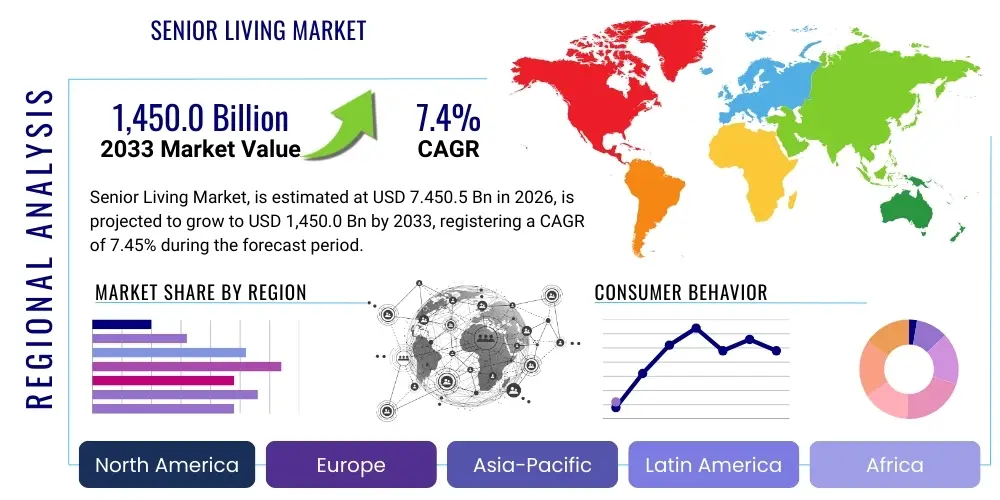

Senior Living Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438091 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Senior Living Market Size

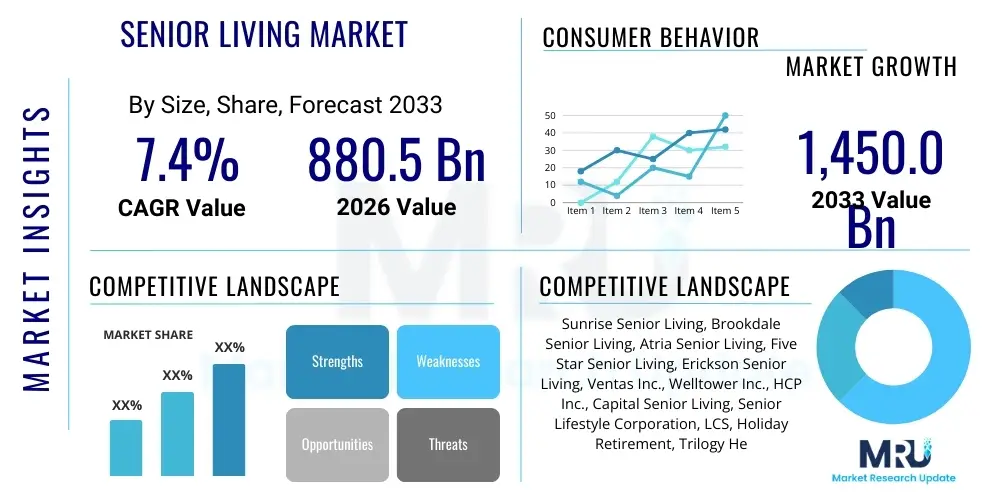

The Senior Living Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.45% CAGR between 2026 and 2033. The market is estimated at $880.5 Billion USD in 2026 and is projected to reach $1,450.0 Billion USD by the end of the forecast period in 2033.

Senior Living Market introduction

The Senior Living Market encompasses a diverse range of residential options and supportive services designed for individuals aged 65 and over, tailored to meet varying levels of physical and cognitive assistance needs. These environments range from independent living communities, which emphasize an active, maintenance-free lifestyle, to specialized settings such as memory care and skilled nursing facilities, providing high-level medical and personal care. The fundamental product offering is a comprehensive housing solution integrated with amenities such as communal dining, social programming, transportation, and health monitoring services, designed to enhance the quality of life, safety, and well-being of residents.

Major applications of senior living services include long-term residency for aging adults who require assistance with Activities of Daily Living (ADLs), short-term stays for rehabilitation following medical procedures, and specialized settings for complex chronic conditions like Alzheimer’s disease. The critical benefits derived from these services include enhanced social engagement, reduced isolation, continuous access to professional care coordination, and the alleviation of caregiving burdens on family members. The modern senior living facility increasingly integrates hospitality models with healthcare provision to create a stimulating and secure environment that delays functional decline and promotes holistic wellness.

The primary driving factors propelling market expansion are the accelerating global demographic shift toward an aging population, particularly the large Baby Boomer generation entering retirement age, and the increasing prevalence of chronic diseases requiring continuous monitoring. Furthermore, evolving consumer preferences, favoring proactive wellness and community living over traditional in-home care models, contribute significantly to market buoyancy. Regulatory frameworks supporting alternative payment models and incentivizing high-quality care delivery also play a pivotal role in stimulating investment and innovation within the senior living sector, driving overall capacity expansion and service diversification across key geographic regions.

Senior Living Market Executive Summary

The Senior Living Market is undergoing significant evolution, driven primarily by favorable demographic trends and substantial technological integration focused on optimizing resident care and operational efficiency. Current business trends indicate a strong move towards hybrid models, combining traditional real estate ownership with advanced care management services, often leveraging partnerships with technology providers to implement monitoring systems, telemedicine platforms, and predictive analytics tools. Financial investment remains robust, particularly in specialized segments like active adult communities and high-acuity memory care, reflecting investor confidence in stable, long-term demand. However, the sector is concurrently grappling with severe labor shortages and escalating construction costs, necessitating innovative staffing solutions and modular building approaches to maintain profitability and scalability across diverse economic landscapes.

Regionally, North America, particularly the United States, commands the largest market share due to its established infrastructure, high penetration of private pay models, and early adoption of sophisticated care technologies. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid urbanization, increasing middle-class wealth, and a structural shift away from traditional multi-generational family caregiving. European markets demonstrate stability, characterized by high regulatory standards and strong governmental support for subsidized or public-private partnership models. Trends in emerging markets indicate a nascent demand for Western-style, professionally managed facilities, pushing international operators to explore expansion opportunities through strategic joint ventures and localized service adaptations.

Segmentation trends highlight the robust growth of Assisted Living and Independent Living components, catering to a broad spectrum of elderly populations seeking socialization and minimal assistance. Memory Care remains the most complex and high-value segment, demanding specialized architectural design and highly trained staff, justifying higher rates. Payment source analysis confirms that Private Pay remains the dominant revenue stream globally, although the increasing acceptance of Medicare Advantage plans and long-term care insurance in certain geographies is subtly altering the payer mix. Overall, the market trajectory confirms a shift towards quality over quantity, with providers investing heavily in service personalization and lifestyle amenities to differentiate their offerings in an increasingly competitive service environment.

AI Impact Analysis on Senior Living Market

Common user questions regarding AI's impact on the Senior Living Market center on how technology can improve safety, reduce operational costs, and enhance personalized care without compromising the human element. Key concerns frequently raised involve data privacy for vulnerable populations, the potential for technology to replace direct human interaction, and the cost-effectiveness of implementing complex AI systems in smaller or rural facilities. Users seek clarity on specific applications, such as predictive fall detection, AI-driven medication adherence systems, and sophisticated robotics for physical assistance or companionship. The consensus expectation is that AI will primarily serve as an augmentative tool, addressing staffing shortages and enabling caregivers to focus more on emotional and high-touch interactions, rather than replacing essential human roles in a compassionate industry.

The integration of Artificial Intelligence is fundamentally reshaping the operational landscape of senior living communities. AI-powered platforms are being deployed to analyze vast amounts of resident data from wearables and ambient sensors, predicting potential health crises such as urinary tract infections, sepsis onset, or increased fall risk days before symptoms become critical. This shift from reactive to proactive care management drastically reduces hospital readmissions and improves resident outcomes. Furthermore, AI optimizes administrative processes, including staffing schedules based on predicted resident needs, supply chain management, and personalized dietary planning, leading to substantial gains in efficiency and operational cost reduction, crucial factors in managing thin profit margins characteristic of this labor-intensive sector.

- AI-Driven Predictive Health Monitoring: Utilizing machine learning algorithms to analyze sensor data and electronic health records (EHRs) for early detection of health deterioration or acute events, reducing emergency room visits.

- Robotics for Assistance and Companionship: Deployment of service robots for tasks such as lifting, fetching, medication reminders, and providing emotional support or cognitive stimulation through interactive programs.

- Optimized Staffing and Resource Allocation: AI scheduling tools that align caregiver deployment with real-time or predicted resident acuity levels, minimizing staff burnout and maximizing care quality during peak demand.

- Personalized Wellness Programs: Using AI to analyze resident interests, activity participation, and health profiles to recommend highly tailored physical and cognitive engagement activities.

- Enhanced Security and Access Control: Facial recognition and AI monitoring systems providing secure access, tracking resident movement within the facility, and ensuring restricted access to hazardous areas.

- Telemedicine and Virtual Care Integration: AI interfaces facilitating remote diagnostic capabilities and specialist consultations, bridging geographical gaps in healthcare provision for isolated communities.

- Natural Language Processing (NLP) for Documentation: Automated transcription and summarization of care notes, reducing the administrative burden on nursing staff and improving documentation accuracy for billing and compliance.

DRO & Impact Forces Of Senior Living Market

The Senior Living Market is propelled by powerful demographic drivers, primarily the rapid increase in the global population aged 80 and above, which requires higher levels of care and specialized environments. This fundamental demand driver is complemented by the rising expectations of incoming seniors for high-quality, amenity-rich environments that integrate seamlessly with modern lifestyle needs. Simultaneously, the inability or reduced willingness of modern families to provide intensive, round-the-clock care serves as a significant structural catalyst for outsourcing eldercare needs to professional facilities. The market also benefits from technological advancements, such as smart home integration and personalized monitoring systems, which significantly improve the perceived value and efficacy of senior living services, attracting a broader spectrum of high-net-worth individuals.

However, significant restraints temper the market’s exponential growth potential. The most critical constraint is the prohibitive cost of services, making quality senior living inaccessible to a substantial portion of the middle-income demographic, particularly in regions with limited public subsidies. Furthermore, the persistent, critical shortage of skilled caregivers (nurses, aides, and specialized staff) globally strains operational capacity and necessitates continuous wage inflation, pressuring margins. Regulatory complexity and stringent compliance requirements across different geographies, particularly concerning quality of care standards and licensing, also pose operational hurdles and increase administrative overhead, slowing down expansion and standardization efforts among global operators.

Opportunities for growth lie primarily in the emerging middle-market senior living segment, focused on offering scalable, standardized, and cost-efficient care solutions for seniors who do not qualify for public assistance but cannot afford luxury facilities. Furthermore, significant opportunities exist in developing specialized segments, particularly dedicated campuses for long-term dementia and Alzheimer's care, utilizing cutting-edge therapeutic designs. The synergistic impact forces of technological innovation—specifically the adoption of telehealth, AI-driven diagnostics, and robotic assistance—are actively mitigating labor and efficiency challenges, transforming the sector’s service delivery model and opening up avenues for higher occupancy rates and superior clinical outcomes, solidifying the industry's indispensable role in the modern healthcare ecosystem.

Segmentation Analysis

The Senior Living Market is systematically segmented based on the type of residence, the acuity level of care required, the primary source of payment, and the geographic location of the facilities. This multi-dimensional segmentation allows operators to tailor their offerings precisely to distinct demographic and economic cohorts. The primary market segmentation, by Type, distinguishes between non-medical hospitality-focused environments (Independent Living) and medically supportive settings (Skilled Nursing Facilities). Understanding these segmentation dynamics is crucial for strategic capital deployment, enabling developers to align facility design and service complexity with localized demand trends, particularly in rapidly aging suburban and urban core areas.

Segmentation by Payment Source—differentiating between private funding, public assistance (Medicaid/Medicare), and long-term care insurance—is vital for revenue cycle management and determining profitability margins, as public funding typically yields lower reimbursement rates but provides a reliable volume stream. Furthermore, the segmentation by Acuity Level directly dictates operational costs, staffing ratios, and regulatory compliance complexity. Specialized segments like Memory Care, demanding intensive staff training and secure environments, command a premium due to the unique care infrastructure required, signifying substantial investment potential for providers focused on highly specialized, high-margin services.

- Type:

- Independent Living (IL)

- Assisted Living (AL)

- Memory Care (MC)

- Skilled Nursing Facilities (SNF)

- Continuing Care Retirement Communities (CCRC)

- Active Adult Communities

- Acuity Level:

- Low Acuity (Minimal Assistance)

- Medium Acuity (Moderate Assistance with ADLs)

- High Acuity (Complex Medical Needs)

- Payment Source:

- Private Pay

- Government/Public Funding (Medicare, Medicaid)

- Long-Term Care Insurance

- Location:

- Urban

- Suburban

- Rural

Value Chain Analysis For Senior Living Market

The Senior Living Value Chain begins with upstream activities dominated by Real Estate Investment Trusts (REITs), private equity firms, and commercial developers who focus on the acquisition, financing, and construction of physical assets. Key upstream suppliers include construction materials providers, architectural and engineering services specializing in age-friendly design, and facility management system vendors. Financing is a crucial component here, often involving complex lease structures or outright ownership models. Efficiency and cost control at this stage are critical, given the high capital expenditure required to establish and maintain compliance-driven facilities, particularly in densely regulated markets like North America and Western Europe.

The mid-stream activities revolve around the operation and management of the facilities, carried out by specialized operators (like Brookdale or Sunrise) or third-party management companies. This segment involves core service delivery: resident assessment, personalized care planning, medical oversight, dietary services, and social programming. This stage is highly labor-intensive, relying heavily on recruiting, training, and retaining skilled healthcare professionals. Quality assurance, regulatory compliance, and integrating sophisticated health technologies represent the primary value-adding functions within this operational core, which directly impacts resident satisfaction and retention rates.

Downstream activities involve marketing and distribution channels, focusing on connecting the service offering with the end-users (seniors and their families). Direct distribution is prevalent, utilizing in-house sales teams, community outreach programs, and digital marketing strategies targeting key decision-makers. Indirect distribution increasingly involves referral networks, including discharge planners from hospitals, geriatric care managers, and third-party placement agencies who guide families through the selection process. The success of the downstream phase relies on strong brand reputation, transparency in pricing and care outcomes, and localized partnerships that establish the facility as a trusted component of the local healthcare continuum.

Senior Living Market Potential Customers

The primary customers for the Senior Living Market are typically categorized into two distinct groups: the elderly individuals (end-users) requiring the residence and care services, and their adult children or legal guardians (decision-makers/payers) who often initiate the selection process and manage the financial arrangements. The end-users are primarily individuals aged 75 and above who have experienced a decline in cognitive or physical abilities, making independent living challenging, or those proactively seeking community and amenities to maintain an active lifestyle, often targeting Independent Living and Active Adult communities.

Decision-makers, who are crucial in the buying process, are usually aged 45 to 65 and seek solutions that guarantee the safety, quality of life, and accessibility of medical care for their parents, while alleviating the heavy burden of direct caregiving. This group values transparent communication, robust safety protocols, and evidence of high-quality clinical outcomes. Targeting this demographic requires sophisticated marketing that addresses emotional concerns (guilt, stress) alongside practical considerations (cost, location, continuum of care).

Furthermore, potential institutional customers include healthcare systems (hospitals and Accountable Care Organizations) seeking post-acute care partners, particularly for Skilled Nursing and high-acuity Assisted Living facilities, to ensure seamless transitions and reduce costly readmissions. These institutional buyers focus intensely on facility certifications, clinical track records, adherence to discharge protocols, and efficient data exchange capabilities. The market is increasingly recognizing the importance of attracting middle-income seniors, necessitating the development of affordable, high-value models to serve the large population segment currently underserved by premium and public-funded options.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $880.5 Billion USD |

| Market Forecast in 2033 | $1,450.0 Billion USD |

| Growth Rate | 7.45% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sunrise Senior Living, Brookdale Senior Living, Atria Senior Living, Five Star Senior Living, Erickson Senior Living, Ventas Inc., Welltower Inc., HCP Inc., Capital Senior Living, Senior Lifestyle Corporation, LCS, Holiday Retirement, Trilogy Health Services, Civitas Senior Living, Belmont Village Senior Living, Genesis Healthcare, Ensign Group, NHC, Sonata Senior Living, Aegis Living |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Senior Living Market Key Technology Landscape

The technological landscape within the Senior Living Market is rapidly shifting towards proactive health management, operational optimization, and enhanced resident engagement. Key technologies employed include sophisticated Electronic Health Records (EHRs) specifically adapted for long-term care settings, ensuring seamless data exchange and regulatory compliance. Crucially, passive monitoring systems, utilizing ambient sensors, radar technology, and non-wearable devices, are being implemented to track behavioral patterns, gait changes, and sleep quality without infringing on resident privacy, allowing caregivers to intervene rapidly in potential emergency situations like falls or sudden illness onset. This focus on preventative technology is foundational to improving clinical outcomes and demonstrating value to prospective residents.

Furthermore, connectivity and digital interaction tools are transforming the resident experience. High-speed, robust Wi-Fi networks are standard requirements to support telemedicine consultations, virtual reality applications for cognitive stimulation, and personalized entertainment platforms. Medication management systems are becoming increasingly automated, integrating smart pill dispensers and software that tracks adherence, reducing the risk of medication errors—a critical safety priority. Staff communication tools, often mobile-based apps, streamline task assignment, incident reporting, and real-time coordination, directly addressing the efficiency challenges posed by the persistent workforce shortages that characterize the operational environment.

The future technology trajectory is heavily invested in Artificial Intelligence and robotics. AI is utilized for analyzing massive datasets to predict staffing needs, personalize care plans, and even manage energy consumption across large facilities, thereby reducing operational overhead. Robotics, while still niche, is expanding from simple delivery robots to complex social robots providing companionship and basic physical assistance. Additionally, the development of specialized telehealth platforms that cater specifically to the elderly—featuring simple interfaces and integrated peripherals—is central to enabling remote specialist access and continuous health monitoring, thereby reducing the dependency on hospital visits and increasing the facility's ability to manage complex resident needs internally.

Regional Highlights

North America, led by the United States and Canada, remains the largest and most mature market for senior living services globally. This dominance is attributed to a highly fragmented but sophisticated private payer market, established regulatory standards, and a high concentration of large, experienced national and regional operators. The U.S. market is characterized by substantial investment in specialized segments like Memory Care and luxury Continuing Care Retirement Communities (CCRCs). Growth in this region is primarily driven by optimizing existing assets through technology upgrades and focusing on higher acuity care provision to maximize reimbursement potential from Medicare Advantage and long-term care insurance products. Competition is fierce, prompting operators to differentiate aggressively through amenity offerings and clinical excellence.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate throughout the forecast period, largely due to unprecedented demographic shifts in China, Japan, and South Korea, where aging populations are challenging traditional family care structures. While Japan has a highly developed, government-subsidized eldercare system, countries like China and India are experiencing explosive growth in private, Western-style senior communities catering to the expanding affluent middle class. European markets show stable, incremental growth, with Northern European nations emphasizing publicly supported or socialized models, focusing on quality of life and integration with community health services. The region focuses heavily on ensuring accessibility and affordability across different socio-economic strata, often resulting in lower private pay dominance compared to North America.

- North America (USA, Canada): Market leader; characterized by private pay dominance, high technological adoption, and focus on high-acuity care and CCRCs.

- Europe (UK, Germany, France): Stable growth; highly regulated environment with strong public/socialized care elements; emphasis on quality standards and integrated health systems.

- Asia Pacific (China, Japan, Australia): Fastest-growing region; driven by rapid aging, urbanization, and a shift towards professionalized care, especially in emerging economies seeking luxury and mid-market solutions.

- Latin America (Brazil, Mexico): Emerging market; nascent sector development focusing primarily on urban centers; high opportunity for international operators to introduce structured senior care models.

- Middle East & Africa (MEA): Limited but growing presence, predominantly focused on high-net-worth segments in GCC countries; increasing awareness of specialized eldercare needs driven by expatriate populations and localized demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Senior Living Market.- Sunrise Senior Living

- Brookdale Senior Living

- Atria Senior Living

- Five Star Senior Living

- Erickson Senior Living

- Ventas Inc.

- Welltower Inc.

- HCP Inc. (now Healthpeak Properties)

- Capital Senior Living

- Senior Lifestyle Corporation

- LCS (Life Care Services)

- Holiday Retirement

- Trilogy Health Services

- Civitas Senior Living

- Belmont Village Senior Living

- Genesis Healthcare

- Ensign Group

- NHC (National HealthCare Corporation)

- Sonata Senior Living

- Aegis Living

Frequently Asked Questions

Analyze common user questions about the Senior Living market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Senior Living Market?

The predominant growth driver is the significant global demographic shift, specifically the aging of the Baby Boomer generation, leading to an exponential increase in the number of individuals requiring professional support services and specialized residential care environments.

How is technology, specifically AI, changing the cost structure of senior care facilities?

AI is improving the cost structure by enabling predictive maintenance, optimizing staffing ratios based on acuity, and reducing high-cost events like hospital readmissions through early detection of health issues, leading to operational efficiencies and better resource allocation.

What is the difference between Independent Living and Assisted Living segments?

Independent Living (IL) caters to active seniors requiring minimal or no daily assistance, focusing on amenities and social engagement. Assisted Living (AL) provides support with Activities of Daily Living (ADLs) such as bathing, dressing, and medication management for residents requiring moderate levels of care.

Which geographic region presents the most significant opportunity for new senior living development?

The Asia Pacific (APAC) region offers the most significant new development opportunity, driven by massive, rapidly aging populations in countries like China and India, where the demand for professional, Western-style eldercare facilities far outstrips current supply.

What is the key challenge facing senior living operators regarding labor?

The primary challenge is the critical and persistent shortage of skilled healthcare workers, including certified nursing assistants and registered nurses, which drives up labor costs, mandates high turnover rates, and limits the ability of facilities to accept high-acuity residents.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Personal Emergency Response System Market Size Report By Type (Landline PERS, Mobile PERS , Standalone PERS), By Application (Home-based Users, Senior Living Facilities, Assisted Living Facilities), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Standalone Personal Emergency Response Systems Market Size Report By Type (Smoke Detectors, Bed Sensors, Fall Detection Sensors, Others), By Application (Home Based Users, Senior Living Facilities, Assisted Living Facilities), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager