Seat organizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438057 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Seat organizer Market Size

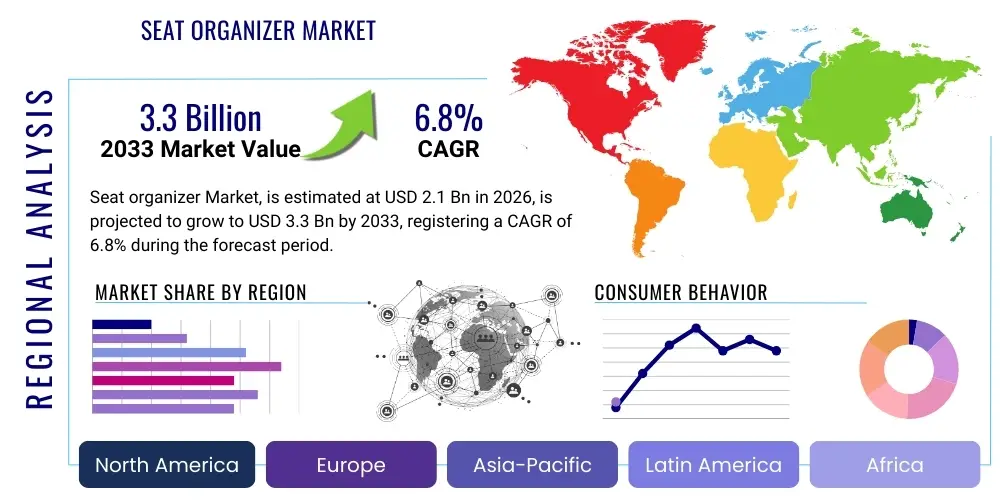

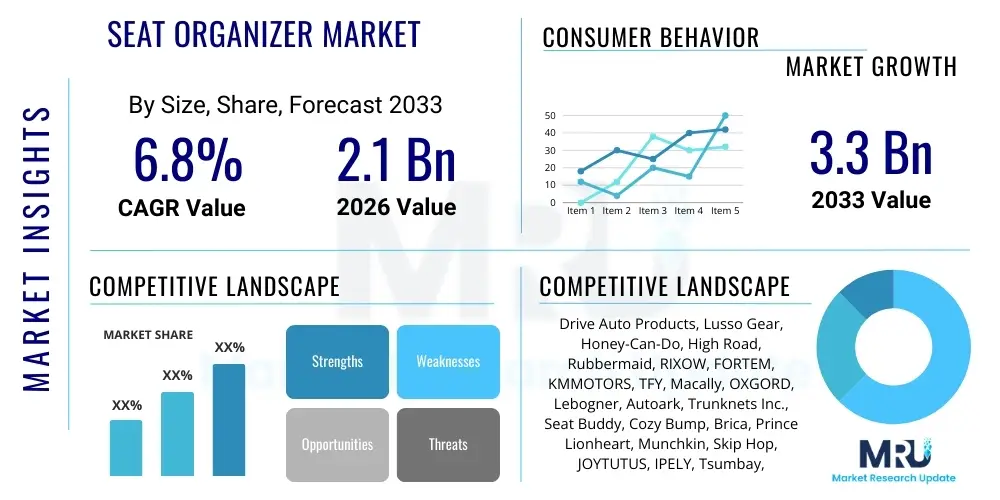

The Seat organizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.3 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the sustained growth of the global automotive industry, particularly the rising sales of Sport Utility Vehicles (SUVs) and minivans which inherently offer more space for organizational solutions.

Market expansion is also supported by changing consumer lifestyles, characterized by longer commutes and increased frequency of family road trips, necessitating efficient interior space management. Modern consumers seek durable, aesthetically pleasing, and multi-functional organizers that seamlessly integrate into the vehicle's interior design. The integration of technology, such as dedicated tablet holders and charging ports within these organizers, contributes significantly to their perceived value and drives higher adoption rates globally, particularly in developed economies.

Furthermore, the commercial vehicle segment, including taxi fleets, delivery services, and ride-sharing operators, presents a lucrative opportunity. These professional users require robust, heavy-duty organizational solutions to manage tools, paperwork, and electronic devices efficiently, ensuring operational readiness and minimizing clutter. The focus on customized solutions tailored for specific vehicle models and usage patterns will be a core driver of value growth through 2033.

Seat organizer Market introduction

The Seat Organizer Market encompasses various accessory products designed to enhance the utility and organization of vehicle interiors, ranging from simple mesh pockets to complex, multi-compartment storage systems. These products address the critical consumer need for efficient space utilization, helping to minimize clutter, improve passenger comfort, and safely store essential items such as electronics, beverages, documents, and emergency kits. The shift towards multi-functional designs, often incorporating insulating materials, durable straps, and adjustable configurations, defines the modern product landscape. Major applications span personal vehicle use (daily commuting, family travel) and commercial fleet applications (delivery and service vehicles). Benefits include improved driving safety by reducing distractions, protection of interior surfaces, and enhanced aesthetic appeal. The market is primarily driven by increasing global vehicle production, rising disposable incomes leading to higher accessory spending, and the pervasive need for convenience and order in confined spaces.

The product segmentation traditionally divides between seat-back organizers, which utilize vertical space behind the front seats, and trunk or console organizers, which focus on maximizing horizontal storage area. Recent market trends indicate a strong move toward sustainable and premium materials, such as recycled plastics and high-grade vegan leather, aligning with broader environmental, social, and governance (ESG) goals and appealing to affluent consumers. The regulatory landscape, while not directly controlling organizer design, indirectly influences standards through automotive safety requirements, pushing manufacturers to ensure accessories do not impede airbag deployment or passenger ingress/egress. This combination of practical utility and premium aesthetics ensures sustained market relevance and growth.

A significant factor driving market sophistication is the differentiation provided by niche products catering to specific demographics, such as pet owners, outdoor enthusiasts, or parents with young children. For example, specialized organizers for baby supplies or tactical equipment require unique structural integrity and material specifications. The competitive landscape is characterized by both large automotive accessory manufacturers and nimble e-commerce focused brands, leveraging digital marketing and direct-to-consumer models to quickly adapt to evolving consumer preferences and technological integration demands, such as integrating inductive charging pads.

Seat organizer Market Executive Summary

The global Seat organizer Market is poised for stable expansion, underpinned by robust business trends focusing on material innovation and omnichannel distribution strategies. Businesses are increasingly investing in proprietary locking mechanisms and modular designs that allow consumers to customize storage based on immediate needs, moving away from generic, one-size-fits-all solutions. The major business trend involves strategic partnerships between organizer manufacturers and Original Equipment Manufacturers (OEMs) to offer integrated, branded accessories at the point of vehicle purchase, capitalizing on convenience and high-quality assurance. Furthermore, consolidation is occurring among smaller players, driven by the necessity to gain economies of scale and meet stringent international quality standards, especially concerning material off-gassing and flammability.

Regionally, North America maintains the dominant market share, primarily due to high penetration of large vehicles (SUVs and trucks) and strong consumer purchasing power dedicated to vehicle enhancement. However, the Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), fueled by the rapidly expanding middle-class population in countries like China and India, coupled with high rates of new vehicle registration. European markets demonstrate a preference for aesthetically integrated and minimalist designs, focusing on organizers made from sustainable or eco-friendly materials, driven by stringent regional environmental policies and high consumer awareness regarding sustainability.

Segment trends reveal a pronounced shift toward premium, durable organizers made from high-quality fabrics and faux leather, surpassing demand for basic mesh or plastic options. The Backseat Organizer segment remains the largest due to its practical application for rear passengers, especially in family settings, while the Trunk Organizer segment is experiencing rapid growth, largely supported by consumers utilizing vehicles for grocery runs, sports equipment transport, and outdoor activities. Distribution channels are favoring E-commerce, which offers a broader range of specialized products, comparative pricing, and direct consumer reviews, influencing purchase decisions and enabling global brand reach efficiently.

AI Impact Analysis on Seat organizer Market

Common user questions regarding AI's impact on the Seat organizer Market generally center on whether AI will lead to the development of 'smart' organizers, how AI influences purchasing decisions, and its role in manufacturing efficiency. Users are keenly interested in predictive analytics for inventory management—specifically, how AI helps determine the optimal product mix for regional markets based on climate, vehicle type demographics, and local lifestyle patterns. Key concerns involve the potential for AI-driven design tools to commoditize product aesthetics and whether 'smart organization' is a necessary or merely gimmicky addition to simple storage solutions. Overall, consumers and industry professionals expect AI to optimize supply chains and personalize the consumer experience, rather than drastically changing the physical product itself, except perhaps through superior material selection and defect detection during production.

The core theme summarized from user inquiries is that AI's major influence will be behind-the-scenes, optimizing the entire value chain from initial product concept to final customer delivery. AI algorithms are increasingly being used to analyze vast datasets of consumer feedback, return rates, and usage patterns, allowing manufacturers to rapidly iterate designs, correct structural weaknesses, and introduce features highly desired by specific vehicle owners (e.g., customized dimensions for specific truck console sizes). Furthermore, AI-powered chatbots and recommendation engines are enhancing the online shopping experience, ensuring consumers are matched with the organizer that precisely fits their vehicle model and intended use, minimizing purchase errors and boosting customer satisfaction. This operational efficiency driven by AI ensures reduced waste and faster time-to-market for innovative products.

- AI-driven Predictive Maintenance: Utilizing AI to analyze material stress points based on simulated vehicle usage data, leading to enhanced product durability and structural integrity testing before mass production.

- Demand Forecasting Optimization: Employing machine learning algorithms to forecast demand for specific organizer types (e.g., trunk vs. seat back) based on seasonal changes, regional economic indicators, and new vehicle model releases.

- Personalized Product Recommendations: AI engines analyze individual customer vehicle ownership data (make, model, year) and past purchase behavior to recommend custom-fit organizers and complementary accessories.

- Automated Quality Control (AQC): Integrating AI vision systems into manufacturing lines to instantly detect subtle cosmetic and structural defects in stitching, seams, and materials, ensuring consistently high product quality.

- Supply Chain Resilience: Using AI to model potential supply chain disruptions (e.g., port delays, material shortages) and instantly re-route logistics or identify alternative sourcing options, maintaining inventory levels.

- Smart Inventory Allocation: Optimizing warehouse placement of different organizer types across regional distribution centers based on real-time sales velocity and predicted local trends, reducing shipping costs and delivery times.

- Generative Design Assistance: AI tools assist designers by proposing optimal structural configurations for complex, multi-pocket organizers, maximizing storage capacity within specified vehicle dimensions.

- Dynamic Pricing Strategies: AI algorithms continuously adjust pricing based on competitor activity, current inventory levels, and consumer demand elasticity, maximizing revenue streams.

- Customer Service Automation: Deployment of AI chatbots capable of answering complex fitting questions (e.g., "Will this fit my 2023 F-150?") by accessing large databases of vehicle specifications.

- Sustainability Tracking: AI platforms track the origin and lifecycle of materials used in organizers, helping manufacturers quantify and report on sustainability goals, such as the percentage of recycled content utilized.

DRO & Impact Forces Of Seat organizer Market

The Seat organizer Market dynamics are heavily shaped by a confluence of accelerating drivers, critical structural restraints, and emerging opportunities, collectively defining the impact forces influencing strategic decision-making. The primary drivers include the global expansion of vehicle ownership, particularly among the growing middle class in emerging economies, coupled with consumer preference for organization and cleanliness within their personal vehicles. Furthermore, the rise of the digital nomad and remote work culture has led to vehicles being used as temporary office spaces, necessitating specific organizers for laptops, tablets, and charging accessories. However, market growth is often restricted by the low-barrier-to-entry for producing basic organizers, leading to intense price competition, the proliferation of low-quality knockoffs, and consumer hesitation regarding product longevity and vehicle fit accuracy. These restraints necessitate constant quality improvement and differentiation strategies by premium players.

Opportunities for growth are significant, particularly in the realm of smart organization and sustainable manufacturing practices. Integrating technology, such as wireless charging pads, temperature-controlled compartments, and customizable LED lighting, offers a pathway to premium pricing and product differentiation. The opportunity to expand into specialized commercial fleet markets (e.g., medical transport, police vehicles) with rugged, industry-specific organizers presents an untapped revenue stream. Additionally, leveraging recycled plastics and sustainable, bio-based materials addresses rising consumer environmental concerns and complies with evolving regulatory requirements, offering a compelling competitive advantage over traditional polyester and nylon producers. The net impact of these forces is moderate to high, with drivers currently outweighing restraints, provided manufacturers focus on quality, innovation, and direct consumer engagement through robust e-commerce channels.

The cumulative impact forces dictate that market success is increasingly dependent on intellectual property protection related to design patents and proprietary fastening systems that ensure stability and safety. The ability to rapidly scale production while maintaining material quality remains a critical challenge, especially when navigating volatile global raw material prices. The convergence of automotive safety standards, material innovation, and the logistical efficiency of fulfilling customized orders determines which companies successfully capture market share. Companies that manage to blend high utility, aesthetic appeal, and environmental responsibility are best positioned to leverage the strong underlying driver of consumer desire for organizational efficiency in daily life.

Segmentation Analysis

The Seat organizer Market is segmented across multiple dimensions, including product type, material composition, vehicle compatibility, and primary distribution channel, reflecting the diverse needs of the global consumer base. Product type segmentation is critical as it defines the functional area within the vehicle, catering specifically to rear passenger needs (backseat organizers) versus cargo management (trunk organizers). Material differentiation, ranging from budget-friendly polyester to luxurious leather, allows manufacturers to target various price points and quality expectations. This multi-faceted segmentation ensures that both high-volume, general-purpose products and low-volume, specialized luxury items are accounted for within the market structure, providing depth to the competitive landscape and allowing for targeted marketing efforts based on demographic and regional purchasing power.

Vehicle compatibility further refines the segmentation, separating the high-volume passenger car segment from the more specialized and rapidly growing commercial vehicle segment, which demands heavy-duty, robust solutions capable of withstanding industrial use. The shift towards SUVs and electric vehicles (EVs) is generating a specific need for organizers optimized for vehicles with flat floors and specific console designs. Furthermore, the distribution channel segmentation highlights the ongoing transition of sales from traditional brick-and-mortar automotive accessory shops to highly efficient, globally accessible e-commerce platforms, which dominate the market due to their convenience and ability to offer vast product variety and detailed fitment information.

Understanding these segmentation nuances is vital for strategic investment, allowing companies to allocate resources towards high-growth areas, such as premium leather organizers sold through online marketplaces or specialized plastic organizers designed for fleet utility vehicles. The evolving material segment, particularly the increasing utilization of sustainable and recycled textiles, represents a burgeoning area of interest. Companies focusing on environmentally conscious materials can leverage this segmentation to appeal to a growing segment of ecologically aware consumers, thereby achieving differentiation beyond traditional pricing and utility factors.

- Product Type

- Backseat Organizers: Primarily focused on passenger entertainment, storage of children's items, and general clutter control behind the front seats.

- Trunk/Cargo Organizers: Large-capacity, durable solutions for managing groceries, tools, sports equipment, and emergency kits in the vehicle's cargo area.

- Console Side Organizers: Smaller, targeted organizers designed to fit into the gap between the seat and the central console, preventing small items from dropping.

- Visor Organizers: Flat organizers attached to the sun visor, often used for holding sunglasses, cards, and pens.

- Overhead/Ceiling Organizers: Niche products utilizing ceiling space, common in specialized SUVs or commercial vans.

- Material

- Polyester/Nylon Fabric: Standard, lightweight, and cost-effective; dominates the economy and mid-range segments.

- Leather/Faux Leather (PU): Premium segment, focusing on aesthetic integration and durability, often featuring refined stitching.

- Plastic/Hard Shell (Polypropylene/ABS): Used for rigid, heavy-duty storage, primarily in trunk and commercial applications, prioritizing structural integrity and cleanability.

- Canvas/Recycled Textiles: Emerging segment focused on sustainability and rugged, casual aesthetics.

- Vehicle Type

- Passenger Cars (Sedans, Hatchbacks): Smaller, more compact organizer designs.

- SUVs and Minivans: Larger, multi-functional, and modular organizer systems designed to maximize vertical and cargo space.

- Commercial Vehicles (Trucks, Vans, Fleet): Heavy-duty, robust, and often customized organizers for tools, documentation, and safety gear.

- Distribution Channel

- Online Sales (E-commerce Platforms, Brand Websites): Fastest-growing channel, offering broad selection and convenience.

- Offline Sales (Automotive Retail Stores, Superstores, Dealerships): Traditional channel relying on immediate availability and in-person assessment.

Value Chain Analysis For Seat organizer Market

The Value Chain for the Seat organizer Market begins with upstream activities focused on raw material sourcing and design. Upstream analysis involves securing steady supplies of high-quality textiles (polyester, nylon, canvas), plastics (ABS, PP), and specialty materials like faux leather or hardware components (zippers, buckles, Velcro). Key challenges at this stage include managing price volatility of petroleum-derived plastics and ensuring ethical sourcing of specialty materials. Design is heavily influenced by CAD (Computer-Aided Design) and rapid prototyping to optimize fitment for new vehicle models. Successful upstream management requires strong relationships with specialized textile and hardware suppliers, often concentrated in Asia, ensuring compliance with automotive-grade material standards, particularly concerning volatile organic compounds (VOCs) and flammability.

Midstream activities involve the core manufacturing processes, including cutting, stitching, heat-sealing, assembly, and quality control. This stage is dominated by large-scale, automated production facilities, primarily in countries offering favorable labor costs and established manufacturing ecosystems. Efficiency in stitching and assembly, especially for complex, multi-pocket designs, is paramount to maintaining cost competitiveness. Quality control focuses on testing the durability of zippers, load-bearing capacity of straps, and the color fastness of materials. The move towards modular design requires flexible manufacturing lines capable of handling variations in size and material quickly. Packaging and labeling are also critical midstream steps, ensuring products are protected during transit and comply with regional import regulations.

Downstream analysis encompasses distribution and post-sales support, primarily segmented into direct and indirect channels. Direct distribution is dominated by e-commerce, allowing manufacturers to bypass intermediaries, retain higher margins, and gather real-time consumer feedback crucial for rapid product iteration. Indirect channels involve sales through large retailers (e.g., Walmart, Target), specialized automotive parts stores, and OEM dealerships. The final link is post-sales service, including managing warranties and returns, which is particularly important in this market due to fitment issues sometimes encountered by consumers. Effective downstream management relies on sophisticated logistics networks and robust digital infrastructure to handle high volumes of geographically dispersed, often individual, shipments.

Seat organizer Market Potential Customers

Potential customers for seat organizers are broadly segmented into three primary groups: private vehicle owners, commercial fleet operators, and specific demographic niches such as parents or outdoor enthusiasts. Private vehicle owners constitute the largest segment, driven by the universal need to maintain order, especially during long commutes or weekend trips. These buyers prioritize aesthetic appeal, ease of installation, and multi-functionality (e.g., integrated cup holders, tablet sleeves). They are highly influenced by online reviews and digital marketing focused on lifestyle improvement and decluttering solutions, often purchasing through direct-to-consumer e-commerce platforms for convenience and product variety.

The second major group, commercial fleet operators (including logistics companies, taxi/ride-share services, and field service technicians), prioritize durability, heavy-duty construction, and job-specific utility. These organizations require organizers designed to withstand continuous professional use, often seeking bulk orders of specialized products, such as lockable compartments for sensitive equipment or rigid plastic totes for tools and safety gear. Sales to this segment often rely on B2B contracts, requiring customized sizing and stringent adherence to fleet maintenance and replacement schedules, emphasizing long-term cost of ownership and robustness over aesthetic features.

The third group focuses on demographic-specific needs. Parents, particularly those with infants and toddlers, are a crucial niche, requiring specialized products for baby wipes, bottles, toys, and changing supplies—features like thermal insulation for bottles are highly valued. Similarly, outdoor and fitness enthusiasts seek waterproof, easily cleanable trunk and cargo organizers for storing muddy gear, diving equipment, or wet sports attire. These niche segments value functional innovation and specialized material properties, indicating a willingness to pay a premium for solutions that specifically address their unique activity requirements, making them high-value targets for specialized product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Drive Auto Products, Lusso Gear, Honey-Can-Do, High Road, Rubbermaid, RIXOW, FORTEM, KMMOTORS, TFY, Macally, OXGORD, Lebogner, Autoark, Trunknets Inc., Seat Buddy, Cozy Bump, Brica, Prince Lionheart, Munchkin, Skip Hop, JOYTUTUS, IPELY, Tsumbay, ZONE TECH, Starling’s. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Seat organizer Market Key Technology Landscape

The technology landscape in the Seat organizer Market is defined less by radical digital innovation and more by sophisticated material science, advanced manufacturing techniques, and the integration of basic electronics to enhance utility. Core technologies revolve around the development of durable, lightweight, and environmentally friendly materials. For instance, manufacturers are increasingly using high-denier polyester blends that offer superior abrasion resistance and water repellency compared to standard fabrics, often treated with specialized coatings for enhanced UV resistance and stain protection. Furthermore, advancements in structural plastics, such as injection-molded ABS and high-density polypropylene, allow for the creation of collapsible, yet structurally rigid, trunk organizers that can bear heavy loads while remaining easily foldable for storage when not in use. These material innovations are crucial for meeting both consumer durability expectations and automotive safety standards.

Beyond materials, the adoption of advanced joining and fastening technologies significantly impacts product quality and ease of use. This includes ultrasonic welding for joining plastic and fabric components seamlessly, providing enhanced water resistance and cleaner aesthetics compared to traditional stitching. Specialized buckle and strap systems, often utilizing proprietary anti-slip coatings and reinforced nylon webbing, ensure the organizers remain securely attached to the seat back or cargo floor, even under aggressive driving conditions. These fastening technologies address a major consumer pain point—organizer sagging or instability—and contribute directly to perceived product quality and safety, requiring precise engineering and testing protocols that simulate various vehicle movements and loads.

Furthermore, technology integration involves incorporating low-voltage electronic features that align with modern consumer connectivity needs. The most common technical features include built-in USB ports (Type-A and Type-C) for device charging, dedicated power bank sleeves, and integrated LED lighting strips for visibility in the cargo area or during nighttime use. A niche, but growing, technological application involves the use of passive cooling or heating gel packs integrated into beverage holders, maintaining drink temperature for extended periods. The challenge lies in integrating these electronics while maintaining organizer durability and avoiding interference with the vehicle's electrical systems, necessitating adherence to strict electromagnetic compatibility (EMC) guidelines and rigorous thermal management design.

Regional Highlights

The global Seat organizer Market exhibits distinct regional consumption patterns and growth trajectories, heavily influenced by local vehicle preferences, regulatory environments, and economic factors. North America stands as the largest market, characterized by high consumer spending on vehicle customization and a preference for large SUVs and pickup trucks, which inherently demand substantial trunk and backseat organizational solutions. Consumers here prioritize heavy-duty, multi-compartment organizers and premium materials like robust faux leather that match high-end vehicle interiors. The robust e-commerce infrastructure facilitates rapid consumer adoption of new products, and the presence of leading accessory brands drives intense competition and continuous product innovation focused on convenience and ruggedness.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven primarily by the rapid urbanization, rising disposable incomes, and the sheer volume of new vehicle sales in populous nations such as China and India. While the market initially focused on budget-friendly, basic polyester organizers, there is a swift transition toward mid-range and premium products as consumers increasingly view organizers as essential lifestyle accessories rather than mere utilitarian additions. The regional demand is often fragmented, requiring specific sizes for smaller Asian car models, while the strong local manufacturing base provides a cost advantage for both domestic consumption and global export.

Europe demonstrates a mature market characterized by stringent quality standards and a strong emphasis on sustainability and aesthetic integration. European consumers often prefer organizers that seamlessly blend with the vehicle's interior design, favoring durable, minimalist, and compact solutions suitable for smaller vehicle models typical of urban environments. The regulatory push towards sustainability translates into higher demand for organizers made from recycled and eco-friendly materials, with manufacturers often emphasizing the ethical sourcing and environmental impact of their products. Demand across both Western and Eastern Europe remains strong, although growth rates are more measured compared to the explosive expansion seen in APAC.

- North America: Market dominance due to large vehicle segments (SUVs, trucks); high accessory expenditure; focus on heavy-duty and technology-integrated organizers; stringent safety compliance.

- Europe: High focus on material quality, aesthetic design, and environmental sustainability; preference for compact and minimalist organizational solutions; adherence to strict EU REACH regulations concerning chemical content.

- Asia Pacific (APAC): Highest growth rate driven by expanding middle class and high new vehicle registrations; shift from budget to premium segment; major global manufacturing hub providing cost competitiveness.

- Latin America (LATAM): Growth influenced by improving economic conditions; strong demand for utility and durability due to challenging road infrastructure in some areas; price sensitivity remains a factor.

- Middle East and Africa (MEA): Growing automotive market, particularly in the GCC states; demand for organizers often includes features suitable for extreme heat (e.g., thermal insulation); market size remains relatively smaller but is expanding steadily with automotive infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Seat organizer Market.- Drive Auto Products

- Lusso Gear

- Honey-Can-Do

- High Road

- Rubbermaid

- RIXOW

- FORTEM

- KMMOTORS

- TFY

- Macally

- OXGORD

- Lebogner

- Autoark

- Trunknets Inc.

- Seat Buddy

- Cozy Bump

- Brica

- Prince Lionheart

- Munchkin

- Skip Hop

- JOYTUTUS

- IPELY

- Tsumbay

- ZONE TECH

- Starling’s

Frequently Asked Questions

Analyze common user questions about the Seat organizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased demand for premium, leather-based seat organizers?

The shift toward premium, leather-based organizers is driven by consumers' desire for interior accessories that match the aesthetic quality of modern vehicle designs, especially in the growing luxury and high-end SUV segments. These materials offer superior durability, ease of cleaning, and a sophisticated appearance that standard nylon or polyester cannot achieve, justifying a higher price point for enhanced interior integration and longevity.

How do I ensure the seat organizer I purchase will fit my specific vehicle model securely?

To ensure proper fitment, prioritize organizers advertised with universal, adjustable straps and buckle systems, or those specifically designed for your vehicle class (e.g., truck console, large SUV back seat). Always check the product dimensions against the available space in your vehicle and look for feedback specifically mentioning fitment for your make and model to guarantee secure and non-obstructive installation.

What role does sustainability play in the manufacturing of current seat organizers?

Sustainability is an increasingly important factor, with manufacturers adopting technologies to utilize recycled PET plastics derived from bottles for fabric components and bio-based polymers for rigid sections. This transition reduces environmental impact, appeals to ecologically conscious consumers, and helps companies comply with evolving global environmental regulations and consumer-driven demand for ethical sourcing.

Are organizers with integrated technology, such as USB charging ports, safe for long-term use in vehicles?

Yes, integrated technology organizers are generally safe, provided they adhere to mandatory automotive electrical standards, including protection against over-current and short-circuiting, and utilize certified low-voltage wiring designed for vehicles. Consumers should select products from reputable brands that explicitly state compliance with relevant safety certifications to ensure safe long-term power delivery without draining the vehicle battery excessively.

Which distribution channel (online vs. offline) is dominating the Seat organizer Market?

The online channel (E-commerce) currently dominates the market due to its ability to offer vast product diversity, detailed customer reviews, competitive pricing, and efficient direct-to-consumer delivery. While offline retail remains important for immediate purchase needs, the online platform provides the essential detailed fitment information and product customization options sought by modern consumers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager