, can forecast potential issues such as crop diseases, natural disasters, or geopolitical shifts by analyzing historical satellite data in conjunction with other environmental and socio-economic indicators. This proactive intelligence empowers users to make timely interventions and mitigate risks. Moreover, AI facilitates the creation of synthetic data for training new models, overcoming challenges associated with data scarcity in certain niche applications. The ongoing advancements in explainable AI (XAI) are also addressing user concerns about the "black box" nature of some AI models, by providing insights into how decisions are made, thereby building trust and enhancing user confidence in AI-derived intelligence. Overall, AI is seen as an indispensable tool for maximizing the utility, accessibility, and strategic value of satellite imagery.

- Automated object detection and classification, significantly reducing manual analysis time and improving accuracy.

- Enhanced change detection capabilities, identifying subtle alterations over time for environmental monitoring, urban planning, and security.

- Improved image processing and quality enhancement, including cloud removal, noise reduction, and atmospheric correction.

- Predictive analytics for various applications such as crop yield forecasting, disaster impact assessment, and resource management.

- Data fusion and integration with other geospatial datasets (e.g., IoT, drone data) to provide comprehensive insights.

- Real-time or near real-time intelligence generation for critical applications like defense and disaster response.

- Development of smart search and retrieval systems for vast archives of satellite imagery, making data more accessible.

- Optimized satellite tasking and constellation management, enhancing data acquisition efficiency.

- Creation of synthetic data for training robust AI models, especially in data-scarce scenarios.

- Streamlined workflow automation from acquisition to actionable intelligence, reducing operational costs.

DRO & Impact Forces Of Satellite Imagery Market

The satellite imagery market is shaped by a complex interplay of drivers, restraints, and opportunities, collectively influenced by various impact forces that dictate its growth trajectory and competitive landscape. Drivers such as the ever-increasing demand for geospatial intelligence across diverse industries, from defense and intelligence to agriculture and urban planning, serve as primary catalysts. This demand is further fueled by rapid technological advancements in satellite sensor capabilities, leading to higher resolution, more frequent revisits, and multispectral imaging. The continuous decline in launch costs, driven by reusable rocket technology and the proliferation of small satellite constellations, has made satellite data more affordable and accessible. Additionally, growing government investments in space infrastructure and national security, alongside the commercialization of space, are creating a fertile ground for market expansion. The digital transformation across industries, demanding data-driven decision-making, also significantly contributes to the escalating need for timely and accurate satellite imagery.

However, several restraints pose challenges to the market's unbridled growth. High initial capital investment required for satellite manufacturing, launch, and ground infrastructure remains a significant barrier for new entrants. Regulatory complexities and stringent licensing requirements for operating earth observation satellites, as well as cross-border data sharing policies, can hinder market operations and data accessibility. Concerns regarding data privacy and security, especially with high-resolution imagery, often lead to public and governmental scrutiny. Technical limitations such as persistent cloud cover in certain regions, which obstruct optical imagery acquisition, and the need for highly skilled personnel to process and interpret complex satellite data, also act as formidable restraints. The integration challenges of satellite data into existing enterprise systems and the perceived high cost of analytical solutions further complicate adoption for some potential users, requiring robust justification of return on investment.

Despite these challenges, substantial opportunities exist for market players to innovate and expand. The integration of satellite imagery with emerging technologies like the Internet of Things (IoT), Big Data analytics, and advanced Geographic Information Systems (GIS) opens up new avenues for sophisticated applications and integrated intelligence platforms. The untapped potential in emerging economies, particularly in Asia Pacific, Latin America, and Africa, where rapid development necessitates efficient resource management, infrastructure planning, and disaster response, presents significant growth prospects. Furthermore, the development of new applications in niche sectors such as autonomous vehicles, maritime surveillance, insurance, and smart cities, coupled with the increasing commercialization of space, is creating novel revenue streams. The continuous evolution of AI and machine learning algorithms promises to further automate and enhance data analysis, making satellite imagery more accessible and actionable for a broader user base, thereby transforming raw data into tangible economic and societal value. These dynamic impact forces, including competitive rivalry from drone technology and aerial imaging, and the bargaining power of data analytics service providers, continuously shape the market’s competitive dynamics.

Segmentation Analysis

The Satellite Imagery Market is broadly segmented based on various critical attributes including application, resolution, end-user, and type. This segmentation provides a granular view of market dynamics, revealing specific growth drivers and opportunities within different niches. Each segment addresses distinct user needs and technological requirements, contributing to the overall diversity and complexity of the market landscape. Understanding these segments is crucial for market participants to tailor their offerings, optimize their go-to-market strategies, and identify underserved areas. The diverse range of applications underscores the versatility of satellite imagery, from strategic defense operations to localized agricultural management, while distinctions in resolution and type cater to varying levels of detail and environmental conditions. End-user classification helps identify primary consumption patterns, differentiating between government, commercial, and other organizational demands for satellite data products and services.

The application segment is particularly expansive, demonstrating the broad utility of satellite imagery across nearly every economic and public sector. High-resolution imagery finds its core utility in detailed mapping and surveillance, whereas lower-resolution but wide-area coverage imagery is essential for regional monitoring and broad environmental studies. The choice of imagery type, whether optical, synthetic aperture radar (SAR), or hyperspectral, depends on specific requirements for clarity, atmospheric penetration, and spectral detail. Optical imagery is prevalent for visual interpretation and land cover mapping, while SAR is indispensable for cloud-penetrating capabilities and precise deformation monitoring. Hyperspectral imagery offers detailed spectral signatures for advanced material identification and environmental assessment. These segmentations are not static but evolve with technological advancements and shifting market demands, reflecting the dynamic nature of geospatial intelligence.

The continuous innovation in satellite technology, coupled with the development of more sophisticated data processing and analytics tools, is constantly blurring the lines between these traditional segments and creating new hybrid categories. For instance, the integration of AI with multi-resolution, multi-sensor data is enabling more comprehensive and automated insights across applications. End-user segments are also becoming more specialized, with a growing demand for customized solutions that fit particular industry workflows and regulatory environments. This detailed segmentation analysis is instrumental for stakeholders to navigate the market effectively, identify key growth areas, assess competitive pressures, and ultimately capitalize on the immense potential offered by satellite imagery in the global information economy. The ability to cater to these segmented demands with specialized products and services is a key differentiator in the competitive market landscape.

- By Application:

- Defense & Intelligence

- Agriculture

- Energy

- Mining

- Construction

- Forestry

- Environmental Monitoring

- Disaster Management

- Urban Planning

- Cartography & Mapping

- Maritime Surveillance

- Media & Entertainment

- Insurance

- Retail & Real Estate

- Transportation & Logistics

- Telecommunications

- Utilities

- Archaeology & Cultural Heritage

- By Resolution:

- High Resolution (equal to or less than 1 meter)

- Medium Resolution (1 meter to 5 meters)

- Low Resolution (greater than 5 meters)

- By End-User:

- Commercial Enterprises

- Government Agencies

- Defense Organizations

- Civil Engineering & Construction Firms

- Environmental & Conservation Bodies

- Academic & Research Institutions

- Non-Governmental Organizations (NGOs)

- By Type:

- Optical Imagery

- Synthetic Aperture Radar (SAR) Imagery

- Hyperspectral Imagery

- Multispectral Imagery

- By Vertical:

- Government & Public Sector

- Agriculture & Forestry

- Oil & Gas and Energy

- Mining & Exploration

- Civil Engineering & Infrastructure

- Defense & Homeland Security

- Environmental & Climate Monitoring

- Insurance & Financial Services

- Transportation & Logistics

- Mapping & Surveying

- Urban Development & Smart Cities

- Telecommunications & Utilities

- Media, Entertainment & Tourism

- Real Estate & Retail

Value Chain Analysis For Satellite Imagery Market

The value chain for the satellite imagery market is an intricate sequence of activities, beginning from the design and launch of satellites to the final delivery of actionable intelligence to end-users. Upstream activities primarily involve satellite manufacturing, including the development of advanced sensors, cameras, and onboard processing units, along with the provision of launch services that place these satellites into orbit. This segment is characterized by high capital expenditure, specialized engineering expertise, and a limited number of key players, often involving government agencies and large aerospace companies. The ground segment, which includes ground stations for telemetry, tracking, and control (TT&C), and data reception stations, also forms a crucial part of the upstream segment, ensuring continuous communication with orbiting satellites and initial data capture.

Midstream activities focus on the raw data acquisition, processing, and archiving. Once images are collected by satellites and downloaded to ground stations, extensive processing is required, including geometric correction, radiometric calibration, atmospheric correction, and orthorectification, to convert raw signals into usable imagery products. Data management and archiving, often involving cloud-based platforms, are critical for storing vast amounts of historical and current imagery, making it accessible for further analysis. This stage requires significant computational resources and specialized software, transforming raw pixel data into standardized, georeferenced images ready for analysis. The quality and efficiency of these processing steps directly impact the value and usability of the final imagery product for downstream applications, forming a crucial link between raw data and actionable insights.

Downstream activities involve the analysis, interpretation, and distribution of processed satellite imagery to end-users. This segment includes various analytical services, such as feature extraction, change detection, object classification, and advanced geospatial modeling, often leveraging AI and machine learning techniques. Companies in this segment focus on developing tailored applications and platforms that provide specific insights for different industries, such as crop health monitoring for agriculture, urban heat island analysis for city planners, or asset tracking for infrastructure management. Distribution channels can be direct, where imagery providers sell data and services directly to large enterprise clients or government bodies, or indirect, through value-added resellers (VARs), integrators, and online marketplaces that package and deliver specialized solutions to a broader customer base. The increasing emphasis on delivering not just data, but actionable intelligence, continues to drive innovation and competition within the downstream segment, fostering a dynamic ecosystem of service providers and technology developers.

Satellite Imagery Market Potential Customers

The potential customers for satellite imagery are incredibly diverse, spanning across nearly every sector that benefits from accurate, up-to-date geospatial information. Government agencies represent a foundational customer base, particularly in defense and intelligence, where satellite imagery is indispensable for surveillance, reconnaissance, border security, and strategic planning. Civil government departments also leverage imagery for urban planning, land use management, infrastructure development, environmental monitoring, disaster response, and agricultural policy making. The public sector's continuous need for broad-area, consistent monitoring, and historical data archives makes it a significant and stable consumer of satellite imagery products and derived services.

Commercial enterprises constitute a rapidly growing segment of potential customers, driven by the increasing commercialization of satellite data and the development of tailored analytical solutions. Industries such as agriculture utilize imagery for precision farming, crop yield prediction, and irrigation management. The oil, gas, and mining sectors employ satellite data for exploration, site monitoring, and environmental impact assessments. Construction and civil engineering firms use it for site selection, project progress tracking, and infrastructure maintenance. Insurance companies leverage imagery for risk assessment, damage assessment post-disasters, and fraud detection. The finance and investment sectors use geospatial intelligence for market analysis, tracking economic activity, and assessing property values.

Beyond these major sectors, the market extends to environmental and conservation organizations for tracking deforestation, water quality, and climate change impacts. Academic and research institutions are significant users for scientific studies across earth sciences, ecology, and urban studies. Media and entertainment companies incorporate satellite views for news reporting, documentary production, and visual effects. Telecommunication companies use imagery for network planning and infrastructure management. Real estate and retail businesses analyze location intelligence for site selection and competitive analysis. This wide spectrum of end-users underscores the pervasive utility of satellite imagery, with demand continually expanding as more industries recognize its value in enhancing efficiency, reducing costs, and enabling informed decision-making.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Airbus S.A.S., Maxar Technologies Inc., Planet Labs PBC, MDA Ltd., L3Harris Technologies, Inc., ICEYE Oy, Spire Global, Inc., Capella Space, Satellogic S.A., Telespazio S.p.A., GHGSat Inc., ImageSat International (ISI), BlackSky Technology Inc., Synspective Inc., SI Imaging Services (SIIS), GeoEye (now part of Maxar), DigitalGlobe (now part of Maxar), China Academy of Space Technology (CAST), European Space Imaging (EUSI), UrtheCast Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Satellite Imagery Market Key Technology Landscape

The satellite imagery market is characterized by a rapidly evolving technological landscape, driven by continuous innovation in sensor design, satellite platforms, data processing, and analytical methodologies. At the core are advancements in sensor technology, including the development of higher resolution optical cameras capable of capturing sub-meter details, enhanced multispectral and hyperspectral imagers for detailed spectral analysis, and more sophisticated Synthetic Aperture Radar (SAR) systems that offer all-weather, day-and-night imaging capabilities. Miniaturization has led to the proliferation of small satellites and CubeSats, enabling the deployment of large constellations for increased revisit rates and global coverage at lower costs, fundamentally changing the economics of data acquisition. These new satellite designs often incorporate advanced onboard processing units that can perform initial data calibration and compression before downlink, improving efficiency and reducing latency in data delivery.

Beyond the hardware, the processing and interpretation of satellite data are being revolutionized by breakthroughs in artificial intelligence (AI) and machine learning (ML). Deep learning algorithms, particularly convolutional neural networks (CNNs), are extensively used for automated feature extraction, object detection, change detection, and classification from vast datasets of imagery. AI enhances the accuracy and speed of identifying urban development, deforestation, agricultural patterns, and military assets. Cloud computing platforms play a pivotal role in enabling the storage, processing, and distribution of enormous volumes of satellite data, making it accessible and scalable for diverse users globally. These platforms provide the necessary computational power for running complex AI models and integrate seamlessly with Geographic Information Systems (GIS) for spatial analysis and visualization.

Furthermore, advancements in data fusion techniques are becoming increasingly important, allowing for the integration of satellite imagery with other geospatial data sources like drone data, IoT sensor data, and traditional GIS layers to create comprehensive and multi-layered intelligence products. This holistic approach provides deeper insights and more robust analytical outcomes for complex problems. The development of advanced image processing software and analytical platforms, often incorporating intuitive user interfaces and API access, is democratizing access to satellite intelligence, moving it beyond specialized analysts to a broader range of business users. The entire ecosystem is shifting towards delivering actionable intelligence rather than just raw data, with technology driving greater automation, precision, and integration across the value chain to meet the sophisticated demands of modern applications.

Regional Highlights

- North America: A dominant market, driven by significant investments from defense and intelligence agencies (e.g., NGA, DoD) and a robust commercial sector. High adoption rates in agriculture (precision farming), oil & gas, and urban planning. Presence of key industry players and advanced research capabilities. Focus on high-resolution imagery and sophisticated analytics.

- Europe: Characterized by strong governmental support for space programs (e.g., Copernicus, ESA) and growing commercialization. Emphasis on environmental monitoring, maritime surveillance, urban planning, and precision agriculture. Stringent regulatory frameworks for data privacy and ethical AI in geospatial applications. Key markets include Germany, France, and the UK.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization, infrastructure development, agricultural modernization, and increasing environmental concerns. Countries like China, India, Japan, and Australia are investing heavily in domestic satellite capabilities and becoming significant consumers of satellite data for diverse applications including disaster management, resource mapping, and national security.

- Latin America: Emerging market with increasing adoption for resource management (mining, forestry, water), agricultural monitoring, and infrastructure development. Growing awareness of climate change impacts drives demand for environmental monitoring. Partnerships with international players are common to access advanced technology and data. Brazil, Argentina, and Mexico are key regional players.

- Middle East and Africa (MEA): Growing demand for satellite imagery in defense & security, oil & gas exploration, urban development, and land management. Regional governments are investing in satellite capabilities for national security and economic diversification. Challenges include limited local technical expertise and reliance on foreign data providers, but opportunities are expanding with infrastructure projects and smart city initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite Imagery Market.- Airbus S.A.S.

- Maxar Technologies Inc.

- Planet Labs PBC

- MDA Ltd.

- L3Harris Technologies, Inc.

- ICEYE Oy

- Spire Global, Inc.

- Capella Space

- Satellogic S.A.

- Telespazio S.p.A.

- GHGSat Inc.

- ImageSat International (ISI)

- BlackSky Technology Inc.

- Synspective Inc.

- SI Imaging Services (SIIS)

- SpaceWill Info Co., Ltd.

- 21AT (Twenty First Century Aerospace Technology Co. Ltd.)

- Beijing Space View Technology Co., Ltd.

- e-GEOS S.p.A.

- OHB SE

Frequently Asked Questions

What is satellite imagery and how is it used?

Satellite imagery refers to photographs of Earth taken by satellites in orbit. It is extensively used across various sectors for purposes such as mapping, environmental monitoring, urban planning, defense and intelligence, agriculture for crop health, and disaster management for damage assessment. Its value lies in providing global coverage, repetitive monitoring, and remote sensing capabilities for inaccessible areas.

What are the key factors driving the growth of the Satellite Imagery Market?

Key drivers include the escalating global demand for geospatial intelligence, advancements in satellite sensor technology and small satellite constellations, declining costs for satellite launches, increased government investment in space programs, and the widespread commercialization of satellite data for diverse business applications. The integration with AI and big data analytics further enhances its utility.

How does AI impact the Satellite Imagery Market?

AI significantly impacts the market by automating image processing, enhancing object detection and change detection accuracy, enabling predictive analytics, and facilitating the fusion of satellite data with other sources. This leads to faster, more precise, and actionable insights, transforming raw data into valuable intelligence for users across all sectors, from environmental monitoring to defense.

What are the main types of satellite imagery available?

The main types include Optical Imagery, which captures visual light and provides high-resolution, color images; Synthetic Aperture Radar (SAR) Imagery, which uses radio waves to penetrate clouds and darkness, offering all-weather capabilities; Hyperspectral Imagery, providing detailed spectral information for material identification; and Multispectral Imagery, which captures data across several distinct spectral bands for land cover classification and vegetation analysis.

Which industries are the primary consumers of satellite imagery?

The primary consumers include government and defense organizations for national security and resource management; agriculture for precision farming; oil, gas, and mining for exploration and site monitoring; civil engineering for infrastructure projects; environmental and climate monitoring agencies; and insurance companies for risk assessment. Its utility is rapidly expanding to new commercial sectors like retail and transportation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager