Self Luminous Displays Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434122 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Self Luminous Displays Market Size

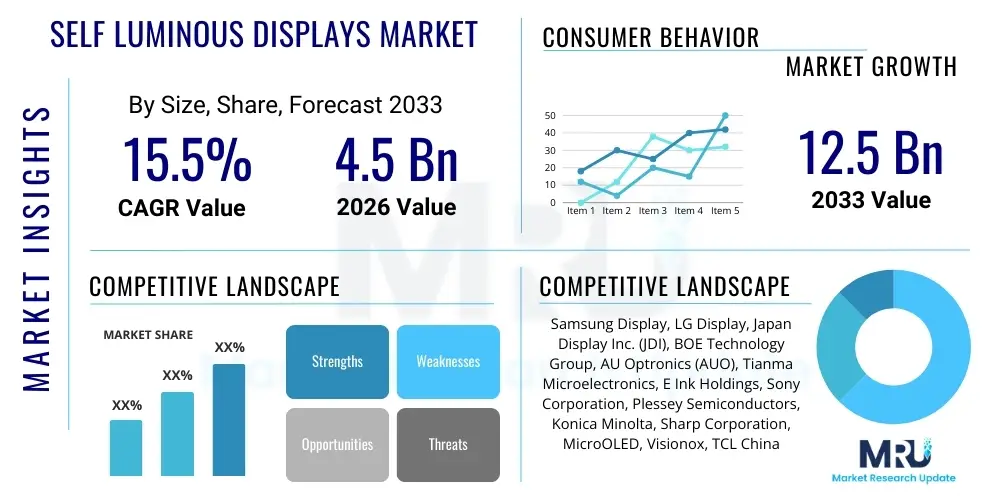

The Self Luminous Displays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 12.5 Billion by the end of the forecast period in 2033.

Self Luminous Displays Market introduction

The Self Luminous Displays Market encompasses technologies, primarily Organic Light Emitting Diodes (OLED) and MicroLEDs, where each pixel generates its own light, eliminating the need for a separate backlight unit. This fundamental characteristic allows for superior contrast ratios, true blacks, faster response times, and thinner, more flexible panel designs compared to traditional Liquid Crystal Displays (LCDs). These displays are rapidly being adopted across high-end consumer electronics, automotive interiors, and specialized industrial applications where image quality and design aesthetics are paramount. The market is characterized by intense technological innovation, focusing on extending display lifespan, improving brightness, and reducing manufacturing costs to enable broader market penetration.

Major applications of self luminous displays span across smartphones, premium televisions, smartwatches, augmented reality (AR) and virtual reality (VR) headsets, and automotive infotainment systems. In the consumer space, the demand is driven by the desire for immersive viewing experiences, particularly in large-screen TVs and mobile devices, where the infinite contrast capability of OLED provides a significant visual advantage. Furthermore, the development of flexible and rollable display formats, exclusively enabled by self-luminous technologies, is opening up new product categories and design possibilities, such as foldable phones and curved dashboard displays in vehicles.

The core benefits driving market expansion include unmatched picture quality due to pixel-level dimming, enhanced power efficiency in displaying darker content, and the capability for ultra-thin, lightweight form factors. Key driving factors include the aggressive transition of major display manufacturers towards OLED and MicroLED production, massive investments in next-generation fabrication plants (Gen 8 and above), and the increasing incorporation of these displays into high-volume products like mainstream smartphones and tablets. The increasing consumer disposable income in emerging economies, coupled with a preference for premium viewing experiences, further accelerates the market trajectory, making self-luminous technology a benchmark for modern display performance.

Self Luminous Displays Market Executive Summary

The Self Luminous Displays Market is poised for robust expansion, driven primarily by the transition from LCD technology to more energy-efficient and visually superior OLED and nascent MicroLED solutions. Business trends indicate a strong push toward vertically integrated manufacturing, where key players control both the display production and the final product assembly (e.g., TVs or smartphones), ensuring quality and optimizing supply chains. Capital expenditure remains exceptionally high in areas related to mass-production techniques for MicroLEDs and the advancement of flexible OLED panels, suggesting a focus on achieving economies of scale necessary for widespread adoption beyond the luxury segment. Furthermore, sustainability is emerging as a critical trend, with manufacturers exploring less toxic materials and more energy-efficient display drivers, responding to growing environmental, social, and governance (ESG) pressures from investors and consumers.

Regionally, Asia Pacific (APAC), particularly South Korea and China, dominates the production landscape due to established manufacturing infrastructure and continuous government support for display technology innovation. However, North America and Europe remain the largest consumers of high-end self-luminous products, driving demand for larger-sized OLED TVs and advanced automotive display solutions. The regional trend in APAC is shifting slightly towards stabilizing OLED supply chains while simultaneously investing heavily in the pilot production and commercialization of MicroLED technology, which is viewed as the long-term successor to OLED, especially in high-brightness applications like outdoor signage and specialized industrial displays. Regulatory environments supporting reduced energy consumption are also subtly favoring these technologies globally.

Segment trends highlight the consumer electronics sector, particularly smartphones and TVs, as the dominant revenue generators, although the automotive segment is witnessing the fastest growth rate as car manufacturers integrate expansive, curved, and multi-functional self-luminous dashboards. By display type, rigid OLEDs maintain a strong market share, but flexible OLEDs are rapidly gaining ground, fueled by the success of foldable mobile devices and wearable technology. The MicroLED segment, while currently niche and high-cost, is expected to experience significant revenue acceleration in the latter half of the forecast period (2030-2033), driven by advancements in transfer printing technology and chip miniaturization, making it viable for large-scale video walls and augmented reality glasses.

AI Impact Analysis on Self Luminous Displays Market

User queries regarding AI's influence on the Self Luminous Displays Market center around performance enhancement, manufacturing efficiency, and content delivery. Key user themes include how AI improves display uniformity and defect detection during production, whether AI-driven algorithms can extend the lifespan of OLED panels by mitigating burn-in, and how intelligent processing units (often AI-powered) optimize image quality (upscaling, motion smoothing) specifically for self-luminous panels. Consumers also express interest in AI’s role in creating truly personalized and adaptive viewing experiences, adjusting brightness and color based on ambient light and user preferences, which leverages the precise light control inherent in self-luminous technologies.

The integration of Artificial Intelligence primarily impacts the post-processing and quality control phases of self-luminous display technology. In manufacturing, AI-powered vision systems are critical for performing ultra-precise inspections of deposition and encapsulation layers, detecting micro-defects that are invisible to the human eye and ensuring maximum yield rates, which is crucial given the complexity and cost of OLED and MicroLED production. Beyond the factory, AI is embedded into Display Driver ICs (DDICs) to perform sophisticated real-time pixel management, enabling features such as dynamic resolution scaling and advanced compensation circuits that optimize picture quality and potentially extend the effective operating life of the display panel by intelligently managing current flow to individual pixels, thereby preventing premature degradation.

Furthermore, AI significantly enhances the utility of self-luminous displays in end-user applications. In high-end televisions, machine learning models analyze content frame-by-frame to optimize local contrast and brightness, capitalizing fully on the perfect black levels achievable with OLED technology. In automotive and AR/VR applications, AI algorithms manage power consumption and brightness control based on complex environmental inputs, ensuring optimal readability and minimizing user fatigue. This synergy between the inherently superior display technology and the intelligent processing capability provided by AI drives premiumization and differentiates products in highly competitive consumer and specialized markets, accelerating the adoption rate of these advanced display types.

- AI-driven Quality Control: Utilized for high-precision defect detection and inspection during complex deposition processes, significantly boosting manufacturing yield rates for MicroLED and OLED.

- Intelligent Pixel Compensation: Machine learning algorithms manage voltage and current distribution across pixel arrays in real-time to prevent burn-in (image retention) and extend the operational lifespan of OLED panels.

- Adaptive Image Processing: AI processors optimize display parameters (color, contrast, motion) based on content type and ambient lighting conditions, enhancing the perceived image quality unique to self-luminous displays.

- Power Efficiency Optimization: AI dynamically adjusts power consumption at the sub-pixel level, maximizing battery life in mobile and wearable devices using self-luminous technology.

- Personalized Viewing Experience: AI integrates biometric and environmental data (e.g., eye tracking, external light sensors) to provide adaptive display outputs, crucial for AR/VR devices utilizing MicroLED micro-displays.

DRO & Impact Forces Of Self Luminous Displays Market

The dynamics of the Self Luminous Displays Market are shaped by powerful drivers, substantial restraints, and transformative opportunities, all interacting to create a highly complex competitive landscape. The market acceleration is fundamentally driven by the relentless consumer demand for devices with better visual performance—thinner form factors, perfect black levels, and faster refresh rates—which only self-luminous technologies can reliably deliver. Simultaneously, the restraints revolve heavily around the technical challenges of mass production, particularly the yield rates and high material costs associated with MicroLEDs and large-sized OLED panels. However, significant opportunities exist in developing highly customized solutions for emerging sectors like automotive display ecosystems and flexible industrial monitoring systems, which require the unique attributes of self-luminous panels. These forces together dictate investment flows, technological focus, and the overall pace of market adoption.

Key drivers include the technological maturity and cost reduction in Flexible OLED production, making it viable for mid-range smartphones and premium wearables, thereby expanding the addressable market dramatically. The continuous investment from giants like Samsung and LG in Gen 8/Gen 10+ OLED fabs ensures a stable and growing supply, pushing down unit costs. The transition in the automotive sector towards large, seamless, and integrated cockpit displays is perhaps the most forceful emerging driver, creating a massive, untapped market for durable, high-contrast, self-luminous screens. On the restraint side, the primary obstacle remains the high capital expenditure required to establish MicroLED manufacturing capabilities (due to intricate mass-transfer techniques) and the lingering concerns regarding OLED longevity in ultra-high-brightness scenarios like outdoor signage or prolonged static image display (burn-in risk).

Opportunities are abundant in the development of disruptive technologies such as Quantum Dot OLED (QD-OLED), which aims to merge the benefits of OLEDs with the color purity of quantum dots, and in establishing efficient, low-cost MicroLED production for small-to-medium displays (e.g., smartwatches, AR glasses), leveraging wafer-level processing. The geopolitical impact forces include global supply chain stability and trade disputes affecting the supply of specialized materials and key components like emissive materials and TFT backplanes, which can cause significant pricing volatility. Moreover, the environmental impact forces, particularly those related to the disposal and recycling of complex multilayer display panels, are increasingly influencing R&D, pushing manufacturers toward more sustainable and circular economy models.

Segmentation Analysis

The Self Luminous Displays Market is comprehensively segmented primarily based on Display Type, Application, and Resolution, reflecting the diverse technological maturity and end-user requirements across different product categories. Segmentation by Display Type—covering OLED (rigid, flexible, foldable, rollable) and MicroLED—is crucial as it delineates manufacturing complexity, cost structure, and target brightness levels. Application segmentation, spanning Consumer Electronics (the largest segment), Automotive, Healthcare, and Industrial sectors, highlights varying performance requirements, such as robustness and thermal tolerance. Understanding these segment dynamics is vital for manufacturers to tailor their production strategies and pricing models, ensuring optimal market penetration across high-volume consumer goods and specialized industrial equipment.

The market analysis reveals that while consumer electronics, particularly mobile devices and televisions, dominate current revenue, the fastest growth is anticipated in specialized segments. For instance, the demand for high-resolution, small-sized self-luminous displays (MicroLED and specialized OLEDs) is skyrocketing within the AR/VR/MR ecosystem, reflecting a new wave of computing interfaces. Similarly, the automotive segment requires displays optimized for extreme temperature ranges and long operational lifecycles, leading to customized self-luminous panel designs. These segmentation nuances indicate that future value creation will shift towards highly differentiated, performance-critical applications rather than solely focusing on commodity consumer displays.

Further segmentation by material and manufacturing process provides deeper insight into the competitive differentiation, such as evaporation versus printing methods for OLEDs, and mass transfer techniques for MicroLEDs. The shift towards solution-processed (printing) OLEDs is a key trend, promising lower capital costs and potentially larger substrates, impacting the supply chain significantly. Geographic segmentation remains critical, with major manufacturing hubs in Asia Pacific dictating supply volumes, while North America and Europe lead in demanding high-end applications like luxury automobiles and professional cinema-grade monitors, setting global standards for quality and innovation.

- Display Type:

- OLED (Rigid, Flexible, Foldable, Rollable)

- MicroLED

- QD-OLED

- Application:

- Consumer Electronics (Smartphones, Televisions, Smartwatches, Tablets)

- Automotive (Infotainment, Digital Cockpits, HUDs)

- Healthcare (Medical Imaging, Diagnostic Equipment)

- Aerospace and Defense (Avionics Displays, Ruggedized Devices)

- Industrial and Commercial (Digital Signage, Monitoring Systems)

- Resolution:

- HD and Full HD

- 4K UHD

- 8K UHD and Above

- Screen Size:

- Small (Below 6 inches)

- Medium (6 to 20 inches)

- Large (Above 20 inches)

Value Chain Analysis For Self Luminous Displays Market

The value chain for the Self Luminous Displays Market is capital-intensive and highly specialized, beginning with the upstream supply of specialized raw materials, including emissive organic materials (for OLEDs), semiconductor wafers, and specialized glass substrates. Upstream activities are dominated by a limited number of specialized chemical companies and material providers, leading to potential supply bottlenecks and strong negotiating power for these suppliers. Manufacturing complexity increases significantly in the middle segment (midstream), encompassing panel fabrication, including Thin Film Transistor (TFT) backplane manufacturing, deposition processes (evaporation or printing), and module assembly. This stage is dominated by large East Asian display conglomerates (e.g., Samsung Display, LG Display) which invest billions in advanced fabrication facilities (fabs) to achieve economies of scale and maintain technological leadership.

The downstream component involves the integration of the display module into the final product. Original Equipment Manufacturers (OEMs) purchase finished panels and integrate them with system components, software, and housing, targeting specific end markets such as smartphones (Apple, Samsung Electronics), televisions (Sony, Panasonic), or vehicles (BMW, Mercedes-Benz). Distribution channels are diverse; large-volume consumer electronics often rely on indirect channels—global retailers, e-commerce platforms, and telecommunications carriers—due to the rapid product turnover. Conversely, specialized displays for military or medical applications often rely on direct sales and specialized integrators due to stringent customization and certification requirements.

The direct sales channel is predominant for specialized B2B transactions, such as selling large video walls or customized automotive displays directly to manufacturers, allowing for detailed technical consultation and long-term supply contracts. Indirect distribution is the lifeblood of the consumer segment, optimizing inventory management and ensuring broad market reach. The efficiency and reliability of this downstream logistics network, particularly for delicate, large-sized panels, are crucial for maintaining profitability. Furthermore, the competitive advantage in the value chain is increasingly shifting towards those players who can master the mass transfer techniques required for MicroLEDs, representing a significant technological choke point that will redefine the midstream market structure in the coming decade.

Self Luminous Displays Market Potential Customers

The potential customers for Self Luminous Displays are concentrated across several high-value industries where visual fidelity, form factor flexibility, and energy efficiency are primary purchasing criteria. The largest cohort of end-users are consumer electronics manufacturers, including major global brands that produce premium smartphones, high-end TVs, and cutting-edge wearable devices. These customers prioritize superior color reproduction, perfect contrast, and the ability to produce flexible or foldable products, making OLED technology an essential component for maintaining a premium market position. The purchasing decisions in this sector are driven by cost-per-unit for high-volume orders and the supplier's capability to deliver panels with highly optimized response times and pixel densities.

A rapidly emerging and highly lucrative customer base is the global automotive industry. Vehicle manufacturers (OEMs) are transitioning their cockpits from traditional analog gauges to expansive, seamless digital displays that integrate infotainment, driver information, and comfort controls. These customers require self-luminous displays that offer high durability, robust thermal resistance, sunlight readability (high brightness), and conform to complex curved interior designs. The long lifecycle requirements and stringent safety certifications make this segment challenging but offer higher margins due to the specialized nature of the components, favoring self-luminous technologies like automotive-grade OLEDs and future MicroLED solutions for projection head-up displays (HUDs).

Further potential customers include professional content creators, medical imaging specialists, and defense contractors. Professional users (e.g., film studios, graphic designers) demand displays with absolute color accuracy and uniformity for tasks like color grading and editing, making self-luminous displays the industry standard for professional monitors. Healthcare buyers require highly reliable displays for surgical monitors and diagnostic imaging, where precise visual information is mission-critical. Defense and aerospace customers require ruggedized, high-brightness displays for avionics and field use, capable of operating under extreme environmental stresses, driving demand for specialized, highly durable MicroLED or ruggedized OLED panels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.5 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Display, LG Display, Japan Display Inc. (JDI), BOE Technology Group, AU Optronics (AUO), Tianma Microelectronics, E Ink Holdings, Sony Corporation, Plessey Semiconductors, Konica Minolta, Sharp Corporation, MicroOLED, Visionox, TCL China Star Optoelectronics Technology (CSOT), Lumileds, OSRAM, Universal Display Corporation (UDC), eMagin, SAKKAI Display, Coherent Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Self Luminous Displays Market Key Technology Landscape

The technological landscape of the Self Luminous Displays Market is dynamic and intensely competitive, centered predominantly on the optimization of two core technologies: Organic Light Emitting Diodes (OLED) and Micro Light Emitting Diodes (MicroLED). OLED technology has reached significant maturity, with current innovations focusing on improving material efficiency, extending operational lifespan through new blue emitter formulations, and advancing solution-processing methods (Inkjet Printing OLED or IJP-OLED) to lower manufacturing costs compared to traditional vacuum thermal evaporation (VTE). A major recent advancement is the commercialization of Quantum Dot OLED (QD-OLED), which utilizes blue OLED emitters and quantum dot color converters to achieve enhanced brightness and a wider color gamut without sacrificing the inherent contrast benefits of OLED, representing a powerful response to competitive LCD technologies.

MicroLED technology represents the cutting edge and the long-term future of self-luminous displays, addressing OLED’s limitations in brightness and longevity. MicroLEDs use arrays of microscopic inorganic LEDs (less than 100 micrometers) that provide superior brightness, energy efficiency, and durability. The primary technological hurdle is the "mass transfer" process—accurately placing billions of micro-sized LED chips onto a backplane with high yield and speed. Significant R&D efforts are concentrated on developing efficient transfer techniques (e.g., laser-based or fluidic assembly) and seamless tiling methods for constructing large screens. Success in these areas will determine the timeline for MicroLED commercialization across mainstream applications like televisions and large-format signage, moving beyond the current niche market of specialized micro-displays for AR/VR.

Beyond the core display structure, key enabling technologies include advanced Thin-Film Transistor (TFT) backplanes, such as Low-Temperature Polycrystalline Silicon (LTPS) and Oxide TFTs (e.g., IGZO), which are essential for driving high pixel densities and managing power efficiently in smaller devices. Furthermore, sophisticated Display Driver Integrated Circuits (DDICs) equipped with AI capabilities are necessary for real-time pixel compensation and uniformity correction, especially in large OLED panels, mitigating the risk of non-uniformity and burn-in. Innovations in encapsulation barriers, particularly thin-film encapsulation (TFE), are critical for protecting the sensitive organic materials from moisture and oxygen, enabling the production of highly flexible and durable display panels crucial for foldable and rollable devices.

Regional Highlights

- Asia Pacific (APAC): The Global Manufacturing Hub and Primary Supply Source

APAC is the undisputed leader in both the production and consumption of Self Luminous Displays, driven primarily by South Korea (Samsung Display, LG Display) and China (BOE, Visionox, TCL CSOT). South Korea holds a dominant position in high-end OLED panel manufacturing, constantly pushing the boundaries of technology with significant investments in Gen 8 and Gen 10 production lines for large-area OLED and QD-OLED. China, benefiting from substantial government subsidies, is rapidly increasing its OLED capacity, aiming to capture market share in flexible displays for mobile devices. The region’s strength lies in its integrated supply chain, extensive engineering talent pool, and massive domestic demand from a large consumer base obsessed with cutting-edge technology. The focus here is scaling up production while actively conducting pilot projects for MicroLED mass transfer and application integration, particularly in high-volume smartphone manufacturing.

Japan maintains expertise in critical material science and high-precision equipment necessary for display fabrication, contributing significantly to the upstream segment of the value chain. Moreover, the demand side is robust across the region, especially in China and India, where rising disposable incomes fuel the uptake of premium electronic devices, including OLED TVs and flexible smartphones. This region not only dictates global pricing and supply stability but also serves as the primary testing ground for next-generation display form factors, such as complex foldable and ultra-thin rollable prototypes.

- North America: Innovation Adoption and High-Value End Markets

North America is characterized by being an early and major adopter of premium self-luminous display products, dominating the demand for large-screen OLED televisions, high-end professional monitors, and specialized micro-displays for emerging technologies like AR/VR headsets. The region is a vital market for technology innovation, housing key technology licensors and intellectual property holders, such as Universal Display Corporation (UDC), which plays a crucial role in providing emissive materials and intellectual property for OLED manufacturing globally. The consumer market here is less sensitive to price erosion compared to APAC, placing higher emphasis on brand quality, display performance specifications, and integration into sophisticated smart home ecosystems.

Furthermore, the U.S. defense, aerospace, and medical sectors represent critical high-value end markets requiring specialized, ruggedized, and highly reliable self-luminous displays, often supplied by domestic specialized display manufacturers and systems integrators. The market penetration of self-luminous displays in the rapidly growing electric vehicle (EV) segment in North America is another strong regional driver, with OEMs pushing for extensive digital cockpits utilizing these displays. This region influences global demand patterns by setting quality benchmarks and leading the integration of AI with display processing.

- Europe: Focus on Automotive Integration and Industrial Applications

Europe demonstrates significant market strength in two critical areas: the automotive industry and high-end industrial automation. European luxury automotive manufacturers (Germany, Italy) are driving the swift adoption of large, curved, and integrated OLED displays for digital dashboards and central control units, valuing the high contrast and flexible design capabilities of self-luminous technology. The stringent safety and quality standards within the European automotive sector necessitate specialized, durable display solutions, often leading to custom manufacturing agreements with Asian panel makers.

Additionally, the demand for self-luminous displays in specialized industrial monitoring systems, broadcasting equipment, and medical devices (especially in Germany and the UK) is robust. While Europe is not a major fabrication center for the panels themselves, it is a crucial center for the development of system integration and specialized manufacturing equipment. The region's regulatory focus on energy efficiency (EU standards) subtly favors OLED technology over traditional backlighting systems, particularly in large professional applications and consumer electronics, accelerating the overall market transition towards self-luminous alternatives.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Consumption Zones

LATAM and MEA currently represent smaller but rapidly growing consumption markets for self-luminous displays, largely driven by the importation of finished consumer products like premium smartphones and large-format televisions. Market growth is closely tied to economic stability, increasing urbanization, and the expansion of high-speed internet infrastructure which drives demand for high-quality media consumption devices. In the MEA region, particularly the GCC countries, large-scale infrastructure projects and investment in smart city development are creating demand for cutting-edge digital signage and control room displays, which increasingly incorporate high-brightness, energy-efficient MicroLED or specialized OLED panels for commercial use.

While local manufacturing remains minimal, the focus in these regions is on distribution network optimization and adapting product specifications (such as brightness levels for sunny climates in MEA) to local conditions. The adoption rate is expected to accelerate significantly as manufacturing costs decrease and self-luminous technology trickles down from the ultra-premium to the mid-range segments of the consumer market, supported by strong local marketing campaigns from global electronics leaders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Self Luminous Displays Market.- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- TCL China Star Optoelectronics Technology (CSOT)

- Visionox Technology Inc.

- Japan Display Inc. (JDI)

- AU Optronics Corp. (AUO)

- Tianma Microelectronics Co., Ltd.

- Universal Display Corporation (UDC)

- Sharp Corporation

- Sony Corporation

- Plessey Semiconductors Ltd.

- eMagin Corporation

- MicroOLED S.A.

- Lumileds Holding B.V.

- OSRAM Licht AG (now ams OSRAM)

- Konica Minolta, Inc.

- Coherent Inc.

- PlayNitride Inc.

- Kopin Corporation

Frequently Asked Questions

Analyze common user questions about the Self Luminous Displays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of self luminous displays over traditional LCDs?

The primary advantage is the ability of each pixel to generate its own light, enabling pixel-level dimming. This results in perfect black levels, leading to an infinite contrast ratio, superior HDR performance, and the elimination of motion blur due to extremely fast response times, all while allowing for ultra-thin, flexible form factors.

Which technology is expected to succeed OLED in the long term?

MicroLED technology is widely considered the long-term successor to OLED. MicroLED offers significantly higher brightness, better energy efficiency, and superior longevity (no burn-in risk) because it uses inorganic LED materials. Current efforts focus on overcoming mass transfer challenges to enable high-volume, cost-effective manufacturing.

How does the increasing adoption of electric vehicles impact the Self Luminous Displays Market?

The transition to electric vehicles (EVs) is a major market driver. EVs require larger, curved, and integrated digital cockpits to display complex information. Self luminous displays, particularly automotive-grade OLEDs, are preferred due to their superior contrast, design flexibility, and responsiveness required for next- generation high-performance vehicle interiors.

What is the main restraint preventing MicroLED displays from entering the mainstream consumer market?

The primary restraint is the extremely high manufacturing cost and complexity associated with the mass transfer process. Successfully placing billions of microscopic LED chips onto a backplane with sub-micron precision at a low defect rate and high speed remains a significant technological and economic hurdle for mass production.

Is the risk of OLED burn-in still a major concern for consumers?

While modern OLED panels have significantly mitigated burn-in risks through advanced hardware (better materials) and software (AI-driven pixel shift and compensation algorithms), it remains a concern, particularly in applications with static user interfaces (e.g., gaming monitors, digital signage). This concern continues to drive R&D into MicroLED and QD-OLED technologies which inherently eliminate this risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager