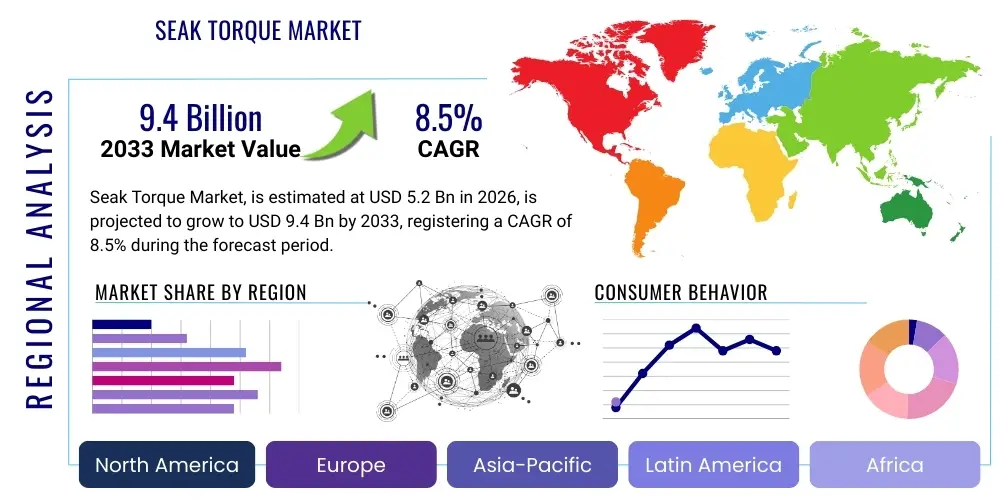

Seak Torque Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436957 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Seak Torque Market Size

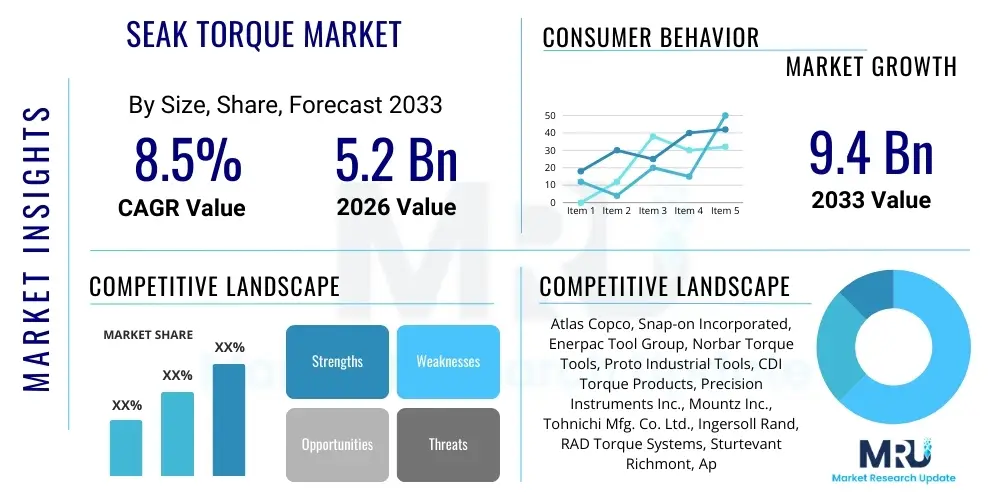

The Seak Torque Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $9.4 Billion by the end of the forecast period in 2033.

Seak Torque Market introduction

The Seak Torque market encompasses the production, distribution, and utilization of advanced mechanical and electronic systems designed for precise rotational force application, measurement, and control, particularly in high-stakes environments where reliability and zero-defect assembly are paramount. These systems are critical components in industries such as aerospace, automotive manufacturing, heavy machinery, and renewable energy infrastructure, where maintaining specific torque tolerances is non-negotiable for structural integrity and operational safety. Modern Seak Torque solutions move beyond simple manual tools, integrating sophisticated digital controls, closed-loop feedback mechanisms, and connectivity features (IoT capabilities) to ensure real-time data logging, traceability, and optimized process parameters, significantly reducing human error and improving overall assembly quality across diverse production lines.

Products within this domain typically include smart torque wrenches (electronic, hydraulic, and pneumatic), torque testers, calibration equipment, and integrated assembly line systems. These tools offer enhanced accuracy compared to traditional counterparts, providing features such as angle measurement, multi-stage tightening protocols, and automated reporting compliance with stringent international standards like ISO 6789. Major applications span engine assembly, airframe manufacturing, critical joint fastening in heavy equipment, and the construction of wind turbines and high-speed trains. The primary benefit derived from adopting advanced Seak Torque technology is the substantial reduction in warranty claims and product failures stemming from incorrect fastening, leading to improved long-term operational efficiency and asset lifespan for end-users operating in capital-intensive sectors.

The market growth is primarily driven by the global expansion of high-precision manufacturing, the increasing regulatory demand for stricter quality control and traceability in critical applications (especially in aerospace and medical devices), and the ongoing shift towards Industry 4.0 paradigms. Automation mandates the integration of digitally controlled torque tools capable of communicating with centralized manufacturing execution systems (MES). Furthermore, the accelerating adoption of lightweight materials, such as carbon fiber and advanced composites in automotive and aviation, requires ultra-precise torque control to prevent material fatigue or crushing, thereby fueling demand for state-of-the-art Seak Torque solutions that offer exceptional measurement resolution and adaptability across varied material surfaces and joint types.

Seak Torque Market Executive Summary

The Seak Torque market is experiencing robust expansion driven by stringent industrial regulations concerning assembly quality and the widespread implementation of automated manufacturing systems globally. Business trends indicate a strong move toward digitalization, with manufacturers prioritizing connected tools that facilitate predictive maintenance and real-time process monitoring. Key market players are investing heavily in software integration, transforming hardware-centric offerings into comprehensive solutions that include calibration services, cloud-based data storage, and proprietary analytics platforms. This shift emphasizes value-added services and recurring revenue models over one-time hardware sales, leading to strategic partnerships between traditional tool manufacturers and specialized software developers to address the complex data management needs of large-scale industrial operations and supply chain verification requirements.

Regional dynamics show Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive industrialization, particularly in China and India, where investments in advanced automotive assembly plants, electronics manufacturing hubs, and large infrastructure projects are soaring. North America and Europe, characterized by established automotive, aerospace, and defense industries, maintain the highest adoption rates of premium, high-accuracy electronic and hydraulic Seak Torque systems, driven by strict quality assurance protocols and the need to comply with high safety standards. Emerging economies in Latin America and the Middle East are showing increasing demand, stimulated by oil & gas sector investments and growing regional aerospace ambitions, necessitating localized sales channels and robust after-sales technical support for specialized industrial equipment.

Segment trends highlight the electronic/digital torque wrench segment as dominating the market due to its superior accuracy, data logging capabilities, and ease of integration into modern production lines. The industrial manufacturing application segment remains the largest consumer, but the aerospace and defense segment is anticipated to exhibit the highest CAGR, primarily because of the extremely high cost of failure and the mandatory requirement for absolute traceability of every bolted joint. Furthermore, there is a pronounced trend toward battery-powered, cordless torque systems that enhance operator mobility and ergonomics while maintaining high precision standards, displacing bulkier pneumatic and corded alternatives in agile manufacturing environments.

AI Impact Analysis on Seak Torque Market

User inquiries regarding the influence of Artificial Intelligence on the Seak Torque Market frequently revolve around the potential for autonomous calibration, predictive failure analysis of tools, and the optimization of tightening strategies in real-time. Key themes include concerns about data security in cloud-connected tools, the integration of deep learning models to compensate for environmental variability (like temperature or material elasticity) during the tightening process, and how AI can ensure zero-defect assembly without constant human supervision. Users seek confirmation that AI will enhance, rather than replace, human expertise, providing smarter decision support regarding tool maintenance schedules, identifying anomalous tightening patterns indicative of material defects, and achieving unprecedented levels of process consistency across geographically dispersed manufacturing facilities operating under diverse procedural protocols.

The introduction of AI-driven analytics is fundamentally transforming the maintenance and usage patterns of Seak Torque equipment. By analyzing massive datasets collected from smart tools—including torque vs. angle curves, operator input variances, and tool usage cycles—AI algorithms can forecast tool wear and drift with high accuracy, enabling predictive calibration scheduling instead of time-based checks. This significantly reduces downtime and ensures that tools are always operating within specified tolerance ranges. Furthermore, AI is being used in sophisticated assembly processes to dynamically adjust the fastening parameters based on real-time feedback from the joint, adapting to slight variations in bolt grade, thread condition, or material surface finish, leading to higher quality joints and minimizing the risk of over or under-tightening failures that often plague manual or static automated systems.

Beyond process optimization, AI is crucial for quality assurance and compliance reporting. Machine learning models can instantly detect and flag non-conforming joints, identifying root causes that might be invisible to traditional statistical process control (SPC) methods. This includes pattern recognition in complex tightening sequences or the detection of subtle operational anomalies in assembly robots utilizing Seak Torque actuators. The expected outcome is a completely self-optimizing assembly line where torque processes are continuously refined based on cumulative successful operations, leading to maximum throughput, minimal scrap rate, and generating fully auditable, AI-verified records essential for regulatory bodies in highly regulated sectors such as aerospace and medical device manufacturing.

- Enhanced Predictive Maintenance: AI analyzes torque data history to forecast tool failure or calibration drift, minimizing unscheduled downtime.

- Real-time Parameter Optimization: Machine learning algorithms dynamically adjust torque application based on sensor inputs and material properties for zero-defect joints.

- Automated Quality Control: AI identifies subtle anomalies and non-conforming tightening patterns instantly, providing superior defect detection compared to human inspection.

- Improved Traceability and Compliance: Comprehensive, AI-verified data logging for every fastening cycle ensures absolute regulatory adherence.

- Autonomous Robotic Assembly: Enables robotic arms to perform complex, adaptive tightening sequences with minimal human oversight and maximum precision.

- Optimized Tool Fleet Management: AI provides insights into tool utilization and lifespan across large factory networks, optimizing capital expenditure.

DRO & Impact Forces Of Seak Torque Market

The Seak Torque market is significantly driven by the escalating global focus on product safety and liability, particularly within the automotive and aerospace sectors, which mandates verifiable fastening quality and full traceability of critical joints. This driver is reinforced by global trends toward lightweight vehicle construction and advanced composite material use, which require sophisticated electronic torque controls to avoid material damage while ensuring structural integrity. However, market expansion is restrained by the high initial capital investment required for implementing sophisticated smart torque systems and the corresponding need for specialized operator training and complex integration with existing legacy manufacturing systems. Opportunities lie primarily in the integration of Industrial Internet of Things (IIoT) frameworks and cloud-based data analytics services, which transform raw torque data into actionable maintenance and quality insights, opening new pathways for service revenue and deeper customer engagement through data monetization strategies.

Drivers compelling market growth include the rigorous adoption of Industry 4.0 standards, which demand interconnected, smart tools capable of seamless communication within the factory ecosystem. The push for automated assembly processes, utilizing collaborative robots and autonomous guided vehicles (AGVs) outfitted with precision torque actuators, further catalyzes demand for Seak Torque systems that are rugged, highly accurate, and software-agnostic. Furthermore, heightened competition among manufacturers in sectors like consumer electronics and medical devices is forcing companies to minimize product defects and recalls, making investments in world-class fastening quality tools a competitive necessity. This continuous need for performance improvement, coupled with regulatory pressure to reduce human error, maintains strong upward momentum across all segments of the Seak Torque market, encouraging rapid innovation in sensor technology and tool ergonomics.

Restraints are complex and multifaceted. Beyond the high initial cost, a significant challenge is the lack of standardized communication protocols among different manufacturers of smart torque tools and manufacturing execution systems (MES), creating integration barriers and increasing implementation complexity for end-users. Additionally, in many emerging markets and smaller industrial shops, reliance on traditional, less expensive manual methods persists due to budget constraints and perceived complexity of digital systems. Another constraint involves the cyclical nature of end-user industries (e.g., automotive production), which can lead to fluctuating demand for high-end capital equipment. Overcoming these restraints requires manufacturers to develop more intuitive user interfaces, standardized data formats, and scalable, modular systems that can integrate seamlessly into both greenfield projects and existing brownfield sites with varying technological maturity levels.

Impact forces are currently dominated by technological advancements (Driver) and regulatory pressures (Driver), which collectively exert a high influence on market direction. The accelerating shift toward electric vehicles (EVs) is a critical impact force, requiring specialized Seak Torque tools for battery pack assembly and structural integrity of high-voltage components, which are often different from internal combustion engine requirements. This technological pivot necessitates rapid tool redesign and recalibration services. Conversely, supply chain fragility, particularly concerning microelectronics used in digital torque tools, acts as a moderate negative impact force (Restraint), potentially delaying production and increasing manufacturing costs, which subsequently limits market access in price-sensitive regions.

Segmentation Analysis

The Seak Torque market segmentation provides a comprehensive view of the diverse technologies, applications, and end-use sectors driving demand, offering strategic insights into niche growth areas and mature segments. The market is primarily divided based on the operational mechanism of the tool (Type: Electronic, Hydraulic, Pneumatic), the sector utilizing the equipment (Application: Automotive, Aerospace, Energy), and the nature of the procurement (End-Use: OEM, Aftermarket Services). Electronic torque solutions, including smart wrenches and drivers, command the largest market share due to their superior precision and integrated data capabilities necessary for Industry 4.0 adoption. Conversely, hydraulic tools maintain dominance in heavy-duty applications such as construction and oil & gas, where massive torque requirements are essential for large bolt tightening and structural integrity checks, highlighting the necessity for diversified product portfolios across key manufacturers.

Analyzing segmentation by Application reveals that Industrial Manufacturing, encompassing general machinery, heavy equipment, and general assembly lines, currently contributes the highest volume due to the sheer scale of global industrial activity. However, the Aerospace & Defense segment demands the highest price premium per unit, driven by the requirement for ultra-high accuracy (often requiring calibration traceability to national standards) and the low tolerance for failure inherent in flight-critical applications. The Energy sector, specifically wind turbine assembly and maintenance, represents a significant growth pocket, requiring specialized, high-capacity portable torque solutions for field service and installation across large infrastructure projects. Understanding these application-specific needs allows manufacturers to tailor features, such as ruggedness for field use or extreme connectivity for cleanroom environments, ensuring optimal product-market fit.

The segmentation also highlights the persistent dichotomy between OEM demand and the Aftermarket Services sector. OEMs drive bulk purchases of new, integrated assembly systems for dedicated production lines, focusing heavily on automation and system efficiency. In contrast, the Aftermarket segment primarily drives demand for portable tools, calibration services, software updates, and replacement parts, focusing on maintenance, repair, and overhaul (MRO) activities. The growing complexity of torque tools, especially those embedded with proprietary software and specialized sensors, is creating a lucrative opportunity in the Aftermarket segment, as calibration and repair services often require manufacturer specialization, thus fostering long-term contractual relationships and stable revenue streams beyond initial equipment sales.

- By Type:

- Electronic/Digital Torque Systems

- Hydraulic Torque Systems

- Pneumatic Torque Systems

- Mechanical/Manual Torque Tools

- By Application:

- Automotive Manufacturing (Assembly, Powertrain, Body-in-White)

- Aerospace and Defense (Airframe, Engine Assembly, MRO)

- Industrial Manufacturing (Heavy Machinery, General Assembly, Fabrication)

- Energy (Oil & Gas, Wind, Nuclear)

- Construction and Mining

- By End-Use:

- Original Equipment Manufacturers (OEMs)

- Aftermarket Services (MRO and Field Service)

- By Capacity Range:

- Low Torque (< 50 Nm)

- Medium Torque (50 Nm – 500 Nm)

- High Torque (> 500 Nm)

Value Chain Analysis For Seak Torque Market

The value chain for the Seak Torque Market is characterized by a high degree of technical specialization across all stages, starting from the upstream sourcing of precision sensors and high-grade materials. Upstream analysis focuses on the procurement of high-resolution transducers, microcontrollers, and specialized alloys that ensure tool durability and measurement accuracy. Key challenges upstream include maintaining a stable supply of advanced microprocessors necessary for digital torque systems and managing material costs for high-strength steel and titanium components used in hydraulic tools. Successful Seak Torque manufacturers maintain long-term partnerships with specialized sensor providers and component fabricators to ensure quality consistency and manage intellectual property related to proprietary calibration mechanisms and signal processing algorithms vital for tool performance and long-term reliability in demanding industrial environments.

The midstream involves complex manufacturing and assembly, focusing on the rigorous calibration and quality testing of the final products. This stage is capital-intensive, requiring specialized cleanroom facilities, advanced machining capabilities, and sophisticated metrology laboratories certified by international bodies (e.g., NIST, UKAS) to ensure traceability of torque measurements. Manufacturers invest heavily in automated assembly lines for electronic components and specialized fluid dynamics testing for hydraulic systems. The integration of software platforms, including firmware development, cloud connectivity modules, and application programming interfaces (APIs) for MES integration, is a crucial value-adding activity performed at this stage, transitioning the product from simple hardware to a sophisticated, connected manufacturing asset.

Downstream distribution channels are multifaceted, utilizing both direct sales and specialized indirect distribution networks. Direct sales are preferred for high-value, complex, integrated assembly line systems sold to major OEMs in aerospace and high-volume automotive production, allowing manufacturers to offer bespoke engineering support and long-term service contracts. Indirect channels, involving authorized distributors and regional service partners, handle standard portable tools, MRO supplies, and calibration services, ensuring wide market penetration and providing essential local technical support and rapid access to spare parts. The strongest value proposition downstream is the provision of comprehensive training, certified calibration services, and ongoing technical consultation, positioning the manufacturer not just as a supplier, but as a long-term quality partner critical to the client's operational success and regulatory compliance obligations.

Seak Torque Market Potential Customers

Potential customers for Seak Torque solutions span a wide spectrum of industrial sectors, ranging from high-volume assembly lines to highly specialized, low-volume critical maintenance operations. The primary end-users are Original Equipment Manufacturers (OEMs) in sectors where structural integrity and safety are paramount, including automotive companies assembling engines, chassis, and increasingly complex battery packs for electric vehicles, and aerospace manufacturers involved in airframe construction, engine component assembly, and critical repair facilities. These buyers prioritize tools with high accuracy, advanced data logging capabilities, and robust integration features that support automated fastening protocols and continuous quality audits mandated by industry standards like AS9100 or IATF 16949, viewing the tools as indispensable quality infrastructure.

Another significant customer base comprises the Maintenance, Repair, and Overhaul (MRO) service providers and utility operators, particularly those managing large infrastructure assets such as power plants, petrochemical facilities, wind farms, and large industrial machinery fleets. These customers require portable, highly durable, and high-capacity torque tools capable of field operation under demanding environmental conditions. Their purchasing decisions are often centered on tool reliability, ease of calibration in the field, and the availability of responsive, certified local service support. For these users, minimizing asset downtime associated with planned maintenance or unexpected repairs is the core economic benefit delivered by reliable Seak Torque equipment, making the service package as crucial as the hardware itself.

Furthermore, specialized industrial customers, including calibration laboratories, military organizations, and medical device manufacturers, represent highly attractive niche markets. Calibration labs purchase Seak Torque testers and reference standards for certifying other tools, valuing ultra-high precision and traceable uncertainty measurements. Military and defense sectors prioritize ruggedness, security, and compliance with mil-spec standards for maintaining essential equipment. Medical device producers require small, extremely precise electronic torque drivers for assembling delicate instruments and implants, where even slight torque variations can compromise patient safety, thus requiring tools capable of low torque measurement with exceptional repeatability and detailed electronic records for stringent regulatory submissions and post-market surveillance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $9.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Snap-on Incorporated, Enerpac Tool Group, Norbar Torque Tools, Proto Industrial Tools, CDI Torque Products, Precision Instruments Inc., Mountz Inc., Tohnichi Mfg. Co. Ltd., Ingersoll Rand, RAD Torque Systems, Sturtevant Richmont, Apex Tool Group, Gedore Tool Group, SPX FLOW, Kistler Group, Hytorc, Torque Solutions Inc., Danaher Corporation (SMC). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Seak Torque Market Key Technology Landscape

The technological evolution of the Seak Torque market is characterized by a pervasive shift towards sensor integration, digital communication, and advanced material science to enhance precision and durability. Key technologies revolve around high-resolution strain gauge transducers and piezoelectric sensors that provide highly accurate and reliable torque data, often paired with gyroscope and accelerometer technologies for precise angle measurement, crucial for torque-plus-angle tightening strategies used in critical fastener applications. Modern electronic torque systems leverage specialized digital signal processing (DSP) hardware to filter noise and rapidly process input data, ensuring instant feedback and maximum repeatability, often achieving measurement uncertainties far below 1% of reading, which is mandatory for aerospace certification. The integration of OLED/LCD displays and intuitive user interfaces further simplifies complex tightening procedures, allowing operators to follow multi-step protocols with guided confirmation steps.

Connectivity is another cornerstone of the current technology landscape, driven by IIoT mandates. New generations of Seak Torque tools are equipped with various wireless protocols, including Bluetooth Low Energy (BLE), Wi-Fi, and sometimes proprietary radio frequencies, allowing for seamless communication with MES or centralized quality management software. This connectivity enables automatic program uploads, real-time tracking of tightening results, immediate locking of the tool upon detecting an error, and automated generation of traceability reports, eliminating manual data entry errors. Software platforms often provide advanced analytical capabilities, including graphical representations of torque vs. angle curves and statistical process control (SPC) charting, enabling proactive identification of process deviations across various assembly stations distributed globally.

Innovation in material science is crucial for hydraulic and pneumatic Seak Torque tools, focusing on developing lighter, more durable, and corrosion-resistant alloys for tool bodies and reaction arms, crucial for deployment in harsh industrial environments like marine or offshore energy sectors. Furthermore, significant research is being conducted into battery technology to improve the power density and operational duration of cordless electric torque wrenches, enhancing ergonomics and productivity without sacrificing high-torque capability. Finally, the development of proprietary closed-loop control systems, utilizing advanced proportional–integral–derivative (PID) controllers, ensures that the applied torque remains stable even under fluctuating load conditions or system pressure changes, which is a significant technical advancement over older, open-loop torque application methods, thereby establishing a new standard for fastening reliability.

Regional Highlights

- North America: North America, led by the United States and Canada, represents a mature and high-value market characterized by early adoption of advanced electronic Seak Torque systems. The robust presence of the aerospace & defense industry (e.g., Boeing, Lockheed Martin) and the demanding high-end automotive sector (including electric vehicle pioneers) ensures consistent demand for premium, data-logging torque tools compliant with strict FAA and DoD quality standards. Regional growth is further solidified by significant investment in infrastructure upgrades and MRO activities across energy and manufacturing sectors, driving the need for certified calibration services and high-capacity hydraulic and pneumatic torque solutions. The region acts as a hub for technology standardization and the development of cloud-based torque management software.

- Europe: Europe holds a strong position, driven primarily by Germany, France, and the UK, due to their world-leading automotive manufacturing capabilities (e.g., Mercedes-Benz, Airbus Group) and highly regulated machinery production. The European market places high emphasis on precision, ergonomics, and adherence to EU directives regarding product safety and worker health. The strong push toward Industry 4.0 initiatives (such as Germany's Platform Industrie 4.0) mandates the integration of smart, connected torque solutions capable of seamless data exchange and full automation integration. The region is also a key center for specialized calibration and metrology institutions, influencing global standards for torque measurement uncertainty and traceability, sustaining strong demand for high-end digital testing equipment and routine calibration services.

- Asia Pacific (APAC): APAC is the fastest-growing region, dominating in terms of volume consumption, propelled by rapid industrialization, massive investments in infrastructure, and the relocation of global manufacturing supply chains. China, Japan, South Korea, and India are the primary growth engines. China’s extensive automotive and consumer electronics manufacturing base, coupled with large-scale projects in shipbuilding and heavy infrastructure, drives high demand for both automated and portable torque solutions. While price sensitivity is often higher in certain segments, the overall regional trend is rapidly shifting toward high-precision electronic torque tools, particularly in Japanese and Korean advanced manufacturing facilities seeking automation and zero-defect quality control to compete globally.

- Latin America: The Latin American market exhibits moderate but steady growth, largely concentrated in key industrial centers in Brazil and Mexico. Demand is highly correlated with the performance of the regional automotive assembly industry and the extraction sectors (mining and oil & gas). Customers often prioritize durability and straightforward maintenance due to challenging logistics and infrastructure. While the penetration of advanced IIoT-enabled Seak Torque systems is lower compared to North America or Europe, increasing foreign investment in high-tech manufacturing and aerospace MRO in countries like Mexico is accelerating the adoption of digital torque solutions for quality compliance and export verification requirements.

- Middle East and Africa (MEA): The MEA market is heavily influenced by the oil & gas industry, which drives significant demand for high-capacity hydraulic and pneumatic torque systems essential for pipeline construction, refinery maintenance, and offshore platform assembly. Countries like Saudi Arabia and UAE are making strategic investments to diversify their economies, leading to emerging demand in defense manufacturing and infrastructure projects (e.g., smart city development). The primary driver is the need for ultra-reliable tools that can perform in extreme temperature and corrosive environments. Local partnerships providing certified calibration and immediate technical support are critical success factors in this region due to geographical isolation and stringent quality demands in the energy sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Seak Torque Market.- Atlas Copco

- Snap-on Incorporated

- Enerpac Tool Group

- Norbar Torque Tools

- Proto Industrial Tools

- CDI Torque Products

- Precision Instruments Inc.

- Mountz Inc.

- Tohnichi Mfg. Co. Ltd.

- Ingersoll Rand

- RAD Torque Systems

- Sturtevant Richmont

- Apex Tool Group

- Gedore Tool Group

- SPX FLOW

- Kistler Group

- Hytorc

- Torque Solutions Inc.

- Danaher Corporation (SMC)

- Warren & Brown Tools

Frequently Asked Questions

Analyze common user questions about the Seak Torque market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Seak Torque technology and how does it differ from traditional fastening?

Seak Torque refers to advanced, often digitally-enabled, systems used for high-precision rotational force application, measurement, and control. Unlike traditional mechanical fastening, these systems incorporate sensors, microprocessors, and data logging capabilities to ensure real-time accuracy, traceability, and adherence to complex tightening specifications like torque-plus-angle protocols, significantly enhancing joint integrity and compliance.

Which industrial applications are driving the highest demand for smart Seak Torque tools?

The highest growth and value demand stem from the Aerospace & Defense and high-end Automotive manufacturing sectors, particularly for electric vehicle battery assembly and structural components. These industries require absolute traceability and zero-defect assembly, necessitating the use of IIoT-enabled electronic torque tools for regulatory compliance and safety-critical fastening tasks.

How is Industry 4.0 influencing the future direction of the Seak Torque Market?

Industry 4.0 mandates the integration of Seak Torque tools into centralized Manufacturing Execution Systems (MES) via wireless connectivity. This shift enables autonomous process control, predictive maintenance of tools, and cloud-based data analytics for continuous quality improvement, transforming the tools from simple instruments into connected data-generating assets crucial for smart factory operations.

What are the primary challenges restraining the widespread adoption of hydraulic Seak Torque systems?

The primary restraints include the high initial capital investment required for these powerful systems, the necessity for specialized operator training, and the logistical challenges associated with integrating high-pressure hydraulic infrastructure into flexible manufacturing layouts. Furthermore, electronic alternatives often offer greater data precision and portability for non-heavy-duty tasks.

Which geographical region is expected to lead the market expansion over the forecast period (2026-2033)?

Asia Pacific (APAC) is projected to lead the market expansion in terms of volume and growth rate. This is driven by rapid investment in advanced manufacturing capabilities in countries such as China, India, and Southeast Asian nations, particularly across automotive, electronics, and heavy infrastructure development projects that require modernization of quality control equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager