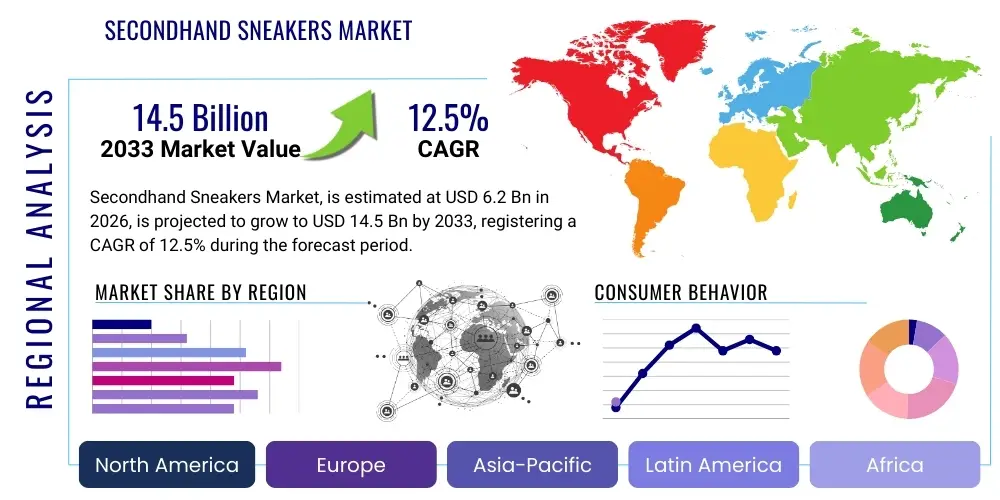

Secondhand Sneakers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438029 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Secondhand Sneakers Market Size

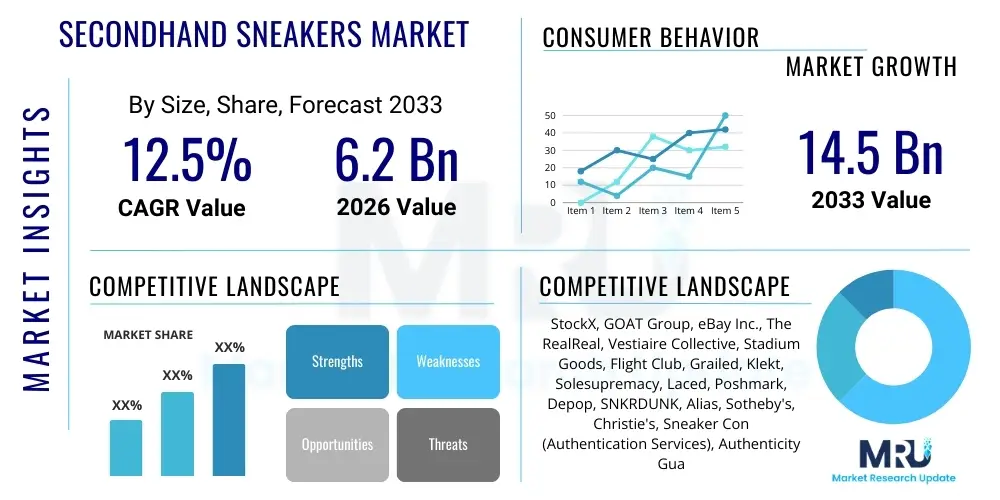

The Secondhand Sneakers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $6.2 Billion in 2026 and is projected to reach $14.5 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing consumer interest in sustainable fashion consumption, combined with the escalating cultural value placed on limited-edition, rare, and vintage footwear. The market transition from niche hobbyist trading to a mainstream retail segment is being driven primarily by advanced digital consignment platforms and the implementation of robust authentication technologies, which collectively build trust and facilitate frictionless cross-border transactions.

The valuation reflects the burgeoning ecosystem surrounding sneaker resale, which encompasses not only peer-to-peer transactions but also formalized corporate platforms that offer high-level authentication, quality guarantees, and sophisticated dynamic pricing models. Furthermore, the market size is heavily influenced by the high value attached to 'grail' sneakers—highly sought-after models often released in collaboration with celebrities or designers—which command exponential premiums on the resale market, elevating the average transaction value significantly. Economic factors such as inflation, ironically, sometimes bolster this market, as collectible sneakers are increasingly viewed by younger investors as alternative, tangible assets that can hedge against volatility, further injecting capital into the ecosystem and driving market maturity towards established retail standards.

Secondhand Sneakers Market introduction

The Secondhand Sneakers Market encompasses the retail environment dedicated to the buying and selling of pre-owned, gently used, or deadstock (unworn but previously purchased) athletic and casual footwear. This domain operates parallel to the primary retail market, deriving significant cultural and economic value from exclusivity, scarcity, and brand legacy, particularly involving major players like Nike, Adidas, and specialized designer collaborations. Products traded range from high-value collectible "grails" that serve as investment vehicles, often priced far exceeding their original retail value, to more affordable, lightly used pairs catering to mainstream consumers seeking sustainability or value. The market is fundamentally driven by the "drop culture" of primary retailers, where limited releases immediately transition to the secondary market, creating immediate resale opportunities and fostering a distinct community centered on fashion, status, and collecting.

Major applications of secondhand sneakers are multifaceted, addressing various consumer needs. For the core collecting demographic, these sneakers function as tangible investments and cultural artifacts, demanding meticulous authentication and storage. Conversely, a large segment of general consumers utilizes this market to access desirable brands and styles that are either sold out in the primary market or offered at a significantly lower price point, aligning with growing global preferences for thrift and circular economy models. The inherent benefit of this market lies in its promotion of sustainability, reducing textile waste by extending the product lifecycle of high-quality footwear, while simultaneously democratizing access to high-demand fashion items, allowing a broader socio-economic spectrum to participate in sneaker culture and potentially profit from it.

The robust growth of the market is primarily driven by three key factors: the pervasive influence of social media and celebrity endorsement, which amplify demand for specific models; the technological advancement in platform infrastructure, which has made cross-continental trading reliable and secure; and a global shift towards conscious consumerism. Limited availability created by intentional scarcity strategies (e.g., restricted 'drops') by primary manufacturers ensures sustained interest and high secondary market valuation. These dynamics create a continuous, profitable cycle where the primary market generates hype, and the secondary market formalizes the transactional infrastructure necessary to monetize that hype, facilitating rapid inventory turnover and attracting formal investment capital into resale platforms, thus stabilizing and professionalizing the entire ecosystem.

Secondhand Sneakers Market Executive Summary

The Secondhand Sneakers Market is currently characterized by hyper-digitalization and increasing institutional investment, transforming formerly informal trading networks into sophisticated global marketplaces underpinned by advanced authentication technologies. Key business trends include the consolidation of major resale platforms, a move toward hybrid models incorporating both online and physical consignment stores, and significant efforts to standardize quality grading and condition reporting to mitigate buyer risk. Geographically, North America and Asia Pacific, particularly China and Japan, dominate the transaction volume and value, driven by deep-rooted sneaker collecting culture and high disposable incomes among key consumer groups, although Europe is rapidly gaining momentum, largely fueled by strong ethical and sustainability purchasing mandates which favor the circular economy models inherent in resale. This rapid formalization is attracting traditional luxury fashion houses to participate, viewing resale as a critical, high-margin channel that enhances brand exclusivity and controls secondary market narratives.

Regional trends indicate a clear distinction in consumer behavior; while North American consumers often prioritize scarcity and investment returns, Asian consumers frequently emphasize brand collaboration and status associated with exclusivity, driving peak prices for limited releases from entities like Supreme and certain designer collaborations. European consumers show a higher inclination towards affordability and environmental responsibility, favoring platforms that emphasize sustainable practices and transparent supply chains, positioning sustainability as a major value driver alongside price. Emerging markets in Latin America and Southeast Asia are experiencing rapid growth, driven by increasing internet penetration and younger populations eager to engage with global fashion trends but constrained by local purchasing power, making the value proposition of secondhand markets particularly appealing and expanding the geographical reach significantly beyond traditional hubs.

Segmentation trends highlight the divergence between the high-value collectible segment and the high-volume daily-wear segment. The collectibles segment, focused on deadstock condition and verifiable provenance, commands premium services like blockchain verification and specialized vault storage, attracting investors seeking non-traditional assets. Conversely, the high-volume segment, comprising mid-tier brands and moderately used mainstream models, thrives on efficiency, rapid shipping, and streamlined peer-to-peer processes offered by marketplaces utilizing robust algorithmic pricing. Distribution channels continue to favor managed online marketplaces (e.g., StockX, GOAT) due to the inherent trust offered by centralized authentication processes, effectively eroding the trust gap that previously hindered large-scale P2P transactions and establishing these centralized entities as critical market intermediaries.

AI Impact Analysis on Secondhand Sneakers Market

User queries regarding AI's influence in the secondhand sneakers domain overwhelmingly center on issues of trust, valuation accuracy, and the efficiency of the buying experience. Users are keen to understand how AI can definitively address the pervasive problem of counterfeits, asking questions about the reliability of computer vision authentication and whether it can replace manual human inspection. Another major theme revolves around dynamic pricing: consumers inquire about how AI algorithms determine fair market value across varying conditions, sizes, and regional demands, and whether these systems are transparent or contribute to price volatility. Furthermore, users frequently express interest in personalized recommendations, anticipating that AI can curate inventory based on hyper-specific purchasing history, stylistic preferences, and investment potential, thereby streamlining the notoriously overwhelming browsing experience associated with vast resale inventories.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally disrupting the infrastructure of the secondhand sneaker market, primarily by establishing unparalleled levels of transactional trust and optimizing supply chain performance. AI-driven computer vision systems are being trained on vast datasets of genuine and counterfeit products, enabling immediate, non-invasive authentication checks by analyzing stitching patterns, material textures, and proprietary manufacturing identifiers with accuracy often surpassing human capability. This technological assurance is critical for scaling operations, allowing platforms to process higher volumes of inventory more rapidly while significantly lowering the rate of successful counterfeit entry into the ecosystem, thereby bolstering consumer confidence—the most vital factor in the growth of any luxury resale market.

Beyond authentication, ML algorithms are proving invaluable in optimizing the highly volatile and complex pricing dynamics of this market. These models continuously scrape global transaction data, current listings, historical sales trends, and cultural indicators (such as celebrity sightings or upcoming brand collaborations) to provide real-time, dynamic valuations. This not only benefits platforms by maximizing margins but also offers sellers the optimal time and price point for listing their goods, reducing inventory holding times and increasing market liquidity. Furthermore, AI enhances customer experience through sophisticated recommendation engines that personalize search results and marketing outreach, tailoring inventory displays based on specific user profiles, investment thresholds, and preferred style categories, translating into higher conversion rates and enhanced user loyalty, crucial competitive differentiators in the crowded digital resale space.

- AI-driven Computer Vision (CV) enhances authentication accuracy, minimizing counterfeit penetration.

- Machine Learning algorithms enable sophisticated dynamic pricing based on real-time global demand and condition grading.

- Predictive analytics optimize inventory forecasting and logistical planning for major resale platforms.

- Natural Language Processing (NLP) improves customer service bots and standardizes product listing descriptions for better AEO visibility.

- Recommendation engines personalize the shopping journey, driving higher average order values and improving user retention.

- Fraud detection systems use behavioral analysis to flag suspicious buyer/seller activity, ensuring transactional security.

DRO & Impact Forces Of Secondhand Sneakers Market

The growth trajectory of the Secondhand Sneakers Market is powerfully driven by cultural shifts favoring scarcity and sustainability, while simultaneously constrained by the constant threat of sophisticated counterfeiting operations and logistical complexities inherent in grading used goods. Market Drivers include the powerful 'hype culture' perpetuated by limited edition releases and social media influence, which generates immediate, high residual value for specific products. Opportunities are centered on geographical expansion into emerging economies and the application of advanced technologies like blockchain for irreversible provenance tracking, fundamentally enhancing trust and market efficiency. Restraints primarily involve the lack of a universally accepted grading system for used condition and the persistent challenge of maintaining consumer trust against the backdrop of highly realistic unauthorized reproductions, demanding continuous investment in advanced verification infrastructure, which can be costly and act as a barrier to entry for smaller platforms.

The primary impact forces shaping the market are economic and technological. Economically, the market benefits from its role as an alternative investment class, attracting capital from younger generations seeking tangible assets with high liquidity, which stabilizes valuation even during broader economic downturns. Technologically, the rapid innovation in authentication methods, particularly in computer vision and forensic tagging, dictates the competitive landscape; platforms that successfully leverage these tools gain a decisive advantage in mitigating fraud risk and securing high-value inventory. Furthermore, the societal shift towards environmental responsibility exerts significant force, driving consumer preference towards resale as a sustainable consumption choice, pushing manufacturers and retailers alike to develop circularity strategies and partner with established secondary market players, formalizing the market integration.

The structural forces affecting market dynamics relate significantly to regulatory and trust mechanisms. The absence of comprehensive international regulation specifically targeting the resale of high-value collectibles introduces operational risks, while the intense media scrutiny regarding fakes pressures platforms to continuously improve their verification protocols, forcing consolidation toward platforms capable of making those large infrastructural investments. Opportunities for market players are vast in utilizing data aggregation; platforms that can accurately map global demand patterns, predict future trend adoption, and offer robust data reporting can successfully differentiate themselves, moving beyond simple transaction facilitation to become essential market intelligence providers, thereby securing long-term dominance and generating new revenue streams from data monetization.

Segmentation Analysis

The Secondhand Sneakers Market is highly segmented, primarily delineated by the value proposition of the product, the channel of distribution, and the end-user’s motivation—be it investment, fashion, or everyday utility. Key segmentations include differentiating between 'Deadstock' (new, unworn condition) and 'Used' condition, where Deadstock commands exponentially higher prices and attracts the investment-focused buyer, while used condition appeals strongly to the price-sensitive consumer focused on accessible style. Segmentation by product type involves separating iconic retro models (e.g., Air Jordans, Yeezys), which often possess the highest resale premium due to their cultural significance and scarcity, from performance or contemporary lifestyle sneakers, which move at higher volumes but lower margins. Analyzing these segments is critical for platforms to tailor their authentication services, logistical solutions, and marketing strategies effectively, optimizing inventory management and operational efficiency across diverse product categories and customer needs.

- By Product Condition:

- Deadstock (New with Box)

- Used (Lightly Used, Moderately Used, Heavily Used)

- By Product Type:

- Retro/Iconic Models (High-Value Collectibles)

- Modern/Performance Sneakers

- Lifestyle/Fashion Sneakers

- By Price Range:

- Premium/High-End (>$500 resale value)

- Mid-Range ($100-$500 resale value)

- Mass/Entry-Level (<$100 resale value)

- By Distribution Channel:

- Managed Online Marketplaces (e.g., StockX, GOAT, Klekt)

- Peer-to-Peer (P2P) Platforms (e.g., eBay, Depop)

- Physical Consignment Stores/Boutiques

- By End-User:

- Collectors and Investors (seeking rarity and appreciation)

- Fashion Enthusiasts (seeking trendy or sold-out items)

- Value Buyers (seeking affordability and sustainability)

Value Chain Analysis For Secondhand Sneakers Market

The value chain for the Secondhand Sneakers Market is intricate, moving away from a linear model to a more circular ecosystem driven by technological intermediaries. The chain begins with the Sourcing and Acquisition phase, where inventory originates primarily from individual sellers, collectors looking to liquidate assets, or, increasingly, from retailers using the secondary market as a formalized channel for returns or unsold deadstock. This upstream activity is heavily influenced by primary market drops and hype cycles, determining the availability and initial potential resale price. Following sourcing, the most crucial and value-additive step is Processing, which includes physical cleaning, detailed condition grading, and, most importantly, rigorous third-party or platform-level Authentication, often leveraging advanced AI and forensic analysis to verify provenance and legitimacy, substantially increasing the product's market value and consumer trust.

Distribution constitutes the midstream section, dominated by high-tech online marketplaces acting as central clearing houses. These platforms manage logistics, standardized secure payment processing, and cross-border shipping, effectively connecting decentralized sellers with global buyers. Direct distribution channels, such as brand-operated resale programs, offer maximum control over pricing and brand image, although they currently represent a smaller volume of transactions compared to independent platforms. Indirect distribution relies heavily on major aggregator marketplaces and smaller, localized physical consignment stores which offer personalized service but often lack the scalability and technological sophistication of the large digital intermediaries. The efficacy of the distribution channel is highly dependent on minimizing friction, guaranteeing authenticity, and optimizing shipping times, particularly for high-value international transactions.

The downstream component involves the Final Sale and Post-Transaction activities. Post-transaction includes data accumulation and analysis, where platforms gather critical market intelligence used for dynamic pricing and trend forecasting, generating inherent intellectual property value. The successful completion of the transaction ultimately relies on the platform's ability to minimize risk, manage returns transparently, and maintain high standards of customer service, thereby fostering brand loyalty within a community-centric market. The circularity is completed when the buyer potentially becomes a future seller, relisting the item back into the ecosystem, further fueling the inventory pool and validating the long-term viability of the product as a reusable asset. Continuous investment in technology across all phases—from AI-driven condition assessment in processing to predictive logistics in distribution—is essential for sustaining competitive advantage within this rapidly evolving value chain.

Secondhand Sneakers Market Potential Customers

The primary consumers driving demand in the Secondhand Sneakers Market are segmented across several distinct demographics, though the market is largely anchored by younger generations, specifically Millennials (ages 28-43) and Gen Z (ages 12-27). These cohorts are deeply engaged with digital culture, heavily influenced by social media trends, and prioritize instant access to desirable, limited-edition products that define personal status and identity. Furthermore, these consumers often align their purchasing decisions with ethical and sustainable values, viewing the circular economy as a necessary alternative to fast fashion, making the secondhand market highly appealing both economically and philosophically. They seek a balance between acquiring coveted, often sold-out items and making environmentally conscious choices, relying heavily on the robust verification systems of centralized platforms to mitigate the inherent risks of buying pre-owned luxury goods.

A rapidly growing segment of potential customers includes dedicated investors and high-net-worth collectors who view rare sneakers not merely as apparel but as a genuine, appreciating asset class. These buyers are less concerned with immediate utility and more focused on provenance, deadstock condition, and historical price appreciation, often engaging in bulk purchases or holding inventory in specialized storage vaults. This demographic is essential as they drive the ultra-high-end of the market, setting benchmark prices for "grail" items and validating the asset value of limited releases. The platforms catering to this segment must offer superior authentication guarantees, often including blockchain traceability, and specialized escrow services to manage high-value transactions effectively, reinforcing the market's perception as a credible alternative investment avenue, distinct from traditional retail.

The third significant group comprises value-oriented buyers and budget-conscious fashion followers who seek affordable access to branded, quality footwear without the high premium of new retail prices. This segment is less focused on limited drops and more on finding well-maintained, everyday-wearable products at substantial discounts. Their motivation is purely utilitarian and economical, driving demand for the lower-priced, high-volume segments of the market. Platforms and resellers targeting these customers must focus on efficiency, transparent grading, and competitive pricing models, often utilizing high-resolution imagery and detailed condition reports to build trust in the product's usability and longevity, thereby extending the market reach beyond the core collector community into the general retail landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $6.2 Billion |

| Market Forecast in 2033 | $14.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | StockX, GOAT Group, eBay Inc., The RealReal, Vestiaire Collective, Stadium Goods, Flight Club, Grailed, Klekt, Solesupremacy, Laced, Poshmark, Depop, SNKRDUNK, Alias, Sotheby's, Christie's, Sneaker Con (Authentication Services), Authenticity Guaranteed (AG). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Secondhand Sneakers Market Key Technology Landscape

The competitive differentiation in the secondhand sneakers market is increasingly determined by technological superiority, specifically in authentication and data management. Central to this landscape is the application of Artificial Intelligence and Machine Learning for image recognition and forensic analysis. Platforms utilize advanced Computer Vision systems to instantly verify product legitimacy by analyzing thousands of data points—including logo placement, stitching density, material texture, and proprietary tagging systems—against massive, proprietary databases of known genuine and counterfeit items. This non-destructive, rapid verification process is fundamental to scaling operations and ensuring consumer trust, effectively automating what was previously a time-consuming manual process. Furthermore, AI fuels sophisticated dynamic pricing engines, crucial in a market defined by volatile demand, allowing pricing to adjust in real-time based on fluctuating scarcity, social media chatter, and micro-regional demand variations, thus maximizing liquidity and profit margins for all market participants while providing transparency into valuation methodologies.

Another crucial technological advancement involves the deployment of distributed ledger technology, primarily Blockchain, to create immutable records of a sneaker's provenance and transaction history. By tokenizing or digitally tagging high-value items upon their initial sale or first entry into the resale market, platforms can establish a permanent, tamper-proof chain of ownership, certifying authenticity and condition history from the factory floor to the final buyer. This technology moves beyond simple verification; it creates a verifiable digital twin that combats sophisticated 'franken-fakes' (sneakers assembled from both genuine and fake components) and prevents item swapping during transit. Additionally, the increasing integration of Near Field Communication (NFC) and Radio-Frequency Identification (RFID) tags embedded either by the original manufacturer or during the platform's authentication process provides a physical-digital link, allowing buyers to instantly verify the item's digital record using a smartphone, adding an extra layer of security and consumer confidence necessary for high-value cross-border transactions.

The ecosystem also relies heavily on specialized logistics technologies and enhanced customer experience tools. Advanced inventory management systems, utilizing robotics and specialized warehouse infrastructure, are necessary to handle the high volume and unique categorization requirements (e.g., separating deadstock from used inventory). For customer engagement, platforms are increasingly leveraging Augmented Reality (AR) and Virtual Reality (VR) technologies, allowing potential buyers to virtually try on sneakers or inspect high-resolution 3D models of the product, minimizing the physical limitations of online shopping and reducing return rates associated with fit or perceived condition issues. The integration of high-definition imaging technologies, combined with standardized, verifiable condition reporting metrics, ensures that the digital representation of the product accurately reflects its physical state, serving as the necessary digital foundation upon which the high-trust, high-value ecosystem of secondhand sneaker commerce is successfully built and maintained.

Regional Highlights

- North America (Dominance and Investment Culture): North America, particularly the United States, represents the most mature and significant market for secondhand sneakers globally, acting as the primary hub for investment-grade collectibles and the pioneering force behind digital resale platforms. The region is characterized by an established sneakerhead culture, high consumer spending power, and early adoption of large managed marketplaces like StockX and GOAT. Driving factors include the influential role of US celebrity culture, major sports leagues (NBA), and the early, large-scale presence of brands like Nike and Adidas. The North American consumer segment often treats sneakers as liquid assets, resulting in high average transaction values for rare or historically significant models. The technological infrastructure for authentication and dynamic pricing is highly advanced here, ensuring operational scalability and cross-border trade efficiency, and this region continues to set the benchmark for market trends and valuation metrics worldwide.

- Asia Pacific (APAC) (Digital Penetration and Status Signaling): The APAC region is experiencing explosive growth, propelled by massive digital penetration, particularly in China (which has become a critical secondary market) and South Korea, alongside Japan's long-standing tradition of vintage and street culture collecting. APAC consumers often prioritize brand status and exclusivity, driving extremely high premiums for collaborations and limited-edition releases, frequently using sneakers as high-visibility social status indicators. Key drivers include rapid urbanization, increasing disposable income among affluent youth, and the dominance of mobile commerce. Localized platforms (e.g., SNKRDUNK) are strong competitors against global giants, successfully adapting their offerings to regional payment methods and cultural nuances. Logistics remain a complex challenge due to geographic diversity, but the sheer volume of transactions positions APAC as the future volume leader, demanding customized authentication and cross-cultural trade solutions.

- Europe (Sustainability and Luxury Integration): The European market, while growing rapidly, is distinguished by its pronounced focus on sustainability and circular economy principles. Consumers across Western Europe, particularly in Germany, the UK, and Scandinavia, are highly motivated by the ethical implications of fashion consumption, favoring resale platforms that actively promote reduced environmental impact and longevity. This ethical mandate helps push the mid-range and accessible used segments. Furthermore, Europe is home to major luxury fashion houses, leading to greater integration of high-end, designer sneaker resale through platforms like Vestiaire Collective. The market is fragmented by national borders and varying consumer protection laws, making EU-wide logistics and consistent authentication more complex, but the adoption rate is high, fueled by a sophisticated consumer base that balances value with ecological responsibility.

- Latin America (LATAM) (Emerging Growth and Affordability Focus): LATAM represents a high-potential emerging market characterized by rapid growth in internet and smartphone usage, coupled with high demand for global fashion brands often constrained by high import tariffs or limited local availability in the primary market. The secondhand market provides crucial affordability, offering access to high-status brands at accessible price points. Market development is currently concentrated in major economies like Brazil and Mexico. Challenges include underdeveloped logistics infrastructure, higher levels of informal P2P trading, and regulatory hurdles concerning imports/exports. However, the youthful demographics and fervent adoption of global trends suggest significant latent demand, positioning LATAM as a key future growth area, provided that secure, trustworthy local resale infrastructure can be established and scaled effectively.

- Middle East and Africa (MEA) (Luxury Niche and Digital Adoption): The MEA region, particularly the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia), shows strong demand within the high-value luxury segment, driven by high disposable income and an appreciation for global collectible trends. Sneakers are often treated as luxury lifestyle investments. Growth is concentrated in sophisticated urban centers with robust digital infrastructure, supporting specialized, often boutique, resale operations. Africa remains highly fragmented, with emerging opportunities driven by increased digital literacy and access to mobile money systems, particularly for affordable, high-volume secondary fashion markets in key hubs like South Africa and Nigeria. Overall regional growth requires focused platform investment to address the unique logistical and security challenges associated with high-value transactions in disparate regulatory environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Secondhand Sneakers Market.- StockX

- GOAT Group (including Flight Club and Alias)

- eBay Inc. (with its Authenticity Guarantee service)

- The RealReal

- Vestiaire Collective

- Stadium Goods

- Grailed

- Klekt

- Laced

- Poshmark

- Depop (Etsy, Inc.)

- SNKRDUNK

- Sole Supremacy

- Sotheby's

- Christie's

- Sneaker Con (Authentication Services)

- Entrupy (Authentication Technology)

- Authenticate Pro

- Rodeo Drive Resale

- Capsule Resale

Frequently Asked Questions

Analyze common user questions about the Secondhand Sneakers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers of growth in the secondhand sneaker market?

The primary drivers include the cultural phenomena of "hype drops" creating artificial scarcity, the recognition of collectible sneakers as alternative investment assets, and a significant consumer shift towards sustainable and circular fashion consumption models, supported by global digital marketplace platforms.

How do resale platforms ensure the authenticity of high-value sneakers?

Platforms employ multi-layered authentication protocols combining human forensic expertise with advanced technologies, including AI-driven computer vision analysis, proprietary data comparison against known genuine and fake products, and the integration of physical security tags like NFC/RFID chips or blockchain-backed digital twins to verify provenance.

Are secondhand sneakers considered a viable investment asset class?

Yes, specific, highly limited edition, and iconic "grail" sneakers are increasingly treated as tangible assets, often demonstrating higher returns and liquidity than traditional investments over short periods, particularly those models released in limited quantities or significant brand collaborations.

What role does technology, specifically AI, play in market valuation?

AI and Machine Learning are crucial for dynamic pricing. Algorithms analyze vast datasets of historical sales, real-time demand across geographies, item condition, size variability, and cultural trends to generate accurate, optimized, and transparent market valuations instantly, benefiting both buyers and sellers.

What is the most significant challenge facing the market's continued expansion?

The most persistent challenge remains the pervasive presence of highly sophisticated counterfeits. Overcoming this requires continuous, substantial investment in proprietary authentication technology, establishing and maintaining universal trust, and developing standardized global grading systems for product condition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager