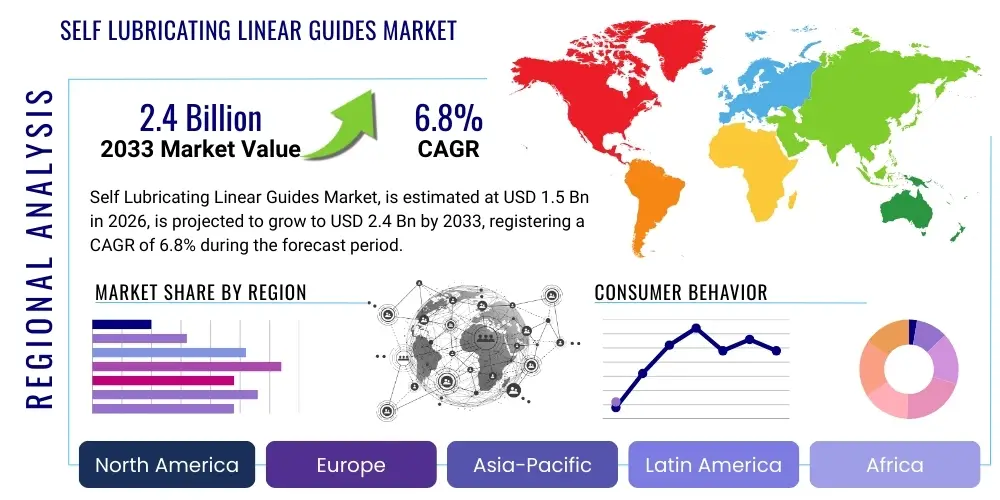

Self Lubricating Linear Guides Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439183 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Self Lubricating Linear Guides Market Size

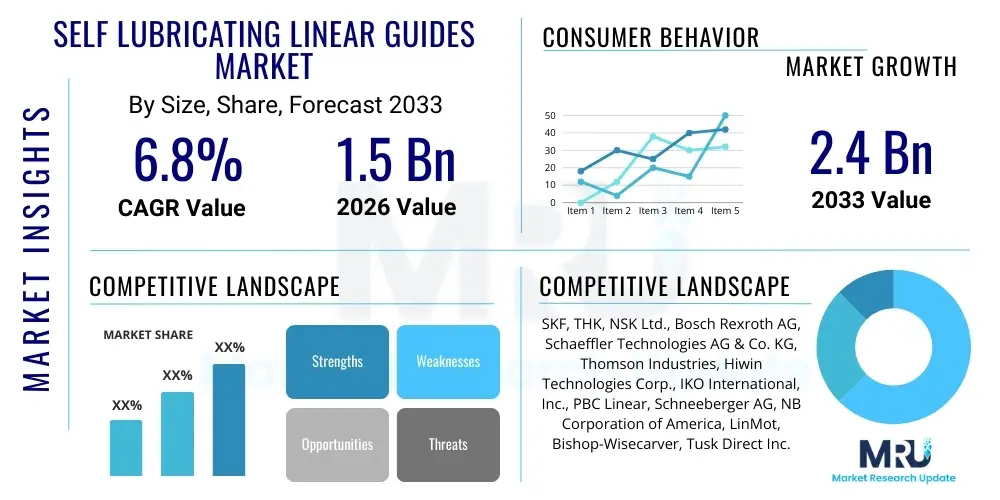

The Self Lubricating Linear Guides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Self Lubricating Linear Guides Market introduction

The Self Lubricating Linear Guides Market encompasses precision mechanical components designed to facilitate linear motion with minimized friction, maintenance, and energy consumption. Unlike traditional guides that require external lubrication systems, these guides incorporate proprietary materials or integrated reservoirs, such as self-lubricating polymers, sintered bronze, or specialty coatings, that release lubrication gradually during operation. This fundamental shift enhances operational efficiency, reduces downtime associated with maintenance routines, and significantly contributes to cleaner industrial environments, particularly in sensitive sectors like food processing, medical devices, and cleanroom manufacturing. The primary function of these guides is to ensure accurate, smooth, and repetitive motion under various load conditions, establishing them as indispensable elements in high-performance automation systems and sophisticated machinery.

The product portfolio includes various structural designs, such as linear ball guides, roller guides, and plain bearings, primarily distinguished by their load-bearing capacity, speed capabilities, and application environments. Major applications span the industrial spectrum, including sophisticated CNC machine tools requiring extreme precision, advanced robotics systems demanding high repeatability, and complex packaging machinery where high speeds and minimal maintenance are critical. Furthermore, the burgeoning demand from the semiconductor and electronics manufacturing industries, driven by the need for ultra-precise placement and handling systems, is a significant growth catalyst. The inherent benefits, such as extended service life, reduced total cost of ownership (TCO), and elimination of potential lubricant contamination risks, solidify the market position of these components as a superior alternative to conventionally lubricated systems.

Key driving factors propelling market expansion include the global trend toward Industrial Internet of Things (IIoT) integration and smart manufacturing initiatives, which necessitate robust, low-maintenance components capable of operating reliably in automated settings. Increased capital expenditure in aerospace and defense, alongside the consistent expansion of the electric vehicle (EV) manufacturing sector, further stimulates demand for reliable, lightweight, and efficient motion components. Furthermore, stringent environmental regulations urging industries to minimize waste and reduce the use of oil-based lubricants provide a strong regulatory tailwind for self-lubricating solutions, positioning them favorably for long-term sustainable growth across diverse geographical regions.

Self Lubricating Linear Guides Market Executive Summary

The Self Lubricating Linear Guides Market demonstrates robust expansion, largely fueled by pervasive business trends emphasizing automation, precision engineering, and sustainability across manufacturing verticals. Contemporary business operations are increasingly prioritizing continuous operation and minimizing reliance on manual intervention, which directly elevates the demand for low-maintenance, high-reliability components. The shift towards lean manufacturing principles and the adoption of high-speed automation in consumer electronics and automotive assembly lines represent critical market drivers. Geographically, the market is characterized by intense competition, with Asia Pacific maintaining dominance due to massive investments in factory automation, particularly in China, Japan, and South Korea. North America and Europe, meanwhile, lead in the adoption of specialized, high-performance guides tailored for medical technology and aerospace applications, driven by stringent quality standards and technological maturity.

Regional trends indicate divergent growth pathways. Asia Pacific's growth is volume-driven, supported by widespread industrial expansion and government initiatives promoting advanced manufacturing infrastructure. Conversely, developed markets in North America and Europe are value-driven, focusing on premium, custom-engineered solutions that offer superior precision, durability, and integration capabilities for smart factory environments. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, spurred by diversification efforts away from resource extraction and towards localized industrialization and infrastructure development. These regions present opportunities for mid-range products offering reliable performance and reasonable total cost of ownership for nascent manufacturing bases.

Segmentation trends highlight the increasing prominence of polymer-based and composite guides, preferred for their inherent self-lubricating properties, weight advantages, and corrosion resistance, particularly in harsh or sanitary environments. While traditional ball and roller guides remain significant due to their high load capacity, the fastest growth is observed within specialized plain bearing segments utilizing advanced plastic materials. Application-wise, the robotics and automation segment is the dominant growth engine, continuously demanding smaller, faster, and maintenance-free guides. Furthermore, the medical equipment segment—including diagnostic platforms and surgical robots—exhibits accelerated adoption due to the critical requirement for non-contaminating, highly sterile linear motion systems.

AI Impact Analysis on Self Lubricating Linear Guides Market

User queries regarding AI's influence frequently center on how artificial intelligence and machine learning (ML) optimize the performance, maintenance schedules, and design of self-lubricating linear guides. Key concerns revolve around the integration of predictive maintenance algorithms that utilize sensor data (vibration, temperature) from guide systems to forecast lubrication needs or component failure, thereby extending operational lifespan beyond fixed maintenance schedules. Users also seek clarity on whether AI-driven design tools can accelerate the development of novel self-lubricating material compositions, optimizing friction coefficients and wear resistance based on simulated real-world stresses. The common expectation is that AI will transform linear guide systems from passive mechanical components into smart, data-generating assets contributing actively to overall machine health monitoring and operational efficiency, reducing reliance on manual inspection and enhancing component longevity.

- AI-Powered Predictive Maintenance: Utilizing ML algorithms to analyze real-time operational data (vibration, load cycles, temperature) to predict wear rates and lubrication effectiveness, thereby optimizing re-lubrication intervals or component replacement timing.

- Optimized Design and Material Science: AI tools accelerating the R&D process for novel self-lubricating materials, simulating complex tribological interactions to identify optimal polymer blends or composite structures offering superior lifespan and performance.

- Manufacturing Process Control: Integration of AI for quality assurance during the fabrication of guide rails and bearing components, ensuring dimensional accuracy and surface finish required for efficient self-lubrication mechanisms.

- Enhanced System Integration: AI platforms managing the overall motion profile of automated machinery, dynamically adjusting speed and load distribution to minimize stress on linear guides and maximize their self-lubrication efficiency.

- Digital Twin Implementation: Creation of high-fidelity digital models of linear motion systems, allowing operators to simulate the effects of different operating conditions and environment factors on the self-lubricating components before deployment.

DRO & Impact Forces Of Self Lubricating Linear Guides Market

The market for self-lubricating linear guides is strongly influenced by a robust set of drivers centered on the global automation imperative and stringent environmental demands. The primary drivers include the escalating need for reduced maintenance costs and minimized machine downtime in high-volume production environments, where traditional oil-based lubrication systems introduce risks of contamination and high maintenance overheads. Simultaneously, regulatory and corporate sustainability mandates push manufacturers toward cleaner, oil-free solutions, which self-lubricating systems inherently provide. Restraints, however, primarily involve the initial higher unit cost of specialized polymer or composite guides compared to standard steel components, and performance limitations related to extremely high temperature or exceptionally high dynamic load applications, where traditional forced lubrication might still be necessary. The high capital expenditure required for sophisticated materials R&D also acts as a minor barrier to entry for smaller manufacturers.

Opportunities in this market are vast, predominantly focusing on the customized design of guides for niche, high-growth sectors. The proliferation of collaborative robots (cobots) and lightweight automated vehicles necessitates linear motion components that are low weight, high precision, and entirely maintenance-free, opening specialized market niches. Furthermore, the drive toward miniaturization in electronics and medical devices requires the development of micro-sized self-lubricating guides capable of handling delicate assembly and alignment tasks. The potential for integrating sensing capabilities directly into the guide materials (smart self-lubricating guides) represents a significant future opportunity, enabling seamless data reporting on wear and load conditions without external sensors, further enhancing their value proposition in smart factories.

The impact forces driving the market expansion are substantial, with technological advancements in material science being the most powerful force. Continuous innovation in tribological polymers and composite coatings is directly improving load capacities and lifespan, addressing previous performance limitations. Economic forces, particularly the increasing global labor costs and the resulting incentive to automate, act as a persistent underlying driver. Competitive forces center around differentiation through proprietary self-lubricating mechanisms and superior warranties offered by major players. Overall, the positive synergy between technological drivers (new materials, smart integration) and economic drivers (automation investment) ensures a strong positive impact trajectory for the self-lubricating linear guides market over the forecast period.

Segmentation Analysis

The Self Lubricating Linear Guides Market is comprehensively segmented based on the component type, the material composition of the self-lubricating element, the specific application area, and the end-use industry utilizing the technology. This multi-dimensional segmentation allows for precise market sizing and strategic targeting. The Type segmentation distinguishes between structural mechanisms like linear ball guides, which offer high rigidity and precision, and plain bearings (or sliding guides), which are favored for dirt resistance, silence, and low speed applications. Material segmentation is crucial, as the performance characteristics—such as temperature limit, load capacity, and chemical resistance—are fundamentally determined by the polymer, ceramic, or composite used for self-lubrication. Application analysis reveals the intensity of demand across diverse machinery, while End-Use Industry segmentation highlights the key vertical markets driving volume and value growth.

- Type:

- Linear Ball Guides (with integrated self-lubrication)

- Linear Roller Guides (with integrated self-lubrication)

- Plain Bearings / Sliding Guides

- Hydrostatic Guides (Specialized)

- Material:

- Polymer-Based Composites (e.g., PTFE, Polyacetal)

- Sintered Bronze/Oil-Impregnated Metals

- Ceramic Composites

- Specialty Engineered Plastics (e.g., PEEK, UHMW)

- Application:

- Machine Tools (CNC, Milling, Grinding)

- Automation & Robotics

- Medical Equipment (Diagnostic, Surgical)

- Packaging and Processing Machinery

- Semiconductor and Electronics Manufacturing

- Aerospace and Defense Systems

- Automotive Production Lines

- End-Use Industry:

- Industrial Machinery and Manufacturing

- Electronics and Semiconductor

- Food and Beverage Processing

- Healthcare and Medical Devices

- Automotive and Transportation

- Textile and Printing

Value Chain Analysis For Self Lubricating Linear Guides Market

The value chain for self-lubricating linear guides commences with complex upstream activities, primarily involving the sourcing and processing of specialized raw materials. This includes high-grade steels and alloys for guide rails and carriage bodies, alongside advanced chemical inputs such as proprietary polymers, PTFE compounds, and specialized composites necessary for creating the self-lubricating elements. Upstream analysis focuses heavily on material science innovation, intellectual property protection related to tribological coatings, and securing stable supply chains for high-performance plastics and rare earth elements used in certain precision components. The cost and quality of these raw materials significantly impact the final product's performance and unit price, necessitating strong, long-term partnerships between guide manufacturers and material suppliers who can ensure purity and consistency.

Midstream activities encompass the core manufacturing processes, including precision machining, grinding, surface treatment, and the highly specialized process of integrating the self-lubricating mechanism into the linear guide structure, whether through injection molding, sintering, or bonding advanced liners. This stage is characterized by high capital investment in precision CNC equipment and quality control systems capable of ensuring extremely tight tolerances crucial for maintaining smooth, friction-free motion. The downstream flow involves rigorous testing, assembly, and finally, distribution. Distribution channels are varied, involving a significant proportion of direct sales to large Original Equipment Manufacturers (OEMs) in the automotive and machine tool sectors, where guides are integral components of the final machine design. Indirect distribution through specialized industrial distributors and integrated parts resellers serves the maintenance, repair, and overhaul (MRO) market and smaller end-users.

The structure of the distribution channel is highly influential in market penetration. Direct channels provide guide manufacturers with crucial application feedback and deeper customer relationships, essential for developing customized solutions for high-value machinery. Indirect channels, characterized by industrial distributors (stockists) and specialized e-commerce platforms, offer geographical reach and inventory access for faster replacement needs. The effectiveness of the supply chain in minimizing lead times—especially for custom or specialized self-lubricating guides—is a critical differentiator. Given the complex nature and high precision required, value chain optimization often focuses on reducing internal manufacturing waste and streamlining logistics to maintain competitiveness against conventional linear guides.

Self Lubricating Linear Guides Market Potential Customers

Potential customers and end-users of self-lubricating linear guides are found across nearly every sector that relies on precise, repeatable, and automated linear motion, placing a high value on reliability and low maintenance. The primary purchasing demographic comprises Original Equipment Manufacturers (OEMs) who integrate these guides directly into their final machinery, such as manufacturers of advanced CNC machine tools, industrial robot builders, and specialized packaging equipment producers. These buyers prioritize high precision, long operational life without external lubrication, and conformity to stringent quality specifications, especially concerning dynamic load capacity and speed ratings. Their purchasing decisions are often based on performance validation and the total lifecycle cost of the component, preferring guides that guarantee long mean time between failures (MTBF).

A second major customer segment includes end-users engaged in continuous production environments, particularly in sensitive sectors. These include pharmaceutical manufacturers, food and beverage processing plants, and cleanroom semiconductor fabrication facilities. For these end-users, the non-contaminating nature of self-lubricating guides is paramount, as traditional oil or grease poses a significant risk of product contamination or particle emission. Their procurement teams prioritize guides made from FDA-approved or inert materials and seek solutions that comply with sanitary design standards, often favoring polymer-based or ceramic-composite guides that eliminate wet lubrication entirely.

The third group encompasses Maintenance, Repair, and Overhaul (MRO) departments and industrial service providers. These customers typically purchase replacement guides or standardized components through distributors when existing machinery requires repair or upgrades. Their demand is driven by the need for quick turnaround times and readily available stock, often selecting self-lubricating versions during replacement to upgrade the machine's reliability and reduce future maintenance complexity. The increasing sophistication of modern factories ensures that the customer base continues to expand, driven by the replacement cycle of older, conventionally lubricated machinery with newer, maintenance-free automated systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, THK, NSK Ltd., Bosch Rexroth AG, Schaeffler Technologies AG & Co. KG, Thomson Industries, Hiwin Technologies Corp., IKO International, Inc., PBC Linear, Schneeberger AG, NB Corporation of America, LinMot, Bishop-Wisecarver, Tusk Direct Inc., Accuride International Inc., Barden Corporation, FAG Industrial Services, Rollon S.p.A., Timken Company, Ewellix. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Self Lubricating Linear Guides Market Key Technology Landscape

The core technological landscape of the self-lubricating linear guides market revolves around advanced tribology and materials engineering, focusing on achieving minimal friction and sustained component life without external fluid introduction. Key technologies include the development of highly advanced Polymer Matrix Composites (PMCs) and thermosetting plastics, such as modified polyetheretherketone (PEEK) and ultra-high-molecular-weight polyethylene (UHMW-PE), which incorporate internal solid lubricants like graphite, PTFE, or silicon compounds. These materials are engineered to offer exceptional mechanical strength, chemical resistance, and a low coefficient of friction, ensuring the continuous transfer of a lubricating layer to the mating surfaces as the guide moves, effectively eliminating the need for periodic grease application in many applications.

Another significant technological advancement involves the integration of micro-reservoir systems, often referred to as lubrication management units or integrated oil pads, particularly within ball or roller guide systems. These integrated components utilize porous materials or specialized polymer blocks saturated with high-performance oils. The design ensures that lubrication is released slowly and precisely onto the raceway surfaces via capillary action or slight pressure changes during motion. This hybrid approach maintains the load capacity and rigidity advantages of traditional metal guides while dramatically extending re-lubrication intervals, sometimes for the entire service life of the machine, representing a crucial bridge between fully dry operation and conventional systems.

Furthermore, surface engineering techniques are pivotal, including specialized plasma treatment and Physical Vapor Deposition (PVD) coatings applied directly to the metal guide rails. These coatings, often based on diamond-like carbon (DLC) or other low-friction ceramics, reduce adhesion and abrasion, enhancing the efficacy of the self-lubricating liners and improving overall wear resistance. The future technological trajectory is increasingly focused on smart materials integration, where sensors are embedded within the polymer guides to monitor temperature, wear thickness, and load distribution, providing data essential for predictive maintenance algorithms and ensuring that the self-lubricating component is utilized to its optimal performance limits within the industrial ecosystem.

Regional Highlights

The market dynamics of the Self Lubricating Linear Guides Market are significantly influenced by regional industrial maturity, investment cycles in automation, and specific regulatory environments. Asia Pacific (APAC) stands as the largest and fastest-growing region, driven primarily by robust manufacturing expansion in China, South Korea, and Southeast Asian nations. The region’s dominance is supported by massive government investments in smart factory initiatives (e.g., Made in China 2025) and the high-volume production needs of the consumer electronics and automotive sectors. The high density of semiconductor fabrication plants also contributes significantly, as these facilities necessitate pristine, non-contaminating linear motion solutions.

Europe represents a mature market characterized by high demand for quality, precision, and adherence to strict environmental standards. Countries like Germany and Italy, leaders in machine tool and specialized machinery manufacturing, require advanced, heavy-duty self-lubricating guides. The European market emphasizes energy efficiency and sustainability, accelerating the shift away from oil-based lubrication toward cleaner, maintenance-free polymer and composite solutions. Demand here is typically high-value, focusing on bespoke engineering solutions for sectors like aerospace and highly regulated food processing.

North America, led by the United States, is a strong adopter of cutting-edge automation and robotics technologies. The market is fueled by revitalization efforts in domestic manufacturing, particularly in the automotive, medical device, and defense industries. North American users prioritize guides that offer maximum longevity and minimal lifecycle cost, driving the adoption of high-end, maintenance-free solutions that integrate seamlessly with digital monitoring and control systems, ensuring high uptime critical for competitive manufacturing operations. Latin America and MEA are focused on gradual industrial modernization, providing opportunities for established guide technologies that offer a favorable balance of cost and performance.

- Asia Pacific (APAC): Dominant in market share and growth rate; driven by high-volume production in electronics, automotive, and rapid expansion of industrial infrastructure, particularly in China and India.

- North America: Strong demand in high-precision sectors such as aerospace, medical equipment, and advanced robotics; characterized by early adoption of smart, sensor-integrated guides for predictive maintenance applications.

- Europe: Focus on premium, customized self-lubricating solutions mandated by stringent environmental regulations and high standards in machine tool and specialized industrial machinery sectors, particularly in Central and Western Europe.

- Latin America & Middle East/Africa (LAMEA): Emerging markets witnessing increasing industrial investment, specifically in localized manufacturing and resource processing; gradual adoption driven by the need for reliable, low-maintenance components in challenging operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Self Lubricating Linear Guides Market.- SKF

- THK

- NSK Ltd.

- Bosch Rexroth AG

- Schaeffler Technologies AG & Co. KG

- Thomson Industries

- Hiwin Technologies Corp.

- IKO International, Inc.

- PBC Linear

- Schneeberger AG

- NB Corporation of America

- LinMot

- Bishop-Wisecarver

- Tusk Direct Inc.

- Accuride International Inc.

- Barden Corporation

- FAG Industrial Services

- Rollon S.p.A.

- Timken Company

- Ewellix

Frequently Asked Questions

Analyze common user questions about the Self Lubricating Linear Guides market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of choosing self-lubricating linear guides over traditional linear guides?

The primary benefits include significantly reduced maintenance requirements, elimination of external lubricant contamination risks (critical for clean environments), extended service life, lower operational noise, and a reduced total cost of ownership (TCO) over the component lifecycle due to minimal downtime.

In which applications do self-lubricating linear guides offer the most significant performance advantage?

Self-lubricating guides offer maximum advantage in applications requiring high cleanliness or maintenance difficulty, such as food and beverage processing, semiconductor manufacturing, medical diagnostics, packaging machinery, and remote automation systems where manual re-greasing is impractical or hazardous.

What types of materials are commonly used for the self-lubricating elements?

Common materials include high-performance Polymer Matrix Composites (PMCs) like PTFE and specialty engineering plastics (e.g., PEEK) infused with solid lubricants, as well as sintered bronze or oil-impregnated metals, each chosen based on required load capacity, speed, and chemical resistance.

How does AI impact the future reliability and maintenance of self-lubricating linear motion systems?

AI integrates with smart guides by analyzing sensor data (vibration, temperature) to implement predictive maintenance models. This capability allows for highly optimized usage, forecasting wear rates, and scheduling replacements only when necessary, maximizing the lifespan and reducing unexpected failures.

Are self-lubricating linear guides suitable for extremely high-load or high-speed industrial applications?

While historically constrained, modern self-lubricating solutions, particularly those utilizing high-grade engineered polymers and integrated micro-reservoirs, are increasingly capable of handling moderate to high loads and speeds. However, extremely demanding, continuous high-load applications may still require supplemental lubrication or forced oil systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager