Security Inspection Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433940 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Security Inspection Equipment Market Size

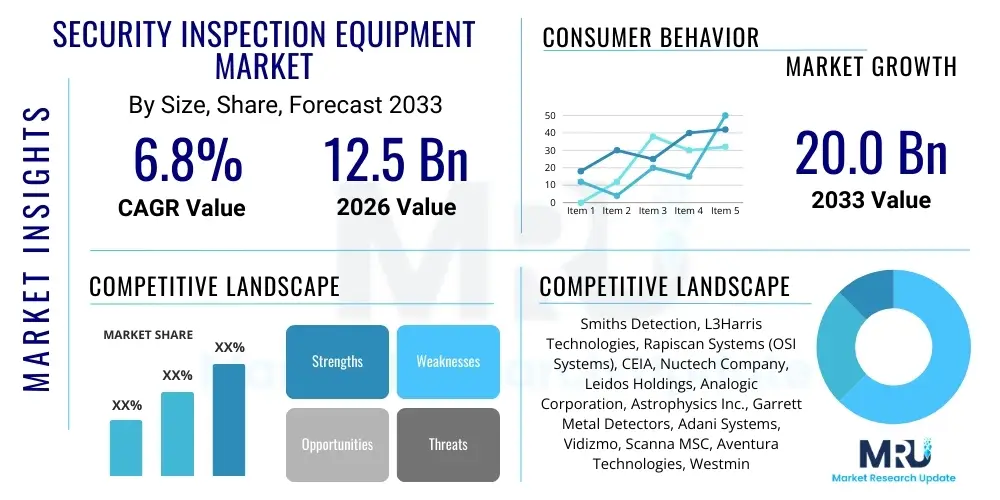

The Security Inspection Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 20.0 Billion by the end of the forecast period in 2033.

The robust growth trajectory of the security inspection equipment market is fundamentally driven by escalating global security threats, including terrorism, illicit trafficking, and geopolitical instability. Governments and private entities globally are increasing their investments in sophisticated inspection technologies to enhance public safety and protect critical infrastructure. This surge in demand spans various sectors, notably aviation, where regulatory bodies continuously mandate stricter passenger and cargo screening protocols, pushing technology providers to innovate rapidly in areas like automated threat detection and non-intrusive imaging.

Furthermore, the digitalization of inspection processes, coupled with the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML), is refining operational efficiency and reducing false alarm rates. The expansion of mass transit systems, coupled with significant infrastructural development in emerging economies, also necessitates the deployment of advanced screening solutions for perimeter protection and access control. This pervasive need for enhanced detection capabilities, moving beyond traditional X-ray systems toward networked, intelligent screening platforms, cements the market’s positive long-term outlook.

Security Inspection Equipment Market introduction

The Security Inspection Equipment Market encompasses a wide array of specialized devices and systems designed to detect prohibited items, contraband, or threats concealed within baggage, cargo, vehicles, or on individuals. Key products include X-ray baggage scanners, metal detectors (walk-through and handheld), Explosive Trace Detectors (ETD), advanced computed tomography (CT) systems, and integrated screening lanes. These sophisticated tools are crucial for maintaining safety and operational integrity across high-security environments, ensuring regulatory compliance, and mitigating risks associated with unauthorized materials, weapons, and explosives. The primary objective of these systems is non-intrusive and rapid assessment, allowing for high throughput while maintaining stringent security standards.

Major applications of security inspection equipment are concentrated in sectors characterized by high human traffic and critical infrastructure status. The aviation industry stands as the largest consumer, utilizing equipment for passenger screening, checked baggage inspection, and cargo examination. Equally vital are border security and customs applications, where advanced scanners deter smuggling and detect illicit goods. Moreover, public venues, including stadiums, courthouses, government buildings, and mass transit stations (rail and subway), increasingly rely on these systems to secure perimeters and entry points. The underlying benefit of deploying such equipment is the proactive deterrence and effective interception of security threats before they can materialize, thereby safeguarding lives and assets while facilitating smooth operational flow.

Key driving factors accelerating market adoption include stringent global aviation security mandates, particularly those issued by organizations like the Transportation Security Administration (TSA) and the European Civil Aviation Conference (ECAC), which necessitate continuous technology upgrades. Furthermore, the rising global threat perception from terrorism and organized crime drives governmental spending on national security infrastructure. Technological advancements, such as high-definition imaging, multi-view detection, and automated object recognition powered by AI, are simultaneously improving system performance and justifying significant capital investments by end-users seeking higher efficiency and lower total cost of ownership over the equipment lifecycle.

Security Inspection Equipment Market Executive Summary

The Security Inspection Equipment Market is experiencing rapid evolution, characterized by a shift from standalone inspection devices to integrated, networked security ecosystems. Business trends emphasize system interoperability, facilitated by open architecture standards, allowing different manufacturers' equipment to communicate and share threat data seamlessly. This shift is crucial for high-throughput environments like large international airports or major logistics hubs, where centralized command and control of distributed screening assets maximize efficiency. Furthermore, market competition is increasingly focused on service-based models, including predictive maintenance and remote diagnostics, rather than purely hardware sales, ensuring longevity and optimal performance of deployed systems.

Regional trends indicate North America and Europe retaining market leadership due to high levels of regulatory maturity and substantial governmental security budgets, driving the early adoption of cutting-edge technologies like Computed Tomography (CT) systems for checked baggage screening. However, the Asia Pacific (APAC) region is forecasted to demonstrate the highest growth rate, fueled by massive investments in new airport construction, expansion of urban rapid transit networks, and heightened geopolitical security concerns, particularly in large economies such as China and India. The Middle East also remains a critical market, driven by high-profile sporting events, tourism, and sustained infrastructure spending requiring world-class security solutions.

Segment trends highlight the dominance of X-ray and screening systems in terms of revenue, primarily driven by aviation and cargo applications. Within this segment, the fastest growth is observed in advanced non-intrusive inspection (NII) technologies, including advanced explosive detection systems (EDS) and millimeter-wave body scanners. The segment breakdown by application shows sustained demand from the transportation vertical, while emerging growth vectors include the commercial security sector, particularly protecting data centers, critical utilities, and corporate campuses that require sophisticated access denial capabilities integrated with perimeter security infrastructure. The focus across all segments is on achieving minimal disruption to the flow of people and goods while maximizing detection accuracy.

AI Impact Analysis on Security Inspection Equipment Market

Common user questions regarding AI's impact on the Security Inspection Equipment Market typically revolve around the efficacy of automated threat recognition, the reduction of human error, and the feasibility of integrating AI into legacy systems. Users are concerned about the reliability of AI algorithms in recognizing novel threats and the potential for increased system complexity or high capital expenditure. They also seek clarity on how AI can alleviate the staffing challenges faced by security operators, particularly in managing the cognitive load associated with continuous, monotonous screening tasks. Overall, the collective expectation is that AI will transform screening from a manual interpretation task into a highly automated, data-driven security function that minimizes operational bottlenecks and drastically improves detection standards.

The integration of deep learning models and computer vision into security inspection equipment is revolutionizing image analysis. AI algorithms are trained on vast datasets of threat materials and benign objects, enabling them to automatically identify prohibited items—such as knives, firearms, and components of improvised explosive devices—with unprecedented speed and accuracy. This capability significantly reduces the reliance on subjective human interpretation, thereby standardizing security checkpoint performance globally. Furthermore, AI assists in contextual understanding, such as distinguishing between high-density legitimate items and potential threats, which is critical for reducing the costly occurrence of false alarms that disrupt operational flow.

Beyond image analysis, AI facilitates predictive maintenance and optimizes throughput management within screening lanes. By analyzing operational data, AI systems can anticipate equipment failures, schedule maintenance proactively, and dynamically adjust system settings based on real-time traffic volumes. This holistic approach ensures maximum system uptime and responsiveness, moving security operations toward a smart, interconnected environment. Ultimately, the successful deployment of AI is key to scaling security operations without proportionally increasing personnel requirements, making it a pivotal technology investment across high-volume sectors like air travel and logistics.

- Deployment of deep learning for automated threat recognition (ATR) in X-ray and CT scanners, reducing operator cognitive load.

- Enhanced false alarm reduction through sophisticated material discrimination algorithms powered by machine learning, improving throughput efficiency.

- Predictive analytics for maintenance scheduling, ensuring maximum system availability and minimizing unscheduled downtime.

- Integration of multi-sensor data fusion capabilities, where AI processes input from millimeter-wave, X-ray, and trace detectors simultaneously for comprehensive assessment.

- Real-time object recognition and classification in cargo and baggage screening, accelerating the identification of high-risk items.

- Facilitation of standardized security procedures globally by providing consistent, objective threat evaluation irrespective of operator experience.

- Development of adaptive screening protocols, allowing systems to dynamically adjust sensitivity and inspection depth based on threat level intelligence.

- AI-powered video surveillance integration with physical inspection points to track individuals flagged during screening procedures.

- Optimization of security lane configurations and staffing levels through AI-driven traffic flow analysis and queue management.

DRO & Impact Forces Of Security Inspection Equipment Market

The dynamics of the Security Inspection Equipment Market are governed by powerful drivers related to global security mandates and technological opportunities, moderated by significant restraints such as high capital investment and data privacy concerns. Market drivers center on the mandatory nature of security upgrades in aviation and critical infrastructure, often imposed by international regulatory bodies, forcing continuous adoption cycles. Opportunities are abundant in the integration of AI, the transition to networked systems, and expansion into emerging markets requiring foundational security installations. Conversely, restraints involve the substantial cost of deploying advanced equipment, particularly CT scanners, which creates financial barriers for smaller entities, alongside complex geopolitical export restrictions impacting technology proliferation.

Key drivers include the pervasive threat of organized criminal activity and transnational terrorism, demanding resilient security measures capable of detecting sophisticated, low-signature threats. Rapid growth in international trade and the logistics sector further drives demand for advanced cargo and vehicle inspection systems to combat contraband and supply chain vulnerabilities. The continuous evolution of screening standards, particularly the move towards higher-resolution imaging and automated detection systems (like those certified by TSA and ECAC), forces manufacturers to commit heavily to research and development, creating a virtuous cycle of innovation and adoption. These external factors exert sustained upward pressure on market growth, validating continued investments in security infrastructure globally.

Restraints are primarily rooted in budgetary limitations of end-users and the lengthy procurement processes often associated with governmental tenders. Furthermore, the operational challenge of ensuring high system accuracy while maintaining a high flow rate remains a persistent constraint, particularly in high-volume settings like transit hubs. The opportunity landscape is defined by the ongoing modernization of existing infrastructure, the development of portable and mobile inspection solutions for flexible deployment, and the increasing focus on cyber security aspects of networked inspection equipment, presenting avenues for specialized security providers. The primary impact forces are regulatory compliance requirements, the pace of AI integration, and the overall global security spending derived from national defense priorities.

Segmentation Analysis

The Security Inspection Equipment Market is extensively segmented based on the type of technology utilized, the application environment, and the end-user industry. The core segmentation by technology reflects the functional difference and sophistication level of the devices, ranging from conventional metal detectors to highly advanced computed tomography systems and spectroscopic analyzers. The application segmentation delineates the specific operating context, such as personnel screening versus cargo inspection, each requiring specialized equipment characteristics tailored to throughput and threat matrix requirements. Furthermore, end-user segmentation clearly indicates the primary market verticals, with transportation consistently dominating demand due to regulatory stringency.

The strategic analysis of these segments reveals that while traditional X-ray screening remains foundational, the fastest revenue growth is projected in the advanced imaging and trace detection categories. This growth is driven by the mandate to detect non-metallic and liquid explosives, which older technologies struggle to identify effectively. Geographically, segmentation underscores the maturation of demand in developed markets—focusing on replacement and upgrade cycles (e.g., swapping conventional X-ray for CT systems)—versus explosive new installations across APAC and MEA regions driven by infrastructure build-out. Understanding these segments is critical for manufacturers to tailor their R&D focus and go-to-market strategies, emphasizing either cost efficiency for emerging markets or cutting-edge performance for high-security environments.

- By Type

- X-ray Screening Systems (Conventional X-ray, Dual-Energy X-ray, Computed Tomography (CT) Systems)

- Metal Detectors (Walk-through Metal Detectors (WTMDs), Handheld Metal Detectors (HHMDs))

- Explosive Trace Detectors (ETD) (Ion Mobility Spectrometry (IMS), Chemiluminescence)

- Non-Intrusive Inspection (NII) Systems (Vehicle and Cargo Inspection Systems, Gamma-ray, High-energy X-ray)

- Body Scanners (Millimeter-Wave Scanners, Backscatter X-ray)

- Liquid Explosives Detection Systems (LEDS)

- By Application/Component

- Hardware (Sensors, Imaging Components, Conveyor Systems)

- Software (Image Analysis Software, Automated Threat Recognition (ATR), Network Management Systems)

- Services (Installation, Maintenance, Training, System Integration)

- By End User

- Transportation (Aviation Security, Mass Transit/Rail Stations, Ports and Border Crossings)

- Critical Infrastructure (Government Buildings, Military, Data Centers, Power Plants)

- Commercial Security (Corporate Campuses, Hospitals, Hotels, Sports Venues)

- Correctional Facilities and Courthouses

- Oil and Gas Sector

- By Technology

- Conventional Imaging Technology

- Advanced Imaging Technology (AIT)

- Trace Detection Technology

- Spectroscopy and Radiation Detection

Value Chain Analysis For Security Inspection Equipment Market

The value chain for the Security Inspection Equipment Market is complex, beginning with highly specialized upstream activities focused on material science and component manufacturing, extending through sophisticated integration and assembly, and concluding with critical downstream deployment, maintenance, and service delivery. Upstream analysis involves suppliers of critical components such as high-energy X-ray sources, detectors (e.g., scintillators and photodiodes), and highly specialized imaging software. The scarcity and proprietary nature of some of these components, particularly high-power generation technology and advanced sensor arrays, often grant significant leverage to these niche component suppliers, emphasizing the need for robust supply chain diversification and management by original equipment manufacturers (OEMs).

In the midstream, OEMs focus heavily on research and development to integrate these components into certified, regulatory-compliant systems. This stage is capital-intensive, involving complex engineering processes to ensure high performance, reliability, and compliance with stringent international security standards (e.g., TSA checkpoint specifications). Direct distribution channels are prevalent, especially for large, customized systems like airport CT scanners or massive cargo inspection portals, where direct engagement allows for better customization, installation supervision, and comprehensive service contracts. Indirect channels, often involving system integrators or authorized regional distributors, are typically utilized for smaller, standardized products like handheld detectors or walk-through metal detectors, allowing for broader geographic market penetration.

Downstream activities are dominated by installation, integration with existing security infrastructure, and ongoing services. Given the mission-critical nature of the equipment, maintenance contracts and software updates are major, recurring revenue streams, shifting the focus towards lifecycle management and system upgrades rather than singular sales events. End-users, predominantly government agencies and large transport operators, prioritize vendors who can offer end-to-end solutions, comprehensive training, and guaranteed service level agreements. The long lifecycle and high cost of the equipment necessitate a strong service backbone, making post-sale support a crucial differentiator and a key source of competitive advantage in the mature phase of the market.

Security Inspection Equipment Market Potential Customers

The primary consumers and end-users of security inspection equipment are governmental and large institutional bodies responsible for national security, public safety, and critical infrastructure protection. The largest segment remains the aviation industry, encompassing commercial airports, private air freight carriers, and dedicated governmental airbases, all mandated to enforce rigorous screening protocols for passengers, checked luggage, and air cargo. This industry segment drives demand for high-throughput, highly accurate technology like CT-based Explosive Detection Systems (EDS) and advanced millimeter-wave personal screening devices, justifying high capital expenditure based on regulatory compliance and security imperative.

Beyond aviation, the mass transit sector, including urban subways, high-speed rail networks, and intermodal transport hubs, represents a rapidly expanding customer base, particularly as these systems become targets for security threats. Although these environments often require less intrusive or more concealed detection methods due to high traffic volume, the trend is moving toward integrated security checkpoints utilizing hidden or less visually disruptive screening technologies. Furthermore, governmental and military facilities, including embassies, strategic defense installations, and high-security research laboratories, represent critical potential customers requiring customized, robust perimeter and access control inspection solutions capable of deterring sophisticated insider and external threats.

A growing segment of potential customers includes operators of critical national infrastructure (CNI) such as power generation facilities, major telecommunication exchanges, and large-scale data centers. These commercial and government-owned entities require advanced layered security solutions, utilizing everything from advanced trace detection at sensitive access points to high-energy non-intrusive inspection for vendor and supply deliveries. The increasing regulatory pressure to protect against physical threats and sabotage is turning CNI protection into a significant long-term growth opportunity for vendors specializing in integrated security equipment and operational technology (OT) security convergence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smiths Detection, L3Harris Technologies, Rapiscan Systems (OSI Systems), CEIA, Nuctech Company, Leidos Holdings, Analogic Corporation, Astrophysics Inc., Garrett Metal Detectors, Adani Systems, Vidizmo, Scanna MSC, Aventura Technologies, Westminster Group, S2 Global, Varex Imaging, VOTI Detection, Gilardoni S.p.A., Optosecurity, Pingshan Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Security Inspection Equipment Market Key Technology Landscape

The technology landscape in the security inspection equipment market is defined by a rapid progression toward non-intrusive, multi-sensor detection platforms that leverage sophisticated algorithms to enhance accuracy and speed. Key innovations center on Computed Tomography (CT) technology, which provides high-resolution 3D volumetric images of baggage and cargo, enabling automated identification of complex threats that were challenging for traditional 2D X-ray systems. This shift is particularly pronounced in checked baggage screening in aviation, driven by mandates requiring superior Explosive Detection System (EDS) capabilities. Furthermore, millimeter-wave technology is now standard for personal screening, offering a privacy-friendly, rapid method to detect both metallic and non-metallic objects concealed under clothing, thereby improving checkpoint efficiency significantly.

Another crucial technological development involves the continuous advancement of Explosive Trace Detection (ETD) systems. Modern ETD devices utilize ultra-sensitive techniques, such as Ion Mobility Spectrometry (IMS) and mass spectrometry, capable of detecting minute quantities of explosive residues or narcotics, addressing the threat of increasingly sophisticated homemade and plastic explosives. These systems are often integrated directly into screening lanes or deployed as mobile units for secondary screening. The convergence of these hardware technologies is enhanced by powerful software platforms, where AI-powered Automated Threat Recognition (ATR) systems analyze the data stream from multiple sensors, providing real-time feedback and minimizing the variability introduced by human interpretation.

Looking forward, the technology landscape is being shaped by miniaturization and mobility, leading to the development of highly effective portable X-ray systems and mobile Vehicle and Cargo Inspection (VCI) units, crucial for deployment in temporary checkpoints, disaster zones, or remote border areas. Furthermore, advancements in spectroscopy and nuclear quadrupole resonance (NQR) are being explored for non-radioactive bulk materials analysis, offering potential breakthroughs in detecting liquid threats and tightly packed substances without disassembly. Overall, the emphasis is placed on networked capabilities, allowing security managers to monitor and manage all deployed assets remotely, integrating physical inspection data seamlessly into broader, intelligence-led security frameworks.

Regional Highlights

Regional dynamics play a significant role in shaping the demand, technology adoption rates, and regulatory compliance requirements across the Security Inspection Equipment Market.

- North America: This region maintains the largest market share, characterized by high technological maturity, stringent governmental mandates (especially from the TSA), and substantial defense and security budgets. The market is primarily driven by replacement cycles, specifically the large-scale transition from conventional X-ray to CT-based EDS systems in major airports, ensuring high investment in advanced imaging and AI integration.

- Europe: A mature market focused heavily on regulatory compliance set by ECAC and the European Union. Demand is robust across both aviation and mass transit sectors, with a strong focus on interoperability and seamless security integration across national borders. The region shows high adoption rates for advanced personal screening technologies and sophisticated perimeter inspection systems.

- Asia Pacific (APAC): Expected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to unprecedented investment in airport expansion, railway infrastructure development, and urbanization. Key countries like China, India, and Southeast Asian nations are deploying large volumes of new inspection equipment, moving rapidly from basic security toward integrated, smart security solutions.

- Middle East and Africa (MEA): Growth is primarily driven by mega-events (e.g., global sporting events) and continuous investment in oil & gas infrastructure and tourism. High-security requirements necessitate the adoption of premium, cutting-edge technology, particularly for border security and high-profile critical infrastructure protection, making it a lucrative market for high-end equipment suppliers.

- Latin America: This region is characterized by steady growth, primarily driven by investments in modernization of ports and airports to facilitate international trade and combat drug trafficking. The market often favors cost-effective, durable equipment, with gradual adoption of advanced imaging techniques influenced by international lending and security aid programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Security Inspection Equipment Market.- Smiths Detection

- L3Harris Technologies

- Rapiscan Systems (OSI Systems)

- CEIA

- Nuctech Company

- Leidos Holdings

- Analogic Corporation

- Astrophysics Inc.

- Garrett Metal Detectors

- Adani Systems

- Vidizmo

- Scanna MSC

- Aventura Technologies

- Westminster Group

- S2 Global

- Varex Imaging

- VOTI Detection

- Gilardoni S.p.A.

- Optosecurity

- Pingshan Technology

- Kromek Group PLC

- Autoclear (A Heico Company)

- Bruker Corporation

- Chemring Group

- Teknotherm AS

- HTDS (High Technology Detection Systems)

- Fisher Scientific

- Thermo Fisher Scientific

- Shanghai Nuo Industrial Co., Ltd.

- Global Security Scanning

Frequently Asked Questions

Analyze common user questions about the Security Inspection Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major technological shift is currently driving the security inspection equipment market?

The primary technological shift driving the market is the transition from conventional 2D X-ray systems to advanced 3D Computed Tomography (CT) technology for both checked baggage and carry-on screening, alongside the pervasive integration of Artificial Intelligence (AI) for Automated Threat Recognition (ATR) to enhance accuracy and operational throughput significantly.

How does Artificial Intelligence (AI) specifically improve screening efficiency?

AI improves screening efficiency by instantly analyzing complex X-ray and CT images to flag potential threats, dramatically reducing the false alarm rate (FAR) and minimizing the need for repetitive manual secondary inspections. This automation allows security personnel to focus only on highly suspicious items, leading to faster passenger processing and maximized system uptime.

Which industry segment holds the largest share of the security inspection equipment market?

The Transportation segment, particularly Aviation Security (airports), holds the largest market share. This dominance is due to mandatory, complex, and high-volume screening requirements for passengers, checked baggage, and air cargo, enforced by strict international and national regulatory bodies like the TSA and ECAC.

What are the primary restraints affecting the growth of this market?

The key restraints include the high initial capital expenditure required for deploying advanced systems like CT scanners and large Non-Intrusive Inspection (NII) cargo systems. Additionally, the lengthy and complex governmental procurement processes and challenges related to integrating proprietary older systems with new networked infrastructure slow adoption rates in certain regions.

What are Explosive Trace Detectors (ETD) primarily used for in modern security checkpoints?

ETD systems, often utilizing Ion Mobility Spectrometry (IMS), are used for secondary screening at checkpoints to detect microscopic traces of explosive or narcotic materials on surfaces (hands, bags, packages). They serve as a critical component in the layered security strategy, identifying chemical signatures that may not be visible through imaging technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager