Sensor Analytical Balances Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437754 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Sensor Analytical Balances Market Size

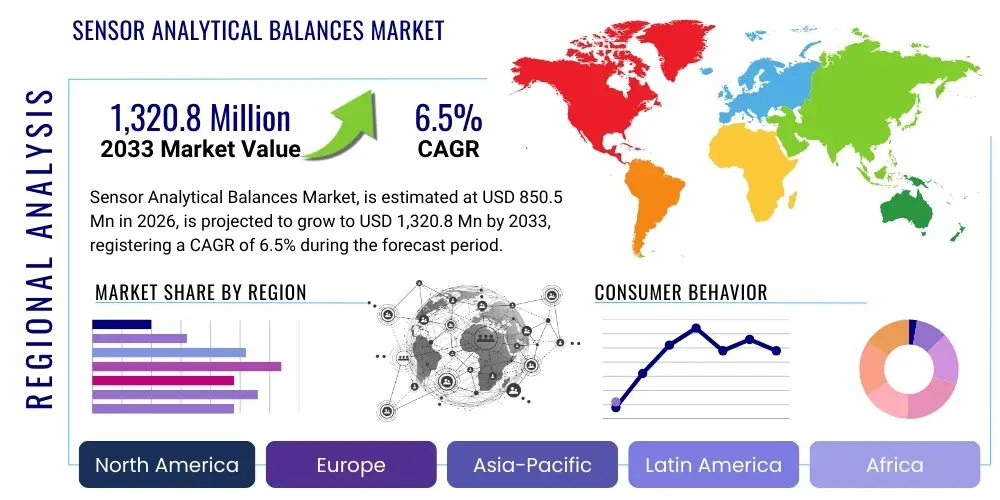

The Sensor Analytical Balances Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,320.8 Million by the end of the forecast period in 2033.

Sensor Analytical Balances Market introduction

The Sensor Analytical Balances Market encompasses the global trade of highly sensitive laboratory instruments designed for precise mass determination, often down to microgram levels. These advanced balances utilize sophisticated sensor technology, such as electromagnetic force compensation (EMFC) or modern capacitive sensors, coupled with digital processing capabilities, to ensure accuracy and repeatability in demanding scientific and industrial environments. Unlike standard precision balances, analytical balances are enclosed in draft shields to prevent minor air currents from affecting the measurement, making them indispensable tools for quantitative analysis.

Analytical balances are crucial components in various regulated industries, including pharmaceuticals, biotechnology, chemicals, and academic research. They are primarily utilized for sample preparation, standard solution creation, moisture analysis, and quality control checks where minimal measurement error is paramount. The increasing complexity of drug formulations, stringent regulatory requirements necessitating traceable and highly accurate measurements, and the expansion of research activities globally are major factors propelling the demand for high-performance sensor analytical balances.

Key benefits of modern sensor analytical balances include rapid stabilization times, self-calibration features, embedded software for data management, and integration capabilities with Laboratory Information Management Systems (LIMS). Driving factors include the escalating investment in pharmaceutical research and development (R&D), the necessity for improved laboratory efficiency through automation, and technological advancements that enhance precision and connectivity. These balances are evolving from standalone instruments into integrated data collection points crucial for digital laboratory workflows.

Sensor Analytical Balances Market Executive Summary

The Sensor Analytical Balances Market is experiencing robust growth driven by accelerating digitalization across laboratory environments and sustained high demand from the life sciences sector. Business trends indicate a strong focus on developing balances that offer enhanced connectivity, enabling seamless integration with existing lab infrastructure and cloud-based data repositories. Manufacturers are prioritizing user interface improvements, ergonomic design, and specialized features such as minimum sample weight determination and advanced self-diagnostics, positioning high-throughput, automated balances as the future standard. Strategic partnerships focusing on providing holistic laboratory solutions, including calibration and servicing contracts, are becoming prevalent among major market players.

Segment trends reveal that the Pharmaceutical and Biotechnology segment maintains market dominance, fueled by increasing drug discovery pipelines and the critical need for compliance with Good Manufacturing Practice (GMP) standards. Geographically, Asia Pacific is emerging as the fastest-growing region, attributed to massive governmental investments in establishing world-class research facilities, rising domestic drug production, and the relocation of manufacturing activities to countries like China and India. However, established markets in North America and Europe continue to hold significant revenue share, driven by strong regulatory frameworks and the consistent upgrading of legacy laboratory equipment.

Overall, the market trajectory is highly dependent on technological innovation, specifically the integration of smart features and Artificial Intelligence (AI) for error prevention and data integrity assurance. Regulatory pressure demanding absolute accuracy and audit trails acts as a powerful motivator for labs to adopt the latest sensor technologies. The shift towards miniaturization in sample handling and the increasing application of analytical balances in novel fields like nanotechnology further underscore the dynamic nature of this specialized instrumentation market, emphasizing precision and compliance as core market differentiators.

AI Impact Analysis on Sensor Analytical Balances Market

User queries regarding the impact of AI on the Sensor Analytical Balances Market frequently center on how these advanced algorithms can minimize human error, automate complex calibration routines, and ensure regulatory compliance without manual intervention. Common concerns include the reliability of AI-driven anomaly detection in micro-weighing, the security of integrated data streams, and the ability of AI to optimize sample preparation protocols for maximum efficiency and material conservation. Users expect AI to transcend basic data logging by providing predictive maintenance alerts and offering real-time guidance on measurement protocols, thereby transforming the balance from a mere measurement device into an intelligent analytical assistant. The analysis highlights a strong user expectation that AI will standardize weighing procedures across multiple laboratories globally, addressing variability issues that currently plague large multi-site organizations.

The primary influence of AI lies in enhancing metrological performance and streamlining workflows. AI models can analyze environmental variables (temperature, humidity, vibration) and dynamically adjust balance parameters, ensuring optimal measuring conditions even in challenging laboratory settings. Furthermore, AI facilitates predictive calibration, determining the precise moment a balance needs adjustment based on usage patterns and internal sensor drift rather than fixed schedules. This approach maximizes uptime and maintains measurement accuracy consistently, which is invaluable for regulated quality control environments where instrument failure or deviation can result in significant material loss or audit non-compliance.

In data integrity management, AI plays a pivotal role. It can autonomously monitor weighing data for patterns indicative of human manipulation, procedural deviations, or instrument malfunction, generating immediate alerts and providing a robust audit trail. This capability is critical for achieving compliance with regulations like 21 CFR Part 11, reducing the labor intensity of manual data review, and accelerating the validation processes for new experimental protocols. The integration of machine learning into balance software elevates the analytical process, enabling laboratories to extract deeper insights from complex, highly precise weighing data.

- AI optimizes balance performance by compensating for dynamic environmental changes.

- Predictive maintenance and calibration scheduling driven by machine learning algorithms reduce instrument downtime.

- Enhanced data integrity and audit trail generation, ensuring compliance (e.g., 21 CFR Part 11).

- Automated anomaly detection identifies potential sources of error or procedural non-conformance in real-time.

- Integration with smart lab systems facilitates automated sample tracking and protocol execution.

- AI-guided minimum weight determination minimizes consumption of expensive or scarce sample materials.

DRO & Impact Forces Of Sensor Analytical Balances Market

The market for Sensor Analytical Balances is shaped by a confluence of influential factors categorized as Drivers, Restraints, and Opportunities, which collectively determine the market’s growth trajectory and impact forces. The dominant Driver is the exponential growth in the pharmaceutical and biotech sectors, particularly concerning sophisticated drug research, formulation, and quality assurance demanding ultra-precise measurement standards. Simultaneously, stringent global regulatory requirements, such as those mandated by the FDA and EMA, enforce the adoption of certified and highly accurate weighing instruments with advanced data management capabilities, thereby boosting market demand. Technological innovation, specifically the introduction of automated features and superior electromagnetic force compensation (EMFC) sensor technologies, acts as a primary market accelerator.

However, the market faces significant Restraints. The high initial procurement cost associated with advanced sensor analytical balances, combined with the expensive, periodic calibration and maintenance requirements, presents a barrier to entry for smaller academic laboratories or emerging market enterprises with restricted capital expenditure budgets. Furthermore, the necessity for specialized training to operate and maintain these complex, high-precision instruments effectively adds to the total cost of ownership, potentially slowing adoption rates in regions lacking sufficient skilled technical personnel. The vulnerability of highly sensitive sensors to rough handling or harsh chemical environments also poses a long-term operational challenge.

Opportunities within this market are centered around digitalization and geographic expansion. The increasing trend towards laboratory automation and the establishment of connected 'smart labs' open avenues for manufacturers to integrate balances into holistic, seamless digital workflows, leveraging IoT capabilities and cloud connectivity. Geographically, significant opportunities exist in developing regions like Asia Pacific and Latin America, where governments are investing heavily in new research infrastructure and modernizing existing industrial facilities. The development of portable, ruggedized analytical balances for field testing applications also represents an untapped niche market opportunity.

The overall impact forces are strongly positive, driven by non-negotiable compliance needs in high-value industries. The necessity for precision in drug development and material science overshadows the cost restraints for major industry players. The market is primarily influenced by the powerful regulatory environment (Impact Force: High), followed by rapid technological evolution (Impact Force: Medium-High), pushing laboratories towards mandatory equipment upgrades to maintain competitive and legal standing.

Segmentation Analysis

The Sensor Analytical Balances Market is systematically segmented based on criteria such as load capacity, end-user industry, and technology employed, providing granular insights into demand patterns across different laboratory needs. The segmentation based on capacity distinguishes instruments used for standard chemical analysis from those specialized for ultra-micro and semi-micro applications, crucial in nanotechnology and material science. End-user classification helps manufacturers tailor product features and marketing efforts specifically to the rigorous demands of pharmaceutical R&D, specialized chemical testing, or high-throughput academic research environments, recognizing that precision requirements vary significantly across these sectors.

Load capacity segmentation is pivotal, as analytical balances are typically categorized into standard analytical (up to 320g, 0.1 mg readability), semi-micro (up to 220g, 0.01 mg readability), and micro/ultra-micro balances (down to 2g, 0.001 mg readability). The growing complexity and cost of raw materials in advanced drug formulation are driving increased demand for semi-micro and micro balances, necessitating finer granularity in mass measurement to conserve precious samples and enhance experimental accuracy. Technological segmentation focuses predominantly on electromagnetic force compensation (EMFC), which remains the industry standard due to its exceptional accuracy, though new sensor developments are continually emerging to challenge this dominance.

- By Load Capacity:

- Standard Analytical Balances (0.1 mg readability)

- Semi-Micro Balances (0.01 mg readability)

- Micro and Ultra-Micro Balances (0.001 mg readability)

- By Technology:

- Electromagnetic Force Compensation (EMFC)

- Capacitive Sensor Technology

- Others (e.g., Load Cell Technology for basic models)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Chemical and Material Testing Laboratories

- Food and Beverage Testing Laboratories

- Environmental Testing Laboratories

- By Application:

- Sample Preparation

- Differential Weighing

- Density Determination

- Calibration and Standard Solution Preparation

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Sensor Analytical Balances Market

The value chain for the Sensor Analytical Balances Market is characterized by highly specialized components and intensive R&D efforts at the upstream level, transitioning into complex manufacturing and highly regulated distribution networks downstream. Upstream activities involve the procurement of specialized raw materials, including high-precision machining components, advanced microprocessors, sophisticated sensor elements (often custom-made quartz or specialized metal alloys for EMFC technology), and high-quality shielding materials. Critical upstream processes include the development of proprietary weighing cell technologies, which are the core differentiator in accuracy and stability among competitors. High intellectual property protection is necessary in this phase.

Midstream activities focus on precision manufacturing, assembly, and rigorous quality control. The manufacturing process demands highly controlled environments to minimize contamination and ensure the stability of the sensor mechanism. Extensive calibration and testing protocols are mandatory to meet international standards (e.g., ISO 9001, GLP/GMP compliance). The integration of proprietary software and connectivity modules (for LIMS compatibility) is a key value-adding step in the manufacturing process, transforming the physical balance into a data-generating analytical system. Direct sales and indirect distribution form the core of the downstream activities, often involving specialized technical distributors.

Distribution channels for analytical balances are predominantly specialized due to the technical nature of the product and the need for expert installation and post-sales support, including calibration and servicing. Direct sales are common for large pharmaceutical corporations and government labs, allowing manufacturers to maintain tight control over product delivery, installation, and service contracts. Indirect channels utilize highly skilled regional distributors and authorized resellers who possess expertise in laboratory instrumentation and can provide localized technical support and regulatory consultation. The complexity of the product means general laboratory equipment distributors often require specialized training, emphasizing the direct relationship between the manufacturer and the technical reseller.

Sensor Analytical Balances Market Potential Customers

The primary consumers and end-users of Sensor Analytical Balances are institutions and corporations operating within highly regulated scientific domains where measurement integrity is critical for product development, quality assurance, and compliance. Pharmaceutical and biotechnology companies represent the largest segment of end-users, utilizing balances extensively in drug discovery, formulation development, clinical trials material preparation, and stringent quality control (QC) labs to ensure batch consistency and regulatory adherence. These users demand balances with advanced features, including automated internal calibration, comprehensive audit trails, and seamless network connectivity to comply with global regulatory guidelines.

Academic and government research institutes form another major customer group. Universities, national laboratories, and specialized government testing centers rely on analytical balances for fundamental research in chemistry, physics, and material science, where accurate mass measurement is foundational to experimental repeatability and validity. While these customers may have less stringent regulatory needs than the pharmaceutical sector, they often require highly versatile instruments capable of diverse applications, including density measurement and specialized micro-weighing for emerging nanotechnology studies.

Furthermore, chemical manufacturing, food and beverage, and environmental testing laboratories constitute significant potential customers. Chemical companies use analytical balances for precise ingredient mixing and quality verification of chemical outputs. Food and beverage labs depend on them for nutritional analysis and trace element determination, while environmental labs use them for residue analysis and standard preparation required for testing pollutants. In all these sectors, the push towards digitalization and automation is driving the adoption of balances that can integrate easily into existing laboratory informatics systems, positioning data-centric capabilities as a critical purchasing criterion for procurement managers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,320.8 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mettler Toledo, Sartorius AG, PerkinElmer Inc., Shimadzu Corporation, A&D Company, Ltd., Ohaus Corporation, Precisa Gravimetrics AG, Adam Equipment, Kern & Sohn GmbH, Contech Instruments Ltd., GRAM Group, Radwag Balances and Scales, Bel Engineering, Citizen Scale (India) Pvt. Ltd., Acculab Inc., Wipotec-OCS GmbH, Gibertini Elettronica, Denver Instrument, Scientech Inc., PCE Instruments |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sensor Analytical Balances Market Key Technology Landscape

The technological core of the Sensor Analytical Balances Market is dominated by Electromagnetic Force Compensation (EMFC) technology, which provides the superior stability, accuracy, and repeatability required for regulatory compliance and high-precision scientific work. EMFC relies on generating an electromagnetic force that precisely counteracts the weight placed on the balance pan, measuring the current required to maintain equilibrium. Recent technological advancements focus on improving the efficiency and robustness of the EMFC cell, reducing stabilization time, and minimizing temperature dependency, thereby allowing for faster and more reliable measurements in dynamic laboratory settings. Manufacturers are also integrating advanced diagnostics within the weighing cell to predict component failure and ensure optimal uptime.

Beyond the core sensing technology, the landscape is rapidly evolving towards enhanced digitalization and connectivity. Modern analytical balances feature integrated touchscreens, multi-language interfaces, and advanced security protocols to protect weighing data. The widespread adoption of IoT standards and connectivity options (such as Ethernet, Wi-Fi, and USB) enables balances to function as critical nodes in laboratory data networks, automatically transferring measurement results to LIMS or ERP systems. This shift reduces transcription errors, supports automated data integrity checks, and streamlines the process of generating audit-compliant reports, which is a major factor driving equipment replacement cycles.

A significant area of innovation is in the field of automated calibration and adjustment. Technologies such as internal motorized calibration weights, which automatically initiate calibration routines based on environmental changes (e.g., temperature drift) or pre-set time intervals, are standard features in high-end models. Furthermore, the development of sophisticated static elimination systems using ionizing technology and advanced draft shields designed for highly laminar airflow is enhancing the accuracy of micro-weighing applications, where even minor static charges or air disturbances can compromise measurement integrity. The market competition is increasingly focused on providing holistic technological packages that combine supreme accuracy with smart, workflow-enhancing features.

Regional Highlights

North America, particularly the United States, holds a commanding position in the Sensor Analytical Balances Market, primarily due to the presence of a robust, well-funded pharmaceutical and biotechnology ecosystem, coupled with significant investment in advanced academic research. The region benefits from stringent regulatory environments, such as those governed by the FDA, which necessitate continuous investment in certified, high-precision weighing equipment compliant with strict validation and audit requirements. High R&D expenditure and the rapid adoption of automated laboratory technologies ensure that North America remains a lucrative and technologically mature market, focusing on ultra-high capacity microbalances and integrated smart solutions.

Europe represents another key market, characterized by strong governmental support for scientific research, particularly in Germany, Switzerland, and the UK. The European market demands highly specialized balances catering to the advanced chemical industry and pioneering efforts in material science and life sciences. The strong presence of global market leaders, coupled with strict adherence to European quality standards (e.g., EU GMP), drives consistent demand for technologically advanced and reliable instrumentation. Focus areas include environmental monitoring applications and specialized weighing solutions for niche sectors, such as forensic science and quality assurance in specialized manufacturing.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This accelerated growth is fueled by massive government investments aimed at boosting domestic drug manufacturing capabilities (ee.g., India and China), the proliferation of Contract Research Organizations (CROs), and increasing foreign direct investment in establishing research and manufacturing bases. While price sensitivity remains a factor in certain segments, the overall trend is shifting towards adopting high-quality, high-precision analytical balances to meet escalating quality standards and regulatory expectations aligned with global best practices, presenting substantial long-term market opportunities.

- North America: Market leader driven by high pharmaceutical R&D spending, stringent FDA regulations, and rapid adoption of lab automation and IoT integration.

- Europe: Mature market characterized by strong academic research infrastructure, demand for specialized balances in chemistry and advanced material science, and adherence to rigorous EU standards.

- Asia Pacific (APAC): Highest growth potential, fueled by expanding domestic biotech industries, rising government investment in research infrastructure (especially China, India, and South Korea), and a shift towards global quality standards.

- Latin America (LATAM): Emerging market showing moderate growth, primarily driven by investments in modernization of pharmaceutical production facilities and increasing food safety regulations.

- Middle East and Africa (MEA): Growth concentrated in areas with active petrochemical research and expanding pharmaceutical manufacturing hubs (e.g., UAE, Saudi Arabia, South Africa), focusing on foundational laboratory infrastructure upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sensor Analytical Balances Market.- Mettler Toledo

- Sartorius AG

- PerkinElmer Inc.

- Shimadzu Corporation

- A&D Company, Ltd.

- Ohaus Corporation

- Precisa Gravimetrics AG

- Adam Equipment

- Kern & Sohn GmbH

- Contech Instruments Ltd.

- GRAM Group

- Radwag Balances and Scales

- Bel Engineering

- Citizen Scale (India) Pvt. Ltd.

- Acculab Inc.

- Wipotec-OCS GmbH

- Gibertini Elettronica

- Denver Instrument

- Scientech Inc.

- PCE Instruments

Frequently Asked Questions

Analyze common user questions about the Sensor Analytical Balances market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for semi-micro and micro analytical balances?

The primary driver is the increasing complexity of pharmaceutical and chemical formulations, requiring the highly accurate measurement of expensive or scarce raw materials at micro-level quantities to ensure both precision and material conservation in R&D and QC processes.

How do sensor analytical balances ensure data integrity and regulatory compliance?

Modern sensor analytical balances achieve data integrity through advanced features such as automatic data logging, secure user access controls, embedded audit trails, connectivity to LIMS, and 21 CFR Part 11 compliance software, minimizing human transcription errors and supporting validation requirements.

What role does Electromagnetic Force Compensation (EMFC) technology play in market growth?

EMFC is the foundational technology providing the highest level of accuracy and repeatability required by regulated industries. Continuous refinements in EMFC sensitivity, stabilization speed, and temperature stability are crucial for meeting increasingly demanding high-precision weighing standards, sustaining market growth.

What are the key operational challenges associated with sensor analytical balances?

Key challenges include managing the high capital cost, ensuring specialized and frequent calibration and servicing to maintain accuracy, and mitigating operational risks related to environmental factors (vibration, temperature fluctuation) and static electricity, which can severely impact measurement results.

Which geographic region is expected to show the fastest growth rate for analytical balances?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily due to substantial governmental investments in research and development infrastructure, the expansion of local biotechnology manufacturing, and a rapid convergence toward international quality and regulatory standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager