Scent Synthesizer and E-Nose Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437109 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Scent Synthesizer and E-Nose Product Market Size

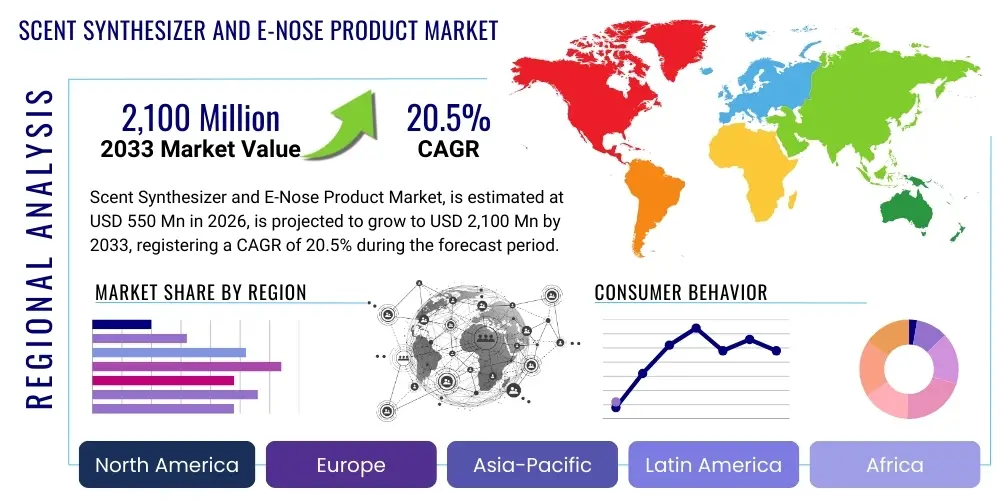

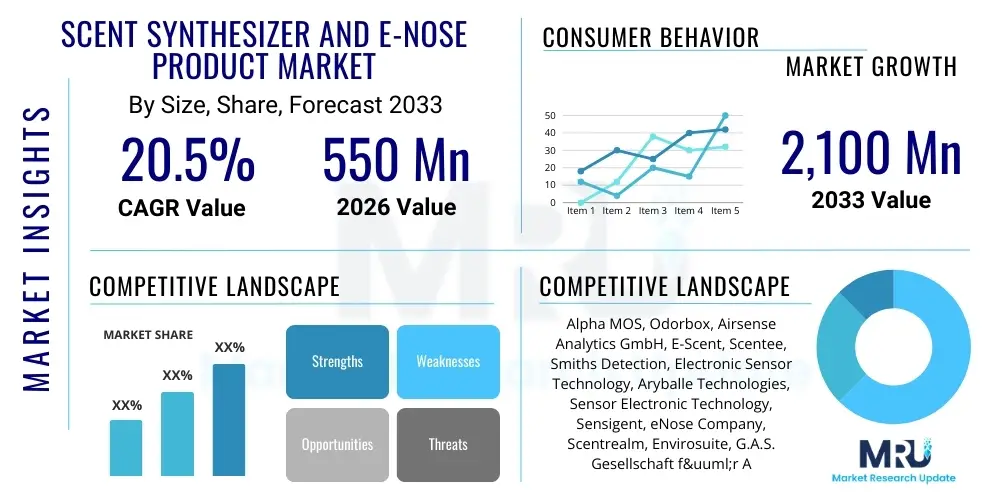

The Scent Synthesizer and E-Nose Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at USD 550 million in 2026 and is projected to reach USD 2,100 million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating demand for non-invasive diagnostic tools, stringent quality control requirements across the food and beverage industry, and the increasing integration of digital olfaction capabilities into consumer electronics and extended reality (XR) environments. The inherent advantages of E-Noses, such as rapid analysis, portability, and high sensitivity, are positioning them as crucial assets in industrial monitoring and environmental protection, paving the way for significant capital investments in sensor research and development.

Scent Synthesizer and E-Nose Product Market introduction

The Scent Synthesizer and E-Nose Product Market encompasses sophisticated technological solutions designed to either digitally analyze odor profiles (E-Nose) or recreate and dispense specific scents (Scent Synthesizer). E-Noses, or electronic noses, are bio-mimetic systems utilizing an array of chemical sensors and advanced pattern recognition algorithms, often leveraging machine learning and AI, to classify complex gaseous mixtures and volatile organic compounds (VOCs). Their primary function is to replicate the olfactory system's ability to discriminate between smells for applications requiring objective, repeatable, and automated detection, moving beyond traditional subjective human sensory evaluations. These devices typically comprise a sensor chamber, a signal processing unit, and a data analysis module capable of recognizing patterns corresponding to specific smells or chemical compositions.

Scent synthesizers, conversely, focus on the generation and control of odors, primarily serving the digital media and consumer experience sectors. They are integrated into virtual reality (VR), augmented reality (AR), and gaming platforms to enhance immersion, or are used in therapeutic and marketing applications to create controlled atmospheric experiences. The confluence of these two technologies—the ability to analyze and the ability to reproduce—is defining the future landscape of digital olfaction. Major applications span medical diagnostics (detecting breath biomarkers for diseases like cancer or diabetes), food safety and quality assessment (identifying spoilage or adulteration), environmental monitoring (tracking pollutants), and military and defense (detecting hazardous substances).

The core benefits driving market adoption include enhanced operational efficiency through automation, superior precision compared to human perception, and the ability to operate continuously in harsh environments. Key driving factors include miniaturization of sensor technology allowing for integration into portable and handheld devices, the proliferation of Internet of Things (IoT) frameworks facilitating remote data transfer and analysis, and growing regulatory pressures for safety and quality assurance across global supply chains. Furthermore, significant research investment into improving sensor selectivity and stability is critical for expanding the commercial viability of these products in highly regulated sectors.

Scent Synthesizer and E-Nose Product Market Executive Summary

The Scent Synthesizer and E-Nose Product Market is characterized by robust technological innovation, marked by a rapid transition from bulky laboratory instruments to integrated, handheld, and cloud-connected solutions. Current business trends indicate a strong move toward platform integration, where E-Nose hardware is bundled with advanced AI and proprietary odor databases, shifting the value proposition from hardware sales to data and analytics services. Strategic partnerships between sensor manufacturers and application-specific software developers are increasing, aiming to create highly specialized diagnostic tools for verticals like healthcare and pharmaceuticals. Venture capital inflow is heavily skewed towards startups developing novel, highly selective sensor materials, such as graphene or carbon nanotube composites, which promise lower costs and improved performance parameters, fundamentally disrupting established sensor technologies.

Regionally, North America maintains market leadership, largely due to high expenditures in research and development, particularly in defense, military, and advanced medical diagnostics, alongside a mature ecosystem for VR/AR development driving scent synthesizer adoption. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid industrialization, stringent food safety regulations in emerging economies like China and India, and the necessity for robust environmental monitoring systems addressing escalating pollution concerns. Europe remains a significant market, particularly strong in industrial quality control and automotive applications, supported by strict regulatory frameworks governing chemical emissions and air quality.

Segment trends highlight the dominance of the E-Nose product segment over scent synthesizers in terms of immediate revenue generation, primarily due to immediate, mission-critical applications in healthcare and industrial quality assurance. Within E-Noses, the Metal Oxide Semiconductor (MOS) sensor technology segment continues to hold a significant market share, though emerging technologies like Quartz Crystal Microbalances (QCMs) and surface acoustic wave (SAW) sensors are gaining traction due to superior stability and lower power consumption, making them ideal for mobile applications. Application-wise, the healthcare and medical diagnostics sector is poised for the most transformative growth, driven by the shift towards early, non-invasive disease screening methods, followed closely by the food and beverage quality control sector.

AI Impact Analysis on Scent Synthesizer and E-Nose Product Market

Common user questions regarding AI's influence center on whether artificial intelligence can truly replicate or surpass human sensory capabilities, how machine learning enhances the accuracy and speed of odor identification, and the necessary data infrastructure required for effective deployment. Users frequently inquire about the feasibility of utilizing AI for detecting complex, subtle mixtures in real-time, such as trace explosives or early disease biomarkers, and are keen to understand how deep learning models mitigate the persistent industry challenge of sensor drift and environmental interference. The prevailing expectation is that AI serves as the foundational processing layer that transforms raw, relatively non-specific sensor data into actionable, high-certainty insights, thereby expanding the E-Nose from a simple detector into a cognitive diagnostic tool.

The integration of AI, particularly advanced neural networks and deep learning algorithms, fundamentally addresses the limitations of traditional chemometric methods in processing data from non-specific sensor arrays. E-Noses often employ broad-spectrum sensors that generate complex, high-dimensional data patterns; AI algorithms excel at classifying these patterns, distinguishing minute variations in odor signatures that might be missed by linear statistical approaches. This capability is paramount in sophisticated applications, such as identifying the specific strain of a bacteria in food spoilage or recognizing subtle changes in breath profiles indicative of metabolic disorders, ensuring higher reliability and speed in critical decision-making scenarios.

Furthermore, AI is instrumental in the continuous calibration and self-optimization of E-Nose systems. Sensor drift—the change in sensor response characteristics over time or due to environmental exposure—has traditionally plagued the electronic nose industry. AI models, using temporal data analysis and predictive modeling, can compensate for this drift in real-time, significantly extending the operational lifespan and maintaining the accuracy of the device without frequent manual recalibration. This inherent self-correction mechanism enhances the market's acceptance of E-Nose technology for continuous, long-term monitoring applications in demanding industrial and environmental settings, solidifying AI as the critical technological differentiator in the modern digital olfaction market.

- AI enables sophisticated pattern recognition for complex odor mixtures, surpassing traditional chemometric analysis.

- Machine learning models enhance detection accuracy and classification speed for real-time applications.

- Deep learning algorithms mitigate sensor drift by providing real-time, predictive self-calibration and baseline correction.

- AI facilitates the creation of vast, accessible, and searchable olfactory databases for rapid identification and comparison.

- Integration with cloud-based AI platforms allows for remote diagnostics, collaborative data analysis, and predictive maintenance.

- AI drives advancements in Scent Synthesizer control, allowing for precise, dynamic odor mixing and dosage control based on user interaction or environmental feedback.

DRO & Impact Forces Of Scent Synthesizer and E-Nose Product Market

The Scent Synthesizer and E-Nose Market is driven by the imperative for enhanced automation in quality control and the escalating need for rapid, non-invasive diagnostic technologies in healthcare. Restraints largely center on the technical complexity associated with achieving sensor stability and selectivity, coupled with the high initial investment required for specialized sensor array fabrication. Significant opportunities exist in the burgeoning fields of virtual and augmented reality, where immersive sensory experiences are highly valued, and in the integration of E-Noses into smart city infrastructure for pervasive environmental monitoring. The market’s trajectory is heavily influenced by impact forces such as stringent global food safety standards, rapid advancements in nanotechnology that enable smaller and more robust sensors, and shifting consumer expectations for personalized health monitoring solutions based on wearable devices.

Key Drivers include the increasing global adoption of IoT and Industry 4.0 paradigms, which necessitate interconnected sensing devices for optimization and predictive maintenance in manufacturing and processing plants. The shift in medical practice toward preventative and personalized care, exemplified by the search for reliable breath-based biomarkers for infectious and chronic diseases, provides a powerful impetus for E-Nose development. Additionally, the defense and security sectors consistently demand advanced, portable detectors for chemical, biological, radiological, and nuclear (CBRN) threats, driving specialized sensor development. These market demands encourage continuous miniaturization and improvements in the sensitivity of the sensor systems, pushing the boundaries of material science and signal processing.

However, the market faces significant hurdles. A major restraint is the lack of universal standardization across the industry, making data comparison and interoperability challenging. Furthermore, while sensor technology has advanced, the lifetime and susceptibility to contamination (fouling) of sensor surfaces remain key technical challenges, contributing to maintenance costs and limiting operational reliability in harsh environments. Opportunities abound, particularly in integrating E-Noses into agricultural smart farming practices for real-time crop health assessment and in expanding scent synthesizers beyond entertainment into therapeutic applications, such as managing anxiety or enhancing cognitive performance through controlled aroma delivery. Successfully navigating regulatory approvals for medical applications and addressing the cost-effectiveness of large-scale manufacturing are critical impact forces determining long-term profitability.

Segmentation Analysis

The segmentation of the Scent Synthesizer and E-Nose Product Market provides granular insights into the diverse technological approaches and distinct application verticals driving market dynamics. The primary segment divisions are based on the core technology utilized in the sensor array, the type of product (Electronic Nose vs. Scent Synthesizer), and the industry end-user. Analyzing these segments helps stakeholders understand which technological pathways are receiving the most investment and where the highest demand currently originates. The technological segmentation is critical as it reflects performance attributes such as sensitivity, response time, and long-term stability, directly influencing applicability in fields requiring high regulatory compliance, like medicine and pharmaceuticals.

From a product perspective, the market is broadly segmented into analytical and generative devices. The analytical segment (E-Noses) is further differentiated by the sensing mechanism, including Metal Oxide Semiconductors (MOS), Quartz Crystal Microbalances (QCM), Conducting Polymers, and optical sensors. MOS sensors currently dominate due to their maturity and cost-effectiveness in high-volume production, while newer technologies like QCM and SAW sensors are gaining traction due to better performance metrics in humid conditions. The generative segment (Scent Synthesizers) is segmented based on the delivery mechanism, typically microfluidic or thermal jet systems, focusing on precision and speed of odor release, predominantly serving the consumer technology and marketing sectors.

The application segmentation is perhaps the most defining characteristic of market demand. The Food and Beverage segment utilizes E-Noses extensively for quality assurance, shelf-life estimation, and detecting bacterial contamination and counterfeit products. The Medical and Diagnostics segment focuses on non-invasive breath analysis, urine analysis, and wound monitoring. Industrial monitoring, environmental protection, and defense sectors constitute other crucial application areas, each demanding tailored sensor configurations and specialized AI pattern libraries. The complexity and high stakes associated with medical diagnostics ensure that this sector commands premium pricing and drives innovation toward ultra-high sensitivity and selectivity.

- By Product Type:

- Electronic Nose (E-Nose)

- Scent Synthesizer (Olfactory Display)

- By Technology:

- Metal Oxide Semiconductor (MOS)

- Quartz Crystal Microbalance (QCM)

- Conducting Polymers

- Surface Acoustic Wave (SAW)

- Optical Sensors

- Others (e.g., Capacitive, Calorimetric)

- By Application:

- Food and Beverage Industry (Quality Control, Spoilage Detection, Authentication)

- Medical and Diagnostics (Breath Analysis, Disease Screening, Health Monitoring)

- Environmental Monitoring and Control (Air Quality, Pollution Detection)

- Industrial Monitoring and Quality Assurance (Chemical Processing, Leak Detection)

- Defense and Security (Explosives, Narcotics, Hazardous Chemical Detection)

- Consumer Electronics and Digital Media (VR/AR Integration, Gaming)

- Automotive and Transportation (Cabin Air Quality, Emissions Monitoring)

- By End-User:

- Commercial/Industrial

- Healthcare Providers and Research Institutes

- Government and Regulatory Bodies

- Defense Agencies

- Academic Institutions

Value Chain Analysis For Scent Synthesizer and E-Nose Product Market

The value chain for the Scent Synthesizer and E-Nose Market begins with intensive upstream activities focused on fundamental materials science and sensor fabrication. This segment involves specialized manufacturers developing high-performance sensing materials, such as novel metal oxides, specific polymers, or micro-electromechanical systems (MEMS) components. Innovation at this stage is crucial, as the quality and selectivity of the base sensor directly determine the performance ceiling of the final product. Key upstream players include specialized chemical companies and semiconductor fabricators that possess the expertise in nanocoating and precise material deposition necessary for mass-producing reliable sensor arrays, which is a significant barrier to entry for new market participants.

The midstream phase involves the core competencies of system integration, signal processing hardware development, and specialized software creation. Here, companies integrate the sensor arrays with microcontrollers, specialized sampling systems (e.g., preconcentrators or humidification control units), and data acquisition circuitry. Crucially, this stage includes the development of proprietary machine learning and AI algorithms tailored for odor classification and pattern recognition. Successful midstream firms manage the transition of complex sensor data into robust, user-friendly digital insights. Distribution channels are generally categorized as direct sales for highly technical or customized industrial systems (allowing for necessary pre-sales consultation and post-sales maintenance) and indirect channels utilizing authorized distributors or e-commerce platforms for standardized, lower-cost consumer or environmental monitoring devices.

The downstream segment encompasses market entry, application-specific customization, and comprehensive service offerings. Downstream activities involve integrating the E-Noses or synthesizers into final end-user environments, such as mounting units on factory assembly lines, incorporating them into medical diagnostic equipment, or integrating them into VR headsets. Direct engagement is often required for highly regulated sectors (like medical or defense) to ensure regulatory compliance and application-specific calibration. The final stage involves extensive post-sales support, including software updates, database maintenance, and continuous calibration services, which are increasingly provided through subscription models, generating recurring revenue and strengthening customer lock-in for the primary system providers.

Scent Synthesizer and E-Nose Product Market Potential Customers

The customer base for the Scent Synthesizer and E-Nose Product Market is highly diversified, ranging from global manufacturers requiring stringent quality controls to advanced research institutions seeking non-invasive diagnostic tools. Primary potential customers include pharmaceutical companies and medical diagnostic labs, which utilize E-Noses for quality control in manufacturing processes and for identifying biomarkers of diseases in patient breath samples, offering immense potential for decentralized and rapid screening. The demand from this sector is driven by the need for regulatory compliance and cost-effective, high-throughput testing methodologies that reduce reliance on complex, expensive laboratory instruments.

Another major demographic consists of the massive Food and Beverage (F&B) industry, including large-scale processors, distributors, and retail chains. These entities deploy E-Noses to monitor food freshness, detect early spoilage, verify product authenticity (e.g., identifying counterfeit high-value beverages like olive oil or whiskey), and ensure adherence to health and safety regulations throughout the supply chain. The automation offered by E-Noses helps mitigate costly product recalls and enhances consumer trust by guaranteeing consistent product quality, making it an essential investment for maintaining brand integrity and meeting global supply chain standards.

Furthermore, the rapidly expanding entertainment and technology sectors represent significant buyers of scent synthesizers. Companies specializing in Virtual Reality (VR), Augmented Reality (AR), gaming development, and immersive training simulations are investing in these devices to deepen user immersion and create realistic sensory feedback loops. Beyond consumer tech, government agencies, including environmental protection bodies and defense departments, are substantial customers for high-end E-Nose systems used for continuous air quality monitoring, detection of hazardous pollutants, and military surveillance. These government and defense applications often require the most robust, portable, and highly customized sensor solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 2,100 Million |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alpha MOS, Odorbox, Airsense Analytics GmbH, E-Scent, Scentee, Smiths Detection, Electronic Sensor Technology, Aryballe Technologies, Sensor Electronic Technology, Sensigent, eNose Company, Scentrealm, Envirosuite, G.A.S. Gesellschaft für Analytische Sensorsysteme mbH, Olorama Technology, Koniku, InspectAir, Breathomix, ScentCom, Bosch Sensortec |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scent Synthesizer and E-Nose Product Market Key Technology Landscape

The technological landscape of the Scent Synthesizer and E-Nose Market is highly dynamic, centered around optimizing sensor performance metrics such as sensitivity, selectivity, and response time, while simultaneously focusing on reducing form factors and power consumption. The foundation of the E-Nose technology rests on various transducer principles. Metal Oxide Semiconductor (MOS) sensors are currently the most mature and widely adopted technology, characterized by their high sensitivity to a broad range of VOCs and their relatively low production cost. However, they suffer from high operating temperatures and high susceptibility to humidity interference, driving research into compensating algorithms and novel heating elements to improve operational reliability in diverse environments.

Emerging sensor technologies, such as Quartz Crystal Microbalance (QCM) and Surface Acoustic Wave (SAW) sensors, are gaining prominence, particularly for portable and high-precision applications. These technologies rely on chemically sensitive films that absorb analytes, causing a mass change that is translated into a measurable frequency shift. QCMs and SAWs operate effectively at room temperature, which lowers power requirements and increases portability, positioning them favorably for integration into handheld medical diagnostic devices and wearable technology. Furthermore, significant research effort is being dedicated to developing conducting polymers and bio-electronic noses, the latter mimicking biological olfactory receptors for unparalleled specificity and ultra-low concentration detection, paving the way for truly disruptive medical diagnostic instruments.

Beyond the hardware, the critical technological advancement lies in data processing and integration. The shift towards miniaturization is intrinsically linked with the adoption of MEMS (Micro-Electro-Mechanical Systems) technology, allowing complex sensor arrays and microfluidic components to be fabricated on a single chip, drastically reducing the size and improving the throughput of the systems. Moreover, sophisticated data fusion algorithms and edge computing capabilities are essential. These technologies allow the devices to process complex, multi-sensor data locally before transmitting only key insights, minimizing latency and bandwidth requirements for IoT deployment. For Scent Synthesizers, the technology landscape is focused on microfluidic control systems and high-resolution thermal inkjet systems capable of instantly vaporizing specific odor molecules with precision, required for seamless integration into high-definition digital experiences like advanced VR environments.

Regional Highlights

- North America: This region dominates the market, primarily due to the presence of key technology developers, substantial private and government investment in R&D (especially in defense, aerospace, and medical sectors), and the early adoption of E-Nose technology for clinical diagnostics (breath testing) and industrial quality assurance. The mature ecosystem for virtual reality and gaming also makes North America the largest consumer market for Scent Synthesizers and olfactory displays.

- Europe: Europe is characterized by stringent environmental and industrial regulations, driving the demand for sophisticated E-Nose solutions in environmental monitoring, automotive emissions testing, and rigorous food quality control mandates set by the European Food Safety Authority (EFSA). Germany, France, and the UK are central hubs, with a strong focus on industrial automation (Industry 4.0) and leveraging public-private partnerships for sensor development.

- Asia Pacific (APAC): Projected to be the fastest-growing region, APAC’s growth is fueled by rapid industrialization, increasing governmental focus on mitigating air and water pollution, and expanding demand for reliable food safety inspection systems due to large population centers. China, Japan, and South Korea are key manufacturing bases and early adopters of E-Nose technology in chemical, electronics, and burgeoning smart agriculture sectors. The increasing penetration of immersive consumer technologies also boosts demand for personalized scent devices.

- Latin America (LATAM): Market growth in LATAM is gradually accelerating, driven by the need for better quality control in significant primary industries such as food processing (meat, sugar, coffee) and petrochemicals. However, adoption remains slower than in developed regions due to higher reliance on imports and less mature local manufacturing of advanced sensor components.

- Middle East and Africa (MEA): This region is seeing specialized adoption, particularly in the Middle East for defense, security (hazardous substance detection), and high-end industrial monitoring in the vast oil and gas sectors. Investment in smart city projects also includes provisions for comprehensive air quality monitoring systems, creating niche, high-value opportunities for E-Nose providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scent Synthesizer and E-Nose Product Market.- Alpha MOS

- Airsense Analytics GmbH

- Electronic Sensor Technology

- Aryballe Technologies

- Sensigent

- Odorbox

- Smiths Detection

- eNose Company

- Scentrealm

- G.A.S. Gesellschaft für Analytische Sensorsysteme mbH

- Bosch Sensortec

- Koniku

- Breathomix

- Envirosuite

- Olorama Technology

- SGX Sensortech

- Figaro Engineering Inc.

- Inficon

- Nose Tech

- Scentee

Frequently Asked Questions

Analyze common user questions about the Scent Synthesizer and E-Nose Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of E-Nose technology in the healthcare sector?

E-Nose technology is critically applied in non-invasive medical diagnostics, primarily through breath analysis. It is used to detect volatile organic compounds (VOCs) that serve as biomarkers for various diseases, including early-stage cancers, diabetes, renal failure, and infectious diseases, offering a rapid, cost-effective, and portable screening alternative to traditional laboratory tests.

How does the integration of AI improve the reliability of Electronic Noses?

AI, particularly machine learning and deep learning, enhances reliability by providing sophisticated pattern recognition necessary to classify complex, subtle odor profiles, significantly improving selectivity. Crucially, AI algorithms continuously monitor and compensate for sensor drift and baseline variations caused by environmental factors, maintaining long-term accuracy without manual recalibration.

What is the main technical challenge facing the broader adoption of E-Nose systems?

The most significant technical challenge is achieving consistent, long-term sensor stability and selectivity, particularly in variable ambient conditions (temperature, humidity). Sensor drift over time and cross-sensitivity to non-target gases necessitate continuous technological investment in highly selective materials and advanced AI-driven compensation mechanisms for widespread industrial acceptance.

Which sensor technology currently dominates the Electronic Nose market segment?

Metal Oxide Semiconductor (MOS) technology currently holds the largest market share due to its established manufacturing base, broad sensitivity range to VOCs, and relative cost-effectiveness. However, newer, lower-power technologies like Quartz Crystal Microbalance (QCM) and Surface Acoustic Wave (SAW) sensors are rapidly gaining momentum, particularly for mobile and integrated applications.

In what sectors are Scent Synthesizers expected to see the fastest growth?

Scent Synthesizers are projected to see the fastest growth in the consumer electronics and digital media sectors, primarily driven by the increasing market penetration of Virtual Reality (VR) and Augmented Reality (AR) platforms. These devices are essential for creating highly immersive, multisensory digital experiences in gaming, training simulations, and specialized digital marketing campaigns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager