Self-Directed Investors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435361 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Self-Directed Investors Market Size

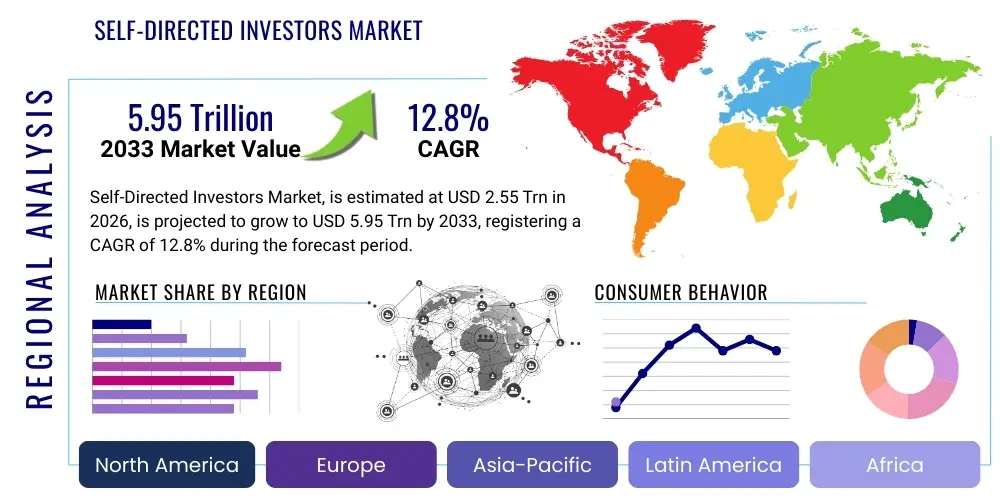

The Self-Directed Investors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $2.55 Trillion in 2026 and is projected to reach $5.95 Trillion by the end of the forecast period in 2033.

Self-Directed Investors Market introduction

The Self-Directed Investors Market encompasses the financial ecosystem supporting individuals who manage their investment portfolios without relying primarily on full-service financial advisors. This market is defined by the proliferation of accessible digital brokerage platforms, innovative fintech tools, and comprehensive financial data sources that empower retail investors to execute trades, conduct research, and manage asset allocation autonomously. Key offerings in this segment include commission-free trading platforms, sophisticated charting tools, fractional share ownership capabilities, and educational resources designed to democratize investment knowledge and participation. The core product description centers on platforms that provide direct access to equity markets, fixed income products, derivatives, cryptocurrencies, and exchange-traded funds (ETFs), allowing users complete control over their transactional decisions and portfolio strategies.

Major applications of self-directed investing span active trading, long-term retirement planning (through self-managed IRAs or similar accounts), speculative ventures into niche asset classes, and sophisticated portfolio construction utilizing tools previously reserved for institutional investors. The expansion of these applications is heavily facilitated by enhanced mobile interfaces and seamless integration of banking and brokerage services. A primary benefit driving the adoption of self-directed investment is the significant reduction in costs, especially the movement towards zero-commission trading, which lowers the barrier to entry for smaller investors. Furthermore, self-direction offers transparency, immediate control over capital, and the opportunity for investors to align their financial decisions precisely with their personal values and risk tolerance, leading to higher perceived autonomy.

The market is predominantly driven by powerful socio-economic and technological shifts. The widespread availability of high-speed internet and the ubiquity of smartphones have made financial market access instantaneous. Demographic shifts, particularly the increasing financial literacy and participation of younger generations (Millennials and Gen Z) who prefer digital-first solutions and distrust traditional financial intermediaries, strongly fuel growth. Moreover, regulatory changes supporting competition and transparency within the financial sector, alongside highly competitive marketing efforts by fintech disruptors, continue to accelerate the transition of retail assets from managed accounts to self-directed platforms, fundamentally reshaping the landscape of retail finance globally.

Self-Directed Investors Market Executive Summary

The Self-Directed Investors Market is experiencing robust acceleration, underscored by significant business trends focusing on platform consolidation, feature diversification, and enhanced regulatory scrutiny concerning investor protection and market manipulation. Key business trends include the merging of wealth management and brokerage services, where platforms are integrating robo-advisory tools and personalized educational content to attract and retain users across varying sophistication levels. Geographically, North America remains the most mature and dominant region due to high household wealth and early adoption of digital brokerage technologies, but the Asia Pacific region, led by China and India, represents the fastest-growing market, driven by rapidly expanding middle-class populations and increasing smartphone penetration. European growth, while steady, is guided by the implementation of MiFID II regulations, pushing for greater transparency and lower costs, thereby encouraging self-directed engagement.

Segment trends reveal a pronounced migration towards mobile-first trading applications, indicating that convenience and accessibility are paramount factors for the modern investor. The segment categorized by investment type shows ETFs and fractional shares achieving disproportionate growth, appealing to risk-averse or novice investors looking for diversification with low capital outlay. Furthermore, there is a distinct segmentation emerging based on investor age, with younger investors heavily participating in high-frequency trading and alternative assets like cryptocurrencies, pushing platforms to innovate in risk management and compliance tailored to high-volatility products. Established investors, conversely, often leverage self-directed platforms for efficiency in managing diversified retirement portfolios, highlighting the market’s dual function as a tool for both speculation and core wealth accumulation.

In essence, the market narrative is characterized by the ongoing technological convergence of trading, banking, and data analytics, creating a highly competitive environment where user experience and security are critical differentiators. Success in this market is increasingly dependent on the ability of platforms to seamlessly integrate complex financial data, provide intuitive trading interfaces, and maintain stringent security protocols against cyber threats. The overall market trajectory indicates a sustained shift towards greater democratization of finance, making investing a commonplace activity accessible to the general population, thereby expanding the total addressable market significantly over the forecast period.

AI Impact Analysis on Self-Directed Investors Market

User inquiries regarding the influence of Artificial Intelligence (AI) on self-directed investing frequently center on themes of automation, competitive disadvantage, and the security of algorithmic recommendations. Common concerns revolve around whether AI tools will make human research redundant, the reliability and transparency of AI-driven portfolio optimization, and the potential for algorithmic bias or market manipulation when high-frequency AI models interact. Users also seek information on how AI can enhance personalized financial education, improve risk assessment accuracy for individual portfolios, and automate sophisticated trading strategies previously inaccessible to retail investors. The key consensus is that AI is fundamentally shifting the role of the self-directed investor from a pure manual executor to a decision-maker leveraging intelligent tools for optimized analysis and execution.

- Enhanced Predictive Analytics: AI algorithms analyze vast datasets (news, social media, economic indicators) to generate superior market insights and sentiment analysis, aiding investor decision-making.

- Personalized Robo-Advisory Integration: AI-powered tools offer tailored portfolio construction, automatic rebalancing, and tax-loss harvesting based on individual financial goals and risk profiles.

- Improved Risk Management: Machine learning models detect anomalies and high-risk trading behaviors faster than traditional methods, protecting both the platform and the investor.

- Automation of Execution: AI enables advanced order routing, optimizing trade timing and pricing, minimizing slippage for self-directed users engaging in complex strategies.

- Hyper-Personalized Education: AI identifies knowledge gaps and delivers customized educational content and simulation tools, accelerating investor proficiency.

- Fraud Detection and Security: Sophisticated AI systems significantly enhance platform security by identifying and mitigating sophisticated cyber threats and fraudulent activities in real time.

DRO & Impact Forces Of Self-Directed Investors Market

The Self-Directed Investors Market is driven by the decreasing cost structure associated with trading, the pervasive digital transformation across financial services, and the heightened demand for financial control among new investor demographics. Simultaneously, growth is restrained by persistent issues surrounding investor financial literacy, the inherent volatility and risk associated with self-management, and increasing regulatory pressure aimed at preventing consumer detriment in complex trading products. Significant opportunities arise from integrating blockchain technology for asset tokenization, leveraging AI for hyper-personalized investment coaching, and expanding market access to emerging economies through localized digital platforms. These forces are fundamentally impacted by the sustained speed of technological innovation, particularly in data processing and user interface design, alongside macroeconomic factors such as interest rate fluctuations and general market confidence, which directly influence retail trading volume and participation rates.

Segmentation Analysis

The Self-Directed Investors Market is highly fragmented and segmented to cater to diverse investor needs, sophistication levels, and capital availability. Segmentation analysis is crucial for platforms to tailor product offerings, user experience, and pricing models. Key segments include categorization based on the type of investment products accessed (e.g., Stocks, Derivatives, Cryptocurrencies), the platform used (e.g., Desktop-based, Mobile-only, Hybrid), the investor's trading frequency (Active Traders vs. Passive/Long-term Investors), and demographic factors such as age and net worth. The market has observed particularly dynamic growth in the mobile-only and cryptocurrency segments, reflecting a strong preference among younger demographics for accessible, high-volatility assets.

- By Investor Type

- Active Traders

- Passive/Buy-and-Hold Investors

- Retirement Focus Investors (IRA/401k Self-Managed)

- By Platform Type

- Mobile-Only Applications

- Desktop/Web-Based Brokerages

- Hybrid Platforms (Offering Digital Tools with Optional Human Consultation)

- By Investment Product

- Stocks and ETFs

- Options and Futures (Derivatives)

- Cryptocurrencies and Digital Assets

- Fixed Income Securities

- By Technology Usage

- Traditional Trading Platforms

- Robo-Advisory Enabled Platforms

- API-Integrated Algorithmic Trading Solutions

Value Chain Analysis For Self-Directed Investors Market

The value chain of the Self-Directed Investors Market begins upstream with critical providers: financial data aggregators, market makers, technology developers who supply the core trading infrastructure, and regulatory bodies setting the operational framework. Midstream operations involve the core brokerage platforms (the primary distribution channel), which integrate these components, handling account management, order execution, compliance, and user interface development. Downstream, the value culminates with the end-users—the self-directed investors—who utilize the platforms to manage their wealth. Distribution channels are predominantly direct-to-consumer digital channels (direct access via proprietary mobile apps and websites), although indirect channels, such as partnerships with financial influencers or comparison websites, also play a role in customer acquisition, emphasizing a highly streamlined, low-friction digital delivery model.

Self-Directed Investors Market Potential Customers

Potential customers for self-directed investment platforms span a wide demographic and economic spectrum, primarily targeting individuals with varying levels of financial sophistication who prioritize control and cost-efficiency. Key buyer segments include the financially literate Mass Affluent segment, typically established professionals seeking to maximize returns by avoiding advisory fees; the vast Millennial and Gen Z demographics, who exhibit a strong preference for digital interaction and personalized, transparent services; and established High Net Worth Individuals (HNWIs) who use these platforms for efficient tactical trading or diversification outside their primary wealth manager's purview. Platforms must cater to these diverse needs, offering low-cost basic accounts for novices alongside advanced analytical tools for sophisticated, high-frequency traders, ensuring the total addressable market remains broad and inclusive.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.55 Trillion |

| Market Forecast in 2033 | $5.95 Trillion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Charles Schwab, Fidelity Investments, Robinhood Markets, Interactive Brokers, E*TRADE (Morgan Stanley), TD Ameritrade (Schwab), Webull, eToro, Public.com, Vanguard Group, Freetrade, Zerodha, SoFi, DriveWealth, Zacks Trade, TradeStation, Plus500, Saxo Bank, ICICI Direct, JPMorgan Chase. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Self-Directed Investors Market Key Technology Landscape

The technology landscape for the Self-Directed Investors Market is defined by high-speed, scalable infrastructure designed to handle immense trading volumes and provide real-time data access. Central to this are robust Application Programming Interfaces (APIs) that allow seamless integration of third-party analytical tools, market data feeds, and core brokerage execution systems, facilitating algorithmic trading and automation. Furthermore, the adoption of advanced cloud computing infrastructure is paramount, enabling platforms to offer high availability, disaster recovery, and the computational power required for complex risk modeling and instantaneous settlement processes. User experience technologies, including advanced charting software, predictive search functionality, and highly intuitive mobile application interfaces, ensure optimal engagement and low friction during the investment process.

Regional Highlights

- North America: This region maintains market leadership due to high disposable income, strong penetration of digital financial services, and the competitive environment fostered by giants like Charles Schwab and Fidelity. The market here is mature but continues to innovate through advanced robo-advisory services and the integration of sophisticated tax management tools. Regulatory clarity, particularly in the US, facilitates strong investor confidence and high trading volumes across all asset classes, making it the bedrock for technological advancement in the sector.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, fueled by the rising affluence of the middle class in economies such as India, China, and Southeast Asia. Market growth is heavily concentrated in mobile-first trading solutions, as many investors bypass traditional desktop brokerage access entirely. Platforms must navigate diverse regulatory environments, but the high digital adoption rates and cultural emphasis on savings and investment create massive growth potential, particularly in retail participation in local equity markets.

- Europe: The European market is characterized by regulatory harmonization efforts, such as MiFID II, which mandates transparency and lower fees, thereby supporting self-directed trading. Key regional hubs like the UK and Germany show strong adoption, often focusing on exchange-traded funds (ETFs) and diversified portfolio management. The challenge lies in fragmented national markets and varying tax regimes, necessitating platforms to offer localized compliance and reporting features, though cross-border digital brokerages are increasingly gaining traction.

- Latin America (LATAM): While smaller, the LATAM market is rapidly expanding, driven by young populations seeking alternatives to traditional banking systems, often characterized by inflation concerns. Adoption of cryptocurrency trading and local stock market access via mobile apps are key growth drivers. Platforms entering this region often prioritize local currency support and basic, low-cost investment options to capture the emerging mass market.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, with the GCC countries showing high growth due to wealth concentration and high digital literacy, favoring self-directed platforms for international diversification. In contrast, emerging African markets focus on mobile access and micro-investment capabilities. Compliance with local financial and Shariah-compliant regulations is a crucial market entry barrier and differentiator for platforms targeting this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Self-Directed Investors Market.- Charles Schwab Corporation

- Fidelity Investments

- Robinhood Markets Inc.

- Interactive Brokers Group

- E*TRADE (Morgan Stanley)

- TD Ameritrade (acquired by Charles Schwab)

- Webull Financial LLC

- eToro Group Ltd.

- Public.com

- Vanguard Group

- Freetrade

- Zerodha Broking Ltd.

- SoFi Technologies Inc.

- DriveWealth LLC

- Zacks Trade

- TradeStation Group, Inc.

- Plus500 Ltd.

- Saxo Bank A/S

- ICICI Direct

- JPMorgan Chase & Co.

Frequently Asked Questions

Analyze common user questions about the Self-Directed Investors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Self-Directed Investors Market?

Market growth is primarily driven by the elimination of trading commissions (zero-commission models), widespread availability of mobile trading applications that lower access barriers, and the general trend of increasing financial literacy among younger demographics seeking greater control over their personal wealth management and investment strategies.

How does AI technology specifically benefit self-directed investors?

AI technology benefits self-directed investors by providing advanced tools for real-time market sentiment analysis, personalized risk assessment, automated portfolio rebalancing (robo-advising capabilities), and highly efficient order execution, enabling retail users to deploy strategies previously reserved for institutional traders.

Which geographical region shows the most significant growth potential for self-directed investing platforms?

The Asia Pacific (APAC) region, especially emerging economies like India and China, is projected to show the highest growth potential. This rapid expansion is attributed to the large, digitally native populations, burgeoning middle class, and strong adoption of mobile-first financial technology solutions for wealth accumulation.

What are the main risks associated with using self-directed investment platforms?

The primary risks include high market volatility exposure due to unsupervised decision-making, insufficient financial literacy leading to poor investment choices, potential security breaches and cyber threats, and the complexity associated with tax reporting and compliance without professional advisory support.

What is the role of fractional shares in attracting new self-directed investors?

Fractional share ownership plays a critical role in democratizing investment by allowing new or capital-constrained investors to purchase portions of high-priced stocks. This capability significantly lowers the minimum capital requirement, facilitates easy diversification, and is highly attractive to Millennial and Gen Z investors entering the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager