Sealed Lead Acid (SLA) Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435277 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Sealed Lead Acid (SLA) Battery Market Size

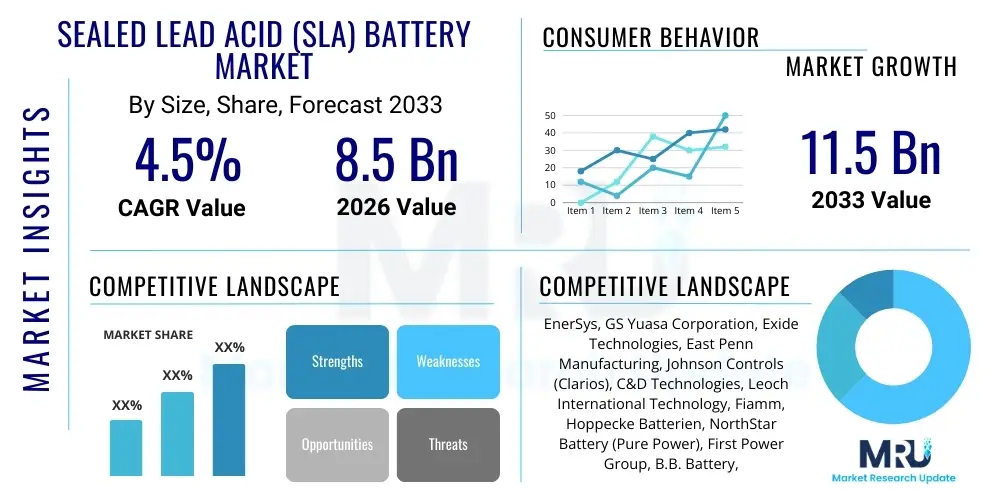

The Sealed Lead Acid (SLA) Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033.

Sealed Lead Acid (SLA) Battery Market introduction

The global Sealed Lead Acid (SLA) Battery Market encompasses a broad category of rechargeable batteries characterized by their maintenance-free operation and sealed container design, primarily utilizing either Absorbed Glass Mat (AGM) or Gel Cell technology. These batteries are foundational components in systems demanding reliable, uninterrupted power supply, offering robust performance, high current output capability, and a proven track record of dependability. The sealed construction prevents electrolyte leakage and gaseous emissions during normal operation, allowing for installation in sensitive environments such as data centers and telecommunication facilities without extensive ventilation requirements, distinguishing them significantly from traditional flooded lead-acid variants. The VRLA (Valve Regulated Lead Acid) design ensures internal gas recombination, further cementing their status as reliable, low-maintenance power sources.

SLA batteries find critical major applications across stationary and motive power sectors globally. In the stationary segment, they are indispensable for Uninterruptible Power Supplies (UPS) protecting vital IT infrastructure, powering sophisticated security systems, and maintaining emergency lighting in commercial and residential buildings, where their long float life is crucial. The motive power sector utilizes them extensively in electric wheelchairs, utility vehicles, and industrial material handling equipment like forklifts and pallet jacks, owing to their reliable deep-cycling capabilities and favorable operational cost structure. The core benefits include a comparatively low initial capital expenditure, an established and highly efficient recycling infrastructure (often exceeding 99% collection rates in developed nations), and a capacity for high surge current delivery, paramount for instantaneous backup power deployment.

Market expansion is principally driven by accelerating global digitalization, which continuously increases the demand for reliable data center capacity and the expansion of 4G and 5G telecommunication networks, all necessitating robust power backup systems to ensure service continuity. Furthermore, increasing regulatory requirements concerning life safety and security systems across building codes globally mandate the use of dependable backup power, solidifying the demand for certified AGM and Gel batteries. While facing intense competition from lithium-ion technologies in performance-intensive niches, the inherent cost-effectiveness, proven safety profile, and well-developed manufacturing base ensure the sustained competitive advantage and growth trajectory of the SLA battery market worldwide, especially in high-volume, cost-sensitive backup applications and replacement markets.

Sealed Lead Acid (SLA) Battery Market Executive Summary

The Sealed Lead Acid Battery market exhibits steady growth, primarily fueled by the indispensable need for reliable backup power in the global digital infrastructure. Key business trends underscore a strategic imperative toward optimizing AGM technology for high-temperature and deep-cycle performance, seeking to enhance operational longevity and reduce total cost of ownership (TCO) to effectively compete with advanced battery chemistries. Manufacturers are also focusing on strengthening their supply chain resilience, particularly regarding lead sourcing, by maximizing reliance on highly efficient secondary (recycled) lead, which reinforces the circular economy model and stabilizes production costs against commodity volatility. Innovation is directed towards battery monitoring systems and predictive maintenance integration, transforming SLA management from reactive servicing to proactive asset optimization.

Regionally, the market dynamics are geographically diverse. Asia Pacific maintains its clear leadership position, commanding the largest share due to aggressive investment in infrastructure, widespread industrialization, and massive domestic manufacturing capacities in countries like China and India, resulting in a high volume of new installations. Conversely, North America and Europe are characterized by mature, replacement-driven demand, where sustained revenue growth stems from the rigorous cyclic maintenance and regulatory replacement of existing, aging battery banks within critical financial, healthcare, and utility infrastructure. Latin America and MEA represent lucrative emerging markets, where infrastructural deficits and unstable grids drive strong adoption rates for Gel batteries utilized in remote telecom sites and small-scale renewable energy storage applications, prioritizing robustness and thermal tolerance.

Segmentation analysis confirms that technological adoption is highly application-specific. Absorbed Glass Mat (AGM) technology holds the dominant market share, driven overwhelmingly by its optimized performance in Uninterruptible Power Supply (UPS) systems vital for data centers. The Standby Power segment, encompassing UPS and telecommunication applications, remains the principal revenue generator globally, reflecting the non-negotiable requirement for power continuity in modern economies. The industrial vertical, including material handling and utility applications, further solidifies demand, demanding heavy-duty, long-life products. The market’s stability is deeply rooted in the predictable replacement cycles inherent to all major segments, providing a consistent revenue base for market stakeholders.

AI Impact Analysis on Sealed Lead Acid (SLA) Battery Market

Common user questions regarding AI's influence on the Sealed Lead Acid (SLA) Battery Market frequently address the potential for AI to extend the service life of current installations and enhance operational efficiency, mitigating the inherent performance disadvantages relative to newer chemistries. Users often query how advanced analytics can leverage complex performance data—such as temperature fluctuations, impedance readings, and discharge patterns—to move beyond rudimentary monitoring toward precise, actionable predictive failure warnings. The underlying concern is whether these AI enhancements can sufficiently boost SLA competitiveness against lithium-ion, especially in large-scale installations where maintenance costs and unplanned downtime are exponentially higher. The consensus expectation is that AI tools will primarily serve as sophisticated lifecycle managers, optimizing charging cycles, load balancing across parallel strings, and accurately forecasting the optimal time for proactive replacement, thereby maximizing the investment value of large, costly SLA battery banks in critical infrastructure like hyperscale data centers and remote telecommunications facilities, effectively competing on operational longevity and reduced maintenance costs rather than solely energy density.

- AI-powered Predictive Maintenance: Utilization of machine learning algorithms to analyze real-time performance data (voltage, temperature, impedance) to predict battery failure, optimizing replacement schedules and reducing unexpected downtime in critical infrastructure like UPS systems, resulting in up to 30% reduction in maintenance costs and increased safety margins.

- Optimized Charging Protocols: Implementation of AI to dynamically adjust charging voltage and current profiles based on ambient temperature and historical usage patterns, substantially mitigating plate corrosion and sulfation, thereby extending the cycle life and overall longevity of SLA batteries by 10-15% across diverse operational environments.

- Enhanced Fleet Management: AI integration in large-scale installations (e.g., thousands of telecom towers, utility substations) for centralized monitoring, balancing, and equalization of battery performance across geographically dispersed assets, ensuring uniform health and reliable network uptime through proactive alerts.

- Demand Forecasting and Energy Management: Use of AI analytics to better forecast instantaneous power requirements during grid fluctuations, leading to optimized sizing and highly efficient utilization of SLA battery banks in microgrids and peak-shaving applications, improving energy conservation and reducing unnecessary cycling stress.

- Competitive Pressure Acceleration: AI-driven materials science and performance optimization in rival lithium-ion technologies may intensify competitive pressure on SLA segments unless similar manufacturing and operational efficiencies are adopted, particularly for motive power and mobile energy storage applications requiring high power-to-weight ratios.

- Sustainability Optimization: AI modeling to optimize the collection, sorting, recycling, and material recovery processes for lead, sulfur, and plastic components within the reverse logistics chain, reinforcing the strong environmental profile and inherent circular economy model of SLA batteries, enhancing compliance reporting and material yield.

- Manufacturing Process Optimization: Application of AI in monitoring production lines for precise grid casting and plate curing, reducing manufacturing defects, and ensuring higher batch consistency, directly translating to improved battery quality, reduced variation, and extended lifespan across product lines.

DRO & Impact Forces Of Sealed Lead Acid (SLA) Battery Market

The market trajectory for Sealed Lead Acid batteries is fundamentally shaped by a delicate balance between persistent infrastructural requirements and rapid technological innovation in competing chemistries. Key drivers, such as the mandated reliability of backup power for the burgeoning global data economy, the entrenched, cost-effective lead-acid recycling network, and the low TCO for stationary applications, provide substantial market support, guaranteeing sustained baseline demand. However, these are counterbalanced by crucial restraints, notably the inherent limitations in energy density, the heavy weight profile unsuitable for many mobile applications, and the sensitivity of lifespan to extreme temperature variations, necessitating strategic investment in enhanced thermal management and high-performance AGM solutions.

A primary market driver is the accelerating investment in industrial automation, telecommunications, and the relentless construction of new data center facilities globally, particularly across the Asia Pacific region, all of which require reliable, large-volume, and cost-efficient standby power solutions, where SLA batteries offer an ideal blend of TCO and performance without the complexity of thermal runaway management often associated with other chemistries. Conversely, the market faces significant competitive pressure as the production costs for lithium-ion batteries continue to decrease, fueled by the mass scaling of Electric Vehicle (EV) manufacturing. This trend makes Li-ion increasingly viable for energy storage applications traditionally dominated by SLA, particularly those requiring frequent deep cycling or maximum power density in constrained spaces, demanding continuous price competitiveness from SLA producers.

Opportunities for sustained market expansion reside in specialized applications where SLA's characteristics are uniquely advantageous, such as large-scale utility switchgear, railway signaling systems, and specific types of industrial motive power where robust construction and high surge current delivery are essential, and the operating environment is harsh. Regulatory impact forces, including evolving standards for fire safety (NFPA, UL listings) and environmental handling (REACH, RoHS), compel continuous product development towards safer, non-gassing, and more resilient sealed designs. Furthermore, the volatility in global lead pricing acts as a pervasive impact force, compelling manufacturers to adopt rigid hedging strategies and further maximize recycling efficiency to stabilize input costs and maintain competitive pricing against advanced battery solutions.

Segmentation Analysis

The Sealed Lead Acid (SLA) Battery Market segmentation provides a strategic framework for understanding the diverse needs of various industrial and consumer sectors, detailing how technological specifications align with application requirements. The core technological differentiation lies between AGM and Gel technologies, where the choice is largely dictated by whether the application prioritizes instantaneous high power delivery (AGM for UPS) or prolonged, resilient deep cycling capability (Gel for remote solar storage and motive power). This granular market structure allows suppliers to customize product attributes such as plate thickness, electrolyte concentration, and housing materials to meet highly specific operational demands, optimizing both performance and operational lifespan for the end-user while adhering to diverse certification standards across regions.

Further analysis of the application segments reveals a strong bifurcation between Standby Power and Motive Power. Standby power, characterized by batteries maintained at a float charge for emergency use, requires extremely reliable long-term capacity retention and minimal self-discharge, making it the bedrock of the market's stability and consistent revenue generation. In contrast, motive power demands batteries capable of enduring frequent, deep discharge cycles, driving innovation in ruggedized casing and active material compositions, particularly focusing on robust, anti-sulfation additives. The End-Use Vertical segmentation underscores the market's reliance on essential infrastructure sectors—Industrial and Utilities—which consistently prioritize longevity, regulatory compliance, and proven safety records inherent to SLA technology over raw energy density metrics.

- By Technology:

- Absorbed Glass Mat (AGM)

- Gel Cell

- Enhanced Flooded Battery (EFB) (Used in start-stop vehicle systems, often VRLA derived)

- By Application:

- Standby Power

- Uninterruptible Power Supplies (UPS) for Data Centers

- Telecommunication Systems (Cell Towers, Exchanges)

- Emergency Lighting and Security Systems (Alarm Panels, CCTV)

- Medical Equipment (Diagnostic Devices, Backup for Critical Care)

- Motive Power

- Electric Vehicles (Golf Carts, Utility Vehicles)

- Material Handling Equipment (Forklifts, Pallet Jacks)

- Autonomous Guided Vehicles (AGVs)

- SLI (Starting, Lighting, and Ignition)

- Automotive Replacement Market (Standard and Start-Stop)

- Marine and Recreational Vehicles

- Standby Power

- By End-Use Vertical:

- Industrial (Oil and Gas, Manufacturing Plants, Railway Signaling)

- Commercial (Data Centers, Hospitals, Financial Institutions, Retail Chains)

- Residential (Home Security, Small-Scale Backup Power Systems)

- Automotive (Vehicle Manufacturing and Replacement)

- Utilities and Infrastructure (Telecommunication, Grid Regulation, Substations, Traffic Control)

- Defense and Aerospace

- By Voltage Range:

- 2V Cells (High-Capacity Telecom and Utility Racks)

- 4V Batteries

- 6V Batteries (Motive Power and Deep Cycle Applications)

- 12V Batteries (General Purpose UPS, Security Systems, Automotive SLI)

- 24V and Above (Specialized Industrial Stacks and High-Power Systems)

Value Chain Analysis For Sealed Lead Acid (SLA) Battery Market

The Sealed Lead Acid Battery value chain commences at the upstream stage with the critical sourcing and purification of raw materials, predominantly high-purity lead, derived significantly from recycled sources due to the mature collection infrastructure. Secondary lead sourcing stabilizes input costs and contributes to the superior sustainability profile of SLA technology. Other essential inputs include sulfuric acid (electrolyte), and high-grade plastics (for housing), alongside specialized fiberglass mats or silica additives crucial for AGM and Gel batteries, respectively. Efficiency in raw material management and robust long-term supplier contracts are key determinants of upstream profitability, given the volatile nature of global commodity markets, particularly lead.

The midstream manufacturing phase involves highly technical, capital-intensive processes: grid casting, applying lead oxide paste to the plates (pasting), plate curing, cell stacking, welding, sealing, and final formation charging. This phase demands extreme precision and automated quality control to ensure uniform product specifications and long-term reliability. Advanced manufacturing techniques are continually employed to optimize active material utilization and reduce plate corrosion, especially in high-performance AGM batteries designed for extended float life in high-temperature environments. Compliance with global quality certifications (e.g., ISO, UL) is mandatory to access high-value industrial markets, driving high operational expenses in quality assurance and process control.

Downstream distribution channels are strategic for market penetration, recognizing the logistical complexity associated with heavy, bulky battery products that require careful handling and temperature control during transit and storage. Direct distribution is typically employed for large Original Equipment Manufacturers (OEMs) and major industrial customers (e.g., telecom networks, UPS integrators), facilitating specialized technical support and long-term service agreements. Indirect channels, utilizing highly specialized regional distributors, electrical wholesalers, and automotive parts retailers, are essential for reaching the fragmented replacement and small commercial markets. Successful downstream operation hinges on efficient, reliable logistics networks capable of rapid delivery and, crucially, managing the reverse logistics of collecting end-of-life batteries for mandated recycling, thereby completing the essential circular economy loop.

Sealed Lead Acid (SLA) Battery Market Potential Customers

The primary cohort of potential customers for Sealed Lead Acid batteries includes global telecommunication giants, major cloud service providers, and large-scale data center operators, who are massive consumers of high-rate 2V and 12V AGM batteries. These entities require robust power infrastructure to guarantee service continuity and data integrity during prolonged power interruptions. These institutional buyers prioritize total reliability, certified long float life (typically 5 to 10 years), and adherence to stringent operational standards (e.g., IEEE, NFPA), making SLA's proven technology and predictable lifecycle costs highly attractive for managing multi-billion dollar IT assets. Their procurement is highly centralized and influenced by the battery supplier's ability to provide scalable, standardized, and globally supportable products.

A second crucial customer segment resides in the industrial and critical infrastructure vertical, encompassing utility substations, railway signaling authorities, essential medical facilities (hospitals), and manufacturing plants. These buyers often utilize ruggedized Gel or specialized VRLA batteries that offer superior resistance against deep discharge, vibration, and extreme temperature cycling, particularly in remote or uncontrolled environments. The decision-making process in this segment is strongly influenced by regulatory mandates for safety, operational redundancy, and long-term asset amortization, favoring established suppliers capable of providing extensive compliance documentation and robust product warranties. Specific demand also comes from the motive power sector, including large logistics companies operating fleets of electric forklifts and material handling equipment.

Finally, the automotive replacement market and the small commercial sector represent a vast, high-frequency stream of demand. This includes individual vehicle owners needing new SLI batteries (both standard and advanced AGM/EFB for start-stop vehicles), small-to-medium enterprises (SMEs) purchasing compact UPS units for office continuity, and residential users acquiring power for home security systems and small emergency lighting setups. These customers are primarily sensitive to product availability, localized service support, warranty coverage, and the immediate purchase cost. The inherent low initial cost of SLA batteries, coupled with widespread retail and service networks, ensures their continuous preference in these highly fragmented but indispensable segments across all geographic regions globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EnerSys, GS Yuasa Corporation, Exide Technologies, East Penn Manufacturing, Johnson Controls (Clarios), C&D Technologies, Leoch International Technology, Fiamm, Hoppecke Batterien, NorthStar Battery (Pure Power), First Power Group, B.B. Battery, CSB Battery, Narada Power Source, SACRED SUN Power Sources, Amara Raja Batteries, Panasonic Corporation, Hitachi Chemical Co. Ltd., Trojan Battery Company, Midac S.p.A., HBL Power Systems Ltd., Chloride Batteries S E Asia Pte Ltd, Yuasa Battery Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sealed Lead Acid (SLA) Battery Market Key Technology Landscape

The core technological landscape of the SLA battery market is firmly rooted in optimizing the performance characteristics of Valve Regulated Lead Acid (VRLA) batteries, primarily categorized into AGM and Gel technologies. Current technological evolution focuses not on revolutionary new chemistries, but on incremental, yet significant, improvements in material science and structural engineering to enhance longevity, resilience, and power throughput. For AGM batteries, this involves intense research into higher porosity and tighter compression of glass mat separators to improve acid stratification mitigation, reduce internal resistance, and minimize premature drying out. These refinements are critical for maximizing efficiency during rapid charge and high-rate discharge cycles essential in modern UPS systems that support massive data loads.

In Gel technology, innovation centers on developing more stable and efficient colloidal silica compounds to ensure consistent electrolyte suspension over extended periods, minimizing dry-out and maintaining optimal conductivity, particularly vital in high-temperature outdoor applications such as remote telecom power supply in the MEA region and tropical climates. Furthermore, significant research effort is directed towards advanced lead alloys, incorporating elements like calcium and tin, which effectively suppress corrosion of the lead grids and significantly reduce gassing, thereby extending the battery’s float life and reducing maintenance requirements. These alloy innovations are essential for ensuring that VRLA batteries meet the stringent demands for long-duration, maintenance-free operation in industrial control and utility backup systems.

A burgeoning technological area involves hybrid designs, specifically integrating supercapacitor elements, as seen in the commercially available UltraBattery. This technology addresses the critical limitation of standard lead-acid batteries—poor performance and rapid degradation under partial state-of-charge (PSoC) and repeated shallow cycling—by utilizing the supercapacitor to absorb and release power quickly, protecting the lead-acid component from cycle-induced stress. This integration significantly increases the cycle life and charge acceptance, strategically positioning SLA technology for high-cycling renewable energy storage, microgrid applications, and sophisticated start-stop vehicle systems where rapid charge acceptance is paramount. The core objective is leveraging these technological enhancements to push the functional boundaries of SLA technology without sacrificing its fundamental advantages in cost and recycling efficiency.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed leader in the Sealed Lead Acid (SLA) Battery Market, not only in terms of production volume but also in market consumption growth, currently holding the largest market share globally. This dominance is intrinsically linked to the relentless pace of digital transformation and infrastructural development across major economies. The rapid deployment of 5G networks in China, Japan, and South Korea necessitates vast, reliable backup power solutions, creating immense demand for high-rate AGM batteries. Furthermore, the burgeoning electric two-wheeler market and industrial motive power sector across Southeast Asia contribute significantly to the cyclic power segment, favoring cost-effective SLA solutions over higher-priced alternatives for localized manufacturing and logistic operations.

North America and Europe demonstrate distinct characteristics as highly mature markets, characterized by high-value, replacement-driven demand in highly regulated sectors. In these regions, the emphasis is heavily placed on stringent regulatory compliance (e.g., UL, CE, and country-specific safety standards) and verifiable product lifespan and performance consistency, driving demand for premium, long-life AGM batteries tailored for sophisticated UPS systems, extensive security apparatus, and mission-critical data retention centers. While infrastructural growth is slower compared to APAC, the massive installed base of telecom and utility infrastructure ensures a continuous, predictable requirement for replacement batteries, supporting stable market pricing and consistent, high-margin sales of specialized industrial batteries focusing on minimal operational disruption.

The Latin America and Middle East and Africa (MEA) regions are emerging as critical high-potential growth zones due to ongoing governmental initiatives aimed at grid stabilization and telecommunication expansion. In MEA, the challenging environmental conditions, particularly high temperatures and often unstable grid infrastructure, drive strong demand for resilient Gel cell technology in remote telecommunication towers, oil and gas monitoring systems, and nascent solar power installations, where robustness and thermal tolerance are non-negotiable. Latin America's market growth is tied to modernization of essential services, including expanded financial infrastructure and healthcare systems, demanding reliable, cost-effective standby power. These regions rely on SLA technology for its robustness, relative ease of local maintenance, and proven track record compared to complex, highly sensitive battery chemistries, ensuring solid short to medium-term adoption rates.

- Asia Pacific (APAC): Dominates the global market share, fueled by rapid expansion of data center ecosystems, aggressive 5G infrastructure deployment, and vast domestic manufacturing hubs in China, India, and Southeast Asia, focusing heavily on high-volume AGM batteries for standby and cyclic applications.

- North America: Characterized by stable, replacement-driven demand in critical infrastructure sectors (finance, healthcare, defense), adherence to strict certification standards, and substantial usage in hyperscale data centers requiring premium, long-duration AGM systems with detailed performance monitoring capabilities.

- Europe: Strong market presence driven by stringent regulatory requirements for safety and environmental compliance (e.g., REACH), sustained high demand from the motive power segment (industrial logistics and warehousing), and a mature market for specialized standby power solutions in utility and security sectors.

- Latin America: Growing demand fueled by infrastructural upgrades in telecommunications and energy access projects, favoring cost-effective 12V and 6V SLA batteries for localized backup power and smaller solar installations due to economic constraints.

- Middle East and Africa (MEA): High growth potential due to investments in oil and gas infrastructure, remote power solutions for telecom towers often requiring robust Gel technology due to high ambient temperatures, and government initiatives for stable power supply in developing urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sealed Lead Acid (SLA) Battery Market.- EnerSys

- GS Yuasa Corporation

- Exide Technologies

- East Penn Manufacturing

- Johnson Controls (Clarios)

- C&D Technologies

- Leoch International Technology

- Fiamm

- Hoppecke Batterien

- NorthStar Battery (Pure Power)

- First Power Group

- B.B. Battery

- CSB Battery

- Narada Power Source

- SACRED SUN Power Sources

- Amara Raja Batteries

- Panasonic Corporation

- Hitachi Chemical Co. Ltd.

- Trojan Battery Company

- Midac S.p.A.

- HBL Power Systems Ltd.

- Chloride Batteries S E Asia Pte Ltd

- Yuasa Battery Inc.

- Shoto Group

- Ritar Power

Frequently Asked Questions

Analyze common user questions about the Sealed Lead Acid (SLA) Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between AGM and Gel SLA batteries?

The primary difference lies in the electrolyte immobilization method; AGM (Absorbed Glass Mat) uses fiberglass separators saturated with electrolyte, offering high power density and quick charging, suitable for UPS systems requiring high current bursts. Gel Cell batteries use colloidal silica to suspend the electrolyte, providing superior deep cycling capabilities and exceptional thermal resilience, making them ideal for solar storage and harsh, remote environments.

How does the high recyclability of SLA batteries affect market sustainability?

SLA batteries maintain an exceptionally high recycling rate, often exceeding 99% in established markets, which is a major environmental and economic advantage. This closed-loop system minimizes the need for primary lead extraction, reduces manufacturing costs associated with raw material sourcing, and provides a favorable sustainability profile that supports long-term market viability against competing chemistries.

Which application segment drives the highest revenue in the SLA battery market?

The Standby Power application segment, particularly Uninterruptible Power Supplies (UPS) for global data centers, telecommunications networks, and essential utility infrastructure, drives the highest revenue. This reliance is due to the critical need for continuous, instantaneous power backup that SLA batteries provide reliably and cost-effectively.

Is the SLA market being significantly threatened by Lithium-ion technology?

While Lithium-ion technology is gaining ground in high-energy density and weight-sensitive sectors, the SLA market remains robust. The threat is mitigated by SLA’s significant advantages in lower initial cost, proven safety, established standards, and exceptional recycling infrastructure, securing its dominance in large-volume, stationary backup power applications where weight is not the primary constraint.

What operational factors most commonly reduce the lifespan of an SLA battery?

The operational factors that most commonly reduce SLA battery lifespan are exposure to consistently high ambient temperatures, which accelerates corrosion and electrolyte dry-out, and frequent deep discharging without adequate recharging, which causes irreversible sulfation. Proper thermal management and adherence to recommended float voltages are critical for achieving the stated design life.

What is the expected Compound Annual Growth Rate (CAGR) for the SLA Battery Market?

The Sealed Lead Acid (SLA) Battery Market is projected to grow at a stable Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. This growth is predominantly supported by the relentless global expansion of data center capacity and the infrastructural requirements of telecommunication networks seeking reliable and economical backup power solutions.

How are SLA battery manufacturers addressing competition from newer battery chemistries?

Manufacturers are addressing competition by focusing on enhancing the Total Cost of Ownership (TCO) through technological refinement, such as utilizing advanced carbon additives to improve partial state-of-charge performance and implementing AI-driven monitoring systems. They also leverage the highly efficient recycling infrastructure to maintain a substantial cost advantage.

Which region offers the highest potential for SLA market growth?

The Asia Pacific (APAC) region offers the highest potential for SLA market growth, driven by rapid industrialization, massive governmental investment in 5G infrastructure, and increasing urbanization, leading to an enormous demand for reliable, cost-effective power storage solutions across residential, commercial, and industrial segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager