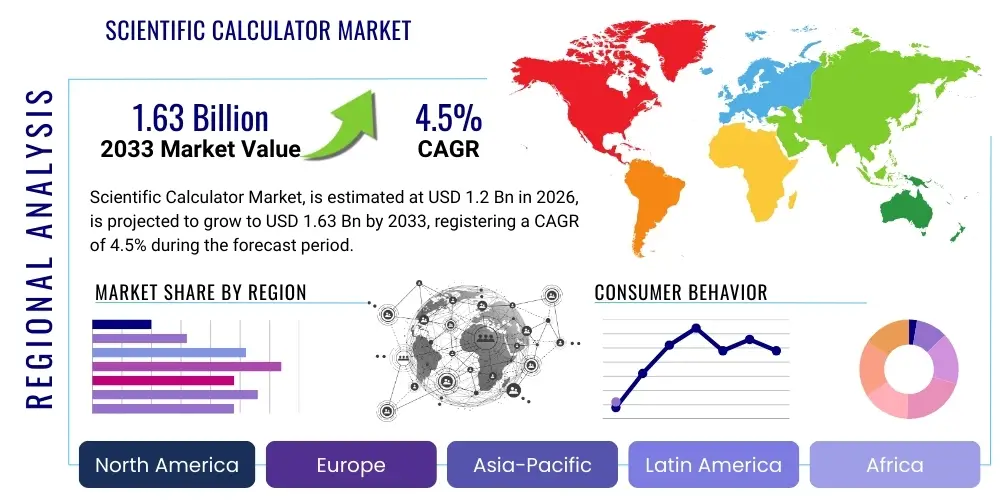

Scientific Calculator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439104 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Scientific Calculator Market Size

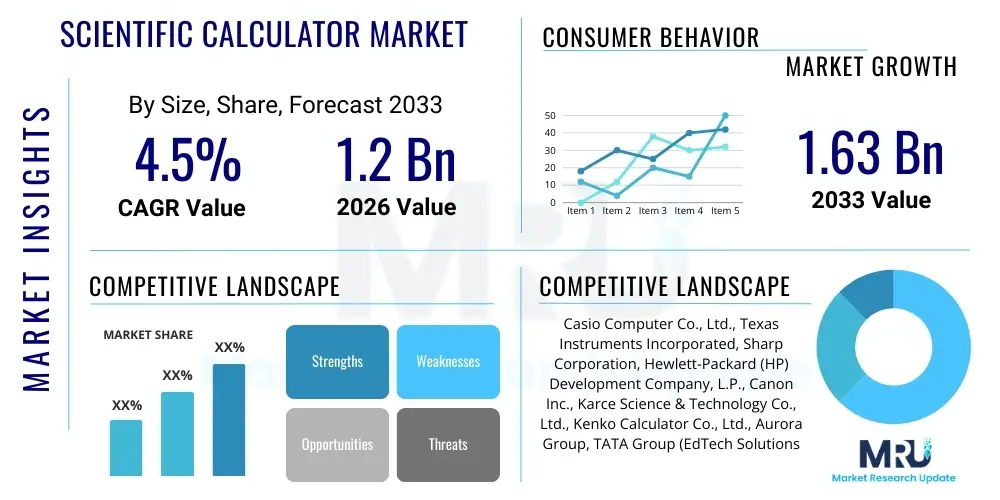

The Scientific Calculator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.63 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the sustained demand from the global education sector, particularly in higher secondary and tertiary education institutions where complex mathematical and scientific calculations are mandatory. Despite the growing presence of advanced software and smartphone applications, specialized hardware remains crucial due to regulatory requirements in standardized testing environments and the inherent reliability required for professional engineering and research applications.

Scientific Calculator Market introduction

The Scientific Calculator Market encompasses specialized electronic devices designed to perform complex mathematical operations beyond the capabilities of basic four-function calculators. These devices are essential tools for students, engineers, scientists, and financial analysts, providing functions for trigonometry, logarithms, complex numbers, statistical analysis, and frequently, basic programming capabilities. The core utility of these products lies in their ability to streamline complex calculations required in subjects like physics, chemistry, engineering disciplines (electrical, civil, mechanical), and advanced mathematics. Manufacturers continually focus on enhancing user interface design, increasing processing speed, and integrating advanced display technologies, such as natural textbook display, to mimic manual mathematical notation, thereby improving accuracy and reducing the learning curve for users.

Major applications of scientific calculators span standardized testing, undergraduate and graduate level science courses, professional fieldwork in engineering, and research laboratory calculations. The benefit of utilizing these dedicated devices includes high precision, enhanced portability, and, critically, compliance with academic and professional regulatory standards that often prohibit the use of internet-connected or multifunctional devices during critical tasks. Driving factors include mandatory governmental curriculum updates emphasizing STEM education globally, the continued global expansion of higher education enrollment, and the necessity for reliable, non-internet-dependent computational tools in sensitive professional environments. Furthermore, product innovation focusing on durability and battery life remains a significant market stimulus.

The product ecosystem is categorized primarily based on functionality, ranging from basic scientific models that handle algebraic and trigonometric functions to highly advanced graphing calculators capable of displaying plotted curves, solving matrices, and running basic programming scripts. Key industry players maintain strong market positions through established brand loyalty, particularly within educational institutional procurement cycles, and continuous investment in ergonomic design tailored for intensive daily use. The market dynamic is characterized by intense competition regarding price points, feature sets, and regulatory compliance specific to major educational markets, such as the requirements set by bodies like the College Board in the United States or equivalent educational ministries globally.

Scientific Calculator Market Executive Summary

The Scientific Calculator Market is demonstrating resilient growth, underpinned by stable demand across the global education sector and niche professional applications. Business trends indicate a shift toward models offering enhanced connectivity options, such as wireless data transfer for classroom use (though often restricted during exams), and increased focus on solar and dual-powered units to improve sustainability and usability. Key market leaders are strategically focusing on bundling software integration services with hardware sales, particularly in the institutional segment, to create comprehensive computational learning ecosystems. Furthermore, the development of specialized calculators for fields like finance (featuring specialized statistical regression tools) represents a subtle but important diversification trend, moving beyond traditional engineering and pure mathematics applications.

Regionally, the Asia Pacific (APAC) market is projected to be the fastest-growing segment, driven by massive investments in K-12 and tertiary education infrastructure, particularly in populous nations like China and India, where student enrollment is rapidly expanding. North America and Europe remain mature markets characterized by high adoption rates and a strong preference for high-end graphing calculator models, largely mandated by established curriculum guidelines and high-stakes standardized testing requirements. The Middle East and Africa (MEA) and Latin America (LATAM) markets are exhibiting moderate growth, spurred by governmental initiatives aimed at improving mathematical literacy and standardized educational policies requiring specific calculator functionalities. Manufacturers are tailoring distribution strategies to address the varying regulatory requirements and economic capacities across these diverse geographical regions.

In terms of segment trends, the Graphing Calculator segment is exhibiting robust revenue growth due to its indispensability in advanced mathematics and calculus courses. However, the basic and intermediate scientific calculator segment, characterized by lower price points and high volume sales, continues to dominate unit shipments, especially in emerging economies and early high school levels. Distribution channels are seeing increased penetration through the online retail segment, driven by convenience and competitive pricing, although institutional bulk procurement through traditional offline distributors remains a critical revenue stream. Sustainability and durability are emerging consumer preference metrics, influencing procurement decisions at both the individual and institutional levels, forcing manufacturers to integrate more recycled materials and robust protective designs into their product lines.

AI Impact Analysis on Scientific Calculator Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the scientific calculator market frequently center on two opposing themes: the potential obsolescence of dedicated hardware versus the integration of sophisticated AI algorithms to enhance computational speed and problem-solving capabilities. Users often express concerns about whether advanced AI tools, such as generative AI platforms and advanced symbolic computation software, will entirely replace physical calculators, especially given their increasing accessibility on standard computing devices. Conversely, there is significant interest in how manufacturers are leveraging AI to improve existing calculator functionality, such as implementing algorithms for automated error detection, enhancing natural language input processing for complex queries, or providing step-by-step problem-solving guidance often restricted in current non-AI devices.

Based on this analysis, the key themes summarize that while AI poses a disruptive threat in generalized computing environments, specialized scientific calculators maintain their critical relevance due to their regulatory compliance (being non-networked and dedicated), high reliability, and focus during standardized examinations. User expectations are shifting towards hybrid devices or educational platforms that can seamlessly transition between AI-enhanced instructional environments and secure, dedicated computational modes. The immediate concern is not displacement but rather the need for the physical calculator industry to justify its price point and value proposition against sophisticated, often free, software alternatives, necessitating innovation beyond basic functional improvements.

The influence of AI is most likely to be felt in two areas: back-end manufacturing optimization and front-end educational integration. Manufacturers are utilizing predictive analytics (an application of AI) to optimize supply chains and anticipate demand cycles. Educationally, AI tools are already providing adaptive learning paths that reduce reliance on manual trial-and-error calculations, thereby potentially decreasing the necessity for basic calculator models but increasing the demand for advanced, computational thinking tools (like high-end graphing calculators) that can interface with these AI-driven learning systems. The market is thus pivoting, not dying, driven by the requirement for secure, focused calculation hardware, even as AI handles the instructional and exploratory computational heavy lifting.

- AI enhances manufacturing efficiency and supply chain optimization for hardware producers.

- Generative AI platforms increase competition for software-based calculation tools, pressuring physical hardware pricing.

- Integration of AI algorithms could lead to smarter calculators offering automated error checking and simplified user inputs.

- AI-driven personalized learning systems may alter curriculum delivery, potentially emphasizing conceptual understanding over rote calculation, impacting basic model demand.

- Physical scientific calculators retain mandatory market position due to non-connectivity requirements in standardized testing environments globally.

- Future models may integrate specific, localized AI capabilities (e.g., advanced predictive statistical modeling) without compromising security protocols.

DRO & Impact Forces Of Scientific Calculator Market

The dynamics of the Scientific Calculator Market are shaped by a complex interplay of driving forces (D), restrictive challenges (R), and compelling opportunities (O), all subjected to significant internal and external impact forces. The primary driver is the institutional requirement for dedicated, reliable calculation tools in educational settings worldwide, coupled with the persistent growth in STEM enrollment. Conversely, the market is significantly restrained by the rapid advancement and pervasive adoption of multifunctional smart devices and powerful, free computational software applications that offer high levels of complexity and visualization capabilities, directly challenging the utility proposition of specialized hardware. A key opportunity lies in the development of specialized, regulatory-compliant calculators tailored for niche professional markets (e.g., advanced financial modeling or specialized statistical research) and integrating features that enhance the learning process, such as secure, guided problem-solving feedback.

Impact forces on the market are multifaceted. Technological impact forces, particularly miniaturization and display technology improvements, enable better user interfaces and portability, sustaining product relevance. However, digital disruption, an overwhelming external force, constantly threatens to replace hardware entirely with software solutions. Regulatory impact forces are crucial; stringent exam board rules concerning allowed devices (often banning networked or programmable devices) act as a protective barrier, ensuring a captive market for specific calculator models. Economic factors, such as disposable income in emerging markets, influence purchasing power, shifting demand toward cost-effective, high-volume units, while institutional budgets dictate bulk procurement cycles. Environmental impact forces are also gaining prominence, pushing manufacturers toward sustainable materials and increased product longevity, appealing to environmentally conscious consumers and institutions.

Addressing these forces requires strategic market positioning. To counteract restraints, manufacturers must focus on durability, superior tactile feedback, and extended battery life, features often lacking in generic smart devices. To capitalize on opportunities, product innovation must center on specialized functionalities that cannot be easily replicated or permitted in general-purpose computing platforms during secure operations. Furthermore, aggressive engagement with educational policy-makers is essential to ensure that curriculum standards and testing requirements continue to necessitate the use of specialized scientific calculation tools. Successful navigation of these DRO and impact forces necessitates a balance between technological advancement and adherence to the foundational requirements of security and focused usability inherent to the product category.

Segmentation Analysis

The Scientific Calculator Market is comprehensively segmented based on various technical specifications, distribution methods, and end-user applications. This segmentation provides critical insights into purchasing behaviors and allows manufacturers to tailor product development and marketing strategies to specific sub-markets. Key segmentation variables include the type of display technology used, the complexity of mathematical functions supported (defining product type), the primary distribution channels utilized, and the ultimate end-user group requiring the calculation tools. Understanding these segments is crucial for accurate forecasting and competitive analysis, as pricing sensitivity, feature requirements, and brand loyalty vary significantly across segments like basic scientific models used in secondary schools versus advanced graphing calculators mandated for university engineering courses.

The segmentation structure highlights the divergence between high-volume, low-margin segments (like basic 10-digit scientific calculators sold in general retail) and low-volume, high-margin segments (like advanced programmable calculators sold directly to educational institutions). The rise of e-commerce has significantly impacted the Distribution Channel segment, offering global reach and competitive pricing, challenging traditional brick-and-mortar retail dominance, though institutional sales often remain tied to established distribution networks. Furthermore, the segmentation by End-User clearly defines the primary revenue streams, confirming that the Education sector, encompassing high school and university students, remains the unequivocal largest consumer base, dictating the majority of design and regulatory compliance considerations.

Segmentation ensures that product innovation remains relevant. For instance, the market for professional scientific calculators requires features like higher precision, specific programming languages, and robust casing suitable for fieldwork, distinguishing it sharply from the student market which prioritizes ease of use and affordability. Analyzing the interaction between these segments reveals opportunities for cross-segment growth, such as introducing slightly advanced features (historically reserved for graphing models) into intermediate scientific calculators to capture upward migration from the basic segment without significant price inflation, thereby maintaining competitive edge against pervasive software solutions.

- By Product Type:

- Basic Scientific Calculators (Standard Functions)

- Intermediate Scientific Calculators (Advanced Statistical and Calculus Functions)

- Graphing Calculators (2D/3D Plotting, Matrix Operations)

- Programmable Scientific Calculators (Customizable Scripts and Functions)

- By Display Type:

- 10-Digit Display

- 12-Digit Display

- Natural Textbook Display (High-resolution, equation-like notation)

- LCD/LED Segmented Display

- By Power Source:

- Battery Powered

- Solar Powered

- Dual Powered (Solar and Battery)

- By Distribution Channel:

- Offline Retail (Bookstores, Office Supply Stores, Institutional Procurement)

- Online Retail (E-commerce Platforms, Manufacturer Websites)

- By End-User:

- Education (K-12, Higher Education)

- Professional (Engineering, Science, Finance, Research)

Value Chain Analysis For Scientific Calculator Market

The value chain for the Scientific Calculator Market begins with the upstream segment, dominated by sourcing and procurement of critical electronic components. This includes microprocessors (often customized ASICs or low-power microcontrollers), specialized LCD/OLED display modules, durable plastic resins for casing and keypads, and high-quality energy components like batteries and solar cells. Successful upstream management requires strong relationships with semiconductor manufacturers and material suppliers, focusing on cost efficiency, component miniaturization, and securing long-term supply, particularly for specialized chipsets that enable advanced functionalities like graphing capabilities. Fluctuation in global semiconductor pricing and geopolitical trade restrictions significantly impact the upstream costs and, consequently, the final product pricing.

The manufacturing and assembly stage involves high-precision injection molding, automated circuit board assembly, rigorous quality control testing (focusing on calculation accuracy and key durability), and packaging. Leading manufacturers often operate large-scale facilities in cost-effective regions to optimize production margins. Downstream activities involve complex logistics and distribution, covering both direct sales (large institutional tenders, often bypassing intermediary distributors) and indirect sales through various distribution channels. The indirect channel relies heavily on mass retailers, specialized educational suppliers, and increasingly, global e-commerce platforms, which necessitate efficient fulfillment and localized marketing efforts tailored to regional educational schedules.

Direct distribution often provides higher control over pricing and branding but requires significant investment in institutional sales teams. Conversely, indirect channels offer broader market penetration and reduced logistical overhead for the manufacturer, relying on the distributor's existing network, though it introduces margin pressure. Marketing and after-sales service, particularly technical support and warranty provisions relevant to student use, complete the chain. The perceived value is heavily influenced by brand reputation, accuracy assurance, and successful institutional endorsements. Effective value chain management focuses on minimizing component costs upstream while maximizing market reach and brand perception downstream, ensuring compliance with diverse global educational standards throughout the process.

Scientific Calculator Market Potential Customers

The Scientific Calculator Market caters to a wide yet distinct customer base, primarily segmented into the Education and Professional sectors. Within the Education sector, the primary end-users are students ranging from upper middle school through university level, with high school students studying Algebra, Geometry, and Calculus being the most significant demographic. University students in Engineering, Physics, Chemistry, and Advanced Mathematics programs require the most sophisticated devices, such as high-end graphing and programmable calculators. Institutional procurement managers and school administrators also act as critical buyers, making bulk purchasing decisions often dictated by standardized curriculum requirements and budget constraints, prioritizing durability, compliance, and institutional pricing.

The Professional segment encompasses a variety of fields where complex, reliable calculations are non-negotiable. Engineers—including civil, mechanical, electrical, and aerospace—rely on these devices for fieldwork and on-site calculations where laptops or smartphones may be impractical or prohibited. Scientists and researchers in laboratory settings utilize scientific calculators for data analysis, complex formula derivation, and statistical computation, valuing precision and speed. Furthermore, specialized financial analysts and actuaries constitute a niche professional market, often requiring calculators with advanced statistical regression, time-value-of-money, and specialized programming functions tailored to financial modeling. These professional users prioritize functionality and certified accuracy over affordability.

Growth opportunities lie in expanding the reach into vocational training and skilled trades education programs, which increasingly require specific mathematical skills but may not traditionally be targeted by high-end calculator marketing. Additionally, parents of students represent a substantial portion of the retail purchasing decisions, often influenced by teacher recommendations and price competitiveness. Targeting these distinct customer profiles—ranging from price-sensitive high school users to precision-focused professional engineers—requires highly segmented marketing campaigns and product lines designed to meet specific functional and regulatory needs. The sustained turnover inherent in the student population ensures continuous demand generation for this product category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.63 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Casio Computer Co., Ltd., Texas Instruments Incorporated, Sharp Corporation, Hewlett-Packard (HP) Development Company, L.P., Canon Inc., Karce Science & Technology Co., Ltd., Kenko Calculator Co., Ltd., Aurora Group, TATA Group (EdTech Solutions), VTech Holdings Limited, Zhenhua Scientific Instruments, Orsen Technology, Deli Group Co., Ltd., M&G International, Comix Stationery, Finer Calculator, Citizen Systems Japan Co., Ltd., Vibe Technologies, TIS-TECH Corporation, E-star Science Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scientific Calculator Market Key Technology Landscape

The technological landscape of the scientific calculator market is characterized by incremental improvements focused on user experience, processing efficiency, and display clarity, rather than revolutionary breakthroughs. A major technological focus remains on Natural Textbook Display (NTD) technology, which allows complex equations, fractions, exponents, and statistical tables to be displayed on the screen exactly as they appear in textbooks, significantly reducing input errors and enhancing comprehension, particularly for students transitioning into higher mathematics. This involves specialized high-resolution LCD or semi-transparent organic light-emitting diode (OLED) screens and sophisticated firmware algorithms that interpret and render complex mathematical syntax accurately. Power management, utilizing low-power microcontrollers (MCUs) and incorporating dual solar/battery power systems, is also a critical technology, ensuring prolonged operational life and reliability, which is a major purchasing factor for institutional buyers.

Processing technology, while often utilizing proprietary or custom ASICs (Application-Specific Integrated Circuits) to minimize cost and maximize power efficiency, is evolving towards faster processing speeds necessary for real-time graphing, complex numerical differentiation, and integration, especially in high-end models. Furthermore, the integration of secure, non-networked connectivity, often via specific proprietary ports or limited-range IR technology, is emerging. This technology allows educators to quickly transfer data, pre-loaded programs, or exam settings to student calculators in a secure, controlled classroom environment, mitigating the concerns associated with unauthorized wireless connectivity while enhancing instructional flexibility. The continuous development in input mechanisms, including improved key press reliability and ergonomic designs, also falls under this landscape, ensuring durability under heavy student usage.

The competitive edge is often secured through firmware optimization and specialized computational algorithms. For instance, enhanced capabilities for handling large matrices, solving systems of linear equations quickly, and performing sophisticated statistical regressions are essential in the professional and advanced educational segments. Security technology is increasingly important, particularly firmware designed to prevent unauthorized programming or external communication during standardized tests, ensuring the integrity of the examination process. Future technological trends point toward integrating haptic feedback for specialized function keys and leveraging thin-film transistor (TFT) color displays in high-end graphing models to improve visualization of complex mathematical concepts, though balancing cost and power consumption remains a persistent design constraint.

Regional Highlights

Regional analysis underscores the diverse maturity levels and growth trajectories within the global Scientific Calculator Market, heavily correlated with local educational investments and regulatory frameworks.

- North America: This region is a mature, high-value market dominated by the demand for advanced graphing calculators. The market size is substantial, driven primarily by strict requirements of standardized testing bodies (like the College Board for the SAT and AP exams) which mandate specific, often high-end, models from key vendors like Texas Instruments and Casio. Institutional sales cycles are well-established, focusing on devices with robust feature sets for calculus, physics, and engineering education.

- Europe: Characterized by diverse national educational standards, the European market exhibits strong demand for intermediate and graphing calculators. Germany and the UK are key revenue centers. The preference often leans towards devices compliant with specific national curriculum structures, leading to slightly more fragmented purchasing patterns than in North America. There is a high focus on quality, durability, and compliance with EU environmental and electronic waste regulations.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by massive increases in student enrollment across China, India, and Southeast Asia, driven by substantial governmental investment in STEM education infrastructure. While affordability drives high unit sales of basic and intermediate scientific calculators, countries like Japan and South Korea also represent a sophisticated market for high-end graphing models. The vast size of the student population ensures sustained high volume demand throughout the forecast period.

- Latin America (LATAM): This region is an emerging market characterized by moderate growth. Market penetration is steadily increasing due to educational reforms aimed at improving mathematical standards. Price sensitivity is high, favoring cost-effective, durable models. Distribution challenges related to fragmented retail networks and varying import duties affect market access, making streamlined supply chain operations a critical success factor for international vendors.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states (Gulf Cooperation Council) and South Africa, driven by rapid urbanization and significant government spending on establishing world-class educational institutions. The demand is currently shifting from basic models towards intermediate scientific calculators as curriculum standards advance. The African sub-region presents long-term potential, dependent on sustained improvements in educational funding and infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scientific Calculator Market.- Casio Computer Co., Ltd. (Global leader with extensive portfolio across all segments)

- Texas Instruments Incorporated (Dominant player in the North American graphing calculator segment)

- Sharp Corporation (Known for innovation in display technology and functional breadth)

- Hewlett-Packard (HP) Development Company, L.P. (Strong presence in professional and advanced engineering calculators)

- Canon Inc. (Focus on ergonomic design and quality assurance)

- Karce Science & Technology Co., Ltd. (Significant presence in the Asia Pacific mass market)

- Kenko Calculator Co., Ltd. (Specializing in educational and bulk institutional supply)

- Aurora Group (Provider of budget-friendly, reliable scientific calculation tools)

- TATA Group (Leveraging subsidiary operations for educational technology solutions in India)

- VTech Holdings Limited (Exploring educational overlap and technology integration)

- Zhenhua Scientific Instruments (Emerging Chinese manufacturer targeting mass domestic and export markets)

- Orsen Technology (Focusing on specialized functional calculators)

- Deli Group Co., Ltd. (Leading office supply manufacturer expanding into calculator segments)

- M&G International (Stationery giant with diversified product offerings)

- Comix Stationery (Targeting cost-effective student market solutions)

- Finer Calculator (Niche player focusing on durability and battery efficiency)

- Citizen Systems Japan Co., Ltd. (Leveraging precision manufacturing heritage)

- Vibe Technologies (Innovating in user interface and educational features)

- TIS-TECH Corporation (Providing technical calculation tools for specific engineering fields)

- E-star Science Instruments (Concentrating on STEM educational tools and software integration)

Frequently Asked Questions

Analyze common user questions about the Scientific Calculator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Scientific Calculator Market?

The market growth is fundamentally driven by the continuous global increase in enrollment in higher education, particularly in STEM fields (Science, Technology, Engineering, and Mathematics). Additionally, regulatory requirements set by standardized testing boards worldwide, which mandate the use of dedicated, non-networked calculation devices, sustain high demand for specialized hardware.

How is the scientific calculator market segmented by product functionality?

The market is primarily segmented by functionality into Basic Scientific Calculators (handling standard functions), Intermediate Scientific Calculators (featuring advanced statistical and calculus capabilities), Graphing Calculators (essential for plotting curves and matrix operations), and advanced Programmable Calculators (allowing user-defined scripts).

Will advanced computational software and AI render scientific calculators obsolete?

While advanced software and AI pose competitive pressure, scientific calculators are unlikely to become obsolete due to their critical role in secure, high-stakes environments like standardized tests. Their non-connectivity, dedicated function, reliability, and physical interface provide a secure and focused computational advantage that software cannot replicate under current regulatory frameworks.

Which region currently offers the highest growth potential for scientific calculator sales?

The Asia Pacific (APAC) region, particularly driven by large-scale educational expansion in China and India, is projected to exhibit the highest growth rate. This growth is characterized by high-volume sales of cost-effective and intermediate scientific models tailored to massive student populations entering secondary and tertiary education.

What technological advancements are key to the future development of scientific calculators?

Key technological advancements focus on improving the user experience through Natural Textbook Display (NTD) technology for better equation visualization, optimizing low-power processing chips for extended battery life, and implementing secure, proprietary connectivity features for streamlined classroom data management while maintaining exam integrity.

What are the main restraints impacting market expansion in developed regions?

The primary restraints in developed regions like North America and Europe include market saturation, the prolonged lifespan of high-quality graphing calculators reducing replacement cycles, and the pervasive availability of powerful, often free, calculation applications on smartphones and personal computers, challenging the perceived necessity of dedicated hardware.

How important are institutional procurement channels compared to online retail for manufacturers?

Institutional procurement (bulk purchasing by schools and universities) remains critical, especially for high-end graphing models, as it guarantees large, stable revenue streams and establishes brand loyalty early. However, online retail is growing rapidly, offering competitive pricing and convenience, driving unit sales primarily in the basic and intermediate consumer segments.

What role does ergonomic design play in competitive differentiation?

Ergonomic design is increasingly vital, particularly for student users who utilize the device intensively over many years. Differentiation is achieved through features such as comfortable key shape and tactile feedback, durable casing materials to withstand drops, and intuitive layout that minimizes strain and speeds up data entry, contributing significantly to overall user satisfaction and brand preference.

Which end-user segment contributes the most to overall market revenue?

The Education end-user segment, spanning K-12 and higher education, contributes the overwhelming majority of market revenue and unit volume. Demand is highly cyclical, correlating directly with academic calendars and curriculum adoption rates, making this segment the most influential driver of product design and distribution strategies.

How do global semiconductor shortages affect the scientific calculator manufacturing process?

Global semiconductor shortages pose a direct risk to the upstream value chain, increasing the procurement costs and lead times for specialized microcontrollers and ASICs necessary for sophisticated functions, potentially leading to increased final product prices or delays in introducing new models requiring advanced chips.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager