Satellites Telephones Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439006 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Satellites Telephones Market Size

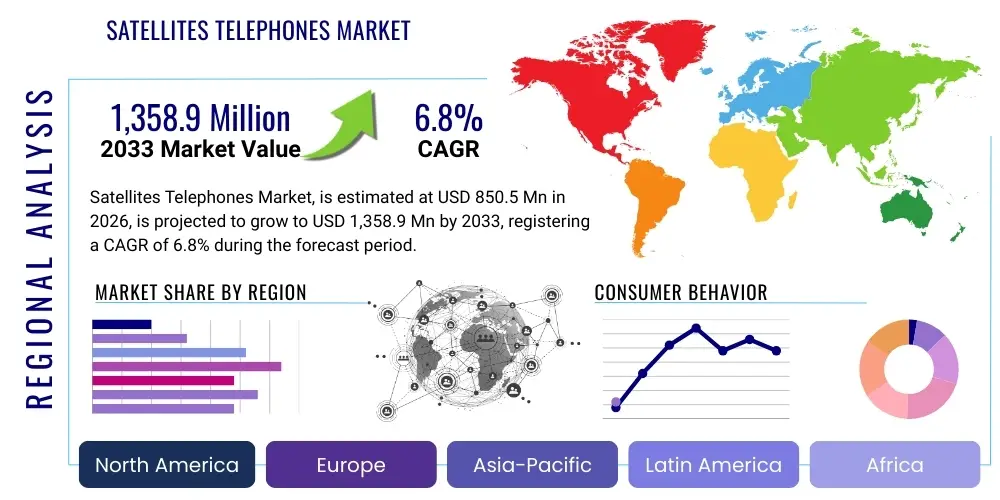

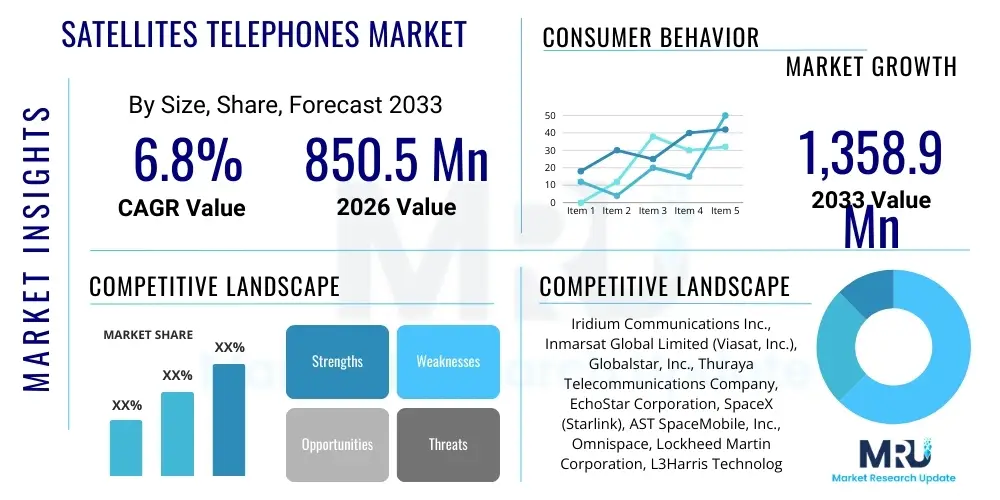

The Satellites Telephones Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850.5 million in 2026 and is projected to reach USD 1,358.9 million by the end of the forecast period in 2033.

Satellites Telephones Market introduction

The Satellites Telephones Market encompasses the global infrastructure and terminal equipment used to provide voice and data communication services via orbiting satellites, particularly in regions lacking terrestrial connectivity. Satellite phones, unlike cellular phones, connect directly to communication satellites, enabling seamless global coverage across oceans, remote wildernesses, and areas devastated by natural disasters. This inherent capability makes satellite communication indispensable for specialized professional sectors, including maritime shipping, aviation, defense, and oil and gas exploration, where reliability and ubiquitous coverage are paramount requirements for operational safety and efficiency.

Key products within this market include handheld satellite phones (like those offered by Iridium and Globalstar), vehicular mounted terminals, and fixed/transportable units designed for remote offices or emergency command centers. These devices utilize various frequency bands—primarily L-band and S-band—to ensure robust signal penetration and minimal latency, though newer systems are integrating higher-frequency bands (Ka/Ku) for enhanced data throughput. The primary applications involve mission-critical communications, emergency response coordination, fleet management, and secure government connectivity. The utility of satellite telephones extends far beyond voice calls, increasingly incorporating features like GPS tracking, short burst data (SBD) services for IoT, and low-speed internet access.

The market's sustained growth is primarily driven by the increasing demand for reliable communication in disaster-prone areas and the expansion of global trade routes necessitating comprehensive maritime and aeronautical coverage. Furthermore, geopolitical instability and the strategic importance of maintaining communication independence for military and intelligence operations significantly bolster demand. Technological advancements, particularly the deployment of Low Earth Orbit (LEO) constellations, are contributing factors, promising reduced latency and potentially lower hardware costs, thereby expanding the potential customer base beyond traditional high-end governmental and enterprise users to include adventure tourists and remote workers.

Satellites Telephones Market Executive Summary

The Satellites Telephones Market is currently undergoing a transformative period marked by intense competition and rapid technological evolution driven by the shift towards LEO constellations. Business trends highlight a consolidation of service providers focusing on vertically integrated solutions that combine voice, high-speed data, and integrated IoT services, moving away from purely voice-centric models. Key industry players are aggressively investing in next-generation satellite infrastructure to deliver enhanced performance metrics, particularly latency reduction, which is critical for time-sensitive applications and expanding integration with machine-to-machine (M2M) communication protocols. Strategic partnerships between established satellite operators and emerging NewSpace companies, including integration with cellular networks via ‘Direct-to-Cell’ capabilities, are redefining market accessibility and competitive landscapes.

Regional trends indicate North America maintaining market leadership, largely due to high defense spending, significant penetration in the energy sector (especially offshore drilling), and established disaster management infrastructure requiring resilient communication backup. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by expanding maritime trade, increasing exploration activities in developing nations, and substantial governmental investments in emergency preparedness and infrastructure projects across remote island chains and mountainous terrains. Europe and Latin America also show consistent growth, particularly in specialized vertical markets such as recreational boating, mining, and sustainable resource management.

Segment trends reveal that the handheld satellite phone segment retains the largest volume share, driven by flexibility and utility in remote operations and emergency use. Concurrently, the L-band segment dominates revenue due to its proven reliability, global coverage, and suitability for essential voice services. However, the high-speed data terminals utilizing Ka-band and Ku-band are experiencing the fastest growth trajectory, driven by the increasing need for broadband-like services in environments previously restricted to low-bandwidth connectivity, such as advanced maritime vessels and airborne platforms. End-user analysis shows the Government and Defense sector remains the most crucial revenue generator, prioritizing secure, dedicated, and resilient communication capabilities.

AI Impact Analysis on Satellites Telephones Market

User inquiries regarding AI's impact on the Satellite Telephones Market frequently focus on how Artificial Intelligence will enhance network efficiency, improve data utilization from remote assets, and secure communication channels against sophisticated threats. Common questions revolve around the integration of AI-driven predictive maintenance for remote terminals, the use of Machine Learning (ML) for optimizing satellite bandwidth allocation in highly congested areas, and the development of AI-enhanced compression algorithms to maximize the efficiency of low-bandwidth satellite links. Users are concerned about whether AI can truly democratize access to satellite data by automating complex analytics and reducing the expertise required to manage these specialized networks. Furthermore, there is significant interest in AI's role in detecting and neutralizing potential jamming and spoofing attacks, ensuring the integrity and resilience of critical satellite telephone services.

AI and Machine Learning are fundamentally transforming the operational paradigm of satellite telecommunication networks, moving them towards autonomous and highly adaptive systems. In network management, AI algorithms are deployed for dynamic resource allocation, predictive failure analysis of ground and space assets, and optimizing beam hopping and gateway switching, thereby minimizing potential service disruptions and improving quality of service (QoS) for satellite phone users. This optimization is crucial for maximizing the utility of complex LEO and MEO constellations. Furthermore, AI contributes significantly to cybersecurity by identifying abnormal traffic patterns indicative of sophisticated cyber threats, ensuring the highly sensitive government and enterprise communication transmitted via satellite phones remains protected.

The integration of AI also profoundly impacts the user experience and application development within the satellite phone ecosystem. Advanced AI models are being used to process and analyze the large amounts of Short Burst Data (SBD) generated by connected remote IoT sensors—often facilitated through satellite phone backhaul—turning raw data into actionable insights for sectors like agriculture, logistics, and environmental monitoring. For satellite phone users, AI-powered voice translation and noise reduction software are becoming standard features, significantly enhancing clarity and communication effectiveness in harsh or noisy environments, which are typical settings for satellite phone utilization. This intelligent enhancement elevates the perceived value and utility of the devices beyond basic connectivity.

- AI-driven Predictive Network Management: Optimizes bandwidth allocation, reduces latency variability, and forecasts potential hardware failures in satellites and ground stations.

- Enhanced Cybersecurity Protocols: Uses ML models to detect real-time anomalies, jamming attempts, and unauthorized access to secure satellite links.

- Dynamic Spectrum Management: AI algorithms autonomously manage frequency utilization, preventing interference and maximizing the efficiency of limited spectrum resources (L-band/S-band).

- Data Compression and Analytics: Utilizes intelligent compression techniques for data transmitted over low-bandwidth satellite connections and applies ML to derive actionable insights from remote asset data (IoT/SBD).

- Automated Customer Support and Diagnostics: AI chatbots and remote diagnostic tools streamline troubleshooting for end-users operating satellite telephone equipment in remote locations.

DRO & Impact Forces Of Satellites Telephones Market

The Satellites Telephones Market is governed by a robust set of dynamic factors categorized as Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary Impact Forces shaping its trajectory. The core driver is the increasing global requirement for reliable, redundant, and always-on communication infrastructure, especially for mission-critical applications where terrestrial networks are non-existent, unreliable, or compromised. Conversely, market growth is significantly restrained by the historically high cost of service subscriptions and terminal equipment, coupled with complex regulatory requirements across different jurisdictions concerning the use of satellite frequencies and imported hardware. However, the burgeoning commercialization of LEO technology and the integration of satellite connectivity into standard consumer devices present substantial opportunities, poised to overcome some traditional barriers and significantly expand the market's total addressable base.

Drivers: The fundamental necessity for global connectivity in transportation sectors (maritime and aviation) remains a primary driver, alongside substantial public sector investments in defense, homeland security, and disaster relief programs, which mandate resilient communication backup independent of local infrastructure. Moreover, the global push towards digital transformation in remote industries such as mining, forestry, and offshore energy exploration requires robust, reliable data transfer capabilities that only satellite networks can guarantee. The growing trend of using satellite phones and terminals for telemetry and Short Burst Data (SBD) services, enabling comprehensive remote asset monitoring and IoT applications, further accelerates demand, making satellite connectivity an integral component of enterprise operational technology stacks.

Restraints: The most prominent restraint is the cost differential relative to terrestrial mobile services; satellite service fees often remain prohibitively high for non-specialized consumer use, limiting widespread adoption. Technical challenges, including potential signal obstruction (the need for clear line-of-sight), bulkier equipment compared to standard smartphones, and geopolitical regulations regarding trans-border satellite communications, also hinder seamless market expansion. Furthermore, the rising proliferation of sophisticated jamming and signal interference techniques represents an ongoing threat, requiring continuous and costly investment in anti-jamming technologies and frequency management, which increases operational expenditure for service providers.

Opportunity: Significant market opportunity lies in the ongoing deployment of mega-LEO constellations, promising drastic reductions in latency and hardware costs, which will make high-quality satellite voice and data more accessible. The emerging 'Direct-to-Cell' capability—allowing standard smartphones to connect to LEO satellites—presents a revolutionary opportunity to integrate basic satellite phone functionality into the mass consumer market, primarily for emergency messaging outside cellular coverage. Additionally, the increasing demand for secure, dedicated 5G backhaul solutions in rural and underserved areas positions satellite telephone providers to act as critical infrastructure enablers, utilizing their robust network architecture to support terrestrial expansion.

Segmentation Analysis

The Satellites Telephones Market segmentation is essential for understanding the diverse needs across various end-user profiles and technological preferences. The market is primarily segmented by Type (Handheld, Fixed, Vehicular), Technology (L-band, S-band, Ku-band, Ka-band), and End-Use Application (Government & Defense, Maritime, Aviation, Energy, Media & Entertainment, and Disaster Management). Handheld devices dominate the volume metric due to their portability and rapid deployment capabilities, crucial for emergency and specialized field use. Meanwhile, segmentation by technology reflects the ongoing transition from traditional, reliable L-band services, which are critical for voice, toward high-throughput Ku- and Ka-band services that cater to the surging demand for broadband data services.

Analyzing the segmentation by end-user highlights the criticality of the Government and Defense sectors, which prioritize secure, resilient, and dedicated communication channels, often employing specialized, ruggedized fixed and vehicular terminals. The Maritime sector represents another cornerstone, relying extensively on L-band services for GMDSS (Global Maritime Distress and Safety System) compliance and operational voice/data connectivity across global shipping lanes. As offshore operations become more data-intensive, the adoption of higher-frequency terminals (Ka/Ku) is accelerating within this segment to support crew welfare and complex vessel management systems.

The strategic differentiation across segments allows market players to tailor service offerings, hardware specifications, and pricing models to specific operational requirements. For example, the Energy sector (oil, gas, and mining) requires highly durable, fixed communication solutions for remote exploration sites, often integrating satellite telephones with data transmission services for real-time telemetry and monitoring. The increasing complexity of global supply chains and the need for pervasive tracking further drive the adoption of satellite-enabled IoT devices, often functioning through specialized low-cost satellite telephone platforms (SBD services), indicating a persistent trend toward integrated voice and data solutions across all major segments.

- By Type:

- Handheld Satellite Phones

- Fixed Satellite Terminals

- Vehicular Satellite Phones

- Transportable/Flyaway Systems

- By Technology:

- L-Band

- S-Band

- Ku-Band

- Ka-Band

- Other Bands (V-band, X-band)

- By End-Use Application:

- Government and Defense

- Maritime

- Aviation

- Energy (Oil, Gas, Mining)

- Media and Entertainment

- Disaster Response and Humanitarian Aid

- General Enterprise and Leisure

Value Chain Analysis For Satellites Telephones Market

The Value Chain for the Satellites Telephones Market is complex and multi-layered, beginning with the upstream segment involving satellite manufacturing and launch services, progressing through network operations, and culminating in downstream distribution and end-user service delivery. Upstream activities involve highly specialized manufacturing companies responsible for designing, building, and launching the satellite infrastructure—including LEO, MEO, and GEO constellations—that form the backbone of the communication network. This segment is capital-intensive and requires significant investment in R&D to ensure the longevity and performance of space-based assets. The middle stage involves satellite network operators (e.g., Iridium, Inmarsat) who manage the ground segment (gateways, network control centers) and the orbiting constellation, ensuring continuous connectivity and service provision.

Downstream activities focus on the delivery of the service to the end-user. This includes the manufacturing of terminal equipment (satellite phones, fixed terminals) by third-party OEMs or in-house divisions, and crucially, the robust distribution network. The distribution channel is bifurcated into direct and indirect routes. Direct sales often cater to large governmental, defense, and maritime contracts where customized integration and high-level security clearances are required, managed directly by the network operators. The indirect channel, however, is significantly larger, utilizing a global network of authorized dealers, Value-Added Resellers (VARs), and regional distributors who handle sales, activation, technical support, and localized billing for enterprise and consumer markets.

The efficiency of the distribution channel is critical, particularly given the specialized nature of satellite telephony equipment and the need for localized regulatory compliance. VARs play an indispensable role by bundling satellite airtime with customized solutions (e.g., fleet tracking software, integrated IT infrastructure for remote sites), adding significant value beyond basic connectivity. The ongoing trend is toward tighter integration across the value chain, where satellite operators are increasingly collaborating with hardware manufacturers and software developers to offer seamlessly integrated, bundled packages, reducing complexity for end-users and accelerating the adoption of data-centric services alongside traditional voice communication.

Satellites Telephones Market Potential Customers

Potential customers for the Satellites Telephones Market primarily consist of organizations and individuals operating in environments where terrestrial infrastructure is unreliable, non-existent, or intentionally disconnected for security reasons. The largest buyer group remains the Government and Defense sector, encompassing military forces, intelligence agencies, and public safety organizations that require resilient, encrypted communication networks for tactical operations, global logistics, and continuity of government during crises. These entities prioritize network redundancy, ruggedized hardware, and highly reliable L-band and specialized military-band services, representing the highest revenue generators due to substantial long-term contracts and dedicated capacity requirements.

The second major group includes commercial entities operating globally, specifically the Maritime industry (large shipping fleets, cruise lines, offshore service vessels) and the Energy sector (oil and gas exploration, mining operations). These customers rely on satellite phones and terminals for essential operational communication, safety compliance (GMDSS), and increasingly, for broadband data to support advanced vessel management, remote diagnostics, and crew welfare. For these segments, reliability in harsh environments and guaranteed global coverage (often leveraging Inmarsat or Iridium networks) are the deciding factors for adoption. The growing complexity of offshore automation further drives demand for integrated satellite data services.

A rapidly expanding customer base includes disaster management agencies, humanitarian organizations, and specialized media professionals (news journalists and film crews) operating in remote or conflict zones. For these users, speed of deployment and independence from local power/communication infrastructure are paramount. Furthermore, the burgeoning adventure travel and high-end outdoor leisure market represents a significant, though lower-volume, segment, driven by individuals seeking emergency communication capabilities outside cellular coverage. This latter group is increasingly targeted by new, lower-cost LEO satellite phone solutions that offer basic emergency messaging and voice services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,358.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Iridium Communications Inc., Inmarsat Global Limited (Viasat, Inc.), Globalstar, Inc., Thuraya Telecommunications Company, EchoStar Corporation, SpaceX (Starlink), AST SpaceMobile, Inc., Omnispace, Lockheed Martin Corporation, L3Harris Technologies, Inc., Hughes Network Systems, TerreStar Corporation, Xplore Inc., Pivotel Group, Satcom Global, Cobham SATCOM, Beam Communications, Avanti Communications, ORBCOMM, Kymeta Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Satellites Telephones Market Key Technology Landscape

The Satellites Telephones Market technology landscape is characterized by a rapid migration from geostationary (GEO) satellite infrastructure towards Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) constellations. This shift is the most crucial technological development, addressing the historical limitation of high latency associated with GEO satellites. LEO systems, championed by companies like Iridium and new entrants such as Starlink, offer significantly reduced signal travel time, making satellite phone communication feel almost instantaneous and enabling high-throughput data services that were previously unfeasible over legacy networks. Furthermore, LEO architectures improve signal penetration and reduce the size and power requirements of the terminal equipment, facilitating more compact and user-friendly satellite phones.

Another pivotal technological advancement involves the expansion across frequency bands. While L-band remains the gold standard for reliable global voice communication and critical safety services (GMDSS) due to its resilience to atmospheric conditions, the demand for high-speed internet is driving the adoption of Ka-band and Ku-band technologies. These higher frequencies offer greater bandwidth capacity essential for modern applications like video conferencing and large data transfers, increasingly required by maritime and remote enterprise customers. Hybrid terminals, capable of dynamically switching between terrestrial cellular, Wi-Fi, and various satellite bands, are gaining prominence, ensuring uninterrupted connectivity regardless of the user's location or network availability.

The convergence of satellite and terrestrial communication, exemplified by "Direct-to-Cell" capabilities, represents a fundamental technological disruption. This innovation leverages the ubiquity of consumer smartphones for basic satellite messaging and emergency calls, effectively bridging the gap between specialized satellite telephony and mass-market mobile communication. Key enabling technologies for this convergence include advanced phased array antennas built into consumer devices, sophisticated signal processing to handle weak satellite signals, and optimized frequency utilization that minimizes interference with existing cellular networks. This integration is set to broaden the scope and application of satellite phone connectivity from niche industrial use cases to a widespread, consumer-accessible safety feature.

Regional Highlights

The global Satellites Telephones Market displays significant regional variation in terms of market maturity, regulatory environment, and primary application drivers. North America, encompassing the U.S. and Canada, currently holds the largest market share. This dominance is attributed to extensive government and military spending on highly secure satellite communication systems, particularly across Alaska and the Arctic regions where terrestrial networks are sparse. Furthermore, the region has a highly developed commercial market characterized by robust demand from the oil and gas sector (offshore and pipeline monitoring) and extensive use by disaster relief organizations (FEMA), driving demand for both reliable L-band voice services and high-throughput Ka/Ku-band data terminals for command and control centers.

Europe represents a mature market with consistent growth, primarily driven by the expanding maritime industry, regulatory mandates for safety communications on vessels (GMDSS), and significant adoption within the European defense and security community. Western European countries exhibit high demand for recreational satellite communication among yacht owners and adventure tourists. A key development in this region is the focus on building pan-European resilient communication systems, often requiring seamless integration between national defense capabilities and commercial satellite operators. Regulatory harmony across the European Union aids in cross-border deployments, though individual country regulations still pose minor fragmentation challenges in hardware certifications.

Asia Pacific (APAC) is forecast to be the fastest-growing region during the forecast period. This growth is underpinned by massive governmental investments in infrastructure development across archipelago nations (e.g., Indonesia, Philippines), increased resource exploration (mining and logging) in remote inland areas of Australia and Southeast Asia, and escalating naval and maritime security requirements in the South China Sea. China and India are emerging as powerful consumers and providers, with domestic satellite systems potentially competing with global players. The vulnerability of many APAC nations to natural disasters (typhoons, earthquakes) makes resilient satellite telephony a critical national security and public safety investment, ensuring rapid communication restoration when conventional systems fail.

Latin America and the Middle East & Africa (MEA) markets are characterized by high reliance on satellite infrastructure due to challenging geography and often underdeveloped terrestrial networks. In Latin America, the market is driven by remote resource extraction (Brazilian Amazon, Andean mining) and government efforts to connect remote populations. The MEA region is crucial for defense operations, humanitarian aid logistics, and oil & gas exploration along the coastline and inland desert areas. While the high cost of equipment historically limited penetration in less affluent segments, the introduction of more cost-effective LEO solutions is expected to significantly accelerate adoption rates, particularly for basic voice and emergency services across vast, sparsely populated territories.

- North America: Market leader; driven by defense spending, oil & gas industry, and established disaster management infrastructure. Key focus on advanced, secure terminals and high-throughput services.

- Europe: Mature market; growth fueled by maritime regulations (GMDSS), robust defense sector collaboration, and adoption in specialized sectors like recreational boating and remote media reporting.

- Asia Pacific (APAC): Highest CAGR; driven by infrastructure development in remote and island nations, increasing maritime trade volumes, and critical investment in disaster preparedness (typhoon and earthquake zones).

- Latin America: Growth tied to remote resource extraction (mining, forestry) and efforts to provide communication coverage across geographically challenging interiors and rainforests.

- Middle East and Africa (MEA): Vital for defense, humanitarian operations, and petroleum exploration; demand increasing for reliable voice services in areas lacking conventional connectivity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellites Telephones Market.- Iridium Communications Inc.

- Inmarsat Global Limited (Viasat, Inc.)

- Globalstar, Inc.

- Thuraya Telecommunications Company

- EchoStar Corporation

- SpaceX (Starlink)

- AST SpaceMobile, Inc.

- Omnispace

- Lockheed Martin Corporation

- L3Harris Technologies, Inc.

- Hughes Network Systems

- TerreStar Corporation

- Xplore Inc.

- Pivotel Group

- Satcom Global

- Cobham SATCOM

- Beam Communications

- Avanti Communications

- ORBCOMM

- Kymeta Corporation

Frequently Asked Questions

Analyze common user questions about the Satellites Telephones market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of satellite telephones in the maritime industry?

The primary factor driving adoption in the maritime industry is the mandatory requirement for compliance with the Global Maritime Distress and Safety System (GMDSS), ensuring reliable, continuous voice and data communication for crew safety, navigation, and emergency response across international waters where terrestrial cellular coverage is unavailable. This is often coupled with the need for operational data transfer and crew welfare services.

How are LEO constellations fundamentally changing the satellite telephone market?

LEO constellations are fundamentally changing the market by drastically reducing signal latency, leading to near-instantaneous communication quality comparable to terrestrial networks. Furthermore, LEO systems are facilitating high-throughput data capabilities and, through emerging Direct-to-Cell technology, promise to integrate basic satellite messaging directly into standard consumer smartphones, expanding market access beyond specialized users.

What are the key differences between L-band and Ka-band satellite telephone services?

L-band services offer lower data rates but provide highly reliable, widespread global coverage with terminals that are smaller and more resilient to weather interference, making them ideal for mission-critical voice and safety services. Ka-band offers significantly higher data throughput for broadband applications (streaming, high-speed internet) but requires larger terminals and is more susceptible to signal degradation during heavy rain ("rain fade").

Which end-user segment contributes the most significant revenue to the Satellites Telephones Market?

The Government and Defense sector consistently contributes the most significant revenue. This segment requires high-volume purchases of highly specialized, secure, and ruggedized equipment, combined with long-term, high-value airtime contracts for dedicated network capacity and global operational security.

What restraints are currently limiting the widespread adoption of satellite phones for general consumer use?

The main restraints limiting widespread consumer adoption include the high subscription costs for airtime minutes, the relatively bulky nature of traditional handheld satellite devices compared to smartphones, and the regulatory complexities involved in operating these devices across different national borders, which necessitate specific licensing or approvals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager