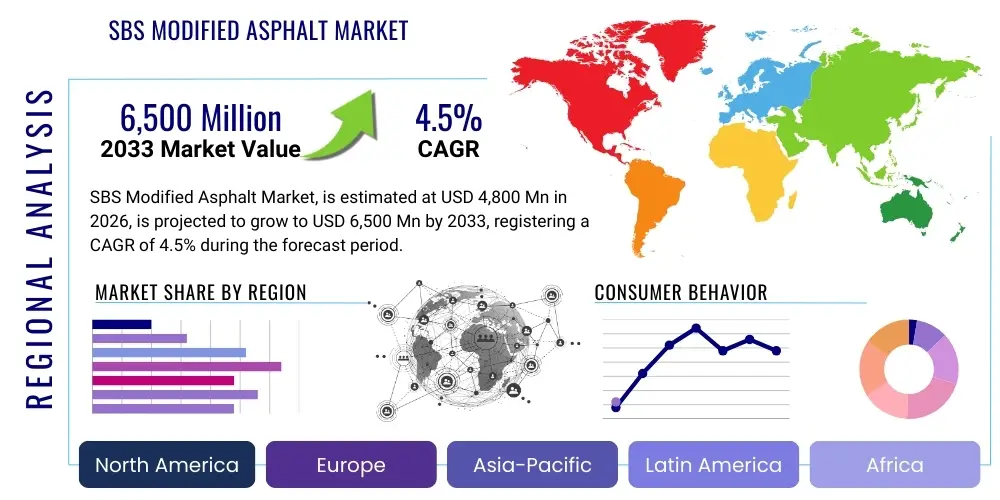

SBS Modified Asphalt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436286 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

SBS Modified Asphalt Market Size

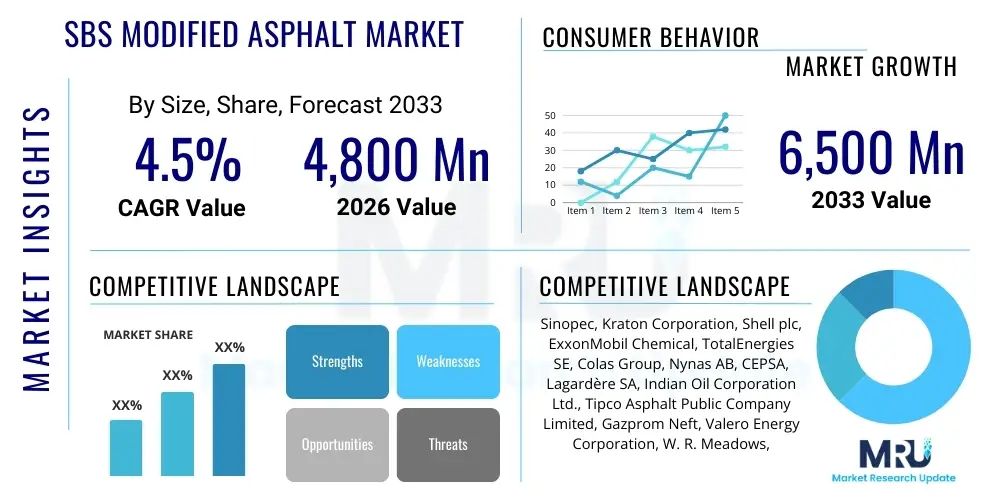

The SBS Modified Asphalt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4,800 Million in 2026 and is projected to reach USD 6,500 Million by the end of the forecast period in 2033.

SBS Modified Asphalt Market introduction

The SBS Modified Asphalt Market encompasses the production and utilization of Styrene-Butadiene-Styrene (SBS) block copolymers blended with conventional asphalt binders. This modification process significantly enhances the physical and chemical properties of the base asphalt, particularly improving elasticity, adhesion, and resistance to high-temperature deformation (rutting) and low-temperature cracking. As a high-performance material, SBS modified asphalt is predominantly employed in critical infrastructure applications where durability and extended lifecycle are paramount. Its superior performance characteristics, compared to unmodified asphalt, position it as the preferred choice for high-traffic roadways, bridge decks, airport runways, and premium roofing membranes.

The key driving factors propelling this market include global government initiatives focusing on infrastructure upgrades, a growing emphasis on extending the service life of pavement systems to reduce maintenance costs, and increasing demand for robust waterproofing solutions in the construction sector. Specifically, the rising urbanization in developing economies, coupled with stricter quality standards for highway construction in developed nations, necessitate the use of advanced binders like SBS modified asphalt. Its primary applications span flexible pavement construction (where it provides enhanced load-bearing capabilities and fatigue resistance), and high-quality roofing shingles and waterproofing materials, offering superior flexibility and UV resistance.

The core benefits of adopting SBS modified asphalt include substantial reductions in lifecycle costs due to reduced frequency of repairs, improved safety owing to enhanced road surface quality, and greater material resilience in extreme climatic conditions. Furthermore, the material contributes to sustainable infrastructure development by extending the operational lifespan of assets. Despite facing competition from other modifiers like crumb rubber (CRM) and polyethylene (PE), SBS remains the gold standard in performance, driven by continuous innovation in polymer blending technologies and its proven efficacy across diverse climatic zones.

SBS Modified Asphalt Market Executive Summary

The SBS Modified Asphalt Market demonstrates robust growth underpinned by global infrastructure development projects, especially in the Asia Pacific region which is witnessing rapid urbanization and heavy investment in national highway networks. Business trends indicate a strong focus on sustainable and resilient infrastructure, leading to increased adoption of high-performance binders to meet stringent quality specifications. Key market players are actively engaged in mergers, acquisitions, and strategic partnerships to strengthen their regional manufacturing footprints and optimize supply chain efficiencies, particularly in securing stable supplies of base asphalt and polymer raw materials. The shift towards warm mix asphalt (WMA) technologies utilizing SBS modification is also a prominent trend, addressing environmental concerns related to energy consumption and emissions during pavement production.

Regionally, North America and Europe represent mature markets characterized by replacement and rehabilitation projects, driving demand for premium, long-lasting modified binders. Regulatory frameworks in these regions often mandate the use of high-grade materials for critical highways, sustaining stable, high-value demand. Conversely, the Asia Pacific market, led by China and India, is the primary engine of volume growth, driven by expansive new construction projects and increasing recognition of the long-term economic benefits of modified asphalt over conventional materials. Latin America and the Middle East and Africa (MEA) are emerging markets, with investments in oil and gas infrastructure and large-scale public works spurring localized growth, particularly in countries with significant temperature variability requiring high-performance materials.

Segment trends reveal that the Pavement application segment holds the largest market share, directly correlated with government spending on road construction and maintenance. However, the Roofing segment is projected to exhibit a competitive CAGR, fueled by the demand for highly durable, weather-resistant roofing membranes and waterproofing systems in both commercial and residential construction. In terms of type, linear SBS modifiers currently dominate, but radial SBS variants are gaining traction due to their enhanced stability and improved compatibility with certain types of asphalt, offering performance advantages in specialized applications. The focus across all segments remains centered on product innovation that reduces application temperature while maintaining or improving performance characteristics, aligning with industry goals for energy efficiency and reduced environmental impact.

AI Impact Analysis on SBS Modified Asphalt Market

User inquiries regarding AI's influence in the SBS Modified Asphalt market frequently center on predictive analytics for material failure, optimization of complex blending processes, and smart infrastructure maintenance scheduling. Users are keen to understand how machine learning can analyze vast datasets—including weather patterns, traffic load history, and material composition—to predict the exact timing and nature of pavement distress, thereby optimizing maintenance interventions and reducing unnecessary material usage. A major concern is the complexity of integrating AI models into traditional, conservative construction processes, along with the need for specialized data infrastructure to capture real-time performance data from road sensors. Expectations are high concerning AI's ability to fine-tune the SBS polymer ratio and blending parameters instantaneously, ensuring batch consistency and maximizing the lifespan extension achieved through modification, ultimately leading to significant cost savings in procurement and construction management.

- AI-driven optimization of SBS polymer-asphalt blending ratios, ensuring superior compatibility and enhanced performance consistency across production batches.

- Predictive maintenance analytics utilizing deep learning algorithms to forecast pavement fatigue, rutting, and cracking based on real-time sensor data and historical climate records.

- Enhanced supply chain management using AI to predict raw material availability (Styrene, Butadiene, crude oil products) and optimize logistics for time-sensitive infrastructure projects.

- Computer vision and drone technology, powered by AI, for rapid, accurate inspection of modified asphalt pavement and roofing surfaces, identifying micro-defects before they escalate.

- Simulation models for testing new SBS formulations under extreme virtual climatic conditions, significantly reducing the R&D cycle time for next-generation modified binders.

DRO & Impact Forces Of SBS Modified Asphalt Market

The market dynamics are fundamentally shaped by the interplay of aggressive infrastructure spending (Drivers), stringent environmental regulations concerning polymer usage (Restraints), the emergence of sustainable modification alternatives (Opportunities), and the influence of fluctuating raw material costs (Impact Forces). Global governmental commitments to repairing and expanding aging road networks, coupled with the proven longevity and superior performance of SBS modified asphalt in severe climate zones, are the primary market drivers. These materials offer a critical economic advantage by reducing the total cost of ownership over the pavement lifecycle, compelling public works agencies to specify their use for major projects. However, the market faces constraints primarily related to the volatility and high cost of styrene and butadiene monomers, which are petrochemical derivatives, along with increasing regulatory scrutiny regarding the disposal and recycling challenges associated with polymer-modified materials.

Opportunities for market growth are significant and largely centered on technological advancements that enhance sustainability and application ease. The development of bio-based SBS modifiers or hybrid systems that integrate recycled materials like crumb rubber alongside SBS offers a pathway to meet environmental objectives without compromising performance. Furthermore, expanding the application scope into industrial flooring, specialized coastal protection structures, and advanced rail track bedding provides new avenues for market penetration. The adoption of Warm Mix Asphalt (WMA) technologies combined with SBS modification is a key opportunity, allowing construction to proceed in less favorable weather conditions while reducing fuel consumption and greenhouse gas emissions at the paving site, making it a highly attractive, environmentally conscious option for contractors.

The primary impact forces influencing profitability and supply chain stability include the highly cyclical nature of the global construction industry and geopolitical factors affecting crude oil prices, which directly impact the cost of base asphalt and polymer modifiers. The market structure, dominated by a few large petrochemical companies that control the supply of virgin SBS polymers, exerts significant pricing power. Furthermore, the specialized equipment and technical expertise required for high-quality blending and application create moderate barriers to entry, concentrating market influence among established players. The shift in climate patterns, leading to more frequent and intense weather events, also acts as an impact force, compelling authorities to invest continuously in high-resilience pavement solutions like those provided by SBS modification.

Segmentation Analysis

The SBS Modified Asphalt Market is comprehensively segmented based on its structural composition (Type), its intended use in infrastructure and building materials (Application), and the geographical regions driving consumption and production. This multi-dimensional segmentation allows for precise analysis of demand trends, competitive landscapes, and technological preferences specific to different end-user needs and regional climates. The market is primarily categorized into Linear SBS and Radial SBS based on the molecular structure of the polymer used for modification, which dictates the resulting asphalt binder's rheological properties and overall stability. Application analysis focuses heavily on the critical sectors of Pavement and Roofing, reflecting the broad utility of SBS materials in both vertical and horizontal construction segments that demand superior durability and performance under stress. Understanding these segments is crucial for manufacturers to tailor product specifications and optimize distribution strategies efficiently.

- By Type:

- Linear SBS

- Radial SBS

- By Application:

- Pavement (Road Construction, Highways, Airport Runways, Bridge Decks)

- Roofing (Shingles, Modified Bitumen Membranes)

- Waterproofing (Tunnels, Foundations, Reservoirs)

- Other Industrial Applications

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For SBS Modified Asphalt Market

The value chain for the SBS Modified Asphalt market begins with the upstream segment, which involves the extraction and refining of crude oil to produce base asphalt (bitumen) and the petrochemical processes required to synthesize Styrene-Butadiene-Styrene (SBS) block copolymers. This upstream phase is capital-intensive and concentrated among major global oil and chemical companies, creating significant dependencies regarding raw material quality and price stability. The middle segment involves the actual modification process, where polymer manufacturers, often specialized blending plants, incorporate the SBS into the base asphalt using high-shear mixers and proprietary techniques to ensure uniform dispersion and optimal structural compatibility. This blending process requires specialized technical expertise and quality control to meet strict rheological specifications mandated by government infrastructure agencies.

The distribution channel plays a critical role in delivering the finished modified asphalt to the downstream consumers. Given the temperature sensitivity and logistical constraints of transporting hot asphalt, distribution relies heavily on specialized truck fleets and strategically located terminals. Direct sales channels are often employed for large government highway projects, where asphalt manufacturers bid directly to contractors based on defined specifications. Indirect channels involve distributors and specialized construction material suppliers who cater to smaller private projects, roofing contractors, and waterproofing specialists. The efficiency of the distribution network directly impacts the cost of the final product and its availability across geographically dispersed construction sites.

The downstream analysis focuses on the end-use applications, primarily large-scale infrastructure construction and commercial/residential roofing. Paving contractors, municipal public works departments, and roofing membrane manufacturers are the primary downstream consumers. The performance validation of the SBS modified product is critical at this stage, with quality assurance testing determining long-term success. Furthermore, the feedback loop from downstream users concerning application challenges and long-term performance feeds back into the modification process, driving iterative improvements in binder formulation and application guidelines. The value chain is characterized by a strong emphasis on quality control and adherence to regulatory standards throughout every stage, from monomer production to final pavement laydown.

SBS Modified Asphalt Market Potential Customers

The primary customers for SBS Modified Asphalt are entities responsible for the development, maintenance, and rehabilitation of critical civil infrastructure and durable building envelopes. These end-users prioritize long-term performance, resistance to severe weather, and minimal maintenance requirements. Government agencies, including Departments of Transportation (DOTs), Public Works Ministries, and municipal bodies, constitute the largest buyer segment, utilizing the material extensively for highways, urban streets, and airport pavements where high traffic volumes and heavy loads necessitate superior durability. These governmental bodies often issue multi-year contracts and tenders, driving significant, predictable demand for high-quality modified binders.

The second major consumer group consists of large construction companies and paving contractors specializing in major infrastructure projects. These contractors act as intermediate buyers, purchasing modified asphalt from blending plants based on specific project requirements and performance standards. Their purchasing decisions are heavily influenced by material cost, supply reliability, and ease of application, especially when using advanced paving techniques like thin asphalt overlays or specialized porous asphalt mixtures. Specialized roofing manufacturers and waterproofing companies form the third core customer segment, demanding SBS modified bitumen for the production of durable membranes used in commercial flat roofs, tunnels, and foundational waterproofing systems, where flexibility and puncture resistance are crucial.

Additionally, private developers involved in large-scale commercial real estate and industrial park construction represent a growing customer base. They increasingly specify high-performance SBS materials for parking lots, access roads, and warehouse roofing to ensure long asset life and reduce liability. The decision to adopt SBS modified asphalt is ultimately driven by a holistic lifecycle cost analysis, where the higher initial material cost is justified by significant savings over decades due to reduced wear and tear, and fewer maintenance interventions, making it an economically rational choice for large asset owners seeking resilience and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4,800 Million |

| Market Forecast in 2033 | USD 6,500 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sinopec, Kraton Corporation, Shell plc, ExxonMobil Chemical, TotalEnergies SE, Colas Group, Nynas AB, CEPSA, Lagardère SA, Indian Oil Corporation Ltd., Tipco Asphalt Public Company Limited, Gazprom Neft, Valero Energy Corporation, W. R. Meadows, Inc., Dow Inc., China National Petroleum Corporation (CNPC), Flint Hills Resources, PTT Public Company Limited, SK Global Chemical Co., Ltd., Axalta Coating Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SBS Modified Asphalt Market Key Technology Landscape

The technological landscape of the SBS Modified Asphalt market is characterized by continuous process innovation aimed at improving polymer dispersion, reducing mixing energy, and enhancing the long-term stability of the binder. A primary focus is on developing high-shear mixing technologies that ensure the SBS polymer is optimally dispersed within the asphalt matrix, preventing phase separation, especially during extended storage and handling at elevated temperatures. Advanced reactor design, including specialized multi-stage mixers and in-line blenders, allows for precise control over temperature and shear rates, leading to superior modified binder quality. Furthermore, the use of specialized compatibilizers and cross-linking agents is gaining prominence. These chemical additives improve the interaction between the non-polar asphalt components and the polar SBS polymer, ensuring a more homogeneous and storage-stable product that maintains its performance properties under prolonged stress.

Another crucial technological advancement involves the integration of SBS modification with energy-efficient application methods, notably Warm Mix Asphalt (WMA) technologies. WMA additives, such as waxes or chemical packages, are used in conjunction with SBS-modified binders to allow for successful paving at temperatures significantly lower than traditional hot mix asphalt (HMA). This reduces fuel consumption, minimizes fuming on-site, and extends the paving season. The successful marriage of SBS performance benefits with WMA sustainability advantages is a critical driver for market adoption in environmentally sensitive regions. Manufacturers are investing heavily in R&D to formulate SBS binders that exhibit excellent workability and compaction characteristics even at reduced application temperatures, maintaining crucial high-temperature performance metrics simultaneously.

The increasing digitalization of quality control and material testing also defines the current technology landscape. Sophisticated rheometers, Dynamic Shear Rheometers (DSR), and Bending Beam Rheometers (BBR) are essential tools used for performance grading (PG) of modified asphalt, moving beyond traditional empirical tests. These instruments provide detailed viscoelastic data that helps engineers predict the actual performance of the pavement under specific climate and traffic conditions. Furthermore, companies are leveraging nanotechnology and advanced material science to introduce reactive polymers and anti-aging additives that delay the oxidation process of the asphalt binder, thereby further maximizing the service life extension provided by the SBS modification, creating premium products suitable for critical infrastructure lifecycles exceeding 20 or 30 years.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by massive public sector investments in transportation infrastructure, particularly in emerging economies like China, India, and Southeast Asian nations. Rapid urbanization necessitates the construction of durable expressways, bridges, and tunnels, creating high volume demand for SBS modified asphalt. Extreme climate variations, from tropical heat to heavy monsoon seasons, mandate the use of high-performance binders to ensure road longevity and minimize maintenance disruptions. Key countries are adopting standardized specifications that favor modified binders, shifting away from conventional asphalt due to long-term economic incentives.

- North America: North America represents a mature, high-value market characterized by replacement, rehabilitation, and maintenance activities. The US market is heavily influenced by the adoption of Performance Grade (PG) specifications, where SBS modification is essential to meet the demanding PG requirements for both extreme heat and cold conditions prevalent across the continent. Infrastructure renewal initiatives and the need to address the backlog of aging interstate highway systems sustain steady demand. Canada’s severe winter climate necessitates binders with exceptional low-temperature cracking resistance, strongly supporting the adoption of modified asphalt systems.

- Europe: Europe holds a strong position, backed by stringent EU regulations emphasizing sustainable infrastructure and the circular economy. European countries, particularly Germany, France, and the UK, have well-established standards for modified asphalt usage in high-speed rail lines, major motorways, and critical waterproofing projects. The market here is also focused on utilizing recycled asphalt pavement (RAP) in conjunction with high-performance SBS modifiers, blending sustainability with superior technical performance. Innovation centers often focus on reducing the environmental footprint of modification processes and enhancing end-of-life recycling potential.

- Latin America (LATAM): The LATAM market is characterized by sporadic, but large-scale infrastructure projects, heavily reliant on commodity prices and foreign investment. Countries like Brazil and Mexico are witnessing increased use of SBS modified asphalt in urban development and trade corridors connecting resource extraction areas. Demand is primarily concentrated in coastal regions and areas with high temperature fluctuations where unmodified asphalt is prone to rapid failure. The market potential remains high, contingent upon sustained governmental funding for public works.

- Middle East and Africa (MEA): The MEA region presents unique challenges due to extremely high summer temperatures, driving demand for SBS modification to combat rutting and deformation. Significant investment in megaprojects, including new cities, major airports, and oil and gas infrastructure in the GCC countries (Saudi Arabia, UAE), creates a strong market for premium, heat-resistant modified bitumen for both pavement and specialized industrial roofing. Economic diversification efforts and large-scale infrastructure ambitions are key demand drivers in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SBS Modified Asphalt Market.- Sinopec

- Kraton Corporation

- Shell plc

- ExxonMobil Chemical

- TotalEnergies SE

- Colas Group

- Nynas AB

- CEPSA

- Lagardère SA

- Indian Oil Corporation Ltd.

- Tipco Asphalt Public Company Limited

- Gazprom Neft

- Valero Energy Corporation

- W. R. Meadows, Inc.

- Dow Inc.

- China National Petroleum Corporation (CNPC)

- Flint Hills Resources

- PTT Public Company Limited

- SK Global Chemical Co., Ltd.

- Axalta Coating Systems

- Marathon Petroleum Corporation

- Vitol Group

- Asphaltos de Venezuela SA (ASFALCA)

- HollyFrontier Corporation

- Ooms Producten BV

Frequently Asked Questions

Analyze common user questions about the SBS Modified Asphalt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is SBS modified asphalt and how does it differ from standard asphalt?

SBS (Styrene-Butadiene-Styrene) modified asphalt is a composite binder created by blending base asphalt with SBS block copolymers. The key difference is the resulting viscoelastic property enhancement; SBS increases elasticity and flexibility, significantly improving resistance to rutting at high temperatures and cracking at low temperatures, thus extending pavement life compared to standard asphalt.

Which application segment drives the highest demand in the SBS Modified Asphalt Market?

The Pavement segment, encompassing road construction, highways, and airport runways, accounts for the highest market share. This dominance is due to large-scale government spending on infrastructure maintenance and expansion globally, where the superior durability of SBS modified asphalt is mandated for high-traffic, critical surfaces.

How do fluctuating raw material costs affect the SBS Modified Asphalt market price?

Raw material costs significantly impact market pricing, as both base asphalt (a crude oil derivative) and SBS polymers (derived from petrochemical monomers like styrene and butadiene) are subject to global oil market volatility. High crude oil prices directly increase the production cost of the modified binder, translating to higher prices for end-users.

What are the primary regional growth opportunities for SBS Modified Asphalt?

The primary growth opportunities lie in the Asia Pacific region, specifically China and India, driven by rapid urbanization and extensive new infrastructure construction projects. Additionally, the adoption of specialized applications like high-performance waterproofing systems and energy-efficient roofing in mature markets offers sustained, high-value growth.

Is SBS Modified Asphalt compatible with sustainable construction methods like Warm Mix Asphalt (WMA)?

Yes, SBS modified asphalt is highly compatible with Warm Mix Asphalt (WMA) technologies. Utilizing WMA additives allows the modified binder to be mixed and laid at reduced temperatures, cutting energy consumption and emissions without sacrificing the critical performance improvements provided by the SBS polymer, aligning performance with environmental sustainability goals.

What are the key technological advancements expected to shape the future of SBS modification?

Future technological advancements will focus on enhancing storage stability through advanced chemical compatibilizers, integrating high-performance SBS formulations with bio-based or recycled additives (like crumb rubber) to improve sustainability, and leveraging AI for real-time quality control and predictive performance modeling during blending and application processes.

What is the difference between Linear SBS and Radial SBS polymers in asphalt modification?

Linear SBS has a simple chain structure, offering good elasticity, while Radial SBS features a branched structure. Radial SBS generally provides enhanced stability, improved rheological properties, and better compatibility with certain asphalt types, often making it preferred for specialized, high-stress applications requiring maximum stability at high temperatures.

How does SBS modification improve the service life of pavements?

SBS modification significantly improves pavement service life by increasing the elastic recovery of the binder. This enhanced elasticity reduces permanent deformation (rutting) under heavy traffic loads and extreme heat, while simultaneously preventing thermal cracking in cold weather, thereby resisting the two primary forms of asphalt pavement failure and extending the maintenance cycle.

Which regulatory factors influence the demand for modified asphalt in Europe?

In Europe, demand is influenced by the Construction Products Regulation (CPR) and specific national standards that mandate high-performance characteristics for critical infrastructure, particularly focusing on durability, low noise emission requirements, and adherence to sustainability objectives, often favoring high-grade modified binders like SBS for long-term projects.

What is the primary restraint faced by manufacturers in the SBS Modified Asphalt supply chain?

The primary restraint is the extreme price volatility and supply concentration of petrochemical raw materials, specifically the styrene and butadiene monomers required for SBS production. Since these are commodity chemicals, their costs fluctuate wildly based on global oil market shifts and industrial capacity utilization, posing significant margin risks for manufacturers.

How does the quality control process ensure high performance of SBS modified asphalt?

Quality control relies heavily on advanced rheological testing methods, including the Dynamic Shear Rheometer (DSR) and Bending Beam Rheometer (BBR), which accurately determine the performance grade (PG) of the binder. These tests verify that the modified material meets precise viscoelastic specifications required to withstand anticipated climate and traffic loads for the intended application.

Beyond roads, what is the role of SBS modified bitumen in the construction sector?

SBS modified bitumen is crucial in the construction sector for manufacturing high-performance waterproofing systems and roofing membranes. Its flexibility, adhesion, and resistance to UV degradation make it ideal for flat roofing, underground structures, tunnels, and bridge deck waterproofing, ensuring long-term structural integrity and moisture protection.

Why is the SBS Modified Asphalt market seeing growth in the Middle East?

The Middle East market is growing due to large-scale infrastructure development (e.g., airports, new cities) and the necessity of combating extreme environmental conditions. The high temperatures prevalent in the GCC region require high-performance binders that resist severe rutting and deformation, making SBS modified asphalt a mandated material for critical projects.

What role does the concept of Lifecycle Cost Analysis play in the adoption of SBS modified asphalt?

Lifecycle Cost Analysis (LCA) is central to adoption, particularly by government agencies. Although SBS modified asphalt has a higher initial cost than conventional asphalt, its superior durability and extended service life drastically reduce subsequent maintenance, repair frequency, and disruption costs over several decades, demonstrating a significant net economic benefit.

How is digital technology impacting the monitoring and repair of modified asphalt infrastructure?

Digital technology, including IoT sensors embedded in pavement and AI-powered drone inspections, is revolutionizing monitoring. These tools provide real-time data on stress, temperature, and structural integrity, allowing infrastructure managers to shift from reactive repairs to predictive maintenance, optimizing the timing and scope of interventions on SBS-modified surfaces.

What are the key technical specifications that define the quality of SBS modified asphalt?

The quality is primarily defined by the Performance Grade (PG) rating (e.g., PG 76-22), which specifies the acceptable range of high and low service temperatures. Other critical specifications include elastic recovery percentage, phase angle (for elasticity), and complex shear modulus (G) to measure stiffness and resistance to deformation under loading conditions.

Does the blending ratio of SBS affect the final asphalt properties, and what is the typical range?

Yes, the blending ratio significantly affects properties; higher SBS content generally results in greater elasticity and temperature stability, but also higher viscosity and cost. Typical SBS content ranges from 3.0% to 7.0% by weight of the base bitumen, with the exact percentage optimized based on the required PG grade and the specific characteristics of the base asphalt used.

In what ways does climate change drive the increasing demand for SBS modified asphalt globally?

Climate change, leading to more frequent and intense heat waves, heavy precipitation, and wider temperature swings, increases the stress on road networks. This forces infrastructure managers to adopt highly resilient materials like SBS modified asphalt, which is specifically engineered to maintain structural integrity and performance across a broader and more severe range of environmental conditions.

What competitive materials pose a threat to the SBS Modified Asphalt market share?

Primary competitive materials include Crumb Rubber Modified (CRM) asphalt, which is gaining traction due to environmental mandates for tire recycling, and certain reactive polymers like Elvaloy (EAC). While CRM offers cost and sustainability advantages, SBS generally remains superior in pure high-temperature performance and elasticity, maintaining its premium market position.

How is the concept of ‘in-situ’ modification evolving in the asphalt industry?

In-situ modification refers to blending the polymer modifier directly at the hot mix plant rather than using pre-modified binder supplied by a blending facility. While technically challenging, advancements in mobile high-shear mixing equipment are making this approach more viable, offering contractors greater flexibility in logistics and inventory management for large, remote paving projects.

What challenges are associated with the recycling of SBS modified asphalt pavement?

Recycling SBS modified asphalt pavement (RAP) presents challenges because the polymer alters the mechanical properties of the recycled binder, sometimes requiring complex rejuvenation techniques and precise blending ratios to prevent the modified RAP from compromising the quality of the new mix. Specialized testing and strict quality control are required to ensure the modified RAP performs correctly in the new pavement structure.

How do specialized SBS binders cater to airport runway requirements?

Airport runways require SBS modified binders that can withstand extremely high static loads from large aircraft, intense braking forces, and high-pressure tire contacts without rutting or shoving. Specialized SBS formulations often include higher polymer content and unique cross-linking agents to deliver exceptional shear resistance and fatigue life necessary for rigorous aviation standards and rapid turnaround maintenance cycles.

Who are the typical upstream suppliers in the SBS Modified Asphalt value chain?

Upstream suppliers are primarily large petrochemical corporations (for Styrene and Butadiene monomers), major oil refiners (for base asphalt), and specialty chemical companies that produce stabilizing and compatibility additives. These entities control the supply and pricing of the fundamental input materials necessary for the modification process.

What is the significance of the "storage stability" property for SBS modified asphalt users?

Storage stability is crucial because modified asphalt is often stored hot for extended periods before use. Poor stability leads to phase separation—the polymer separating from the asphalt—which destroys the performance characteristics. Manufacturers focus on highly stable formulations to ensure contractors can maintain inventory without compromising material quality or application reliability on site.

How are environmental regulations related to VOCs (Volatile Organic Compounds) influencing product innovation?

Stricter environmental regulations globally are pushing manufacturers to innovate lower-fume and lower-VOC SBS formulations, particularly for roofing and waterproofing applications used indoors or in sensitive urban areas. This pressure accelerates the development and adoption of non-solvent-based and water-based polymer modified emulsions, shifting the market toward safer and cleaner products.

What specific advantages does Radial SBS offer over Linear SBS in infrastructure projects?

Radial SBS polymers are generally cross-linked, forming a more robust network within the asphalt matrix. This results in superior shear strength and temperature stability, particularly beneficial for heavily trafficked roads or bridge deck membranes where material integrity must be maintained under constant, severe stress and deformation cycles.

How does the demand for durable roofing membranes contribute to the SBS market?

The demand for durable commercial and residential roofing membranes, especially flat roofs, is a major contributor. SBS modification imparts excellent flexibility, thermal shock resistance, and puncture resistance to bitumen membranes, allowing them to expand and contract without cracking, thereby offering superior weather protection and extending the typical warranty period of the roofing system.

What economic benefit does the use of SBS modified asphalt provide to municipalities?

Municipalities realize significant economic benefits primarily through substantial reduction in lifecycle costs. By investing more upfront in SBS modification, they decrease the frequency of expensive road repair and reconstruction interventions, minimizing taxpayer expenditure on maintenance and reducing traffic disruption costs associated with frequent road closures.

In the Value Chain, why is the blending process considered highly specialized?

The blending process is highly specialized because it requires precise control of temperature, time, and high shear forces to achieve optimal polymer dispersion and compatibility within the viscous asphalt binder. Improper blending can lead to an unstable, inferior product that fails to meet performance grade specifications, demanding advanced equipment and trained chemical engineers.

What impact do government infrastructure bonds and funding have on the market forecast?

Government infrastructure bonds and dedicated funding initiatives (like the US Infrastructure Investment and Jobs Act or similar EU programs) have a direct, positive impact on the market forecast. These large, guaranteed funding sources ensure continuous, high-volume demand for specified materials like SBS modified asphalt over the multi-year forecast period, stabilizing market growth.

How is the market addressing the logistical challenges of transporting high-temperature modified asphalt?

Logistical challenges are addressed through the strategic location of blending terminals near major consumption centers and the use of highly insulated, specialized tanker trucks. Furthermore, the increasing adoption of WMA technologies combined with SBS reduces the necessary transport temperature, mitigating some thermal degradation and handling risks.

What is the significance of the fatigue resistance enhancement provided by SBS modification?

Fatigue resistance is critical for preventing pavement failure due to repetitive traffic loading, especially on high-volume roads. SBS modification enhances the binder’s ability to dissipate stress energy without permanent damage, thereby significantly delaying the onset of fatigue cracking and extending the structural lifespan of the pavement layer.

What emerging technology is being used to predict material degradation in SBS pavements?

Emerging technology utilizes advanced non-destructive testing (NDT) coupled with machine learning algorithms. Data from sensors and ground-penetrating radar are fed into models that analyze micro-cracking and material density shifts, allowing for precise, early prediction of degradation onset in SBS modified asphalt layers before visible surface distress occurs.

How do global market trends in crude oil influence R&D investment in SBS alternatives?

High and volatile crude oil prices incentivize R&D investment into alternatives, particularly bio-binders and advanced crumb rubber modifiers, which could reduce dependency on petrochemical sources for both the base asphalt and the polymer. This diversification effort aims to stabilize input costs and improve the long-term sustainability profile of road construction materials.

What specific characteristics make SBS modified asphalt ideal for bridge deck applications?

Bridge decks require materials with exceptional waterproofing properties, flexibility, and resistance to chemical de-icing salts. SBS modified asphalt provides a highly durable, impermeable barrier that accommodates the structural movement and thermal expansion of the bridge deck while protecting the underlying concrete or steel from moisture and corrosion.

How do quality certification standards, such as those from AASHTO or CEN, drive the market?

Quality certification standards established by bodies like AASHTO (US) or CEN (Europe) define the mandatory performance characteristics for materials used in publicly funded projects. These standards often require performance grades achievable only through modification, thus acting as a primary regulatory driver for the widespread adoption and specification of high-quality SBS modified asphalt.

What is the role of specialized chemical additives in enhancing SBS modified asphalt performance?

Specialized chemical additives, often referred to as cross-linking agents or sulfur compounds, are used to chemically bond the SBS polymer chains. This cross-linking process significantly enhances the physical network structure within the binder, improving elasticity, storage stability, and overall resistance to permanent deformation under long-term high temperatures.

Why is the waterproof segment, while smaller than Pavement, considered critical for SBS market growth?

The waterproofing segment, particularly for critical infrastructure like tunnels, reservoirs, and foundations, is considered critical because it requires the absolute highest performance standards. SBS modified bitumen offers the necessary extreme flexibility, adhesion, and crack-bridging capabilities under hydrostatic pressure, securing its position as the preferred, high-margin solution for these specialized, failure-intolerant applications.

How do key players manage the complex supply chain of SBS modified asphalt?

Key players manage the complexity by integrating vertically—either by owning blending facilities or securing long-term contracts for base bitumen and polymer supply—and by utilizing advanced logistics planning. Strategic inventory management and establishing regional blending hubs near end-use markets are essential to mitigate the risks associated with volatile raw material supply and just-in-time delivery requirements.

What risks are associated with using low-quality or poorly blended SBS modified asphalt?

Using low-quality or poorly blended SBS material leads to premature pavement failure, typically manifested as rapid rutting, accelerated fatigue cracking, and stripping. This results in significant non-compliance costs for contractors, demands early pavement replacement, and undermines the expected lifecycle cost benefits, posing severe financial and reputational risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager