Scandium Oxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435421 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Scandium Oxide Market Size

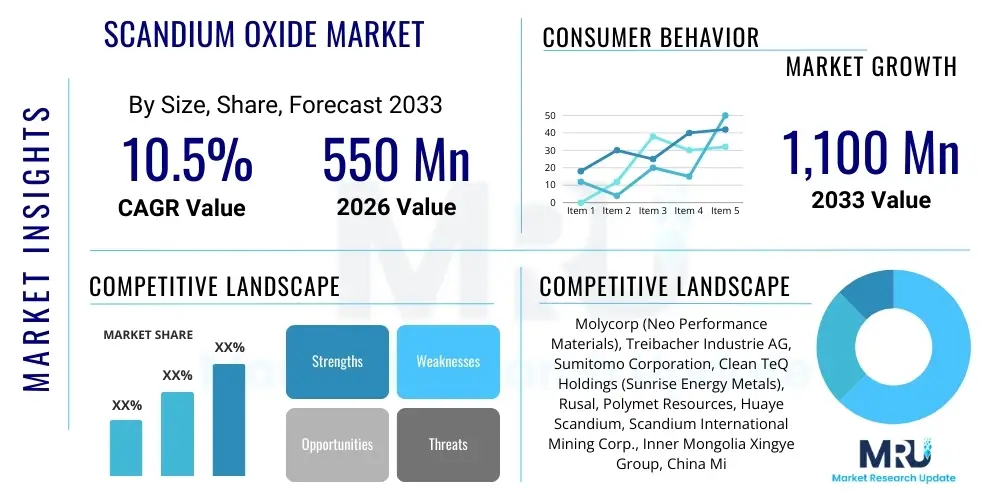

The Scandium Oxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $550 Million USD in 2026 and is projected to reach $1,100 Million USD by the end of the forecast period in 2033.

Scandium Oxide Market introduction

Scandium Oxide (Sc2O3), a rare earth element compound, is increasingly recognized as a critical material due to its unique thermal, mechanical, and electrical properties, enabling significant performance enhancements across several high-technology sectors. Primarily obtained as a byproduct of processing other rare earth minerals, its global supply remains constrained, contributing to its high price point and the intense focus on developing new extraction and recycling methodologies. The compound is characterized by its high melting point, excellent dielectric constant, and low density when alloyed with aluminum, making it indispensable in applications demanding superior strength-to-weight ratios and thermal stability. The market expansion is intricately linked to global investments in renewable energy infrastructure, advanced defense systems, and next-generation consumer electronics, where miniaturization and efficiency are paramount design objectives.

The product description centers on its chemical stability and functional advantages. Scandium Oxide serves as a precursor material for producing high-purity scandium metal and various specialty compounds. Major applications include solid oxide fuel cells (SOFCs), where scandia-stabilized zirconia (SSZ) significantly improves ionic conductivity and operational longevity. In the aerospace and automotive industries, the integration of Scandium-Aluminum (Sc-Al) alloys provides unmatched structural integrity and weight reduction, directly translating into improved fuel efficiency and payload capacity. Furthermore, its use in high-intensity discharge (HID) lamps, specifically metal-halide lamps, ensures superior color rendering and brightness, although this application area is undergoing a gradual transition due to the penetration of LED technologies.

Key benefits driving market adoption include enhanced performance in critical components, such as increased efficiency and reduced operating temperatures in SOFCs, and superior material strength for structural applications. Driving factors are predominantly technological advancements, including the push toward lighter, more fuel-efficient aircraft, the necessity for robust and efficient energy conversion devices (SOFCs), and increasing governmental emphasis on secure, diversified rare earth supply chains. However, the high cost and scarcity of primary scandium sources remain significant barriers, necessitating innovative solutions in secondary recovery and material substitution research. The market trajectory is fundamentally positive, underpinned by sustained demand from energy and high-performance alloy sectors.

Scandium Oxide Market Executive Summary

The global Scandium Oxide market is characterized by constrained supply, high value addition, and concentrated downstream demand, leading to distinct business trends focused on vertical integration and supply security. Key business trends involve mining companies actively seeking economically viable secondary sources, particularly from residues of titanium, tungsten, and rare earth processing, to alleviate supply volatility. Furthermore, collaborative partnerships between primary producers, alloy manufacturers, and end-users (especially in the defense and aerospace sectors) are vital for long-term procurement agreements and specialized product development. The competitive landscape is currently fragmented yet dominated by a few major players specializing in high-purity refining, with increasing investment directed towards sustainable and localized supply chain establishment in North America and Europe to reduce reliance on traditional Asian sources.

Regional trends indicate that Asia Pacific (APAC), particularly China, maintains dominance in production capacity and raw material sourcing, though consumption is rapidly accelerating in North America and Europe due to robust aerospace manufacturing and SOFC implementation initiatives. North America is emerging as a critical growth region, driven by governmental funding into lightweight military alloys and domestic rare earth independence projects. Europe’s market growth is heavily influenced by green energy policies, specifically the adoption of highly efficient SOFC technology for distributed power generation and stationary applications, necessitating stable, high-quality Scandium Oxide supply. The establishment of robust recycling infrastructure remains a shared regional priority to mitigate resource depletion risk.

Segmentation trends highlight the increasing purity requirements across various end-use segments. High-purity grades (99.99% and above) command significant price premiums and are essential for advanced electronics and solid oxide fuel cells, driving revenue growth. By application, the Aluminum-Scandium (Al-Sc) alloys segment is poised for the fastest expansion, fueled by burgeoning commercial aerospace orders and the integration of these materials into structural components where weight reduction is critical. Conversely, while SOFCs represent a smaller volume segment, their high value density and long-term utility in the energy transition contribute significantly to market revenue. Investment in technological optimization focuses heavily on enhancing the efficiency of SSZ electrolytes and streamlining the metal alloying process.

AI Impact Analysis on Scandium Oxide Market

User queries regarding AI's influence on the Scandium Oxide market frequently revolve around how artificial intelligence can stabilize volatile supply chains, optimize costly extraction processes, and accelerate materials discovery for potential substitutes or enhanced alloys. Key themes emerging from these questions include the application of machine learning (ML) in predictive mineralogy to identify new commercially viable secondary sources of scandium, the use of AI-driven process control systems to minimize energy consumption and maximize yield during complex refining operations, and the role of computational chemistry and generative design in developing novel scandium-containing alloys tailored for specific high-performance applications in aviation and defense. Users are keen to understand if AI can effectively counter the inherent supply scarcity and high cost that currently restricts broader market adoption of scandium technology.

AI and ML algorithms are beginning to play a transformative role in upstream mining and processing by providing enhanced capabilities for geological data interpretation, allowing producers to accurately model mineral distribution and concentration within complex ores and waste streams. This capability is particularly crucial for scandium, which is typically present in trace amounts in materials like bauxite or titanium residues. By simulating various extraction parameters, AI minimizes empirical experimentation, thereby reducing operational costs and environmental impact associated with chemical processing. Furthermore, in quality control, computer vision systems combined with ML models can ensure consistent high purity, a critical factor for electronics and SOFC applications, flagging inconsistencies in real-time during the refining stage.

In downstream applications, particularly in the material science domain, AI-driven computational methods are accelerating the design cycle for advanced Al-Sc alloys. Generative AI assists material scientists in predicting the performance characteristics (strength, fatigue life, corrosion resistance) of hundreds of alloy formulations before physical synthesis is attempted, drastically reducing R&D timelines and associated costs. This capability allows manufacturers to quickly tailor materials for specialized needs, such as ultra-lightweight components for electric vertical take-off and landing (eVTOL) aircraft or extreme temperature tolerance components for advanced energy systems, thus driving increased, customized demand for Scandium Oxide as the key alloying agent.

- AI-driven Predictive Mineralogy: Optimizes exploration and identification of high-yield secondary scandium resources, improving supply resilience.

- Machine Learning in Refining: Enhances process control systems to maximize extraction yield and purity (e.g., 99.999%), minimizing chemical waste and energy footprint.

- Generative Design for Alloys: Accelerates the discovery and optimization of new Scandium-Aluminum alloys with superior mechanical properties for aerospace applications.

- Supply Chain Forecasting: Utilizes advanced ML models to predict demand fluctuations and potential supply bottlenecks, aiding strategic inventory management.

- Automated Quality Control: Deploys computer vision and AI for real-time purity verification during production, ensuring specifications are met for high-end uses like SOFCs.

- Computational Chemistry: Simulates the performance of scandia-stabilized zirconia (SSZ) in SOFC environments, leading to more durable and efficient energy storage solutions.

DRO & Impact Forces Of Scandium Oxide Market

The Scandium Oxide market dynamics are governed by a unique interplay of powerful drivers rooted in technological necessity, significant restraints primarily concerning supply scarcity and cost, and compelling opportunities derived from innovative application growth. The primary drivers revolve around the indispensable material performance advantages offered by scandium, particularly in aerospace and SOFCs, which cannot be easily replicated by substitutes without performance degradation. Conversely, the market’s inherent structure, where scandium is a byproduct of other processes (such as titanium or uranium mining), introduces extreme supply inelasticity and vulnerability to geopolitical instability or shifts in primary commodity markets, forming the core restraints. Opportunities lie squarely in establishing closed-loop recycling processes and exploring deep-sea or unconventional mineral deposits, coupled with the exponential growth trajectory of advanced energy storage and transportation sectors.

Impact forces on the market are significantly driven by regulatory pressure and global energy transition mandates. Environmental regulations demanding higher fuel efficiency in aviation directly boost demand for Al-Sc alloys, acting as a strong positive force. Concurrently, government-led initiatives supporting clean energy adoption worldwide create a consistent demand base for SOFCs, solidifying scandium oxide’s role as a key enabler in high-efficiency power generation. However, the high capital expenditure required for establishing specialized scandium extraction and refining facilities acts as a frictional force, limiting new market entrants and concentrating supply control. The impact of rapid technological obsolescence in related industries, such as the gradual phasing out of metal-halide lamps, also necessitates continuous application diversification.

Strategic responses to these forces define market success. Companies are investing heavily in geopolitical diversification of supply chains, moving away from single-source reliance, and entering into long-term strategic partnerships to stabilize pricing and availability. The high unit value of Scandium Oxide allows for substantial investment in recovery technology, making recycling economically feasible compared to other rare earths. This focus on secondary sourcing is a critical opportunity that, if successfully scaled, promises to mitigate the impact of primary supply restraints, stabilize pricing, and pave the way for broader industrial adoption, ultimately allowing the market to capitalize fully on the powerful demand drivers from the aerospace and fuel cell sectors.

Segmentation Analysis

The Scandium Oxide market is primarily segmented based on Purity Grade, Application, and End-Use Industry, reflecting the varied quality requirements and functional roles of the compound across different sectors. Purity levels are critical, as electronic and fuel cell applications demand ultra-high purity (99.999% or 5N), which directly influences pricing and production complexity. The major application segmentation highlights the material's two dominant roles: alloying material (Al-Sc alloys) and electrolyte stabilization (SSZ in SOFCs), which possess fundamentally different market growth characteristics and supply chain requirements. This segmentation aids stakeholders in prioritizing investment, capacity expansion, and technological focus based on the most lucrative and fastest-growing segments, particularly those driven by stringent performance specifications in aerospace and defense.

- By Purity Grade:

- 99.9% (3N)

- 99.99% (4N)

- 99.999% (5N) and Above (Ultra-high Purity)

- By Application:

- Aluminum-Scandium Alloys (Aerospace Structures, Sports Equipment, Automotive Components)

- Solid Oxide Fuel Cells (SOFCs) (Electrolytes and Cathodes, primarily using Scandia-Stabilized Zirconia (SSZ))

- High-Intensity Discharge (HID) Lamps (Metal-halide Lamp Additives)

- Electronics (High-K Dielectrics, Semiconductors, Sputtering Targets)

- Lasers and Optics (Crystal Growth)

- By End-Use Industry:

- Aerospace and Defense

- Energy and Power Generation (Fuel Cells)

- Automotive and Transportation

- Electronics and Semiconductors

- Lighting

Value Chain Analysis For Scandium Oxide Market

The Scandium Oxide value chain is complex and highly specialized, beginning with upstream analysis focused on the extraction of scandium as a trace element. Upstream activities involve the sourcing of primary raw materials, which are typically residues or tailings from bauxite refining (aluminum production), titanium processing, tungsten mining, or rare earth element separation. Unlike bulk commodities, scandium requires highly selective and intensive processing steps, often involving solvent extraction and ion exchange techniques, to separate and purify the low concentrations of Sc2O3 from the complex matrix of the source material. A key challenge upstream is securing reliable, consistent feedstock, as the viability of scandium production is entirely dependent on the operational efficiency and output of the primary commodity process.

The midstream focuses on the refining and purification of raw scandium concentrate into high-purity Scandium Oxide, which is then processed further into specialized forms such as SSZ powder or used as a precursor for metallic scandium. The distribution channel is relatively narrow, typically involving specialized chemical distributors or direct sales to large, strategic downstream users like alloy manufacturers (e.g., master alloy producers) and major SOFC component fabricators. Direct distribution is common for high-value, customized orders where stringent purity and technical specifications necessitate close collaboration between the producer and the end-user. Indirect distribution often involves trading houses facilitating cross-border movement of standard purity grades.

Downstream analysis highlights the transformation of Scandium Oxide into end-use products. In the aerospace sector, this involves blending Sc2O3 with aluminum (or producing master alloys) to create lightweight, high-strength alloys utilized in airframe structures. In the energy sector, it involves sintering Scandium-stabilized Zirconia (SSZ) powder into solid-state electrolytes for high-performance fuel cells. The market structure downstream is characterized by high barriers to entry due to the specialized manufacturing equipment and precise technical knowledge required, ensuring strong negotiating power for high-ppurity material suppliers. The sustained expansion of the downstream segments is the primary determinant of long-term demand and price stability for Scandium Oxide.

Scandium Oxide Market Potential Customers

The primary customers for Scandium Oxide are technology-intensive manufacturers requiring advanced materials that deliver critical performance enhancements in areas like strength, weight, and energy efficiency. The most significant customer base resides within the aerospace and defense industry, specifically airframe component manufacturers (e.g., Boeing, Airbus suppliers) and military contractors who leverage the superior properties of Al-Sc alloys for structural integrity and weight savings in advanced fighters, missile systems, and commercial jets. The value proposition here is highly technical and tied directly to operational performance and fuel cost reduction, making price sensitivity secondary to material quality and guaranteed supply security.

Another major segment consists of specialized power generation equipment producers, particularly those involved in the manufacturing of Solid Oxide Fuel Cells (SOFCs). Companies specializing in stationary power generation, uninterruptible power supplies (UPS), and distributed energy solutions are core buyers of ultra-high purity Scandium Oxide, which is formulated into Scandia-Stabilized Zirconia (SSZ) to enhance the efficiency and longevity of the SOFC electrolyte layer. These customers require consistent purity and batch traceability to meet stringent regulatory and performance standards for long-duration energy applications, often necessitating long-term supply contracts.

Additionally, the market includes niche customers in the high-end consumer electronics sector and lighting industry. Electronics firms utilize high-K dielectrics derived from scandium for advanced semiconductor fabrication and specialized sputtering targets. While the lighting segment (metal-halide lamps) is contracting, the emerging applications in high-power lasers and advanced optics crystal growth represent high-value, albeit lower volume, opportunities. Future customer expansion is expected from the burgeoning electric vehicle and eVTOL sectors, which are intensely focused on lightweighting initiatives where Al-Sc alloys offer a distinct competitive advantage over conventional alloys.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million USD |

| Market Forecast in 2033 | $1,100 Million USD |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Molycorp (Neo Performance Materials), Treibacher Industrie AG, Sumitomo Corporation, Clean TeQ Holdings (Sunrise Energy Metals), Rusal, Polymet Resources, Huaye Scandium, Scandium International Mining Corp., Inner Mongolia Xingye Group, China Minmetals Rare Earth Co., Ltd., Materion Corporation, AMG Advanced Metallurgical Group, NioCorp Developments Ltd., Arafura Resources, Yunnan Liyuan, Ganzhou Rare Earth, Hunan Rare Earth, American Elements, Sibelco, Platina Resources Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scandium Oxide Market Key Technology Landscape

The technology landscape governing the Scandium Oxide market is primarily centered on advancements in extraction metallurgy, high-purity refining, and subsequent material integration methodologies crucial for end-use performance. Upstream, the focus is heavily on developing specialized solvent extraction and ion exchange resins capable of efficiently isolating trace amounts of scandium from complex, high-volume waste streams, such as red mud (bauxite residue) or spent refinery catalysts. Innovation in this area is directed towards continuous flow processes that minimize reagent consumption and increase throughput, essential for making secondary source recovery economically competitive with traditional rare earth processing. The adoption of pressure acid leaching (PAL) technologies coupled with sophisticated sensor systems for real-time process monitoring is becoming standard practice to enhance yield stability and reduce operational variables inherent in byproduct recovery.

Midstream technological sophistication is defined by ultra-purification techniques required to meet the 5N (99.999%) purity standard necessary for solid oxide fuel cells and advanced electronic dielectrics. Chemical vapor deposition (CVD) and physical vapor deposition (PVD) grade materials require exceptional thermal stability and low impurity profiles, driving the deployment of advanced calcination and plasma spray processing technologies. Furthermore, the commercialization of scandium requires efficient conversion from oxide to metallic form, often via molten salt electrolysis, where technological improvements focus on energy reduction and higher conversion efficiency, critical given the high energy intensity of the process.

Downstream, the technology landscape is dominated by alloying and material fabrication expertise. In the aerospace sector, techniques for creating homogeneous Al-Sc master alloys, often utilizing vacuum melting and rapid solidification, are paramount to ensuring optimal distribution of scandium atoms within the aluminum matrix, which maximizes grain refinement and structural strength. For SOFCs, controlled atmosphere sintering techniques are essential for fabricating dense, defect-free Scandia-Stabilized Zirconia (SSZ) electrolytes with optimal ionic conductivity. The intersection of material science and manufacturing technology dictates the final product quality and, consequently, the sustained adoption rate of Scandium Oxide across high-value applications, necessitating continuous technological investment in precision manufacturing and quality assurance.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global Scandium Oxide production, primarily driven by China's extensive rare earth and bauxite processing capabilities. The region benefits from established supply chains and refining expertise, leading to production volume dominance. However, APAC's consumption, particularly in Japan and South Korea, is rapidly expanding due to high demand from advanced SOFC stack manufacturers and the growing electronics sector. China is increasingly focused on vertical integration, using its raw material advantage to support domestic aerospace development, thereby increasing internal consumption and potentially limiting export volumes of the refined oxide.

- North America: North America represents a high-value consumption market, overwhelmingly driven by the aerospace and defense industries seeking superior Al-Sc alloys for lightweighting military and commercial aircraft programs. Due to geopolitical supply risk concerns, significant investment is being channeled into developing domestic, secure supply sources, often focusing on unconventional deposits or secondary recovery from mining waste within the US and Canada. Government mandates and defense modernization programs serve as major catalysts for robust, localized demand growth.

- Europe: European market growth is highly dependent on clean energy policy, particularly the ambitious rollout of high-efficiency Solid Oxide Fuel Cells (SOFCs) for stationary and distributed power applications across countries like Germany and Italy. Europe is heavily reliant on imports for raw Scandium Oxide but is a leader in advanced SOFC research and commercialization. Strategic efforts are underway to establish localized refining capacity and secure diversified supply agreements with non-traditional global partners to ensure long-term stability for its critical energy transition technologies.

- Latin America (LATAM): LATAM currently holds a smaller share of the market, primarily serving as a potential source region, given its vast mineral resources, including bauxite deposits in countries like Brazil. While production and refining activities are limited, the region presents long-term opportunities for strategic upstream investment by global players looking to diversify extraction sites, particularly focusing on the exploitation of bauxite residues as secondary sources of scandium, which remain largely untapped.

- Middle East and Africa (MEA): The MEA region is emerging due to significant aluminum refining operations (bauxite processing) in the Gulf region, offering a potential, large-scale source of scandium-containing red mud. Currently, demand is low, but the potential for the region to become a major upstream supplier is substantial, contingent upon the successful deployment of commercial scandium extraction technologies tailored for the local mineralogical composition of the waste streams.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scandium Oxide Market.- Molycorp (Neo Performance Materials)

- Treibacher Industrie AG

- Sumitomo Corporation

- Clean TeQ Holdings (Sunrise Energy Metals)

- Rusal

- Polymet Resources

- Huaye Scandium

- Scandium International Mining Corp.

- Inner Mongolia Xingye Group

- China Minmetals Rare Earth Co., Ltd.

- Materion Corporation

- AMG Advanced Metallurgical Group

- NioCorp Developments Ltd.

- Arafura Resources

- Yunnan Liyuan

- Ganzhou Rare Earth

- Hunan Rare Earth

- American Elements

- Sibelco

- Platina Resources Ltd.

Frequently Asked Questions

Analyze common user questions about the Scandium Oxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor limiting the widespread adoption of Scandium Oxide?

The primary constraint is the highly limited global supply coupled with the high cost associated with its extraction and purification. Scandium is predominantly a byproduct, making supply inelastic and susceptible to volatility in the primary commodity markets it is sourced from, hindering large-scale industrial commitments.

Which industry accounts for the largest projected demand increase for Scandium Oxide?

The aerospace and defense industry is projected to drive the largest increase in demand, primarily due to the imperative need for lightweight, high-strength Aluminum-Scandium (Al-Sc) alloys essential for enhancing aircraft fuel efficiency, payload capacity, and structural resilience in new-generation platforms.

How is Scandium Oxide utilized in the energy sector, specifically Solid Oxide Fuel Cells (SOFCs)?

Scandium Oxide is used as a critical stabilizing agent, forming Scandia-Stabilized Zirconia (SSZ). SSZ acts as the high-performance electrolyte in SOFCs, significantly enhancing ionic conductivity, reducing operating temperatures, and improving the overall efficiency and lifespan of the fuel cell stack.

What are the key technological advancements addressing the supply scarcity of Scandium Oxide?

Key advancements focus on developing highly efficient, low-cost hydrometallurgical technologies, such as advanced solvent extraction and ion exchange processes, specifically designed for the economic recovery of trace scandium from high-volume secondary sources, including bauxite processing residue (red mud).

What purity grade of Scandium Oxide is required for advanced electronic applications and SOFCs?

Advanced applications such as high-K dielectrics in semiconductors and SOFC electrolytes typically require ultra-high purity grades, specifically 99.999% (5N) and above, due to the extreme sensitivity of these devices to even minor impurities which can severely degrade performance and operational stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager