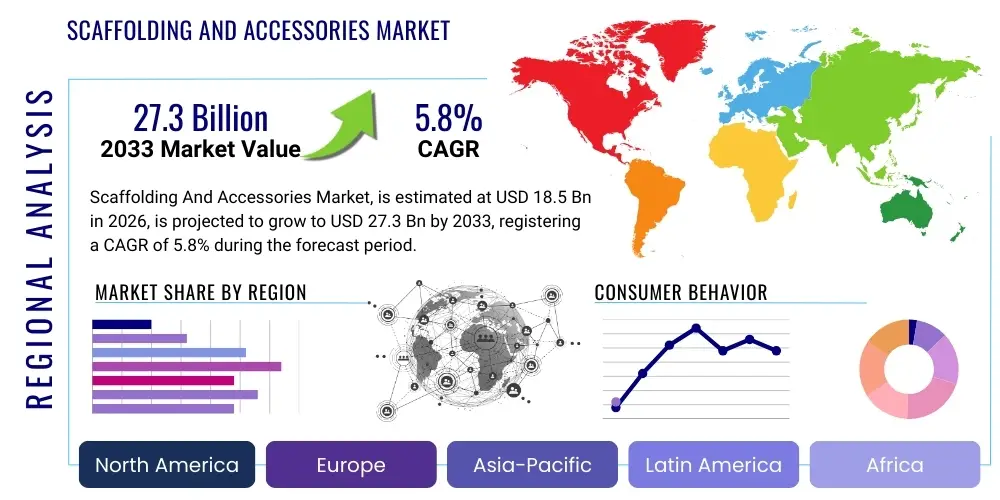

Scaffolding And Accessories Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437976 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Scaffolding And Accessories Market Size

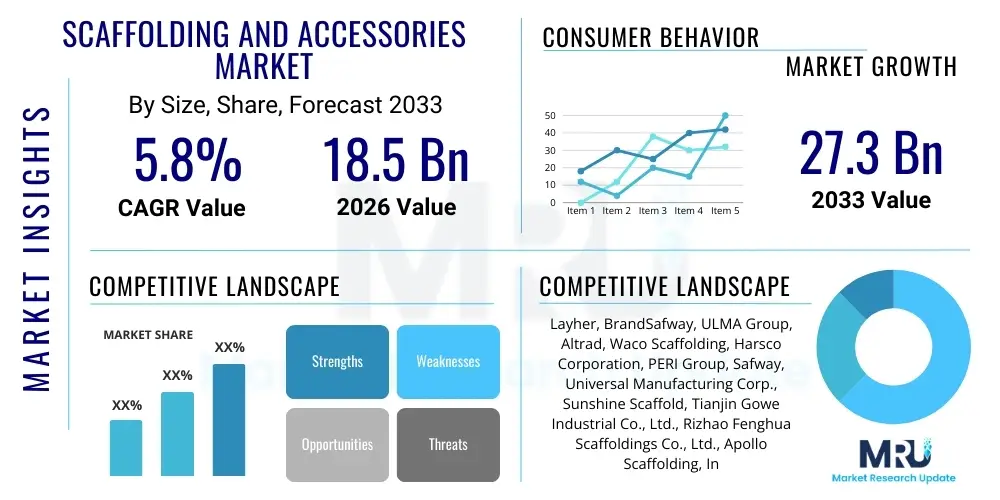

The Scaffolding And Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $27.3 Billion by the end of the forecast period in 2033.

Scaffolding And Accessories Market introduction

The Scaffolding And Accessories Market encompasses a vast array of temporary structures and support components utilized primarily in the construction, maintenance, and industrial sectors to provide safe access and working platforms at heights. These systems are fundamental to nearly all major construction activities, including residential, commercial, and massive infrastructure projects such as bridges, power plants, and refineries. The core products range from traditional tube and coupler systems and modular systems (like system scaffolding) to specialized accessories such as safety nets, toe boards, specialized hoists, and advanced coupling mechanisms, all designed to enhance structural integrity and worker safety compliance. The increasing stringency of global safety regulations, particularly those mandated by bodies like OSHA and European standards organizations, necessitates the use of high-quality, certified scaffolding components, driving consistent market demand.

Major applications of scaffolding extend far beyond typical building construction; they are indispensable in shipbuilding, aviation maintenance, specialized industrial shutdowns, and restoration of historical structures where custom access solutions are critical. The inherent flexibility and scalability of modern scaffolding systems, particularly the ring-lock and cup-lock variants, allow for rapid deployment and dismantling, significantly reducing project timelines and labor costs. Furthermore, the development of lightweight, high-strength materials such as aluminum and fiberglass scaffolding is expanding the product's applicability in environments sensitive to heavy loading or requiring non-conductive materials, thereby catering to specialized niche market demands within utilities and petrochemical operations.

The primary driving factor sustaining market growth is the global acceleration of infrastructure investment, particularly across developing economies in Asia Pacific and the Middle East. Governments worldwide are prioritizing large-scale public works projects, including the construction of mass transit systems, energy facilities, and large commercial hubs. Alongside new construction, a significant portion of demand is generated by the maintenance, repair, and overhaul (MRO) sector, where aging civil infrastructure requires constant structural assessment and refurbishment, necessitating reliable and adaptable temporary access solutions. These dynamics collectively ensure that the market for scaffolding and related accessories remains robust, underpinned by both cyclical construction booms and non-cyclical maintenance requirements.

Scaffolding And Accessories Market Executive Summary

The Scaffolding And Accessories Market is characterized by moderate fragmentation and increasing technological sophistication, driven largely by regulatory pressures emphasizing worker safety and efficiency improvements. Key business trends indicate a definitive shift toward modular and system scaffolding components, which offer superior load-bearing capacity, faster erection times, and reduced labor intensity compared to traditional systems. Rental services dominate the market structure, particularly in mature markets like North America and Europe, as construction companies seek to minimize capital expenditure and manage inventory fluctuations efficiently. Sustainability is also emerging as a major trend, with manufacturers exploring recyclable materials and designing components that minimize material waste and transport logistics, aligning with broader green building initiatives across the globe.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by unprecedented urbanization rates and substantial governmental spending on megaprojects in China, India, and Southeast Asian nations. While North America and Europe demonstrate slower, stable growth, their focus is heavily centered on technological adoption, specifically integrating sensors for structural health monitoring and utilizing Building Information Modeling (BIM) platforms to optimize scaffolding design and placement. The Middle East and Africa (MEA) region also presents high potential, particularly due to large-scale development projects related to economic diversification and major international events, demanding innovative and rapidly scalable access solutions.

Segment trends reveal that frame scaffolding maintains a high market share due to its cost-effectiveness in low-to-medium-rise applications, but ring-lock and cup-lock systems are experiencing the fastest adoption growth globally, reflecting the complexity of modern architectural designs requiring high versatility. In terms of material, steel remains the dominant choice owing to its durability and strength, though aluminum scaffolding is gaining traction in specialized applications where lightweight handling and corrosion resistance are prioritized. The accessories segment, including coupling devices, guardrails, and computerized anti-fall systems, is expected to see accelerated growth, directly driven by enhanced mandatory safety requirements across all construction sites.

AI Impact Analysis on Scaffolding And Accessories Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Scaffolding and Accessories Market primarily revolve around three central themes: safety optimization, design efficiency, and asset management. Users frequently ask how AI can detect structural faults in real-time, whether machine learning algorithms can automate the creation of complex scaffolding plans compliant with local regulations, and how AI-driven predictive maintenance can reduce equipment failure rates. Concerns often focus on the upfront cost of integrating smart scaffolding components (IoT sensors) and the need for specialized training for construction personnel. There is a clear expectation that AI will transition scaffolding from a static support structure into a dynamic, "smart" system capable of proactively mitigating risks and optimizing material usage, thereby fundamentally improving operational workflows in high-risk environments.

The direct application of AI technology is currently focusing on enhancing safety protocols through computer vision and sensor data analysis. AI algorithms are trained to monitor worker movement, ensure mandatory harness usage, and detect unauthorized deviations from safety zones on the platform. This real-time monitoring significantly reduces the probability of human error-related accidents, which historically account for a large percentage of construction fatalities. Furthermore, integrating AI into the planning phase, through sophisticated algorithms processing BIM data, allows for optimal scaffolding configurations, minimizing material overages and ensuring structural stability under varying environmental and load conditions, leading to substantial cost savings and accelerated approval processes.

Beyond safety and planning, AI is crucial in managing vast inventories of scaffolding assets. Machine learning models analyze historical usage data, rental patterns, and maintenance records to predict necessary repairs and optimize logistics, ensuring the right equipment is available at the right time and location. This predictive asset management reduces downtime and extends the usable life of high-value system scaffolding components. Although the initial integration costs are high, the long-term benefits derived from enhanced safety compliance, reduction in liability costs, and improved project efficiency are expected to justify the investment, cementing AI's role as a transformative technology in the scaffolding industry.

- AI-driven real-time structural health monitoring using embedded sensors.

- Predictive maintenance schedules for high-wear components using machine learning.

- Computer vision systems for automated safety compliance checks (e.g., helmet and harness detection).

- Optimization of scaffolding design layouts based on complex BIM inputs and structural load simulations.

- Automated inventory management and tracking of rented or owned components via smart tags and location analytics.

- Enhanced worker training simulations using virtual reality environments informed by AI-analyzed accident data.

- Dynamic load-sensing alerts to prevent overloading of working platforms.

DRO & Impact Forces Of Scaffolding And Accessories Market

The Scaffolding And Accessories Market is subject to numerous impactful forces categorized under Drivers, Restraints, and Opportunities (DRO). The paramount Driver is the global regulatory impetus toward stringent worker safety standards, particularly concerning work-at-height safety, which mandates the use of certified, regularly inspected scaffolding and accessories. This is strongly coupled with massive infrastructural development cycles occurring globally, requiring expansive and complex temporary access solutions. Conversely, major Restraints include the highly cyclical nature of the construction industry, making long-term capital planning difficult for manufacturers and rental providers, alongside the persistent risk of volatile raw material prices, particularly steel and aluminum, which directly impact production costs and market pricing stability. Opportunities are predominantly found in technological innovation, specifically the development of lightweight, smart scaffolding components integrated with IoT for monitoring, and the untapped potential in emerging markets for professionalized rental services.

The primary impact forces shaping the market trajectory are Safety and Standardization (as a positive force) and Labor Skill Gaps (as a restraining force). The enforcement of global safety standards elevates the barrier to entry for lower-quality manufacturers and necessitates continuous product innovation focusing on enhanced modularity, fail-safe mechanisms, and improved ergonomic design for rapid assembly. This drives demand for premium system scaffolding. Simultaneously, the increasing complexity of modern systems requires higher skilled labor for safe erection and dismantling, a shortage of which in many mature markets slows project turnaround times and increases reliance on automated or highly standardized components. The balance between regulatory demand for quality and the supply side challenge of skilled labor dictates the pace of market penetration for advanced scaffolding systems.

Furthermore, urbanization trends serve as a significant long-term driver, compelling cities to build upwards and denser, necessitating highly stable and adaptable façade access solutions, often requiring customized solutions like mast climbing work platforms or specialized hanging scaffolds, which command premium pricing. The environmental impact force is also gaining prominence, pushing manufacturers toward adopting sustainable practices, utilizing recycled materials, and designing components that minimize transport weight and volume, reducing the overall carbon footprint of construction projects. Successfully navigating the high capital costs associated with maintaining vast rental fleets and the continuous need for regulatory compliance updates remains crucial for sustained competitive advantage in this essential segment of the construction supply chain.

Segmentation Analysis

The Scaffolding And Accessories Market segmentation provides a granular view of market dynamics based on type, material, end-use application, and component. This analysis is critical for understanding consumer preference and identifying high-growth sub-segments. The segmentation by Type, encompassing supported scaffolding, suspended scaffolding, and specialized platforms, reveals structural differences in demand based on project height and complexity. Supported scaffolding, including system and frame types, accounts for the largest share due to its widespread use in standard construction and maintenance activities. However, suspended scaffolding and mast climbing work platforms are registering higher growth rates, driven by tall building construction and stringent requirements for façade access and maintenance in metropolitan areas worldwide.

Material segmentation distinctly highlights the trade-offs between durability and cost-effectiveness. Steel dominates due to its superior strength and lower cost base, making it the preferred material for heavy-duty construction and infrastructure projects where load-bearing capacity is paramount. Aluminum, though higher priced, captures market share in applications requiring lightweight properties, portability, or enhanced corrosion resistance, such as maintenance in marine or sensitive industrial environments. The choice of material is increasingly dictated by regional climate, specific project demands, and evolving standards concerning material weight limits for worker handling, influencing manufacturers to offer hybrid solutions combining the benefits of both metals.

End-use application segmentation categorizes demand across sectors such as construction (residential, commercial, infrastructure), industrial maintenance (oil and gas, power generation), and specialized events/stages. The infrastructure and commercial construction sectors remain the largest revenue contributors due to the size and longevity of these projects. The accessories segment, often overlooked, represents a critical component of safety and efficiency, including crucial items like couplers, planking, tie-ins, and safety accessories, and its growth is directly proportional to the volume of scaffolding erected, underpinned by continuous safety upgrades mandated by regulatory bodies like OSHA and regional equivalents, ensuring a consistent and non-cyclical demand stream.

- Type:

- Supported Scaffolding (System, Frame, Tube & Coupler)

- Suspended Scaffolding (Swing Stages, Platforms)

- Rolling/Mobile Scaffolding

- Specialized Access Equipment (Mast Climbing Work Platforms, Aerial Work Platforms)

- Material:

- Steel

- Aluminum

- Wood

- Fiberglass/Composite

- End-Use Application:

- Construction (Residential, Commercial, Infrastructure)

- Industrial Maintenance (Oil & Gas, Power, Manufacturing)

- Civil Engineering & Restoration

- Component:

- Scaffolding Systems (Standard, Ledger, Transom)

- Accessories (Couplers, Guardrails, Safety Nets, Base Jacks, Bracing)

Value Chain Analysis For Scaffolding And Accessories Market

The value chain for the Scaffolding And Accessories Market begins with the sourcing of raw materials, primarily steel (high-grade galvanized steel tubing) and aluminum. Upstream analysis involves major global metal suppliers, where price volatility and sustainability sourcing mandates heavily influence the manufacturer's operational costs. Manufacturers then engage in design, engineering, and precision fabrication of scaffolding components, focusing on compliance with structural and safety standards (e.g., European standard EN 12810/12811 or ANSI/ASSE A10.8). Specialized processes such as welding, galvanization, and precision cutting are critical to ensuring the durability and interoperability of modular systems. Certification and quality control represent a substantial portion of the upstream value addition, establishing the reliability of the product in high-risk applications.

The midstream segment is dominated by distribution channels, which are bifurcated into direct sales (for large-scale infrastructure projects or specialized equipment) and indirect channels, predominantly involving rental companies and third-party distributors. Rental firms are central to the industry, acquiring equipment in large volumes and managing the storage, maintenance, inspection, and logistics of the fleet. This service model allows construction firms to manage project-specific capital expenditures effectively. Indirect channels also include regional construction supply houses that cater to smaller contractors and provide supplementary accessories and replacement parts, ensuring broad market reach and localized support services crucial for rapid deployment.

Downstream analysis focuses on the end-users—construction contractors, industrial maintenance teams, and specialized access providers. The ultimate value delivery resides in providing safe, compliant, and efficient temporary access solutions that minimize project delays and reduce worker liability risks. Aftermarket services, including technical support, training for safe erection/dismantling, and certified inspection services, form a critical part of the downstream value chain, enhancing customer loyalty and extending the revenue potential beyond the initial sale or rental contract. The overall efficiency of the value chain is highly dependent on effective logistics management due to the bulkiness and weight of scaffolding components.

Scaffolding And Accessories Market Potential Customers

The primary customers in the Scaffolding And Accessories Market are extensive, ranging from small, independent residential builders to multinational engineering, procurement, and construction (EPC) firms executing multi-billion-dollar infrastructure projects. Construction contractors form the largest customer base, purchasing or renting various scaffolding types necessary for building erection, façade work, and interior finishing across residential, commercial, and institutional structures. Their demand is project-specific, requiring flexible rental options and high adherence to localized safety regulations, often preferring modular systems for their speed and reliability on complex building geometries.

A second major customer category includes industrial clients, specifically those operating in the oil and gas, petrochemical, power generation, and specialized manufacturing sectors. These end-users typically require non-standard, heavy-duty, and specialized access solutions for routine maintenance shutdowns (turnarounds), inspections, and non-destructive testing within often hazardous environments. This segment demands specialized materials like non-conductive fiberglass or highly corrosion-resistant aluminum scaffolding, prioritizing safety certifications and specialized engineering support over initial cost, leading to higher average transaction values.

Finally, dedicated scaffolding rental and service companies constitute a vital intermediate customer segment. These companies purchase high volumes of standardized components directly from manufacturers, acting as the primary service provider for smaller and mid-sized construction firms that lack the resources for internal fleet ownership and maintenance. By offering integrated services, including engineering, erection, and dismantling, these rental companies streamline project execution for contractors, demonstrating their critical role as significant volume purchasers and key downstream influencers in the overall market structure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $27.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Layher, BrandSafway, ULMA Group, Altrad, Waco Scaffolding, Harsco Corporation, PERI Group, Safway, Universal Manufacturing Corp., Sunshine Scaffold, Tianjin Gowe Industrial Co., Ltd., Rizhao Fenghua Scaffoldings Co., Ltd., Apollo Scaffolding, Instant UpRight, Xtreme Manufacturing, RUX, Pilosio Group, StepUp Scaffold, Ischebeck Titan, KHK Scaffolding. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scaffolding And Accessories Market Key Technology Landscape

The Scaffolding And Accessories Market is undergoing significant technological evolution, moving away from traditional, labor-intensive tube and coupler systems toward advanced modular and digitized solutions. The core technological shift involves the widespread adoption of system scaffolding, such as ring-lock and cup-lock systems, which prioritize standardized components, integrated safety features, and simplified connections. These engineered systems drastically reduce assembly and dismantling time, simultaneously minimizing the potential for human error and enhancing overall structural integrity. Innovations in material science are also pivotal, with manufacturers increasing the use of lightweight, high-tensile steel alloys and advanced aluminum composites that offer superior strength-to-weight ratios, easing logistics and manual handling on site while maintaining strict load-bearing requirements necessary for complex, modern construction projects.

Digitalization represents the next frontier, driving efficiency across the entire lifecycle of scaffolding deployment. The integration of Building Information Modeling (BIM) software is becoming mandatory for large projects, allowing engineers to design scaffolding layouts virtually, detect clashes with building structures, and calculate precise material lists before mobilization, eliminating costly on-site modifications. Furthermore, the incorporation of Internet of Things (IoT) sensors into scaffolding components is enabling "smart scaffolding." These sensors monitor factors such as structural load, wind speed, inclination, and component stress in real-time, transmitting data to site managers to proactively identify potential hazards. This shift from reactive safety measures to proactive, data-driven monitoring fundamentally transforms risk management in high-altitude work.

Additionally, advancements in robotic technology and automation are beginning to influence the logistics and maintenance aspects of the industry. Automated inspection drones equipped with high-resolution cameras and thermal imaging are used to perform rapid, comprehensive safety checks on vast scaffolding structures, tasks that are often hazardous and time-consuming for human inspectors. Simultaneously, new fastening and connecting accessories are engineered for ease of use, incorporating quick-release mechanisms and self-locking features that enhance worker efficiency and reduce the need for specialized tools. This technological landscape emphasizes enhanced safety, maximized operational efficiency, and seamless integration with broader construction management platforms, solidifying the market trend toward high-precision engineered solutions.

Regional Highlights

The global distribution of the Scaffolding And Accessories Market demonstrates distinct regional characteristics driven by varying levels of construction activity, regulatory frameworks, and technological adoption rates.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, primarily due to rapid urbanization, massive government investment in infrastructure (e.g., China's Belt and Road Initiative, India's Smart Cities mission), and burgeoning residential and commercial construction in Southeast Asia. This region exhibits high demand for both cost-effective frame scaffolding and modern, high-volume system scaffolding necessary for skyscraper construction. China and India are central to market volume, while robust economic expansion in Vietnam and Indonesia contributes significantly to growth opportunities, increasingly adopting stringent international safety standards which favor certified accessories.

- North America: Characterized by mature infrastructure and high regulatory compliance (OSHA), North America focuses heavily on safety, efficiency, and the integration of technology. The market is dominated by large rental companies, reflecting a preference among contractors to lease rather than purchase high-capital equipment. Growth is driven by industrial maintenance (oil and gas, chemical plants) and the renovation of aging civil infrastructure, leading to a strong demand for specialized access equipment like suspended scaffolding and mast climbing work platforms.

- Europe: Europe is defined by stringent quality standards (EN standards) and a strong emphasis on worker protection and environmental sustainability. Western European countries (Germany, UK, France) are early adopters of advanced modular systems (Layher, PERI) and digital planning tools (BIM). While new construction growth is stable, the MRO segment, particularly the refurbishment of historical buildings and complex industrial sites, drives consistent demand for high-quality, lightweight aluminum systems and customized solutions.

- Middle East and Africa (MEA): This region experiences high volatility driven by cyclical oil prices and megaprojects (e.g., NEOM in Saudi Arabia, World Cup infrastructure in Qatar). Demand is concentrated in large-scale commercial and infrastructure construction. MEA requires rapidly scalable, heavy-duty scaffolding solutions, often imported, with a growing focus on complying with international safety standards to manage large expatriate labor forces effectively.

- Latin America (LATAM): Growth in LATAM is moderate, influenced by varied economic stability across countries. Brazil and Mexico represent the largest markets, driven by residential construction and resource extraction projects. The market remains sensitive to price points, with a mix of traditional and basic modular scaffolding systems being prevalent, though there is a gradual movement toward certified, modern systems as safety standards are incrementally tightened.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scaffolding And Accessories Market.- Layher

- BrandSafway

- ULMA Group

- Altrad

- Harsco Corporation (Patent Construction Systems)

- PERI Group

- Waco Scaffolding & Equipment

- Universal Manufacturing Corp.

- Safway Group

- Sunshine Scaffold

- Rizhao Fenghua Scaffoldings Co., Ltd.

- Tianjin Gowe Industrial Co., Ltd.

- Apollo Scaffolding

- Instant UpRight

- Xtreme Manufacturing (Skyjack Scaffolding)

- RUX (Part of Altrad Group)

- Pilosio Group

- StepUp Scaffold

- Ischebeck Titan

- KHK Scaffolding and Formwork LLC

Frequently Asked Questions

Analyze common user questions about the Scaffolding And Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Scaffolding And Accessories Market?

The primary factor driving demand is the global enforcement of stringent worker safety regulations (such as OSHA standards and European EN norms) concerning work-at-height safety, necessitating the use of certified, high-quality, and modern scaffolding systems and associated safety accessories.

How are technological advancements impacting the traditional use of scaffolding?

Technological advancements are transitioning scaffolding from simple support structures into smart, integrated systems through the use of modular (ring-lock) designs, Building Information Modeling (BIM) for optimized planning, and IoT sensors for real-time monitoring of structural load and safety compliance, significantly enhancing operational efficiency and risk mitigation.

Which segment of scaffolding material holds the largest market share and why?

Steel scaffolding holds the largest market share due to its superior strength, exceptional durability, and competitive cost-effectiveness compared to other materials, making it the preferred choice for heavy-duty construction and large-scale infrastructure projects requiring high load-bearing capacity.

What is the significance of the rental market versus direct sales in this industry?

The rental market is highly significant, particularly in mature economies like North America and Europe, as it allows construction companies to minimize large capital expenditure, efficiently manage fluctuating inventory demands, and ensures access to maintained, compliant, and regularly inspected equipment for project-specific needs.

Which geographical region is projected to experience the fastest growth in the scaffolding market?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, fueled by rapid urbanization, massive governmental infrastructure investments, and intense construction activity in major economies like China, India, and various developing Southeast Asian nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Scaffolding Platform (Scaffolding and Accessories) Market Size Report By Type (Tower Scaffolding and Accessories, Facade Access Scaffolding and Accessories, Other types(such as suspended Scaffolding and Accessories, attached lifting Scaffolding and Accessories and etc.)), By Application (Construction Industry, Other Applications (Such as ship building, electrical maintenance, temporary stage and etc.)), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Scaffolding And Accessories Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Carnosic Acid, Rosemarinic Acid, Essential Oil), By Application (Food Industry, Household Chemicals, Pharmaceutical Industry, Other Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager