Satellite Laser Communication System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434763 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Satellite Laser Communication System Market Size

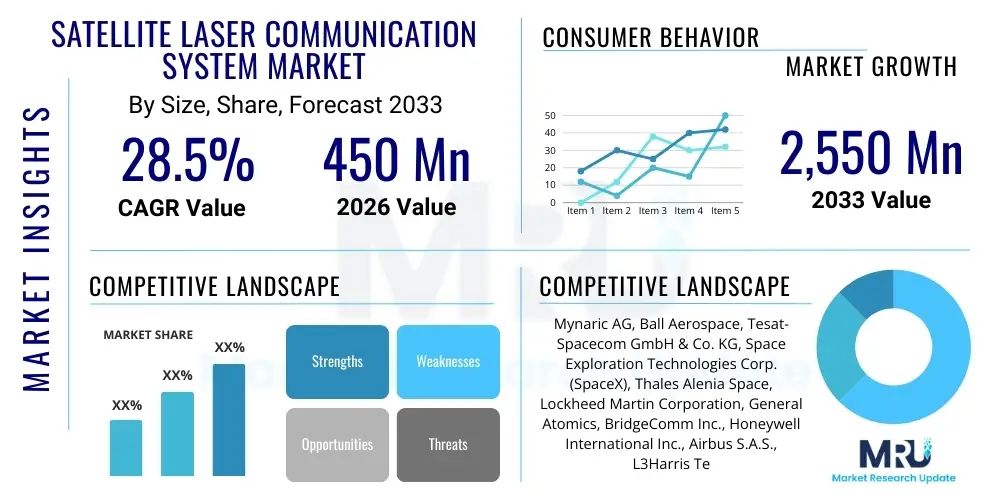

The Satellite Laser Communication System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 2,550 Million by the end of the forecast period in 2033.

Satellite Laser Communication System Market introduction

The Satellite Laser Communication System (SLCS) Market encompasses the technologies and services utilizing free-space optical (FSO) links to transmit data between satellites, or between satellites and ground stations. These systems, often referred to as optical inter-satellite links (O-ISL) or laser satellite communication, leverage highly collimated laser beams instead of traditional radio frequency (RF) waves. This transition is driven primarily by the need for ultra-high data throughput, enhanced security, and minimized electromagnetic interference, particularly in the rapidly expanding low earth orbit (LEO) satellite constellation ecosystem.

SLCS products include optical terminals, precise pointing, acquisition, and tracking (PAT) systems, modulators, demodulators, and specialized ground infrastructure. Major applications span defense and government intelligence, commercial high-speed internet backhaul, scientific data relay, and secure communication networks. The inherent advantages of laser communications, such as bandwidth availability exceeding RF spectrum capabilities and lower size, weight, and power (SWaP) characteristics for space-based terminals, make them essential for next-generation satellite architectures requiring terabit-scale connectivity.

Driving factors for this robust market growth include the proliferation of mega-constellations (like Starlink, Kuiper, and OneWeb), increased investment in national security space programs demanding resilient high-capacity links, and the continuous advancement in component miniaturization and laser stability. The benefits delivered by SLCS—low latency data transmission critical for financial trading and military operations, coupled with the difficulty of intercepting or jamming narrow laser beams—cement its position as a foundational technology for future global space connectivity.

Satellite Laser Communication System Market Executive Summary

The Satellite Laser Communication System (SLCS) market is experiencing transformative growth, fueled by the commercial space race and geopolitical focus on resilient space assets. Business trends indicate a shift from purely governmental and defense procurement toward hybrid models involving large commercial satellite operators adopting laser links for inter-satellite data transfer, thus establishing space-based mesh networks. This has intensified competitive innovation, driving down the cost and increasing the maturity of optical terminal technology. Strategic partnerships between traditional aerospace contractors and new space startups specializing in optical technology are defining the current competitive landscape, prioritizing standardization efforts necessary for mass deployment and interoperability across different satellite platforms.

Regionally, North America maintains market dominance due to substantial R&D expenditure by NASA and the Department of Defense (DoD), alongside the headquarters of major commercial LEO constellation operators. The Asia Pacific region, led by China and India, is emerging as the fastest-growing market, driven by ambitious national space programs focusing on domestic SLCS development and deployment for both military and civilian applications. Europe is also strengthening its position through the European Space Agency (ESA) programs and private investments aimed at creating sovereign communication infrastructure, focusing heavily on integrating quantum key distribution (QKD) capabilities with optical links for unmatched security.

Segmentation trends highlight the dominance of the Inter-Satellite Link (ISL) segment, reflecting the mass deployment of interconnected LEO satellites designed for global broadband coverage. By application, the commercial segment, particularly for internet services, is rapidly overtaking the traditional military/government segment in terms of unit deployment volume, although the military segment remains a high-value market focused on specific, highly secure, and high-reliability terminals. The market is also seeing increasing investment in robust, atmospheric-resistant ground segment technology to handle the challenges associated with laser propagation through the atmosphere, ensuring end-to-end optical connectivity.

AI Impact Analysis on Satellite Laser Communication System Market

User queries regarding AI's impact on SLCS frequently revolve around system autonomy, optimization of pointing and tracking, and managing network load dynamically in mega-constellations. Key concerns center on whether AI can mitigate the inherent technical challenges of FSO, particularly atmospheric attenuation and precise beam steering over vast distances, and how AI can improve the efficiency and lifespan of space-based optical terminals. Users expect AI to move SLCS beyond mere data transport, enabling intelligent network management that self-heals, reroutes traffic based on environmental factors (e.g., cloud cover or orbital debris warnings), and autonomously manages power consumption for optimal performance.

The core influence of Artificial Intelligence lies in enhancing the operational robustness and scalability of laser communication networks. AI algorithms are crucial for refining the Pointing, Acquisition, and Tracking (PAT) mechanism, which is the most sensitive element of an SLCS terminal. Machine learning models process real-time environmental data (such as atmospheric turbulence levels and platform vibrations) to predict and instantaneously compensate for potential misalignment, ensuring link stability, especially during high-speed movement or atmospheric transitions. Furthermore, AI facilitates autonomous link establishment and handoff protocols between satellites and ground stations, minimizing human intervention and maximizing network uptime, which is vital for commercial viability.

Beyond physical layer optimization, AI is transforming SLCS network architecture by enabling cognitive networking. AI tools manage massive data flows generated by LEO constellations, optimizing routing decisions to avoid congested nodes and prioritize critical traffic. This intelligent resource allocation ensures that the terabits of data transmitted via laser links are utilized efficiently. Moreover, predictive maintenance driven by AI monitors the health of optical components, anticipating potential failures and recommending adjustments or reconfigurations, thereby extending the operational lifespan and reliability of the extremely costly space assets.

- AI enhances Pointing, Acquisition, and Tracking (PAT) precision through real-time predictive modeling.

- Machine Learning (ML) algorithms optimize dynamic power management and thermal control of optical terminals.

- Cognitive networking facilitates autonomous, real-time traffic routing and load balancing within space-based mesh networks.

- AI-driven predictive maintenance increases terminal reliability and reduces the risk of in-orbit failure.

- Advanced image processing algorithms aid in debris detection and collision avoidance for satellite platforms hosting SLCS terminals.

DRO & Impact Forces Of Satellite Laser Communication System Market

The Satellite Laser Communication System market is propelled by the surging demand for high-throughput connectivity driven by LEO mega-constellations and the inherent security advantages laser links offer over RF. However, technical complexities related to atmospheric interference and the high precision required for beam steering serve as significant restraints. The market offers extensive opportunities in commercial applications like global broadband and 5G backhaul, alongside defense modernization efforts. These factors collectively generate an impact force favoring aggressive technological development and rapid commercial deployment, necessitating standardization and cost reduction strategies to realize the full potential of space-based optical connectivity.

Drivers: The paramount driver is the exponential growth in global data consumption, necessitating high-speed, low-latency backhaul that traditional RF systems struggle to provide efficiently, especially across space-to-space links. The deployment of thousands of LEO satellites by companies like SpaceX and Amazon fundamentally requires O-ISL for networking these assets, establishing a massive anchor market. Furthermore, the defense sector increasingly values the intrinsic security and difficulty of detection/jamming associated with laser links, driving substantial governmental investment into secure military communication architectures utilizing SLCS. The technological maturity of components like high-efficiency lasers and sensitive photodetectors has also reached a critical inflection point, making large-scale deployment feasible.

Restraints: Significant restraints include the susceptibility of ground-to-satellite links to atmospheric attenuation, caused by weather phenomena such as heavy cloud cover, fog, and atmospheric turbulence, necessitating complex site diversity solutions. The high precision required for the PAT systems (often in the microradian range) is technically demanding, increasing the initial cost and complexity of the terminals. Moreover, lack of standardization across different vendor technologies and regulatory hurdles regarding spectrum allocation for potential hybrid RF/Optical systems pose integration challenges for a globally interconnected network, slowing down broader adoption by smaller satellite operators.

Opportunities: Key opportunities lie in the integration of SLCS with emerging technologies like Quantum Key Distribution (QKD), positioning laser links as the future backbone for unhackable communication networks. The transition to higher orbital data rates (100 Gbps and beyond) and the development of cost-effective, mass-produced optical terminals present substantial market expansion potential, particularly for connecting underserved rural and remote areas globally. Furthermore, the demand for high-capacity data transfer from earth observation satellites and scientific missions presents niche, high-value opportunities for laser terminals capable of transmitting petabytes of sensor data quickly back to Earth.

Segmentation Analysis

The Satellite Laser Communication System market is segmented across several critical dimensions including component, application, solution type, and terminal platform, reflecting the varied technological requirements and end-user needs. This segmentation reveals market maturity in key hardware components like transceivers and detectors, while highlighting the growth trajectory of specific application areas, particularly commercial broadband services. The solution type segmentation, focusing on the link configuration (ISL, GSL, A2S), demonstrates the current heavy investment bias toward establishing space-based mesh networks via Inter-Satellite Links, the foundational element of LEO constellations, suggesting a future where optical connectivity dominates intra-constellation traffic.

Further analysis of segmentation by terminal platform—categorizing terminals based on whether they are installed on LEO, MEO, or GEO satellites, aircraft, or ground stations—underscores the diverse technical specifications required for varying orbital environments. LEO platforms demand smaller, lighter, and more agile terminals capable of frequent handoffs, whereas GEO platforms require highly stable, higher-power systems due to the greater transmission distances. Understanding these nuanced segments is crucial for manufacturers to tailor their R&D investments and product strategies, ensuring compliance with the stringent reliability and performance criteria specific to each operational domain.

The commercial application segment is set to experience the fastest growth, largely driven by the sheer volume of terminals required for consumer broadband. However, the military and defense segment continues to command significant market value due to the high-cost, customized nature of their robust and secure terminals, emphasizing capabilities like anti-jamming and ultra-low probability of intercept (LPI/LPD). Segmentation provides clear visibility into where market demand is concentrating and helps stakeholders identify emerging niches, such as maritime and aerial connectivity, where high-speed laser links can deliver significant operational advantages over traditional RF alternatives.

- By Component:

- Optical Transceivers

- Pointing, Acquisition, and Tracking (PAT) Systems

- Modulators and Demodulators

- Processors and Control Electronics

- Photodetectors and Amplifiers

- By Application:

- Commercial (Broadband, Data Backhaul, Telemetry)

- Military and Defense (Secure Communications, ISR Data Transmission)

- Government and Scientific (Earth Observation, Scientific Data Relay)

- By Solution Type:

- Inter-Satellite Link (ISL)

- Ground-to-Satellite Link (GSL)

- Airborne-to-Satellite Link (A2S)

- By Terminal Platform:

- LEO Satellites

- MEO and GEO Satellites

- Ground Stations

- Airborne Platforms (UAVs, Aircraft)

Value Chain Analysis For Satellite Laser Communication System Market

The Satellite Laser Communication System value chain is complex, starting with highly specialized upstream component manufacturing and culminating in diverse downstream service provision. Upstream activities are dominated by specialized photonics and electronics companies producing core components such as high-power lasers, precision optics, and sensitive detectors, characterized by stringent quality controls and high intellectual property requirements. Midstream involves system integrators and aerospace contractors who design, assemble, and test the complex optical terminals, integrating the PAT system with the satellite platform’s power and communication subsystems. Efficiency in this stage relies heavily on miniaturization and ruggedization for space deployment.

Downstream activities involve the deployment, operation, and maintenance of the SLCS network infrastructure. This stage is dominated by large satellite operators (the direct buyers) who integrate the terminals into their constellations and manage the resulting high-speed data traffic. The distribution channels for SLCS products are primarily direct: component manufacturers sell directly to integrators, who then supply the finished terminals directly to satellite prime contractors or large constellation owners. Indirect channels are less common but involve strategic partnerships or joint ventures for technology transfer and regional deployment, particularly in defense sectors where security clearance and local manufacturing mandates apply.

The primary control points in the value chain reside in the intellectual property related to PAT mechanisms and the manufacturing cost scaling of terminals. Companies that can successfully transition from bespoke, high-cost terminal production to a mass-manufacturing model suitable for LEO mega-constellations gain significant leverage. Furthermore, the ground segment infrastructure providers, responsible for managing the interfaces between the optical space network and terrestrial fiber networks, hold crucial positions in ensuring seamless, high-availability service delivery to the ultimate end-users.

Satellite Laser Communication System Market Potential Customers

The primary customers for Satellite Laser Communication Systems are entities requiring ultra-high bandwidth, secure, and low-latency global connectivity, often in environments where traditional RF links are saturated, slow, or vulnerable. The largest current end-users are commercial mega-constellation operators who require thousands of O-ISL terminals to create their interconnected LEO networks for delivering global broadband internet services, treating laser links as essential infrastructure rather than an optional add-on. This group is focused on volume, low SWaP, and cost-efficiency.

A second major customer base comprises government and defense organizations, including military branches, intelligence agencies, and space commands globally. These buyers utilize SLCS for secure, resilient command, control, and communication (C3) links, transferring vast amounts of Intelligence, Surveillance, and Reconnaissance (ISR) data from space assets to ground forces rapidly and covertly. Their focus is heavily weighted toward anti-jamming capabilities, encryption integration (including QKD readiness), and extreme reliability under harsh operational conditions.

Emerging potential customers include large maritime and aeronautical operators (e.g., commercial airlines seeking true broadband in-flight connectivity, or large shipping companies needing high-volume data transfer) who are looking to connect their mobile assets directly via laser links to satellite constellations. Additionally, scientific organizations and specialized Earth observation satellite providers, which generate terabytes of sensor data per orbit, are significant buyers, leveraging SLCS to quickly downlink data that would take hours using conventional RF methods, thereby maximizing mission throughput.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 2,550 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mynaric AG, Ball Aerospace, Tesat-Spacecom GmbH & Co. KG, Space Exploration Technologies Corp. (SpaceX), Thales Alenia Space, Lockheed Martin Corporation, General Atomics, BridgeComm Inc., Honeywell International Inc., Airbus S.A.S., L3Harris Technologies, Inc., Blue Origin, Northrop Grumman Corporation, TNO (Netherlands Organisation for Applied Scientific Research), Analytical Space Inc., Xenesis Inc., Skyloom Global Corp., LaserFleet, Inc., SA Photonics, Inc., Mitsubishi Electric Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Satellite Laser Communication System Market Key Technology Landscape

The technology landscape of the Satellite Laser Communication System market is defined by continuous innovation focused on overcoming the challenges of long-distance free-space optical transmission, primarily revolving around enhanced laser sources, sensitive detection methods, and precise mechanical and electronic pointing mechanisms. Key technological advancements include the maturation of high-efficiency, space-qualified solid-state and fiber lasers operating in the 1550 nm band, which offers relatively higher resistance to atmospheric scattering and aligns well with existing terrestrial fiber infrastructure standards. The development of advanced focal plane arrays and coherent detection techniques is crucial for maintaining high data rates over vast distances while operating with extremely low signal power, a necessity for smaller LEO terminals with power constraints.

The Pointer, Acquisition, and Tracking (PAT) subsystem remains the most complex and critical element of SLCS technology. Modern PAT systems leverage sophisticated electromechanical gimbals, fine-steering mirrors (FSMs), and advanced sensor fusion algorithms (often incorporating AI) to achieve the required sub-microradian accuracy. Technological progress in this domain is focused on reducing the SWaP of these mechanical systems while increasing their speed and robustness against satellite vibrations and thermal fluctuations. Furthermore, the integration of advanced coding and modulation schemes, such as high-order Pulse Position Modulation (PPM) and Coherent Differential Phase-Shift Keying (CDPSK), is vital for maximizing spectral efficiency and link margin, pushing data rates past the 10 Gbps barrier for mass-produced terminals.

Future technological convergence is focusing on developing standardized optical interfaces to ensure interoperability among terminals from different vendors, a prerequisite for a truly resilient global mesh network. Significant R&D is also being poured into ground station technology, particularly the use of adaptive optics to compensate for atmospheric turbulence in real time, and site diversity strategies (using multiple ground stations across varying geographical locations) to mitigate the impact of localized weather conditions. Finally, the incorporation of Quantum Key Distribution (QKD) capability into laser terminals is poised to revolutionize secure space communication, establishing optical links as not only high-throughput but also quantum-proof, representing the cutting edge of secure communication technology.

Regional Highlights

- North America: North America, particularly the United States, holds the dominant share in the SLCS market, primarily due to immense governmental investment through DoD and NASA programs prioritizing resilient space communications and deep space exploration. The region is home to industry leaders and the largest commercial constellation operators (SpaceX, Amazon Kuiper), driving both R&D and rapid commercial deployment. The emphasis here is on technological maturity, large-scale manufacturing capacity for LEO terminals, and strategic integration of SLCS into military architecture (e.g., Space Development Agency's Tracking Layer).

- Europe: Europe is a key player, focusing heavily on sovereign space infrastructure and high-security applications, championed by the European Space Agency (ESA) and the European Commission’s secured connectivity programs (e.g., the planned EU constellation IRIS²). European companies like Tesat-Spacecom and Airbus are at the forefront of highly reliable, high-data-rate terminals, particularly focusing on geostationary and medium-earth orbit applications. Europe is also a leader in integrating SLCS with QKD for ultra-secure communications, aiming to establish regional autonomy in sensitive data transfer.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, driven by national space ambitions in China, India, Japan, and South Korea. China is aggressively developing its own large-scale LEO constellations and is rapidly mastering the required optical terminal technology to reduce reliance on Western suppliers. India’s space programs (ISRO) are increasingly prioritizing high-data-rate links for remote sensing and communication satellites. Market growth here is stimulated by high domestic demand for connectivity and strong governmental support for localization of space technology manufacturing.

- Latin America: This region currently represents a smaller portion of the market but is a critical future end-user area. As connectivity requirements increase, Latin American governments and regional satellite providers are evaluating SLCS solutions to bridge digital divides, particularly in areas with challenging topography where traditional fiber deployment is difficult or prohibitively expensive. The focus is mainly on acquiring GSL and ISL services rather than manufacturing capabilities.

- Middle East and Africa (MEA): Growth in MEA is primarily driven by defense and governmental security needs, where secure and robust communication links are paramount. Key players, particularly in the UAE and Saudi Arabia, are investing in localized space programs and acquiring satellite assets equipped with SLCS to ensure resilient communication architecture. The market uptake is often tied to technology transfer agreements and strategic partnerships with established North American and European vendors to build regional expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite Laser Communication System Market.- Mynaric AG

- Ball Aerospace & Technologies Corp.

- Tesat-Spacecom GmbH & Co. KG

- Space Exploration Technologies Corp. (SpaceX)

- Thales Alenia Space

- Lockheed Martin Corporation

- General Atomics

- BridgeComm Inc.

- Honeywell International Inc.

- Airbus S.A.S.

- L3Harris Technologies, Inc.

- Blue Origin

- Northrop Grumman Corporation

- TNO (Netherlands Organisation for Applied Scientific Research)

- Analytical Space Inc.

- Xenesis Inc.

- Skyloom Global Corp.

- LaserFleet, Inc.

- SA Photonics, Inc.

- Mitsubishi Electric Corporation

Frequently Asked Questions

Analyze common user questions about the Satellite Laser Communication System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Satellite Laser Communication Systems (SLCS) over traditional Radio Frequency (RF) links?

SLCS offers significantly higher data throughput (up to 100 times greater), inherent security due to the narrow beam width (making interception difficult), and minimal interference, unlike congested RF spectrums. Laser terminals also typically have lower Size, Weight, and Power (SWaP) requirements compared to high-gain RF antennas.

How does atmospheric attenuation affect the reliability of Satellite Laser Communications?

Atmospheric attenuation, caused by clouds, fog, and turbulence, significantly weakens laser signals during ground-to-satellite links (GSL). This challenge is mitigated through techniques like adaptive optics, which correct wavefront distortions in real time, and site diversity, which uses multiple geographically separated ground stations to ensure line-of-sight availability.

Which market segment is driving the largest volume demand for optical terminals?

The Inter-Satellite Link (ISL) segment, driven by large commercial Low Earth Orbit (LEO) mega-constellations (e.g., Starlink, Kuiper) focused on providing global broadband internet, is currently driving the largest volume demand for standardized, mass-produced optical terminals.

What role does Artificial Intelligence play in the operation of Satellite Laser Communications?

AI is critical for enhancing operational stability by optimizing the Pointing, Acquisition, and Tracking (PAT) systems to compensate for vibrations and movement instantaneously. AI also enables cognitive networking, managing autonomous traffic routing and dynamic load balancing across the complex satellite mesh network to ensure efficiency.

What are the key technical challenges facing the mass deployment of SLCS?

Key challenges include achieving cost-effective mass production of high-precision optical terminals, ensuring global standardization and interoperability between different vendor terminals, and developing robust, affordable ground infrastructure that can effectively overcome atmospheric interference for reliable space-to-earth connectivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager