SDHI Fungicide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433409 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

SDHI Fungicide Market Size

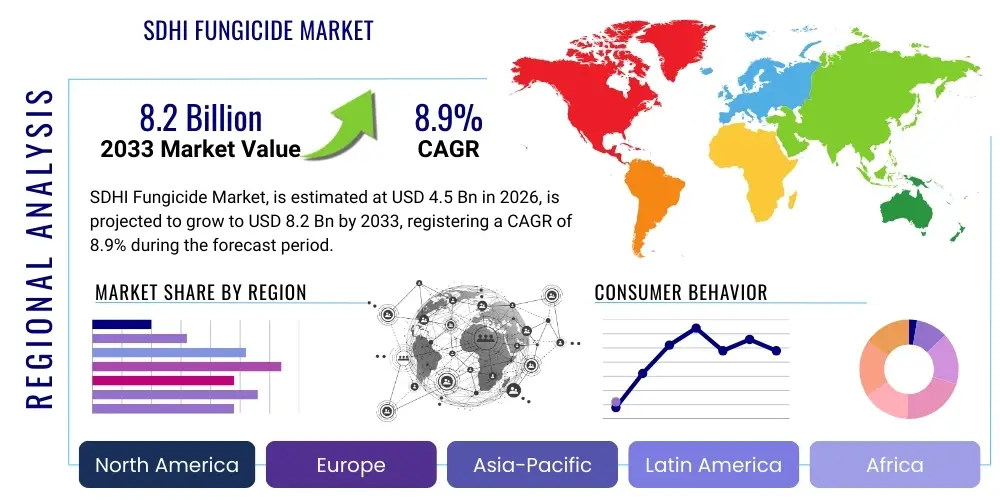

The SDHI Fungicide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.2 Billion by the end of the forecast period in 2033.

SDHI Fungicide Market introduction

The SDHI (Succinate Dehydrogenase Inhibitors) Fungicide Market comprises a critical class of agrochemicals designed to combat a wide spectrum of fungal pathogens that threaten global crop yields. SDHIs function by inhibiting the succinate dehydrogenase enzyme (Complex II) within the fungal mitochondrial respiratory chain, effectively disrupting energy production and leading to pathogen death. This systemic and translaminar mode of action makes SDHIs highly effective against major agricultural diseases such as rusts, powdery mildew, scab, and blight, providing robust protection across various crop types, including cereals, specialty crops, and row crops.

The product description of modern SDHI formulations often emphasizes broad-spectrum activity, excellent residual control, and favorable compatibility within integrated pest management (IPM) strategies. Major applications span seed treatment, foliar sprays, and soil treatments, providing flexibility for farmers in disease management planning. Key benefits include enhanced crop quality, prevention of significant yield losses, and the ability to manage pathogens resistant to older chemistry classes. These benefits are particularly pronounced in high-value horticulture and specialty crops where disease pressure is intense and quality standards are stringent.

Driving factors propelling market expansion include the escalating global demand for food security, the increasing intensity of fungal disease outbreaks due to climate variability, and the need for high-efficacy, reliable crop protection solutions. Furthermore, continuous investment in R&D by major agrochemical companies to develop new SDHI molecules with improved resistance management profiles and synergistic co-formulations is fueling adoption. The global trend toward precision agriculture and the shift away from broad-spectrum older chemicals also favor the adoption of targeted, modern SDHI chemistry.

SDHI Fungicide Market Executive Summary

The SDHI Fungicide Market is characterized by strong business trends focusing on strategic portfolio diversification and stringent resistance management protocols. Leading agrochemical manufacturers are increasingly investing in developing pre-mixed formulations, combining SDHIs with fungicides having different Modes of Action (MOAs), primarily triazoles or strobilurins, to extend the product lifespan and mitigate the risk of pathogen resistance. The core business strategy involves maximizing the efficacy of existing chemical assets while adhering to global regulatory guidelines, which often require extensive data submissions regarding environmental fate and toxicological profiles, driving up R&D costs but solidifying market barriers for new entrants.

Regionally, the market exhibits dynamic growth, particularly within the Asia Pacific (APAC) area, driven by expanding arable land, intensifying agricultural practices in countries like China and India, and the rising prevalence of fungal diseases in tropical and subtropical climates. While North America and Europe remain foundational markets due to early adoption and high-value crop cultivation (e.g., specialized cereals and vineyards), regulatory scrutiny, particularly in the European Union regarding maximum residue limits (MRLs), heavily influences product strategy. Latin America, propelled by vast soybean and corn production, represents a high-growth corridor demanding scalable and efficient SDHI solutions.

Segment trends reveal that the Boscalid and Fluopyram segments dominate the market based on chemical type due to their proven efficacy and broad registration across crops. Application-wise, cereals and oilseeds constitute the largest revenue-generating segments, given the sheer volume of global production and persistent threat of rust and leaf spot diseases. The systemic mode of action sub-segment maintains the leading position, valued for its ability to protect newly grown tissue and offer curative properties. Future segmentation growth is expected in seed treatment applications, leveraging SDHIs for early-season disease control and enhanced crop establishment.

AI Impact Analysis on SDHI Fungicide Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the SDHI Fungicide Market typically center on predictive disease modeling, optimization of application timing, and personalized resistance management strategies. Users frequently ask: "Can AI accurately forecast fungal outbreaks to minimize unnecessary SDHI applications?" and "How will AI-driven precision spraying technologies impact the volume and efficacy of SDHI use?" There is a clear market expectation that AI will transition SDHI use from prophylactic scheduling to predictive, site-specific treatment, thereby optimizing chemical load and extending the effective life of these crucial molecules, which face increasing resistance pressure. Concerns also revolve around data privacy, the cost of implementing AI-integrated farm management systems, and ensuring AI models accurately account for local climatic and pathogenic variables before recommending expensive SDHI treatments.

The key themes emerging from user concerns emphasize sustainability and efficiency. Farmers seek AI tools to confirm the exact location and severity of disease pressure before deploying high-cost SDHI products. This shift toward diagnostic and prescriptive intelligence is vital because overuse or improper timing accelerates resistance, posing a severe threat to the long-term viability of the SDHI chemistry class. Therefore, the core user expectation is that AI serves as a protective layer, safeguarding the effectiveness of SDHIs through scientifically rigorous, real-time application guidance. This integration aims to create a closed-loop system where drone and satellite imagery feed data to models that recommend tailored SDHI concentrations and application zones, maximizing yield protection while minimizing environmental impact.

Furthermore, AI is expected to play a profound role in enhancing the discovery phase of new SDHI molecules. By analyzing vast genomic and proteomic datasets of fungal pathogens and potential SDHI binding targets, machine learning algorithms can rapidly screen millions of compounds, drastically reducing the time and cost associated with synthesizing and testing novel fungicides. This accelerated R&D pipeline is critical for companies attempting to stay ahead of rapidly evolving fungal resistance, ensuring a continuous supply of proprietary, effective SDHI derivatives. The technology is not merely an application tool but a strategic asset in maintaining fungicidal innovation and managing the sustainability challenges inherent in modern agriculture.

- AI-driven predictive modeling forecasts specific fungal disease outbreaks, optimizing SDHI application timing and reducing prophylactic overuse.

- Precision agriculture technologies leverage AI to guide variable rate application (VRA) of SDHIs, minimizing input costs and mitigating environmental runoff risks.

- Machine learning algorithms assist in resistance monitoring by analyzing field surveillance data and identifying emerging resistant pathogen strains faster than conventional methods.

- AI streamlines the R&D process, accelerating the discovery and optimization of new SDHI chemical derivatives by screening molecular targets and predicting efficacy.

- Farm management software integrated with AI provides prescriptive recommendations, enhancing the integration of SDHIs into complex crop rotation and IPM plans.

DRO & Impact Forces Of SDHI Fungicide Market

The SDHI Fungicide Market is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, resulting in significant impact forces across the agricultural value chain. A primary Driver is the increasing global prevalence and virulence of fungal diseases, exacerbated by global warming, which creates ideal conditions for pathogen proliferation and mandates the continuous use of high-efficacy fungicides like SDHIs to protect economically important crops. Simultaneously, regulatory pressures, particularly the stricter Maximum Residue Limits (MRLs) and the lengthy, costly process of molecule registration and re-registration, act as a substantial Restraint, limiting market access for some formulations and increasing the complexity of market operations globally. The greatest Opportunity lies in the development of targeted, synergistic co-formulations and expanding market penetration into emerging economies in APAC and Africa, where agricultural intensification is rapidly increasing, necessitating advanced crop protection solutions.

The core Impact Forces currently shaping the market revolve around sustainability and resistance management. The market is driven by the imperative to maintain food security (a positive force), but it is simultaneously restricted by the growing threat of fungicide resistance (a negative force). The industry addresses this through mandatory resistance risk assessment programs and developing products that combine SDHIs with non-cross-resistant chemistries to preserve the longevity of the SDHI class. Furthermore, the strategic adoption of bioscience integration, where SDHIs are used alongside biological control agents, represents a significant positive impact force, moving the industry toward truly integrated pest management and sustainable farming practices, which are increasingly demanded by consumers and regulatory bodies worldwide.

Technological advancement is another major impact force. The continuous pipeline of novel SDHI molecules offering broader spectrum control and improved environmental profiles strengthens the market's resilience against competition from older fungicide classes. However, the high capital expenditure required for R&D acts as a barrier to entry, consolidating the market share among a few large, multinational agrochemical corporations. Overall, the market remains fundamentally driven by the non-negotiable need for effective crop protection, positioning SDHIs as indispensable tools, provided that resistance challenges are managed through continuous innovation and responsible use protocols supported by industry-wide stewardship programs.

Segmentation Analysis

The SDHI Fungicide Market is comprehensively segmented based on chemical type, crop type (application), mode of action, and formulation type, providing a detailed view of consumption patterns and strategic opportunities across the globe. Understanding these segments is crucial for identifying market hotspots and customizing product development. The market is primarily dominated by a few highly efficacious molecules, but future growth hinges on the successful introduction of new-generation SDHIs designed for improved spectrum and resistance profiles. The application segmentation highlights the economic importance of specific crops that drive the highest demand for advanced fungicidal protection.

Segmentation by chemical type reflects the ongoing research efforts, with newer, proprietary molecules commanding premium pricing. The choice of segmentation is heavily influenced by the regulatory environment of specific regions; for example, certain molecules might be phased out or restricted in Europe, while their use remains widespread in developing markets, impacting global revenue streams. The formulation segment, encompassing wettable powders, suspension concentrates, and granular forms, addresses the diverse needs of different application machinery and specific crop requirements, contributing significantly to user acceptance and operational efficiency.

Overall, segment analysis indicates that the systemic mode of action sub-segment, driven by its capacity for protective and curative action, retains the highest market share. Geographically tailored strategies are essential, targeting large-scale cereal production (wheat, barley) in temperate zones and high-value fruit and vegetable cultivation in tropical and subtropical regions, where specific SDHI chemistry is critical for ensuring marketable quality and preventing significant post-harvest losses due to fungal infection.

- By Type:

- Boscalid

- Penthiopyrad

- Fluopyram

- Bixafen

- Fluxapyroxad

- Other SDHIs (Isopyrazam, Sedaxane, etc.)

- By Crop Type (Application):

- Cereals & Grains (Wheat, Barley, Rice, Corn)

- Fruits & Vegetables (Grapes, Apples, Potatoes, Cucurbits)

- Oilseeds & Pulses (Soybean, Canola, Sunflower)

- Turf & Ornamentals

- Others (Sugar Beet, Cotton)

- By Mode of Action:

- Systemic

- Contact/Translaminar

- By Formulation:

- Wettable Powders (WP)

- Suspension Concentrates (SC)

- Emulsifiable Concentrates (EC)

- Water Dispersible Granules (WDG)

Value Chain Analysis For SDHI Fungicide Market

The Value Chain for the SDHI Fungicide Market begins with intense upstream activities focused on proprietary chemical synthesis and high-cost R&D. This initial phase is dominated by a few multinational agrochemical corporations that possess the necessary expertise and capital to discover, test, and register new, complex SDHI molecules. Upstream analysis involves sourcing specialized raw materials, including specific organic compounds and precursors, which are subjected to rigorous quality control before large-scale production. The capital-intensive nature of this phase, coupled with strict intellectual property rights surrounding patented molecules, creates high barriers to entry, concentrating manufacturing power among key industry leaders.

The midstream stage involves manufacturing, formulation, and primary distribution. After the active ingredient (AI) is synthesized, it must be formulated into user-friendly products (e.g., suspension concentrates or wettable powders) often combined synergistically with other fungicides (like triazoles) to ensure optimal field performance and resistance management. Quality assurance and regulatory compliance are paramount at this stage, as all formulations must meet specific local and international standards regarding efficacy, toxicity, and environmental fate. Manufacturing sites are highly specialized, requiring advanced chemical reactors and containment facilities to handle complex chemistries.

The downstream analysis focuses on the distribution channel, which is typically a multi-tiered system involving global distributors, regional wholesalers, local agrochemical retailers, and ultimately, the end-user farmers. Direct sales channels, where manufacturers engage large commercial farms, are common for strategic product placements. However, the majority of volume moves through indirect channels, relying on established networks that provide technical support and agronomic advice to smaller and medium-sized farmers. Effective distribution requires sophisticated logistics to manage seasonal demand peaks and ensure product freshness and compliance with storage requirements across diverse geographical regions.

SDHI Fungicide Market Potential Customers

The primary customers and end-users of SDHI fungicides are diverse entities within the global agricultural ecosystem, ranging from large-scale commercial farming enterprises to individual smallholder farmers, each requiring tailored product sizes and technical support. Large commercial farms, particularly those specializing in monocultures like corn, soybean, and wheat, represent the largest volume buyers. These operations utilize advanced precision agriculture techniques and require bulk supplies of high-efficacy SDHI formulations for seasonal preventative and curative treatments, often negotiating directly with major manufacturers or large regional distributors for technical packages and competitive pricing.

Horticultural and specialty crop growers, including vineyards, orchards, and vegetable producers, form another crucial customer segment. These users place a high premium on product performance and residue management, as SDHIs are critical for ensuring the marketable quality of high-value produce, preventing blemishes, and extending shelf life. Their purchasing decisions are often influenced by local cooperative recommendations, and they require highly specific, low-dose formulations tailored to particular disease spectra common in specialty crops.

Additionally, key secondary buyers include professional seed treatment companies and agrochemical distributors. Seed treatment specialists use SDHIs to protect germinating seeds and young seedlings from early-season soil-borne diseases, offering a crucial layer of initial protection. Agrochemical distributors and retailers serve as the final touchpoint for smallholder farmers, providing necessary agronomic advice, blending services, and access to products. These distributors are critical for market penetration in developing regions and ensuring proper stewardship and application of SDHIs at the grassroots level.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.2 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Syngenta AG, Bayer CropScience AG, FMC Corporation, Corteva Agriscience, Adama Agricultural Solutions Ltd., Nufarm Ltd., Sumitomo Chemical Co., Ltd., UPL Limited, Gowan Company, Certis USA LLC, Nissan Chemical Corporation, Isagro S.p.A., AMVAC Chemical Corporation, Helm AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SDHI Fungicide Market Key Technology Landscape

The technological landscape surrounding the SDHI Fungicide Market is primarily characterized by advanced chemical synthesis, sophisticated formulation science, and integration with digital agriculture tools. The core technology lies in synthesizing the active ingredients (AIs), which are complex molecules requiring highly specialized and proprietary processes to ensure purity, stability, and optimal biological activity. Companies continuously refine these synthesis processes to improve yield and reduce manufacturing costs, while also investing heavily in R&D to discover next-generation SDHIs that bypass existing pathogen resistance mechanisms and offer broader compatibility with various crop inputs.

A critical aspect of technological advancement is formulation science. The efficacy of an SDHI is not solely dependent on the AI but also on how it is delivered to the plant. Key technologies include micro-encapsulation, suspension concentrate (SC) development, and optimizing surfactant systems to enhance foliar adhesion, absorption, and translocation within the plant tissue. Modern formulations aim to maximize rainfastness, reduce volatility, and ensure uniform coverage, which is vital for providing long-lasting disease protection under varying environmental conditions. Furthermore, the development of synergistic co-formulations—combining SDHIs with chemistries having complementary modes of action—is a key technological strategy to prevent resistance and broaden the spectrum of diseases controlled, securing the long-term effectiveness of the product line.

The growing convergence of chemistry and information technology is profoundly impacting the landscape. Precision application technologies, including variable rate technology (VRT) sprayers and drone application systems, are increasingly utilized to optimize the deployment of SDHIs based on real-time disease pressure mapping generated by sensors and AI analytics. This smart application reduces overall chemical load while ensuring targeted treatment. Resistance management technology is also evolving, utilizing high-throughput molecular diagnostics to monitor fungal populations for SDHI sensitivity, allowing for data-driven rotation strategies. This focus on digital stewardship ensures that high-value SDHI products are used responsibly and retained as effective tools for sustainable crop protection.

Regional Highlights

- North America: This region is characterized by high adoption rates of advanced crop protection chemistry and large-scale farming operations, particularly in the corn belt and wheat-growing states. The market here demands high-efficacy, broad-spectrum SDHIs suitable for large-acreage application. Regulatory approval, particularly by the EPA, dictates market entry. Key countries driving demand include the United States and Canada, with a strong focus on resistance management protocols and integration into conservation tillage systems.

- Europe: Europe represents a mature but highly regulated market. The European Union's stringent regulatory framework, including the potential phasing out of certain molecules based on environmental and toxicological data (e.g., specific MRL restrictions), limits product availability but drives innovation towards environmentally favorable formulations. Demand is high in specialized crop sectors such as viticulture (grapes) and high-value vegetable production in countries like France, Germany, and Italy, necessitating precision application and low-residue SDHI solutions.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rising population, increasing demand for quality food, and the rapid adoption of modern agricultural practices in countries like China, India, and Australia. High humidity and warmth contribute to intense fungal pressure, driving the need for robust SDHI usage, especially in rice, fruit, and vegetable cultivation. Market growth is also supported by increasing farmer awareness and government subsidies promoting modern inputs.

- Latin America (LATAM): Dominated by large-scale soybean, corn, and sugarcane production in Brazil and Argentina, LATAM is a critical high-volume market. SDHIs are essential for managing prevalent diseases like Asian Soybean Rust (Phakopsora pachyrhizi). Market dynamics are characterized by intense competition, high seasonal consumption, and a significant reliance on imports of active ingredients, making local formulation and distribution partnerships key to success.

- Middle East and Africa (MEA): This region is witnessing emerging growth driven by ongoing investments in agricultural infrastructure and efforts to enhance food self-sufficiency, particularly in North Africa and South Africa. SDHI adoption is growing but remains focused on high-value export crops, specialized horticulture, and certain cereal grains. Challenges include fragmented distribution networks and varying regulatory standards across different nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SDHI Fungicide Market.- BASF SE

- Syngenta AG

- Bayer CropScience AG

- FMC Corporation

- Corteva Agriscience

- Adama Agricultural Solutions Ltd.

- Nufarm Ltd.

- Sumitomo Chemical Co., Ltd.

- UPL Limited

- Gowan Company

- Certis USA LLC

- Nissan Chemical Corporation

- Isagro S.p.A.

- AMVAC Chemical Corporation

- Helm AG

- Rotam CropSciences

- Shandong Weifang Rainbow Chemical Co., Ltd.

- Koppert Biological Systems

- Limin Chemical Co., Ltd.

- Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the SDHI Fungicide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an SDHI fungicide and how does it work?

SDHI stands for Succinate Dehydrogenase Inhibitor. These fungicides belong to the FRAC Group 7 and function by disrupting fungal energy production through the inhibition of the Complex II enzyme in the mitochondrial respiratory chain. This systemic action provides high-efficacy control against numerous fungal pathogens, protecting crops from diseases like rusts, blights, and powdery mildew.

What are the primary challenges facing the long-term use of SDHI fungicides?

The primary challenge is the rapid development of fungicide resistance in target fungal populations, necessitating strict stewardship and anti-resistance strategies. Other challenges include stringent global regulatory restrictions, particularly in Europe, and the high cost of R&D required to introduce novel, resistance-breaking SDHI chemistries.

Which crop application segment drives the highest demand for SDHI products?

The Cereals and Grains segment, particularly encompassing corn, wheat, and barley, currently drives the highest volume and revenue demand for SDHI fungicides globally. This is due to the large acreage devoted to these staple crops and their consistent susceptibility to economically damaging diseases such as Fusarium head blight and various rusts.

How is precision agriculture impacting the deployment of SDHI fungicides?

Precision agriculture, supported by AI and VRT technology, allows farmers to apply SDHIs variably and only where disease pressure is detected. This site-specific application minimizes chemical usage, reduces input costs, and is critical for resistance management, extending the effective market life of these premium products.

Which regional market is exhibiting the fastest growth in SDHI consumption?

The Asia Pacific (APAC) region is demonstrating the fastest Compound Annual Growth Rate (CAGR) for SDHI fungicide consumption. This acceleration is driven by the rapid intensification of agriculture, the rising need for high-quality food production, and favorable climatic conditions that increase fungal disease pressure in key agricultural economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager