SERS Substrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433868 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

SERS Substrate Market Size

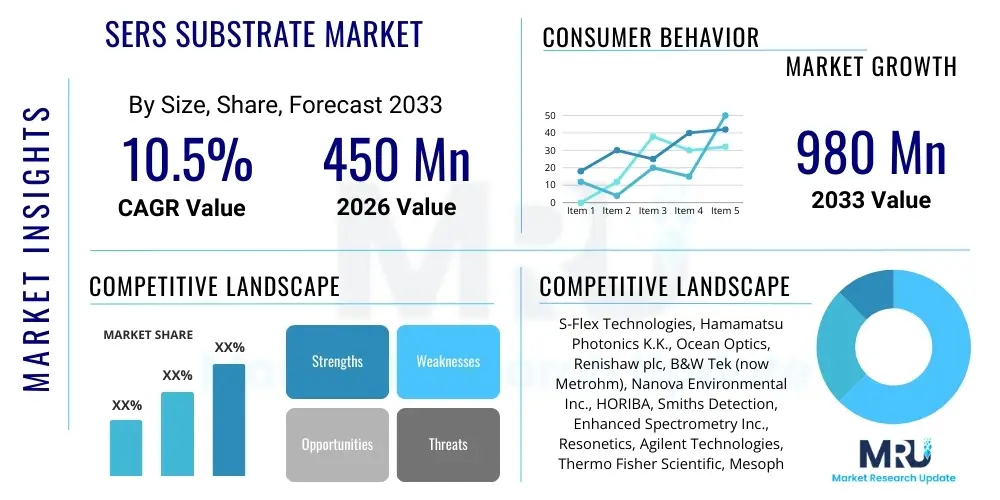

The SERS Substrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 980 Million by the end of the forecast period in 2033.

SERS Substrate Market introduction

The Surface-Enhanced Raman Spectroscopy (SERS) Substrate Market encompasses specialized materials designed to significantly enhance the weak Raman scattering signal from molecules adsorbed on their surface. SERS technology leverages plasmonic nanomaterials, typically silver or gold nanoparticles or nanostructured surfaces, which create localized surface plasmon resonance (LSPR) when illuminated by a laser. This resonance drastically increases the electromagnetic field near the surface, leading to signal enhancement factors reaching 106 to 108, enabling ultra-sensitive detection and identification of trace amounts of chemical and biological analytes. These substrates are crucial for advancing analytical chemistry, offering capabilities far exceeding traditional Raman methods in terms of sensitivity.

The core product within this market segment is the SERS chip or substrate, which can be fabricated using various sophisticated techniques including electron beam lithography (EBL), nanoimprint lithography (NIL), template-assisted deposition, and chemical synthesis methods. These substrates are categorized based on their material (e.g., gold, silver, hybrid), format (e.g., disposable chips, integrated flow cells, flexible films), and structure (e.g., periodic arrays, random deposition films, colloidal solutions). Standardization and reproducibility remain critical challenges, driving innovation towards highly uniform, high-density plasmonic nanostructures optimized for specific laser wavelengths and application environments. The market benefits from ongoing miniaturization trends, making SERS a viable option for portable and point-of-care (POC) diagnostic devices.

Major applications driving the demand for SERS substrates include forensic science for trace analysis, food safety testing for contaminants and adulterants, environmental monitoring for pollutants, and, most prominently, biomedical diagnostics for disease markers and drug detection. The inherent benefits of SERS—including high sensitivity, rapid analysis time, molecular specificity (fingerprinting), and minimal sample preparation—position it as a superior analytical tool in comparison to conventional techniques like ELISA or standard chromatography for certain applications. Key driving factors include the increasing global focus on non-invasive diagnostic tools, rising complexity in pharmaceutical analysis, and the critical need for rapid detection of pathogens and explosives, particularly in homeland security and defense sectors.

SERS Substrate Market Executive Summary

The SERS Substrate Market is characterized by robust growth, primarily fueled by significant advancements in nanotechnology manufacturing and the expanding adoption of high-sensitivity analytical techniques across biomedical and security sectors. Business trends indicate a strong focus on producing highly reproducible and cost-effective disposable substrates, moving away from expensive, customized fabrication methods towards scalable technologies like roll-to-roll processing. Strategic partnerships between specialized substrate manufacturers and major analytical instrumentation providers are key to market penetration, ensuring seamless integration of SERS technology into existing Raman platforms. Furthermore, venture capital interest is surging in companies offering innovative, portable SERS systems, signifying a market shift from academic research tools to commercial diagnostic products.

Regionally, North America and Europe currently dominate the market due to substantial government funding for nanotechnology research, a high concentration of leading analytical instrument companies, and stringent regulatory environments demanding ultra-trace detection capabilities, especially in clinical diagnostics and pharmaceutical quality control. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period. This accelerated growth in APAC is attributed to rapid industrialization, increasing public health expenditure, and growing investment in local R&D centers focused on developing cost-effective, localized testing solutions for food safety and environmental monitoring in countries like China, India, and South Korea. Market maturity differences across these regions dictate varied competitive strategies, ranging from IP protection in the West to volume manufacturing efficiencies in the East.

Segment trends highlight the dominance of the active substrate segment, which offers superior enhancement compared to passive structures, although the latter is gaining traction for specific low-cost applications. By material, Gold (Au) substrates are favored in biomedical applications due to their biocompatibility and chemical stability, whereas Silver (Ag) substrates remain crucial for applications demanding the highest enhancement factors, despite their tendency to oxidize. The diagnostics application segment is expected to be the fastest-growing, driven by the shift towards non-invasive, molecular-level diagnostic tools for oncology and infectious diseases. Custom substrates designed for microfluidic integration and automated testing platforms represent a significant technological segment poised for massive commercialization over the next five years, redefining how SERS is utilized in high-throughput analytical settings.

AI Impact Analysis on SERS Substrate Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the SERS Substrate Market often center on three key areas: optimizing substrate design, enhancing data processing for complex spectra, and automating diagnostic workflows. Users frequently question how machine learning (ML) algorithms can be utilized to predict the optimal nanostructure geometries (e.g., gap size, particle morphology) required to maximize SERS enhancement factors for specific target molecules, thereby reducing time-consuming experimental iteration. A major concern revolves around utilizing AI for effective baseline subtraction, noise reduction, and quantitative analysis of SERS spectra, which are notoriously complex and subject to variability. Furthermore, there is significant anticipation regarding the deployment of deep learning models to automatically classify samples in high-throughput clinical or security applications, turning raw spectral data into immediate, actionable diagnostic results.

AI’s influence is revolutionizing the computational phase of SERS analysis, addressing historical limitations such as data variability and interpretational complexity. Traditional spectral analysis requires extensive expertise, but AI-driven chemometrics, particularly supervised and unsupervised ML techniques, now enable robust pattern recognition, accurate spectral unmixing, and classification of complex biological matrices (e.g., blood, urine) analyzed using SERS substrates. This transformation enhances the reliability and objectivity of SERS results, making the technology more appealing for routine commercial use where rapid and definitive answers are required. AI models trained on large datasets of SERS spectra can effectively differentiate subtle spectral shifts associated with early-stage disease biomarkers or trace contaminants, far surpassing human analysis capabilities.

Beyond data interpretation, AI is crucial in the manufacturing and quality control segments of the SERS market. Generative Adversarial Networks (GANs) and other optimization algorithms are being tested to model and simulate the electromagnetic properties of novel nanostructures before physical fabrication, significantly accelerating the design cycle for next-generation, high-performance substrates. By integrating in-line spectral monitoring during the production process and utilizing AI for real-time defect detection and structural conformity checking, manufacturers can ensure unprecedented levels of batch-to-batch reproducibility, overcoming one of the primary historical barriers to SERS commercialization. This synergistic relationship—where highly sensitive SERS substrates provide detailed molecular data and AI provides intelligent processing—is foundational to future market growth, particularly in developing autonomous sensing platforms.

- AI-driven optimization of nanostructure geometry for maximized plasmonic enhancement.

- Machine learning algorithms for automated baseline correction and spectral noise reduction in complex SERS data.

- Deep learning classification models enabling rapid, accurate diagnosis in biomedical applications.

- Predictive maintenance and quality control during substrate manufacturing using real-time spectral monitoring.

- Integration of AI chemometrics for robust quantitative analysis of trace analytes on SERS platforms.

- Development of standardized, AI-validated spectral libraries for global regulatory acceptance.

DRO & Impact Forces Of SERS Substrate Market

The SERS Substrate Market is subject to a complex interplay of Drivers, Restraints, and Opportunities, which collectively dictate its trajectory and rate of adoption. The dominant drivers stem from technological breakthroughs, specifically the ability to mass-produce uniform, high-density plasmonic nanostructures at a competitive cost, making SERS viable outside of specialized research labs. The critical need for ultra-high sensitivity detection in emerging fields like personalized medicine, where biomarker concentrations are often extremely low, provides a substantial pull for SERS technology. Conversely, the market faces significant restraints, primarily related to the inherent challenge of ensuring batch-to-batch reproducibility and long-term substrate stability, which introduces variability that hinders regulatory approval for clinical use. Furthermore, the specialized knowledge required to interpret SERS data and the high initial capital investment for advanced Raman systems act as barriers to entry for many potential users in developing economies or smaller laboratories.

The primary opportunities for market expansion lie in the miniaturization and integration of SERS substrates with microfluidics (Lab-on-a-Chip technology) and portable Raman instruments, enabling point-of-care testing and field deployment for security and environmental monitoring. The development of flexible, transparent SERS substrates presents opportunities in wearable sensing devices and surface contamination mapping. Impact forces, particularly related to regulatory harmonization and standardization efforts, are crucial; as standards for SERS measurements and data quality emerge, regulatory bodies like the FDA and EMA will become more receptive to clinical applications, thereby accelerating commercial adoption. Geopolitical trends, specifically increasing concerns over biosecurity and food supply chain integrity, also act as strong impact forces driving investment into rapid, portable SERS detection systems capable of identifying biological warfare agents or major food allergens instantly.

Technological advancement in fabrication techniques, such as cost-effective nanoimprint lithography and large-area deposition methods, is actively mitigating the restraint associated with high manufacturing costs, pushing SERS substrates towards disposable consumer pricing structures. This opens up opportunities in high-volume, low-cost applications like routine pathogen screening or water quality monitoring. However, a persistent restraint is the complexity of integrating SERS into existing analytical workflows without extensive procedural changes, requiring significant user training and specialized software. Ultimately, the market growth will be determined by the successful translation of high laboratory performance into robust, reliable, and user-friendly commercial products, leveraging opportunities in AI-enhanced data interpretation to overcome existing complexity restraints and capitalize on the strong demand for ultra-trace detection driven by regulatory and safety requirements worldwide.

Segmentation Analysis

The SERS Substrate Market is comprehensively segmented based on substrate material, fabrication method, and application area, providing a detailed view of technological preferences and end-user demands. The segmentation by material—primarily Gold (Au), Silver (Ag), and hybrid compositions—reflects a trade-off between chemical stability/biocompatibility (Gold) and maximum signal enhancement (Silver). Hybrid substrates are emerging as a key growth area, combining the benefits of both metals or incorporating semiconductor materials to enhance specific spectral performance characteristics, particularly for multi-analyte detection. The dominance of specific materials is heavily influenced by the end-user application; for instance, the clinical diagnostic segment disproportionately favors Gold due to its inertness in biological environments.

Segmentation by fabrication method highlights the ongoing technological evolution aimed at improving uniformity and reducing costs. While expensive but precise techniques like Electron Beam Lithography (EBL) are used for high-end research and reference standards, scalable methods such as Nanoimprint Lithography (NIL) and self-assembly of colloidal nanoparticles are dominating commercial production for disposable SERS chips. The shift towards large-area, high-throughput manufacturing processes is critical to achieving the economies of scale necessary for widespread market adoption in routine testing scenarios like food safety. The choice of fabrication method directly impacts the resulting substrate morphology, which in turn determines the magnitude and uniformity of the SERS enhancement factor, driving competitive differentiation among manufacturers.

Application-based segmentation reveals that Biomedical and Life Sciences constitute the largest segment, driven by oncology diagnostics, pathogen detection, and pharmaceutical research (e.g., drug-cell interaction studies). The second major segment, Food & Environmental Safety, is experiencing rapid growth fueled by global regulations requiring stringent monitoring of pesticides, heavy metals, and bacterial contaminants. Security and Forensics, while smaller in volume, represent a high-value segment due to the critical need for rapid, non-destructive identification of explosives, narcotics, and chemical warfare agents in field operations. The diverse requirements across these segments—from clinical compatibility to field robustness—necessitate a highly specialized product portfolio from leading market vendors, ensuring optimized performance for each distinct analytical challenge.

- By Material: Gold Substrates, Silver Substrates, Hybrid and Other Substrates.

- By Fabrication Method: Electron Beam Lithography (EBL), Nanoimprint Lithography (NIL), Self-Assembly (Colloidal), Chemical Etching/Deposition, and Other Methods.

- By Application: Biomedical & Life Sciences (Diagnostics, Drug Screening), Food & Environmental Safety (Contaminant Detection, Water Quality), Security & Forensics (Explosives, Narcotics), Chemical Analysis & Research.

Value Chain Analysis For SERS Substrate Market

The SERS Substrate value chain is characterized by highly specialized expertise required at both the upstream material preparation stage and the downstream integration stage. Upstream activities involve the procurement and refinement of high-purity noble metals (gold, silver) and the synthesis of specialized chemical precursors necessary for nanoparticle creation or thin-film deposition. This segment is dominated by chemical suppliers and specialized materials science companies. The quality and homogeneity of these raw materials directly influence the plasmonic properties and subsequent performance of the finished substrate. Manufacturing of the actual substrate is the most value-intensive step, involving complex nanofabrication techniques like EBL or NIL, which requires significant capital investment in cleanroom facilities and advanced lithography equipment, often resulting in high barriers to entry for new competitors.

The midstream channel focuses on quality assurance, characterization, and functionalization. Substrates must undergo rigorous characterization using advanced microscopy (SEM, AFM) and spectroscopy to ensure structural uniformity and optimal enhancement factors. Functionalization involves modifying the substrate surface, often with specialized ligands or binding agents, to selectively capture or concentrate the target analyte, thereby increasing specificity. Distribution channels are highly fragmented, relying on a mix of direct sales to large analytical instrument manufacturers (OEMs) who integrate the substrates into their systems, and indirect sales through specialized scientific distributors serving research laboratories, universities, and dedicated diagnostic companies. Direct sales are crucial for custom or high-volume contracts, while indirect channels provide market reach and technical support for smaller research orders.

Downstream activities center on the end-user adoption and integration of SERS technology. This includes the development of proprietary analytical protocols, integration with automated fluid handling systems (microfluidics), and the development of specialized spectral libraries and software tailored for specific applications (e.g., classifying cancerous tissue based on spectral signature). Potential customers rely heavily on the robustness and reproducibility demonstrated by the substrate vendor. The indirect channel, managed by distributors, plays a pivotal role in providing essential application support and training, bridging the gap between highly technical substrate fabrication and practical analytical use in diverse environments like field hospitals or border checkpoints. Ensuring seamless interoperability between the substrate and the Raman instrumentation is a persistent downstream challenge that requires tight collaboration within the value chain.

SERS Substrate Market Potential Customers

The primary end-users and buyers of SERS substrates span across multiple high-tech analytical sectors, reflecting the technology's versatile ability to perform ultra-trace molecular fingerprinting. Pharmaceutical and Biotechnology companies represent a significant customer base, leveraging SERS for quality control of drugs, real-time monitoring of bioprocessing, and high-content drug screening against cellular models. They require highly stable and reproducible substrates, often gold-based, for use in controlled, regulated laboratory environments. Clinical diagnostic companies are another rapidly growing segment, focusing on integrating SERS chips into disposable cartridges for point-of-care testing of disease biomarkers (e.g., protein signatures, nucleic acids) and rapid pathogen identification, demanding low-cost, mass-produced substrates suitable for single use.

Governmental and Academic Research Institutions constitute a core segment, acting as early adopters and drivers of technological innovation. Academic labs purchase SERS substrates for fundamental research in chemistry, materials science, and biology, exploring new fabrication methods and applications. Government agencies, including forensic laboratories, environmental protection agencies (EPA), and homeland security organizations, utilize SERS for mandatory testing protocols, such as detecting trace explosives at airports, analyzing narcotics in forensic casework, or monitoring industrial pollutants in water sources. These users prioritize high performance under diverse, non-laboratory conditions and often require custom substrates optimized for field portability and sensitivity to specific target molecules.

Furthermore, specialized manufacturing and analytical service providers (CROs/CMOs) represent substantial potential customers. These entities use SERS technology to offer high-throughput analytical services to smaller companies that lack in-house capabilities, especially in quality assurance for food and beverage manufacturing where trace contaminant detection is mandatory (e.g., detecting melamine, pesticides). The demand profile across all these customer segments is unified by the need for high sensitivity and chemical specificity, but varies significantly regarding volume requirements, price sensitivity, and the required level of substrate biocompatibility or chemical inertness, necessitating tailored marketing and product offerings from substrate manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 980 Million |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S-Flex Technologies, Hamamatsu Photonics K.K., Ocean Optics, Renishaw plc, B&W Tek (now Metrohm), Nanova Environmental Inc., HORIBA, Smiths Detection, Enhanced Spectrometry Inc., Resonetics, Agilent Technologies, Thermo Fisher Scientific, Mesophotonics, Diagnostic Photonics, Nanosurf AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SERS Substrate Market Key Technology Landscape

The technology landscape of the SERS Substrate Market is primarily defined by advanced nanofabrication techniques aimed at creating highly uniform and densely packed plasmonic nanostructures to maximize electromagnetic field enhancement. Two major competing approaches dominate this landscape: top-down lithography methods and bottom-up colloidal self-assembly. Top-down techniques, particularly Electron Beam Lithography (EBL) and Focused Ion Beam (FIB), offer unparalleled precision in controlling the shape, size, and spacing of nanostructures, which is crucial for maximizing the density of "hot spots"—the areas of maximum plasmonic field enhancement. However, EBL is slow and expensive, limiting its use mainly to research or high-standard calibration substrates. Nanoimprint Lithography (NIL) has emerged as a high-throughput, lower-cost alternative to EBL, capable of replicating intricate patterns across large areas, making it commercially viable for mass-produced disposable chips for diagnostic applications.

Conversely, bottom-up approaches, utilizing chemical synthesis to produce colloidal noble metal nanoparticles (NPs), offer simplicity and cost-effectiveness. These NPs can be deposited onto various solid supports, often forming random, aggregated films. While colloidal methods are highly scalable, controlling the uniformity and achieving consistent hot spot density across the entire substrate area remains a significant technical challenge, leading to high signal variability. The latest technological advancements are focusing on hybridizing these approaches, such as using lithographically defined templates to guide the self-assembly of nanoparticles, creating ordered or semi-ordered structures that combine the precision of top-down methods with the scalability of bottom-up synthesis. These structured colloidal assemblies represent a cutting-edge segment promising both high performance and commercial scalability.

Further technological differentiation occurs in material science and surface functionalization. There is increasing research into dielectric-based SERS substrates (e.g., Silicon or Aluminum Oxide covered with metal films) and three-dimensional (3D) SERS architectures, such as nanorod arrays or porous templates, designed to increase the surface area available for analyte adsorption and enhance light trapping capabilities. Crucially, the functionalization technology—the chemical modification of the substrate surface to ensure selective capture of target analytes—is paramount for real-world application specificity. This involves advanced chemistry for attaching molecular recognition elements (like antibodies or aptamers) without compromising the underlying plasmonic properties. Integration technology, particularly the seamless coupling of SERS substrates with microfluidic systems for automated sample delivery and processing, is rapidly becoming a standard requirement for next-generation commercial SERS devices.

Regional Highlights

- North America: North America holds the largest market share, driven by extensive research and development activities in the biomedical sector, particularly oncology and infectious disease diagnostics. The region benefits from substantial federal funding for nanotechnology research and a robust presence of major analytical instrument manufacturers and early-stage diagnostic startups. The rigorous regulatory standards of the FDA encourage the use of highly reproducible, high-performance SERS substrates for drug testing and clinical trials, consolidating its leadership position. This region is characterized by high adoption rates of advanced SERS systems in specialized forensic and security laboratories.

- Europe: Europe represents the second-largest market, characterized by strong governmental support for the European nanotechnology framework and stringent environmental and food safety regulations, particularly within the EU. Countries such as Germany, the UK, and France are hubs for SERS research and commercialization, focusing on developing integrated, portable systems for real-time quality control in pharmaceutical manufacturing and agricultural monitoring. The region is particularly active in exploring SERS applications for rapid pathogen detection in hospital settings, leveraging both academic expertise and industrial innovation.

- Asia Pacific (APAC): The APAC region is projected to register the highest CAGR due to burgeoning investments in healthcare infrastructure, rapid industrial expansion, and an acute need for cost-effective analytical tools for massive population centers. China, Japan, and South Korea are key markets, with China emerging as a global hub for cost-effective nanofabrication and high-volume production of SERS chips. The market growth here is strongly propelled by applications in affordable food safety screening and environmental pollution monitoring, often emphasizing scalable, bottom-up manufacturing techniques suitable for localized testing needs.

- Latin America (LATAM): The LATAM market is nascent but shows potential, primarily driven by academic adoption and increasing focus on agricultural technology (AgriTech) and basic healthcare diagnostics. Market penetration is often constrained by high capital costs and limited local manufacturing infrastructure, leading to a reliance on imported SERS technology. However, opportunities exist for simple, robust, portable SERS systems to address localized needs in water quality testing and food adulteration analysis across major countries like Brazil and Mexico.

- Middle East and Africa (MEA): Growth in MEA is highly selective, concentrated in regions with high investments in petroleum and petrochemical analysis, where SERS is used for trace contamination detection. Security applications, particularly explosive and chemical threat detection in critical infrastructure (airports, defense facilities), are also significant drivers in the Middle East. Africa presents opportunities in low-cost, decentralized diagnostic solutions for infectious diseases, pending the availability of affordable, robust SERS systems that require minimal operational infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SERS Substrate Market.- S-Flex Technologies

- Hamamatsu Photonics K.K.

- Ocean Optics (A Halma Company)

- Renishaw plc

- B&W Tek (Now Metrohm)

- Nanova Environmental Inc.

- HORIBA Ltd.

- Smiths Detection

- Enhanced Spectrometry Inc.

- Resonetics (formerly part of other major players)

- Agilent Technologies

- Thermo Fisher Scientific Inc.

- Mesophotonics

- Diagnostic Photonics

- Nanosurf AG

- Silmeco A/S

- Klarity Analytics

- G&G Sciences

- NanoLight Technology

- Optics Balzers

Frequently Asked Questions

Analyze common user questions about the SERS Substrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary challenge hindering the widespread commercial adoption of SERS substrates?

The primary challenge is ensuring high batch-to-batch reproducibility and long-term stability of the SERS enhancement factor. Variability, often caused by inconsistencies in nanostructure fabrication and 'hot spot' distribution, complicates regulatory approval for routine clinical and industrial applications, necessitating ongoing advancements in scalable, precise nanofabrication techniques like Nanoimprint Lithography (NIL).

How do Gold and Silver SERS substrates differ in application preference?

Silver (Ag) substrates generally provide higher signal enhancement factors, making them ideal for ultra-trace chemical analysis where sensitivity is paramount. However, Gold (Au) substrates are preferred for biomedical and diagnostic applications due to their superior chemical stability, resistance to oxidation, and excellent biocompatibility in complex biological matrices, ensuring reliable performance in clinical settings.

Which application segment is expected to drive the highest growth in the SERS market?

The Biomedical and Life Sciences segment, particularly point-of-care diagnostics for infectious diseases and oncology, is expected to drive the highest market growth. This demand is fueled by the need for rapid, non-invasive molecular analysis and the technological maturation of microfluidic-integrated, disposable SERS platforms suitable for decentralized healthcare settings.

What role does Artificial Intelligence play in enhancing SERS technology?

AI, specifically machine learning and deep learning, is crucial for two main areas: optimizing the complex nanostructure design to maximize plasmonic effects and, more importantly, automating the interpretation of complex SERS spectra. AI algorithms provide robust data processing, classification, and noise reduction, transforming raw spectral data into reliable, actionable diagnostic results quickly and objectively.

What is the current trend regarding the fabrication methods for commercial SERS substrates?

The trend is shifting from expensive, high-precision methods like EBL towards high-throughput, cost-effective techniques such as Nanoimprint Lithography (NIL) and structured colloidal self-assembly. This shift is necessary to achieve the economies of scale required for mass-producing disposable SERS chips, essential for expanding into routine industrial quality control and high-volume clinical testing markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager