Scissor Jack Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431656 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Scissor Jack Market Size

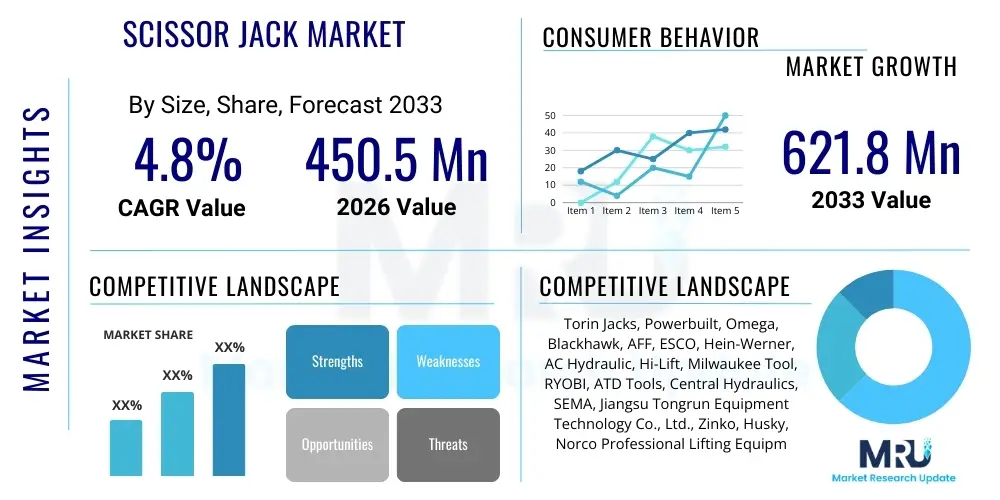

The Scissor Jack Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 621.8 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the sustained expansion of the global automotive parc, particularly in developing economies, coupled with the necessity of emergency tire changing equipment universally included with passenger vehicles. The inherent simplicity and compact design of scissor jacks make them the standard choice for original equipment manufacturers (OEMs) seeking cost-effective and space-saving solutions for trunk storage, despite the increasing availability of more technologically advanced lifting mechanisms.

The market valuation reflects the robust demand across both the OEM segment and the highly active aftermarket. While OEM demand is cyclical and tied to new vehicle production volumes, the aftermarket sector provides a stable revenue stream driven by replacement cycles, expansion of personal vehicle fleets, and demand from Do-It-Yourself (DIY) automotive enthusiasts. Geographically, Asia Pacific remains the dominant revenue contributor, largely due to high vehicle production and dense road networks requiring frequent maintenance and emergency roadside assistance. The forecast period indicates a moderate but stable CAGR, suggesting market maturity in developed regions, balanced by accelerating adoption rates in emerging markets, where vehicle service infrastructure is still evolving, increasing reliance on personal emergency equipment.

Scissor Jack Market introduction

The Scissor Jack Market encompasses the global production, distribution, and sale of mechanical or electromechanical lifting devices characterized by their cross-braced, parallelogram structure that extends vertically to lift loads, predominantly vehicles. Scissor jacks are essential automotive accessories designed for temporary lifting operations, primarily for changing tires or performing minor undercarriage inspections. The product's core value proposition lies in its portability, ease of storage, and sufficient load capacity for standard passenger cars and light trucks. Market dynamics are closely linked to automotive production trends, consumer maintenance habits, and regulatory requirements mandating basic safety tools in vehicles. The primary applications span emergency roadside assistance, home garage maintenance, and commercial fleet support operations.

Driving factors for this market include the global increase in vehicle ownership, particularly in rapidly urbanizing regions, and the regulatory mandate for automakers to include spare tire kits, often accompanied by a factory-standard scissor jack. Furthermore, the rising interest in vehicle maintenance among consumers and the growth of the used vehicle market amplify demand in the aftermarket segment. Scissor jacks offer benefits such as cost-effectiveness, minimal operational complexity, and high reliability when used within their specified load limits. However, the market faces constraints related to user safety concerns and competition from more robust lifting equipment like hydraulic floor jacks, which offer greater efficiency and stability for workshop environments. Manufacturers are continually innovating, focusing on improved materials to increase strength while reducing weight, and introducing electric or battery-powered variants for enhanced user convenience.

Scissor Jack Market Executive Summary

The Scissor Jack Market is poised for steady growth through 2033, underpinned by fundamental demand drivers within the global automotive industry and consumer maintenance sectors. Key business trends indicate a shift towards incorporating lighter, high-strength steel and aluminum alloys in jack construction to meet OEM demands for vehicle weight reduction, thereby enhancing fuel efficiency. Strategic mergers and acquisitions among established accessory providers and entry into adjacent electric vehicle (EV) maintenance tool markets define the competitive landscape. Furthermore, technological integration, specifically the introduction of electric or battery-operated scissor jacks, is gaining traction, addressing user dissatisfaction with the physical exertion required by traditional manual models and streamlining the lifting process for a broader demographic.

Regional trends highlight the Asia Pacific region’s dominance, driven by mass vehicle production hubs in China, India, and Japan, which significantly contribute to the OEM segment volume. North America and Europe, characterized by mature automotive markets, exhibit strong demand in the replacement and premium aftermarket segments, favoring products with superior durability and enhanced safety features. Segmentation trends show the mechanical scissor jack retaining the largest market share due to its low manufacturing cost and widespread OEM adoption. However, the hydraulic and electric sub-segments are forecast to experience faster growth rates, appealing to consumers seeking greater convenience and efficiency for frequent use scenarios. The shift toward larger SUV and light truck formats also influences product design, necessitating jacks capable of handling higher lift heights and heavier loads, ensuring continued product evolution across all segments.

AI Impact Analysis on Scissor Jack Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Scissor Jack Market primarily revolve around automation possibilities, supply chain optimization, and the integration of smart features into lifting technology. Consumers and industry professionals frequently question how AI algorithms could predict maintenance failures (reducing the need for emergency roadside use), optimize manufacturing processes (improving consistency and reducing defects), and whether future vehicle architectures will entirely eliminate the need for manual tire changing tools through advanced autonomous repair capabilities or run-flat technology. Key themes indicate that while AI may not directly transform the physical product itself, its pervasive influence on surrounding ecosystems—such as manufacturing robotics, predictive maintenance software, and logistics planning—will indirectly enhance the market efficiency and product quality. The integration of AI in robotics for quality control ensures higher reliability, addressing core user safety concerns related to jack failures, thus indirectly bolstering consumer confidence in specialized automotive tools.

- AI-driven Predictive Maintenance: Reduces the overall frequency of emergency equipment use by forecasting and preempting tire failures and maintenance needs in commercial fleets.

- Manufacturing Optimization: AI algorithms enhance quality control through machine vision inspection, detecting micro-defects in load-bearing components, thereby improving product safety and consistency.

- Supply Chain Management: Utilizes AI for demand forecasting and inventory optimization, ensuring manufacturers can respond rapidly to fluctuating OEM and aftermarket requirements.

- Autonomous Vehicle Integration: Research into autonomous vehicle maintenance concepts might reduce reliance on traditional manual jacks, although this remains a long-term future disruption.

- Design and Simulation: AI-powered generative design tools optimize the structure of scissor mechanisms for maximum strength-to-weight ratio, enhancing performance and portability.

DRO & Impact Forces Of Scissor Jack Market

The Scissor Jack Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DROs) that dictate its overall trajectory and impact forces. The primary driver remains the continuous expansion of the global vehicle fleet, necessitating the widespread distribution of emergency lifting tools as standard equipment. This demand is further amplified by the growth in the used car market and the corresponding need for reliable, affordable repair tools for consumers engaging in routine DIY maintenance. Conversely, the market faces significant restraints, chiefly related to safety concerns associated with manual lifting devices, which have led some consumers to opt for professional roadside assistance services or invest in heavier, more stable hydraulic alternatives. Furthermore, the slow replacement cycle for these tools in the OEM segment, where they are built to last the life of the vehicle, caps consistent growth.

Opportunities for market expansion are centered on product innovation, particularly the adoption of lightweight, high-performance composite materials and the electrification of the lifting mechanism (electric scissor jacks), which address key pain points related to physical effort and time consumption. Regulatory requirements for vehicle safety standards also indirectly create opportunities for manufacturers who can produce certified, load-tested equipment that exceeds minimum compliance thresholds. Impact forces shaping the competitive landscape include intense price competition, especially from Asian manufacturers, and the increasing stringency of safety certifications in key regions like North America and Europe. The collective influence of these forces means that manufacturers must prioritize both cost-efficiency and demonstrable product reliability to maintain market share and capitalize on growth opportunities in specialized, higher-margin segments.

Segmentation Analysis

The Scissor Jack Market is strategically segmented based on factors including Product Type, Load Capacity, Sales Channel, and Application, allowing for detailed analysis of consumption patterns and market potential across various user groups. Understanding these segments is crucial for manufacturers to tailor their product offerings, optimize distribution networks, and target specific customer demographics, ranging from large automotive OEMs requiring millions of standardized units to individual consumers seeking specialized, robust lifting tools for personal use. The segmentation highlights the intrinsic differences in demand drivers, pricing sensitivities, and quality requirements between the OEM and aftermarket sectors, with the latter demanding greater product variety and rapid availability.

Detailed analysis reveals that Load Capacity segmentation, particularly the 1-2 Ton segment, dominates the market due to its alignment with the majority of passenger car specifications globally. However, the heavier 3-5 Ton segment is experiencing accelerated growth, propelled by the rising popularity of SUVs, light commercial trucks, and electric vehicles (which often have higher curb weights due to battery packs). Furthermore, the Type segmentation, encompassing Mechanical, Hydraulic, and Electric variants, illustrates the technological evolution of the market. While the foundational Mechanical segment remains the volume leader due to its low cost, the Hydraulic and Electric segments are capturing market value by offering superior convenience and reducing the physical strain associated with emergency lifting procedures, satisfying the needs of modern, convenience-oriented consumers. This granular segmentation approach informs strategic decisions regarding material selection, production scalability, and regional market penetration strategies.

- Product Type:

- Mechanical Scissor Jacks

- Hydraulic Scissor Jacks

- Electric Scissor Jacks

- Load Capacity:

- Less than 1 Ton

- 1 Ton to 2 Tons

- 2 Tons to 5 Tons

- Above 5 Tons

- Application:

- Passenger Vehicles (Sedans, Hatchbacks, SUVs)

- Commercial Vehicles (Light Duty Trucks, Vans)

- Off-Road and Specialty Vehicles

- Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, Online, Service Stations)

Value Chain Analysis For Scissor Jack Market

The Value Chain for the Scissor Jack Market commences with the Upstream Analysis, primarily involving the procurement of raw materials, predominantly high-tensile steel, aluminum alloys, and specialized plastics for components like handles and bases. Key activities at this stage focus on securing stable supply contracts, negotiating competitive pricing for metals, and ensuring compliance with material quality standards necessary for load-bearing applications. Efficiency in material conversion, minimizing waste, and managing the volatility of global steel prices are critical success factors for early-stage profitability. Manufacturers often integrate backwards to control some aspects of forging or casting processes to ensure precise component geometry and material integrity, which is paramount for product safety and regulatory compliance.

The Midstream component encompasses the core manufacturing, assembly, and quality assurance processes. This involves stamping, welding, machining, and final assembly of the parallelogram mechanism, screw spindle, and handle. Quality control protocols, including stringent load-testing and fatigue analysis, are heavily emphasized due to the critical nature of the product. Distribution channels represent the Downstream Analysis, which is bifurcated into Direct and Indirect sales. Direct sales dominate the OEM channel, involving large, long-term contracts with automotive companies and Just-In-Time (JIT) delivery logistics. Indirect sales characterize the aftermarket, relying heavily on a wide network of wholesalers, automotive parts distributors, specialized retail chains (like auto parts stores), and increasingly, e-commerce platforms, which provide broad market reach and inventory flexibility. The shift towards online retail requires robust logistics and fulfillment capabilities to handle the weight and dimensions of the product efficiently.

The efficacy of the distribution channel dictates market penetration and customer accessibility. For the OEM segment, the distribution is characterized by tight integration with the automaker's production schedule, requiring high volume consistency and adherence to global manufacturing standards. In the aftermarket, brand recognition and the ability to offer diverse product specifications (e.g., varying load capacities and lift heights) are key. The role of indirect channels, particularly large-scale e-commerce vendors, has been transformative, offering consumers direct access to premium or specialized hydraulic and electric jacks, circumventing traditional brick-and-mortar limitations. This blend of structured direct supply to automakers and agile, multi-channel distribution to end-users defines the mature operational structure of the global scissor jack value chain.

Scissor Jack Market Potential Customers

The potential customer base for the Scissor Jack Market is extensive and diverse, primarily categorized into Original Equipment Manufacturers (OEMs), automotive aftermarket consumers, and specialized industrial users. OEMs represent the largest volume segment, comprising major global automotive manufacturers of passenger cars, SUVs, and light commercial vehicles (LCVs). These buyers are driven by cost-effectiveness, mandated safety compliance, compact design integration, and the requirement for millions of identical, reliable units annually to include in their vehicles as standard emergency equipment. Their purchasing decisions are highly sensitive to unit cost and adherence to globally recognized quality and load-bearing standards, focusing primarily on the mechanical scissor jack segment.

The second major category involves Aftermarket Consumers, which includes individual vehicle owners, DIY enthusiasts, small garages, and tire service shops. These buyers seek replacement jacks, upgrades, or specialized tools. DIY enthusiasts often look for higher quality, more robust jacks (like heavy-duty mechanical or light hydraulic models) that offer greater stability and ease of use for routine maintenance. Commercial service providers, such as roadside assistance fleets and tire repair facilities, typically purchase more durable, frequently used electric or hydraulic versions that minimize technician effort and maximize speed and efficiency during service calls. The growth of vehicle customization and restoration activities further broadens the demand for specialized, high-lift capacity jacks designed for specific vehicle types, such as lifted trucks or low-profile sports cars, demonstrating a fragmentation within the aftermarket demand structure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 621.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Torin Jacks, Powerbuilt, Omega, Blackhawk, AFF, ESCO, Hein-Werner, AC Hydraulic, Hi-Lift, Milwaukee Tool, RYOBI, ATD Tools, Central Hydraulics, SEMA, Jiangsu Tongrun Equipment Technology Co., Ltd., Zinko, Husky, Norco Professional Lifting Equipment, Shinn Fu Company of America, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scissor Jack Market Key Technology Landscape

The technology landscape of the Scissor Jack Market, while fundamentally mature, is undergoing evolutionary changes driven by material science innovation and electrification. Traditional mechanical jacks rely on standardized screw mechanisms (trapezoidal or Acme threads) and stamped steel construction, a technology optimized for low-cost, high-volume production. Recent advancements focus primarily on increasing the strength-to-weight ratio. This involves adopting high-tensile strength low-alloy (HSLA) steel and, in premium models, lightweight aluminum alloys. Aluminum jacks significantly reduce the weight for easier portability and handling, a key selling point in the aftermarket, though they command a higher price point due to increased material costs and specialized manufacturing techniques necessary for structural integrity under load.

The most significant technological development is the transition to electrified lifting mechanisms. Electric scissor jacks incorporate a compact DC motor and gear reduction unit, allowing the user to operate the jack via a standard 12V cigarette lighter plug or a dedicated battery pack, eliminating manual cranking. This enhancement dramatically improves user convenience, particularly for older demographics or individuals with physical limitations, positioning electric jacks as a premium offering in the aftermarket. Furthermore, micro-sensor integration and feedback loops are emerging in high-end commercial jacks to monitor load distribution and stability, providing warnings if the load exceeds limits or if the jack is placed on an unstable surface. This technological integration, while niche, underscores the industry's focus on enhancing safety and operational simplicity, directly addressing traditional product restraints and broadening the potential user base beyond seasoned DIY mechanics to the general public seeking simple, reliable emergency tools.

The integration of safety features is another crucial technological focus. Manufacturers are employing advanced computer-aided design (CAD) and finite element analysis (FEA) to simulate stress points and potential failure modes, allowing for optimized material thickness and structural geometry, ensuring consistent performance at maximum rated capacity. For hydraulic scissor jacks, which are less common than mechanical ones but exist in the market, the technology involves improved seal design and fluid dynamics to enhance lifting speed and reduce maintenance requirements. Overall, while the core mechanical principles remain unchanged, the application of lightweight materials, precise manufacturing techniques enabled by automation, and the introduction of electric power are defining the key differentiators and future growth vectors in the scissor jack technology landscape, moving the product from a basic utility item to a more advanced, user-friendly emergency tool.

Regional Highlights

- North America: This region is characterized by a strong demand for high-capacity and premium lifting equipment, driven by the prevalence of larger vehicles (SUVs and light trucks) and a robust DIY culture. The aftermarket dominates the regional revenue, emphasizing quality, brand reputation, and advanced features such as electric operation and high safety standards (e.g., ASME PASE certification). Regulatory scrutiny on lifting equipment safety is high, favoring established manufacturers who invest in rigorous testing. The region also sees significant demand from commercial fleet operators prioritizing speed and durability in roadside repair tools.

- Europe: The European market focuses heavily on compliance with stringent safety regulations (e.g., CE marking) and efficiency. While passenger vehicle production drives the OEM segment, the aftermarket is discerning, favoring compact, lightweight designs suitable for smaller European vehicles and urban use. Demand for hydraulic and electric variants is growing steadily as consumers seek ergonomic solutions. Sustainability and material traceability are also emerging trends influencing procurement decisions across the continent.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, largely due to high-volume automotive production in China, India, and Southeast Asia. The OEM segment drives immense demand for low-cost, standardized mechanical scissor jacks. Rapid urbanization and increasing vehicle ownership in developing nations fuel explosive growth in both OEM sales and the low-to-mid-range aftermarket segments. Price competitiveness is extremely high, although rising affluence in countries like China is beginning to spur demand for higher-quality, branded aftermarket products.

- Latin America (LATAM): The LATAM market is characterized by fluctuating economic conditions, leading to strong price sensitivity. The market relies heavily on imports and localized manufacturing for basic mechanical jacks. Demand is primarily driven by replacement needs in the aging vehicle fleet and basic roadside emergency requirements, prioritizing affordability and functional reliability over premium features.

- Middle East and Africa (MEA): Growth in MEA is primarily linked to infrastructure development and the increasing commercial fleet size, particularly in the Gulf Cooperation Council (GCC) nations. Demand includes both standard passenger vehicle jacks and more heavy-duty equipment for commercial vehicles and industrial use in oil and gas and construction sectors. Political stability and high disposable income in certain areas allow for the introduction of premium, brand-name lifting solutions, though the overall market remains segmented by significant economic disparities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scissor Jack Market.- Torin Jacks

- Powerbuilt

- Omega

- Blackhawk

- AFF

- ESCO

- Hein-Werner

- AC Hydraulic

- Hi-Lift

- Milwaukee Tool

- RYOBI

- ATD Tools

- Central Hydraulics (Harbor Freight Tools)

- SEMA

- Jiangsu Tongrun Equipment Technology Co., Ltd.

- Zinko

- Husky

- Norco Professional Lifting Equipment

- Shinn Fu Company of America, Inc.

Frequently Asked Questions

Analyze common user questions about the Scissor Jack market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for scissor jacks?

The primary factor driving demand is the sustained growth in the global automotive fleet and regulatory requirements mandating the inclusion of emergency tire changing equipment as standard accessories in new passenger vehicles, heavily influencing the OEM segment volume.

How do electric scissor jacks differ from traditional mechanical jacks?

Electric scissor jacks integrate a 12V DC motor to perform the lifting operation automatically, eliminating the need for manual cranking. This enhances user convenience, speed, and overall ease of use, positioning them as a premium option in the aftermarket.

Which region holds the largest market share for scissor jacks?

The Asia Pacific (APAC) region holds the largest market share, driven primarily by high-volume automotive production centers in China and India, coupled with rapid vehicle ownership growth in emerging economies across the continent.

Are scissor jacks being replaced by alternative vehicle lifting technologies?

While robust hydraulic floor jacks offer greater stability for garage use, and run-flat tires reduce emergency roadside incidents, the scissor jack remains essential for OEMs due to its low cost, compact size, and effectiveness as a universal emergency tool.

What are the key materials used in modern scissor jack manufacturing?

Modern scissor jacks primarily utilize high-tensile steel for durability. Premium and lightweight models incorporate aluminum alloys and high-strength, low-alloy (HSLA) steels to reduce weight while maintaining the necessary load-bearing capacity and structural integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager