Satellite Internet Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435117 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Satellite Internet Service Market Size

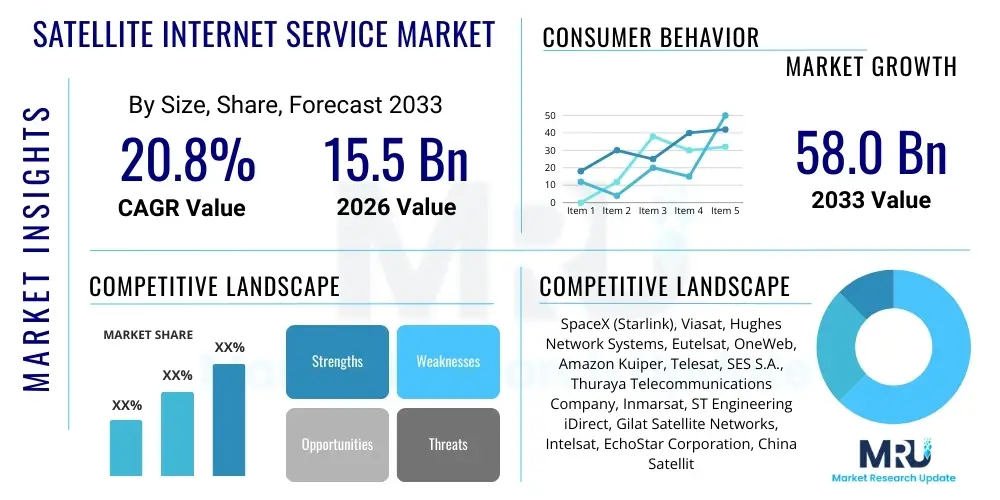

The Satellite Internet Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 58.0 Billion by the end of the forecast period in 2033.

Satellite Internet Service Market introduction

The Satellite Internet Service Market encompasses the provision of broadband connectivity utilizing orbiting satellites rather than terrestrial infrastructure like fiber optics or copper cables. This technology is fundamentally designed to bridge the digital divide, offering reliable internet access to remote, rural, maritime, and aeronautical locations globally where traditional infrastructure deployment is economically or logistically challenging. The rapid evolution of satellite technology, particularly the shift from Geostationary Earth Orbit (GEO) satellites to Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) constellations, has dramatically reshaped the market landscape, enabling significantly lower latency and higher data throughput capabilities, thereby positioning satellite broadband as a competitive alternative to ground-based services.

The product description centers around the delivery of high-speed internet through a network comprising ground stations (gateways), orbiting satellites, and user terminals (dish antennas). Major applications span various sectors, including residential broadband access in underserved areas, enterprise connectivity for remote operations (mining, energy, agriculture), government and defense communications, and critical backhaul services for mobile network operators. Benefits derived from satellite internet are substantial, including universal coverage, rapid deployment in disaster-stricken zones, resilience against terrestrial network failures, and enhanced mobility connectivity for aviation and maritime industries. These advantages are crucial in driving its adoption, especially in emerging economies and geographical areas with sparse population density.

Driving factors for the substantial growth of this market are multifaceted, primarily fueled by the burgeoning global demand for ubiquitous, high-bandwidth connectivity and the strategic push by governments and private entities to achieve universal internet access goals. Technological advancements, such as the successful deployment of large LEO mega-constellations like Starlink and OneWeb, which drastically reduce signal latency compared to legacy GEO systems, are key market accelerators. Furthermore, the increasing sophistication of phased array antennas and the subsequent reduction in the cost and size of user terminals are making satellite broadband more accessible and economically viable for consumers and businesses alike, solidifying its role as a foundational technology for global digital transformation efforts.

Satellite Internet Service Market Executive Summary

The Satellite Internet Service Market is undergoing a radical transformation, moving away from niche, high-latency solutions toward scalable, broadband-competitive offerings. Business trends are dominated by intense capital investment in LEO constellation deployment, leading to heightened competition among major players like SpaceX, Amazon, and OneWeb. This trend is driving innovation in antenna design and ground infrastructure, focusing on reducing operational expenditure and improving the user experience, particularly concerning latency and reliability. Strategic partnerships between satellite operators and major telecommunication companies (MNOs) for cellular backhaul and direct-to-device services represent a significant future revenue stream, shifting the market dynamics from direct consumer sales to B2B infrastructure provision in many regions.

Regional trends indicate North America currently holds the largest market share, driven by early adoption, significant military/government spending, and the presence of leading satellite operators and technology developers. However, the Asia Pacific (APAC) region, particularly countries like India and China, is projected to exhibit the fastest growth rate due to vast unserved populations and aggressive government initiatives aimed at digital inclusion. Emerging markets in Latin America and the Middle East and Africa (MEA) are also critical growth frontiers, where terrestrial infrastructure is highly fragmented, making satellite internet a crucial immediate solution for bridging connectivity gaps in remote communities and supporting key industries such as resource extraction and humanitarian aid operations.

Segmentation trends reveal that the Low Earth Orbit (LEO) technology segment is the dominant growth engine, owing to its superior performance characteristics (low latency, high speed) compared to traditional Geostationary (GEO) and Medium Earth Orbit (MEO) systems. Within application segmentation, the residential sector, fueled by direct-to-consumer LEO services, is expected to see the highest volume growth, while the commercial and government sectors remain crucial for high-value contracts requiring robust, secure, and resilient communications. Furthermore, the mobility segment—especially maritime and aviation—is experiencing rapid growth as commercial airlines and shipping fleets increasingly require high-throughput internet for operational efficiency and enhanced passenger experience, driving specialized service demand within the market.

AI Impact Analysis on Satellite Internet Service Market

Common user questions regarding AI’s impact on the Satellite Internet Service Market primarily revolve around operational efficiency, network optimization, and service reliability. Users frequently inquire about how AI can manage the complexity of thousands of LEO satellites, asking questions such as, "How does AI prevent collision in massive LEO constellations?" or "Can AI dynamically allocate bandwidth based on real-time user demand across diverse geographic areas?" Another key theme involves service enhancement, specifically the use of machine learning (ML) to predict equipment failures, automate troubleshooting, and personalize service offerings in remote environments. Users expect AI to fundamentally reduce operational latency beyond physical limits and dramatically improve network resilience against adverse weather conditions or jamming attempts. Consequently, the key themes summarizing user expectations are the automation of complex constellation management, intelligent network resource allocation, predictive maintenance, and enhanced security protocols, all driven by sophisticated AI algorithms.

The integration of Artificial Intelligence and Machine Learning (AI/ML) is paramount to the commercial viability and scalability of next-generation satellite constellations. Managing orbital dynamics, capacity planning, and beam switching for thousands of LEO satellites is humanly impossible; therefore, AI-driven autonomous operations are essential for maintaining uptime and optimizing throughput. AI algorithms analyze vast streams of telemetry data to detect anomalies, optimize power usage on board the satellites, and ensure precise orbital maneuvering to avoid space debris and potential collisions, fundamentally enabling the safe operation of mega-constellations. This automation shifts labor requirements from manual monitoring to algorithm development and system oversight, fostering a highly specialized workforce within satellite operations.

Furthermore, AI significantly enhances the quality of experience (QoE) for end-users by optimizing the ground segment and network routing. ML models predict fluctuating demand patterns based on time of day, weather, and geographical events, allowing the network to dynamically shift capacity and direct beams to high-demand areas in real-time. This dynamic capacity allocation ensures service level agreements (SLAs) are met even under peak load conditions, differentiating competitive offerings. In the customer service realm, AI-powered predictive maintenance analyzes data from user terminals (dishes) to anticipate component degradation, allowing providers to proactively replace equipment or resolve issues before a service interruption occurs, thereby dramatically improving customer satisfaction and reducing truck rolls.

- AI-Driven Constellation Management: Autonomous control of LEO/MEO satellite orbits, collision avoidance, and station-keeping, ensuring operational safety and efficiency at scale.

- Dynamic Resource Allocation: Use of Machine Learning to analyze real-time demand, intelligently adjusting satellite beam capacity and frequency utilization for optimal network throughput.

- Predictive Maintenance and Diagnostics: ML models analyze telemetry data from ground stations and user terminals to forecast hardware failure, enabling proactive intervention and reducing downtime.

- Enhanced Cybersecurity: AI algorithms detect and mitigate sophisticated cyber threats, including signal jamming, spoofing, and unauthorized access, crucial for military and government applications.

- Ground Station Optimization: Automated scheduling and power management of ground station antennas, maximizing data transfer efficiency and minimizing operational energy costs.

- Next-Generation Antenna Steering: AI optimization of phased array antennas to lock onto fast-moving LEO satellites seamlessly, improving signal handovers and connectivity reliability for mobile users (aviation, maritime).

DRO & Impact Forces Of Satellite Internet Service Market

The market is driven primarily by the escalating demand for high-speed connectivity in unconnected regions and the deployment of technologically superior LEO satellite networks which deliver latency competitive with fiber optics. Key restraints include the high initial capital expenditure required for constellation deployment and launch services, coupled with regulatory hurdles associated with frequency spectrum allocation and orbital debris mitigation. Opportunities lie in penetrating underserved vertical markets such as 5G backhaul, IoT connectivity in remote industrial settings, and direct-to-device satellite communication services. These forces collectively exert a profound impact on market growth, dictating the pace of innovation, pricing strategies, and global market penetration rates.

The drivers are powerfully centered on technological disruption. The successful commercialization of reusable rockets has drastically lowered launch costs, making the deployment of vast LEO constellations economically feasible. Furthermore, global initiatives, often sponsored by international bodies or national governments, prioritize digital inclusion, creating guaranteed demand for satellite solutions in areas lacking terrestrial alternatives. The exponential increase in data consumption across all sectors, necessitating robust and geographically independent communication links, further strengthens the driver side, positioning satellite internet as an indispensable element of the global connectivity ecosystem, particularly for enterprises needing redundancy and global coverage.

Restraints, however, pose significant challenges to market scaling. Beyond the immense upfront investment—which creates high barriers to entry for new players—the operational sustainability of mega-constellations is a concern. Space debris proliferation and the necessary international coordination required for responsible spectrum use complicate regulatory approval processes. Moreover, adverse weather conditions, which can degrade signal quality (rain fade), and the competition from rapidly expanding terrestrial fiber networks in densely populated areas, constrain the market share that satellite providers can capture in established urban centers, forcing a continued focus on niche or remote markets where the competitive advantage remains substantial.

Segmentation Analysis

The Satellite Internet Service Market is comprehensively segmented based on technology, application, end-use, and component (hardware and services). This granular analysis provides a detailed view of market structure and growth pockets. The technological segmentation, differentiating between GEO, MEO, and LEO systems, is arguably the most dynamic axis of the market, with LEO capturing significant attention due to its transformative impact on latency performance. Application segmentation highlights the diverse needs of residential users, large enterprises, and government bodies, each requiring distinct service specifications regarding bandwidth, security, and coverage availability. The segmentation analysis confirms the market's migration from traditional, high-cost, fixed-point connectivity to high-volume, low-latency, global mobile broadband solutions, facilitating diverse pricing and service models tailored to specific vertical demands.

- By Technology

- Geostationary Earth Orbit (GEO)

- Medium Earth Orbit (MEO)

- Low Earth Orbit (LEO)

- By Application

- Residential

- Commercial

- Government & Defense

- Aerospace & Aviation

- Maritime

- By Component

- Hardware (Antennas, Modems/Routers, Other Equipment)

- Services (Subscription, Installation, Value-Added Services)

- By End-Use

- Enterprise

- Mobility (Aviation, Maritime, Land Mobile)

- Rural & Remote Areas

- Backhaul and Trunking

Value Chain Analysis For Satellite Internet Service Market

The value chain of the Satellite Internet Service Market is complex and capital-intensive, starting with the upstream segment involving satellite manufacturing, launch services, and ground infrastructure development. Satellite manufacturers, such as Boeing and Lockheed Martin, and launch providers, like SpaceX and Arianespace, form the foundation, providing the critical orbiting assets. This phase demands extreme precision, robust engineering, and significant R&D investment, particularly as the industry shifts towards mass-produced, software-defined LEO satellites. Investment in reusable launch technology has fundamentally lowered the cost base of this upstream segment, which is crucial for the profitability of mega-constellations.

The midstream involves the core satellite network operators (e.g., Viasat, Hughes, Starlink, OneWeb) who manage the constellation, operate the gateways, and manage the backbone infrastructure connecting the satellites to the global internet fabric. These operators hold the intellectual property for network management and optimization, dictating service quality and coverage. They control the distribution channels, which are typically a mix of direct-to-consumer sales for residential services and indirect partnerships with telecommunications providers, resellers, and integrators for enterprise and governmental clients. Direct distribution allows for tighter control over branding and customer relationships, while indirect channels provide scale and local market expertise, particularly in fragmented international markets.

The downstream segment focuses on the delivery of the service to the end-user, including the manufacture and deployment of user terminals (Customer Premises Equipment or CPE) and the provision of subscription and value-added services. The CPE market, encompassing antennas (especially flat-panel phased arrays), modems, and routers, is a critical bottleneck, as the cost and performance of the user terminal significantly influence customer adoption rates. Integration and installation services, often outsourced to local vendors, ensure last-mile connectivity. The entire value chain is characterized by deep integration among core players, vertical integration strategies (e.g., SpaceX controlling both manufacturing and launch), and strategic reliance on specialized technology providers for crucial components like high-throughput processors and advanced antenna arrays.

Satellite Internet Service Market Potential Customers

The core customer base for Satellite Internet Service is highly diverse, spanning residential users in unconnected or poorly served geographical locations, large-scale commercial entities requiring global connectivity, and governmental/defense organizations prioritizing resilient and secure communication lines. Residential end-users in rural North America, Europe, and densely populated but infrastructure-poor regions of APAC and MEA represent the high-volume segment, driven by the need for remote work, education, and entertainment that terrestrial services cannot provide. These customers seek affordable, easy-to-install solutions with competitive latency, often making LEO services the preferred option over legacy GEO solutions.

Enterprise buyers represent the high-value segment, encompassing industries such as oil and gas, mining, agriculture, and construction, where remote site monitoring, critical operational data transmission, and field communication are essential. These clients demand guaranteed SLAs, high throughput, and robust cybersecurity features, often utilizing specialized fixed or mobile terminals. Furthermore, the mobility sector, including global maritime fleets (container shipping, cruise lines) and commercial airlines, constitutes a rapidly expanding potential customer group, prioritizing high-speed connectivity to support crew welfare, passenger Wi-Fi, and operational data telemetry across transoceanic routes where only satellite coverage is viable.

Government and military organizations are critical end-users, requiring secure, high-capacity networks for defense, disaster response, border control, and intelligence gathering. These customers often procure customized services, either directly through dedicated military satellites or via secured channels on commercial constellations (e.g., MEO or protected GEO). Additionally, mobile network operators (MNOs) are increasingly becoming potential customers for satellite backhaul services, utilizing satellite links to extend their 4G/5G networks into remote or geographically challenging territories, thereby ensuring comprehensive national coverage and fulfilling regulatory obligations for universal service provision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 58.0 Billion |

| Growth Rate | 20.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SpaceX (Starlink), Viasat, Hughes Network Systems, Eutelsat, OneWeb, Amazon Kuiper, Telesat, SES S.A., Thuraya Telecommunications Company, Inmarsat, ST Engineering iDirect, Gilat Satellite Networks, Intelsat, EchoStar Corporation, China Satellite Communications, Hispasat, Dish Network, Kacific Broadband Satellites, Globalstar. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Satellite Internet Service Market Key Technology Landscape

The current technology landscape of the Satellite Internet Service Market is defined by intense innovation, primarily driven by the transition from large, powerful GEO satellites to vast, interconnected LEO and MEO constellations. Key technological advancements include the maturation of High-Throughput Satellites (HTS), which utilize frequency reuse and spot beam technology to significantly increase data capacity compared to traditional Fixed Satellite Services (FSS). HTS technology, foundational to both Viasat and Hughes’ latest GEO systems, focuses on delivering high bandwidth to concentrated areas. This evolution has raised the bar for data rates, making satellite internet viable for bandwidth-intensive applications that were previously limited to terrestrial networks. Furthermore, the shift to software-defined satellites (SDS) allows operators to dynamically adjust coverage areas and capacity on orbit, maximizing resource utilization and responding quickly to changing demand patterns without physical hardware modification.

A crucial technological differentiator in the LEO/MEO segment is Inter-Satellite Links (ISLs), which utilize laser communication to create a mesh network in space. ISLs allow data to be routed directly between satellites without immediately needing to downlink to a ground station, dramatically reducing latency, particularly for long-distance international traffic. This architecture minimizes reliance on extensive, geographically dispersed gateway infrastructure and enables truly global, high-speed data transmission paths. The development and refinement of laser technology for ISLs represent a significant competitive advantage for constellations like Starlink and Project Kuiper, pushing network performance closer to that of terrestrial fiber optic backbones and expanding the addressable market considerably.

On the ground segment, the technological frontier is dominated by the development and mass production of advanced user terminals. Phased array antennas are replacing large, mechanically steered parabolic dishes. These flat-panel terminals are electronically steered, allowing them to track fast-moving LEO satellites seamlessly and handle rapid satellite handovers (make-before-break connections) without physical movement. The challenge remains reducing the cost and complexity of these terminals to make them accessible to residential consumers and mass mobility markets. Furthermore, the integration of specialized satellite modems, capable of managing complex waveforms, advanced coding techniques (such as DVB-S2X), and AI-driven traffic prioritization, ensures efficient bandwidth usage and service quality, completing the technological loop necessary for the reliable delivery of next-generation satellite broadband.

Regional Highlights

Regional dynamics play a vital role in shaping the adoption and growth trajectory of the Satellite Internet Service Market, reflecting varying levels of terrestrial infrastructure maturity, regulatory environments, and consumer demand profiles across continents. North America, encompassing the United States and Canada, remains the largest and most mature market segment. This dominance is attributed to the presence of key industry pioneers, substantial investment in LEO and GEO technologies, and significant market penetration among rural communities and government sectors (particularly defense). The region benefits from early deployment of advanced HTS and LEO services (e.g., Starlink, Viasat), creating a highly competitive landscape where technological capability and service pricing are constantly benchmarked against fiber and 5G deployment.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is driven by the sheer scale of the unserved population, government initiatives to connect remote islands and mountainous regions (e.g., in Indonesia, Philippines, and India), and growing military modernization efforts by regional powers. While terrestrial infrastructure is robust in major urban hubs, the vast rural and remote areas present an ideal environment for satellite broadband adoption. Operators are focusing on partnerships with local MNOs to provide cellular backhaul and subsidized terminals to meet national digital connectivity mandates.

Europe represents a highly concentrated market with strong regulatory influence, balancing robust fiber infrastructure in core countries with significant demand for mobility services (maritime and aviation) and coverage in peripheral regions (e.g., Scandinavian Arctic, Eastern Europe). The European Union’s investment in independent satellite capabilities (like the IRIS2 constellation) signals a long-term commitment to ensuring sovereign, high-speed connectivity across the continent. Latin America and the Middle East & Africa (MEA) are emerging markets characterized by low broadband penetration and geographic complexities (e.g., Amazon rainforest, large deserts). Here, satellite internet is not merely a competitive option but often the only feasible solution for resource extraction industries (oil, mining) and connecting remote villages, yielding high growth potential as regional economies expand and digital transformation accelerates.

- North America (NA): Market leader driven by high investment in LEO infrastructure, strong military contracts, and mature rural broadband demand. Key countries include the United States and Canada.

- Asia Pacific (APAC): Fastest-growing region due to enormous unmet demand in rural and remote populations, significant governmental digital inclusion programs, and expansion of maritime trade routes. Key growth drivers include India, Australia, and Southeast Asian nations.

- Europe: Focus on regulated deployment, high mobility demand (maritime and aviation traffic), and strategic investment in sovereign constellation projects to ensure regional connectivity independence and compete with global providers.

- Latin America (LATAM): High adoption rates driven by remote industrial operations (mining, energy) and addressing significant connectivity gaps in vast, complex geographical areas like the Amazon basin.

- Middle East and Africa (MEA): Critical market for enterprise connectivity in desert and remote oil/gas fields; major focus on utilizing satellite internet for immediate infrastructural connectivity where fiber rollout is impractical or delayed, supporting rapid 5G deployment through backhaul.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite Internet Service Market.- SpaceX (Starlink)

- Viasat

- Hughes Network Systems (EchoStar Corporation)

- Eutelsat

- OneWeb (Eutelsat-owned)

- Amazon Kuiper

- Telesat

- SES S.A.

- Thuraya Telecommunications Company

- Inmarsat (Viasat-owned)

- ST Engineering iDirect

- Gilat Satellite Networks

- Intelsat

- China Satellite Communications (China Satcom)

- Hispasat

- Dish Network

- Kacific Broadband Satellites

- Globalstar

- Iridium Communications

- Avanti Communications

Frequently Asked Questions

Analyze common user questions about the Satellite Internet Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between LEO and GEO satellite internet services?

The primary difference lies in orbital altitude and latency. Geostationary Earth Orbit (GEO) satellites operate approximately 36,000 km from Earth, resulting in high latency (600+ milliseconds) but offering stable coverage from a single satellite. Low Earth Orbit (LEO) satellites operate below 2,000 km, dramatically reducing latency to 20-40 ms, making the service suitable for real-time applications like online gaming and video conferencing. LEO systems, however, require massive constellations and advanced user terminals to maintain continuous connectivity.

How is the growth of 5G terrestrial networks impacting the demand for satellite internet?

The growth of 5G is positively impacting satellite internet demand by creating a need for robust satellite backhaul solutions. While 5G covers urban centers, satellite internet is crucial for extending 5G reach to rural, remote, and mobile environments (maritime, aviation) where building fiber or cell towers is impractical. Furthermore, new standards focusing on direct-to-device connectivity facilitate seamless integration, positioning satellites as complementary infrastructure rather than direct competitors to 5G core networks.

What are the key drivers for the massive investment in Low Earth Orbit (LEO) constellations?

The key drivers for LEO investment are the overwhelming global demand for low-latency, high-speed broadband and the significant reduction in launch costs enabled by reusable rocketry. LEO technology enables high-performance connectivity that is competitive with fiber in terms of speed and latency, opening up massive new markets, including rural residential customers and global mobility sectors, which were previously underserved by high-latency GEO systems.

What is the role of phased array antennas in the modern satellite internet service market?

Phased array antennas are critical technology enabling the adoption of LEO and MEO services. Unlike large, mechanical parabolic dishes, phased arrays are flat, electronically steered terminals that can instantly lock onto and track fast-moving satellites. This capability is essential for seamless connectivity and handover management in non-geostationary orbits, improving service reliability, particularly for mobile platforms like ships, planes, and vehicles, while reducing the size and complexity of the user terminal.

What major regulatory challenges face the expansion of satellite internet service providers globally?

Major regulatory challenges include the allocation and coordination of radio frequency spectrum, especially in the Ka and Ku bands, to prevent interference between competing mega-constellations. Additionally, regulators globally are grappling with rules regarding orbital debris mitigation and the sustainable use of low Earth orbit space, often requiring providers to demonstrate robust plans for satellite deorbiting and collision avoidance before granting operational licenses, which significantly affects deployment timelines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager