Seamless Stainless Steel Pipes and Tubes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434413 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Seamless Stainless Steel Pipes and Tubes Market Size

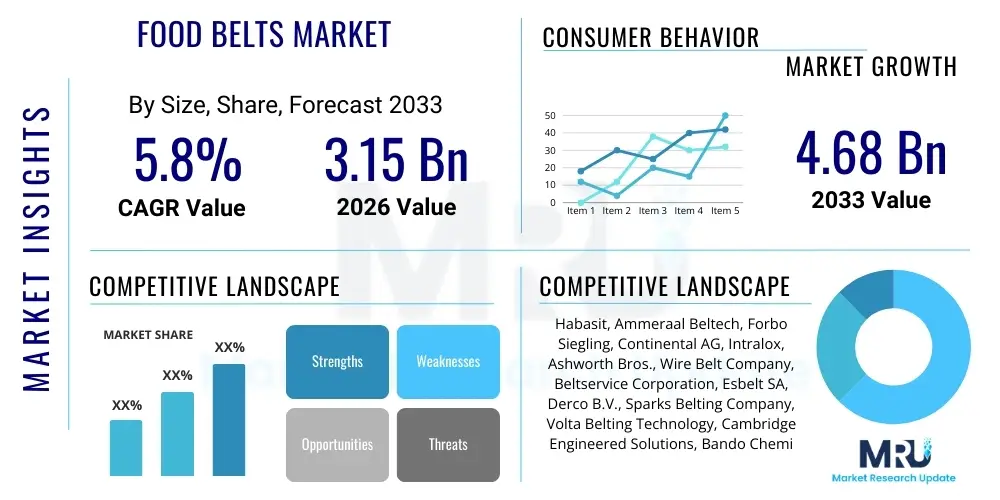

The Seamless Stainless Steel Pipes and Tubes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $23.0 Billion by the end of the forecast period in 2033.

Seamless Stainless Steel Pipes and Tubes Market introduction

The Seamless Stainless Steel Pipes and Tubes Market encompasses the production and distribution of cylindrical components manufactured without welding, offering superior mechanical properties, high corrosion resistance, and structural integrity compared to their welded counterparts. These products are critical infrastructure components across various heavy industries due to their ability to withstand high pressure, high temperatures, and corrosive environments, ensuring operational longevity and safety in demanding applications. The fundamental product characteristic—the absence of a seam—eliminates potential weak points, making them indispensable for critical fluid and gas transportation systems.

Major applications of seamless stainless steel pipes and tubes span sectors such as oil and gas exploration (O&G), chemical processing, power generation (nuclear and thermal), pharmaceuticals, and food and beverage processing. In the O&G sector, they are extensively used in downhole applications, process piping, and heat exchangers where aggressive media necessitates exceptional material performance. Their inherent benefits, including high dimensional accuracy, uniform wall thickness, enhanced mechanical strength, and excellent resistance to pitting and crevice corrosion, drive their preferential selection over alternative materials, particularly in high-specification projects.

Key driving factors accelerating market expansion include rapid industrialization in emerging economies, increasing investment in global infrastructure development, and the stringent regulatory frameworks governing safety and material standards in critical industries. Furthermore, the rising focus on renewable energy infrastructure, such as concentrated solar power and advanced geothermal plants, necessitates high-performance stainless steel components capable of long-term reliable service under extreme conditions. The consistent demand for grades like 304/304L and 316/316L across diverse end-use sectors underpins the market's robust trajectory.

Seamless Stainless Steel Pipes and Tubes Market Executive Summary

The Seamless Stainless Steel Pipes and Tubes Market is characterized by intense focus on material quality, supply chain efficiency, and technological advancements in manufacturing processes, reflecting robust growth driven primarily by industrial expansion and infrastructure projects. Business trends indicate a shift towards specialized product offerings, including high-performance duplex and super duplex stainless steel grades, addressing specific challenges in ultra-deep water oil exploration and highly corrosive chemical environments. Major manufacturers are consolidating operations and expanding capacities in high-growth regions, emphasizing lean manufacturing techniques and automation to maintain cost competitiveness and meet stringent global certification requirements, such as API, ASTM, and PED standards.

Regionally, Asia Pacific continues to dominate the market landscape, primarily due to large-scale investment in the chemical, power generation, and refining sectors, particularly in China and India. North America and Europe maintain a mature market status but exhibit steady demand driven by infrastructure modernization, replacement of aging piping systems, and significant activity in the pharmaceutical and aerospace industries which demand extremely high-purity tubing. The Middle East and Africa (MEA) region is witnessing substantial market uplift fueled by large petrochemical and oil & gas pipeline projects requiring extensive quantities of high-pressure seamless tubing, supported by sustained governmental efforts to enhance upstream and downstream capabilities.

Segment trends highlight the dominance of austenitic stainless steel (SS 304 and SS 316) due to its versatility and cost-effectiveness across general industrial applications. However, the fastest growth is anticipated in specialized segments, specifically duplex and super duplex grades, reflecting their adoption in challenging marine and sour service environments where superior stress corrosion cracking resistance is mandatory. Furthermore, the energy end-use segment remains the largest consumer, but demand from the mechanical and instrumentation sector is rising sharply, driven by precision engineering applications requiring tight tolerances and superior surface finishes for instrumentation tubing and hydraulic systems.

AI Impact Analysis on Seamless Stainless Steel Pipes and Tubes Market

User queries regarding AI's influence in the seamless stainless steel pipes and tubes market primarily revolve around operational efficiency, predictive maintenance capabilities, and optimization of complex manufacturing processes. Users frequently ask how AI can reduce defects during hot extrusion or cold drawing, whether machine learning models can accurately forecast raw material price volatility (especially nickel and chromium), and how AI-driven quality control systems compare to traditional inspection methods. Key themes center on leveraging AI to enhance precision, minimize waste, and improve the overall throughput of high-value products, alongside concerns about the initial investment cost and the required upskilling of the workforce necessary to manage sophisticated AI tools in traditionally manual processes.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the production floor of seamless tube manufacturing. AI algorithms are being deployed to analyze vast datasets collected from sensors on pilger mills, extrusion presses, and annealing furnaces. This data-driven approach allows manufacturers to achieve real-time optimization of critical parameters such as temperature profiles, drawing speeds, and lubrication application, leading directly to reduced energy consumption, minimized production cycle times, and a significant decrease in material defects, particularly those related to wall thickness variation or internal surface flaws. This heightened process control ensures consistent product quality, essential for compliance in regulated sectors like nuclear and aerospace.

Furthermore, AI plays a crucial role in enhancing supply chain resilience and demand forecasting. Predictive analytics models utilize external factors, including geopolitical events, commodity market fluctuations, and large-scale project announcements, to forecast future demand for specific stainless steel grades. This capability allows manufacturers to optimize inventory levels of critical raw materials (like billets and hollows) and finished goods, mitigating risks associated with supply bottlenecks and price volatility. In quality assurance, AI-powered image recognition systems are revolutionizing non-destructive testing (NDT), rapidly identifying minute surface cracks or inclusions during ultrasonic and eddy current testing, thereby exceeding the accuracy and speed of traditional human inspection methods.

- AI optimizes furnace temperature profiles during annealing, improving grain structure homogeneity and mechanical properties.

- Machine learning models predict equipment failure in pilger mills, facilitating proactive maintenance and reducing unplanned downtime.

- AI-driven sensor data analysis enhances process control in cold drawing, achieving tighter dimensional tolerances (AEO optimization).

- Predictive analytics models forecast nickel and chromium price trends, optimizing raw material procurement strategies.

- Computer vision systems automate and accelerate non-destructive quality inspection, identifying surface defects with high accuracy.

- Smart factories leverage AI for dynamic scheduling and workload balancing, improving overall equipment effectiveness (OEE).

DRO & Impact Forces Of Seamless Stainless Steel Pipes and Tubes Market

The market dynamics are defined by a powerful interplay of growth drivers stemming from industrial necessity and significant restraints related to operational complexity and economic volatility, mitigated by emerging opportunities in specialized sectors. Drivers primarily focus on escalating demand from energy and infrastructure sectors that require high-integrity components resistant to severe operating conditions. Restraints include the high capital expenditure required for advanced seamless manufacturing facilities and the inherent volatility in the pricing of primary raw materials, such as nickel and molybdenum, which directly impacts production costs and market pricing stability. Opportunities lie in expanding the utilization of high-strength alloys and tapping into nascent markets in hydrogen energy infrastructure and advanced nuclear reactor construction.

The foremost driver is the global emphasis on critical infrastructure longevity and safety, particularly within the oil and gas, petrochemical, and power generation industries. Seamless pipes are non-negotiable in applications involving highly flammable or corrosive substances under extreme pressures, where failure could result in catastrophic economic and environmental consequences. Regulatory mandates, such as those imposed by international bodies requiring specific material certifications and traceability, further solidify the demand for high-quality seamless products. The ongoing necessity for deep-sea drilling and complex chemical synthesis processes continuously pushes the material science envelope, creating steady demand for premium, specialized seamless tubing.

However, the market faces considerable restraints, notably the resource-intensive nature of seamless pipe production. The manufacturing process, which typically involves hot extrusion, piercing, and complex cold finishing techniques (like cold drawing or cold pilgering), demands significant energy input and substantial initial investment in specialized machinery, creating high barriers to entry. Furthermore, the price stability of the final product is heavily dependent on the global stainless steel raw material index. Sudden surges in the cost of alloying elements, especially those controlled by a few global producers, can squeeze profit margins and necessitate rapid price adjustments, complicating long-term contracting and market stability.

Opportunities for expansion are clearly visible in the transition toward future energy technologies. The development of hydrogen infrastructure (transport and storage) requires specialized seamless stainless steel tubes capable of handling hydrogen embrittlement risks. Similarly, the construction of Small Modular Reactors (SMRs) and advanced nuclear facilities requires unique, high-specification seamless materials designed for extreme radiation and temperature environments. Additionally, the increasing complexity of pharmaceutical and biotechnology manufacturing necessitates ultra-high purity (UHP) seamless tubing with exceptional interior surface finishes, representing a high-margin niche opportunity.

The impact forces are substantial, driven by technology adoption and global economic cycles. The intense competition among major manufacturers necessitates continuous investment in process innovation (e.g., enhanced heat treatment technologies and tighter tolerance controls). Macroeconomic factors, such as global GDP growth and investment cycles in the upstream energy sector, directly dictate project approvals and, consequently, the demand for seamless tubes. Regulatory tightening, particularly concerning environmental discharge and material safety standards, acts as a continuous force pushing manufacturers toward higher quality, certified products, often favoring established market players capable of meeting these complex requirements.

- Drivers:

- Increasing global investment in critical energy infrastructure (Oil & Gas, Power Generation).

- Mandatory requirement for high-integrity piping systems in high-pressure and high-temperature applications.

- Rapid industrialization and chemical plant expansion in developing economies, driving material demand.

- Stringent regulatory standards prioritizing safety and operational reliability in hazardous environments.

- Restraints:

- High volatility and price fluctuations of essential raw materials like Nickel and Chromium.

- High capital expenditure and significant energy consumption associated with seamless manufacturing processes.

- Trade protectionism and import tariffs affecting cross-border material flow and pricing.

- Opportunities:

- Emerging demand from hydrogen generation, transport, and storage infrastructure (Hydrogen Economy).

- Expansion into specialized, high-margin segments such as duplex/super duplex grades and UHP tubing.

- Modernization and replacement of aging pipeline networks in mature industrial regions.

- Impact Forces:

- Macroeconomic cycles influencing capital expenditure in heavy industries.

- Technological advancements in cold finishing and non-destructive testing (NDT) methodologies.

- Geopolitical tensions affecting global trade routes and raw material supply chain stability.

Segmentation Analysis

The Seamless Stainless Steel Pipes and Tubes Market is comprehensively segmented based on material grade, outer diameter (size), manufacturing process, and critical end-use applications, allowing for granular market analysis and strategic targeting. The segmentation by material grade is perhaps the most crucial, determining the product’s suitability for specific corrosive or high-temperature environments. Standard grades, such as Austenitic 304/304L and 316/316L, form the backbone of the market due to their general utility and cost-effectiveness, while specialized grades command premium prices driven by technological necessity in demanding environments.

Segmentation by size (Outer Diameter) is essential as it dictates the primary application, ranging from small-diameter instrumentation tubing used in highly sensitive control systems to large-bore piping utilized for high-volume fluid transport in refineries and power plants. Furthermore, the manufacturing process—whether primarily hot-finished or cold-finished—determines the final product's dimensional precision and surface finish, with cold finishing being preferred for precision applications like heat exchangers and instrumentation, whereas hot finishing suits heavy-wall structural and high-pressure applications.

The segmentation by end-use application provides the clearest view of demand drivers, where the Oil & Gas and Chemical industries collectively represent the largest consumers, primarily due to their intrinsic need for robust, reliable, and corrosion-resistant fluid handling systems. Understanding the consumption patterns across these segments is vital for manufacturers in tailoring their production mixes, allocating resources efficiently, and ensuring compliance with the varying industry-specific standards (e.g., API 5CT for O&G, ASME B31.3 for Process Piping, and various pharmaceutical GMP requirements).

- By Material Grade:

- Austenitic Stainless Steel (e.g., 304, 304L, 316, 316L, 321)

- Duplex and Super Duplex Stainless Steel (e.g., S31803, S32750, S32760)

- Ferritic Stainless Steel

- Martensitic Stainless Steel

- By Manufacturing Process:

- Hot Finished

- Cold Finished (Cold Drawing, Cold Pilgering)

- By Outer Diameter (Size):

- Small Diameter (Under 1 inch, Instrumentation Tubing)

- Medium Diameter (1 inch to 6 inches, Process Piping)

- Large Diameter (Above 6 inches, High-Pressure Pipeline)

- By End-Use Application:

- Oil & Gas (Upstream, Midstream, Downstream Refining)

- Chemical and Petrochemical Processing

- Power Generation (Thermal, Nuclear, Renewables)

- Automotive and Transportation

- Food, Beverage, and Dairy Processing

- Pharmaceuticals and Biotechnology

- Mechanical and General Engineering

Value Chain Analysis For Seamless Stainless Steel Pipes and Tubes Market

The seamless stainless steel pipes and tubes value chain is complex and capital-intensive, starting with the extraction and processing of raw materials and culminating in specialized installation and maintenance services for the end-user. The chain begins at the upstream segment with the sourcing of primary alloying elements—nickel, chromium, and molybdenum—which are melted, refined, and cast into stainless steel billets or hollows. This stage is dominated by global steel giants and is characterized by high price volatility, requiring sophisticated risk management strategies from pipe manufacturers to stabilize input costs. Efficient control over the alloying process directly dictates the mechanical and corrosive properties of the final seamless product.

The core manufacturing stage involves converting these billets into seamless pipes and tubes through hot working (e.g., hot extrusion and piercing) and subsequent cold finishing (e.g., drawing and pilgering) processes, followed by rigorous quality checks, heat treatment, and surface finishing. This midstream segment is characterized by high technological requirements and significant quality assurance investments to comply with international standards (API, ASME). Manufacturers often differentiate themselves here through precision engineering, specialized heat treatment capabilities, and the ability to produce highly customized product specifications (e.g., tight OD/ID tolerances or specific material grades like super duplex).

Distribution channels form the downstream segment, involving a mix of direct sales and complex indirect networks. Direct sales are common for large-scale, project-based procurement in the Oil & Gas and Power sectors, where manufacturers deal directly with Engineering, Procurement, and Construction (EPC) firms or major end-users. Indirect channels utilize specialized stockists, distributors, and agents who maintain large inventories of standard grades and sizes, providing immediate availability to smaller projects and maintenance, repair, and operations (MRO) demand. The final stage involves installation, welding, and application-specific servicing provided by specialized contractors, completing the value proposition to the ultimate end-user, emphasizing the importance of product traceability and certification throughout the entire chain.

Seamless Stainless Steel Pipes and Tubes Market Potential Customers

The primary consumers of seamless stainless steel pipes and tubes are highly regulated industrial entities that prioritize material reliability, corrosion resistance, and high mechanical performance in critical applications where system failure is unacceptable. These customers are typically large corporate entities or governmental bodies engaged in capital-intensive projects. The largest buyer segment encompasses major international and national oil companies (IOCs and NOCs) and their associated drilling and refining contractors, who require materials capable of surviving high-sulfur crude, acidic gases (sour service), and extreme pressure in deep-water environments, making them consistent purchasers of high-nickel alloys and duplex grades.

Another crucial customer segment includes global EPC firms specializing in designing and constructing large-scale chemical processing plants and petrochemical facilities. These buyers procure vast quantities of standard (304/316) and specialized seamless pipes for process lines, heat exchangers, and reactors, prioritizing long-term asset integrity and adherence to stringent quality documentation (Mill Test Certificates). Their purchasing decisions are highly influenced by total cost of ownership, material lifespan, and supplier reputation for on-time delivery and adherence to project specifications.

Furthermore, major utility providers and independent power producers (IPPs), particularly those operating nuclear, high-efficiency thermal, or advanced geothermal plants, represent significant potential customers. These buyers demand seamless tubing for boiler tubes, steam condensers, and heat exchangers that must maintain structural integrity under persistent high heat and pressure cycles. In the life sciences sector, pharmaceutical and biotechnology companies are high-value customers for ultra-high purity (UHP) seamless tubing used in sterile process lines and clean utilities, where internal surface finish and freedom from contamination are non-negotiable requirements regulated by global health authorities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $23.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Outokumpu Oyj, Sandvik AB, ThyssenKrupp AG, Nippon Steel Corporation, TISCO (Taiyuan Iron & Steel Co. Ltd.), Wuxi seamless pipe Co. Ltd., Tenaris S.A., Salzgitter AG, JFE Steel Corporation, Tsingshan Holding Group, Tubacex S.A., Ratnamani Metals & Tubes Ltd., ArcelorMittal S.A., Marcegaglia Spa, Kobe Steel Ltd., Centravis Production Group, Zhejiang JIULI Hi-Tech Metals Co., Ltd., Zelezarny Veseli a.s., Penn Stainless Products Inc., Sosta Inox Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Seamless Stainless Steel Pipes and Tubes Market Key Technology Landscape

The manufacturing technology landscape for seamless stainless steel pipes and tubes is dominated by highly specialized techniques aimed at enhancing material properties, dimensional accuracy, and internal surface quality. A pivotal technology is the utilization of advanced Hot Extrusion and Piercing Mills (e.g., Mandrel Mill Process or Plug Mill Process) that transform solid billets into hollow shells. Recent technological developments focus on optimizing the piercing process through computerized control systems to ensure minimal internal surface defects and high eccentricity tolerance, which is critical for subsequent cold finishing operations. The precise control of temperature and deformation rate during hot working is paramount to achieving the necessary metallurgical structure before final sizing.

In the Cold Finishing segment, Cold Pilgering (a reciprocating rolling process) and Cold Drawing are the cornerstones for producing smaller diameter, thin-walled, and high-precision tubes, particularly for instrumentation and heat exchanger applications. Technological advancements here include the use of sophisticated tooling materials (dies and mandrels) offering enhanced wear resistance, allowing for longer production runs and superior surface finish quality. Furthermore, inline Non-Destructive Testing (NDT) technologies, specifically ultrasonic testing (UT) and eddy current testing (ET), integrated with high-speed sensor arrays, are standard practice, enabling rapid and comprehensive flaw detection and dimensional gauging, thereby guaranteeing product integrity before final delivery.

Metallurgical technology represents another critical area, focusing on the development and large-scale manufacturing of specialized grades, such as high-nitrogen duplex and super duplex stainless steels (e.g., S32750/UNS 32760). Production of these alloys requires specialized solution annealing and quenching processes, where heat treatment cycles must be precisely controlled to prevent the formation of deleterious intermetallic phases (like sigma phase), which would compromise corrosion resistance and ductility. Advanced heat treatment furnaces, utilizing controlled atmospheres and rapid cooling capabilities, are essential technological investments for manufacturers seeking to serve high-specification sectors like aerospace, offshore oil and gas, and advanced power generation.

Regional Highlights

Geographically, the Seamless Stainless Steel Pipes and Tubes Market exhibits distinct consumption patterns and growth dynamics across key global regions, driven by localized industrial activity and regulatory frameworks.

- Asia Pacific (APAC): APAC is the epicenter of growth in the global market, led primarily by massive infrastructural investments and relentless industrial expansion, particularly in China, India, and Southeast Asian nations. China remains the world's largest consumer and producer, fueled by enormous capacity expansion in chemical, petrochemical, and power generation (both coal-fired and nuclear). India’s continuous development of its refining capacity and ambitious pipeline infrastructure projects create immense, sustained demand. The region benefits from lower production costs and increasing self-sufficiency in stainless steel production, although quality concerns remain a differentiating factor for high-specification imports.

- North America: North America represents a mature but technically demanding market, driven by the Oil & Gas sector, specifically the demanding requirements for specialized tubes used in hydraulic fracturing and high-pressure well applications. Although capital expenditure for new mega-projects can fluctuate, strong underlying demand comes from infrastructure refurbishment, strict API standards enforcement, and robust activity in the aerospace and pharmaceutical manufacturing sectors, which require ultra-clean, high-specification seamless tubing. The focus here is on value-added, highly certified products rather than sheer volume.

- Europe: The European market is characterized by stringent environmental regulations and a strong emphasis on modernization and efficiency in the chemical, power generation, and automotive industries. Key countries like Germany and Italy are major producers and consumers, focused on high-quality, cold-finished precision tubes for high-performance heat exchangers, mechanical components, and advanced power systems (including renewables). The adoption of high-strength alloys like Duplex stainless steel for infrastructure replacement, driven by compliance with the Pressure Equipment Directive (PED), ensures stable, high-value demand.

- Middle East and Africa (MEA): This region is heavily influenced by the massive capital investments in upstream oil and gas production, refining, and petrochemical complexes, predominantly across the Gulf Cooperation Council (GCC) nations (Saudi Arabia, UAE, Qatar). The requirement for seamless pipes is enormous, often involving extremely high volumes of corrosive-resistant grades (316L and Duplex) for sour service applications, pipelines, and export terminals. Government-led diversification efforts are also stimulating demand in water desalination and power generation projects.

- Latin America: The market in Latin America is tied significantly to the performance of major national energy companies (like Petrobras) and associated infrastructure development in Brazil, Mexico, and Argentina. While politically and economically sensitive, the large offshore exploration activities and necessary modernization of aging refineries provide cyclical, large-scale opportunities for suppliers capable of navigating complex logistical and regulatory environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Seamless Stainless Steel Pipes and Tubes Market.- Outokumpu Oyj

- Sandvik AB

- ThyssenKrupp AG

- Nippon Steel Corporation

- TISCO (Taiyuan Iron & Steel Co. Ltd.)

- Wuxi seamless pipe Co. Ltd.

- Tenaris S.A.

- Salzgitter AG

- JFE Steel Corporation

- Tsingshan Holding Group

- Tubacex S.A.

- Ratnamani Metals & Tubes Ltd.

- ArcelorMittal S.A.

- Marcegaglia Spa

- Kobe Steel Ltd.

- Centravis Production Group

- Zhejiang JIULI Hi-Tech Metals Co., Ltd.

- Zelezarny Veseli a.s.

- Penn Stainless Products Inc.

- Sosta Inox Group

Frequently Asked Questions

Analyze common user questions about the Seamless Stainless Steel Pipes and Tubes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of seamless stainless steel pipes over welded pipes?

Seamless pipes offer superior structural integrity because they lack a welded seam, eliminating a potential failure point under high stress or pressure. They also exhibit more uniform strength across the wall thickness and are preferred in critical applications involving high temperatures, high pressures, or highly corrosive media, such as downhole drilling and power generation heat exchangers.

Which stainless steel grades dominate the current seamless pipe market?

Austenitic grades, specifically Type 304/304L (used widely for general corrosion resistance and fabrication) and Type 316/316L (offering enhanced resistance to pitting corrosion due to Molybdenum content), dominate the volume share. However, Duplex (e.g., S31803) and Super Duplex (e.g., S32750) grades are the fastest-growing segments due to their high strength and exceptional resistance to stress corrosion cracking in challenging offshore and chemical environments.

How does the volatility of raw material prices impact the seamless pipes industry?

Raw material prices, particularly for key alloying elements like Nickel, Chromium, and Molybdenum, constitute a major portion of production costs. High volatility necessitates the use of complex pricing mechanisms, such as alloy surcharge systems, which transfer risk to the customer. This volatility often complicates long-term project planning and affects the capital expenditure cycles of major end-users like Oil & Gas firms.

Which manufacturing technique is utilized to achieve high-precision seamless tubing for instrumentation?

High-precision seamless tubing, often required for instrumentation and heat exchanger applications, is predominantly manufactured using Cold Finishing techniques, particularly Cold Drawing and Cold Pilgering. These processes reduce the diameter and wall thickness while significantly improving dimensional tolerances, enhancing surface finish quality, and increasing the material's mechanical strength through work hardening.

What role does the energy sector play in driving the demand for seamless stainless steel products?

The energy sector, encompassing Oil & Gas (exploration, transport, and refining) and Power Generation (fossil, nuclear, and high-efficiency renewables), is the single largest consumer. Seamless pipes are crucial for handling corrosive fluids, high-pressure steam, and aggressive process streams, guaranteeing safety and long operational life, making the sector's capital spending a direct proxy for market demand fluctuations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager