Seniors Health and Wellness Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436811 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Seniors Health and Wellness Market Size

The Seniors Health and Wellness Market is experiencing robust expansion driven by unprecedented demographic shifts globally, particularly the rapid increase in the population aged 65 and above. This demographic segment not only requires traditional healthcare services but also demands sophisticated wellness solutions focused on preventative care, lifestyle management, and maintaining independence. The market scope encompasses a wide array of products and services, including remote patient monitoring (RPM) systems, age-in-place technologies, specialized nutritional supplements, mental wellness programs, and tailored fitness equipment designed for geriatric populations. Market growth is further stimulated by increased consumer awareness regarding proactive health management and technological advancements that make personalized care accessible outside traditional clinical settings.

The convergence of digital health platforms and established healthcare infrastructure is significantly influencing market dynamics. Telehealth and virtual care platforms have become critical components, particularly in addressing healthcare accessibility issues in rural or underserved areas, which are often heavily populated by seniors. Furthermore, investment in digital therapeutics, which deliver evidence-based therapeutic interventions via software programs, is rising, positioning them as viable alternatives or complements to traditional pharmacological treatments for chronic conditions prevalent among seniors, such as diabetes, cardiovascular diseases, and dementia. These integrated solutions enhance patient compliance and provide continuous data streams critical for effective chronic disease management.

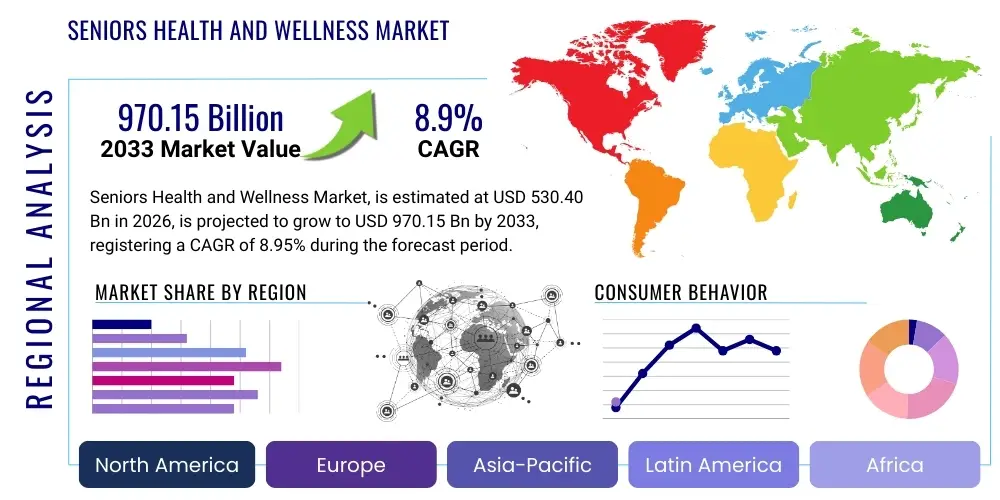

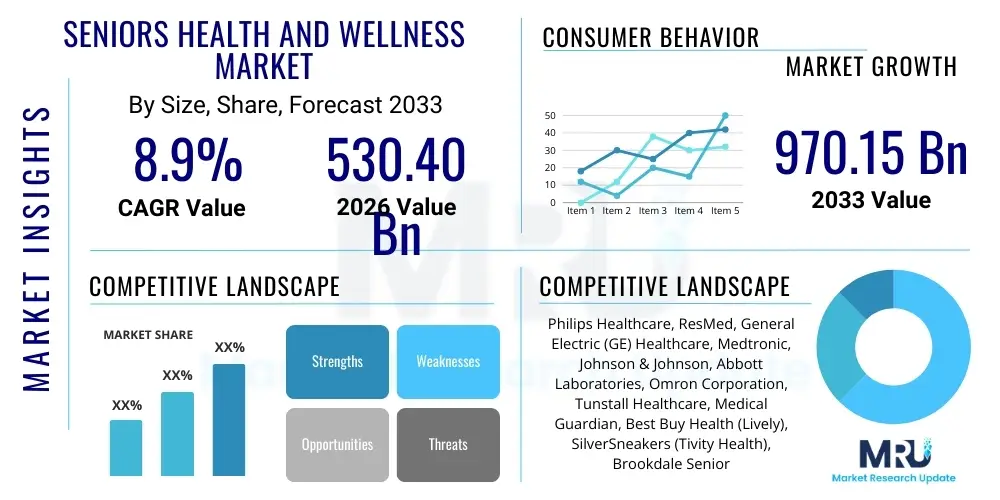

The Seniors Health and Wellness Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.95% between 2026 and 2033. The market is estimated at USD 530.40 Billion in 2026 and is projected to reach USD 970.15 Billion by the end of the forecast period in 2033. This substantial growth trajectory underscores the necessity for healthcare providers, technology firms, and regulatory bodies to collaboratively develop scalable and cost-effective solutions tailored to the evolving needs of the aging demographic, ensuring high quality of life and sustained independence.

Seniors Health and Wellness Market introduction

The Seniors Health and Wellness Market fundamentally addresses the complex healthcare and lifestyle needs of individuals typically aged 65 and older, aiming to optimize their physical, mental, and social well-being. This specialized market integrates conventional medical care with preventative and lifestyle-focused services, ranging from specialized pharmaceutical products and medical devices to non-clinical offerings like personalized fitness training, nutritional counseling, and social engagement platforms. Key market components include assistive living devices, mobility aids, home healthcare services, digital health applications for chronic disease management, and specialized insurance products. The market’s overarching goal is to support 'aging in place'—the ability of seniors to live independently and safely in their own homes for as long as possible—thereby mitigating the high costs associated with institutionalized care.

Major applications of solutions within this market span across geriatric care management, chronic disease management (CDM), mental health support, physical rehabilitation, and preventative wellness programs. The benefits realized by effective market solutions include reduced hospital readmission rates, improved patient outcomes, enhanced quality of life, and substantial cost savings for both patients and healthcare systems by shifting the focus from reactive treatment to proactive prevention. Products and services are increasingly designed with user-centric interfaces, incorporating principles of universal design to ensure accessibility and ease of use for individuals who may have cognitive or physical impairments. For example, remote monitoring devices now utilize simplified interfaces and passive data collection methods, minimizing the interaction burden on the senior user while providing essential data to caregivers and clinicians.

The primary driving factors propelling this market include the global demographic shift towards an older population structure, characterized by lower birth rates and increased longevity, which necessitates sustained healthcare innovation. Concurrently, the increasing prevalence of age-related chronic conditions, such as Alzheimer's disease, arthritis, and cardiovascular issues, mandates continuous monitoring and sophisticated care pathways. Furthermore, favorable regulatory environments in many developed economies, which incentivize the adoption of telehealth and digital health tools, coupled with substantial private and public investments in geriatric research and care infrastructure, accelerate market expansion. High-speed internet penetration, particularly 5G technology, is enabling reliable, real-time data transmission required for advanced remote care services, solidifying technology as a core growth catalyst.

Seniors Health and Wellness Market Executive Summary

The Seniors Health and Wellness Market is defined by dynamic business trends, marked by significant consolidation among technology and healthcare providers, alongside strategic partnerships aimed at creating integrated care platforms. A primary business trend involves the shift from fee-for-service models to value-based care, compelling providers to prioritize outcomes and preventative measures, which subsequently fuels demand for cost-effective remote monitoring and preventative wellness solutions. Furthermore, venture capital funding is increasingly targeting startups specializing in "Silver Tech," focusing on solutions that merge AI, IoT, and personalized medicine to cater specifically to the senior demographic, resulting in a flurry of innovation across medical devices and digital therapeutic fields. Large healthcare systems are actively acquiring smaller, specialized technology firms to rapidly integrate digital capabilities into their service offerings, optimizing their ability to manage large, geographically dispersed senior populations.

Regionally, North America remains the dominant market segment due to advanced healthcare infrastructure, high disposable income among seniors, and strong governmental support for digital health initiatives, particularly within the US Medicare system. Europe is characterized by stringent regulatory standards but benefits from universal healthcare systems focusing on preventative care, leading to high adoption rates of home healthcare services and non-pharmacological interventions, with countries like Germany and the Nordic nations leading in smart-home integration for the elderly. Asia Pacific (APAC) represents the fastest-growing region, driven by countries like China and India facing rapidly aging populations coupled with infrastructural development and rising middle-class healthcare spending. This region is witnessing rapid adoption of low-cost mobile health solutions and localized cultural adaptations of wellness programs, often emphasizing traditional medicine integration alongside modern technology.

Segment trends highlight the exceptional growth of the technology and digital health segment, specifically driven by the demand for sophisticated remote patient monitoring (RPM) and personal emergency response systems (PERS), which provide crucial safety nets for independent living. Within services, home healthcare and specialized rehabilitation services are experiencing increasing demand, outpacing institutional care growth as seniors prioritize comfort and familiarity. Furthermore, the specialized nutrition segment, including fortified foods and supplements designed to address age-related nutritional deficiencies (e.g., bone health, cognitive function), is exhibiting strong performance. Overall, the market trajectory indicates a clear move towards highly personalized, technology-enabled, decentralized care models that empower seniors to manage their health proactively while maintaining maximum autonomy.

AI Impact Analysis on Seniors Health and Wellness Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Seniors Health and Wellness Market frequently revolve around three core themes: the feasibility of personalized geriatric care, the reliability and ethics of AI-driven diagnostic tools, and the efficiency gains in administrative and care coordination processes. Users are keen to understand how AI can move beyond basic data aggregation to deliver predictive analytics that proactively prevent health crises, asking questions like, "Can AI detect early signs of cognitive decline better than human clinicians?" and "How will AI ensure data privacy for sensitive health information collected via wearables?" There is also a strong expectation that AI will democratize high-quality care, especially for seniors in remote areas, by enabling sophisticated remote diagnostics and personalized therapeutic recommendations without requiring frequent physical visits to specialists. Key concerns often center on the digital literacy gap among older adults and the potential for algorithmic bias in care recommendations.

The integration of AI systems is fundamentally transforming the approach to seniors' health, shifting it towards highly individualized and predictive models. AI algorithms can analyze vast datasets derived from Electronic Health Records (EHRs), genomic information, and real-time wearable data to identify subtle patterns indicating health deterioration long before symptoms become severe enough to necessitate emergency intervention. This capability is particularly vital in managing complex comorbidities common in the elderly population, allowing clinicians to adjust care plans dynamically. For example, machine learning models are being deployed to predict fall risks based on gait analysis and environmental factors, facilitating timely interventions such as physical therapy adjustments or home modifications, thereby significantly reducing one of the leading causes of injury and fatality among seniors.

Beyond diagnostics, AI optimizes resource allocation and improves the patient-provider interaction experience. AI-powered tools manage scheduling, triage patient inquiries, and automate repetitive administrative tasks, allowing nursing staff and geriatric specialists to dedicate more time to direct patient care and complex case management. Furthermore, AI is crucial in developing personalized engagement strategies for wellness, such as creating adaptive exercise routines or suggesting tailored nutritional plans based on continuous feedback loops regarding physical activity levels, dietary intake, and biometric data. The long-term impact promises a more efficient, less error-prone, and profoundly patient-centric care continuum for the aging population, provided ethical deployment and data security standards are rigorously maintained.

- AI-driven Predictive Analytics: Early identification of chronic disease exacerbations, cognitive decline, and acute health risks (e.g., sepsis, falls).

- Personalized Digital Therapeutics: Creation of adaptive treatment plans and rehabilitation exercises tailored to individual functional status and recovery speed.

- Automated Remote Patient Monitoring (RPM): Intelligent filtering of large volumes of sensor data to flag actionable alerts for clinicians, reducing alarm fatigue.

- Enhanced Care Coordination: AI systems optimizing logistical planning for home healthcare visits, medication management, and appointment scheduling.

- Diagnostic Support: Machine learning models assisting radiologists and pathologists in identifying subtle age-related pathology in imaging and lab results.

- Optimization of Senior Living Operations: AI used for staff scheduling, resource management, and improving safety protocols within assisted living and nursing homes.

DRO & Impact Forces Of Seniors Health and Wellness Market

The Seniors Health and Wellness Market is shaped by a powerful interplay of Driving forces (D), Restraints (R), and Opportunities (O), collectively forming the fundamental Impact Forces. The primary Driving force is the unrelenting demographic aging across nearly all global regions, placing immense structural pressure on healthcare systems to provide sustainable, long-term care solutions that prioritize quality of life. Simultaneously, rapid technological innovation, particularly in IoT, wearables, and telehealth infrastructure, serves as a crucial enabler, making sophisticated, continuous health monitoring and intervention accessible outside clinical settings. Increased awareness and patient empowerment also drive demand, as modern seniors are proactive consumers seeking preventative measures and solutions that support an active lifestyle, rather than simply accepting age-related decline. Government initiatives globally, focused on reducing institutionalization and promoting community-based care, further solidify these drivers.

However, significant Restraints temper market growth. High initial costs associated with advanced senior care technologies, such as integrated smart-home systems and sophisticated digital therapeutics, often pose financial barriers, especially in emerging economies or for seniors relying solely on fixed incomes. Furthermore, regulatory hurdles related to data privacy (e.g., HIPAA, GDPR) and the slow pace of reimbursement adjustments by public health insurers for novel digital interventions create friction for market adoption and scalability. A significant practical restraint is the pervasive issue of digital literacy and technological aversion among a segment of the older population, requiring extensive training and simplified interface designs. Lastly, the shortage of qualified geriatric care professionals and specialized technical support staff capable of implementing and maintaining these complex systems limits service delivery capacity.

These forces create compelling Opportunities for strategic investment and innovation. The shift towards preventive and personalized medicine opens vast avenues for specialized nutrition, precision wellness programs, and pharmacogenomic testing tailored to the elderly. The market presents a substantial opportunity in developing scalable, low-cost community-based care models utilizing remote patient monitoring and AI-enabled diagnostics, bridging the accessibility gap in rural areas. Moreover, the convergence of social wellness and physical health represents a fertile ground, focusing on developing platforms that address loneliness and social isolation, recognized as major health risks for seniors. The development of interoperable systems that seamlessly integrate data across various care settings—from hospitals to home care—is a critical, yet largely untapped, opportunity for market leaders to establish robust platforms.

Segmentation Analysis

The Seniors Health and Wellness Market is intricately segmented based on the nature of the product or service provided, the specific application area, and the delivery channel utilized to reach the aging population. Comprehensive segmentation allows manufacturers, service providers, and investors to precisely target their offerings to distinct demographic needs, improving effectiveness and resource allocation. The market typically divides across core categories including Product Type (Devices, Pharmaceuticals, Supplements), Service Type (Home Healthcare, Institutional Care, Wellness Services), and Application (Chronic Disease Management, Mobility Assistance, Cognitive Health). Analyzing these segments reveals varying growth rates, with technology-enabled services and preventative wellness applications generally outpacing traditional segments due to shifting consumer preferences towards independence and proactive health management.

A crucial segmentation differentiator is the level of technological integration involved. The digital health segment, encompassing remote monitoring devices, telehealth platforms, and AI-driven applications, is characterized by high innovation and substantial capital inflows. Conversely, the traditional segment, covering mobility aids, specialized medical equipment, and traditional pharmaceuticals, offers stability but lower growth potential, primarily driven by replacement demand. Geographic segmentation remains vital, reflecting disparities in regulatory acceptance, healthcare spending power, and cultural attitudes toward aging; for example, smart home technology penetration is significantly higher in North America and Western Europe compared to parts of Asia where multi-generational households are more common.

Effective segmentation strategies must also consider the payer type, distinguishing between services reimbursed by public insurance programs (e.g., Medicare/Medicaid), private insurance, and out-of-pocket spending, as reimbursement policies heavily influence the adoption trajectory of new technologies. Furthermore, targeting by functional ability—ranging from highly independent seniors requiring preventative wellness to frail seniors needing high-acuity home care—enables the development of appropriately scaled and priced solutions. This granular approach ensures that market offerings are not only medically effective but also economically viable and aligned with the lifestyle requirements of diverse senior subsets.

- By Type:

- Medical Devices and Equipment (Mobility Aids, Diagnostic Equipment, Monitoring Devices)

- Pharmaceuticals and OTC Products (Age-related Chronic Disease Medications)

- Nutritional Supplements and Specialized Foods (Vitamins, Minerals, Meal Replacement Shakes)

- Technology and Digital Health (Telehealth, RPM Systems, Digital Therapeutics, Wearables)

- By Service:

- Home Healthcare Services (Skilled Nursing, Physical Therapy, Personal Care)

- Wellness and Fitness Centers (Specialized Gyms, Rehabilitation Clinics)

- Institutional Care (Assisted Living, Skilled Nursing Facilities)

- Mental and Cognitive Health Services (Counseling, Brain Training Programs)

- By Application:

- Chronic Disease Management (Diabetes, Cardiovascular, Respiratory)

- Preventive Care and Lifestyle Management

- Mobility and Rehabilitation Support

- Safety and Emergency Response (PERS)

- By End-User:

- Hospitals and Clinics

- Home Care Settings

- Senior Living Communities

- Individuals

Value Chain Analysis For Seniors Health and Wellness Market

The value chain of the Seniors Health and Wellness Market is highly complex, involving multiple integrated steps from raw material supply to final service delivery and ongoing support. The upstream analysis focuses heavily on research and development (R&D) and manufacturing. R&D activities are crucial for developing innovative, user-friendly medical devices, age-appropriate pharmaceuticals, and sophisticated software for digital health platforms. Manufacturers must adhere to stringent regulatory standards (FDA, CE Mark) while focusing on miniaturization, durability, and simplified functionality for senior users. Key upstream suppliers include pharmaceutical active ingredient manufacturers, medical-grade sensor providers, and specialized software developers providing AI and cloud infrastructure.

The midstream phase involves complex distribution and logistics, reflecting the heterogeneous nature of the products. Distribution channels are highly fragmented, categorized into direct and indirect routes. Direct channels involve manufacturers selling high-value, specialized equipment or proprietary software solutions directly to large healthcare systems or institutional care providers. Indirect channels, which form the bulk of consumer-facing sales, rely on third-party distributors, wholesalers, pharmacies, specialized medical supply stores, and increasingly, major e-commerce platforms like Amazon and specialized digital marketplaces. Effective inventory management and cold chain logistics are critical, especially for sensitive pharmaceuticals and nutritional products.

Downstream activities center on service delivery and patient engagement, crucial for driving value capture in this market. This phase involves home healthcare agencies, specialized geriatric clinics, rehabilitation centers, and technology support teams. Direct interaction with the senior end-user or their family caregivers is paramount, necessitating trained staff capable of handling both medical and technical support needs. The value chain is increasingly augmented by digital platforms that provide continuous monitoring, virtual consultations, and education, ensuring that the initial product sale is complemented by ongoing service revenue and high patient retention rates, thus creating a recursive feedback loop for continuous product improvement and service personalization.

Seniors Health and Wellness Market Potential Customers

The primary potential customers and end-users of the Seniors Health and Wellness Market are categorized into three main groups: independent seniors and their family caregivers, institutional care providers, and large-scale public and private payers. Independent seniors, particularly those classified as "Active Agers," prioritize preventative wellness, fitness technology, and specialized nutrition aimed at sustaining their active lifestyles, representing a high-margin, consumer-driven segment. Their family caregivers often act as the decision-makers and purchasers for larger, integrated solutions such as remote patient monitoring systems, emergency response services (PERS), and complex home modifications, driven by safety concerns and the desire to manage caregiving responsibilities more effectively.

Institutional care providers, including hospitals, skilled nursing facilities (SNFs), assisted living communities, and dedicated rehabilitation centers, constitute a major B2B customer segment. These entities invest heavily in enterprise-level solutions such as centralized health management software, advanced diagnostic equipment, high-volume mobility aids, and staff training programs. Their procurement decisions are heavily influenced by regulatory compliance, operational efficiency, and the ability of the solution to improve patient outcomes metrics, which directly impact reimbursement rates and overall facility ratings. The adoption of telehealth infrastructure and predictive analytics platforms is driven by the need to optimize resource utilization and reduce costly readmissions.

The third major segment consists of public health systems (e.g., Medicare, NHS) and large private health insurance companies. While not direct consumers of the physical products, these payers dictate market demand through their reimbursement policies and coverage decisions. They are crucial purchasers of preventative programs, chronic disease management services, and digital therapeutics proven to reduce overall healthcare expenditure. Their focus is on long-term population health management, seeking solutions that demonstrate compelling cost-effectiveness and measurable impact on reducing acute care episodes, making evidence-based efficacy a critical purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 530.40 Billion |

| Market Forecast in 2033 | USD 970.15 Billion |

| Growth Rate | 8.95% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Philips Healthcare, ResMed, General Electric (GE) Healthcare, Medtronic, Johnson & Johnson, Abbott Laboratories, Omron Corporation, Tunstall Healthcare, Medical Guardian, Best Buy Health (Lively), SilverSneakers (Tivity Health), Brookdale Senior Living, Sodexo (Seniors Care), Nestlé Health Science, Amgen, Stryker Corporation, Invacare Corporation, AARP, Humana (Senior Products Division), Cerner Corporation (now Oracle Health). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Seniors Health and Wellness Market Key Technology Landscape

The technological landscape of the Seniors Health and Wellness Market is dominated by pervasive computing, connectivity, and data analytics tools designed to improve autonomy and clinical monitoring. Remote Patient Monitoring (RPM) systems, utilizing interconnected biosensors and wearable devices (smartwatches, patches, specialized apparel), form the backbone of this ecosystem. These technologies passively or actively collect vital health metrics—such as heart rate, blood pressure, glucose levels, and activity patterns—and transmit the data securely to cloud platforms for AI-driven analysis. The goal is to provide continuous surveillance and early intervention capabilities, thereby preventing acute events and managing chronic diseases with greater precision than episodic clinical visits allow. Crucially, these systems must be non-intrusive and reliable to ensure high compliance among the elderly population.

Another rapidly advancing area is the integration of Ambient Assisted Living (AAL) and smart home technology tailored for geriatric users. AAL systems utilize discreet, often invisible, environmental sensors (motion detectors, contact sensors, smart appliances) and voice-activated assistants to monitor daily routines, detect deviations that might signal a problem (e.g., unusual inactivity, prolonged bathroom visits), and facilitate communication. These technologies support the fundamental market trend of 'aging in place' by enhancing home safety, facilitating medication adherence through smart dispensers, and providing instant connectivity to emergency services (via advanced PERS). The increasing sophistication of Natural Language Processing (NLP) is making these interfaces intuitive even for users with limited technical proficiency.

Furthermore, the application of Digital Therapeutics (DTx) is expanding rapidly. DTx solutions are evidence-based software programs designed to treat, manage, or prevent a medical disorder or disease. In the seniors market, DTx is employed for conditions like insomnia, chronic pain management, and cognitive impairment (e.g., VR/AR based memory exercises). These solutions offer personalized, scalable, and non-pharmacological interventions, often achieving regulatory approval as standalone medical treatments. The synergy between DTx, RPM data, and AI-driven personalized feedback loops represents the pinnacle of technological advancement in this sector, promising highly effective, integrated, and continuous care that adapts dynamically to the individual's changing health status.

Regional Highlights

- North America: This region holds the largest market share, characterized by high healthcare expenditure, advanced technological infrastructure, and robust reimbursement frameworks (especially Medicare/Medicaid coverage for telehealth and RPM). The market benefits from substantial investment in R&D, a high concentration of key industry players, and a culturally high acceptance rate of home-based technology among affluent seniors. Demand is heavily concentrated on sophisticated digital solutions for chronic disease management and proactive longevity planning. The US market drives innovation in predictive analytics and specialized care coordination platforms targeting complex geriatric cases, reflecting an aggressive push towards value-based care models.

- Europe: The European market is mature and highly segmented, driven by strong governmental emphasis on universal access and community-based care models, particularly in Scandinavia and Western Europe. Adoption is steady across home healthcare services and specialized age-friendly construction (AAL). Regulatory harmonization efforts, such as GDPR and European medical device regulations, influence the development landscape. Key growth areas include non-pharmacological interventions, mental wellness programs, and government-subsidized telecare services aimed at reducing the burden on institutional facilities. Germany, France, and the UK are major revenue contributors, focusing on integrating social care services with medical health platforms.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, facing the most rapid aging population growth globally (e.g., Japan, South Korea, China). The market is transitioning quickly from traditional care models to technology-enabled solutions. Growth is fueled by increasing disposable incomes, expanding healthcare infrastructure, and government policies addressing the lack of formal caregivers. While high-end tech adoption occurs in developed economies like Japan, emerging economies focus on scalable, mobile-based health solutions and localized wellness programs. The primary growth drivers are preventative medicine and the necessity of managing mass elderly populations in settings where institutional capacity is limited.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent nascent but rapidly emerging markets. Growth is currently localized, driven by private sector investment in urban centers and high-net-worth individuals seeking quality geriatric care. In LATAM, market penetration is accelerating due to increasing internet access and mobile health adoption. In MEA, particularly the GCC countries, governmental initiatives to diversify healthcare and cater to expatriate populations are spurring investment in specialized wellness resorts and technologically advanced institutional care facilities. However, market scalability is often hindered by fragmented healthcare financing and infrastructure gaps outside major cities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Seniors Health and Wellness Market, covering technology developers, device manufacturers, and service providers who are pivotal in shaping market trends and competitive dynamics through continuous innovation and strategic expansion.- Philips Healthcare

- ResMed

- General Electric (GE) Healthcare

- Medtronic

- Johnson & Johnson

- Abbott Laboratories

- Omron Corporation

- Tunstall Healthcare

- Medical Guardian

- Best Buy Health (Lively)

- SilverSneakers (Tivity Health)

- Brookdale Senior Living

- Sodexo (Seniors Care Division)

- Nestlé Health Science

- Amgen

- Stryker Corporation

- Invacare Corporation

- AARP

- Humana (Senior Products Division)

- Cerner Corporation (now Oracle Health)

- Teladoc Health

- WellSky

- Life Alert Emergency Response

- Evolent Health

- Accolade

Frequently Asked Questions

Analyze common user questions about the Seniors Health and Wellness market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological drivers enabling seniors to 'age in place'?

The primary technological drivers are Remote Patient Monitoring (RPM) systems, which track vital signs continuously; Personal Emergency Response Systems (PERS), offering immediate connectivity to aid; and Ambient Assisted Living (AAL) technologies, which use discreet sensors and AI to monitor daily routines and enhance home safety. These technologies empower seniors to maintain independence by providing real-time data and safety nets without requiring institutional relocation.

How is the shift towards value-based care impacting the Seniors Health and Wellness Market?

The transition to value-based care models is compelling providers to prioritize preventative interventions and long-term health outcomes over episodic treatment. This shift significantly increases demand for digital health solutions, such as chronic disease management platforms and remote monitoring, which demonstrably reduce hospital readmissions and lower overall healthcare costs, aligning payment incentives with quality of life improvements for seniors.

Which segment of the Seniors Health and Wellness Market is experiencing the fastest growth?

The Technology and Digital Health segment, specifically encompassing Telehealth, Remote Patient Monitoring (RPM), and Digital Therapeutics (DTx), is experiencing the fastest growth. This acceleration is driven by the need for scalable, non-invasive solutions to manage the increasing prevalence of age-related chronic diseases and the critical need for continuous, decentralized care delivery, particularly post-pandemic.

What are the key challenges in the adoption of advanced health technologies by the senior population?

Key challenges include the digital literacy gap and technological aversion among certain older demographics, leading to low adoption rates. Other hurdles involve high initial costs for sophisticated systems, concerns over data privacy and security, and the necessity for robust technical support tailored to elderly users to ensure effective long-term utilization and reliable data generation for clinical purposes.

In the global Seniors Health and Wellness Market, why is the Asia Pacific region projected for such significant growth?

The Asia Pacific (APAC) region is projected for significant growth primarily due to the rapid, unprecedented demographic aging in countries like China, Japan, and South Korea, combined with simultaneous economic growth and rising middle-class healthcare spending. Governments are actively investing in infrastructural development and policies supporting geriatric care technology to manage this massive demographic shift, ensuring market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager