Sealless ANSI Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436782 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Sealless ANSI Pumps Market Size

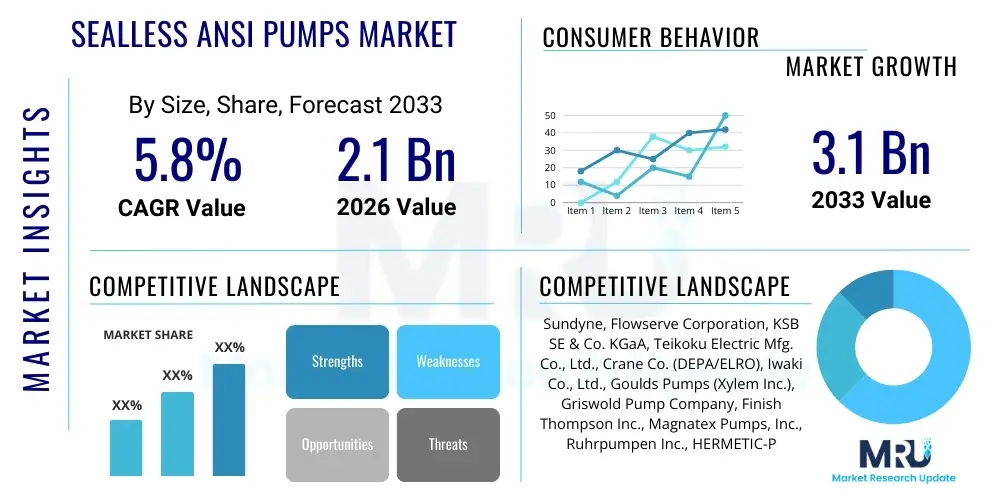

The Sealless ANSI Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033.

Sealless ANSI Pumps Market introduction

The Sealless ANSI Pumps Market encompasses centrifugal pumps designed to handle fluids without the use of conventional mechanical seals, adhering strictly to the dimensional and performance standards set forth by the American National Standards Institute (ANSI) B73.1. These pumps primarily utilize magnetic couplings (magnetic drive pumps) or fully enclosed motors (canned motor pumps) to eliminate leakage pathways, making them crucial components in processes involving hazardous, toxic, highly corrosive, or expensive fluids where environmental compliance and zero emissions are mandatory. The core product description emphasizes enhanced safety, operational uptime, and reduced maintenance costs associated with seal failure, which is a major pain point in traditional pump systems. Sealless pumps, by their inherent design, offer superior containment integrity, meeting stringent regulatory requirements globally.

Major applications for Sealless ANSI Pumps span across several critical industrial sectors, most notably the chemical processing industry (CPI), petrochemical refining, pharmaceutical manufacturing, and specialized water treatment applications. In the CPI, these pumps are indispensable for handling volatile organic compounds (VOCs) and highly corrosive acids, ensuring process efficiency and worker safety. The benefits derived from deploying sealless technology include significant reductions in unplanned downtime, elimination of expensive mechanical seal procurement and repair, and long-term compliance with environmental regulations such as the EPA’s Leak Detection and Repair (LDAR) programs. Furthermore, the inherent design simplicity, coupled with reduced reliance on utility systems like seal flush plans, contributes to lower overall operating expenditure (OPEX).

The market is currently being driven by a confluence of factors, including the increasing global focus on occupational safety and environmental protection, stringent regulations mandating fugitive emission control, and the continuous growth of chemical production capacity in emerging economies. Technological advancements in magnetic coupling materials and pump housing metallurgy are enabling sealless designs to handle more demanding operating conditions, such as high temperatures and high pressures, thereby expanding their applicability beyond traditional domains. The sustained push for digitalization in industrial infrastructure also contributes, as sealless pumps are inherently more compatible with condition monitoring and predictive maintenance systems due to their sealed, contained nature. This operational reliability profile makes them a preferred choice for new plant construction and modernization projects worldwide.

Sealless ANSI Pumps Market Executive Summary

The Sealless ANSI Pumps market demonstrates robust growth, primarily propelled by stringent global environmental mandates and the industrial shift toward minimizing operational risk and maximizing plant safety. Key business trends indicate a strong move towards advanced materials, specifically non-metallic linings and high-performance composites, to enhance chemical resistance and longevity, tackling traditionally difficult applications involving hydrofluoric acid or chlorine. Furthermore, consolidation among key manufacturers, coupled with strategic focus on localized manufacturing facilities in Asia Pacific, aims to shorten supply chains and improve responsiveness to rapidly industrializing markets. The integration of smart monitoring capabilities—such as vibration sensors and remote diagnostics—into pump packages is emerging as a dominant trend, transforming the purchasing criteria for large-scale industrial buyers who prioritize total cost of ownership (TCO) over initial acquisition cost.

Regionally, the market is highly segmented, with North America and Europe currently representing the mature markets characterized by replacement demand driven by aging infrastructure and rigorous safety protocols, especially within the established petrochemical hubs. Conversely, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by massive investments in new chemical plants, pharmaceutical facilities, and capacity expansion projects, particularly in China, India, and Southeast Asia. These emerging markets are often adopting best-in-class sealless technology from the outset to avoid future retrofitting costs associated with environmental compliance. The Middle East and Africa (MEA) are also showing promising growth, attributed to significant planned investments in oil and gas infrastructure expansion and diversification strategies within the regional energy sectors, emphasizing reliable fluid handling under extreme desert conditions.

Segmentation trends reveal that magnetic drive pumps retain market dominance due to their robust design and suitability for high-flow applications, although canned motor pumps are gaining traction in specialized, highly compact, and lower-flow applications requiring absolute noise reduction and minimum maintenance footprint. By application, the chemical processing segment remains the largest end-user, demanding customization across materials of construction (MOC) to handle diverse chemical compositions. The shift toward modular and standardized pump skid solutions, designed for rapid deployment and simplified maintenance procedures, is influencing how end-users procure and install these critical pieces of rotating equipment, providing an impetus for suppliers focusing on full lifecycle service agreements rather than just equipment sales.

AI Impact Analysis on Sealless ANSI Pumps Market

User queries regarding the impact of Artificial Intelligence (AI) on the Sealless ANSI Pumps Market primarily focus on operational longevity, maintenance planning, and design optimization. Users frequently question how AI algorithms can predict coupling failure, bearing wear, or cavitation, thus maximizing Mean Time Between Failure (MTBF). There is significant interest in using AI to correlate process variables (temperature, pressure, flow rate, motor current) with internal pump health, particularly since sealless designs lack easily accessible internal components. Key concerns revolve around the complexity of integrating AI systems with legacy industrial control systems (ICS) and the accuracy of models trained on relatively stable, low-failure-rate equipment like sealless pumps. Expectations center on AI driving substantial reductions in maintenance costs, facilitating remote diagnostics, and automating compliance reporting, thereby lowering the total cost of ownership and increasing equipment uptime in hazardous environments.

AI is set to revolutionize predictive maintenance strategies for sealless pumps, moving beyond basic condition monitoring. By analyzing high-frequency data streams from embedded sensors—such as magnetic flux density in magnetic drive pumps or stator temperature in canned motor units—AI models can detect subtle anomalies indicative of impending failure far earlier than traditional threshold alarms. This capability allows plant operators to schedule interventions precisely during planned shutdowns, eliminating costly emergency repairs. Furthermore, AI-driven diagnostics can accurately isolate the root cause of an issue, differentiating between issues like bearing failure, dry running, or external system disturbances, which is crucial for pumps handling aggressive media where opening the unit poses safety risks. This precision contributes directly to improved reliability metrics and enhanced safety compliance, aligning perfectly with the core value proposition of sealless technology.

Beyond maintenance, AI is also influencing the design phase of Sealless ANSI Pumps. Generative design techniques, powered by AI, can rapidly iterate through thousands of geometric possibilities for impellers and volutes, optimizing hydraulic efficiency for specific fluid properties and flow regimes while adhering to the ANSI B73.1 envelope constraints. Computational Fluid Dynamics (CFD) simulations, traditionally slow and requiring extensive human input, are accelerated and refined through machine learning, resulting in pumps that operate closer to their Best Efficiency Point (BEP) under varied load conditions. This optimization minimizes energy consumption and reduces internal stresses, extending the life of critical components like containment shells and secondary bearings. The overall effect is a market shift towards highly efficient, digitally optimized pumping solutions tailored specifically to end-user process demands.

- AI enables predictive failure detection by analyzing magnetic flux, vibration, and temperature data.

- Generative AI optimizes pump hydraulic design, improving energy efficiency (BEP).

- Machine learning algorithms enhance diagnostics, accurately isolating root causes of operational anomalies.

- AI facilitates automated condition monitoring and real-time performance benchmarking against digital twins.

- Optimization of spare parts inventory and logistics based on AI-predicted component lifespan.

DRO & Impact Forces Of Sealless ANSI Pumps Market

The Sealless ANSI Pumps Market is significantly influenced by powerful Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces shaping its trajectory. The primary driver is the pervasive legislative environment globally, particularly regulations enforcing zero fugitive emissions for volatile and hazardous substances, compelling industries like chemical and petrochemical to replace traditionally sealed pumps with inherently leak-proof sealless designs. This mandate is reinforced by the economic benefit derived from reduced product loss and minimized environmental remediation costs associated with leakage events. However, a major restraint is the comparatively higher initial capital expenditure (CapEx) required for magnetic drive or canned motor pumps relative to conventional sealed pumps, often creating budgetary resistance, especially in smaller enterprises or non-critical applications. Furthermore, the perceived complexity of maintaining specialized components like rare-earth magnets or secondary fluid circulation systems, although offset by reduced routine maintenance, occasionally acts as a barrier to rapid adoption. Opportunities abound in the integration of these pumps into Smart Factory ecosystems, leveraging their robust design for advanced digital monitoring and remote operational control, particularly in high-risk or inaccessible locations, further enhancing their value proposition as critical infrastructure components.

The core Impact Forces demonstrate a reinforcing positive feedback loop where safety, reliability, and regulatory compliance drive demand. The reliability factor of sealless pumps, especially in handling high-temperature or high-pressure applications, substantially reduces catastrophic failure risk, a critical consideration in safety-conscious industries. This reliability is highly valued and acts as a strong gravitational pull, overriding the initial investment restraint over the total lifespan of the equipment. Opportunities are particularly strong in developing specialized pumps for emerging applications, such as handling liquefied natural gas (LNG) or supercritical fluids, where absolute containment is non-negotiable and standard sealing technology proves inadequate. Conversely, market restraints such as the need for specialized training for maintenance personnel and the potential for magnetic coupling decoupling (slippage) during system upsets—though addressed by advanced monitoring systems—require continuous attention from manufacturers to mitigate these technical challenges through improved design margins and robust protection mechanisms.

The strategic market dynamic centers on capitalizing on the opportunity presented by the global focus on sustainability and industrial efficiency. Sealless pumps inherently contribute to sustainable operations by minimizing waste and energy use (due to optimized hydraulic performance and the absence of seal flush systems). Manufacturers are strategically aligning their product portfolios to emphasize energy efficiency and lifecycle cost savings, effectively turning the initial high CapEx restraint into a long-term OPEX driver. The competitive environment dictates that firms must invest heavily in R&D to develop materials capable of handling more abrasive and high-solids-content slurries, traditionally the domain of sealed pumps, thereby expanding the addressable market for sealless technologies. Successfully navigating these impact forces requires a blend of technological superiority, rigorous adherence to standards, and effective communication of the long-term economic advantages to end-users.

Segmentation Analysis

The Sealless ANSI Pumps Market segmentation provides a clear view of market structure based on the operational mechanism, material composition, and industrial application. The primary technological split occurs between Magnetic Drive and Canned Motor pumps, reflecting fundamentally different engineering approaches to achieve leak-proof operation; Magnetic Drive pumps rely on external magnetic coupling to transmit power through a containment shell, while Canned Motor pumps integrate the rotor and stator into a sealed enclosure, utilizing the process fluid for lubrication and cooling. Analyzing these segments is critical for manufacturers tailoring their R&D and production efforts to specific end-user needs, whether for high torque requirements or noise-sensitive environments. Further differentiation is achieved through material segmentation, distinguishing between metallic alloys (e.g., stainless steel, Hastelloy) necessary for high-pressure/high-temperature applications and non-metallic options (e.g., fluoropolymers) preferred for extremely corrosive fluids at lower pressures.

The market’s demand structure is heavily dictated by application segmentation, with the Chemical Processing Industry (CPI) acting as the foundational consumer due to its inherent requirements for handling toxic and flammable chemicals. Other significant end-users include the Oil & Gas sector, where compliance with API standards for containment is paramount, and the Pharmaceutical industry, which demands pumps with minimal contamination risk and high levels of sterility. This segmentation allows for precise market sizing and strategic targeting, identifying high-growth niches such as semiconductor manufacturing, which requires ultra-pure fluid handling. Trends indicate a growing demand for highly customized, multi-stage sealless pumps capable of handling complex flow profiles and minimizing net positive suction head required (NPSHr), pushing manufacturers toward specialized engineering solutions rather than relying solely on standard catalogue offerings.

- By Product Type:

- Magnetic Drive Pumps (Dominate high-power, high-flow applications)

- Canned Motor Pumps (Preferred for high-system pressure and silent operation)

- By Material of Construction:

- Metallic Pumps (Stainless Steel, Hastelloy, Titanium)

- Non-metallic Pumps (PPR, PFA/PTFE Lined)

- By Application:

- Chemical Processing Industry (CPI)

- Oil and Gas (Upstream, Midstream, Downstream)

- Pharmaceutical and Biotechnology

- Water and Wastewater Treatment

- Power Generation (Heat Transfer Fluids)

- General Industrial Use

- By End-User Industry:

- Refineries and Petrochemicals

- Specialty Chemicals

- Fertilizers

- Semiconductors

Value Chain Analysis For Sealless ANSI Pumps Market

The Value Chain for Sealless ANSI Pumps begins with the upstream procurement and processing of specialized raw materials, which are significantly more complex than those required for conventional pumps. This includes the sourcing of high-grade, corrosion-resistant metals like specialty alloys (e.g., Hastelloy C-276, Duplex Stainless Steel) and, critically, high-performance rare-earth magnets (Neodymium-Iron-Boron or Samarium Cobalt) essential for magnetic drive technology. The ability of manufacturers to secure stable, high-quality supplies of these components, particularly the magnets, often dictates production capacity and cost competitiveness. Manufacturing involves precision casting, sophisticated machining to maintain tight ANSI B73.1 tolerances, and complex assembly processes, particularly for the containment shells which must withstand high pressures while remaining non-magnetic (or non-conductive, in the case of Canned Motor pumps). R&D and design optimization, focusing on improving magnetic coupling efficiency and bearing life (typically sleeve bearings lubricated by the process fluid), form a crucial high-value component early in the chain, differentiating premium offerings.

The downstream analysis focuses on market reach, installation, and post-sales support, which is often a critical differentiator for specialized equipment. Distribution channels are typically a combination of direct sales teams for major capital expenditure projects (e.g., new refinery construction) and highly specialized indirect distributors or channel partners who possess deep technical expertise in fluid dynamics and pump maintenance. These indirect channels are vital for servicing the long tail of replacement and retrofit markets, providing localized inventory and emergency technical support. The installation phase often requires certified engineers due to the criticality of alignment and coupling checks. Post-sales support involves specialized maintenance services, including the handling of potentially contaminated components, emphasizing the need for robust service networks capable of quick turnaround times to minimize plant downtime, thereby extending the value chain into a profitable service loop.

The distinction between direct and indirect distribution heavily influences pricing and customer relationship management. Direct sales afford greater control over technical consultation and large-scale contract negotiations, frequently involving customization for API or specific corporate engineering standards. Indirect channels, conversely, provide broader geographical reach and faster access to maintenance, repair, and overhaul (MRO) markets. The overall value derived by the end-user is heavily concentrated in the operational efficiency and safety components—the successful elimination of leaks and the maximization of MTBF. Therefore, manufacturers are increasingly focusing on digital services, such as remote monitoring subscriptions and digital twin integration, embedded within the downstream process to maintain ongoing customer engagement and capture recurring revenue streams, effectively cementing their position as critical technology partners rather than mere equipment vendors.

Sealless ANSI Pumps Market Potential Customers

The primary customer base for Sealless ANSI Pumps comprises industries where the reliable and safe handling of hazardous, toxic, or high-value fluids is non-negotiable. End-users fall predominantly within the specialized sectors of process manufacturing that face strict regulatory oversight regarding fugitive emissions, primarily the Chemical Processing Industry (CPI) and the Petrochemical sector. Within the CPI, potential customers include manufacturers of specialty chemicals, polymers, acids, and fertilizers, which require diverse materials of construction (MOC) to handle their complex process streams. These customers prioritize operational safety and compliance with standards such as the Toxic Substances Control Act (TSCA) in the US and equivalent directives globally. They purchase sealless pumps not just for performance, but as a preventative measure against costly environmental fines and plant shutdowns due to leaks.

Beyond the core chemical and oil and gas sectors, significant potential exists in the pharmaceutical and biotechnology industries. These end-users, particularly those involved in Active Pharmaceutical Ingredient (API) synthesis, require pumps that ensure product purity, prevent cross-contamination, and facilitate clean-in-place (CIP) and sterilize-in-place (SIP) procedures. Canned motor pumps, known for their minimal dead space and sterile characteristics, are often the preferred technology in this segment. Furthermore, the semiconductor and electronics manufacturing industries represent a high-growth customer segment, demanding ultra-pure fluid handling for etchants and cooling media where even minute particulate contamination or leakage is unacceptable. The purchasing decision for these customers is driven by the need for ultra-reliability and the lowest possible contamination risk, often resulting in specifications for highly specialized, non-metallic or ceramic-lined sealless pumps.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sundyne, Flowserve Corporation, KSB SE & Co. KGaA, Teikoku Electric Mfg. Co., Ltd., Crane Co. (DEPA/ELRO), Iwaki Co., Ltd., Goulds Pumps (Xylem Inc.), Griswold Pump Company, Finish Thompson Inc., Magnatex Pumps, Inc., Ruhrpumpen Inc., HERMETIC-Pumpen GmbH, Richter Chemie-Technik GmbH, Tuthill Pump Group, Chempump (Division of Teikoku), Dickow Pumpen GmbH & Co. KG, Klaus Union GmbH & Co. KG, March Manufacturing Inc., Sterling Sihi Group, Vertiflo Pump Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sealless ANSI Pumps Market Key Technology Landscape

The technological landscape of the Sealless ANSI Pumps Market is characterized by continuous innovation focused on enhancing component durability, magnetic coupling efficiency, and monitoring integration. A primary area of R&D investment is in advanced materials science, specifically developing inert and wear-resistant materials for internal components, such as secondary bearings (often silicon carbide, carbon graphite, or specialized ceramics) that are lubricated only by the process fluid. Improving these materials is essential for extending the pump's service life when handling fluids with low lubricity or high particulate content. Furthermore, the design and material composition of the containment shell are crucial; they must minimize eddy current losses, particularly in magnetic drive pumps, necessitating the use of high-strength, non-metallic composites or thin metallic alloys that balance pressure rating with efficiency. This material innovation directly addresses historical limitations related to dry run susceptibility and bearing premature failure, boosting overall reliability metrics.

Digitalization forms the second major technological pillar. The integration of Industrial IoT (IIoT) sensors and robust communication protocols (like OPC UA or Modbus TCP) is becoming standard, enabling real-time remote monitoring of parameters such as bearing temperature, vibration, and magnetic coupling status. Modern sealless pumps often incorporate intelligent monitoring systems capable of detecting slight deviations in performance that signal potential problems, such as partial decoupling or impending bearing failure, allowing for pre-emptive maintenance. This technological shift from reactive to predictive maintenance leverages AI and cloud computing, transforming the pump from a standalone mechanical asset into a networked, intelligent component of the overall process control system. The adoption of robust, integrated health monitoring platforms is crucial for end-users seeking to maximize operational uptime in critical applications.

Specific advancements in magnetic technology also define the competitive landscape. Manufacturers are continuously seeking to increase the torque transmission capacity per unit size of magnetic couplings by improving the power density of rare-earth magnets, allowing sealless pumps to handle higher horsepower applications that were previously restricted to sealed designs. Additionally, specialized design configurations, such as jacketed containment shells for heat transfer or cryogenic applications, and specialized hydraulic designs to optimize for low Net Positive Suction Head Available (NPSHa) conditions, represent core technological differentiation points. These innovations are critical for expanding the addressable market beyond traditional chemical processing into specialized fields like high-vacuum systems, supercritical fluid extraction, and applications requiring precise, pulsatile-free metering of corrosive media.

Regional Highlights

The global Sealless ANSI Pumps market exhibits distinct regional dynamics driven by varying industrial maturity, regulatory enforcement, and investment patterns in processing infrastructure. North America, primarily led by the United States, represents a mature but highly valuable market segment. Demand here is characterized by stringent adherence to environmental standards, especially those enforced by the EPA concerning fugitive emissions (LDAR programs). This region sees strong replacement demand as aging chemical and petrochemical plants upgrade their equipment to modern, environmentally compliant sealless technologies. Furthermore, the expansion of midstream infrastructure and specialized chemical manufacturing related to shale gas derivatives drives continuous, high-specification demand. Key users in this region prioritize product reliability, compliance documentation, and advanced digital monitoring capabilities.

Europe, driven by the EU’s environmental directives such as REACH and ATEX, demonstrates robust growth focused heavily on safety and energy efficiency. The market is concentrated in established chemical clusters in Germany, the Netherlands, and the UK. European customers place a premium on energy-efficient designs (pumps close to their Best Efficiency Point) and documented low lifecycle carbon footprints. The push towards sustainable manufacturing processes and circular economy principles is accelerating the adoption of sealless technology over conventional pumps, particularly in specialized fields like pharmaceutical bulk drug manufacturing and fine chemical synthesis. The regulatory landscape acts as a powerful, non-negotiable driver for technology adoption across the continent.

Asia Pacific (APAC) is currently the fastest-growing region, propelled by rapid industrialization, massive capacity expansion in the chemical and pharmaceutical sectors (especially in China, India, and South Korea), and increasing adoption of Western regulatory standards. As governments in this region emphasize pollution control and industrial safety, new construction projects are overwhelmingly specifying sealless pumps from the design phase onward. The market dynamic in APAC is split between high-volume, cost-sensitive standard applications and highly specialized, critical applications requiring state-of-the-art materials. Local manufacturing partnerships and competitive pricing strategies are crucial for market penetration in this expansive and diverse region.

- North America (US, Canada): Mature market dominated by replacement demand; driven by strict EPA/OSHA regulations; focus on TCO and digital integration.

- Europe (Germany, UK, France): High compliance standards (REACH, ATEX); strong demand from pharmaceutical and specialty chemical manufacturing; emphasis on energy efficiency.

- Asia Pacific (China, India, Japan): Highest growth rates due to extensive greenfield industrial investment; increasing regulatory pressure on environmental protection; competitive landscape driven by localization.

- Latin America (Brazil, Mexico): Growth tied to oil & gas exploration and national industrial modernization programs; fluctuating demand influenced by commodity prices.

- Middle East & Africa (Saudi Arabia, UAE): Significant investments in petrochemical refining and capacity expansion; demand driven by harsh operating environments and high-volume, critical applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sealless ANSI Pumps Market.- Sundyne

- Flowserve Corporation

- KSB SE & Co. KGaA

- Teikoku Electric Mfg. Co., Ltd.

- Crane Co. (DEPA/ELRO)

- Iwaki Co., Ltd.

- Goulds Pumps (Xylem Inc.)

- Griswold Pump Company

- Finish Thompson Inc.

- Magnatex Pumps, Inc.

- Ruhrpumpen Inc.

- HERMETIC-Pumpen GmbH

- Richter Chemie-Technik GmbH

- Tuthill Pump Group

- Chempump (Division of Teikoku)

- Dickow Pumpen GmbH & Co. KG

- Klaus Union GmbH & Co. KG

- March Manufacturing Inc.

- Sterling Sihi Group

- Vertiflo Pump Company

Frequently Asked Questions

Analyze common user questions about the Sealless ANSI Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of Sealless ANSI Pumps over standard sealed pumps?

The primary benefit is the complete elimination of potential leakage pathways, which is achieved through magnetic coupling or a canned motor design. This ensures zero fugitive emissions, critical for handling hazardous, toxic, or high-value chemicals, significantly improving plant safety and environmental compliance.

How do Sealless ANSI Pumps adhere to industry standards?

Sealless ANSI Pumps strictly adhere to the ANSI B73.1 standard for dimensional interchangeability and hydraulic performance. This compliance allows for seamless integration and replacement within existing chemical processing infrastructure designed around ANSI specifications.

Are Sealless ANSI Pumps more expensive than conventional pumps?

The initial capital expenditure (CapEx) for Sealless ANSI Pumps is typically higher due to specialized materials and complex containment technology. However, the total cost of ownership (TCO) is often lower over the pump's lifespan due to reduced maintenance costs, eliminated seal replacement downtime, and savings from product loss prevention.

What are the main types of Sealless ANSI Pumps available?

The market is primarily segmented into Magnetic Drive Pumps, which use external magnets to drive the impeller through a containment shell, and Canned Motor Pumps, where the motor rotor and stator are encapsulated within the fluid path, eliminating the need for seals or external coupling.

What role does condition monitoring play in Sealless ANSI Pump maintenance?

Condition monitoring, often utilizing integrated IIoT sensors and AI analytics, is vital. It enables predictive maintenance by detecting early signs of internal issues like bearing wear or magnetic coupling misalignment, maximizing Mean Time Between Failure (MTBF) and ensuring proactive intervention before catastrophic failure occurs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager