Serial Attached SCSI Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433464 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Serial Attached SCSI Technology Market Size

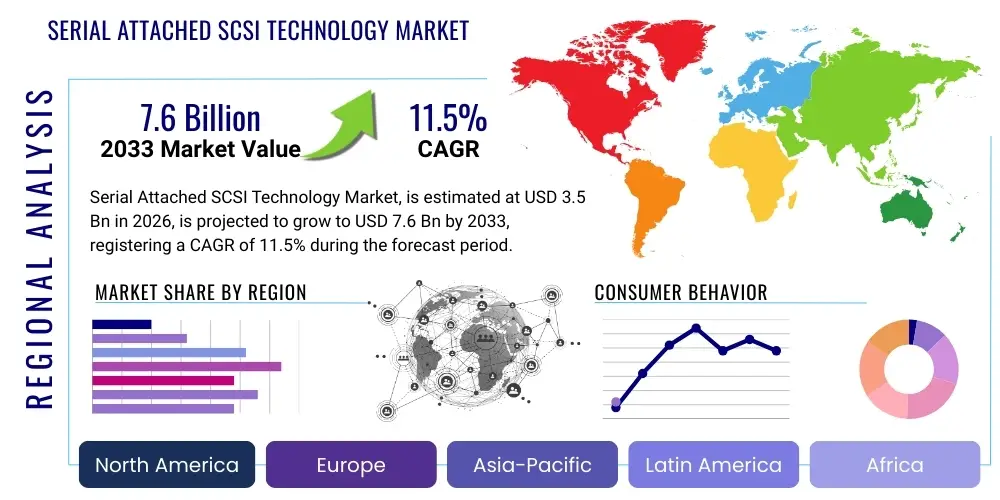

The Serial Attached SCSI Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Serial Attached SCSI Technology Market introduction

Serial Attached SCSI (SAS) technology represents a crucial high-speed data transfer protocol designed specifically for connecting enterprise-level storage devices, such as Hard Disk Drives (HDDs) and Solid State Drives (SSDs), to server systems and storage arrays. Developed as the logical evolution of the venerable parallel SCSI standard, SAS introduced significant advantages including point-to-point architecture, increased data throughput, full duplex connectivity, and robust scalability. This technology is foundational to modern data center infrastructure, providing the necessary performance and reliability required for mission-critical applications where data integrity and continuous operation are non-negotiable prerequisites. SAS enables sophisticated features like dual-porting, which ensures path redundancy and high availability, crucial for environments subject to stringent uptime service level agreements (SLAs).

The core product offerings within the SAS market include host bus adapters (HBAs), RAID controllers, expanders, specialized cables, and storage devices embedded with SAS interfaces. Major applications span hyper-scale data centers, private and hybrid cloud infrastructure, high-performance computing (HPC) environments, and large-scale virtualization platforms. The inherent benefits of SAS—superior reliability, deep queuing capability (allowing efficient handling of simultaneous I/O requests), and extensive backward compatibility with SATA devices (via Serial ATA Tunneling Protocol)—solidify its position as a preferred choice for tiered storage solutions where performance, cost, and capacity must be meticulously balanced. Furthermore, the protocol offers high bandwidth capabilities, with the latest standards (e.g., 24G SAS) pushing theoretical limits to meet the escalating demands generated by data-intensive workloads such as transaction processing, large database management, and business intelligence analytics.

Driving factors propelling the sustained growth of the SAS technology market include the explosive proliferation of unstructured and structured data globally, necessitating continuous investment in scalable storage backbones. The ongoing digital transformation across enterprise sectors mandates robust, high-availability storage solutions that SAS reliably delivers. Although facing competition from emerging protocols like NVMe/PCIe, SAS maintains a vital role in hybrid storage architectures, offering a cost-effective pathway for integrating capacity-optimized HDDs alongside performance-optimized SSDs within a unified storage fabric. The longevity and maturity of the SAS ecosystem, supported by a vast network of vendors and established integration protocols, continue to ensure its relevance in infrastructure planning for organizations prioritizing stability and long-term operational efficiency.

Serial Attached SCSI Technology Market Executive Summary

The Serial Attached SCSI Technology Market is characterized by resilient growth, primarily driven by persistent global demands for enterprise-grade storage resilience and expanding data center footprints, particularly within the hybrid cloud sector. Current business trends indicate a critical focus on 24G SAS deployment, as enterprises seek to double the existing throughput capabilities to manage rapidly increasing data ingestion rates from sources like IoT, edge computing, and complex transactional systems. While the market equilibrium is constantly challenged by the disruptive performance metrics offered by NVMe/PCIe interfaces, SAS technology remains strategically indispensable for cost-optimized, high-capacity, and high-reliability storage tiers, especially those utilizing nearline HDDs. Investment in SAS infrastructure is heavily influenced by the imperative for enhanced security features integrated directly into controllers and the need for standardized management frameworks that simplify large-scale deployment and maintenance.

Regionally, North America maintains market dominance due to the dense concentration of global hyperscale cloud providers and the early adoption of advanced data center technologies, fostering robust demand for high-end SAS controllers and storage arrays. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by massive infrastructural investments in developing economies, rapid digitalization across manufacturing and finance sectors, and substantial governmental initiatives supporting localized data center development. Europe contributes significantly, driven by stringent data sovereignty regulations (like GDPR) that necessitate localized, resilient storage infrastructure, often favoring the mature and highly reliable SAS standard. These regional trends underscore a polarized demand structure: North America focuses on technological refresh cycles and performance optimization, while APAC concentrates on capacity expansion and foundational infrastructure build-out.

Segment trends reveal that the SAS SSD segment is experiencing accelerated growth, albeit from a smaller base, as companies leverage the reliability features of SAS combined with flash performance for critical application workloads. Concurrently, the Host Bus Adapters (HBAs) and RAID Controllers segment maintains the largest market share by revenue, reflecting the continuous need to upgrade server connectivity to manage larger, denser storage enclosures. The application segmentation shows that the Data Center and Cloud Storage segment is the primary revenue generator, directly correlating with the continuous expansion and modernization of global computing infrastructure. These trends collectively emphasize the market’s pivot towards hybrid solutions where SAS provides the backbone for capacity-centric, highly available storage layers, working in conjunction with faster, low-latency interfaces.

AI Impact Analysis on Serial Attached SCSI Technology Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the SAS market frequently center on two main themes: whether AI workloads demand exclusively NVMe storage due to high performance requirements, and how SAS infrastructure can still play a relevant role in the AI data lifecycle. Key concerns revolve around latency performance during AI training phases and the scalability required for managing massive AI datasets. Users are seeking clarity on the feasibility of integrating existing SAS arrays into the AI data pipeline, particularly for data staging, long-term archival, and inference execution where the primary requirement shifts from peak IOPS to consistent throughput and cost-effective capacity. The collective expectation is that while AI training may favor ultra-low-latency NVMe, the majority of the data consumed and generated by AI systems will reside in large, cost-optimized tiered storage, reinforcing SAS's role in the wider AI ecosystem.

The impact of AI on the SAS market is primarily felt through the increased demand for data persistence and tiered storage architectures capable of handling vast datasets. AI and Machine Learning (ML) algorithms require continuous, high-volume access to data for training and inferencing. While training is often performed on NVMe-based flash arrays to minimize latency, the source data (the petabytes of raw, unstructured, or semi-structured information) is typically stored on reliable, high-capacity SAS-connected HDDs or capacity-optimized SAS SSDs. This necessity creates a symbiotic relationship: AI drives the need for high-performance processing, which in turn necessitates robust and highly available backend storage systems, ensuring data pipelines are consistently fed. Furthermore, SAS controllers are increasingly incorporating advanced features, such as enhanced error correction and diagnostic capabilities, which are essential for maintaining the integrity of large datasets critical for accurate AI model development and deployment, thereby bolstering the market for sophisticated SAS components.

- AI workloads increase demand for high-capacity, low-cost tiered storage solutions where SAS excels.

- Data staging and archival components of the AI pipeline rely heavily on reliable SAS HDDs and capacity SSDs.

- Increased data generation from AI models drives the need for higher bandwidth SAS standards (24G) for data transport.

- AI infrastructure promotes the convergence of reliability (SAS strength) and performance (NVMe/PCIe), leading to hybrid array architectures.

- Advanced analytics tools utilize SAS infrastructure data for predictive maintenance and storage optimization within data centers.

DRO & Impact Forces Of Serial Attached SCSI Technology Market

The Serial Attached SCSI Technology Market dynamics are shaped by a complex interplay of internal growth catalysts and external competitive pressures, necessitating continuous innovation in throughput, density, and management features. The principal drivers include the unyielding global growth of data volumes, particularly stemming from IoT sensors, mobility, and video streaming services, compelling enterprises to continuously expand their storage capacity while prioritizing system reliability, a hallmark of SAS. Opportunity forces center on the transition to 24G SAS, enabling double the performance over the previous generation, crucial for high-density storage applications and alleviating potential bottlenecks in aggregated bandwidth environments. Restraints are primarily rooted in the accelerating adoption of the NVMe protocol, which offers substantially lower latency and higher IOPS, particularly attractive for high-frequency trading and low-latency transactional databases, posing a significant competitive threat to the pure-performance segment of the SAS market.

The positive impact forces are heavily weighted toward the enterprise segment’s non-negotiable requirement for high availability and redundancy. SAS architecture, through features like dual-porting, provides inherent fault tolerance, making it the default choice for mission-critical applications that cannot tolerate downtime, regardless of whether flash or traditional spinning media is used. Moreover, the extensive maturity and stability of the SAS ecosystem lower the Total Cost of Ownership (TCO) for large-scale deployments compared to newer, less mature protocols, securing its position in capacity-centric storage tiers. The ability of SAS HBAs and controllers to simultaneously manage both SAS and SATA devices offers unparalleled flexibility in tiered storage solutions, enabling organizations to dynamically balance performance needs against budgetary constraints. This hybrid compatibility significantly broadens the potential application scope and defers large-scale, costly infrastructural overhauls, solidifying its adoption in existing enterprise installations.

Conversely, the impact of competitive restraints is intensifying as NVMe extends its reach beyond pure flash arrays into capacity-optimized SSDs and even specialized high-capacity devices. This shift challenges the traditional dominance of SAS in the high-end storage sphere. Furthermore, the complexity associated with migrating legacy infrastructure to the latest SAS standards (e.g., from 12G to 24G) and the associated hardware costs can sometimes restrain immediate adoption, particularly among small to medium-sized enterprises (SMEs) with tighter capital expenditure budgets. However, opportunities arising from specialized niches, such as ruggedized storage for industrial and military applications where proven reliability and robust connectivity are paramount, continue to favor the established SAS protocol. Successful navigation of the market requires SAS vendors to emphasize integration capabilities, security enhancements (like TCG encryption standards), and long-term capacity advantages over competing technologies.

Segmentation Analysis

The Serial Attached SCSI Technology Market is comprehensively segmented based on its components, product types, data rate specifications, and end-user applications, allowing for detailed analysis of consumption patterns and technological trends across different industry verticals. Segmentation helps stakeholders understand where technological investment is concentrated, revealing dominant market shares in infrastructure components necessary to facilitate high-speed data transfer and storage management. Key segments reflect the complete infrastructure ecosystem, from the fundamental silicon used in controllers to the final storage media and connectivity solutions deployed in large-scale data centers. The analysis highlights the growing importance of component specialization, particularly the demand for advanced controller chips capable of handling 24G data rates and integrating advanced features like data encryption and enhanced error recovery.

By Product Type, the market is dissected into Host Bus Adapters (HBAs), RAID Controllers, Expanders, and Cables & Connectors. RAID controllers, which provide hardware-level data protection and performance acceleration, often command the largest share due to their critical role in ensuring data integrity and optimizing I/O performance in enterprise environments. Component segmentation focuses on ASICs, memory modules, and physical connectors, illustrating the reliance on semiconductor innovation to achieve higher data rates and improved power efficiency. Data Rate segmentation tracks the transition from older 6G and 12G standards to the current 24G SAS, indicating the pace of technological refresh cycles within the enterprise storage sector. The application segmentation clearly demonstrates the market’s primary focus on Data Centers and Cloud Infrastructure, although substantial demand also originates from High-Performance Computing (HPC) and Banking, Financial Services, and Insurance (BFSI) sectors that require high transaction speeds and absolute data reliability.

The evolution of storage media also provides a vital segmentation axis, differentiating between SAS Hard Disk Drives (HDDs) and SAS Solid State Drives (SSDs). While SAS HDDs dominate the capacity segment, catering to archival and tiered storage where cost per terabyte is paramount, SAS SSDs are rapidly gaining traction in performance-sensitive workloads that require the protocol's reliability combined with the speed of flash memory. Understanding these segments is critical for forecasting market shifts, as the increasing density of both HDD and SSD technology, coupled with the introduction of multi-actuator HDDs and QLC flash, continuously redefines the cost-performance characteristics within the SAS domain. This comprehensive segmentation framework ensures that technological advancements and market opportunities are accurately mapped against specific product requirements and end-user needs.

- By Product Type:

- Host Bus Adapters (HBAs)

- RAID Controllers

- Expanders

- Cables & Connectors (including SAS-4 compliant cabling)

- By Component:

- ASICs (Application-Specific Integrated Circuits)

- Controllers and Processors

- Memory Modules

- Physical Connectors

- By Data Rate:

- 6 Gbps

- 12 Gbps

- 24 Gbps (SAS-4)

- By Application:

- Data Centers and Cloud Infrastructure

- High-Performance Computing (HPC)

- Enterprise Storage Systems (Non-Cloud)

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications

- By Storage Media:

- SAS Hard Disk Drives (HDDs)

- SAS Solid State Drives (SSDs)

Value Chain Analysis For Serial Attached SCSI Technology Market

The Serial Attached SCSI Technology market value chain is extensive, beginning with specialized component manufacturing and extending through complex system integration into final enterprise deployment. The upstream segment is dominated by semiconductor designers and manufacturers responsible for producing the specialized ASICs, controller chips, and PHY layers that define SAS performance capabilities. These component manufacturers (often highly specialized firms) invest heavily in R&D to adhere to evolving standards (e.g., SAS-4) while managing the intricate process of chip fabrication and validation. The quality and performance of these upstream components directly dictate the speed and reliability of the final storage solution. Crucial activities at this stage include intellectual property development, chip fabrication, and rigorous compliance testing to ensure interoperability across the ecosystem.

Moving downstream, the value chain involves Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) who integrate these controllers into finished products such as HBAs, RAID cards, storage array chassis, and purpose-built SAS SSDs and HDDs. These integrators must ensure seamless connectivity and management software integration. Distribution channels for SAS products are bifurcated: Direct channels involve large-scale transactions where OEMs sell directly to hyperscale data center operators (like AWS or Google) who purchase components and subsystems in massive volumes for customized infrastructure build-out. Indirect channels rely on value-added resellers (VARs), system integrators, and distributors who provide tailored storage solutions, installation services, and post-sales support to enterprise and mid-market customers. The complexity of enterprise storage mandates that indirect channels often provide consultative expertise, especially concerning tiered storage design and disaster recovery planning, adding significant value.

The final stage involves the end-user deployment and service provision. This stage includes managed service providers (MSPs) and cloud operators utilizing SAS infrastructure to deliver cloud services, as well as enterprise IT departments managing their on-premise data centers. The profit margins tend to be highest at the component design level (upstream) and the high-value system integration and maintenance service level (downstream). The continuous pressure for higher capacity and performance, driven by the end-users’ data needs, flows back up the chain, driving further innovation in controller and drive technology. Efficient logistics and robust quality control throughout the entire chain are essential due to the mission-critical nature of the data handled by SAS systems. Furthermore, regulatory compliance and data security requirements impose additional complexity and cost structures across all stages, particularly impacting the development of self-encrypting drives (SEDs) compliant with SAS protocols.

Serial Attached SCSI Technology Market Potential Customers

Potential customers for Serial Attached SCSI technology are predominantly entities requiring massive, reliable, and highly available storage capacity, characterized by intense I/O operations and strict uptime requirements. The primary customer segment includes large-scale Data Center Operators and Hyperscale Cloud Service Providers (CSPs) such as Amazon Web Services, Microsoft Azure, and Google Cloud. These entities consume SAS controllers, HBAs, and vast quantities of SAS HDDs and SSDs to build the fundamental infrastructure underpinning their storage-as-a-service offerings. For these high-volume users, the established reliability, dual-port redundancy, and cost efficiency of SAS for capacity storage tiers make it an indispensable technology, even as performance tiers shift towards NVMe. Their procurement strategies focus on high volume, standardized components, and long-term supply stability, often utilizing direct procurement models.

Another significant customer base comprises large Enterprises across verticals like Financial Services (BFSI), Telecommunications, and Healthcare. These organizations maintain substantial on-premise data centers for mission-critical applications such as core banking systems, electronic health records, and transactional databases. For BFSI, the high data integrity and reliability offered by SAS are paramount for regulatory compliance and fraud prevention systems. Telecommunication providers use SAS for storing vast amounts of call detail records, billing information, and network operational data, demanding scalability and robustness. These enterprise customers often purchase through Value-Added Resellers (VARs) and System Integrators, seeking tailored solutions, installation expertise, and complex integration with existing server architectures. The shift toward hybrid cloud models means these customers are also purchasing SAS-enabled infrastructure to ensure seamless compatibility between their on-premise and off-premise environments.

Finally, the High-Performance Computing (HPC) and Research Institutions represent a specialized, albeit smaller, segment. While HPC often leverages the fastest possible interconnects, SAS still plays a role in large archival systems and pre-processing stages where massive datasets are managed before being moved to high-speed scratch space. Additionally, governmental and defense organizations rely on the proven security features and robustness of SAS systems for sensitive data storage, particularly in environments requiring physical resilience and high levels of certification. The purchasing decision for this segment is typically driven by security accreditation, long operational lifespan, and resistance to environmental stress, rather than simply cost per gigabyte, underscoring the enduring value proposition of SAS in highly specialized operational contexts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Broadcom (LSI Logic), Microchip Technology (Microsemi), Marvell Technology Group, Western Digital (HGST), Seagate Technology, Toshiba Corporation, Hewlett Packard Enterprise (HPE), Dell Technologies, Cisco Systems, Intel Corporation, Lenovo, Amphenol Corporation, TE Connectivity, Adata Technology, Kingston Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Serial Attached SCSI Technology Market Key Technology Landscape

The technological landscape of the Serial Attached SCSI market is currently defined by the transition to the 24 Gbps standard, also known as SAS-4, which represents a critical leap in raw data throughput. This latest generation technology utilizes signal processing techniques such as equalization and advanced encoding schemes to double the effective data rate over the previous 12 Gbps standard, addressing the massive bandwidth requirements of modern, high-density storage enclosures. The move to SAS-4 necessitates not only new controller chips (HBAs and RAID silicon) but also highly specialized, compliant cabling and connector systems engineered to minimize crosstalk and signal degradation at higher frequencies. Key technological evolution focuses on improving the efficiency of data flow, reducing latency within the protocol stack, and maintaining the highly reliable error handling mechanisms for which SAS is renowned.

Crucial technological development is centered on controller intelligence and integration capabilities. Modern SAS HBAs and RAID controllers are moving toward greater integration of features that enhance data management and security. This includes integrated hardware acceleration for RAID processing, enhancing the performance of parity calculations and minimizing the strain on the host CPU. Furthermore, controller technologies are being developed with advanced capabilities for managing hybrid storage arrays, intelligently tiering data between SAS HDDs and SAS SSDs based on access patterns and workload demands. The inclusion of hardware-based encryption (TCG protocols) directly on the controller chip is becoming standard, offering performance-neutral security essential for compliance in regulated industries. These technological enhancements ensure that SAS infrastructure remains a robust, manageable, and secure platform for enterprise data storage.

The competitive pressure exerted by NVMe/PCIe has spurred innovation in how SAS interacts with the broader storage ecosystem. Emerging technologies focus on protocol translation and bridging, allowing SAS devices to integrate seamlessly into NVMe-over-Fabric (NVMe-oF) environments, effectively extending the utility of reliable SAS capacity storage arrays within high-speed fabric architectures. This convergence, known sometimes as the NVMe/SAS integration, aims to leverage the reliability and established management tools of SAS for capacity while gaining the low-latency networking benefits of NVMe-oF. Furthermore, advances in drive technology, such as high-capacity Helium-filled HDDs and Quad-Level Cell (QLC) SAS SSDs, are continually pushing the capacity boundaries. The integration of Multi-Actuator Technology in high-end SAS HDDs is also a notable development, significantly increasing the effective Input/Output Operations Per Second (IOPS) of mechanical drives, thereby narrowing the performance gap with entry-level SSDs and preserving SAS’s vital role in optimizing cost-per-terabyte ratios in the enterprise storage landscape.

Regional Highlights

- North America: North America holds the largest market share in the Serial Attached SCSI Technology market, primarily driven by the massive presence and continuous expansion of hyperscale cloud providers and global technology companies. The region is characterized by high rates of technological refresh, early adoption of 24G SAS standards, and heavy investment in cutting-edge data center infrastructure designed for resilience and ultra-high availability. Demand is concentrated in highly sophisticated enterprise environments requiring best-in-class RAID controllers and storage arrays to manage complex transactional workloads and large-scale virtualization platforms. Regulatory compliance mandates (like HIPAA and SOX) further drive the adoption of high-reliability SAS storage solutions with integrated security features, emphasizing quality over cost-efficiency in many critical applications. The US and Canada are the dominant contributors, driven by a mature IT services sector and substantial R&D investments in storage technologies.

- Asia Pacific (APAC): The APAC region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion is fueled by unprecedented digital transformation initiatives across nations like China, India, Japan, and South Korea, coupled with significant governmental spending on local data center construction and smart city projects. The booming telecommunications, e-commerce, and manufacturing sectors generate enormous data volumes, creating an urgent need for scalable and reliable SAS storage infrastructure. While cost considerations remain important, the increasing establishment of regional cloud providers and the shift from local servers to centralized data centers are boosting demand for high-capacity SAS HDDs and entry-to-mid-range SAS controllers. Manufacturing hubs in Taiwan and China also play a pivotal role as they house key component suppliers for SAS controllers and storage media, impacting the global supply chain dynamics and fostering regional adoption.

- Europe: Europe represents a mature and highly regulated market for SAS technology, driven primarily by the need for robust data governance and compliance with regulations such as the General Data Protection Regulation (GDPR). Countries like Germany, the UK, and France exhibit strong demand, particularly in the Financial Services, Automotive, and Healthcare sectors, which prioritize data sovereignty and high redundancy. SAS solutions are critical for European enterprises relying on tiered storage strategies, where performance-intensive data utilizes high-speed flash, and the majority of structured and semi-structured data resides on reliable SAS-connected HDDs. The trend toward developing localized hybrid cloud architectures across Europe further secures the demand for integrated SAS components that offer proven reliability and management consistency, essential for cross-border data management and backup infrastructure.

- Latin America (LATAM): The LATAM market is developing, with growth concentrated in Brazil, Mexico, and Argentina. Adoption of SAS technology is tied to infrastructural modernization efforts, particularly in the banking and government sectors aiming to improve operational efficiency and implement data centralization projects. The region often prioritizes cost-effectiveness and proven technology, leading to sustained demand for 12G SAS and capacity-optimized HDDs. Investments are typically made through large governmental contracts or partnerships with international cloud providers expanding their regional presence, suggesting a growing market for standardized, reliable enterprise storage solutions suitable for emerging market conditions.

- Middle East and Africa (MEA): Growth in the MEA region is accelerating, primarily driven by large-scale technology investments in the Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, where massive data center projects support economic diversification goals (e.g., Saudi Vision 2030). The oil and gas industry, telecommunications, and finance sectors in this region are significant adopters of SAS technology, leveraging its ruggedness and reliability for large-scale data retention and analysis. South Africa also serves as a critical technology hub for the African continent. Demand tends to focus on high-capacity and highly secure SAS arrays to manage sensitive national and corporate data within sophisticated, newly built data center facilities, favoring the latest generation of reliable SAS components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Serial Attached SCSI Technology Market.- Broadcom (LSI Logic)

- Microchip Technology (Microsemi)

- Marvell Technology Group

- Western Digital (HGST)

- Seagate Technology

- Toshiba Corporation

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Cisco Systems

- Intel Corporation

- Lenovo

- Amphenol Corporation

- TE Connectivity

- Adata Technology

- Kingston Technology

- Supermicro

- ASUS (ASRock Rack)

- Chenbro Micom Co., Ltd.

- Inspur Group

- Fujitsu

Frequently Asked Questions

Analyze common user questions about the Serial Attached SCSI Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Serial Attached SCSI (SAS) over SATA?

The primary advantage of SAS over SATA is its superior reliability, robust scalability, and enterprise-grade feature set. SAS offers full-duplex communication, higher data transfer rates (up to 24 Gbps), and crucial features like dual-porting, which provides path redundancy and fault tolerance essential for mission-critical enterprise storage and high-availability data center environments, contrasting with SATA’s simpler, single-path consumer-grade architecture.

How is NVMe technology impacting the future adoption of SAS in data centers?

NVMe (Non-Volatile Memory Express) is primarily impacting the performance-centric segment of the SAS market by offering significantly lower latency and higher IOPS, making it ideal for tier-zero, high-frequency workloads. However, SAS remains competitive and relevant for tiered storage architectures, high-capacity SAS HDDs, and reliable, cost-effective SAS SSDs, ensuring its continued use in capacity and archival storage tiers where cost per terabyte and high reliability are paramount over ultra-low latency.

What is 24G SAS and why is it important for the enterprise storage market?

24G SAS (SAS-4) is the latest generation of the Serial Attached SCSI protocol, offering a raw data transfer rate of 22.5 Gbps (effectively 24 Gbps throughput after overhead), doubling the bandwidth of the previous 12G standard. This speed increase is critical for alleviating bottlenecks in high-density storage enclosures, managing massive data ingestion rates from IoT and AI workloads, and maintaining system efficiency in modern hyperscale and cloud infrastructure environments.

Do SAS storage systems support integration with older SATA drives?

Yes, one of the key benefits of the SAS protocol is its backward compatibility and interoperability with SATA devices. SAS controllers and HBAs can manage both SAS and SATA drives within the same storage enclosure using the Serial ATA Tunneling Protocol (STP). This feature allows enterprises to design flexible, cost-optimized tiered storage solutions by incorporating cost-effective SATA drives for capacity while leveraging the reliable SAS backplane management.

Which key component segment holds the largest revenue share in the SAS market?

The Host Bus Adapters (HBAs) and RAID Controllers segment typically holds the largest revenue share. These components are the intellectual core of the SAS architecture, responsible for managing I/O operations, ensuring data integrity (via RAID), and providing the host interface connectivity. Their continuous technological advancement, driven by the shift to 24G standards and integrated security features, ensures high value contribution across all enterprise deployments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager