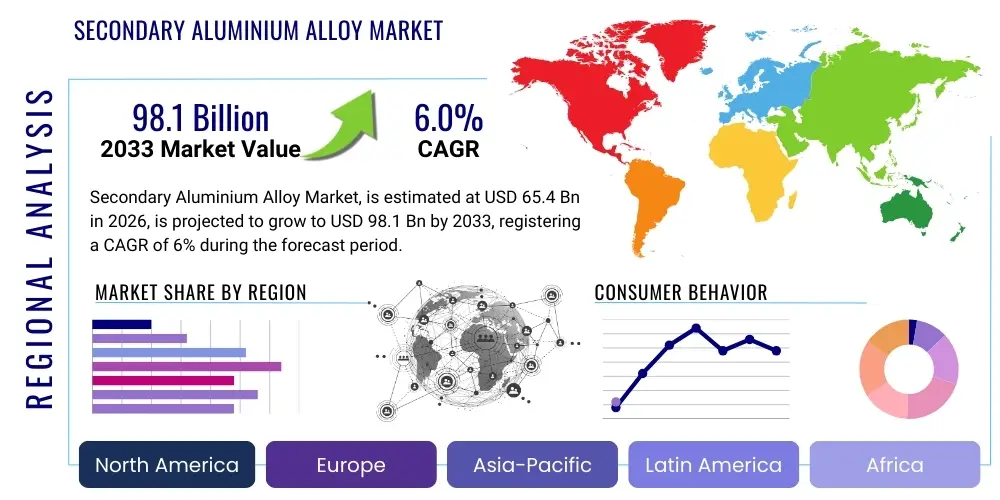

Secondary Aluminium Alloy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436627 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Secondary Aluminium Alloy Market Size

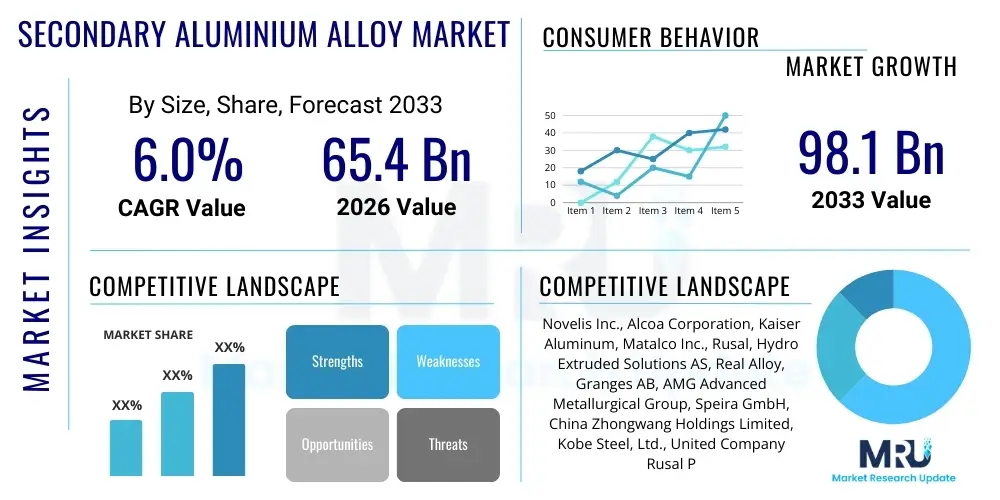

The Secondary Aluminium Alloy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at USD 65.4 Billion in 2026 and is projected to reach USD 98.1 Billion by the end of the forecast period in 2033.

Secondary Aluminium Alloy Market introduction

The Secondary Aluminium Alloy Market encompasses the processes involved in recycling scrap aluminum, melting it, and transforming it into specific alloy compositions tailored for various industrial applications. Unlike primary aluminum production, which requires significant energy expenditure through the Hall–Héroult process, secondary production consumes only about 5% of the energy needed, positioning it as a cornerstone of sustainable manufacturing globally. This market thrives on the continuous availability of post-consumer and post-industrial scrap, including end-of-life vehicles (ELVs), used beverage cans (UBCs), and manufacturing remnants. The resulting alloys retain nearly identical physical and mechanical properties to primary aluminum alloys, making them highly desirable substitutes in demanding sectors. Furthermore, the inherent economic advantage due to lower processing costs contributes significantly to the material’s competitive edge against other metals and primary aluminum.

Secondary aluminium alloys are fundamentally defined by their alloying elements, primarily silicon, magnesium, copper, and zinc, which impart specific characteristics such as increased strength, improved castability, and corrosion resistance. The most common alloys, such as A356 and A380, are extensively utilized in die-casting and permanent mold casting processes. Key applications span across the automotive industry, where lightweighting is critical for enhancing fuel efficiency and reducing emissions, the construction sector, utilized in windows, doors, and structural components, and the packaging industry, particularly for cans and foils. The versatility, combined with the commitment to circular economy principles, ensures a sustained high demand for these recycled materials across industrialized and rapidly developing nations.

The primary driving factor sustaining the robust growth of this market is the stringent regulatory environment promoting material recycling and carbon footprint reduction, notably in North America and Europe. Additionally, the fluctuating and often high price of primary aluminum makes secondary alloys an economically attractive alternative for large-scale manufacturers. Continuous advancements in sorting and refining technologies, such as heavy media separation and spectroscopic analysis, enable the production of higher purity secondary alloys, broadening their potential application in high-specification engineering fields where purity was traditionally a constraint. These technological improvements mitigate contamination risks, ensuring the final product meets exacting quality standards, thereby accelerating market penetration across critical sectors.

Secondary Aluminium Alloy Market Executive Summary

The global Secondary Aluminium Alloy Market is experiencing significant upward momentum, driven predominantly by sustainability mandates and the escalating cost pressures associated with primary metal production. Business trends reveal a pronounced shift toward closed-loop recycling systems, especially among major automotive Original Equipment Manufacturers (OEMs) who are establishing captive recycling facilities or forging long-term contracts with specialized secondary alloy producers to secure consistent supply and quality traceability. Consolidation is observable in the refining segment, as large players acquire smaller, regional recyclers to expand geographical reach and secure diverse scrap sources. Furthermore, the development of specialized high-performance secondary alloys, particularly those suited for structural components in electric vehicles (EVs), represents a critical innovation vector enhancing market valuation.

Regionally, Asia Pacific (APAC), led by China and India, maintains the largest market share due to rapid industrialization, massive automotive production capacities, and less stringent, though evolving, environmental regulations compared to Western markets, allowing for high-volume, cost-effective production. North America and Europe, however, exhibit the highest growth rates, primarily attributed to robust legislation such as the European Union’s End-of-Life Vehicle (ELV) Directive and ambitious carbon neutrality targets which directly incentivize the use of low-carbon materials like secondary aluminum. The maturity of the scrap collection infrastructure in these regions ensures a reliable feedstock supply, supporting advanced refining operations and premium alloy production.

Segmentation trends highlight the dominance of the automotive sector as the primary end-user, demanding high volumes of aluminum-silicon alloys (e.g., A380) for engine blocks, transmission casings, and chassis components. However, the construction and packaging segments also show strong incremental growth, fueled by urbanization and consumer demand for sustainable packaging solutions, respectively. By process, the smelting and refining segment commands the largest market value, representing the crucial stage where scrap integrity is restored and composition specifications are met. Technology adoption, especially in advanced sorting (e.g., X-ray fluorescence) and efficient melting technologies (e.g., regenerative burners), is proving pivotal in maximizing yield and minimizing energy consumption across all processing segments.

AI Impact Analysis on Secondary Aluminium Alloy Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the notoriously complex and varied scrap sorting and refining processes in the secondary aluminium market, often expressing concerns regarding the purity levels achievable through traditional methods. Key questions center on AI's ability to automate precise alloy composition monitoring, forecast scrap availability and pricing volatility, and enhance energy efficiency in high-temperature smelting operations. The prevailing user expectation is that AI will revolutionize feedstock categorization, moving beyond current limitations to enable high-throughput, accurate identification of specific alloy grades mixed in complex scrap streams. This focus underscores the industry’s drive to minimize operational costs associated with manual sorting errors and to guarantee the consistent quality required for demanding applications like aerospace and next-generation automotive parts, ultimately making secondary alloys competitive even in ultra-high-specification markets.

- AI-powered visual recognition systems significantly enhance the accuracy and speed of non-ferrous metal sorting, specifically identifying and separating different aluminium alloy series (e.g., 6xxx vs. 7xxx series) from complex mixed scrap streams.

- Machine learning algorithms are deployed for predictive maintenance on high-heat furnaces and refining equipment, minimizing unplanned downtime and maximizing the operational lifespan of critical assets.

- AI models analyze historical and real-time market data (LME prices, regional inventory levels, regulatory changes) to forecast the availability and pricing volatility of various scrap inputs, optimizing procurement strategies for secondary alloy producers.

- Integration of AI in process control systems allows for real-time adjustments to melting temperatures, flux additions, and holding times, ensuring precise composition control and reduced energy consumption during the refining phase.

- Natural Language Processing (NLP) tools assist in analyzing global compliance reports and material certification standards, ensuring secondary alloy producers maintain stringent quality control documentation necessary for international trade and high-tier customer requirements.

- Optimized resource allocation and energy management in smelting operations through AI leads to measurable reductions in carbon dioxide equivalent (CO2e) emissions per ton of alloy produced, improving overall sustainability metrics and market positioning.

DRO & Impact Forces Of Secondary Aluminium Alloy Market

The Secondary Aluminium Alloy Market is fundamentally driven by cost efficiency, regulatory support for sustainable practices, and the intrinsic energy savings associated with recycling compared to primary production. However, market expansion faces notable constraints, primarily surrounding the inconsistent quality and heterogeneous nature of scrap feedstock, which necessitates intensive and costly sorting and pre-treatment processes. Opportunities are vast, particularly in the structural expansion into Electric Vehicle (EV) manufacturing, where demand for lightweight chassis and battery enclosures provides new, high-value applications for advanced secondary alloys. The overall market is heavily influenced by impact forces such as stringent environmental regulations, including the European Green Deal and China's 14th Five-Year Plan, which directly promote scrap utilization quotas, alongside the technological maturity of separation techniques that enhance yield and purity, mitigating feedstock challenges and bolstering market confidence.

Drivers: A paramount driver is the substantial energy conservation achieved through secondary production, requiring up to 95% less energy than primary aluminum, translating directly into lower operational costs and a superior environmental profile. This economic advantage is particularly attractive when primary aluminium commodity prices are high or volatile. Furthermore, global regulatory frameworks, especially those related to Extended Producer Responsibility (EPR) schemes and mandatory recycling targets for packaging and end-of-life vehicles, systematically channel increasing volumes of scrap aluminum back into the manufacturing lifecycle. This steady increase in high-quality, recoverable scrap supply, supported by advanced collection infrastructure in developed economies, ensures the long-term viability and growth trajectory of the secondary market, providing material security against geopolitical supply chain disruptions that often plague primary metal sources.

Restraints: The primary constraint hinges on the issue of 'tramp elements'—unwanted impurities such as lead, zinc, and tin—that accumulate in the scrap stream with repeated recycling cycles, potentially compromising the mechanical properties of the final alloy. Removing these elements necessitates expensive and energy-intensive dilution or specialized refining techniques, which can erode the cost advantage of secondary alloys, particularly for high-purity specifications. Moreover, the global trade of aluminium scrap is frequently subject to complex import restrictions and quality standards imposed by major consuming nations (e.g., China’s ban on low-grade scrap imports), creating logistical bottlenecks and increasing the complexity of international sourcing for refiners lacking local scrap access. The necessity for specialized equipment and highly technical expertise to manage complex alloy mixes also presents a barrier to entry for smaller or developing recyclers, limiting global supply consistency.

Opportunities: Significant market opportunities lie in tailoring advanced secondary alloys specifically for the rapidly expanding electric vehicle battery and body structure market, which demands highly specialized, crash-resistant, and lightweight materials. Developing certified, traceable, high-strength secondary alloys that meet aerospace-grade specifications presents a premium opportunity, provided strict compositional control can be achieved consistently. Additionally, geographical expansion into emerging markets in Southeast Asia and Latin America, coupled with investments in local scrap infrastructure development, promises access to untapped feedstock reserves and rapidly growing domestic manufacturing demands. Innovation in pyrometallurgical and hydrometallurgical processes aimed at selectively removing detrimental trace elements will unlock new segments previously restricted to primary aluminum utilization.

Segmentation Analysis

The Secondary Aluminium Alloy Market is extensively segmented based on the type of alloy produced, the primary end-use application, the form of the scrap utilized, and the specific recycling process employed. Understanding these segments is crucial for mapping the flow of recycled material from scrap source to final component integration. The market's complexity is defined by the need to match highly variable input material (scrap) with tightly specified output requirements (alloys), leading to specialization among recyclers. The automotive sector remains the undeniable heavy consumer, demanding consistent batches of casting alloys, while the structural and extrusion industries utilize specialized wrought alloys refined from segregated scrap streams. Regional variations in industrial output and scrap availability further differentiate the market landscape, influencing the prevalent alloy types and process technologies adopted across geographies.

- By Alloy Type:

- Aluminium-Silicon Alloys (e.g., A380, A356)

- Aluminium-Copper Alloys

- Aluminium-Magnesium Alloys

- Aluminium-Zinc Alloys

- Others (Specialty Alloys)

- By End-Use Application:

- Automotive and Transportation (Engine parts, wheels, structural components)

- Building and Construction (Window frames, architectural systems)

- Packaging (Foils, containers)

- Electrical and Electronics (Heat sinks, wiring)

- Machinery and Equipment

- Others (Consumer goods, defense)

- By Process:

- Melting and Refining (Smelting, fluxing, degassing)

- Shredding and Sorting (Pre-treatment)

- Ingot Casting and Billets

- By Scrap Source:

- New Scrap (Manufacturing off-cuts, trimmings)

- Old Scrap (Post-consumer: ELVs, UBCs, demolition scrap)

Value Chain Analysis For Secondary Aluminium Alloy Market

The value chain for secondary aluminium alloys begins with complex scrap collection and aggregation (upstream), a highly fragmented and logistics-intensive stage involving scrap yards, brokers, and specialized sorting facilities. The primary bottleneck and value addition occur in the middle stream, which includes pre-treatment (shredding, sorting, cleaning) and the core process of smelting and refining. These processes transform heterogenous, low-value scrap into certified, high-specification alloy ingots or liquid metal. Downstream analysis reveals that distribution channels are bifurcated: direct sales, often involving specialized liquid metal contracts delivered straight to large automotive foundries to bypass remelting costs, and indirect sales through distributors who supply smaller casting shops and machine shops globally. The efficiency of this chain is highly dependent on technology adopted during the refining stage to maintain purity and maximize yield, as scrap procurement costs represent the largest variable expense.

Upstream operations are characterized by intense competition among collectors and processors to secure diverse and consistent sources of aluminium scrap, which is often benchmarked against LME aluminium prices but trades at a significant discount based on purity and grade. The critical activity here is maximizing the purity of the input material before it reaches the furnace; poor sorting results in higher energy consumption and lower metal yield during refining. Effective upstream segregation, utilizing advanced sensors and mechanical separation techniques, directly dictates the final quality and profitability of the secondary alloy produced. Furthermore, regulatory frameworks regarding hazardous waste and material classification profoundly influence the complexity and cost of these initial collection and processing steps, necessitating robust compliance management.

Downstream integration focuses heavily on maintaining stringent quality control and achieving customer-specific delivery methods. Large-scale alloy producers often establish dedicated infrastructure for delivering molten aluminum directly to key automotive customers within a short geographical radius, a highly customized service that significantly reduces customer energy costs and enhances material efficiency. Indirect distribution relies on established networks of metal traders and warehousing facilities, which manage inventory and supply customized ingot sizes (e.g., sow or T-bar ingots) to diverse small and medium-sized enterprises (SMEs) in the construction and general engineering sectors. The increasing demand for low-carbon material certification requires secondary alloy producers to enhance traceability throughout their distribution channels, leveraging blockchain or similar technologies to guarantee origin and recycled content percentages to demanding end-users.

Secondary Aluminium Alloy Market Potential Customers

The primary purchasers and end-users of secondary aluminium alloys are large-scale industrial consumers requiring high volumes of cost-effective, lightweight materials with consistent casting characteristics. The automotive industry represents the largest consumer segment, including global Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers (foundries and component manufacturers) who utilize secondary alloys for critical structural and powertrain components such such as cylinder heads, transmission housings, engine blocks, and increasingly, battery enclosures and crash management systems for Electric Vehicles (EVs). These customers prioritize alloys that offer excellent castability, high mechanical strength relative to weight, and verified compliance with low-carbon procurement mandates, often driving demand for specific alloys like A380 and A356 derived from segregated scrap streams.

The building and construction sector forms another substantial customer base, primarily consuming secondary aluminum for window and door profiles, curtain wall systems, and structural framing. Architects and developers increasingly favor secondary alloys due to their superior sustainability credentials, which contribute positively to building certification schemes like LEED (Leadership in Energy and Environmental Design). This segment demands high corrosion resistance and attractive surface finishes, often achieved through specialized extrusion and finishing processes downstream. Unlike the automotive sector, which often requires high-purity casting alloys, the construction sector frequently utilizes wrought alloys (e.g., 6xxx series) derived from both pre-consumer and post-consumer scrap sources, demanding suppliers with robust extrusion billet production capabilities.

Furthermore, manufacturers of electrical and electronic goods, including producers of telecommunications equipment and advanced heat dissipation systems (heat sinks), are becoming key niche customers. These applications require alloys with specific thermal conductivity properties and dimensional stability, often sourced through specialized die-casting techniques. The packaging sector, particularly producers of beverage cans (UBCs), represents a unique closed-loop customer, as they are both major consumers and the source of the highest-purity, easily recyclable scrap stream. The stability of demand from these diverse, large-scale industrial customers underscores the resilience and systemic importance of the secondary aluminium alloy market within the global material supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.4 Billion |

| Market Forecast in 2033 | USD 98.1 Billion |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novelis Inc., Alcoa Corporation, Kaiser Aluminum, Matalco Inc., Rusal, Hydro Extruded Solutions AS, Real Alloy, Granges AB, AMG Advanced Metallurgical Group, Speira GmbH, China Zhongwang Holdings Limited, Kobe Steel, Ltd., United Company Rusal Plc, Slim Aluminium S.p.A., Vedanta Resources Ltd., Bahrain Aluminium Extrusion Co. (BALEXCO), Tomra Systems ASA (Sorting Technology Provider), Ardagh Group S.A., Constellium SE, Kairali Steels & Alloys Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Secondary Aluminium Alloy Market Key Technology Landscape

The core technology landscape in the Secondary Aluminium Alloy Market centers on optimizing the efficiency, purity, and environmental profile of the smelting and refining process, moving away from rudimentary methods towards advanced separation and compositional control. Key technological advancements include sophisticated sensor-based sorting systems, such as X-ray Transmission (XRT) and Laser-Induced Breakdown Spectroscopy (LIBS), which enable rapid, highly accurate separation of different alloy series and identification of non-metallic contaminants (tramp elements) in mixed scrap streams. This enhanced pre-treatment capability is vital for producing high-specification secondary alloys suitable for high-stress applications. Furthermore, the adoption of regenerative burner technology in melting furnaces significantly improves energy efficiency by recapturing waste heat, directly addressing the industry’s push towards reduced operational costs and lower carbon emissions.

In the refining stage, advanced fluxing and degassing technologies are crucial for removing undesirable elements and minimizing hydrogen porosity in the final casting. Innovations focus on developing environmentally friendlier flux chemistries that are highly efficient at removing magnesium and non-metallic inclusions without generating hazardous waste. Specialized refining processes, such as dilution with primary metal or the use of specific vacuum induction melting (VIM) techniques, are increasingly employed to achieve ultra-low tramp element levels required by the aerospace and defense sectors. These process improvements ensure that secondary alloys can effectively compete in segments traditionally reserved exclusively for primary materials, maximizing the market value derived from recycled aluminum.

The digital transformation of the recycling process is also a major technological trend. Integration of Industrial Internet of Things (IIoT) sensors and robust data analytics platforms allows operators to monitor furnace temperatures, alloy chemistry, and energy consumption in real-time. This data-driven approach supports faster decision-making regarding process adjustments, optimizing yield and quality consistency across multiple batches. Furthermore, the development of specialized software for scrap inventory management and supply chain traceability is becoming standard practice, driven by customer demand for verified recycled content percentages, fostering greater transparency and trust within the value chain and supporting global regulatory compliance requirements for sustainable sourcing.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the secondary aluminium alloy market in terms of volume, primarily due to the colossal manufacturing base in China and the burgeoning industrial expansion across India, Southeast Asia (SEA), and Japan. China, while being the world’s largest producer and consumer, has recently focused heavily on upgrading its domestic recycling capacity and improving environmental standards following scrap import restrictions, driving investment into advanced domestic sorting and refining technologies. The region's growth is fueled by massive urbanization projects and rapid automotive fleet expansion, creating both significant scrap availability (end-of-life products) and overwhelming demand for cost-effective casting alloys.

- Europe: Europe is characterized by stringent environmental regulations, particularly the ELV Directive and the push toward carbon neutrality, positioning it as the technological leader in high-specification secondary alloy production and closed-loop recycling systems. The region possesses highly efficient collection and segregation infrastructure, leading to a consistently high quality of available scrap feedstock. Demand is extremely robust from the sophisticated European automotive industry (Germany, France, UK), which mandates the maximum possible recycled content in their new vehicle platforms, particularly for high-pressure die-cast components utilized in electric vehicle structures.

- North America: North America presents a highly mature market with significant recycling capacity concentrated in the US and Canada, heavily reliant on the steady supply of Used Beverage Cans (UBCs) and manufacturing new scrap. The market is primarily driven by the domestic automotive sector and packaging industries. Investment trends focus on increasing capacity for producing high-strength wrought alloys and ensuring secure domestic scrap supply chains to reduce reliance on volatile international markets. The focus on lightweighting for fuel economy standards continues to solidify demand from major OEMs based in the Midwest.

- Latin America (LATAM): LATAM, while smaller in market size, represents a high-potential growth area, especially in Brazil and Mexico, driven by growing local automotive manufacturing and increased urbanization. The market here is fragmented, often characterized by less formal recycling sectors, but formal investment is increasing to build modern, large-scale refining facilities capable of serving multinational companies operating in the region. The primary challenge remains establishing consistent, organized scrap collection networks.

- Middle East and Africa (MEA): The MEA region is developing, with growth focused primarily in countries with large primary aluminum smelters (e.g., UAE, Bahrain), which are now integrating secondary capabilities to diversify their material offerings and improve overall environmental performance. Local construction booms and infrastructure projects drive demand, though feedstock availability often relies heavily on imports of high-grade scrap due to nascent domestic collection infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Secondary Aluminium Alloy Market.- Novelis Inc.

- Alcoa Corporation

- Kaiser Aluminum

- Matalco Inc.

- Rusal

- Hydro Extruded Solutions AS

- Real Alloy

- Granges AB

- AMG Advanced Metallurgical Group

- Speira GmbH

- China Zhongwang Holdings Limited

- Kobe Steel, Ltd.

- United Company Rusal Plc

- Slim Aluminium S.p.A.

- Vedanta Resources Ltd.

- Bahrain Aluminium Extrusion Co. (BALEXCO)

- Tomra Systems ASA

- Ardagh Group S.A.

- Constellium SE

- Kuusakoski Group Oy

Frequently Asked Questions

Analyze common user questions about the Secondary Aluminium Alloy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary environmental advantage of secondary aluminium alloy production?

Secondary aluminium production is significantly more sustainable, consuming approximately 95% less energy compared to primary aluminum smelting, resulting in substantially lower greenhouse gas emissions and a reduced overall carbon footprint per ton of material produced.

How does the quality of secondary aluminium alloys compare to primary alloys?

Modern refining technologies allow secondary alloys to achieve physical and mechanical properties nearly identical to primary alloys. However, specialized, high-purity applications, such as in aerospace, sometimes require primary material due to accumulated tramp elements in recycled scrap, though technology is rapidly closing this gap.

Which end-use sector drives the highest demand for secondary aluminium alloys globally?

The Automotive and Transportation sector is the dominant end-user, utilizing secondary casting alloys extensively for lightweight components like engine blocks, transmission cases, wheels, and structural parts, driven by global mandates for fuel efficiency and electric vehicle manufacturing.

What major regulatory factors influence the growth of this market in Europe?

European market growth is strongly influenced by the End-of-Life Vehicle (ELV) Directive and the Circular Economy Action Plan, which mandate high recycling and material recovery rates, thereby ensuring a steady, high-quality stream of scrap and incentivizing manufacturers to prioritize secondary material usage.

What technological advancement is most critical for improving secondary alloy purity?

The most critical advancement is the implementation of sensor-based sorting technologies, such as LIBS and XRT, in the pre-treatment phase. These systems enable accurate, high-throughput segregation of specific alloy types and tramp elements, essential for producing high-specification secondary materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager