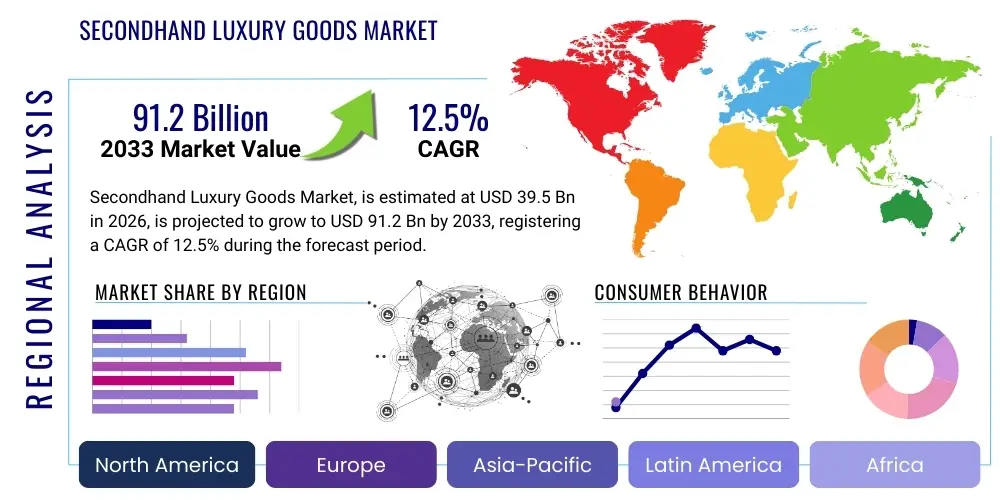

Secondhand Luxury Goods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438967 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Secondhand Luxury Goods Market Size

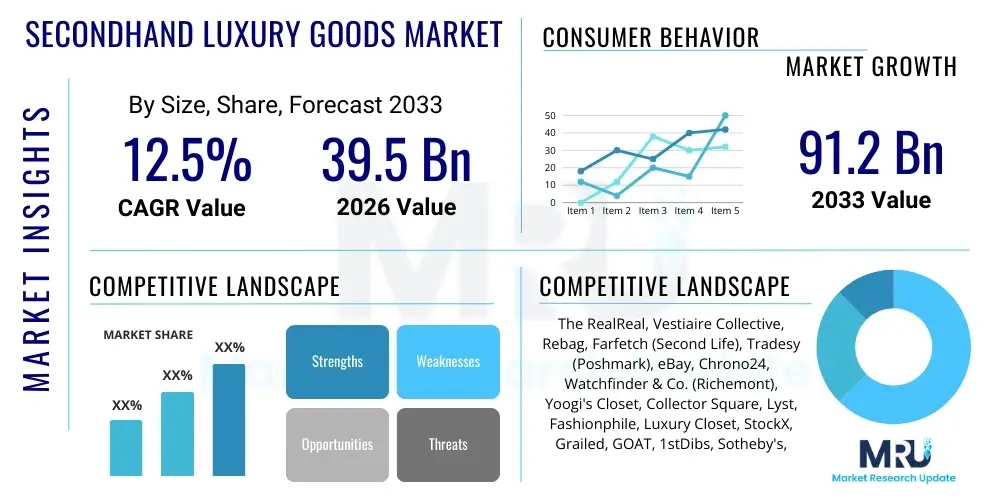

The Secondhand Luxury Goods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 39.5 Billion in 2026 and is projected to reach USD 91.2 Billion by the end of the forecast period in 2033.

Secondhand Luxury Goods Market introduction

The Secondhand Luxury Goods Market encompasses the resale of high-value, branded items across various categories including watches, jewelry, handbags, apparel, and accessories. This market is fundamentally shifting consumer perception, moving away from the stigma associated with pre-owned items towards valuing sustainability, exclusivity, and affordability. The primary drivers fueling this expansion include the rising popularity of circular fashion, the strong purchasing power of Gen Z and Millennials who prioritize ethical consumption, and the enhanced digitization of resale platforms, which assures authenticity and streamlines transactions. The longevity and enduring value of luxury products make them ideal candidates for resale, establishing this sector as a powerful economic force challenging traditional primary luxury retail models.

The product description for secondhand luxury goods spans items retained from previous ownership that maintain significant brand cachet and inherent quality. Major applications of this market revolve around sustainable consumption, accessing sold-out or vintage collections, and investment, particularly for rare watches and heritage handbags which often appreciate in value over time. Furthermore, the ability to democratize luxury by providing lower entry price points allows a broader consumer base to engage with high-end brands. This accessibility is crucial for attracting younger consumers who seek branded status but operate within constrained budgets, thereby expanding the overall market reach and diversity of the clientele.

Key benefits derived from participating in the secondhand luxury market include environmental sustainability, as it extends the lifecycle of products, and significant financial advantages for both buyers and sellers. Sellers can recoup substantial portions of their initial investment, while buyers acquire premium items at a discount relative to retail prices. Driving factors are deeply rooted in technological advancements, specifically the development of sophisticated authentication techniques using AI and blockchain, which mitigate the risk of counterfeiting. Additionally, influential celebrity endorsements and social media trends promoting vintage and archival fashion contribute immensely to the desirable nature and continued growth trajectory of this dynamic and rapidly evolving retail landscape.

Secondhand Luxury Goods Market Executive Summary

The Secondhand Luxury Goods Market is characterized by robust growth, primarily driven by digital transformation and a significant cultural shift favoring circular economic models. Key business trends include the entry of primary luxury brands, such as Gucci and Richemont, into the resale space through strategic partnerships or internal platforms, validating the segment and enhancing consumer trust. Furthermore, the professionalization of the resale infrastructure, exemplified by robust authentication protocols, superior packaging, and expedited logistics, is transforming what was once a fragmented peer-to-peer market into a highly organized and institutionalized retail channel. This convergence of traditional luxury retail and the resale ecosystem signals a mature market poised for sustained expansion.

Regionally, North America and Europe maintain dominance, driven by established consumer affinity for luxury goods and advanced e-commerce penetration. However, the Asia Pacific region, particularly Greater China and Southeast Asia, is emerging as the fastest-growing market, propelled by a rapidly expanding middle class and strong desire for status symbols, combined with increasing awareness regarding sustainable consumption. Regional trends also highlight localized adaptations in payment methods and logistics, catering to specific consumer behaviors, such as the preference for in-person consignment in certain high-density urban areas, although online sales continue to capture the vast majority of market share globally, optimizing convenience and inventory accessibility.

Segment trends underscore the enduring popularity of iconic segments, specifically high-end watches (Rolex, Patek Philippe) and luxury handbags (Hermès, Chanel), which often exhibit strong investment potential, exceeding inflation rates. Watches and jewelry remain the highest value segments due to their inherent durability and standardized authentication requirements. Apparel and accessories are growing rapidly, benefiting from short fashion cycles and the influence of fast-moving trends, although they present greater challenges regarding condition assessment and standardization. Overall, the market is segmenting based on authentication depth—with top-tier platforms offering guaranteed authenticity commanding premium pricing and attracting highly affluent clientele seeking risk-free transactions.

AI Impact Analysis on Secondhand Luxury Goods Market

User inquiries regarding the impact of AI on the Secondhand Luxury Goods Market frequently focus on three core themes: authenticity assurance, dynamic pricing optimization, and personalized shopping experiences. Consumers are keenly interested in how AI can definitively solve the persistent problem of counterfeits, seeking information on AI algorithms trained on massive datasets of genuine and fake products to provide instant, verifiable authentication. Simultaneously, sellers and buyers question how machine learning models determine fair market value, especially for rare or vintage items, expecting dynamic pricing that reflects real-time supply, demand, and item condition nuances. The third major concern revolves around the deployment of AI for hyper-personalization, querying how systems recommend items that match specific aesthetic preferences, investment goals, and collection gaps, moving beyond simple category filtering to sophisticated style matching and predictive purchasing behavior.

The key themes emerging from user concerns indicate a high expectation for AI to bring unprecedented levels of trust and efficiency to a historically fragmented and risk-prone market. Users anticipate that AI will serve as the ultimate trust layer, providing digital provenance and condition scoring that minimizes disputes and increases transaction speeds. Concerns often touch upon the ethical deployment of these technologies, particularly ensuring the AI models are unbiased in their valuation, especially for items whose value is subject to cultural or temporal trends. The expectation is that AI will democratize expert knowledge, offering sophisticated insights on market saturation and future value predictions previously only accessible to professional dealers and appraisers, thereby leveling the playing field for casual buyers and sellers.

Ultimately, the consensus among market participants is that AI is not merely an incremental improvement but a foundational shift that enhances profitability and consumer confidence. AI-driven platforms are expected to achieve higher conversion rates by accurately matching inventory to demand and reducing operational costs associated with manual labor in authentication and appraisal. This technological integration is crucial for scaling global operations, enabling platforms to handle millions of unique, non-standardized items efficiently. The successful implementation of robust AI strategies is thus viewed as the primary competitive differentiator determining market leadership in the coming decade, ensuring transparency and fostering a more resilient luxury resale ecosystem.

- Enhanced Counterfeit Detection: AI algorithms rapidly analyze materials, stitching, fonts, and serial numbers against extensive digital databases, significantly boosting authentication accuracy.

- Dynamic Price Optimization: Machine learning models utilize real-time market data, condition reports, and historical transaction volumes to provide optimal pricing recommendations for sellers and buyers.

- Personalized Curation and Recommendation: AI analyzes user browsing history and purchase patterns to curate highly specific collections, increasing engagement and conversion rates.

- Automated Inventory Management: AI streamlines logistics, predicts storage needs, and optimizes shipment routing based on demand forecasts and geographic constraints.

- Customer Service Automation: Deployment of intelligent chatbots and virtual assistants to handle common inquiries regarding condition, authenticity, and returns, improving operational scalability.

- Predictive Trend Forecasting: AI analyzes social media, runway shows, and search engine trends to predict future high-demand luxury items, informing sourcing strategies.

DRO & Impact Forces Of Secondhand Luxury Goods Market

The Secondhand Luxury Goods Market is fundamentally shaped by a powerful confluence of drivers, restraints, and opportunities that dictate its growth trajectory and competitive dynamics. Key drivers include the global push towards sustainability and ethical consumption, especially among younger demographics who view resale as a responsible choice. This is coupled with the democratization of luxury, allowing a broader consumer base to access high-value items at more manageable price points, significantly expanding the addressable market. Furthermore, the financial motive acts as a strong driver, as sellers look to monetize unused assets and buyers seek investment pieces that hold or appreciate in value. These driving forces combine to create a compelling consumer proposition based on both economic prudence and environmental consciousness, strongly supported by global digital platforms.

Restraints, however, pose significant challenges to the market's full potential realization. The most critical restraint is the pervasive threat of counterfeiting, which erodes consumer trust and requires continuous, heavy investment in advanced authentication technologies. Another constraint is the logistical complexity involved in handling unique, high-value items, including condition grading subjectivity, secure high-cost shipping, and managing international duties and taxation for cross-border transactions. Moreover, achieving consistent supply of desirable inventory is a perpetual challenge; unlike primary retail, resale depends on individual decisions to sell, creating inherent volatility in stock availability, particularly for the rarest items. Overcoming these restraints necessitates industry collaboration and standardized operational protocols across all major platforms.

Opportunities in this space are vast and center primarily on technological innovation and market expansion into underserved regions. The integration of blockchain technology offers a clear opportunity to create immutable digital provenance records for luxury goods, virtually eliminating counterfeiting concerns and maximizing resale value. Additionally, vertical expansion into new luxury categories, such as high-end furniture, specialized art, and unique collectibles, presents avenues for diversification. The primary impact force driving current growth is the overwhelming consumer demand for circularity, pressuring traditional luxury brands to actively participate in the resale market, thereby institutionalizing the segment and accelerating its acceptance across mainstream retail channels. This pressure from consumer ethics and financial pragmatism ensures sustained market transformation.

Segmentation Analysis

The Secondhand Luxury Goods Market is systematically segmented based on Product Type, Distribution Channel, and Geography, enabling granular analysis of consumer behavior and market dynamics. Understanding these segmentations is critical for market players to tailor their sourcing, marketing, and operational strategies effectively. The Product Type segmentation reveals consumer preferences for different luxury categories, with highly recognizable and enduring items like watches and handbags consistently dominating in terms of transaction value, owing to their strong investment characteristics and ease of authentication. This segmentation helps platforms prioritize high-margin, high-demand inventory, crucial for maximizing profitability in a capital-intensive industry.

The Distribution Channel segmentation is undergoing the most rapid transformation, highlighting the shift from offline, traditional consignment stores and specialized antique shops to sophisticated, global online marketplaces. Online platforms now capture the majority share due to unparalleled reach, inventory depth, and the convenience offered to both buyers and sellers globally. Within the online segment, dedicated luxury resale platforms (like The RealReal or Vestiaire Collective) are outpacing generic e-commerce sites by offering specialized services such as professional authentication, cleaning, and sophisticated photography, establishing themselves as trusted authorities in the market ecosystem.

Geographically, market segmentation identifies key revenue generators and future growth hotspots. While mature markets in North America and Europe possess the highest consumption rates per capita, driven by established wealth and e-commerce infrastructure, the emerging markets in the Asia Pacific region are forecast to exhibit the highest CAGR. This rapid growth in APAC is fueled by a burgeoning affluent consumer base that is environmentally conscious and technologically adept. Strategic analysis of these segmentations informs key decisions regarding regional marketing budgets, logistics network expansion, and inventory flow management, ensuring localized relevance while maintaining global operational efficiency.

- By Product Type:

- Handbags and Accessories

- Watches and Jewelry

- Apparel and Footwear

- Other Luxury Goods (e.g., Art, Furniture)

- By Distribution Channel:

- Offline Stores (Consignment Shops, Auctions, Vintage Retailers)

- Online Platforms (Dedicated Resale Websites, Brand Certified Pre-Owned (CPO), Peer-to-Peer Marketplaces)

- By Geography:

- North America (US, Canada)

- Europe (UK, Germany, France, Italy)

- Asia Pacific (China, Japan, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (UAE, Saudi Arabia)

Value Chain Analysis For Secondhand Luxury Goods Market

The value chain for the Secondhand Luxury Goods Market is intricate, deviating significantly from traditional retail chains due to the non-standardized nature of the inventory. It begins with upstream analysis focusing on sourcing, which is primarily driven by individual consumers or specialized vintage dealers looking to liquidate assets. The effectiveness of sourcing platforms—whether through direct buyouts, consignment models, or trade-in programs—is paramount. Upstream operations also include the initial assessment of product condition and preliminary verification of authenticity. Successful platforms invest heavily in digital tools to streamline the submission process for sellers, ensuring accurate initial appraisals and maintaining a steady, high-quality flow of unique inventory, which is the lifeblood of the resale market.

Midstream activities are centered around transforming the sourced product into retail-ready inventory, involving highly specialized processes. This includes rigorous, multi-point authentication (often utilizing proprietary AI and expert inspection), professional cleaning, restoration, detailed photography, and the assignment of a fair market price based on condition and real-time demand. This labor-intensive phase, particularly authentication, adds the most significant value and builds consumer confidence. Distribution channels, forming a critical link in the midstream, are predominantly indirect, relying on highly optimized e-commerce platforms. Direct sales, such as occasional pop-up stores or private client viewings, serve niche segments but lack the scale provided by digital channels, making online logistics and platform security essential components of success.

Downstream analysis focuses on reaching the end customer, which involves sophisticated digital marketing targeting specific demographics, secure high-value logistics, and robust post-sale customer service. Direct marketing efforts emphasize trust, authenticity guarantees, and the sustainability narrative. Indirect distribution relies on partnerships with secure shipping providers and, increasingly, integration with luxury brand ecosystems through CPO programs. The reverse logistics process, dealing with returns, is also a crucial downstream consideration, requiring standardized condition checking upon return to maintain inventory integrity. Overall, value creation is concentrated in the middle of the chain, where digital trust and physical authentication converge to transform an individual’s used item into a certified, globally marketable luxury asset.

Secondhand Luxury Goods Market Potential Customers

The potential customer base for the Secondhand Luxury Goods Market is highly diversified, spanning multiple demographic and psychographic segments, but is primarily defined by those seeking value, sustainability, and unique items. The fastest-growing segment consists of environmentally conscious Millennials and Gen Z consumers. These groups actively seek sustainable consumption patterns, viewing the purchase of pre-owned luxury items as a method of reducing their environmental footprint. For this cohort, the appeal lies equally in the brand status and the adherence to circular economy principles. Furthermore, digital native skills make them comfortable engaging with specialized online authentication platforms, driving the shift towards e-commerce dominance in the resale market.

Another major segment includes value-driven consumers and aspirational luxury buyers who seek entry-level access to high-end brands they might not afford at retail prices. These customers prioritize significant discounts (often 30% to 70% off retail) and view the secondhand market as a strategic way to build their luxury collection. This segment demands strong assurances of quality and authenticity, making platform reputation and comprehensive return policies critical determinants in their purchasing decisions. Their buying behavior is often concentrated on iconic, easily recognizable items that offer maximum brand visibility for their investment.

The third, equally important customer segment comprises serious luxury collectors and high-net-worth individuals (HNWIs). For this affluent group, the secondhand market serves two distinct purposes: acquiring rare, vintage, or discontinued pieces unavailable in the primary market, and utilizing specific luxury assets (like high-end watches or Hermès bags) as investment vehicles. These buyers are less price-sensitive but highly demanding regarding condition, provenance documentation, and absolute authenticity. Platforms catering to this segment must offer specialized, white-glove services, including private client consultation and highly detailed condition reports, effectively treating luxury resale as a high-end financial transaction rather than typical consumer retail.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 39.5 Billion |

| Market Forecast in 2033 | USD 91.2 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The RealReal, Vestiaire Collective, Rebag, Farfetch (Second Life), Tradesy (Poshmark), eBay, Chrono24, Watchfinder & Co. (Richemont), Yoogi's Closet, Collector Square, Lyst, Fashionphile, Luxury Closet, StockX, Grailed, GOAT, 1stDibs, Sotheby's, Christie's, ThredUp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Secondhand Luxury Goods Market Key Technology Landscape

The operational efficiency and trust within the Secondhand Luxury Goods Market are intrinsically linked to technological innovation, with core technologies centering on authenticity, pricing, and supply chain transparency. Authentication technology is paramount, dominated by advanced image recognition software utilizing machine learning models trained on vast datasets of genuine and counterfeit item features. This AI-driven visual inspection is increasingly supplemented by microscopic analysis tools and material composition scanners, ensuring a multi-layered verification process that significantly surpasses traditional human expertise alone. The development and continuous refinement of these proprietary authentication technologies form the primary competitive barrier for leading platforms, directly correlating with consumer confidence and market share.

Beyond authentication, the integration of data science and predictive analytics is reshaping how luxury goods are valued and marketed. Sophisticated algorithms are employed for dynamic pricing, factoring in real-time global sales data, the item’s provenance, precise condition grading, and even cultural trend momentum to determine an optimal, competitive price point. This technology minimizes inventory holding time and maximizes profitability for both the platform and the seller. Furthermore, robust Enterprise Resource Planning (ERP) systems are essential for managing the sheer volume and uniqueness of inventory—each luxury item essentially being a unique SKU that requires specific tracking, photography, and detailed listing specifications, necessitating highly customized inventory management software.

Looking forward, blockchain technology is rapidly emerging as a transformative tool for establishing irrefutable digital provenance and ownership history. By creating an immutable record tied to a physical luxury item, typically through near-field communication (NFC) chips or serialized digital certificates, blockchain can eliminate the need for repeated physical authentication upon subsequent resale, dramatically increasing transaction speed and trust. Other technologies, such as advanced photogrammetry for creating 3D product visualization, and augmented reality (AR) features allowing consumers to 'virtually try on' accessories, are enhancing the online shopping experience, bridging the tactile gap between physical retail and digital commerce and driving higher conversion rates in this premium segment.

Regional Highlights

North America commands a significant share of the Secondhand Luxury Goods Market, driven by high disposable income, established consumer acceptance of e-commerce, and the presence of several market-leading resale platforms headquartered in the region. The U.S. consumer exhibits a strong affinity for both financial return and the sustainability narrative, making the consignment and resale model particularly appealing. Growth in this region is sustained by constant technological investment in logistics and authentication, ensuring a seamless, trustworthy transaction environment. The high concentration of fashion-forward and affluent urban populations ensures a consistent supply of high-quality, desirable luxury items for resale, maintaining market velocity and segment diversity.

Europe remains a foundational market, benefiting from its deep historical roots in luxury manufacturing and consumption. Countries like France, Italy, and the UK boast high per capita ownership of premium goods, providing a rich source of vintage and pre-owned inventory. The European market distinguishes itself through strong regulatory frameworks favoring consumer protection, which reinforces trust in high-value online transactions. While traditional offline consignment and auction houses maintain a robust presence, particularly for highly collectible vintage pieces, major European resale platforms are aggressively expanding their digital footprint, capitalizing on the increasing demand from younger consumers who seek European heritage brands through sustainable channels. Furthermore, cross-border European luxury trade is thriving, supported by streamlined intra-EU logistics.

Asia Pacific (APAC) is positioned as the fastest-growing region, driven primarily by the massive middle-class expansion in Greater China, South Korea, and Japan. This region demonstrates an immense appetite for Western luxury brands and, increasingly, embraces the concept of resale as a status-conscious and financially intelligent choice. Japan, with its mature and highly respected vintage market known for meticulous quality control, acts as a sophisticated hub for sourcing rare goods. While cultural nuances regarding pre-owned items are still evolving in some markets, the strong digital adoption rates and rapid urbanization across APAC are accelerating the shift towards organized, authenticated online resale platforms, making it the strategic focus for major global luxury retailers and resale providers seeking exponential revenue growth over the forecast period.

- North America: Leads in market size, driven by high disposable income, advanced e-commerce penetration, and strong consumer trust in established luxury resale giants.

- Europe: Highly mature market characterized by deep heritage in luxury, strong demand for vintage items, and advanced regulatory environment supporting cross-border resale trade.

- Asia Pacific (APAC): Fastest-growing region; rapid expansion fueled by China's rising affluent population and sophisticated vintage markets in Japan and South Korea; high acceptance of mobile commerce.

- Latin America (LATAM): Emerging market with nascent but growing luxury resale interest, focused mainly on handbags and watches; challenges include logistics infrastructure and high import duties.

- Middle East & Africa (MEA): Growth concentrated in wealthy GCC countries (UAE, KSA), emphasizing high-value items like exclusive watches and jewelry; local platforms are focusing on highly personalized, high-touch services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Secondhand Luxury Goods Market.- The RealReal

- Vestiaire Collective

- Rebag

- Farfetch (with specific secondhand initiatives)

- Poshmark (Tradesy integration)

- eBay

- Chrono24

- Watchfinder & Co. (owned by Richemont)

- Yoogi's Closet

- Collector Square

- Fashionphile

- Luxury Closet

- StockX

- Grailed

- GOAT

- 1stDibs

- Sotheby's

- Christie's

- ThredUp

- Resale platforms operated by primary luxury brands (e.g., Gucci, Chanel CPO programs)

Frequently Asked Questions

Analyze common user questions about the Secondhand Luxury Goods market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the substantial growth in the Secondhand Luxury Goods Market?

The market growth is primarily driven by the increasing consumer focus on sustainability and circularity, the affordability appeal of luxury items to younger demographics (Millennials and Gen Z), and the enhanced trust provided by sophisticated online platforms utilizing AI-driven authentication technology.

How significant is the impact of counterfeiting on the resale market?

Counterfeiting remains the single largest restraint. However, major resale platforms mitigate this risk by employing rigorous, multi-point authentication processes, including expert inspection, AI image recognition, and the potential future use of blockchain to establish immutable digital provenance records.

Which product category holds the highest investment value in the secondhand market?

High-end luxury watches (e.g., Rolex, Patek Philippe) and iconic designer handbags (e.g., Hermès Birkin, Chanel Flap Bag) consistently hold the highest residual and investment values due to scarcity, brand heritage, and their tendency to appreciate in value over time, often outperforming traditional asset classes.

What role do traditional luxury brands play in the secondhand ecosystem?

Traditional luxury brands are actively integrating into the secondhand market through Certified Pre-Owned (CPO) programs, strategic partnerships with resale platforms, or launching their own internal resale initiatives. This engagement validates the market, formalizes the supply chain, and increases consumer confidence in authenticated pre-owned goods.

Which geographical region is expected to show the highest CAGR growth?

The Asia Pacific (APAC) region, specifically driven by the rapid economic expansion and increasing luxury consumption in China, South Korea, and Southeast Asia, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to a large, newly affluent, and digitally adept consumer base.

The preceding report provides a detailed overview of the Secondhand Luxury Goods Market, synthesizing quantitative projections with qualitative strategic analysis across key segments, technological landscapes, and geographical concentrations. The comprehensive characterization of market drivers and restraints, coupled with a specific focus on the transformative influence of Artificial Intelligence, positions this analysis as an indispensable resource for stakeholders navigating the complexities and opportunities within the luxury circular economy. The market's inherent reliance on trust, authenticity, and digital efficiency underscores the continued importance of technological innovation in securing long-term growth and maximizing shareholder value across the global luxury resale ecosystem. Strategic planning must prioritize advanced authentication protocols and dynamic pricing models to maintain competitive superiority in this rapidly evolving retail sector. The projection of significant market expansion confirms the enduring consumer shift towards value-driven, sustainable luxury consumption, guaranteeing the segment’s critical role in the future of retail globally.

Further strategic insights indicate that vertical integration within the value chain—where leading platforms control sourcing, authentication, and distribution—will become a major factor in determining market profitability. Companies that successfully leverage data analytics not only for pricing but also for predictive inventory sourcing will gain substantial advantages, minimizing risk and optimizing cash flow. The growing synergy between primary luxury houses and secondary market platforms suggests a future where the two markets are viewed not as competitive alternatives, but as complementary components of a unified, cyclical luxury experience. Investors and operators must remain vigilant regarding regulatory changes, particularly those impacting cross-border logistics and digital compliance, to capitalize fully on the identified growth opportunities. The democratization of luxury through accessible resale channels continues to expand the market's reach, ensuring that the secondhand segment remains a high-priority area for both investment and innovation throughout the forecast period and beyond, necessitating continuous review of technological standards and consumer behavior shifts for sustained success.

The emphasis on environmental, social, and governance (ESG) factors further cements the market position of secondhand luxury goods. Consumers are increasingly scrutinizing the sustainability credentials of their purchases, and the inherent circularity of the resale model offers a powerful and verifiable ESG narrative that primary retail often struggles to match. Platforms that transparently report on the carbon and water savings achieved by diverting items from landfill will resonate deeply with the Millennial and Gen Z demographics, thereby fostering brand loyalty that transcends transactional relationships. This ethical dimension is not merely a marketing tool but a structural driver, influencing sourcing decisions and operational processes. Consequently, strategic alignment with global sustainability goals is no longer optional but a prerequisite for market leadership, transforming the luxury resale sector into a powerful vector for ethical business practices within the broader retail industry landscape.

The competitive environment is intensifying, leading to consolidation and specialization among market participants. Larger players are focusing on full-service consignment models offering end-to-end solutions, while smaller entities are carving out highly profitable niches based on specific product expertise (e.g., vintage watches only) or geographic specialization. This segmentation of services ensures that the diverse needs of the global luxury clientele are met, from casual sellers seeking hassle-free monetization to serious collectors demanding high-touch, secure transactions. Continuous assessment of competitor strategy regarding technological investments—particularly in AI authentication and blockchain implementation—is vital for maintaining a competitive edge. The ability to integrate advanced technology with high-quality, personalized customer service will differentiate enduring market leaders from platforms struggling with scaling and trust issues, ensuring long-term profitability and sustainable growth momentum in this dynamic segment.

Future market expansion is heavily dependent on regulatory harmonization across major trading blocs. Disparities in import duties, tax regulations for secondary sales, and intellectual property enforcement regarding counterfeits can significantly impede cross-border luxury resale volumes, increasing logistical complexity and consumer costs. Advocacy for streamlined global resale commerce policies represents a substantial opportunity for industry bodies to unlock suppressed market potential. Furthermore, educational initiatives aimed at informing consumers about authentication processes and the environmental benefits of resale are crucial for mainstream adoption in less mature markets. The overall trajectory suggests a continued, aggressive shift towards digital dominance, professionalization, and a strong convergence with the primary luxury sector, establishing the secondhand luxury goods market as a permanent, high-growth fixture in the global economic landscape, necessitating proactive adaptation by all stakeholders to capitalize on the sustained consumer shift toward circularity.

The strategic importance of proprietary data assets cannot be overstated within this competitive environment. Each authenticated item, transaction record, and pricing movement contributes to a valuable, high-fidelity dataset that informs future operational decisions, trend forecasting, and risk management. Platforms possessing superior data lakes—particularly concerning authentication patterns of niche and vintage items—hold a distinct competitive advantage in accurately predicting market demand and securing optimal inventory. This data superiority directly translates into higher appraisal accuracy, faster turnaround times, and ultimately, greater consumer trust, reinforcing a virtuous cycle of growth. Consequently, investment in robust data infrastructure and specialized data science teams is becoming as critical as physical authentication expertise, fundamentally redefining the skill sets required for leadership within the secondhand luxury goods industry.

The evolution of payment infrastructure, including the acceptance of various cryptocurrencies and the integration of Buy Now, Pay Later (BNPL) schemes, is also broadening accessibility and reducing friction for high-value purchases. While cryptocurrency integration caters to a tech-savvy demographic potentially seeking investment diversification, BNPL options democratize access by breaking down large luxury purchases into manageable installments, particularly appealing to younger consumers. These financial innovations enhance transaction flexibility and speed, facilitating greater liquidity in the market. Platform operators must carefully balance the risks associated with various payment methods, especially concerning chargebacks and fraud in high-value transactions, but the overall effect of payment diversification is positive, accelerating conversion rates and expanding the global consumer pool capable of engaging with luxury resale goods.

Finally, the growing maturity of the appraisal profession within the luxury resale sphere signals the segment's institutionalization. Specialized training and certification programs for authenticators and appraisers are establishing industry-wide standards for condition grading and valuation, moving away from subjective judgment toward quantifiable, professional assessment. This standardization is vital for platforms seeking to scale their operations and enter into high-stakes partnerships with traditional luxury auction houses and retailers. By professionalizing the workforce and formalizing the expertise required to handle unique luxury assets, the secondhand market reinforces its credibility, attracts higher-value inventory, and assures regulatory compliance, solidifying its trajectory toward becoming an integral, fully respected component of the global luxury economy. These operational advancements underscore the market's successful transition from a niche activity to a mainstream retail force.

The development of mobile-first experiences is intrinsically linked to the market’s future success, particularly in the APAC region where mobile commerce dominates. Leading resale platforms prioritize highly intuitive mobile apps that offer seamless listing processes for sellers—including AI-assisted photography and descriptive tools—and engaging, personalized browsing for buyers. The mobile interface must effectively convey the item’s condition and authenticity details through high-resolution imagery and detailed provenance records, compensating for the lack of a physical inspection. Platforms excelling in mobile user experience (UX) and interface (UI) design capture significant market share by providing convenience and accessibility, appealing directly to the digitally native consumer who expects instant, secure transactions regardless of geographic location, thereby driving market velocity and facilitating instantaneous cross-border luxury commerce.

The strategic deployment of influencer marketing and collaborative digital campaigns is indispensable for maintaining brand relevance and attracting both supply and demand. Platforms leverage social media influencers, fashion editors, and celebrity stylists to showcase the appeal of pre-owned luxury, effectively normalizing the behavior and associating it with high style and ethical consciousness. These campaigns often focus on the narrative of unique vintage finds and sustainable fashion choices, tapping into the broader cultural zeitgeist favoring responsible consumption. Successful digital marketing strategies ensure that the resale platform maintains top-of-mind awareness among potential sellers looking to monetize their unused assets and buyers searching for unique additions to their collections, sustaining the critical flow of desirable inventory necessary for market liquidity and exponential growth.

Furthermore, managing the perceived risk of buying pre-owned items requires strategic communication about platform guarantees and insurance coverage. Offering comprehensive authentication guarantees, often backed by financial guarantees (e.g., double the purchase price refund if proven fake), drastically reduces buyer apprehension. Additionally, partnerships with specialized insurance providers to offer transit and post-purchase item protection further enhances consumer confidence, particularly for extremely high-value items like rare watches or heritage jewelry. These trust-building measures, which go beyond standard e-commerce practice, are crucial differentiators in the premium secondhand sector, signaling the platform’s unwavering commitment to integrity and quality assurance, thereby justifying the premium pricing often associated with authenticated luxury resale items and safeguarding the long-term reputation of the market.

The integration of virtual reality (VR) showrooms and advanced 3D modeling technologies is beginning to offer immersive shopping experiences that further erode the distinction between online and physical luxury retail. While still nascent, the potential for VR to allow customers to virtually inspect every detail of a handbag or try on a piece of jewelry in a realistic digital environment promises a future where condition inspection is more standardized and interactive. These investments in experiential technology are aimed at high-end consumers who demand the highest level of detail and visualization before committing to a significant purchase, addressing the tactile limitations of e-commerce. As these technologies become more accessible, they will increase conversion rates for the highest-value segments and solidify the digital dominance of the leading resale platforms.

Finally, the competitive landscape is shifting towards circular ecosystem creation, where leading platforms seek to manage the luxury lifecycle entirely—from primary purchase recommendation to repair, maintenance, and eventual resale. Strategic acquisitions or partnerships focusing on specialized luxury repair and refurbishment services enhance the platform's value proposition, extending the longevity of items and increasing their potential resale value. By offering comprehensive care services, resale companies position themselves not just as transactional marketplaces but as trusted custodians of luxury wealth, deepening customer relationships and securing recurring revenue streams across the full ownership period of a luxury asset. This focus on long-term stewardship is a key strategic move for maintaining market leadership and capitalizing on the inevitable shift towards a fully cyclical model within the global luxury industry.

The increasing consumer sophistication regarding vintage items and specific archival collections represents a lucrative niche. Platforms specializing in historical luxury research and provenance verification cater to expert collectors, commanding premium prices for items with documented heritage. This segment requires specialized knowledge that often surpasses the capabilities of generic AI authentication systems, relying heavily on human expertise and access to historical brand records. Therefore, successful strategies involve balancing broad market appeal with deep, specialized knowledge in high-value, niche areas, ensuring that the platform can serve both the mass affluent seeking accessible luxury and the specialized collector pursuing investment-grade historical pieces. This duality highlights the necessity for hybrid operational models that combine scalable technology with expert human curation.

Furthermore, the utilization of sophisticated financial tools, such as collateralized lending against luxury assets, is emerging as a novel service for high-net-worth sellers. Platforms that facilitate secure, quick liquidity by offering loans against authenticated luxury items (watches, jewelry) transform these assets into actively managed financial instruments. This service increases the velocity of the assets and provides unique value to affluent clients seeking flexible financial solutions, distinguishing top-tier platforms from simple consignment services. The ability to manage both the retail transaction and the financial utility of luxury goods underscores the market's maturation and its increasing convergence with specialized financial services, expanding the revenue potential beyond traditional retail margins and further integrating the secondary market into the broader wealth management ecosystem.

The development of robust international logistics and customs handling is vital for capitalizing on the global demand for secondhand luxury. Successfully managing cross-border transactions—including accurate valuation for customs declaration, compliance with varying import tariffs, and secure, insured shipping—is a complex operational challenge. Platforms that invest in highly optimized international shipping networks and automated customs clearance protocols gain a significant advantage in serving global buyers and sellers efficiently. This logistical excellence reduces the friction of international trade, unlocking vast inventory pools and demand markets, and is fundamental to achieving the global scale projected for the secondhand luxury goods sector during the forecast period.

Finally, the ethical sourcing and verification of pre-owned luxury items, ensuring they are not stolen or obtained through illicit means, is an ethical imperative and operational necessity. Platforms must maintain stringent checks against global databases and utilize sophisticated identity verification processes for sellers. The commitment to ethical practices not only protects the platform's reputation but also reinforces consumer trust in the high-value nature of the items traded. As the market grows and institutionalizes, ethical compliance and transparent sourcing protocols will become essential audit points for investors and a key selection criterion for conscious consumers, solidifying the market’s transition towards a highly responsible and regulated retail segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager