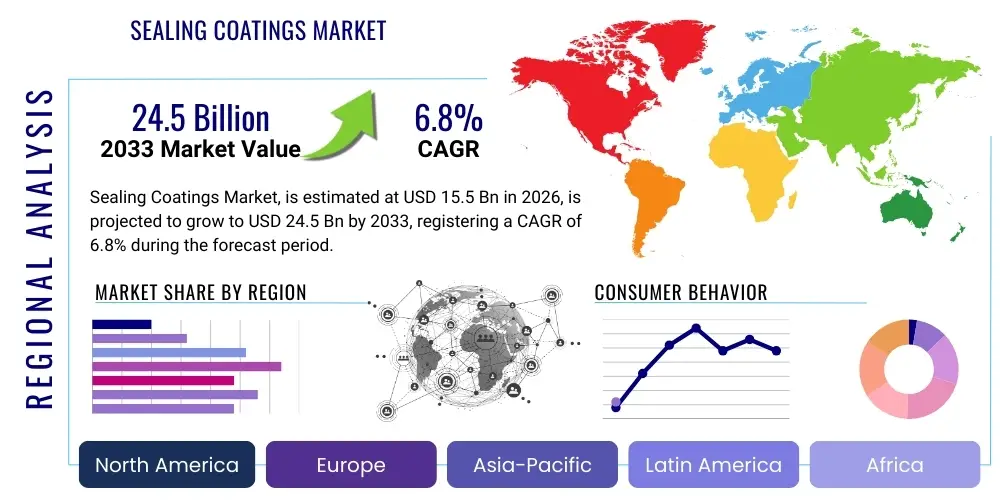

Sealing Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438450 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sealing Coatings Market Size

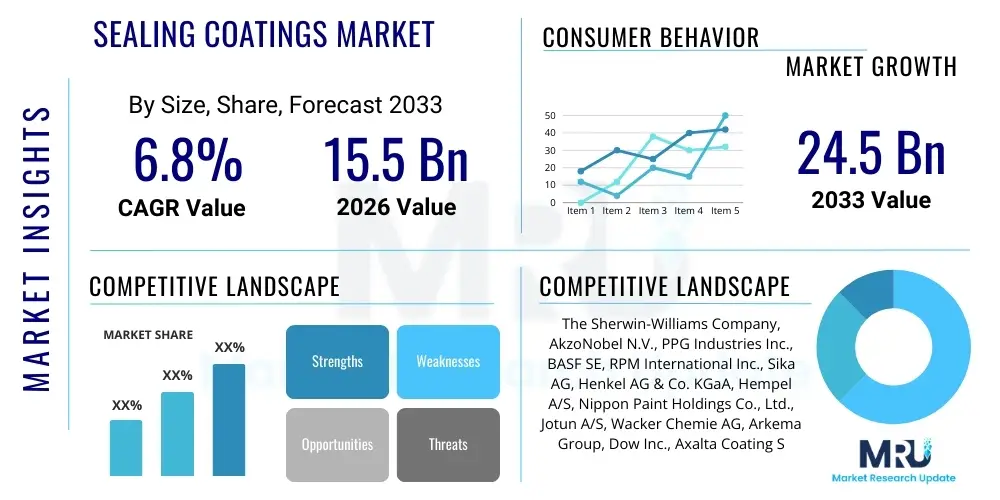

The Sealing Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.5 Billion by the end of the forecast period in 2033.

Sealing Coatings Market introduction

The Sealing Coatings Market encompasses a broad range of protective and functional materials applied to substrates to prevent the ingress of moisture, chemicals, gases, or other detrimental environmental factors, thereby extending asset longevity and enhancing performance characteristics. These coatings are distinct from standard paints as their primary function is barrier protection and sealing integrity, often possessing high elasticity, chemical resistance, and excellent adhesion to diverse materials such as concrete, metal, and specialized polymers. Key product descriptions include high-performance epoxy formulations, versatile polyurethane systems, and specialized acrylic or silicone sealants tailored for specific environmental stresses, ranging from extreme temperatures to high mechanical abrasion, making them indispensable across critical infrastructure and manufacturing sectors.

Major applications of sealing coatings span vital industries including construction and infrastructure (waterproofing roofs, bridges, and tunnels), automotive manufacturing (sealing engine components and bodies), marine vessels (protecting hulls from saltwater corrosion and biofouling), and industrial maintenance (lining storage tanks and processing pipelines). The core benefits derived from the application of these specialized coatings involve superior corrosion mitigation, structural waterproofing, enhanced chemical stability, and significant reduction in maintenance costs over the lifecycle of the sealed assets. Furthermore, the increasing global emphasis on maintaining and upgrading aging infrastructure, coupled with stringent regulatory standards concerning environmental protection and material durability, acts as a pivotal driving factor fueling sustained market expansion, particularly in rapidly urbanizing economies across Asia Pacific and Latin America.

Sealing Coatings Market Executive Summary

The Sealing Coatings Market is characterized by robust business trends centered on sustainability, advanced material science, and regulatory compliance. A prominent trend involves the shift toward high-solids, solvent-free, and bio-based coating formulations, driven by stringent Volatile Organic Compound (VOC) regulations in North America and Europe, pushing manufacturers to invest heavily in R&D for environmentally friendly alternatives like waterborne polyurethanes and powder coatings. Furthermore, the integration of smart technologies, such as self-healing polymers and coatings embedded with sensors for condition monitoring, is rapidly moving from niche application to mainstream industrial adoption, particularly in high-value asset protection across energy and aerospace sectors, signaling a fundamental transformation in product functionality.

Regional trends indicate that the Asia Pacific (APAC) region is poised to maintain its position as the dominant market, propelled by massive government investment in infrastructure development, burgeoning construction activities, and rapid industrialization in countries like China, India, and Southeast Asian nations. While mature markets in North America and Europe focus on the refurbishment of existing infrastructure and adherence to high environmental and safety standards, the demand growth in these regions is driven by specialized, high-performance applications (e.g., extreme temperature resistance, chemical containment). Conversely, the Middle East and Africa (MEA) exhibit strong growth potential fueled by large-scale oil and gas projects and expanding urban construction, particularly requiring heavy-duty anti-corrosion and thermal insulation sealing solutions adapted to harsh desert environments.

Segment trends highlight the dominance of Polyurethane and Epoxy resins due to their exceptional durability, flexibility, and chemical resistance, making them staples in demanding construction and industrial flooring applications. However, the Silicone segment is experiencing accelerated growth, particularly in architectural and automotive sealing, owing to its superior UV resistance and thermal stability. In terms of application, the Construction segment holds the largest market share, driven primarily by the critical need for effective waterproofing and thermal sealing solutions in both commercial and residential structures. The Automotive segment shows high potential, integrating specialized sealing coatings for noise reduction, vibration dampening, and lightweight component protection, ensuring the longevity and performance integrity required by modern electric vehicle manufacturing standards.

AI Impact Analysis on Sealing Coatings Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Sealing Coatings Market typically revolve around optimizing material formulation, enhancing quality control during manufacturing, and implementing predictive maintenance models for applied coatings. Users are keenly interested in how machine learning algorithms can accelerate the discovery and testing of novel coating chemistries, particularly bio-based and self-healing materials, minimizing the time and cost associated with traditional R&D cycles. Furthermore, significant concerns and expectations focus on AI’s role in automating coating application processes (e.g., robotic spraying optimization), ensuring flawless surface preparation, and using computer vision systems for real-time defect detection, thereby guaranteeing high uniformity and performance integrity in complex industrial settings. The key overarching theme is the transition from reactive material science to proactive, data-driven formulation and asset management facilitated by advanced analytical tools and smart factory integration.

- AI optimizes material formulation by simulating molecular interactions, predicting performance parameters (e.g., curing time, adhesion strength, chemical resistance) before physical synthesis.

- Machine learning algorithms enhance quality control by analyzing vast datasets from manufacturing lines, identifying subtle variations in viscosity, pigment dispersion, or cure characteristics in real-time.

- Predictive Maintenance (PdM) models, powered by AI, assess the degradation rate of applied coatings on infrastructure (bridges, pipelines) using sensor data and historical environment factors, enabling timely re-application.

- AI-driven robotics optimize coating application efficiency, adjusting spray patterns and layer thickness based on complex geometries, reducing material waste and achieving superior uniformity (Generative Engine Optimization).

- AI facilitates supply chain resilience by forecasting demand fluctuations for raw materials (resins, additives, solvents) and optimizing inventory levels, mitigating risks associated with commodity price volatility.

- Natural Language Processing (NLP) tools assist researchers in rapidly synthesizing decades of material science literature, accelerating the identification of synergistic additive combinations for performance enhancement.

DRO & Impact Forces Of Sealing Coatings Market

The Sealing Coatings Market dynamics are fundamentally shaped by robust drivers such as escalating global infrastructure spending, the imperative for corrosion protection across critical industrial assets, and the mandatory shift toward sustainable and low-VOC compliant products. Counterbalancing these drivers are significant restraints, notably the high volatility of key raw material prices (derived primarily from petrochemical feedstocks), coupled with increasingly complex and varying regional regulatory frameworks regarding hazardous chemicals and disposal protocols. Opportunities primarily emerge from the rapid technological advancements in specialized, high-margin applications, including self-healing coatings for structural resilience, nanotechnology integration for ultra-thin barriers, and customized solutions tailored for the rapidly growing electric vehicle (EV) battery sealing and protection sector, demanding highly specific thermal and chemical stability. These core factors exert powerful impact forces on market profitability, R&D direction, and competitive positioning across all major geographical regions.

Specific market drivers include the substantial rise in offshore energy exploration and production, requiring high-durability coatings for submerged structures, and the mandatory adoption of passive fire protection (PFP) coatings in high-rise commercial and industrial buildings. The increasing awareness among asset owners regarding the total cost of ownership (TCO) associated with poor maintenance practices further accelerates the adoption of premium, long-lifecycle sealing solutions. However, the market faces structural constraints due to the relatively long product development cycle required for certifications (e.g., marine, aerospace standards) and the requirement for specialized labor and precise application conditions, which can be challenging in remote or demanding environments, thereby limiting wider adoption of highly technical systems in certain emerging markets.

The primary impact forces influencing market growth are the speed of regulatory enforcement and the pace of technological innovation. Regulatory tightening, particularly in Europe and North America concerning Bisphenol A (BPA) and other hazardous components, forces immediate reformulation, creating competitive advantage for companies already focused on bio-based or alternative chemistries. Simultaneously, the success of technological advancements, such as the commercialization of durable waterborne epoxies that achieve performance parity with solvent-based counterparts, acts as a powerful catalyst for expansion, opening new market possibilities in segments previously dominated by conventional solvent technologies, ensuring compliance while maintaining asset integrity.

Segmentation Analysis

The Sealing Coatings Market is comprehensively segmented based on several critical parameters, including the type of resin utilized, the final application environment, the end-user industry, and the coating technology employed. This multi-dimensional segmentation allows for a granular understanding of demand patterns and technological priorities across different sectors. Resin type segmentation is crucial as it determines the fundamental performance characteristics—such as flexibility, hardness, chemical resistance, and curing speed—required for specific sealing tasks, ranging from general waterproofing in construction to specialized chemical containment in industrial settings. Analyzing these segments provides market players with targeted insights into areas demanding specialized material innovation, particularly concerning environmental compliance and long-term durability metrics required for modern infrastructure projects.

- By Resin Type:

- Epoxy

- Polyurethane

- Acrylic

- Silicone

- Bituminous

- Polyaspartic

- Others (Fluoropolymers, Hybrid Systems)

- By Application Technology:

- Solvent-Based

- Waterborne

- Powder Coatings

- UV/EB Cured

- 100% Solids

- By End-Use Industry:

- Construction & Infrastructure (Residential, Commercial, Industrial, Civil)

- Automotive & Transportation (OEM, Aftermarket, Electric Vehicles)

- Marine & Protective (Ship Hulls, Offshore Platforms)

- Aerospace

- Energy (Oil & Gas, Power Generation)

- Industrial Maintenance & Machinery

Value Chain Analysis For Sealing Coatings Market

The value chain for the Sealing Coatings Market is complex, beginning with the upstream supply of fundamental raw materials, predominantly derived from the petrochemical industry. Upstream analysis focuses on the procurement of critical inputs, including specialized resins (e.g., Bisphenol A for epoxies, isocyanates for polyurethanes), various performance additives (rheology modifiers, anti-settling agents, UV stabilizers), pigments (titanium dioxide being crucial), and solvents. Price volatility and supply chain disruption in the petrochemical sector directly impact coating manufacturers’ production costs and profitability. Key upstream suppliers are global chemical giants who specialize in intermediate materials. The relationship between raw material producers and coating formulators is typically long-term and strategic, focusing on secure supply and collaborative R&D for developing next-generation compliant chemistries.

The midstream segment involves the core manufacturing, formulation, and distribution of the finished coating products. Coating manufacturers invest heavily in blending equipment, quality control testing, and R&D labs to tailor formulations for specific performance standards (e.g., fire rating, pot life, abrasion resistance). Distribution channels are highly varied: direct sales are common for large-scale industrial or OEM clients (like major infrastructure projects or automotive manufacturers), allowing for technical service and customized formulation support. Conversely, indirect distribution relies on a network of specialized distributors, wholesalers, and retail outlets for smaller construction or aftermarket projects. The effectiveness of the distribution network, particularly the ability to handle hazardous materials and provide timely technical advice, is a key determinant of market reach and success.

Downstream analysis centers on the application and final end-use of the sealing coatings. This stage involves professional applicators, contractors, and specialized industrial maintenance crews who must adhere to precise surface preparation and application specifications to ensure the coating performs as designed. The quality of the application process is paramount; a superior coating material can fail if surface preparation is inadequate. Final end-users, such as construction companies, shipyards, or municipal bodies, demand comprehensive service that includes not just the product but technical consultation, warranty, and adherence to regional safety standards. Efficient technical support and training programs for applicators provided by the coating manufacturers are essential elements of value delivery in this competitive market.

Sealing Coatings Market Potential Customers

The potential customers for sealing coatings are highly diverse, spanning sectors where asset protection, longevity, and structural integrity are non-negotiable requirements. The primary customer base includes large infrastructure developers and government agencies responsible for maintaining civil engineering projects such as bridges, tunnels, water treatment plants, and public transport systems. These customers typically require bulk volumes of specialized, high-performance coatings, often procured through stringent bidding processes that prioritize performance certification (e.g., C5-M for marine environments) and compliance with national safety standards. Secondary crucial customers are major industrial manufacturers, particularly in the oil and gas, chemical processing, and power generation sectors, who use sealing coatings to protect critical processing equipment, storage tanks, and pipelines from extreme chemical attack, high temperatures, and continuous abrasive wear, prioritizing long-term durability and minimum downtime.

Another significant customer segment comprises the Original Equipment Manufacturers (OEMs) in the automotive, aerospace, and marine industries. Automotive OEMs require specialized coatings for sealing battery enclosures, engine parts, and underbodies for corrosion and NVH (Noise, Vibration, and Harshness) reduction, directly impacting vehicle quality and safety ratings. Aerospace manufacturers demand highly precise, lightweight sealing coatings resistant to extreme atmospheric conditions and specialized fuels. Furthermore, the residential and commercial construction sector represents a constantly renewing customer base, where contractors and developers purchase significant volumes for roofing membranes, foundation waterproofing, and interior floor sealing applications (e.g., parking decks and industrial kitchens), seeking materials that offer easy application, fast curing times, and extended warranties against water ingress.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.5 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Sherwin-Williams Company, AkzoNobel N.V., PPG Industries Inc., BASF SE, RPM International Inc., Sika AG, Henkel AG & Co. KGaA, Hempel A/S, Nippon Paint Holdings Co., Ltd., Jotun A/S, Wacker Chemie AG, Arkema Group, Dow Inc., Axalta Coating Systems, Carboline Company, Polyglass S.p.A., Conklin Co., Inc., The Dymax Corporation, Fosroc International, KCC Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sealing Coatings Market Key Technology Landscape

The Sealing Coatings Market is undergoing rapid technological evolution, primarily driven by demands for enhanced performance, superior environmental profile, and simplified application methods. A significant technological focus is placed on 100% solids and high-solids systems, particularly in epoxy and polyurethane formulations, which minimize or eliminate the use of volatile organic compound (VOC) solvents, aligning with global green building standards and industrial safety protocols. Furthermore, advancements in specialized additive packages, including anti-corrosion pigments based on non-heavy metals (e.g., zinc-free solutions) and advanced rheology modifiers, are critical for ensuring coatings maintain stable application properties and achieve maximum film thickness in challenging environments without sagging or running, a crucial factor for large-scale protective applications on vertical surfaces.

Nanotechnology represents a frontier in sealing coatings, where incorporating nanoparticles (such as nanoclays, carbon nanotubes, or modified silica) significantly improves barrier properties by creating a denser, less permeable film structure, drastically enhancing corrosion resistance and scratch durability. Self-healing coating technology is another emerging and highly disruptive area; these systems, often polymer-based, contain microcapsules filled with healing agents (like monomers or resins) that rupture upon detecting a crack or micro-damage, automatically sealing the breach and restoring the barrier function. While still maturing, self-healing materials promise to fundamentally change maintenance cycles for high-cost assets like aircraft and deep-sea pipelines, justifying the higher initial material cost through massive lifecycle savings.

Application technologies are also evolving, shifting toward automated and efficient curing methods. Ultraviolet (UV) and Electron Beam (EB) curing technologies are gaining traction, especially in OEM segments (automotive, packaging), due to their rapid cure speeds, which allow for immediate handling and processing, significantly improving production throughput and energy efficiency compared to traditional thermal curing methods. This technological push is also accompanied by the increasing use of robotics for surface preparation and coating application, ensuring precise film thickness control and consistent quality, which is vital for specialized sealing tasks where uniformity directly translates to asset lifespan, further reinforcing the market's technical sophistication and driving demand for highly tailored coating solutions.

Regional Highlights

The regional dynamics of the Sealing Coatings Market are segmented into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA), each presenting distinct market drivers and growth trajectories dictated by economic development, regulatory stringency, and infrastructural needs.

- Asia Pacific (APAC): APAC is the global engine of growth for sealing coatings, primarily driven by rapid urbanization and unprecedented levels of government and private investment in infrastructure, including mass transit systems, energy projects, and commercial real estate across China, India, and ASEAN countries. The region’s focus is dual: high volume demand in construction and increasing demand for specialized, high-performance protective coatings in expanding shipbuilding and heavy industrial sectors, although regulatory enforcement regarding VOC emissions remains more relaxed in certain sub-regions compared to Western markets.

- North America: This mature market is characterized by stringent environmental regulations, particularly driven by the Environmental Protection Agency (EPA), forcing a strong focus on high-solids, waterborne, and low-VOC compliant coatings. Growth is primarily driven by the repair and rehabilitation of aging infrastructure (bridges, highways, municipal water systems) and the exponential growth of the electric vehicle manufacturing sector, which demands specialized thermal and sealing materials for battery components and enclosures.

- Europe: The European market is defined by the strictest environmental standards globally (REACH regulations) and a strong emphasis on sustainability and circular economy principles. Demand is concentrated on high-quality, specialized products such as passive fire protection coatings, high-performance elastomeric sealants for energy-efficient buildings, and advanced solutions for marine and renewable energy infrastructure (offshore wind farms), where quality and compliance are prioritized over low cost.

- Latin America (LATAM): Growth in LATAM is heterogeneous, driven primarily by construction booms in major economies like Brazil and Mexico, coupled with significant investment in oil and gas infrastructure. While cost-sensitivity is higher, there is increasing adoption of standardized protective coatings driven by multinational corporate investment in industrial facilities, demanding reliable anti-corrosion and chemical resistance solutions.

- Middle East and Africa (MEA): This region is heavily reliant on the oil and gas sector and massive construction projects (e.g., Saudi Vision 2030). The demand profile is dominated by heavy-duty protective coatings capable of withstanding extreme temperature fluctuations, high salinity, and severe UV exposure inherent to the desert and marine environments, often requiring specialized thermal insulation and anti-corrosion systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sealing Coatings Market.- The Sherwin-Williams Company

- AkzoNobel N.V.

- PPG Industries Inc.

- BASF SE

- RPM International Inc.

- Sika AG

- Henkel AG & Co. KGaA

- Hempel A/S

- Nippon Paint Holdings Co., Ltd.

- Jotun A/S

- Wacker Chemie AG

- Dow Inc.

- Axalta Coating Systems

- Carboline Company

- Kansai Paint Co., Ltd.

- Huntsman Corporation

- Ashland Global Holdings Inc.

- KCC Corporation

- Polyglass S.p.A.

- Tnemec Company Inc.

Frequently Asked Questions

Analyze common user questions about the Sealing Coatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and market driver for sealing coatings?

The primary function of sealing coatings is to provide a durable, impermeable barrier against environmental ingress (moisture, chemicals, gas) to prevent corrosion and degradation, significantly extending the lifespan of assets. The main driver is the necessity for infrastructure maintenance and stringent global anti-corrosion regulations.

Which resin type currently dominates the Sealing Coatings Market?

Polyurethane and Epoxy resins collectively dominate the market due to their superior chemical resistance, mechanical strength, and versatility across diverse industrial and construction applications, including demanding protective coatings for floors and pipelines.

How do VOC regulations impact the future development of sealing coatings?

Volatile Organic Compound (VOC) regulations compel manufacturers, particularly in North America and Europe, to shift development toward sustainable alternatives like 100% solids, high-solids, and waterborne formulations, driving significant R&D investment in green coating chemistry.

Where is the highest growth potential for sealing coatings expected geographically?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by massive, ongoing infrastructure development and rapidly expanding industrial sectors in China, India, and Southeast Asia, requiring extensive protective and sealing solutions.

What are self-healing coatings and their relevance to the market?

Self-healing coatings incorporate microcapsules that release a healing agent upon damage, automatically repairing minor cracks. They are highly relevant as they minimize the need for manual maintenance and offer significantly enhanced long-term structural integrity for high-value assets in aerospace and energy sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager