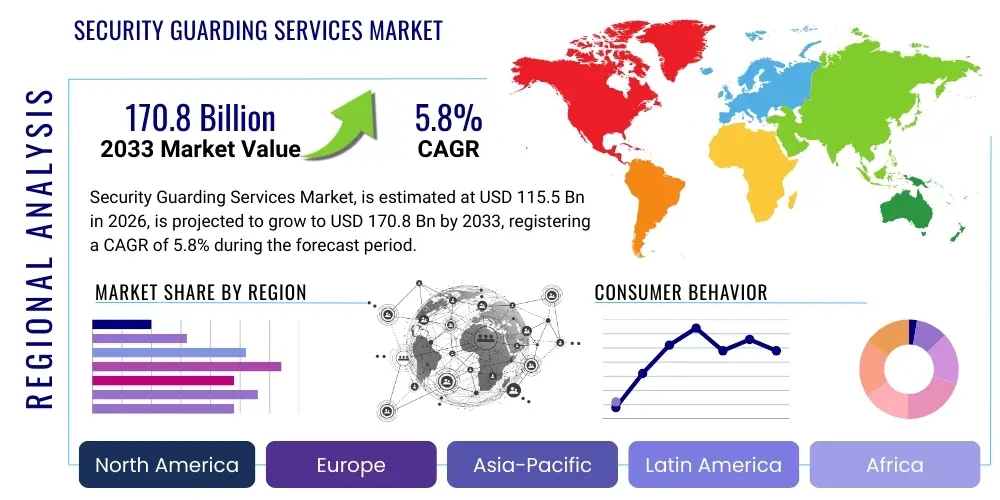

Security Guarding Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434986 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Security Guarding Services Market Size

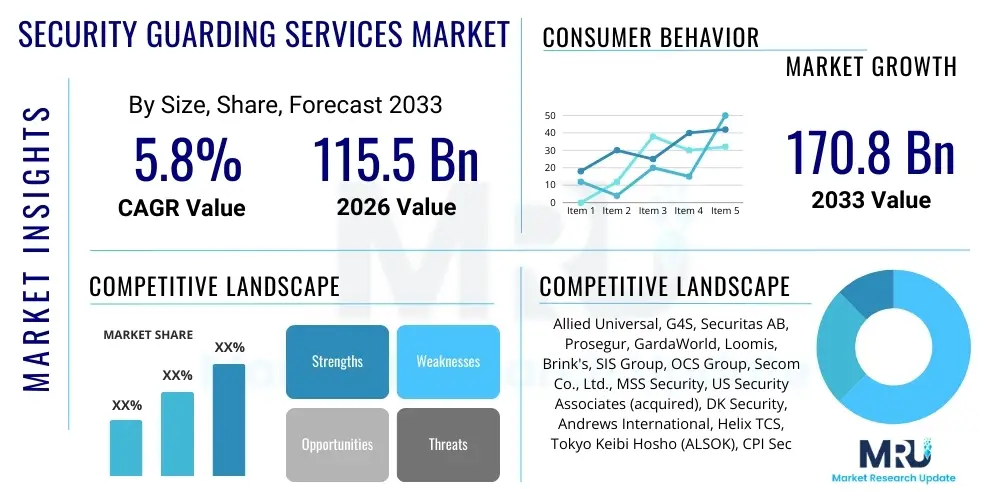

The Security Guarding Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 115.5 Billion in 2026 and is projected to reach USD 170.8 Billion by the end of the forecast period in 2033.

Security Guarding Services Market introduction

The Security Guarding Services Market encompasses the provision of human personnel and technology-enabled surveillance solutions aimed at protecting assets, people, and property against unauthorized access, theft, damage, and malicious acts. This essential service includes manned guarding, mobile patrols, alarm response, and integrated security consulting, serving a diverse array of sectors from critical infrastructure and governmental facilities to commercial enterprises and private residences. The increasing complexity of global security threats, ranging from organized crime to workplace violence and terrorism, serves as the fundamental catalyst driving continuous demand for professional security services.

Security services have evolved significantly from traditional static guarding roles to sophisticated, risk-managed solutions that incorporate technology such as CCTV monitoring, access control systems, and data analytics. Major applications span retail loss prevention, industrial site protection, corporate security, residential community safeguarding, and perimeter defense for logistics and transportation hubs. The core benefit derived by end-users is enhanced risk mitigation, regulatory compliance, and the establishment of a safe operational environment, allowing organizations to focus on core business activities while outsourcing specialized security responsibilities to expert providers. The demand for highly trained security personnel capable of handling complex situations, often involving de-escalation techniques and emergency response procedures, is consistently rising, reinforcing the market’s growth trajectory.

Key driving factors propelling market expansion include rapid urbanization leading to increased density of commercial establishments, mandatory security protocols imposed by industry regulations (particularly in finance and pharmaceuticals), and the rising value of assets requiring physical protection. Furthermore, the convergence of physical security and cybersecurity threats necessitates a holistic approach to risk management, often implemented through hybrid guarding models that combine human intuition with technological efficiency. This blend ensures comprehensive coverage and real-time threat detection, sustaining the market’s positive growth outlook.

Security Guarding Services Market Executive Summary

The Security Guarding Services Market is characterized by robust resilience and steady growth, driven primarily by escalating geopolitical instability and the resulting increase in corporate risk exposure globally. Business trends show a significant shift towards integrated security solutions (ISS), where traditional manned guarding services are bundled with advanced technology offerings such as remote video monitoring, drone surveillance, and predictive analytics. This integration allows providers to offer higher efficiency and demonstrable ROI to clients, moving away from purely cost-based competition to value-added service delivery. Consolidation remains a defining feature of the competitive landscape, with major international players actively acquiring regional specialists to expand geographic reach and specialized sector expertise, thereby enhancing market concentration and driving professional standards upward.

Regional trends indicate that North America and Europe remain mature markets, focusing heavily on technology adoption, labor optimization, and regulatory compliance, particularly regarding data privacy and security personnel licensing. Conversely, the Asia Pacific (APAC) region is demonstrating the highest growth potential, fueled by massive infrastructure development, increasing foreign direct investment in manufacturing and commercial real estate, and the nascent professionalization of local security industries. Emerging economies in Latin America and the Middle East and Africa (MEA) are also experiencing accelerated growth, largely due to high security expenditure necessitated by volatile local environments and large-scale government projects demanding stringent security protocols. The segmentation analysis highlights that the Manned Guarding segment retains the largest market share due to its non-substitutable role in complex environments and customer interface, but the Mobile Security and Alarm Monitoring segments are expanding rapidly due to cost-efficiency and technological advancements.

Segment trends underscore the rising importance of specialized sector expertise, particularly within critical infrastructure (energy, utilities) and the highly regulated BFSI (Banking, Financial Services, and Insurance) sector, which demands bespoke security solutions tailored to specific threat vectors. The long-term outlook is strongly influenced by the adoption of Artificial Intelligence (AI) and automation, which are reshaping service delivery models by enhancing surveillance capabilities, optimizing patrol routes, and reducing reliance on manual incident reporting. While these technologies present challenges regarding investment and workforce reskilling, they ultimately position the market for enhanced profitability and superior service quality, catering to sophisticated demand from large corporate and governmental clients seeking comprehensive security resilience.

AI Impact Analysis on Security Guarding Services Market

Users frequently inquire about how Artificial Intelligence (AI), Machine Learning (ML), and video analytics are transforming the traditionally labor-intensive Security Guarding Services market. Key user themes center on displacement risk for human guards, the cost-effectiveness of implementing AI-powered surveillance systems, and the improved capabilities AI offers in threat detection and predictive policing compared to conventional CCTV monitoring. Furthermore, users are keen to understand the regulatory and ethical implications, particularly regarding privacy and data collection using facial recognition and behavioral analysis tools. The underlying expectation is that AI will shift the guard's role from reactive observation to proactive, technology-assisted intervention and management, requiring significantly different skill sets. Users also prioritize learning about hybrid solutions that optimally blend AI monitoring with human response teams for critical incidents.

The strategic incorporation of AI technologies is fundamentally altering the service delivery model in security guarding. AI-driven video analytics, for instance, dramatically reduce false alarms and allow security operators to focus solely on confirmed threats, significantly improving response times and operational efficiency. Predictive models using machine learning analyze historical incident data, traffic patterns, and environmental factors to identify potential security risks before they materialize, enabling proactive deployment of resources. This transition towards 'smart security' ensures that human resources are allocated only where their unique skills—such as decision-making, judgment, and physical intervention—are indispensable, thereby enhancing the overall value proposition of security service providers.

AI's influence extends beyond mere surveillance; it is deeply embedded in access control, identity verification, and operational management. For security providers, adopting AI is a necessity to remain competitive, offering sophisticated service levels required by high-value clients, especially in sectors like BFSI and logistics where precision and accountability are paramount. While initial investment costs in AI infrastructure are substantial, the long-term benefits derived from optimized labor utilization, reduced incident frequency, and superior client reporting capabilities cement AI as a core disruptive, yet beneficial, force driving the market towards more automated and intelligent security paradigms. This technological shift necessitates continuous training for security personnel, transforming them into tech-savvy security system managers rather than static observers.

- AI-powered video analytics enhance real-time threat detection and significantly minimize false alarms.

- Machine Learning algorithms enable predictive security measures by analyzing patterns in crime and operational data.

- Automation assists in optimizing patrol routes and managing workforce scheduling, increasing labor efficiency.

- Facial recognition technology, managed responsibly, enhances access control and personnel tracking in restricted areas.

- Integration of AI systems allows for seamless coordination between physical guarding and remote monitoring centers.

- AI transforms the role of human guards into specialized responders and technology supervisors.

- Enhanced data processing capabilities allow for sophisticated client reporting and security posture audits.

- Implementation of autonomous surveillance robots (drones and ground vehicles) in low-risk or large-area environments.

DRO & Impact Forces Of Security Guarding Services Market

The dynamics of the Security Guarding Services Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction of industry participants. Primary drivers include the global increase in crime rates, terrorism threats, and organized theft, compelling both private and public sectors to escalate their investment in professional security infrastructure. This heightened risk perception is coupled with the growing regulatory mandates in various high-risk industries, requiring certified and trained security personnel for compliance. However, the market faces significant restraints, chiefly concerning high operational costs associated with labor, leading to pressure on service margins, and the persistent challenge of high employee turnover within the security sector. Recruiting, training, and retaining qualified personnel capable of handling integrated technological systems remains a major constraint limiting rapid expansion and quality consistency across the market.

Opportunities in the security guarding domain are predominantly driven by technological convergence, specifically the integration of physical security services with digital solutions like IoT, cloud-based monitoring, and advanced AI analytics. This provides a pathway for specialized service diversification, allowing providers to offer high-value consulting and managed security services, moving beyond basic static guarding. Furthermore, the burgeoning demand for specialized security services in emerging sectors such as data centers, renewable energy facilities, and sophisticated logistics operations presents significant untapped market potential. The shift towards hybrid models, incorporating remote monitoring and mobile security patrols, enables companies to offer scalable and flexible security solutions tailored to evolving client needs, particularly appealing to SMEs and multi-site corporations seeking centralized management and cost optimization.

The impact forces influencing the market are multifaceted, encompassing economic factors such as global wage inflation impacting labor costs, and technological factors requiring continuous capital expenditure in system upgrades and staff training. Regulatory impact forces, including stringent licensing requirements for security personnel and data protection laws (e.g., GDPR), dictate operational standards and compliance burden, affecting smaller players disproportionately. Social factors, like public perception of safety and the increasing prevalence of workplace violence, elevate the priority of security services for employers. Collectively, these forces necessitate that security providers adopt robust labor management strategies, invest heavily in technology to optimize manual tasks, and develop highly specialized vertical market offerings to maintain profitability and secure long-term contracts in this increasingly competitive and technologically demanding industry.

Segmentation Analysis

The Security Guarding Services Market is comprehensively segmented based on Type of Service, End-User Vertical, and Geographical Region, providing granular insights into demand patterns and competitive positioning. The segmentation highlights the intrinsic preference for traditional security methods while simultaneously tracking the explosive growth of technologically enhanced solutions. By Type, Manned Guarding holds the dominant share, reflecting the essential requirement for human intervention, judgment, and visible deterrence in many high-security and public-facing environments. However, rapid deployment and scalability offered by Alarm Monitoring and Mobile Security services are capturing incremental market share due to their superior cost-efficiency in surveillance and response protocols.

The End-User segmentation reveals that the Commercial sector, encompassing office buildings, retail, and hospitality, remains the largest consumer, driven by asset protection needs and customer safety obligations. Simultaneously, the Government/Public Sector and Critical Infrastructure (e.g., ports, airports, power plants) represent high-value segments characterized by long-term contracts and stringent technical specifications, often requiring specialized, highly certified security clearances and bespoke technological integration. Understanding these vertical nuances is critical, as the security threat landscape and regulatory environment vary significantly, necessitating customized service offerings from market participants to secure and retain specialized clientele.

- By Type:

- Manned Guarding Services (Static, Patrol, Specialized)

- Alarm Monitoring and Response

- Mobile Security and Patrol Services

- Security Consulting and Risk Assessment

- Technological Surveillance and System Integration (Hybrid Services)

- By End-User:

- Commercial (Corporate Offices, Retail, Hospitality)

- Industrial (Manufacturing, Logistics, Energy)

- Residential (Gated Communities, Apartments)

- Government and Public Sector (Defense, Infrastructure, Municipal)

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Education

Value Chain Analysis For Security Guarding Services Market

The value chain for the Security Guarding Services Market is intrinsically linked to the effective recruitment, deployment, and technological enablement of security personnel. The upstream segment involves critical activities such as specialized security training academies, procurement of essential equipment (uniforms, communication gear, patrol vehicles), and increasingly, the sourcing of advanced surveillance technology, including specialized AI software licenses and high-definition camera systems. The strength of the upstream supply is heavily dependent on the quality of human resources and the provider's ability to maintain a robust pipeline of certified, highly skilled security professionals, a critical success factor given the high attrition rates common in the industry.

The midstream phase focuses on service delivery—the core operations of manned guarding, mobile patrol scheduling, and command center management. Key activities here include risk assessment, formulation of security protocols tailored to the client's specific environment, and the efficient deployment of integrated security technology. The efficiency and profitability of service providers are determined by their ability to optimize labor utilization, manage scheduling complexity across multiple client sites, and ensure regulatory compliance in all operational zones. Sophisticated providers often use workforce management software to maximize productivity and minimize downtime, linking operational efficiency directly to gross margins.

Downstream activities involve client relationship management, incident reporting, and the distribution channel, which is predominantly direct-to-client contracting, especially for large corporate and governmental accounts. However, indirect channels, such as subcontracting specialized services (e.g., executive protection or technical maintenance) or partnerships with facility management companies, also play a significant role. The distribution of services is inherently local, requiring security firms to maintain strong regional presence and local regulatory knowledge. Success in the downstream market relies heavily on service reputation, contract renewal rates, and the ability to demonstrate quantifiable improvements in client security posture, supported by detailed, technology-enabled performance reports.

Security Guarding Services Market Potential Customers

Potential customers for security guarding services span virtually every sector of the modern economy, defined by the need to protect high-value assets, maintain business continuity, and ensure personnel safety. End-users fall broadly into four high-volume categories: the Commercial Sector (retail malls, corporate campuses), the Industrial Sector (manufacturing plants, warehouses, petrochemical facilities), the Residential Sector (private estates, high-rise residential buildings), and the Governmental/Critical Infrastructure Sector. Commercial entities are primarily motivated by preventing inventory loss, securing intellectual property, and ensuring a safe customer experience, viewing security as both a necessary operating expense and a component of brand integrity. For these customers, cost-effectiveness coupled with technological integration is highly attractive.

Customers in the Industrial and Critical Infrastructure sectors represent the highest intensity users, demanding specialized, high-alert security, often around the clock, due to the high risk associated with complex processes, hazardous materials, or national security relevance. Facilities such as data centers, power generation sites, and transportation hubs require highly customized solutions involving stringent access control, comprehensive perimeter defense, and guards possessing specific technical certifications. These customers prioritize reliability, compliance with strict regulatory standards (e.g., C-TPAT, NERC CIP), and the ability of the security provider to integrate seamlessly with existing operational technologies, often resulting in multi-year, multi-million dollar contracts.

The BFSI sector, encompassing banks, insurance companies, and fintech institutions, forms another critical customer base. These entities require a delicate balance of physical security for branches and vaults, coupled with sophisticated electronic surveillance and cybersecurity integration to protect transactional data and customer privacy. Key buyers in this segment seek providers who can offer professional, courteous security presence that enhances the customer experience while maintaining a robust deterrent against robbery and fraud. The underlying need across all potential customers is a shift from purely reactive security to proactive, risk-managed resilience, driving demand for providers who excel in technology, training, and strategic consulting.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Billion |

| Market Forecast in 2033 | USD 170.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allied Universal, G4S, Securitas AB, Prosegur, GardaWorld, Loomis, Brink's, SIS Group, OCS Group, Secom Co., Ltd., MSS Security, US Security Associates (acquired), DK Security, Andrews International, Helix TCS, Tokyo Keibi Hosho (ALSOK), CPI Security Systems, China Security & Protection Group, Paragon Security, Control Risks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Security Guarding Services Market Key Technology Landscape

The core technology landscape underpinning the Security Guarding Services market is rapidly evolving from simple manual systems to sophisticated, interconnected digital platforms focused on real-time intelligence and resource optimization. Key technologies include advanced Video Surveillance Systems (VSS) equipped with high-definition, thermal, and networked IP cameras, enabling superior clarity and remote access. Crucially, the integration of Video Content Analytics (VCA) software, often powered by deep learning models, allows systems to automatically identify suspicious behaviors, unauthorized object removals, or perimeter breaches, thereby minimizing the reliance on continuous human monitoring and shifting the guarding role towards specialized intervention.

Access Control Systems (ACS) form another pillar of the technology landscape, moving away from traditional key cards to biometric solutions (fingerprint, iris, facial recognition) and mobile credentials, significantly enhancing security validation and audit trails. Furthermore, the advent of the Internet of Things (IoT) sensors and connected devices is enabling comprehensive site monitoring, tracking everything from environmental conditions to asset location. These IoT ecosystems feed data into centralized Security Information Management (SIM) platforms, which correlate inputs from various sources—alarms, video feeds, access logs—to provide security operators with a holistic, prioritized view of site status, thus facilitating rapid and informed decision-making during incidents.

Future technology advancements are centered around developing Autonomous Security Solutions (ASS), including drone surveillance for wide-area monitoring (e.g., construction sites, large industrial parks) and ground-based autonomous patrolling robots equipped with sensory arrays. The convergence with cybersecurity is also paramount, as physical security systems become network-dependent, requiring robust encryption and authentication mechanisms. For security service providers, effective leveraging of these technologies is not just about adopting new gadgets, but about integrating them into an efficient, hybrid operational model that reduces response time, improves situational awareness, and ultimately, provides a higher degree of protective assurance to the end-user clientele.

Regional Highlights

- North America: North America represents a mature and technologically advanced market for security guarding services, characterized by high adoption rates of integrated security solutions and a strong emphasis on regulatory compliance, particularly in sectors like BFSI and critical infrastructure. The US market dominates the region, driven by substantial corporate spending on asset protection, coupled with sophisticated demand for specialized services such as executive protection and remote video monitoring integrated with AI analytics.

- The North American market demonstrates robust pricing stability, supported by high labor costs and the consequent necessity for technology investments aimed at labor optimization. Key drivers include increasing threats of workplace violence and the need for security protocols compliant with state and federal regulations, requiring security personnel to possess advanced training and certifications. Providers in this region focus heavily on providing end-to-end risk management consulting alongside physical guarding, positioning themselves as strategic partners rather than just service vendors.

- The increasing penetration of hybrid security models, where manned guards act as first responders managed by centralized, high-tech command centers, defines the market evolution here. Canada also contributes significantly, with a particular focus on resource sector security (oil and gas, mining), demanding expertise in rugged and remote operational environments. The market trend favors consolidation, with large players utilizing M&A to acquire specialized technical capabilities and regional footprints, ensuring they meet the sophisticated demands of large multinational corporations.

- Europe: The European security guarding market is vast and highly fragmented, governed by stringent national labor laws, varying regulatory frameworks (e.g., differing licensing requirements across the EU), and a pronounced focus on data privacy, influenced by GDPR compliance requirements for video surveillance and data collection. Western European nations, including the UK, Germany, and France, hold the largest market shares, driven by high commercial activity and strong demand from the retail, public transport, and governmental sectors.

- A critical trend in Europe is the strong push towards sustainable and ethical security provision, with public sector contracts often emphasizing social responsibility and high standards of employee welfare. The emphasis on labor quality means European providers invest heavily in training and professional certification. However, the high cost of labor across most of Western Europe accelerates the adoption of mobile security patrols, alarm monitoring, and technological solutions like perimeter detection systems to achieve cost efficiencies without compromising security effectiveness.

- Eastern Europe is experiencing rapid growth, fueled by rising commercial real estate development, increasing foreign investment in manufacturing, and the modernization of infrastructure, leading to demand for internationally compliant security standards. The market structure dictates that security firms must navigate complex cross-border regulations if they operate across multiple EU states, making local regulatory expertise a significant competitive advantage and a necessary requirement for large-scale corporate contracts.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally, propelled by explosive urbanization, massive infrastructural investments (such as ports, logistics hubs, and smart cities projects), and the expansion of the manufacturing and technology sectors across China, India, and Southeast Asia. The market is characterized by a high volume of demand for traditional manned guarding, primarily due to lower labor costs compared to Western counterparts, making human presence a highly cost-effective deterrent.

- However, technological adoption is accelerating rapidly, particularly in technologically advanced economies like Japan, South Korea, and Singapore, which are pioneers in deploying robotics, facial recognition, and AI-driven surveillance in public safety and commercial security applications. These countries are setting global benchmarks for integrating smart city technology with physical security services. India and China represent the largest untapped market potential, with security spending increasing exponentially driven by growing affluence and the subsequent need for asset protection in retail, corporate, and high-net-worth residential sectors.

- The regional challenge lies in regulatory fragmentation and varying levels of professionalization among local providers. International security firms entering APAC often focus on large multinational clients who require standardized global security protocols, while local firms compete aggressively on price for domestic contracts. The key growth driver remains the unprecedented scale of construction and industrial expansion, necessitating large-scale, 24/7 static guarding and mobile patrol capabilities across complex industrial sites and sprawling economic zones.

- Latin America: The Latin American security guarding services market is strongly influenced by socio-economic factors, including high rates of crime, political instability, and pervasive concerns over personal safety and corporate theft. This environment necessitates high levels of security expenditure, making it a critical market for security services despite underlying economic volatility. Brazil and Mexico are the dominant markets, generating the majority of regional revenue, driven by robust demand from the mining, energy, and retail banking sectors.

- Security services in Latin America often involve higher levels of risk and specialized requirements, such as armored transport (a key service offered by major providers like Prosegur and GardaWorld), technical surveillance for high-value targets, and rapid alarm response capabilities in densely populated urban centers. The market is highly price-sensitive but willing to pay premiums for perceived quality, reliability, and guaranteed response times, given the prevalence of serious security incidents.

- Technological adoption, while historically slower than in North America, is catching up, particularly in sophisticated access control and GPS tracking for mobile patrols, utilized to enhance accountability and safety of the security workforce. Foreign investment continues to flow into sectors requiring robust security, maintaining steady demand. Providers must expertly navigate complex local labor laws and operate under elevated threat levels, making deep local knowledge and strong relationships with law enforcement vital for successful operations.

- Middle East and Africa (MEA): The MEA region presents a diverse and rapidly expanding market, segmented largely between the high-spend economies of the Gulf Cooperation Council (GCC) countries and the rapidly developing but heterogeneous markets across Africa. The GCC market (UAE, Saudi Arabia, Qatar) is characterized by massive state-led infrastructure projects (e.g., NEOM, Expo 2020 sites), demanding world-class security solutions, often incorporating advanced technology like biometrics, integrated command centers, and specialized event security.

- GCC nations prioritize prestige and technological sophistication, leading to significant investments in smart security solutions and partnerships with global leaders in physical security technology. Regulations here are strict regarding the licensing and management of security personnel, often necessitating high standards of appearance and training appropriate for highly sensitive diplomatic and commercial environments. The growth is intrinsically tied to large government initiatives in tourism, finance, and critical energy infrastructure, ensuring stable, high-value contracts.

- In Africa, the security market is fragmented, with significant demand driven by the resource sector (oil, gas, mining) and increasing penetration of multinational corporations requiring standardized security protocols. Challenges include logistical complexity, varying regulatory compliance, and localized threats. The need for basic manned guarding remains extremely high due to low labor costs, but there is emerging demand for sophisticated remote monitoring and mobile security to cover vast, often remote, operational areas, signaling a gradual shift toward hybrid service models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Security Guarding Services Market, analyzing their strategic initiatives, market positioning, service offerings, and recent merger and acquisition activities.- Allied Universal

- G4S

- Securitas AB

- Prosegur

- GardaWorld

- Loomis

- Brink's

- SIS Group

- OCS Group

- Secom Co., Ltd.

- MSS Security

- US Security Associates

- DK Security

- Andrews International

- Helix TCS

- Tokyo Keibi Hosho (ALSOK)

- CPI Security Systems

- China Security & Protection Group

- Paragon Security

- Control Risks

Frequently Asked Questions

Analyze common user questions about the Security Guarding Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Security Guarding Services Market?

The primary driver is the escalating global risk landscape, encompassing heightened corporate risk exposure to crime, theft, and security breaches, alongside increasing regulatory mandates requiring certified security protocols, particularly within critical infrastructure and high-value commercial sectors. This results in sustained demand for professional, comprehensive risk mitigation solutions.

How is AI and technology integration impacting the traditional role of a security guard?

AI, through advanced video analytics and predictive algorithms, is shifting the security guard's role from passive observation to proactive management and specialized response. Technology optimizes surveillance and automates routine tasks, allowing human guards to focus on judgment-intensive tasks, client interaction, and critical incident intervention, fostering a hybrid service model.

Which segment holds the largest share in the Security Guarding Services Market?

The Manned Guarding Services segment currently holds the largest market share. This dominance is due to the non-substitutable necessity for human presence as a visible deterrent, the ability of trained personnel to exercise judgment in complex situations, and the requirement for physical security presence in high-risk and customer-facing environments.

What are the main restraints affecting the profitability of security service providers?

Major restraints include high operational costs associated with labor, driven by rising minimum wages and benefits, coupled with the persistent industry challenge of high employee turnover rates. These factors necessitate continuous investment in recruitment, training, and technology adoption to optimize labor efficiency and maintain profitability margins.

Which geographical region is expected to show the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is fueled by rapid industrialization, massive infrastructure development, increasing urbanization, and the nascent professionalization of security services across emerging economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager