Scalp Care Solution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438034 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Scalp Care Solution Market Size

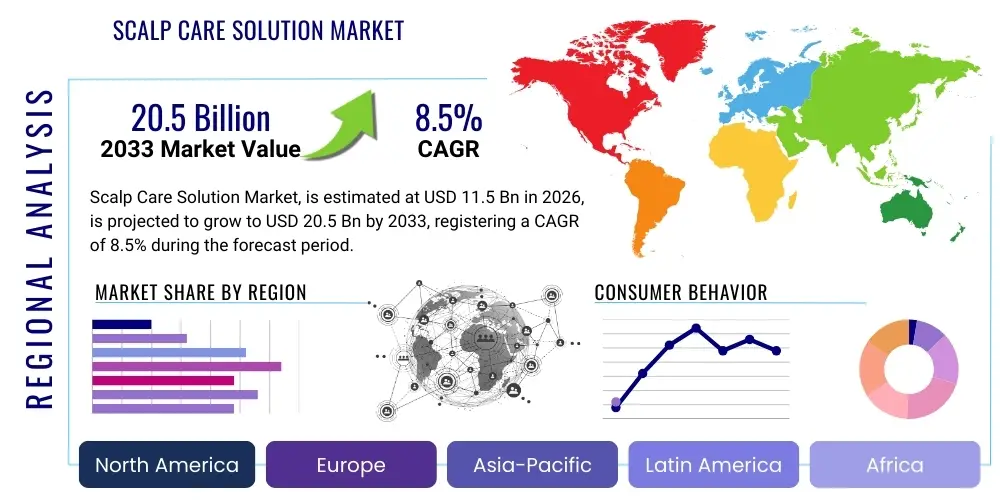

The Scalp Care Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 20.5 billion by the end of the forecast period in 2033.

Scalp Care Solution Market introduction

The Scalp Care Solution Market encompasses a diverse range of products specifically designed to maintain the health of the scalp, addressing issues such as dandruff, dryness, oiliness, inflammation, and hair loss. This market includes specialized shampoos, conditioners, serums, oils, masks, and treatments formulated with active ingredients like salicylic acid, zinc pyrithione, essential oils, and advanced biotechnology components such as probiotics and prebiotics. These solutions are categorized under cosmeceuticals, bridging the gap between cosmetics and pharmaceuticals, driven by a global shift in consumer perception that recognizes the scalp as the foundation for healthy hair growth and overall aesthetic appearance.

Major applications for scalp care solutions span therapeutic treatments for diagnosed dermatological conditions, such as seborrheic dermatitis and psoriasis, as well as preventative and maintenance routines focused on detoxification, balancing the microbiome, and anti-aging effects. The primary benefit derived from these products is improved hair density and strength, reduced discomfort (itching, flaking), and enhanced personal well-being. The evolution from simple anti-dandruff remedies to complex wellness regimens highlights the market's maturity and sophistication, increasingly targeting specific demographic needs, including men's grooming and sensitive skin categories.

Key factors driving the expansion of the Scalp Care Solution Market include escalating levels of stress and pollution which exacerbate scalp conditions, an aging global population seeking solutions for thinning hair, and significant advancements in ingredient technology enabling targeted delivery and higher efficacy. Furthermore, the extensive digitalization of beauty education, coupled with influential social media trends promoting holistic health and personalized beauty routines, has significantly heightened consumer awareness regarding the crucial importance of consistent scalp health maintenance, thereby stimulating sustained product demand across all major geographies.

Scalp Care Solution Market Executive Summary

The Scalp Care Solution Market is demonstrating robust business trends characterized by significant investment in R&D focusing on sustainable and ‘clean label’ formulations, including the integration of certified organic and naturally derived ingredients. The shift toward personalized diagnostics, often utilizing digital imaging and AI, is transforming product development and consumer consultation models. Companies are increasingly diversifying their product portfolios beyond traditional wash-off formats, focusing heavily on specialized, leave-on treatments such as serums and tonics, which promise higher efficacy and targeted delivery, reflecting a premiumization trend within the sector.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely fueled by sophisticated beauty routines in East Asian countries (South Korea, Japan) that prioritize preemptive scalp maintenance and detoxifying rituals, alongside rapid urbanization and rising disposable incomes in emerging economies like India and China. North America and Europe maintain leading market shares due to high consumer awareness, established distribution channels, and strong regulatory frameworks supporting medical-grade claims. These regions are seeing increased demand for clinical-grade solutions and products addressing pollution-related damage.

Segment-wise, the Treatment Products segment (including masks and specialized serums) is expected to exhibit the highest growth rate, overshadowing traditional shampoo sales, as consumers seek intensive solutions for chronic issues like hair loss and severe dryness. In terms of distribution, the e-commerce channel is rapidly gaining dominance, offering consumers access to a vast array of niche and international brands, supported by detailed product information and user reviews, though professional channels (salons and dermatology clinics) remain vital for premium, high-efficacy offerings and specialized treatments.

AI Impact Analysis on Scalp Care Solution Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Scalp Care Solution Market predominantly revolve around personalization, diagnosis accuracy, and product innovation speed. Common questions center on how AI-powered devices can analyze individual scalp microbiomes and oil production rates, whether AI can accurately predict the most effective combination of ingredients for unique customer needs, and the role of machine learning in discovering novel botanical extracts or synthesized compounds. These concerns highlight a strong consumer expectation for hyper-personalized, results-driven solutions that move beyond generic product recommendations, pushing manufacturers to leverage data analytics to connect specific scalp conditions with optimal ingredient performance metrics, ultimately accelerating the development cycle from concept to consumer availability while minimizing clinical trial costs.

- AI-Driven Diagnostics: Utilizing machine learning algorithms on high-resolution images or genetic data to accurately identify and classify complex scalp disorders (e.g., specific types of alopecia or dermatitis).

- Personalized Formulation: AI models analyze consumer data (lifestyle, environment, DNA, current symptoms) to generate unique, customized product formulations manufactured on-demand.

- Supply Chain Optimization: Predictive analytics forecasts ingredient sourcing needs and optimizes logistics for temperature-sensitive natural extracts, ensuring freshness and reducing waste.

- Consumer Engagement and Recommendation Engines: Chatbots and virtual assistants provide real-time, expert-level consultation on scalp health and recommend suitable product regimens based on user input and tracked results.

- Novel Ingredient Discovery: Machine learning accelerates the screening of millions of molecules or botanical extracts to identify compounds with high potential for addressing inflammation, hair growth stimulation, or microbial balance.

- Manufacturing Automation: Robotics and AI integration streamline the production of customized batches, enabling economical micro-manufacturing required for personalization.

DRO & Impact Forces Of Scalp Care Solution Market

The dynamics of the Scalp Care Solution Market are profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, resulting in significant directional forces shaping its trajectory. The primary driver is the pervasive consumer shift toward wellness and holistic beauty, recognizing that skin health extends beyond the face to the entire body, coupled with rising environmental stresses (pollution, hard water exposure) that directly compromise scalp integrity. Restraints often include the perception of high cost associated with clinical-grade or custom solutions, along with the challenge of consumer adherence to multi-step, long-term treatment protocols, which can be perceived as time-consuming. Opportunities lie in leveraging technological advancements, such as integrating prebiotics and postbiotics for microbiome balancing, and expanding penetration into untapped demographic segments, particularly the male grooming sector and consumers seeking chemical-free, sustainable solutions.

Driving forces center around innovation in delivery systems—moving away from heavy, pore-clogging formulations towards lighter, highly penetrative serums and ampoules that offer immediate relief and visible results. The increasing prevalence of chronic dermatological conditions related to the scalp, such as psoriasis and persistent flaking, necessitates continuous product development. Furthermore, extensive media coverage and influencer marketing campaigns focused on scalp detoxification and micro-needling treatments for hair restoration have normalized and accelerated the adoption of specialized solutions.

Conversely, restraining forces include the intense competitive pressure resulting in pricing volatility and saturation in basic product categories (like standard anti-dandruff shampoos). Regulatory scrutiny over therapeutic claims, particularly in regions like the European Union and the US, compels companies to invest heavily in clinical validation, raising development costs. The most significant impact force on the market is the sustained consumer demand for transparency and efficacy, driving manufacturers to adopt sophisticated ingredient tracing technologies and verifiable clinical data, thereby elevating the overall quality standards across the entire product spectrum.

Segmentation Analysis

The Scalp Care Solution Market is segmented across several critical parameters including product type, application, formulation, and distribution channel, providing a clear framework for analyzing market dynamics and targeting specific consumer needs. This detailed segmentation reflects the diversity of scalp health issues and the various formats through which treatments are delivered. The distinction between segments is becoming increasingly blurred as hybrid products, such as medicated shampoos with cosmetic benefits, gain popularity. Understanding these segments is crucial for market participants to tailor their innovation pipeline and strategic marketing efforts, ensuring relevance in a rapidly evolving cosmetic and therapeutic space.

- By Product Type:

- Shampoos and Cleansers (Medicated, Detoxifying, Balancing)

- Conditioners and Rinses (Scalp-focused moisturizers)

- Serums, Tonics, and Leave-On Treatments (High-concentration actives)

- Masks and Peels (Exfoliating and deep conditioning)

- Oils and Essential Blends (Nourishing and soothing)

- By Application:

- Anti-Dandruff and Anti-Fungal Treatments

- Hair Loss and Hair Thinning Management

- Scalp Detoxification and Clarifying

- Dry and Itchy Scalp Relief

- Oil Control and Sebum Regulation

- By Formulation:

- Chemical/Synthetic Based

- Natural and Organic (Clean Label)

- Biotechnology-Based (Probiotics, Stem Cells)

- By Distribution Channel:

- Professional Channels (Salons, Clinics, Spas)

- Retail Channels (Supermarkets, Drug Stores, Specialty Stores)

- E-commerce and Online Retail

Value Chain Analysis For Scalp Care Solution Market

The value chain for the Scalp Care Solution Market begins with upstream activities heavily focused on specialized ingredient sourcing and research and development, particularly for patented biotechnology components and sustainably harvested natural extracts. Key upstream players include specialized chemical manufacturers and botanical extract suppliers who must meet stringent purity and ethical sourcing standards. The high barrier to entry at this stage is maintained by intellectual property surrounding novel molecules designed for targeted scalp treatment, such as peptides or advanced microbial balancing agents. Effective collaboration between research institutions and ingredient suppliers is paramount to ensuring consistent supply of high-efficacy raw materials.

Midstream processes involve formulation and manufacturing, where blending, stability testing, and packaging occur. This stage is dominated by major cosmetic houses and specialized contract manufacturers who possess the necessary expertise for handling complex, sensitive ingredients (like active botanicals or growth factors) and adhering to Good Manufacturing Practices (GMP). Quality control is critical at this stage, particularly for products making cosmeceutical claims. The cost structure here is heavily influenced by energy consumption and compliance with increasingly eco-friendly packaging requirements.

Downstream activities center on distribution, sales, and marketing. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves professional channels (dermatology clinics, upscale salons) where products require expert application or consultation, often commanding premium prices. Indirect distribution, encompassing mass retail and the burgeoning e-commerce platforms, focuses on volume sales and accessibility. E-commerce platforms excel in providing detailed product knowledge and customer reviews, acting as a crucial touchpoint for consumer education and brand building, circumventing traditional intermediaries and providing niche brands immediate global reach.

Scalp Care Solution Market Potential Customers

The potential customer base for the Scalp Care Solution Market is highly fragmented and segmented by specific dermatological needs and wellness goals, extending far beyond the traditional demographic for hair care. The end-users or buyers primarily include individuals experiencing chronic scalp disorders such as persistent dandruff, seborrheic dermatitis, and scalp psoriasis, who seek clinically proven therapeutic relief. A substantial and growing segment consists of middle-aged and older adults concerned with androgenetic alopecia (hair loss) and the general thinning of hair associated with aging, driving demand for growth-stimulating serums and densifying treatments.

Moreover, the market is increasingly appealing to younger consumers focused on preventative care and holistic beauty routines. This group often seeks detoxifying and balancing products to combat the effects of environmental pollution, product buildup, and stress-related inflammation. High-income consumers demonstrate a strong preference for bespoke solutions derived from DNA analysis or personalized consultations, willing to pay a premium for formulations that integrate high-end, rare ingredients or advanced biotechnology components like stem cell culture media or specialized probiotics tailored to individual microbiome needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 billion |

| Market Forecast in 2033 | USD 20.5 billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (P&G), L'Oréal S.A., Unilever, The Estée Lauder Companies Inc., Shiseido Company, Limited, Kao Corporation, Henkel AG & Co. KGaA, Johnson & Johnson, Beiersdorf AG, Natura &Co Holding S.A., Church & Dwight Co., Inc., Amorepacific Corporation, Kérastase (L'Oréal), Living Proof, Aveda (The Estée Lauder Companies), Briogeo Hair Care, Oribe Hair Care, Philip Kingsley. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scalp Care Solution Market Key Technology Landscape

The technology landscape within the Scalp Care Solution Market is characterized by intense innovation centered on enhancing ingredient efficacy, optimizing delivery systems, and facilitating personalized consumer experiences. A significant technological advancement involves the integration of microbiome science, utilizing prebiotics, probiotics, and postbiotics to restore the natural balance of microorganisms on the scalp, effectively addressing inflammatory conditions like dandruff and itching at their root cause rather than merely treating symptoms. This approach leverages biotechnology to create symbiotic environments conducive to healthy hair growth and reduced sensitivity, representing a major leap forward from traditional fungicidal treatments.

Furthermore, microencapsulation and liposomal delivery systems are widely adopted to protect active ingredients, such as vitamins, peptides, and fragile botanical extracts, ensuring their stability and maximizing their penetration depth into the stratum corneum and hair follicles. These advanced delivery methods allow for sustained release of actives over time, improving product performance and requiring less frequent application. Parallel to formulation technology, sophisticated diagnostic tools are becoming pervasive; these include handheld trichoscopes and smartphone applications integrated with AI that analyze scalp condition (e.g., density, irritation levels, sebum production) using high-definition imagery and data processing.

The manufacturing process is also benefiting from technological disruption, particularly through the implementation of customized compounding machinery. This allows companies to create individualized products based on specific customer diagnostic data, leveraging proprietary algorithms. Cleanroom technologies and rigorous purity testing using advanced chromatographic techniques are essential to ensure the safety and regulatory compliance of highly sensitive cosmeceutical formulations, particularly those utilizing stem cell derivatives or synthesized growth factors designed for regenerative scalp treatments.

Regional Highlights

Regional dynamics heavily influence the product mix, distribution preferences, and growth trajectories of the Scalp Care Solution Market, driven by cultural beauty standards, climate, and economic maturity. North America, encompassing the United States and Canada, represents a mature market characterized by high consumer spending on specialized anti-hair loss treatments and clinical-grade therapeutic solutions. The region benefits from strong brand presence from major pharmaceutical and cosmetic conglomerates, alongside a thriving segment of indie brands focused on natural and clean formulations. Demand here is strongly influenced by social media trends and clinical endorsements, leading to high adoption rates of advanced treatments like scalp micro-needling accessories and high-frequency devices for home use.

Europe, driven by the UK, Germany, and France, maintains a robust market share, emphasizing sustainability, dermatological validation, and stringent quality control. European consumers prioritize products with certified organic ingredients and proven anti-inflammatory properties, often linking scalp care to overall mental well-being. The regulatory framework, particularly the EU Cosmetics Regulation, significantly shapes ingredient usage and labeling claims. There is a notable preference for sophisticated salon-exclusive brands and specialized pharmacies for therapeutic purchases.

Asia Pacific (APAC) is recognized as the engine of growth, propelled by the highly intricate and preventative beauty routines prevalent in South Korea, Japan, and China. APAC consumers, especially in metropolitan areas, are proactive in addressing scalp aging, pollution effects, and oxidative stress, driving immense demand for detoxifying masks, scalp essences, and specialized anti-aging treatments. Rising disposable incomes and increasing beauty consciousness in populous markets like India and Southeast Asia further contribute to rapid market expansion, often adopting novel ingredients inspired by Traditional Chinese Medicine (TCM) or Ayurvedic principles blended with modern biotechnology.

Latin America (LATAM) shows a steady growth trajectory, with Brazil and Mexico leading consumption. Market demand is driven by the desire for products addressing oiliness and heat damage, stemming from the tropical climate. Consumers show high loyalty to local brands that incorporate regional botanical ingredients known for soothing and nourishing properties. Price sensitivity remains a factor, balancing the preference for therapeutic efficacy with affordability across mass market channels.

The Middle East and Africa (MEA) market is emerging, characterized by increasing urbanization, exposure to harsh climatic conditions (intense heat and dryness), and a growing awareness of hair and scalp health. High-net-worth individuals in the GCC countries drive demand for ultra-premium, luxury scalp treatments, often imported from Europe and North America. The region's growth is accelerating due to the expansion of organized retail and an influx of international cosmetic brands addressing specific issues like dehydration and sun damage.

- North America: Focus on clinical efficacy, anti-hair loss solutions, and demand for sophisticated DIY devices for home use; high adoption of clean beauty standards.

- Europe: Strong emphasis on sustainability, dermatological testing, natural ingredients, and professional salon distribution channels; stringent regulatory environment.

- Asia Pacific (APAC): Highest growth potential driven by preventative care culture, demand for detoxifying and anti-aging essences, and quick adoption of innovative Korean and Japanese beauty trends.

- Latin America (LATAM): Growth driven by products countering environmental damage (oiliness, humidity), high brand loyalty, and reliance on local, natural ingredient sourcing.

- Middle East and Africa (MEA): Emerging market, characterized by premiumization in GCC nations and demand for solutions addressing extreme dryness and heat damage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scalp Care Solution Market.- Procter & Gamble (P&G)

- L'Oréal S.A.

- Unilever

- The Estée Lauder Companies Inc.

- Shiseido Company, Limited

- Kao Corporation

- Henkel AG & Co. KGaA

- Johnson & Johnson

- Beiersdorf AG

- Natura &Co Holding S.A.

- Church & Dwight Co., Inc.

- Amorepacific Corporation

- Wella Company

- Kérastase (L'Oréal)

- Living Proof (Unilever)

- Aveda (The Estée Lauder Companies)

- Briogeo Hair Care

- Oribe Hair Care

- Philip Kingsley

- The Ordinary (Deciem/Estée Lauder)

Frequently Asked Questions

Analyze common user questions about the Scalp Care Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the specialized Scalp Care Solution Market?

The market growth is primarily driven by heightened consumer awareness regarding the link between scalp health and overall hair quality, increasing exposure to environmental pollutants, and the rising global prevalence of stress-related scalp conditions such as alopecia and seborrheic dermatitis.

Which segment is expected to show the highest growth rate by application?

The Hair Loss and Hair Thinning Management segment is projected to exhibit the highest growth rate. This acceleration is fueled by the aging global population and continuous technological advancements in effective, non-invasive treatments like peptide-based serums and proprietary botanical complexes.

How is AI impacting the personalization of scalp care products?

AI is crucial for personalization, enabling companies to analyze user data (microbiome scans, lifestyle factors) via digital diagnostics to create hyper-customized product formulations on demand, significantly enhancing efficacy and consumer satisfaction over generic solutions.

What are the primary challenges restraining market expansion?

Key challenges include the high cost associated with advanced cosmeceutical formulations, which limits mass adoption, and regulatory complexities concerning the substantiation of clinical efficacy and therapeutic claims for novel biotechnology-derived ingredients.

Is the demand for natural and organic scalp care formulations increasing?

Yes, the demand for natural and organic formulations is substantially increasing globally, driven by the clean beauty movement and consumer preference for products free from sulfates, parabens, and harsh chemicals, focusing instead on plant-derived and sustainably sourced active ingredients.

What is the significance of the scalp microbiome in product development?

The scalp microbiome is highly significant; new product development focuses on prebiotics and probiotics to modulate the microbial balance, reducing inflammation and addressing conditions like dandruff and itching at the root level, moving beyond surface-level cleaning.

Which distribution channel dominates the sales of specialized scalp treatments?

While retail remains strong for mass market products, the e-commerce and online retail channel is rapidly gaining dominance for specialized treatments, offering a wider variety of niche international brands and necessary educational content directly to consumers.

Are specialized scalp devices contributing to market growth?

Yes, the integration of specialized scalp devices, such as high-frequency brushes, laser caps, and micro-needling rollers for home use, is significantly contributing to market growth by bringing professional-grade treatments into the consumer setting and enhancing product absorption.

How do environmental factors influence the need for scalp solutions?

Environmental factors like air pollution, UV exposure, and hard water minerals cause oxidative stress and buildup on the scalp, necessitating the use of detoxifying and protective scalp solutions to prevent follicle damage and premature aging of the skin barrier.

What role do peptides play in modern scalp care formulations?

Peptides play a vital role, particularly in anti-hair loss segments, as they act as signaling molecules to encourage collagen production, stimulate hair follicle activity, and anchor the hair shaft more firmly, promoting density and reducing shedding.

How is the APAC region setting trends in scalp care?

APAC is setting trends by emphasizing preventative care, often incorporating multi-step routines (essences, toners, serums) and leveraging traditional ingredients alongside high-tech fermentation and biotechnology for advanced anti-aging and moisturizing benefits.

What are cosmeceuticals in the context of scalp care?

Cosmeceuticals are products that contain biologically active ingredients and are intended to have medicinal or drug-like benefits. In scalp care, this refers to specialized solutions containing proven concentrations of ingredients like minoxidil or powerful natural anti-inflammatories.

Is stress a significant factor driving consumer purchasing?

Stress is a major factor. Consumers are increasingly seeking products that address stress-related hair and scalp issues, such as telogen effluvium (temporary hair loss) and stress-induced inflammation, driving demand for soothing and fortifying treatments.

How are manufacturers ensuring transparency in ingredients?

Manufacturers are ensuring transparency by using blockchain technology for ingredient sourcing verification, obtaining recognized certifications (e.g., COSMOS Organic), and providing clear, detailed labeling regarding the concentration and origin of active components.

What is the outlook for the scalp care professional services market?

The professional services market (salons, trichology clinics) maintains a positive outlook, particularly for high-end, intensive treatments and personalized consultation services that utilize advanced diagnostic equipment unavailable to the general consumer.

Why is detoxification a growing application area?

Detoxification is growing because modern lifestyles lead to significant product buildup, environmental residue, and hard water mineral accumulation on the scalp, necessitating specialized clarifying and exfoliating treatments to maintain follicular health and optimize hair growth.

What is the primary difference between a scalp tonic and a serum?

A scalp tonic is generally lighter and watery, often used for refreshment and minor stimulation, while a scalp serum is typically thicker, containing higher concentrations of potent active ingredients for targeted treatment of issues like hair loss or severe inflammation.

How do temperature and climate affect regional market demands?

Temperature and climate dictate regional demands; hot, humid regions require sebum-regulating and anti-fungal solutions, while cold, dry climates drive demand for intensely moisturizing and barrier-repairing products to combat flakiness and dryness.

What innovations are seen in anti-dandruff solutions?

Innovations are moving beyond traditional zinc pyrithione to focus on microbiome-balancing ingredients, such as specific prebiotics and fermented yeast extracts, which treat the root cause of Malassezia overgrowth without harshly stripping the scalp's natural oils.

Are male consumers significantly contributing to market expansion?

Yes, male consumers represent a high-growth demographic, primarily driven by concerns over pattern baldness and thinning hair, leading to increased investment in specialized, high-efficacy leave-on treatments, often marketed distinctly within the male grooming sector.

What role does sustainability play in product development?

Sustainability is paramount, driving a preference for waterless or low-water formulations, refillable packaging, ethically sourced natural ingredients, and minimizing the environmental impact throughout the product lifecycle, influencing consumer choice significantly.

How is the trend of 'skinification of hair' influencing this market?

The 'skinification of hair' trend treats the scalp as an extension of facial skin, utilizing advanced skincare ingredients such as hyaluronic acid, niacinamide, and chemical exfoliants (AHAs/BHAs) in scalp products to address hydration, barrier function, and cellular turnover.

Which ingredient type is preferred in emerging market formulations?

In many emerging markets, there is a strong preference for efficacious, locally sourced botanical extracts and essential oils combined with functional active ingredients, balancing traditional remedies with modern scientific validation for reliable results.

Are medicated products dominating the therapeutic segment?

Medicated products maintain dominance in addressing severe chronic conditions; however, the segment is increasingly challenged by sophisticated cosmeceuticals that offer therapeutic-level efficacy without pharmaceutical status, appealing to preventative users.

What is the long-term outlook for the hair density enhancement segment?

The long-term outlook for the hair density enhancement segment is exceptionally strong, supported by continuous breakthroughs in stem cell research, advanced peptide technology, and rising consumer willingness to invest in solutions that deliver measurable hair growth results.

How are drug stores competing with specialty retailers in distribution?

Drug stores are competing by enhancing their specialized sections, offering premium, often clinically endorsed brands previously exclusive to specialty retailers, and leveraging pharmacist recommendations to establish trust and credibility for therapeutic purchases.

What impact is remote consultation having on the market?

Remote consultation, facilitated by telemedicine and AI diagnostics, is increasing accessibility to expert advice, allowing consumers globally to receive personalized product recommendations and follow-up care without requiring in-person visits to dermatologists or trichologists.

Are consumers more loyal to brands or specific ingredients in this sector?

Consumer loyalty in the scalp care sector is increasingly shifting from brand names to specific, clinically validated active ingredients (e.g., Minoxidil, specific peptides, patented biotech complexes) known for delivering targeted and reliable results.

Why is the focus on scalp anti-aging accelerating?

The focus on scalp anti-aging is accelerating because consumers recognize that the scalp skin ages faster than the facial skin, leading to weakened follicles and hair thinning. Products now incorporate antioxidants and UV protectants to mitigate environmental aging factors.

What defines a clean label scalp care solution?

A clean label solution is defined by transparency and the exclusion of controversial ingredients like sulfates (SLS/SLES), phthalates, parabens, synthetic fragrances, and certain silicones, prioritizing non-toxic, generally recognizable ingredients.

How are professional channels adapting to e-commerce competition?

Professional channels are adapting by offering highly exclusive product lines unavailable online, integrating advanced in-clinic treatments with tailored take-home regimens, and positioning themselves as essential diagnostic and expertise providers.

What role do essential oils play beyond fragrance?

Essential oils play a key role beyond fragrance, providing therapeutic benefits such as tea tree oil for anti-fungal properties, peppermint oil for stimulating blood circulation, and lavender for soothing inflammatory responses on the scalp.

What is the significance of the base year 2025 in the forecast?

The base year 2025 represents the latest comprehensive data point reflecting post-pandemic normalization, current inflationary pressures, and the full market adoption of major technological shifts, such as widespread AI integration in diagnostics and sustainability mandates.

How are new entrants disrupting the established market?

New entrants are disrupting the market by focusing heavily on niche, highly specialized problems (e.g., scalp eczema), leveraging direct-to-consumer (D2C) models, and maintaining radical transparency regarding ingredient sourcing and clinical validation, appealing to highly informed consumers.

What is the future outlook for sustainable packaging in this market?

The future outlook is dominated by sustainable packaging mandates, including the shift towards PCR (post-consumer recycled) plastics, glass, aluminum, and fully compostable materials, driven both by consumer demand and tightening environmental regulations across key regions.

Why are leave-on treatments gaining popularity over wash-off products?

Leave-on treatments (serums, tonics) are gaining popularity because they allow active ingredients sufficient contact time with the scalp to maximize absorption and therapeutic efficacy, delivering superior results compared to brief exposure from wash-off products.

How does lifestyle influence consumer choice in scalp care?

Lifestyle choices, including diet, exercise, stress levels, and location (urban vs. rural), heavily influence consumer choices, leading to demand for specific products tailored to combat effects like stress-induced inflammation or pollution-related buildup.

What are the key patent trends in scalp care technology?

Key patent trends focus on novel delivery systems (micro- and nano-encapsulation), proprietary blends of peptides and growth factors for hair growth, and innovative uses of microbiome-modulating ingredients (probiotics and prebiotics).

Is there a noticeable trend toward combining scalp treatments with hair coloring services?

Yes, salons are increasingly integrating specialized scalp protection and restorative treatments immediately before and after chemical services (like coloring or perming) to mitigate irritation and maintain scalp integrity, promoting healthier overall results.

What factors contribute to the market's high growth CAGR?

The high CAGR of 8.5% is attributable to the premiumization of products, expansion in high-growth APAC markets, consistent innovation in biotechnology ingredients, and the successful shift of consumer spending from general hair care to targeted scalp health solutions.

How important is clinical validation for market success?

Clinical validation is extremely important for market success, particularly for premium and therapeutic products, as consumers rely heavily on proven efficacy and peer-reviewed data to justify the higher investment, driving trust and brand credibility.

Which sub-segment of Formulation is growing fastest?

The Biotechnology-Based Formulation sub-segment, including products utilizing engineered proteins, exosomes, and advanced microbiome solutions, is growing the fastest due to their high efficacy potential and strong scientific backing.

How do regulatory standards in different regions affect product launches?

Regulatory standards significantly impact product launches; for instance, strict definitions of "cosmetic" versus "drug" in the US (FDA) and EU compel manufacturers to tailor formulations and claims specifically for each region, often slowing global rollout strategies.

What is the role of digital imaging in modern scalp analysis?

Digital imaging, using tools like high-magnification trichoscopes, allows for non-invasive, precise analysis of scalp surface texture, follicle health, and micro-inflammation, forming the essential first step in creating truly personalized treatment plans.

Are consumers willing to pay a premium for personalized products?

Yes, high-income consumers are increasingly willing to pay a substantial premium for products that utilize personalized diagnostics, viewing these tailored solutions as a necessary investment offering significantly higher chances of achieving desired health outcomes.

How is the concept of 'scalp aging' being marketed?

Scalp aging is marketed through products containing anti-oxidants, UV filters, and DNA repair enzymes, positioning them as preventative measures against thinning, graying, and loss of hair quality caused by chronological and environmental stressors.

What is driving the demand for scalp peels and masks?

The demand for scalp peels and masks is driven by the 'self-care' ritual trend and the need for deeper cleansing and exfoliation, particularly among urban populations experiencing heavy pollution and product buildup that simple shampoos cannot adequately address.

How is the competitive landscape characterized?

The competitive landscape is highly fragmented, featuring dominance by large multinational corporations (P&G, L'Oréal) in mass markets, alongside rapid growth and innovation from smaller, agile, science-focused indie brands in the premium and niche therapeutic segments.

What are the primary challenges in formulating natural scalp solutions?

The primary challenges involve ensuring the stability and preservation of highly sensitive natural and organic ingredients, maintaining adequate shelf life without harsh chemical preservatives, and guaranteeing consistent efficacy across batches.

Is the market leaning towards preventative or remedial solutions?

The market is rapidly shifting toward preventative solutions, especially among younger demographics in established markets, who adopt routines aimed at maintaining microbiome health and preventing inflammation before severe issues manifest, though remedial solutions for existing chronic issues remain essential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager