Server Cabinets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433032 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Server Cabinets Market Size

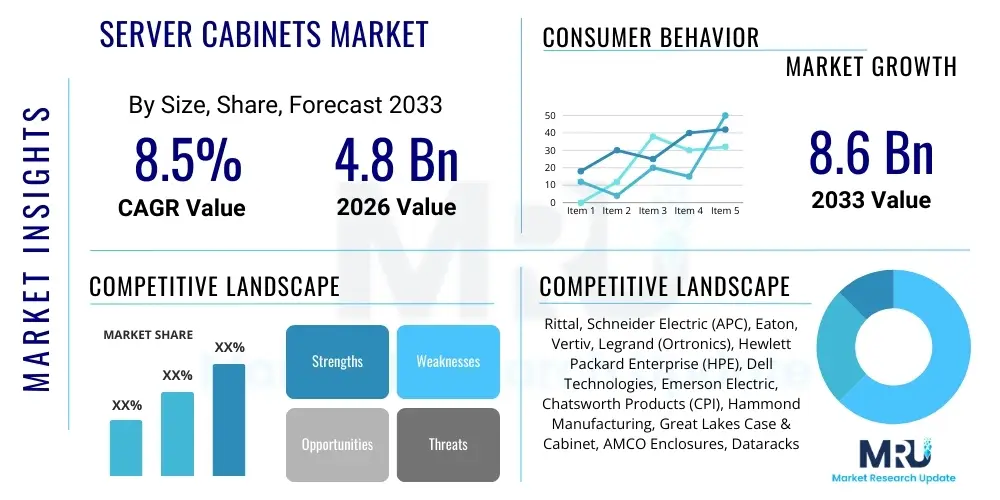

The Server Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating global demand for data processing capacity, necessitating the expansion of both hyperscale and enterprise data centers. Furthermore, the rapid adoption of cloud computing services and the proliferation of 5G networks are accelerating the deployment of specialized server cabinet solutions capable of managing high-density power and advanced thermal dissipation.

Server Cabinets Market introduction

Server cabinets, also widely known as server racks or enclosures, are integral infrastructure components designed to house, secure, and organize critical IT equipment such as servers, networking devices, storage arrays, and power distribution units (PDUs). These specialized enclosures provide standardized mounting structures, typically measured in Rack Units (U), ensuring compatibility and scalability within data center environments. Modern server cabinets are essential for efficient cable management, security protection against unauthorized access, and, most critically, effective thermal management, which is vital for maintaining optimal operating temperatures for high-performance computing hardware.

The primary applications of server cabinets span across large enterprise data centers, colocation facilities, telecommunications hubs, and burgeoning edge computing locations. The benefits derived from utilizing high-quality server cabinets include maximizing physical space utilization through stacking and consolidation, enhancing equipment longevity by preventing overheating, and complying with stringent physical security and safety regulations. Key driving factors propelling market expansion involve the continuous digital transformation across industries, the explosive generation of big data requiring dedicated storage infrastructure, and mandatory technological upgrades to support higher wattage servers utilized for artificial intelligence and machine learning operations. As data density increases, the focus shifts toward intelligent cabinets offering advanced monitoring and cooling integration.

Server Cabinets Market Executive Summary

The Server Cabinets Market is experiencing robust growth fueled by several interconnected business and technological trends. Business trends highlight increased capital expenditure (CapEx) by cloud service providers (CSPs) on hyperscale data center construction globally, demanding specialized, high-capacity cabinet solutions. Furthermore, the push towards sustainability mandates the integration of energy-efficient thermal management systems directly within cabinet designs. Segment trends emphasize the dominance of the enclosed cabinet type due to heightened security and containment needs, particularly in sensitive environments, while the 42U and 48U size formats remain standard, though custom and highly-dense micro data center cabinets are gaining traction. Technologically, the transition to liquid cooling solutions integrated into cabinet doors or rear heat exchangers represents a significant evolutionary step to accommodate GPUs and high-power CPUs.

Regional trends indicate that North America, driven by massive investments from major technology companies and established infrastructure, maintains the largest market share. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, primarily due to rapid digitalization, government initiatives supporting data localization, and increasing penetration of internet services across emerging economies like India and Southeast Asia. Europe remains a stable market, focusing heavily on modular data center deployment and stringent energy efficiency standards, driving demand for advanced, optimized cabinet solutions. Overall, the market's trajectory is defined by the necessity of higher power densities, improved physical security features, and seamless integration capabilities with advanced data center infrastructure management (DCIM) platforms.

AI Impact Analysis on Server Cabinets Market

User inquiries frequently center on how the massive power and cooling demands of AI workloads, characterized by high-density GPU clusters, will revolutionize server cabinet design. Users are primarily concerned with whether traditional air-cooled cabinets can handle the thermal output of next-generation AI servers (often exceeding 30 kW per rack), leading to common questions about the mandatory adoption of direct-to-chip or immersion cooling solutions and the requisite cabinet structural integrity. Key themes revolve around thermal management efficiency, the physical space requirements for liquid delivery systems within racks, and the ability of existing cabinet infrastructure to be retrofitted to support these high-power environments. The market expectation is a definitive shift away from general-purpose racks toward highly specialized, purpose-built enclosures engineered for extreme thermal dissipation and optimized for specific AI hardware form factors.

- Increased Power Density: AI training models necessitate racks that support power delivery exceeding 30 kW, pushing standard cabinets to their thermal limits and driving demand for specialized infrastructure.

- Mandatory Liquid Cooling Integration: The proliferation of high-TDP (Thermal Design Power) GPUs mandates integration readiness for closed-loop liquid cooling systems, rear-door heat exchangers, and potential immersion cooling tanks, changing standard cabinet footprint and material requirements.

- Enhanced Structural Integrity: AI servers are typically heavier due to advanced cooling mechanisms and denser components, requiring cabinets with higher load ratings and reinforced frames.

- Edge AI Deployment: The necessity of processing AI data closer to the source (Edge AI) drives demand for rugged, smaller, and self-contained micro data center cabinets that can operate reliably outside traditional climate-controlled data centers.

- Smart Monitoring and Automation: AI-enabled DCIM tools require cabinets equipped with advanced sensors for real-time monitoring of temperature, humidity, and power consumption at the rack level, facilitating predictive maintenance.

DRO & Impact Forces Of Server Cabinets Market

The Server Cabinets Market is significantly influenced by the rapid global expansion of digital infrastructure, creating substantial opportunities for advanced solutions, while simultaneously facing constraints related to standardization and high initial investment costs. The primary driver is the exponentially increasing data traffic fueled by cloud services and IoT, necessitating constant data center expansion. Opportunities arise from the transition to 5G infrastructure deployment and the growing need for specialized edge computing facilities requiring purpose-built, rugged enclosures. However, restraints include the challenge of retrofitting existing data center infrastructure to accommodate new, larger, and power-intensive cabinets and the high regulatory compliance costs associated with physical security and cooling standards. Impact forces such as technological advancement (high-density cooling) and competitive rivalry among global manufacturers shape market pricing and innovation cycles.

Drivers: The explosive growth in data volumes globally directly translates into demand for more racks and higher-density solutions. Furthermore, the rise of hyperscale data centers, operated by major cloud providers, necessitates bulk procurement of highly standardized, efficient server cabinets optimized for massive scale deployment. Regulatory requirements, particularly concerning physical security and data center efficiency (PUE), also compel organizations to invest in modern, enclosed, and monitored cabinet systems. The global deployment of advanced network technologies, including 5G and fiber optics, requires robust cabinet infrastructure at transmission points and network aggregation sites, ensuring sustained market impetus.

Restraints: The market faces significant restraints related to the high initial capital expenditure required for deploying modern, liquid-cooling ready server cabinets, especially for smaller enterprises. Moreover, the standardization challenges across different regional markets and specific hardware vendor requirements can complicate global deployment strategies. Supply chain volatility, particularly regarding specialized metals and components used in advanced thermal solutions, can also impact manufacturing costs and timelines. Another key restraint is the operational complexity and skilled labor required to manage ultra-high-density racks, including specialized liquid cooling maintenance, which increases the total cost of ownership (TCO).

Opportunity: Significant market opportunities lie in the rapidly developing edge computing sector, which requires durable, small-footprint server cabinets that can withstand diverse environmental conditions and offer integrated power and cooling solutions (micro data centers). The growing trend towards modular and prefabricated data center solutions offers a specialized market for containerized, fully equipped server cabinet arrays. Furthermore, the increasing focus on sustainability drives opportunities for manufacturers who develop energy-efficient cabinet designs featuring advanced airflow management, optimized hot/cold aisle containment, and natural cooling integration, appealing to environmentally conscious corporations.

Impact Forces: The impact forces heavily influencing the server cabinets market are centered on technological advancements in density and thermal management. The transition to higher U-count racks (e.g., 52U and 54U) and the integration of advanced security features (biometrics, RFID) are paramount. Economic impacts, particularly global recessionary pressures or fluctuations in construction costs for data centers, directly affect cabinet procurement budgets. The competitive landscape is characterized by established players offering standardized solutions competing intensely with specialized manufacturers focusing on niche, high-performance computing (HPC) or rugged industrial applications, leading to continuous innovation and aggressive pricing strategies.

Segmentation Analysis

The Server Cabinets Market is meticulously segmented based on several key operational and structural parameters, providing a detailed view of demand drivers across various end-user environments. Primary segmentation categories include Type, focusing on structural differences such as enclosed versus open frame cabinets; Size, standardized by the number of rack units (U) supported; Application, distinguishing between data center, industrial, and networking uses; and Material, predominantly steel or aluminum. This granular segmentation aids vendors in tailoring product offerings to meet specific requirements, such as high-density cooling needs in hyperscale facilities or ruggedized protection necessary for industrial control systems. The enclosed segment dominates due to universal requirements for security and sophisticated airflow containment, which are non-negotiable in modern IT infrastructure deployments.

- By Type:

- Enclosed Cabinets (Racks with fixed or removable doors and side panels, offering maximum security and environmental control)

- Open Frame Racks (Two-post and Four-post racks used primarily for networking and laboratory environments where access and rapid deployment are prioritized)

- By Size:

- 36U and Below (Used for small office, network closet, and edge computing applications)

- 42U (The most standard size globally, offering a balance between height and floor space utilization)

- 48U and Above (Commonly used in hyperscale and colocation facilities to maximize vertical density)

- By Material:

- Steel Cabinets (Offering superior load-bearing capacity and durability)

- Aluminum Cabinets (Lighter weight, preferred in situations requiring portability or reduced floor loading)

- By Application:

- Data Centers (Hyperscale, Enterprise, Colocation)

- Networking and Telecom (Telecommunications centers, central offices, and switching stations)

- Industrial Environment (Ruggedized cabinets used in manufacturing, oil & gas, and harsh conditions)

- Others (Testing labs, government, military)

Value Chain Analysis For Server Cabinets Market

The value chain for the Server Cabinets Market begins with upstream activities involving raw material procurement, primarily steel, aluminum, and specialized alloys, followed by the acquisition of components such as fans, sensors, locks, and power accessories. Raw material costs significantly influence final product pricing and manufacturers often manage these supply relationships closely to ensure quality and cost efficiency. The subsequent key stage is manufacturing and assembly, where sophisticated engineering and precision fabrication transform raw materials into complex enclosures ready for integration. This manufacturing stage often involves specialized processes for thermal management features, such as perforated doors and integrated cable management systems, distinguishing product quality and performance in the competitive landscape.

Downstream activities focus on the distribution channels and final deployment. Distribution primarily occurs through direct sales channels to large hyperscale or enterprise clients, offering customized solutions and large-volume contracts, or through indirect channels involving value-added resellers (VARs), system integrators, and electrical distributors who cater to smaller businesses and regional markets. System integrators play a crucial role by providing integrated solutions that bundle cabinets with PDU, cooling units, and monitoring software, adding significant value before final installation. The end of the chain involves post-sales services, including warranty, maintenance, and technical support, which are critical for maximizing the longevity and operational efficiency of the cabinets within dynamic data center environments.

Server Cabinets Market Potential Customers

The potential customer base for server cabinets is broad, spanning any organization or entity that utilizes IT infrastructure requiring structured housing and protection. The primary and most influential customers are Hyperscale Cloud Providers (e.g., AWS, Google Cloud, Microsoft Azure), who purchase massive volumes of standardized, often customized, high-density cabinets optimized for speed and scale. Enterprise Data Centers, ranging from financial institutions to healthcare providers, represent another significant customer segment demanding high-security, standardized 42U cabinets that comply with industry-specific regulations (e.g., HIPAA, PCI-DSS). These customers prioritize reliability, physical security, and advanced cooling capabilities.

Telecommunication companies and network service providers constitute a rapidly growing segment, driven by 5G rollouts, requiring specialized, ruggedized cabinets for outdoor or remote base stations and central offices. Furthermore, the emerging market of Edge Computing facilities and Industrial Internet of Things (IIoT) applications creates demand for specialized potential customers in manufacturing, oil and gas, and utility sectors, who require enclosures capable of operating reliably in non-ideal, harsh environments. The shift towards colocation facilities also means that operators of these facilities are major buyers, purchasing bulk cabinets to rent out space to multiple tenants, emphasizing flexibility and secure containment features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rittal, Schneider Electric (APC), Eaton, Vertiv, Legrand (Ortronics), Hewlett Packard Enterprise (HPE), Dell Technologies, Emerson Electric, Chatsworth Products (CPI), Hammond Manufacturing, Great Lakes Case & Cabinet, AMCO Enclosures, Dataracks, Cannon Technologies, Belden, Siemens, Middle Atlantic Products, Pentair (Schroff), Tripp Lite (Eaton), Black Box. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Server Cabinets Market Key Technology Landscape

The current technology landscape in the server cabinets market is heavily focused on enhancing thermal efficiency, improving physical security, and enabling intelligent infrastructure management. Advanced thermal solutions are paramount, moving beyond basic perforated doors to incorporate active cooling technologies such as rear door heat exchangers (RDHX) utilizing chilled water or refrigerant, and specialized integration points for direct-to-chip liquid cooling manifolds. These technologies are essential for managing the extreme heat generated by modern high-density computing clusters, including advanced CPUs and GPUs used in AI and HPC workloads. Furthermore, dynamic airflow management systems, including variable speed fans and blanking panels automatically adjusted by sensors, are crucial for optimizing cooling based on real-time load, drastically improving Power Usage Effectiveness (PUE) scores.

Intelligent cabinet technology, often referred to as 'smart racks,' integrates sophisticated sensor arrays for environmental monitoring (temperature, humidity, vibration), power consumption tracking, and advanced access control. These integrated systems communicate seamlessly with Data Center Infrastructure Management (DCIM) software, allowing operators to visualize, analyze, and automate cabinet-level operations, improving fault tolerance and maximizing operational uptime. Security technologies are evolving to include biometric access control, RFID asset tracking embedded within the rack, and electronic locking mechanisms linked to centralized security protocols, replacing traditional key-based systems. This enhanced technological integration ensures that server cabinets are transforming from mere housing units into essential, active components of the modern IT ecosystem, capable of contributing actively to data center optimization and security posture.

A significant trend in the technology landscape is modularity and rapid deployment readiness. Manufacturers are increasingly designing cabinets that are part of a prefabricated or modular data center solution, allowing for faster installation and scalability. This includes pre-integrated power distribution units (PDUs) and uninterruptible power supplies (UPS) housed within or adjacent to the cabinet frame. The focus on modularity also extends to structural design, utilizing lighter, yet stronger, materials and tool-less assembly features to streamline on-site setup. Finally, the development of robust, specialized cabinets for edge computing necessitates advancements in ingress protection (IP ratings) and environmental hardening, ensuring sensitive equipment is protected from dust, moisture, and extreme temperatures outside traditional data center environments.

Regional Highlights

- North America: This region maintains the largest market share, characterized by the presence of global technology giants and leading cloud service providers (CSPs). The market here is defined by massive investment in hyperscale facilities and early adoption of high-density solutions, including advanced liquid cooling integration. Demand is highly concentrated in metropolitan hubs, with a strong emphasis on sustainability and energy efficiency regulations driving the adoption of high-efficiency rack designs and integrated DCIM systems. The high degree of technological maturity ensures sustained market leadership.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, driven by rapid urbanization, massive internet penetration, and supportive government policies focused on digital infrastructure development in countries like China, India, and Japan. The region sees significant demand for both hyperscale deployments and localized edge infrastructure to serve booming mobile and IoT markets. Investment in new data center construction, particularly in Southeast Asia, fuels substantial bulk procurement of server cabinets.

- Europe: The European market is stable and mature, characterized by stringent data privacy laws (GDPR) and ambitious renewable energy targets. This drives strong demand for modular data center solutions, highly energy-efficient cooling racks (often utilizing free cooling methods), and cabinets with robust physical security features. Germany, the UK, and the Nordics are major hubs, with the Nordics specifically leveraging natural climate advantages for sustainable cooling, influencing cabinet design towards optimized cold aisle containment.

- Latin America (LATAM): The LATAM market is expanding steadily, primarily driven by increasing digitalization in financial services and the growing presence of global cloud providers establishing regional availability zones. Brazil and Mexico are leading markets, focusing on standardized rack solutions but beginning to transition toward higher density requirements as digital service consumption accelerates.

- Middle East and Africa (MEA): Growth in MEA is driven by government-led digital transformation initiatives (such as Saudi Vision 2030 and UAE projects) and the construction of new data center parks. Demand is high for resilient and robust cabinets capable of handling the region's challenging environmental conditions (high temperatures and dust). The market shows increasing interest in modular and micro data center solutions for remote deployments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Server Cabinets Market.- Rittal GmbH & Co. KG

- Schneider Electric SE (APC)

- Eaton Corporation plc

- Vertiv Holdings Co.

- Legrand SA (Ortronics)

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- Emerson Electric Co.

- Chatsworth Products, Inc. (CPI)

- Hammond Manufacturing Co. Ltd.

- Great Lakes Case & Cabinet Co., Inc.

- AMCO Enclosures

- Dataracks Ltd.

- Cannon Technologies Ltd.

- Belden Inc.

- Siemens AG

- Middle Atlantic Products (Legrand)

- Pentair (Schroff)

- Tripp Lite (Eaton)

- Black Box Corporation

Frequently Asked Questions

Analyze common user questions about the Server Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-density server cabinets?

The primary factor driving the demand for high-density server cabinets is the widespread adoption of AI, machine learning, and advanced analytics, which rely heavily on high-powered GPU accelerators and specialized servers. These components generate substantially more heat and require higher power input (often exceeding 20 kW per rack) compared to traditional servers, necessitating specialized cabinets designed for enhanced thermal management, such as those integrated with liquid cooling solutions. Furthermore, cloud service providers aim to maximize compute capacity per square foot, making efficient vertical density crucial for operational economics, directly boosting demand for 48U and higher U-count enclosures.

How are edge computing requirements influencing server cabinet design?

Edge computing mandates server cabinet designs that are smaller, more rugged, and self-contained, forming micro data centers. Unlike traditional data center racks, edge cabinets must often operate outside controlled environments, requiring enhanced ingress protection (IP ratings) against dust, humidity, and temperature fluctuations. Key features include integrated uninterruptible power supplies (UPS), specialized thermal management solutions optimized for small spaces, and robust physical security features to protect equipment deployed in remote or non-secure locations. This shift emphasizes compact, durable, and highly resilient enclosure solutions.

What are the key differences between open frame racks and enclosed server cabinets?

Open frame racks, typically two-post or four-post structures, offer easy, unrestricted access to cabling and equipment, making them ideal for laboratory testing environments, networking distribution frames, or secured data centers where physical security is managed at the room level. They are cost-effective but offer no environmental protection or access control. Conversely, enclosed server cabinets feature secure doors, side panels, and integrated thermal management features like perforated front and rear doors or heat exchangers. Enclosed cabinets provide superior physical security, optimized airflow containment (hot/cold aisles), and are mandatory for compliance in environments requiring high protection against unauthorized access and strict temperature regulation.

What role does DCIM software play in the modern server cabinet ecosystem?

Data Center Infrastructure Management (DCIM) software integrates directly with intelligent server cabinets to provide crucial real-time operational visibility and control. DCIM allows operators to monitor environmental parameters (temperature, power load) within each rack, track asset locations via RFID, and manage access control systems remotely. By aggregating data from cabinet sensors, DCIM enables proactive thermal optimization, identifies stranded capacity, aids in capacity planning for future rack deployment, and ensures operational efficiency, thereby maximizing the return on investment for the cabinet infrastructure.

What materials are commonly used for server cabinets and how does material choice impact performance?

The two primary materials used for server cabinet construction are steel and aluminum. Steel cabinets are favored for their superior strength, high load-bearing capacity (critical for supporting dense, heavy equipment like UPS units and high-performance servers), and durability, making them the standard choice for most enterprise and hyperscale data centers. Aluminum cabinets are significantly lighter, making them easier to handle, transport, and install, and are often preferred in environments where floor loading limits are a concern or where portability is necessary. While steel dominates due to its robustness, the choice of material directly impacts the rack's weight capacity, cost, and overall ease of deployment within a facility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager