Scraper Centrifuge Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432669 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Scraper Centrifuge Market Size

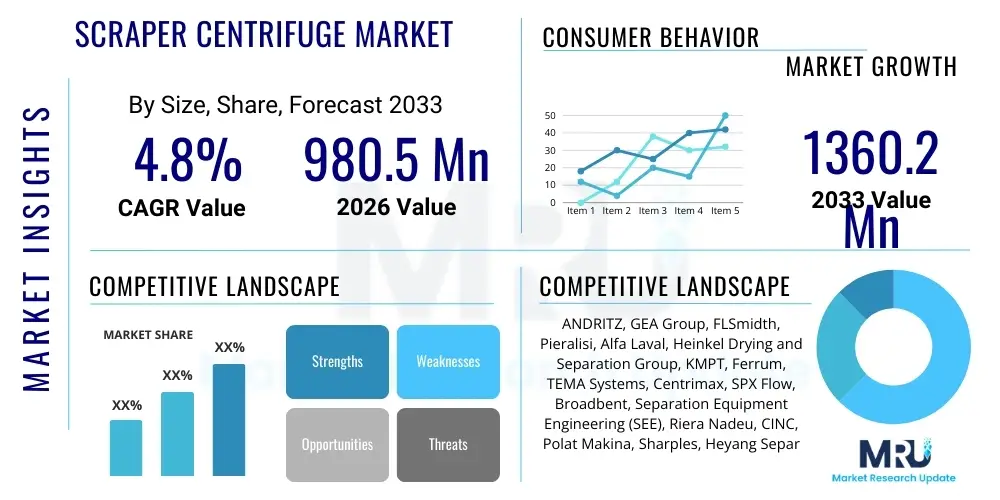

The Scraper Centrifuge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 980.5 Million in 2026 and is projected to reach USD 1360.2 Million by the end of the forecast period in 2033.

Scraper Centrifuge Market introduction

The Scraper Centrifuge Market encompasses the manufacturing, distribution, and utilization of high-performance filtration and separation equipment designed for solid-liquid separation processes, primarily in industrial settings. These centrifuges operate on the principle of centrifugal force to rapidly separate solids from liquids, achieving high purity and low moisture content in the final solid product. Characterized by batch operation and robust construction, scraper centrifuges are indispensable in industries where product integrity and efficient separation are paramount, offering superior performance compared to conventional settling or filtration methods, especially for fine, crystalline, or fragile solids.

Key applications of scraper centrifuges span across chemical processing, pharmaceutical manufacturing, food and beverage production, and environmental management sectors. In the chemical industry, they are vital for separating active ingredients and intermediate compounds, while in pharmaceuticals, they ensure the purification of APIs (Active Pharmaceutical Ingredients) under stringent aseptic conditions. The inherent design, which includes a mechanical scraping mechanism for automatic discharge of the filtered cake, significantly reduces manual intervention, improves cycle time, and enhances operational safety. This automation capability, coupled with advancements in material science enabling handling of corrosive and abrasive slurries, positions the scraper centrifuge as a critical piece of capital equipment.

Major market driving factors include the escalating global demand for high-quality, pure chemical and pharmaceutical products, increased investment in wastewater treatment infrastructure, and the continuous push for process optimization and energy efficiency in industrial separation technology. The benefits derived from these systems—such as high throughput, reduced residual moisture, and operational flexibility to handle diverse particle sizes—solidify their strategic importance across numerous industrial verticals. Furthermore, strict regulatory environments, particularly in developed economies, necessitate reliable and verifiable separation equipment, further stimulating market growth.

Scraper Centrifuge Market Executive Summary

The Scraper Centrifuge Market is experiencing steady expansion driven by robust growth in the specialty chemicals and biotechnology sectors globally. Business trends indicate a strong shift towards highly automated, explosion-proof (ATEX compliant), and Clean-In-Place (CIP) compatible centrifuges to meet rigorous safety and hygiene standards. Key manufacturers are focusing on integrating advanced sensor technology and predictive maintenance capabilities to maximize uptime and operational efficiency. Furthermore, supply chain resilience remains a critical strategic focus following recent global disruptions, encouraging localization of manufacturing capabilities in core markets.

Regionally, Asia Pacific (APAC) dominates the market, primarily fueled by massive industrialization, rapid expansion of domestic pharmaceutical manufacturing capabilities in countries like China and India, and significant infrastructure development related to water and wastewater management. North America and Europe, while mature, exhibit demand concentrated on advanced, custom-engineered, and high-specification units tailored for high-value applications, such as sensitive API separation and complex material purification. Latin America and the Middle East & Africa (MEA) represent emerging high-growth opportunities, spurred by investments in petrochemical complexes and localized food processing plants.

Segment trends highlight the dominance of the vertical axis configuration due to its flexibility and ease of maintenance, although horizontal units are gaining traction in specific high-throughput chemical applications. The pharmaceutical segment remains the fastest-growing application area, necessitated by stringent quality control requirements and the burgeoning pipeline of biopharmaceuticals. Strategic alliances, mergers, and acquisitions focused on acquiring specialized separation technologies or expanding geographical footprint define the current competitive landscape.

AI Impact Analysis on Scraper Centrifuge Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Scraper Centrifuge Market center around how AI can optimize batch cycles, predict mechanical failure, and enhance the separation efficiency of complex slurries. Users are keenly interested in transitioning from reactive maintenance to predictive maintenance, minimizing unplanned downtime which is costly in high-volume production environments. Concerns also revolve around the integration challenges of legacy equipment with modern AI-driven monitoring systems and the return on investment (ROI) associated with implementing sophisticated machine learning algorithms for process control. Overall, the expectation is that AI will transform the operational model from fixed parameters to dynamic, self-optimizing separation processes.

The application of AI in this domain is focused on leveraging vast amounts of historical operational data, including torque readings, vibration analysis, temperature fluctuations, and flow rates, to create precise digital twins of the centrifuge operation. This allows for real-time adjustments to scraper speed, basket speed, and wash cycles, optimizing product purity and minimizing solvent usage. Predictive analytics powered by AI algorithms can anticipate bearing wear or imbalance issues weeks in advance, scheduling maintenance during planned shutdowns rather than suffering catastrophic failures, thereby significantly extending the equipment’s lifespan and improving overall equipment effectiveness (OEE).

- AI-driven Predictive Maintenance: Reduces unplanned downtime by analyzing vibration and thermal signatures.

- Process Optimization: Machine learning algorithms adjust speed and timing for maximum yield and purity in real-time.

- Automated Anomaly Detection: Immediate flagging of deviations in slurry input characteristics or discharge behavior.

- Enhanced Energy Efficiency: Optimization of motor operation based on load and desired separation outcome, reducing power consumption.

- Digital Twin Modeling: Creation of virtual representations for testing new process parameters without affecting production.

- Improved Data Integrity: Automated logging and analysis for regulatory compliance and batch tracing (critical in pharma).

DRO & Impact Forces Of Scraper Centrifuge Market

The dynamics of the Scraper Centrifuge Market are heavily influenced by a combination of key drivers, fundamental restraints, and emerging opportunities, all mediated by critical impact forces such as regulatory changes and technological advancements. Market growth is primarily driven by the expanding chemical manufacturing base globally and the stringent requirement for high-purity crystalline products in pharmaceutical and fine chemical synthesis. The critical impact forces include globalization of manufacturing standards, which demands universally high-quality equipment, and rapid technological obsolescence necessitating continuous R&D investment by manufacturers.

While demand is strong, the market faces significant restraints, including the high initial capital expenditure associated with purchasing and installing robust industrial centrifuges, which can be prohibitive for smaller enterprises. Furthermore, the market requires highly skilled technical personnel for operation and specialized maintenance, posing a challenge in regions facing labor skill gaps. Opportunities lie in developing modular, compact, and energy-efficient models, and expanding penetration into emerging sectors such as specialty polymers and biofuel production, where precise separation is becoming increasingly important. The impact force of environmental sustainability is also pushing manufacturers toward designs that minimize waste generation and solvent use during washing phases.

- Drivers (D): Increased global pharmaceutical API manufacturing; expansion of specialty chemical processing; stringent environmental regulations demanding efficient dewatering.

- Restraints (R): High capital investment and installation costs; complexity of maintenance and need for specialized expertise; slow adoption rate in highly regulated emerging markets.

- Opportunities (O): Development of continuous or semi-continuous high-throughput centrifuges; integration of Industry 4.0 technologies (IoT, AI) for remote monitoring; focus on niche applications (e.g., bioplastics separation).

- Impact Forces (I): Technological innovation in materials science (handling abrasive/corrosive media); fluctuating raw material costs; regulatory pressure (FDA, EMA) dictating design standards.

Segmentation Analysis

The Scraper Centrifuge Market is comprehensively segmented based on axis type, operational mode, material of construction, and end-use application, providing a detailed view of specific market niches and demand trends. Segmentation by axis type, dividing the market into Vertical Axis and Horizontal Axis centrifuges, reflects differences in operational footprint, ease of cake discharge, and suitability for various particle characteristics. The application segmentation provides critical insight into the primary demand drivers, with the Chemical industry typically accounting for the largest volume share, while the Pharmaceutical segment commands the highest growth rate due to its demand for aseptic and validation-ready equipment. This structure allows market participants to tailor product development and marketing strategies to the distinct needs of each segment.

Furthermore, segmentation by material of construction, such as stainless steel grades (e.g., Duplex, Hastelloy) or specialized alloys, is crucial because the material must withstand the corrosive, abrasive, and temperature conditions inherent in chemical and acid processing. Operational modes, whether focusing on fully automatic, semi-automatic, or specialized batch operation, define the level of human intervention required and directly correlate with throughput capacity and labor costs. Understanding these cross-segment dynamics is essential for forecasting equipment demand, especially given the trend towards multi-purpose centrifuges that can handle diverse product batches within the same facility.

- By Type: Vertical Axis Scraper Centrifuge, Horizontal Axis Scraper Centrifuge

- By Operation: Automatic Scraper Centrifuge, Semi-Automatic Scraper Centrifuge

- By Material of Construction: Stainless Steel (SS 316L, Duplex), Hastelloy and Nickel Alloys, Special Coatings/Linings

- By Application: Chemical Processing (Inorganic & Organic), Pharmaceutical Manufacturing (API & Intermediates), Food & Beverages (Sugar, Starches), Wastewater Treatment & Environmental, Mining and Minerals, Others (Biotechnology, Polymers)

Value Chain Analysis For Scraper Centrifuge Market

The value chain for the Scraper Centrifuge Market begins with upstream activities involving the sourcing and processing of high-grade specialized materials, particularly stainless steel alloys (like Duplex or Hastelloy) and advanced polymers necessary for internal components and linings that require exceptional corrosion and abrasion resistance. Critical upstream suppliers include specialized metallurgy firms, precision bearing manufacturers, and advanced motor/drive system providers. Manufacturers must maintain strong relationships with these suppliers to ensure quality control, supply chain predictability, and compliance with material certifications required for pharmaceutical and food-grade equipment.

The midstream phase involves core manufacturing activities: design, precision machining of the basket and housing, complex welding, assembly, and rigorous testing, including vibration analysis and balancing. This stage is highly proprietary and capital-intensive, requiring specialized engineering expertise. Distribution channels, forming the downstream segment, are typically handled via direct sales teams for major projects and high-value custom installations, supplemented by a network of specialized local distributors and agents who provide critical after-sales support, spare parts, and localized maintenance services. The quality of after-sales service is a key differentiating factor, particularly for mission-critical applications.

Direct channels are preferred for large, complex pharmaceutical or chemical installations where bespoke engineering and extensive client consultation are required, ensuring precise alignment with process validation requirements. Indirect channels, utilizing specialized mechanical equipment distributors, are common for standard-model sales in geographically diverse or smaller industrial markets. The profitability throughout the value chain is largely concentrated in the manufacturing and high-margin after-sales service components, reflecting the technical complexity and lifecycle support required for this industrial machinery.

Scraper Centrifuge Market Potential Customers

The primary end-users and buyers of scraper centrifuges are large-scale industrial processors requiring high efficiency and purity in their solid-liquid separation steps. The core customer base resides in the bulk and specialty chemical sectors, where these machines are used to dewater products such as fertilizers, plasticizers, and industrial salts. These customers prioritize high throughput, material compatibility, and robust construction to handle challenging, often corrosive, chemical environments. The purchasing decisions are typically centralized and involve detailed technical evaluations by process engineers.

Another rapidly expanding segment of potential customers includes pharmaceutical and biotechnology firms, particularly those involved in Active Pharmaceutical Ingredient (API) production and crystallization processes. These buyers demand features such as GMP compliance, sterile operation, validation documentation (IQ/OQ/PQ), Clean-In-Place (CIP) capabilities, and containment systems for hazardous or potent compounds. For these highly regulated buyers, reliability and documentation supersede initial cost considerations. Furthermore, environmental agencies and municipal wastewater treatment plants represent steady customers for dewatering sludge and fine solids, focusing on minimizing disposal costs and maximizing dryness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980.5 Million |

| Market Forecast in 2033 | USD 1360.2 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ANDRITZ, GEA Group, FLSmidth, Pieralisi, Alfa Laval, Heinkel Drying and Separation Group, KMPT, Ferrum, TEMA Systems, Centrimax, SPX Flow, Broadbent, Separation Equipment Engineering (SEE), Riera Nadeu, CINC, Polat Makina, Sharples, Heyang Separation Machinery, Jorss Separation, ZK Separation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scraper Centrifuge Market Key Technology Landscape

The technological landscape of the Scraper Centrifuge Market is characterized by continuous refinements aimed at improving purity, increasing throughput, and enhancing operational safety and flexibility. A critical technological focus is the development of advanced filtration media and liner materials, which allow the centrifuge to handle increasingly fine particles and highly corrosive chemical solutions without compromising separation efficiency or mechanical integrity. Modern centrifuges often incorporate vibration monitoring systems and dynamic balancing technology to ensure stable high-speed operation, which is crucial for maximizing efficiency and equipment longevity. Furthermore, sealed systems and inert gas purging capabilities are standard requirements for handling flammable or explosive materials in chemical environments (ATEX compliance).

Automation and control systems represent another significant area of technological advancement. Current models utilize sophisticated Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) for precise control over the entire batch cycle, including feeding, washing, spinning, and scraping phases. Integration of Variable Frequency Drives (VFDs) allows for flexible speed control tailored to specific product characteristics. The emerging trend involves integrating these control systems with facility-wide SCADA and MES systems, enabling remote diagnostics and centralized data analysis, which aligns with Industry 4.0 paradigms.

Specialized washing technologies are also paramount, particularly in pharmaceutical applications where residual solvent must be minimized. Techniques such as displacement washing and pulsed washing cycles are optimized through automated controls to achieve high product purity using minimal solvent volumes, improving both operational cost efficiency and environmental footprint. Furthermore, innovations in basket design, including specialized wedge wire screens and proprietary internal flow diverters, are continually being introduced to enhance cake homogeneity and expedite the dewatering process.

Regional Highlights

The Scraper Centrifuge Market demonstrates distinct regional dynamics dictated by industrial maturity, regulatory environment, and investment patterns in key manufacturing sectors.

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by massive capacity additions in chemical production, particularly in China, India, and Southeast Asia. Regulatory environments are tightening, pushing manufacturers to invest in higher-quality, automated separation equipment, especially in the rapidly expanding domestic pharmaceutical and food processing sectors. Infrastructure spending on municipal wastewater treatment also fuels steady demand for robust dewatering solutions.

- North America: Characterized by a mature industrial base and a strong emphasis on high-tech manufacturing, North America demands specialized, custom-engineered centrifuges. Growth is highly concentrated in the high-value pharmaceutical, biotechnology, and specialty chemical segments, focusing on maximizing efficiency and minimizing operator exposure, leading to high adoption rates of fully automated and contained systems.

- Europe: The European market is highly regulated (e.g., REACH and stringent environmental standards), driving demand for highly efficient, energy-saving, and solvent-recovery-enabled centrifuges. Western Europe maintains strong demand for replacement and technology upgrades, while Central and Eastern Europe provide growth opportunities through industrial modernization and increased capacity utilization in the chemical and energy industries.

- Latin America (LATAM): Growth in LATAM is closely linked to investments in petrochemicals, mining, and food & beverage production, particularly in Brazil and Mexico. The market often favors cost-effective, durable models, though demand for automated systems is rising as multinational companies increase their regional manufacturing footprint.

- Middle East and Africa (MEA): This region is heavily influenced by large-scale oil and gas investments (petrochemical production) and rapidly developing water desalination and treatment infrastructure. Demand focuses on robust, high-capacity equipment capable of handling harsh environmental conditions and specialized corrosive media in fertilizer production and large industrial complexes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scraper Centrifuge Market.- ANDRITZ

- GEA Group

- FLSmidth

- Pieralisi

- Alfa Laval

- Heinkel Drying and Separation Group

- KMPT

- Ferrum

- TEMA Systems

- Centrimax

- SPX Flow

- Broadbent

- Separation Equipment Engineering (SEE)

- Riera Nadeu

- CINC

- Polat Makina

- Sharples

- Heyang Separation Machinery

- Jorss Separation

- ZK Separation

Frequently Asked Questions

Analyze common user questions about the Scraper Centrifuge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of scraper centrifuges over conventional filtration methods?

Scraper centrifuges offer high separation efficiency, achieving very low residual moisture content in the solid cake. They provide automated cake discharge, facilitating continuous or semi-continuous batch processing, which reduces manual labor, enhances cycle time, and ensures high product purity, particularly critical for fine crystalline materials.

Which end-use application accounts for the highest growth rate in the Scraper Centrifuge Market?

The Pharmaceutical and Biotechnology manufacturing segment exhibits the highest growth rate. This is due to stringent regulatory requirements for Active Pharmaceutical Ingredient (API) purity, the need for aseptic handling, and the increasing demand for validated, high-containment separation equipment necessary for complex drug synthesis processes globally.

How does the integration of Industry 4.0 technologies influence centrifuge operation?

Industry 4.0 integration, specifically IoT and AI, enables real-time remote monitoring, predictive maintenance scheduling based on operational data (vibration, temperature), and automated optimization of batch cycles. This substantially reduces unplanned downtime, maximizes equipment lifespan, and improves overall energy efficiency and process consistency.

What is the difference between Vertical Axis and Horizontal Axis scraper centrifuges?

Vertical Axis centrifuges typically save floor space and are often preferred for batch operations handling sensitive or fragile solids due to easier cake removal and maintenance. Horizontal Axis centrifuges are better suited for higher throughput, continuous industrial processes and are often integrated into complex, multi-stage chemical process lines.

What are the critical material considerations for a scraper centrifuge purchase?

The material of construction must be chosen based on the chemical compatibility with the slurry, temperature, and abrasiveness of the solids. Stainless steel grades (like SS 316L) are common, but specialized alloys such as Hastelloy are required for highly corrosive acids and chemicals to ensure durability and prevent costly process contamination.

The Scraper Centrifuge Market is positioned for stable growth, fueled by global industrial expansion and necessary process upgrades across core sectors. The future trajectory will be defined by advancements in automation, integration of smart technologies for process control, and adherence to increasingly rigorous safety and environmental standards. Strategic investments in R&D focusing on energy efficiency and material science innovation will be crucial for maintaining competitive advantage.

The transition toward smart manufacturing and the increasing complexity of synthesized materials, particularly in the pharmaceutical space, necessitates high-precision separation tools. Manufacturers are actively developing modular, flexible systems that can rapidly switch between different product batches while maintaining regulatory compliance. This adaptability is key to servicing modern, multi-product chemical and bio-processing facilities. Moreover, the demand for after-sales service, including long-term maintenance contracts and spare parts, forms a substantial and stable revenue stream for established market players, underscoring the total cost of ownership as a crucial factor in purchasing decisions.

Regulatory frameworks, such as those governing GMP (Good Manufacturing Practice) and environmental discharge limits, act as both drivers and barriers. While they necessitate investment in compliant, high-end equipment, the complexity of validation and compliance can slow down adoption, especially in emerging markets. Companies that can provide fully validated, turnkey separation solutions, especially those incorporating data management capabilities required for auditing, are expected to capture premium market share. The competitive environment remains focused on technological differentiation, especially concerning filter bag discharge mechanisms, residual heel reduction systems, and enhanced washing methodologies.

The ongoing industrial shift towards sustainability also impacts equipment design, prompting the adoption of closed-loop systems and centrifuges optimized for efficient solvent recovery. This focus on minimizing waste and maximizing resource utilization is becoming a mandatory requirement across global supply chains. Furthermore, the risk associated with handling hazardous or explosive substances necessitates robust safety features, including specialized inertization systems (nitrogen blanketing) and explosion-proof designs (ATEX/IECEx certifications), making safety compliance a non-negotiable factor in market participation.

In summary, the market is structurally sound, benefiting from non-discretionary industrial requirements for separation. Geopolitical stability and access to high-quality raw materials are persistent concerns for manufacturers. However, technological innovation, particularly the successful implementation of AI for predictive operational intelligence, promises to unlock new levels of efficiency and reliability, ensuring the long-term viability and growth of the Scraper Centrifuge Market.

Detailed analysis reveals that the vertical axis segment maintains a structural advantage due to its relative simplicity in operation and cleaning, making it highly preferred in batch-centric industries like pharmaceuticals. However, the horizontal axis segment is making technological strides by improving maintenance accessibility and discharge reliability, positioning it strongly for large-volume continuous chemical synthesis facilities. Investment decisions across regions are heavily weighted by the total lifecycle cost, including energy consumption and labor requirements, favoring highly automated solutions despite the higher initial capital outlay.

The trend towards customized solutions tailored to specific particle morphology and process temperatures continues to drive manufacturer specialization. Smaller, niche players often excel in highly specific applications (e.g., handling ultra-fine particles or highly viscous slurries), competing effectively against major global players who offer standardized, high-volume units. Strategic partnerships between centrifuge manufacturers and system integrators specializing in downstream drying and handling processes are increasingly common, aimed at providing end-to-end solid-liquid separation solutions and streamlining procurement for end-users.

Finally, the long operational lifespan of scraper centrifuges (often exceeding 15-20 years) means that the aftermarket for refurbishment, parts, and technical upgrades constitutes a significant portion of the total market value. Companies that establish extensive global service networks capable of quick response times and specialized mechanical repairs secure strong customer loyalty and recurring revenue streams, mitigating the cyclical nature sometimes observed in new equipment sales tied to large capital investment cycles.

The chemical processing application remains the largest volume segment globally, characterized by demand for rugged construction and resistance to aggressive media. Growth in commodity chemicals drives volume, while high-value specialty chemical applications demand custom material specifications. The inherent need to comply with varied regional safety standards, such as those related to pressure vessel design and electrical safety, adds a layer of complexity to manufacturing and distribution, making localized expertise in engineering compliance essential for global market penetration.

Emerging markets continue to rapidly adopt modern centrifuge technology as they upgrade from older, less efficient filtration systems. Governments in countries like India and Vietnam are promoting domestic manufacturing capabilities, which indirectly drives local demand for advanced separation equipment. These regions often represent strong targets for entry-level or mid-range automated centrifuges, balancing cost-effectiveness with improved operational standards compared to existing manual or outdated machinery.

In conclusion, the Scraper Centrifuge Market is an established, high-technology industrial sector where incremental engineering improvements and digital integration define competitive success. The persistent demand for purity across critical industries, coupled with ongoing technological modernization, ensures a positive and sustained growth outlook for the forecast period.

Further analysis of the competitive dynamics reveals that mergers and acquisitions serve as a crucial tool for consolidating expertise and expanding geographical reach. Larger industrial conglomerates often acquire smaller, specialized centrifuge manufacturers to integrate proprietary separation technologies or to gain immediate access to niche markets such as biopharma separation. This consolidation trend affects pricing power and often leads to harmonization of technical standards across acquired product lines.

The primary barrier to entry for new competitors remains the high degree of technical validation and performance assurance required by major end-users. Customers demand proven reliability over decades of operation, often necessitating extensive pilot testing and documentation before procurement. This preference for established suppliers with long track records creates significant friction for newer entrants, who must often compete aggressively on price or offer disruptive, patented technological improvements to gain traction. The intellectual property landscape is densely populated, particularly around cake discharge mechanisms and internal flow dynamics, requiring constant innovation to bypass existing patents.

Global economic stability directly influences large capital expenditure decisions, making the market sensitive to macroeconomic fluctuations, particularly in the chemicals and mining sectors. However, the essential nature of separation technology in core industries like pharmaceuticals and water treatment provides a buffering effect against severe cyclical downturns. Investment in robust manufacturing capabilities and efficient supply chain management, particularly sourcing specialized alloys, is a strategic priority for key players seeking to minimize exposure to geopolitical risks and inflationary pressures on raw materials.

The long-term outlook is inherently tied to global efforts in resource recovery and sustainability. Scraper centrifuges, which minimize water content in solid waste streams, are essential tools in achieving environmental compliance. Their role in recovering valuable materials from waste or minimizing the volume of hazardous sludge ensures their continued relevance in circular economy initiatives, providing a sustainable growth foundation irrespective of purely commercial chemical market cycles.

The market also witnesses considerable differentiation in post-sale support. The requirement for specialized expertise means that manufacturers offering comprehensive training programs, readily available regional service engineers, and guaranteed spare parts availability often secure high-value long-term contracts. The shift towards connected equipment allows manufacturers to offer performance-based service level agreements (SLAs), where maintenance is triggered by real-time operational metrics rather than fixed schedules, further optimizing uptime for critical industrial processes.

Focusing on pharmaceutical clients, the necessity for complete product containment (isolators/glove boxes integrated with the centrifuge) is a rapidly growing technological requirement driven by the increasing potency of Active Pharmaceutical Ingredients (APIs). Manufacturers investing in seamless integration of separation and drying equipment within contained environments are securing contracts in the high-margin biopharma sector. This demonstrates a market move toward highly integrated process modules rather than standalone separation units.

In the chemical sector, customization is driven by slurry characteristics, including density, viscosity, temperature, and crystal size distribution. A successful market strategy requires manufacturers to maintain an extensive portfolio of centrifuge models and configurations capable of handling the vast diversity of chemical products, ranging from fine pigments to coarse industrial salts, ensuring optimal separation parameters for each specific application.

The Scraper Centrifuge Market thus operates at the intersection of heavy mechanical engineering, advanced process control, and regulatory compliance. Success requires deep application expertise, global service infrastructure, and a proactive approach to adopting AI and IoT technologies to deliver superior operational efficiency and reliability to end-users.

Investment in specialized manufacturing facilities capable of adhering to international quality standards (such as ISO 9001 and specific pharmaceutical GMP guidelines) is non-negotiable for competitive differentiation. The complexity of balancing the high-speed rotating components necessitates superior precision engineering, placing a high value on manufacturers with proven track records in metallurgical control and machining accuracy. Furthermore, ensuring that all pressure components comply with local and international codes (e.g., ASME, PED) adds significant cost and regulatory burden to the manufacturing process but is mandatory for market access globally.

The trend towards modularity also impacts manufacturing strategies, allowing companies to assemble customized units from standardized, pre-validated components, thereby reducing lead times and engineering costs. This approach provides a balance between the need for application-specific customization and the efficiency of mass production for core components, enhancing supply chain responsiveness to sudden increases in demand across different regional markets.

The competitive rivalry in this market is intense among the top five global players, who leverage brand recognition, installed base, and global service networks. Mid-sized players often focus on geographical specialization or technological niche markets, such as offering centrifuges exclusively designed for highly corrosive applications or for handling extremely delicate biological solids. Pricing strategies are highly variable, ranging from premium pricing for custom pharmaceutical units to highly competitive bids for large-volume industrial commodity chemical projects, requiring sophisticated sales channel management.

Looking ahead, emerging technological threats are limited, as centrifugal separation remains fundamentally efficient for many industrial tasks. However, advances in membrane technology and ultra-filtration systems pose competitive pressure in certain low-volume, high-purity applications. Scraper centrifuge manufacturers are responding by improving their equipment's ability to handle the pre-concentration phase for these complementary separation technologies, positioning themselves as part of a larger, multi-stage purification train rather than direct competitors in all instances.

The enduring need for solid-liquid separation in virtually every process industry ensures the scraper centrifuge market's resilience. Factors such as urbanization, which increases the demand for municipal and industrial wastewater treatment, and the global population growth, which boosts food and pharmaceutical production, provide structural tailwinds supporting sustained demand for efficient, reliable separation equipment throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager