Satellite TV Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433484 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Satellite TV Market Size

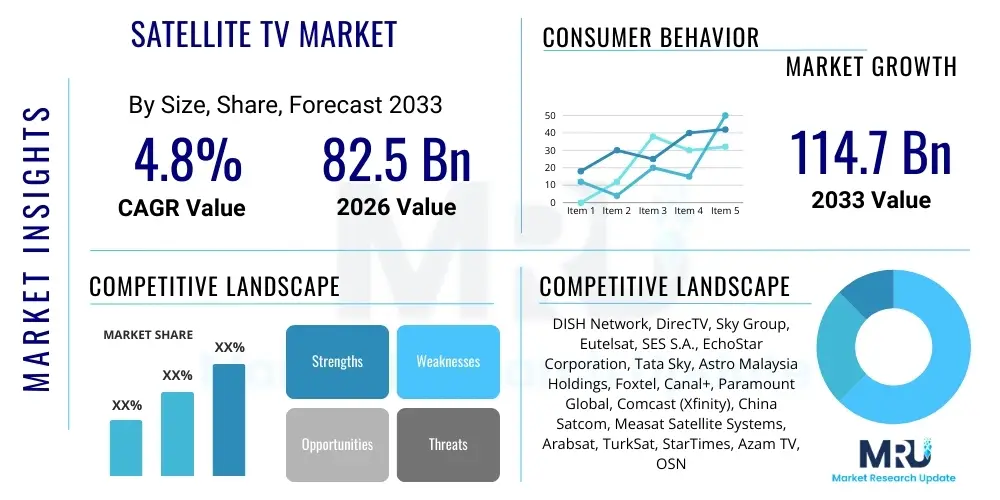

The Satellite TV Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 82.5 Billion in 2026 and is projected to reach USD 114.7 Billion by the end of the forecast period in 2033. This growth trajectory reflects persistent demand for high-quality video content, particularly in regions where terrestrial and broadband infrastructure remains underdeveloped or prohibitively expensive. Despite the rising competition from Over-The-Top (OTT) streaming services, satellite television continues to leverage its widespread geographical coverage and reliability, providing a crucial entertainment and information access mechanism globally.

Satellite TV Market introduction

The Satellite TV Market encompasses the transmission of television signals directly from geosynchronous satellites to viewers' homes, requiring a satellite dish and a set-top box (STB) for reception and decoding. This technology offers massive channel capacity and unparalleled reach, making it a primary distribution method for broadcast content across vast and remote territories. The core product involves receiving, decrypting, and displaying multi-channel television programming, ranging from standard definition to advanced Ultra High Definition (UHD) formats. Major applications span residential entertainment, commercial installations (such as hotels and bars), and specialized services like emergency broadcasting.

Key benefits of satellite TV include extensive coverage regardless of local terrain or infrastructure, consistent signal quality, and the ability to bundle extensive programming packages, often including exclusive sports and international channels. Driving factors influencing market expansion involve the continuous migration toward high-definition (HD) and 4K content, increasing disposable incomes in emerging economies boosting demand for premium entertainment, and strategic partnerships between satellite operators and local content providers. Furthermore, the resilience of satellite infrastructure during natural disasters positions it as a reliable communication backbone, maintaining its relevance even in technologically mature markets.

Satellite TV Market Executive Summary

The global Satellite TV market demonstrates resilience against the backdrop of digital disruption, driven primarily by persistent subscriber growth in high-population, underserved regions across Asia Pacific and Latin America. Current business trends indicate a strategic shift by major operators toward hybrid offerings, integrating satellite delivery with IP-based streaming functionalities to counter pure-play OTT competition and enhance user personalization. Operational efficiency is being boosted through advanced compression standards (like HEVC) and the deployment of High Throughput Satellites (HTS), significantly lowering bandwidth costs per bit and improving service delivery capabilities, thereby sustaining profitability margins despite evolving market dynamics.

Regionally, the Asia Pacific remains the largest segment, characterized by high growth potential due to rapid urbanization, vast rural populations relying solely on DTH (Direct-to-Home) technology, and competitive pricing strategies adopted by local players. North America and Europe, while witnessing some subscriber attrition in the traditional pay-TV segment, are focusing on value retention through bundled services encompassing high-speed internet, telephone, and advanced TV features like PVR (Personal Video Recorder) functionality and multi-room viewing. Segment trends highlight a dominant movement towards HD and UHD content consumption, necessitating continuous investments in high-end STBs and transmission capabilities. The commercial segment, particularly hospitality and aviation, shows robust stability, valuing satellite TV for its uniform service quality across multiple locations.

AI Impact Analysis on Satellite TV Market

Common user questions regarding AI's impact on Satellite TV frequently revolve around personalized content discovery, enhanced customer support, and the potential for AI to optimize satellite bandwidth allocation and transmission efficiency. Users are concerned about whether AI integration can make the traditionally linear satellite TV experience feel more modern and competitive with recommendation engines used by streaming giants. There is significant interest in how AI can preprocess data streams to improve video quality compression without noticeable artifacts, and how predictive maintenance driven by AI can minimize service outages across large geographic footprints. Expectations center on AI transforming the set-top box experience from a simple decoder into a smart entertainment hub capable of anticipating viewing habits and optimizing the operator's operational expenditure through smart network management.

AI is fundamentally altering the operational and consumer-facing aspects of the Satellite TV ecosystem. On the operational side, machine learning algorithms are crucial for sophisticated network planning, optimizing transponder utilization, and predictive failure analysis of orbital assets and ground equipment, leading to higher service reliability and reduced CapEx. For content management, AI tools analyze vast datasets of viewing behavior, demographic information, and social media trends to inform programming schedules, target advertising placement, and develop hyper-personalized content recommendations displayed directly on the STB interface. This personalization capability is vital for retaining subscribers who are increasingly accustomed to tailored viewing experiences offered by streaming platforms.

- AI-driven personalized content recommendations reduce churn rates by mirroring OTT platform user experience.

- Predictive maintenance and fault detection in satellite operations enhance service uptime and network reliability.

- Intelligent bandwidth allocation optimizes transmission efficiency, particularly critical for 4K/UHD broadcasts.

- Automated customer service (chatbots, AI-powered IVR) streamlines support, lowering operational costs.

- AI assists in dynamic ad insertion tailored to individual viewer profiles, increasing advertising revenue effectiveness.

- Machine learning algorithms optimize video compression (e.g., adaptive bitrate streaming via satellite) to maintain quality with less bandwidth.

DRO & Impact Forces Of Satellite TV Market

The Satellite TV market is shaped by a unique blend of structural drivers and technological headwinds. Key drivers include the extensive geographical reach of satellite technology, making it indispensable for providing reliable video services in rural and remote areas lacking fiber or strong cellular infrastructure. The inherent appeal of bundled service packages (including internet and voice where applicable) offered by DTH operators also stabilizes subscriber bases. Conversely, the market faces significant restraints, primarily the pervasive substitution threat posed by affordable and globally scalable Over-The-Top (OTT) streaming video platforms, which offer greater flexibility and on-demand access, leading to cord-cutting in mature markets. High initial investment costs for infrastructure, including launching satellites and deploying STBs, also act as a barrier to entry for new players.

Opportunities for growth lie in the rapid adoption of Ultra High Definition (UHD) and 4K broadcasting, which often requires robust satellite capacity for efficient distribution, providing a competitive differentiator over constrained terrestrial networks. Hybrid STBs that seamlessly integrate linear satellite content with third-party streaming applications offer a strategic path to market relevance and enhanced consumer value. Furthermore, penetrating untapped emerging markets, particularly in Africa and parts of Southeast Asia, where digital infrastructure is still nascent, presents substantial long-term subscriber acquisition potential. These forces create an environment where strategic innovation in delivery and content aggregation is paramount for market success.

Segmentation Analysis

The Satellite TV market is segmented across several critical dimensions, including the type of content quality delivered, the components required for service provision, the end-user application domain, and the underlying pricing structure. Understanding these segments is vital for assessing market demand and identifying specific investment avenues. The shift towards higher definition formats (HD and UHD) is the most prominent trend driving component upgrades and pricing model innovation. Furthermore, the residential sector remains the bedrock of market revenue, although the commercial sector, leveraging specialized broadcasting needs, offers stable, high-value contracts. The market structure emphasizes hardware dependency (STBs and dishes) and service delivery sophistication.

- By Type:

- Standard Definition (SD)

- High Definition (HD)

- Ultra High Definition (UHD/4K)

- By Component:

- Set-Top Box (STB)

- Dish Antenna

- Low Noise Block (LNB) Converter

- Receiver and Decoder Systems

- By Application:

- Residential

- Commercial (Hospitality, Aviation, Maritime, Corporate)

- By Pricing Model:

- Basic Package

- Premium Package

- Add-on Services (A-la-carte channels, VOD)

Value Chain Analysis For Satellite TV Market

The Satellite TV value chain is extensive and capital-intensive, starting with upstream activities involving the design, manufacturing, and launch of specialized communications satellites and ground control infrastructure. Key players in this stage are aerospace companies and satellite operators (such as SES or Eutelsat). The midstream phase involves content acquisition and aggregation, where DTH operators secure broadcasting rights from content providers, encrypt the signals, and uplink them to the orbiting satellites. This phase is characterized by intense negotiation over content licensing fees and intellectual property rights, representing a significant cost component.

Downstream activities focus on signal reception and consumer interaction. This includes the manufacturing and distribution of consumer equipment (dish antennas, LNBs, and STBs) and the actual delivery of the service to the end-user. Distribution channels are typically a mix of direct sales through company-owned retail stores and indirect sales via authorized dealers, third-party electronic retailers, and installation contractors. The success of the downstream component heavily relies on the efficiency of the installation process and the quality of localized customer support, which directly impacts churn rates and overall brand reputation. Direct distribution channels allow operators greater control over the customer experience and data, while indirect channels facilitate rapid penetration into dispersed geographical areas.

Effective management of this complex chain is crucial, especially in optimizing the logistics of hardware distribution and minimizing latency in signal transmission. Value creation increasingly shifts towards enhancing the midstream and downstream phases, particularly through developing proprietary set-top box software and integrating hybrid functionalities that combine satellite reliability with internet-based services. This integration improves customer loyalty and diversifies revenue streams beyond traditional subscription models.

Satellite TV Market Potential Customers

The primary customers for the Satellite TV market are geographically diverse, spanning both individual households and large commercial entities. In the residential segment, the target audience includes households located in rural or remote areas where reliable terrestrial broadband or cable services are either unavailable or cost-prohibitive. This demographic values the universal coverage and reliability that satellite technology inherently provides. A second major subset of residential customers includes enthusiasts and expatriates seeking access to extensive international programming or specialized, premium sports content that may not be available on local terrestrial or streaming platforms.

The commercial segment represents robust demand, particularly from industries requiring synchronized, high-quality, wide-area video distribution. This includes the hospitality sector (hotels and resorts) that mandate centralized entertainment systems for guest rooms, and the transportation sector (maritime and aviation) needing reliable inflight or onboard entertainment across vast distances. Furthermore, educational institutions and government bodies utilize satellite services for distance learning, emergency communication networks, and secure data distribution, highlighting the market’s utility beyond consumer entertainment. These commercial buyers prioritize Service Level Agreements (SLAs), network resilience, and bulk pricing efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 82.5 Billion |

| Market Forecast in 2033 | USD 114.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DISH Network, DirecTV, Sky Group, Eutelsat, SES S.A., EchoStar Corporation, Tata Sky, Astro Malaysia Holdings, Foxtel, Canal+, Paramount Global, Comcast (Xfinity), China Satcom, Measat Satellite Systems, Arabsat, TurkSat, StarTimes, Azam TV, OSN, Nippon Hoso Kyokai (NHK) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Satellite TV Market Key Technology Landscape

The core technology landscape of the Satellite TV market revolves around efficient signal compression, high-power satellite transmission, and sophisticated receiver decoding systems. The migration from older MPEG-2 compression standards to highly efficient codecs like MPEG-4 (H.264) and High Efficiency Video Coding (HEVC or H.265) is a critical ongoing technological trend. HEVC allows operators to deliver twice the amount of data or maintain the same video quality using half the bandwidth, which is essential for rolling out UHD/4K services without launching new capacity. Furthermore, the deployment of High Throughput Satellites (HTS) operating in the Ka-band or Ku-band has dramatically increased the total available data capacity, fundamentally transforming the unit economics of satellite broadcasting.

At the consumer end, the technology focus is on advanced Set-Top Boxes (STBs). Modern STBs are evolving from simple decoders into integrated media gateways, supporting hybrid capabilities that blend DTH reception with IP connectivity for Video-on-Demand (VOD) services and integration with major streaming apps. These boxes incorporate advanced middleware, Electronic Program Guides (EPGs) with predictive search functions, and Personal Video Recorder (PVR) technology, enhancing interactivity and user control over their viewing experience. Security remains paramount, driving continuous advancements in Conditional Access Systems (CAS) and Digital Rights Management (DRM) to protect premium content from piracy, ensuring the revenue streams of content creators and distributors.

Future technological investments are heavily directed towards software-defined satellite systems and maximizing spectral efficiency through advanced modulation techniques and frequency reuse. The incorporation of cloud technologies for broadcast origination and playout is streamlining operations, moving away from traditional hardware-centric infrastructure. Moreover, the integration of 5G capabilities in ground networks is anticipated to create new synergistic opportunities, potentially allowing DTH operators to utilize their substantial coverage footprint for supplementary services like high-speed satellite broadband, further solidifying their role in the global connectivity landscape.

Regional Highlights

- Asia Pacific (APAC): Dominance and High Growth Potential

APAC is the world's largest and fastest-growing region for the Satellite TV market, characterized by extremely high population density and varying levels of fixed infrastructure maturity. Countries like India, China, and Indonesia are primary drivers, where Direct-to-Home (DTH) services provide the most reliable and affordable multi-channel TV access, particularly outside major metropolitan areas. The market growth here is fueled by aggressive competition among local operators offering low-cost packages, rapid digitization efforts replacing analog terrestrial systems, and rising consumer demand for HD content. India, with its extensive rural reach, showcases the inherent strength of the DTH model against streaming competition due to limited pervasive broadband penetration. Strategic regional focus involves localized content acquisition and competitive pricing to win first-time TV households.

- India: Massive subscriber base, driven by affordable DTH packages and essential service for remote regions.

- China: Government-controlled saturation utilizing satellite for national broadcasting reach and specialized education.

- Indonesia and Philippines: Archipelagic geography makes satellite the most feasible technology for universal service coverage.

- Key Trend: Aggressive rollout of hybrid STBs integrating local streaming apps alongside satellite channels.

- North America: Maturity and Service Bundling Focus

The North American market, led by the US and Canada, is highly mature and characterized by high subscriber attrition (cord-cutting) due to the strong presence of fiber broadband and dominant streaming services. Satellite operators (like DirecTV and DISH Network) focus intensely on high-value subscriber retention, offering sophisticated bundle packages that integrate high-speed internet (often via separate infrastructure or partnership), voice services, and premium 4K sports content, leveraging their unique positioning for nationwide coverage. Their primary strategy is value stabilization rather than subscriber growth, focusing on enhancing user experience through advanced PVR technology and hybrid IP integration. The commercial segment, including sports bars and aviation, remains a stable revenue pillar.

- United States: Focus on premium sports broadcasting rights (NFL Sunday Ticket) to differentiate from cable and streaming.

- Canada: Strategic integration of DTH with telecommunication services to maintain subscriber ARPU (Average Revenue Per User).

- Key Challenge: Overcoming high churn rates driven by competitive pricing and content exclusivity of OTT players.

- Europe: Hybrid Transition and Regulatory Complexity

Europe presents a fragmented market structure governed by national regulatory environments and strong incumbent players (like Sky, Canal+). While cable and fiber hold dominance in urban cores, DTH remains crucial for coverage in mountainous and outlying regions. The European strategy heavily emphasizes hybrid business models, where the STB acts as a unified platform for linear satellite channels, free-to-air content, and third-party VOD platforms. The adoption of 4K broadcasting is accelerating in Western Europe, demanding high capacity and advanced receiving equipment. Regulatory scrutiny over content ownership and market consolidation continues to shape competitive dynamics.

- United Kingdom and Germany: Rapid adoption of hybrid models and aggressive deployment of advanced UHD STBs.

- France and Italy: Strong competition from state-owned broadcasters and significant focus on localized premium content acquisition.

- Key Driver: Demand for premium sports and cinema content distributed efficiently across borders via satellite footprint.

- Latin America (LATAM): Economic Volatility and Expansion

The LATAM region exhibits strong growth potential, particularly in countries like Brazil, Mexico, and Argentina, driven by improving economic conditions and the large number of households gaining access to pay TV for the first time. Satellite TV provides essential, reliable service in regions where fixed infrastructure development is slow or highly expensive. The market faces challenges from economic instability and currency fluctuations, which impact pricing and hardware import costs. Operators rely on prepaid models and flexible package structures to appeal to price-sensitive consumers. Competition focuses on speed of deployment and achieving maximum penetration in secondary and tertiary cities.

- Brazil and Mexico: High uptake of satellite services due to expansive geography and limited fiber penetration outside major cities.

- Key Strategy: Prepaid DTH services to mitigate subscription risk and cater to lower-income segments.

- Middle East and Africa (MEA): Untapped Potential and Infrastructure Necessity

MEA is viewed as a high-potential future growth region, especially Africa, where the absence of comprehensive fixed or mobile infrastructure makes DTH the foundational platform for TV consumption. Operators like StarTimes and Azam TV are expanding rapidly, leveraging low-cost satellite reception and localized content strategies. The Middle East, particularly the Gulf Cooperation Council (GCC) states, demands premium, high-quality international and sports content, driving adoption of advanced HD and 4K services. Piracy remains a significant challenge, necessitating continuous investment in sophisticated Conditional Access Systems.

- Africa: Rapid penetration fueled by affordability and necessity; DTH is often the only available source of multi-channel television.

- Middle East: High demand for premium international content and robust anti-piracy solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite TV Market.- DISH Network

- DirecTV

- Sky Group

- Eutelsat

- SES S.A.

- EchoStar Corporation

- Tata Sky

- Astro Malaysia Holdings

- Foxtel

- Canal+

- Paramount Global

- Comcast (Xfinity)

- China Satcom

- Measat Satellite Systems

- Arabsat

- TurkSat

- StarTimes

- Azam TV

- OSN

- Nippon Hoso Kyokai (NHK)

Frequently Asked Questions

Analyze common user questions about the Satellite TV market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the continued relevance of Satellite TV despite the rise of streaming services?

Satellite TV remains relevant primarily due to its expansive geographical reach and reliability, providing multi-channel content access to remote and rural areas globally where fiber or high-speed broadband infrastructure is non-existent or inadequate. It is also preferred for large-scale commercial distribution and high-value bundled services.

How are DTH operators competing with pure-play OTT platforms?

DTH operators are competing through hybrid models, deploying advanced set-top boxes that integrate linear satellite broadcasting with IP-based streaming applications and VOD services. They leverage their unique offering of exclusive premium content, particularly high-value sports, and robust infrastructure resilience to maintain market share.

What is the primary technological trend shaping the future of satellite broadcasting?

The primary technological trend is the adoption of High Efficiency Video Coding (HEVC/H.265) and the deployment of High Throughput Satellites (HTS). These technologies significantly boost bandwidth efficiency, enabling operators to deliver more 4K/UHD content and supplementary data services without increasing orbital infrastructure costs.

Which regional market shows the highest growth potential for Satellite TV?

The Asia Pacific (APAC) region, particularly India, Indonesia, and Southeast Asian nations, exhibits the highest growth potential. This is driven by large, underserved populations transitioning from analog to digital television and the logistical advantages satellite TV offers in vast and archipelagic territories.

What is the role of Artificial Intelligence (AI) in optimizing Satellite TV operations?

AI is crucial for optimizing satellite operations by performing predictive maintenance on ground and orbital assets, enhancing network efficiency through intelligent bandwidth allocation, and improving the consumer experience via personalized content recommendation engines integrated into the STB platform.

How does the fragmentation of content rights impact DTH operators?

Content fragmentation significantly increases the cost of aggregation for DTH operators, as major studios and streaming services increasingly retain exclusive rights to proprietary content. This forces DTH providers to invest heavily in competitive original or exclusive sports programming to maintain subscriber loyalty and differentiate their offering.

Are prepaid models becoming more prevalent in the Satellite TV market?

Yes, prepaid DTH models are increasingly prevalent, especially in emerging markets like Latin America and Africa. These models allow operators to cater to price-sensitive consumers, mitigate subscription default risk, and facilitate broader market penetration among low-income segments lacking formal banking access.

What major challenges does the distribution channel face in the Satellite TV industry?

Distribution channels face challenges related to the high complexity and cost of installation, particularly in remote areas. Ensuring consistent quality control for installation technicians and managing the logistics of hardware inventory (STBs, dishes, LNBs) across large geographic areas are significant operational hurdles.

How is the Commercial Application segment distinct from the Residential segment?

The Commercial segment focuses on high-reliability, bulk service contracts for non-residential premises like hotels, hospitals, and transportation (maritime/aviation). It prioritizes consistent nationwide signal quality, specialized channel packages (e.g., international news or sports packages), and robust Service Level Agreements (SLAs), rather than individual household customization.

What are the implications of Low Earth Orbit (LEO) satellite constellations on traditional GEO satellite TV operators?

LEO constellations primarily focus on high-speed broadband internet, posing an indirect but significant threat by potentially enabling high-quality streaming services even in previously underserved satellite TV areas. While LEO systems are not optimized for traditional mass video broadcast, their penetration may accelerate cord-cutting by providing a viable, fast internet alternative for content consumption.

Is Standard Definition (SD) content still relevant in the market?

Yes, SD content remains highly relevant, particularly in price-sensitive emerging markets where viewers utilize older television sets or subscribe to the most basic entry-level packages. While the industry is migrating towards HD and UHD, SD retains a substantial global subscriber base, driving volume in high-population, low-ARPU markets.

What security measures are critical for protecting satellite broadcast revenue?

Critical security measures include advanced Conditional Access Systems (CAS) and Digital Rights Management (DRM). CAS systems manage subscriber entitlements and encryption keys, preventing unauthorized viewing and signal piracy, which is a continuous and major revenue threat for premium content owners.

How are environmental concerns influencing the Satellite TV market?

Environmental concerns are driving demand for greater energy efficiency in ground equipment, particularly Set-Top Boxes, which are designed to consume less power in operation and standby modes. Additionally, regulatory pressure is increasing regarding space debris mitigation strategies by satellite operators during orbital deployments and end-of-life procedures.

What role do government broadcasting mandates play in market stability?

Government mandates, such as requirements for universal access to public service broadcasting or deadlines for analog switch-off, stabilize the DTH market by creating mandatory demand for digital reception equipment and ensuring a baseline subscriber count for official communication channels, particularly beneficial in large countries with dispersed populations.

What defines a 'Hybrid' Set-Top Box in the context of Satellite TV?

A Hybrid Set-Top Box is a device capable of receiving and decoding traditional digital satellite signals (DVB-S2) while simultaneously possessing internet connectivity to access Over-The-Top (OTT) streaming applications, Video-on-Demand (VOD) libraries, and interactive services, unifying linear and non-linear content consumption.

How do currency fluctuations affect the profitability of DTH operators in Latin America?

Currency fluctuations severely impact profitability in LATAM because core operational costs, such as content licensing fees (often priced in USD) and the purchase price of imported satellite hardware (STBs and dishes), are dollar-denominated, while subscriber revenue is collected in local, fluctuating currencies.

What is the significance of the Low Noise Block (LNB) converter in the receiving system?

The LNB converter, mounted on the satellite dish, is critical because it captures the extremely weak microwave signal transmitted from the satellite, amplifies it, and down-converts its high frequency to a lower, intermediate frequency that can be transmitted through conventional coaxial cable to the indoor receiver unit without significant signal loss.

Why is the ability to deliver 4K content a differentiator for Satellite TV over terrestrial networks?

The high bandwidth requirements of 4K (UHD) video strain the capacity of most terrestrial and DTT (Digital Terrestrial Television) networks. Satellite infrastructure, particularly when utilizing HTS and HEVC compression, provides the necessary massive bandwidth pipes to efficiently and reliably distribute high volumes of 4K content simultaneously over wide service areas.

How are DTH providers using data analytics to reduce subscriber churn?

DTH providers utilize advanced data analytics, often powered by AI, to monitor viewing habits, engagement levels, and historical customer service interactions. This allows them to predict which subscribers are at high risk of churning, enabling timely, targeted retention efforts, such as personalized discount offers or exclusive content previews.

What are the typical upstream activities involved in the Satellite TV value chain?

Upstream activities primarily include the research, development, and manufacturing of satellite hardware (transponders, body, antennae), securing orbital slots and spectrum licenses, physically launching the satellite into Geosynchronous Earth Orbit (GEO), and managing the initial satellite deployment and ground control infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Satellite Service Market Statistics 2025 Analysis By Application (Maritime, Aircraft, Enterprise, Residential, Government, Other), By Type (Satellite TV Service, Satellite Fixed Communication Service, Earth Observation Service, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Community Antenna Television (CATV) Amplifiers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cable TV, Fiber to the Home (FTTH), Satellite TV (SATV)), By Application (Outdoor, Indoor), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager